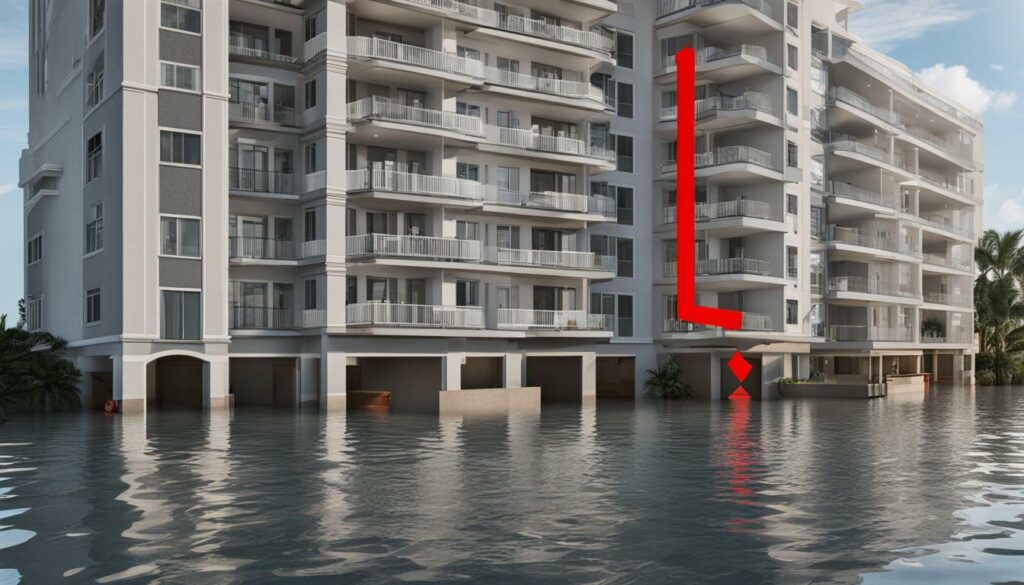

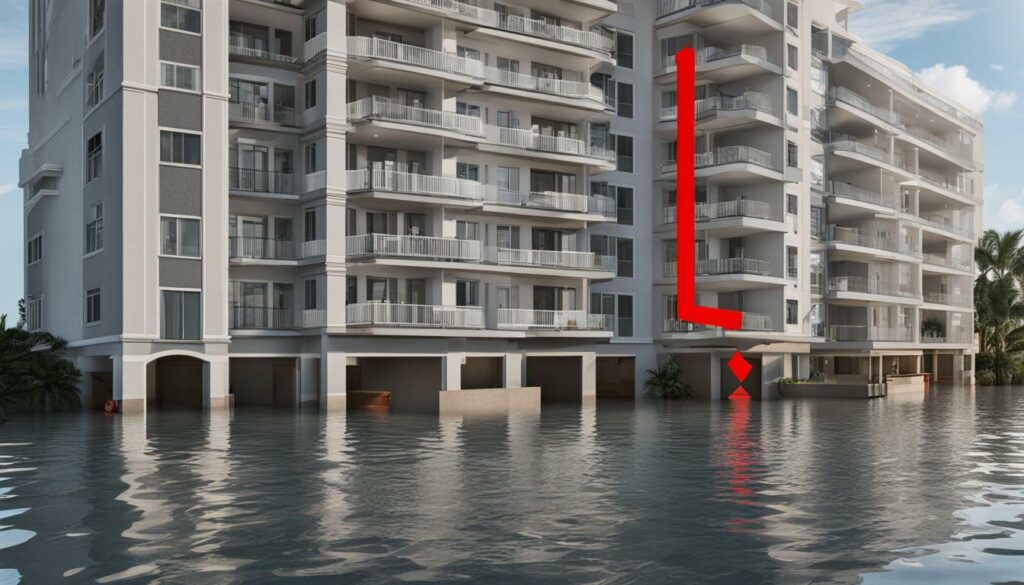

If you own a condo in Florida, it’s essential to understand the importance of flood insurance. With the state’s frequent hurricanes, heavy rainfall, and proximity to the ocean, flooding is a real risk that could result in costly damages to your condo. In this article, we’ll guide you through the specifics of flood insurance coverage for condos in Florida, so you can ensure that you have the necessary protection.

Key Takeaways:

- Flood insurance is crucial for Florida condo owners due to the state’s high risk of flooding.

- Understanding the specific requirements and regulations for flood insurance coverage is important for condo owners.

- Condo association flood insurance can provide coverage, but it’s essential to be aware of its limitations.

- There are different types of insurance coverage for condo floods, including building and personal property coverage.

- Flood damage coverage can vary, so it’s important to understand what is covered and what is not.

- Finding affordable flood insurance options can be challenging, but there are strategies to save on costs.

- Navigating the condominium flood insurance policy can be complex, so it’s important to understand the terms and exclusions.

- The benefits of flood insurance for condos in Florida include financial protection and peace of mind.

- Successfully filing a condo flood insurance claim requires proper documentation and understanding of the process.

Understanding Flood Insurance Requirements for Florida Condo Owners

If you own a condominium in Florida, it is essential to understand the specific flood insurance requirements that apply to you. As a resident of a state with a high risk of flooding, you are vulnerable to significant damage to your property and belongings.

Firstly, it’s important to know that flood insurance is generally not included in standard condo insurance policies. Therefore, it is recommended that you obtain separate flood insurance coverage to adequately protect yourself and your property.

Many Florida mortgage lenders require condo owners to have flood insurance as a condition of their mortgage agreement. This requirement is in place to protect both the lender and the condo owner. In addition to mortgage requirements, condominium associations may also require flood insurance for their members.

According to the National Flood Insurance Program, the minimum amount of flood insurance coverage required for condominiums in Florida is $250,000 for the building and $100,000 for personal property. However, these requirements may vary depending on your location and the specific regulations of your condominium association.

It’s important to note that even if your condo association provides flood insurance, it may not cover all damages. Make sure to review the policy carefully to understand what is and is not covered.

To ensure you meet the necessary flood insurance requirements for your Florida condo, consult with your condominium association and insurance agent. By taking proper precautions, you can protect your investment and mitigate the risks associated with flooding in Florida.

Condo Association Flood Insurance: What You Need to Know

Condominium associations play a vital role in providing flood insurance coverage for condos in Florida. By pooling resources and negotiating with insurers, condo associations can often secure comprehensive flood insurance policies at a more affordable rate than individual condo owners.

However, it is important to note that the scope of coverage provided by condo association flood insurance policies can vary widely. Some policies may only cover the building structure and common areas, while others may extend coverage to individual units.

Before purchasing additional flood insurance coverage as a condo owner, it is important to review the condo association’s existing policy and understand the specific coverage limits and exclusions. This can help you determine whether you need to purchase additional coverage to protect your personal property or other assets.

It is also important to note that relying solely on condo association flood insurance may not provide enough coverage in the event of a catastrophic flood. In some cases, condo associations may face difficulty securing sufficient insurance coverage or may be unable to rebuild after a major flood.

As a condo owner, it is important to weigh the benefits and limitations of condo association flood insurance and consider purchasing additional coverage to ensure you have the necessary protection in the event of a flood.

Understanding Insurance Coverage for Condo Floods

As a condo owner in Florida, it’s important to understand the different types of insurance coverage available for floods. Typically, there are two types of coverage: building and personal property coverage.

Building coverage includes the physical structure of the building, such as the walls, floors, and ceilings. This coverage may also include built-in appliances and fixtures. On the other hand, personal property coverage includes your personal belongings, such as furniture, electronics, and clothing.

It’s important to note that not all flood insurance policies cover both building and personal property coverage. It’s crucial to review your policy and consult with your insurance agent to ensure you have the appropriate coverage.

Additionally, it’s important to understand the limits of your coverage. Most policies have coverage limits, meaning there is a maximum amount that your insurance company will pay out for damages. It’s essential to review your coverage limits and consider if they are sufficient enough to cover potential damages from a flood.

When choosing insurance coverage for condo floods, it’s essential to consider your individual needs and assess your risk factors. Consulting with a trusted insurance agent can help you choose the right coverage for your condo in Florida.

Flood Damage Coverage for Condos in Florida

If you own a condo in Florida, you’re likely aware of the risks associated with flooding in the state. As a condo owner, it’s important to understand your flood insurance coverage and what damages are typically covered by your policy.

Flood damage coverage for condos in Florida usually includes damages to the building structure and common areas, such as hallways, elevators, and parking garages. It may also cover damage to personal property, including furniture, appliances, and clothing.

However, it’s important to note that not all damages are covered by flood insurance for condos in Florida. For example, damages caused by mold and mildew are typically excluded from coverage. It’s crucial to thoroughly review your policy and understand any limitations or exclusions.

Additionally, it’s important to consider the amount of coverage you have for flood damage. Some policies may only cover a portion of the damages, leaving you with a significant financial burden. Make sure to review and adjust your coverage limits accordingly.

In the event of a flood, it’s important to take immediate action to minimize damages. This includes contacting your insurance provider as soon as possible and documenting all damages with photographs and videos. The more thorough your documentation, the easier it will be to file a successful condo flood insurance claim.

Remember, having flood insurance coverage for your condo in Florida can provide peace of mind and financial protection in the event of a flood-related disaster. Make sure to carefully review your policy, understand your coverage, and take necessary steps to protect your property.

Finding Affordable Flood Insurance for Condos in Florida

Condo living in Florida has many advantages, but it also comes with the risk of flooding. That’s why it’s essential to have a proper flood insurance policy in place. However, finding affordable flood insurance for your condo can be challenging. Here are some tips to help you navigate this process:

1. Shop Around

Don’t settle for the first condo flood insurance policy you come across. Shop around and get quotes from multiple insurance providers. Each provider will have different rates, coverage options, and discounts. Compare and analyze the options available to find the best deal that suits your budget and needs.

2. Bundle Your Policies

Many insurance providers offer discounts if you bundle your condo flood insurance policy with other policies, such as auto or home insurance. Bundling your policies can save you a significant amount of money on insurance premiums.

3. Raise Your Deductible

A higher deductible means a lower premium. Consider raising your deductible to reduce your flood insurance premium. But keep in mind that you’ll have to pay out of pocket before the insurer covers any damages.

4. Install Flood Prevention Measures

Some insurance providers offer discounts on flood insurance premiums if you take preventative measures to reduce the risk of flooding in your condo. These measures may include installing flood sensors, sump pumps, or flood barriers.

5. Consult an Insurance Agent

If you’re struggling to find affordable flood insurance for your condo in Florida, consider consulting with an experienced insurance agent. They can help you navigate the insurance marketplace and find options that best fit your specific needs and budget.

By following these tips, you can find affordable flood insurance coverage tailored specifically for your condo in Florida, giving you the peace of mind and financial protection you need.

Navigating the Condominium Flood Insurance Policy

Understanding the condominium flood insurance policy can be overwhelming. However, it is crucial to know what is covered and what is not in your condominium unit.

First, ensure that you have a copy of the condominium’s flood insurance policy. Next, pay close attention to the policy’s definitions, such as “building” and “personal property.” The definitions will help determine what is covered under the policy.

Additionally, take note of the policy’s coverage limits. The coverage limit for the building or personal property may differ.

It is also important to know what the policy excludes. For example, the policy may not cover damages caused by mold or mildew.

To ensure that you understand the policy fully, do not hesitate to ask your insurance agent or the condominium association for clarification.

Taking the time to understand the condominium flood insurance policy can save you from financial losses if a flood damages your unit.

Benefits of Flood Insurance for Condos in Florida

If you own a condo in Florida, you already know that the state is prone to flooding. However, many condo owners do not realize the importance of having flood insurance. Here are some of the key benefits of having flood insurance for your condominium:

- Peace of mind: With flood insurance, you can rest easy knowing that your condo is protected from flood-related damages. You don’t have to worry about the financial burden of repairing or replacing your property.

- Financial protection: If your condo is damaged in a flood, the costs of repairs can quickly add up. With flood insurance, you’ll have the financial protection you need to cover those costs.

- Ability to recover: Floods can be devastating, but with flood insurance, you’ll have the resources you need to recover from the damage and get your life back to normal.

Don’t underestimate the value of flood insurance for your condo. It’s an investment that can pay off in the long run, providing you with the protection and peace of mind you need.

Tips for Filing a Condo Flood Insurance Claim

When it comes to filing an insurance claim for flood damage to your condo in Florida, it’s important to be prepared and informed. Follow these tips to ensure a smooth process:

- Document the damage: Take photos or videos of the flood damage to your condo and personal property. Make a list of damaged items and their value.

- Contact your insurance company: Notify your insurance company as soon as possible after the flood occurs. Follow their instructions for filing a claim.

- Provide necessary documentation: Be prepared to provide documentation, including your insurance policy, photos or videos of the damage, and a list of damaged items with their value.

- Work with adjusters: Your insurance company will assign an adjuster to assess the damage. Work with them to ensure all damages are properly documented.

- Keep track of expenses: Keep track of any expenses related to the flood damage, such as temporary housing or repairs. Your insurance company may cover these costs.

- Be patient: Processing a flood insurance claim can take time. Be patient and follow up with your insurance company if necessary.

By following these tips, you can ensure that your flood insurance claim for your condo in Florida is processed smoothly and efficiently.

“Being prepared and informed can help you when filing an insurance claim for flood damage to your condo in Florida.”

Conclusion

As a condo owner in Florida, protecting your investment from flooding is crucial. Understanding the flood insurance requirements and options available can be overwhelming, but it is necessary to ensure you have the right coverage in the event of a flood.

Make sure you check with your condo association to see what flood insurance coverage they provide, and consider purchasing additional coverage to protect your personal property. It’s also important to regularly review and understand your condominium flood insurance policy to ensure you know what is covered and what is not.

While no one wants to think about the possibility of a flood damaging their condo, having flood insurance can provide you with peace of mind and financial protection. In the event of a flood, make sure you know the necessary steps to file a condo flood insurance claim and keep all necessary documentation.

Don’t wait until it’s too late to protect your condo from flooding. Take action today to find affordable flood insurance tailored for your condo in Florida and rest easy knowing you’re prepared for whatever comes your way.

FAQ

Q: Do all condos in Florida require flood insurance?

A: While flood insurance requirements may vary depending on the specific location and regulations of the condo association, it is highly recommended for all condo owners in Florida to have flood insurance. Flooding is a common risk in the state, and having insurance coverage can provide financial protection in the event of flood-related damages.

Q: Can I rely on condo association flood insurance for my condo?

A: Condo association flood insurance can provide coverage for common areas and the building structure, but it may not cover personal property or individual units. It is important to review the condo association’s flood insurance policy and consider supplementing it with additional coverage if needed.

Q: What does flood insurance for condos typically cover?

A: Flood insurance for condos typically covers damages to the building structure, including walls, floors, and electrical systems. It may also provide coverage for personal property, such as furniture and appliances, depending on the policy. It is important to review the policy details to understand the extent of coverage.

Q: How can I find affordable flood insurance for my condo in Florida?

A: To find affordable flood insurance for condos in Florida, it is recommended to shop around and compare quotes from different insurance providers. Additionally, consider working with an insurance agent who specializes in flood insurance to find the best options tailored to your specific needs. Some insurance providers may offer discounts or cost-saving measures, so be sure to inquire about those as well.

Q: What should I do if I need to file a condo flood insurance claim?

A: If you need to file a condo flood insurance claim, it is important to document the damages by taking photos or videos. Notify your insurance provider as soon as possible and provide them with the necessary documentation, such as proof of ownership and receipts for damaged items. Follow the claims process outlined by your insurance provider and keep track of any communication or updates regarding your claim.