As a renter, you may be wondering whether you really need renters insurance. After all, your landlord probably has insurance, so why should you have to pay for more coverage?

The truth is, renters insurance can be a lifesaver in many situations. From theft to fire, natural disasters to accidents, having renters insurance can provide valuable financial protection when you need it most.

But is it really necessary? That’s up to you to decide. Here’s what you need to know to make an informed decision.

Key Takeaways

- Renters insurance may not be required by law, but it can provide important financial protection.

- Understanding what renters insurance covers and how it works is essential in making a decision about whether it’s necessary for you.

- Comparing different insurance policies and calculating the cost can help you find an affordable policy that meets your needs.

Understanding Renters Insurance Coverage

As a renter, you might wonder what damages or losses will be covered by renters insurance. In general, renters insurance provides protection for your personal belongings, liability coverage, and additional living expenses in case of a covered loss.

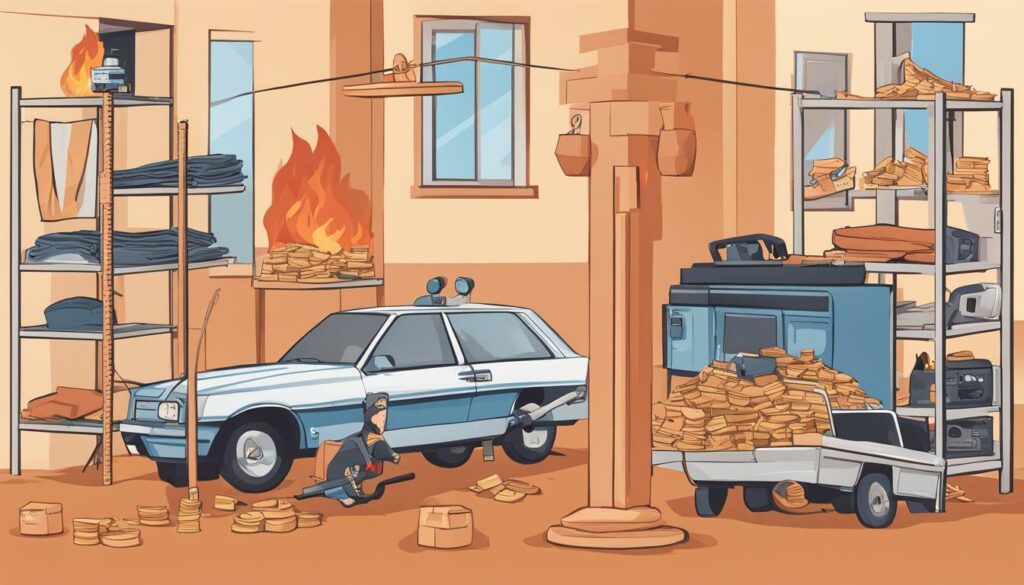

When it comes to personal belongings, renters insurance can cover losses resulting from fire, theft, vandalism, or other disasters. The coverage usually includes items such as furniture, electronics, clothing, and jewelry. However, certain items such as expensive art collections or musical instruments may require additional coverage. You should discuss these valuable items with your insurance provider to ensure they are adequately covered.

Liability coverage is another crucial aspect of renters insurance. It can protect you against lawsuits arising from accidents that occur within your rented property. This includes situations where someone is injured or their property is damaged while in your home. Additionally, it can provide coverage for legal fees and court expenses.

If your rental home becomes uninhabitable due to a covered loss, renters insurance can provide additional living expenses. This coverage can pay for expenses like temporary accommodation, meals, and other necessary costs while you wait for repairs to be completed.

Renters Insurance Coverage Options

You can choose the amount of coverage you want based on the value of your personal belongings and your liability needs. Most insurance providers offer a range of coverage options to suit different budgets and circumstances. When selecting a policy, consider the following:

- Actual Cash Value vs Replacement Cost: An actual cash value policy will pay out the current market value of your belongings, whereas a replacement cost policy will provide enough money to replace them with new items of similar quality.

- Coverage Limits: Make sure your policy covers the entire value of your belongings. Some policies may limit coverage for specific items or categories, such as jewelry or electronics.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance kicks in. Generally, higher deductibles can lower your premium but will increase your out-of-pocket expenses in case of a claim.

- Add-On Coverage: Consider additional coverage options such as coverage for water damage, earthquakes, or floods, which may not be included in a standard policy.

By understanding renters insurance coverage and choosing the right policy for your needs, you can have peace of mind knowing that your personal belongings and your liability are protected.

Why Get Renters Insurance?

As a renter, you might think that you don’t need insurance since you don’t own the property. However, renters insurance is important because it provides financial protection against theft, fire, or other disasters. In fact, many landlords now require their tenants to carry renters insurance, as it also covers damages to the rented property caused by the tenant.

One of the main benefits of renters insurance is that it can provide peace of mind. Knowing that you’re protected against unexpected expenses can help you sleep better at night. In the event of a covered loss, renters insurance can also help cover the cost of temporary housing and other additional living expenses.

Another often overlooked benefit of renters insurance is liability coverage. If someone is injured in your rented property due to your negligence, renters insurance can help cover their medical bills and legal fees. This type of coverage can be especially important if you frequently entertain guests in your rented space or if you have children or pets.

Overall, renters insurance is a small price to pay for the peace of mind and financial protection it provides. Don’t wait until it’s too late; get renters insurance today and rest easy knowing that you’re covered.

Renters Insurance vs Homeowners Insurance

While homeowners insurance provides coverage for the structure of the home as well as personal property, renters insurance only covers personal belongings and liability. So if you’re renting a home or apartment, it’s important to have renters insurance to protect your personal property in case of theft, fire, or other unexpected disasters.

Even if your landlord has homeowners insurance, it only covers the building and their personal property, not your belongings. So if you want to ensure that your belongings are covered, you need renters insurance.

Additionally, renters insurance is typically less expensive than homeowners insurance because it covers less. However, it’s important to note that the cost of renters insurance can vary depending on factors such as your location and the coverage limits and deductibles you choose.

Ultimately, whether you need renters insurance or homeowners insurance depends on your living situation. But if you’re renting a home or apartment, renters insurance is a must-have to protect your belongings and provide financial security in case of unexpected events.

Calculating the Cost of Renters Insurance

When considering renters insurance, one of the top concerns is the cost. You may be wondering, how much does renters insurance cost? The truth is, the cost of renters insurance varies depending on several factors.

| Factors that affect the cost of renters insurance include: |

|---|

| Type and level of coverage |

| Location of your rental property |

| Your deductible amount |

| Your credit score |

| Claims history |

Generally, the more coverage you have, the higher the cost of renters insurance. However, it’s important to remember that having adequate coverage can provide peace of mind and financial security in the event of unexpected circumstances.

One way to find affordable renters insurance policies is to shop around and compare quotes from different insurance providers. Some providers may offer discounts for bundling renters insurance with other policies, such as auto insurance. Additionally, maintaining a good credit score and claims history can help lower your insurance premiums.

Ultimately, the cost of renters insurance is a small price to pay for the protection and security it provides. It’s important to assess your personal circumstances and needs when choosing a policy, and to ensure you have adequate coverage in the event of unforeseen circumstances.

Why Get Renters Insurance?

While you may think that having renters insurance is an unnecessary expense, it is important to understand the benefits of having this type of coverage should anything unexpected happen. Renters insurance provides financial protection against theft, fire, or other disasters, giving you peace of mind knowing that you are covered in case of an emergency.

Imagine this scenario: you come home from work one day to find that your apartment has been broken into and your valuable possessions are missing. Without renters insurance, you would be left to foot the bill yourself, which could be a major financial burden. But with renters insurance, you can file a claim and receive reimbursement for your stolen items, allowing you to start rebuilding your life.

In addition to protecting your personal belongings, renters insurance also provides liability coverage. If someone is injured while on your rental property, your renters insurance policy may cover their medical bills or legal expenses should they decide to sue you. Additionally, renters insurance can cover additional living expenses if you are forced to vacate your rental property due to a covered loss such as a fire or natural disaster.

Overall, the benefits of having renters insurance far outweigh the costs. It is important to remember that while your landlord may have homeowners insurance, this will not cover your personal belongings or liability. It is up to you to protect yourself and your assets by investing in renters insurance.

Factors to Consider When Choosing Renters Insurance

When choosing renters insurance, there are several factors to consider to ensure that you are getting the coverage that meets your needs. Here are some key factors that you should keep in mind:

- Coverage Limits: It is important to choose the right coverage limits that adequately protect your personal belongings. Consider the value of your possessions and select coverage that will cover their full replacement cost.

- Deductibles: A deductible is the amount you must pay out of pocket before the insurance coverage kicks in. Choose a deductible that you can afford in the event of a claim.

- Additional Coverage Options: Many renters insurance policies offer additional coverage options. These can include coverage for high-value items, such as fine jewelry, or for specific risks, like floods or earthquakes. Consider whether these options are necessary based on your individual circumstances.

- Insurance Provider: Look for a reputable insurance provider with a track record of excellent customer service. Research customer reviews and ratings to ensure that you are choosing a trustworthy provider.

- Cancellation Policy: Make sure you understand the cancellation policy of your renters insurance policy. Some policies may have a penalty for early cancellation or may require a certain notice period before cancellation.

- Cost: While cost should not be the only factor you consider, it is important to choose a policy that is affordable within your budget. Compare quotes from multiple providers to find the best value for your money.

By considering these factors, you can choose a renters insurance policy that provides you with the protection you need at a price that fits your budget. Remember, renters insurance is an important investment that can offer you peace of mind and protection against unexpected expenses.

Tips for Getting the Most Out of Renters Insurance

Now that you understand the many benefits of renters insurance, it’s important to make sure you’re getting the most out of your policy. Here are some tips to help:

- Create a home inventory: Knowing what you own and how much it’s worth can help ensure you have the right coverage. Use a tool like the National Association of Insurance Commissioners’ free home inventory checklist.

- Understand policy exclusions: Make sure you understand what your policy does and does not cover. For example, most policies exclude damage caused by floods and earthquakes.

- Regularly review and update coverage: Your coverage needs may change over time, so it’s a good idea to review your policy annually and make updates as needed.

- File claims promptly: If you do need to file a claim, do so as soon as possible to ensure a timely payout.

- Maintain good communication with your insurance company: Keep your insurer informed of any changes to your circumstances, such as a move or new roommate.

By following these tips, you can make sure you’re fully protected and getting the most out of your renters insurance policy.

Conclusion

In conclusion, whether renters insurance is a need or want depends on your personal circumstances. However, after considering the benefits and risks, it’s clear that having renters insurance is a smart decision.

Renters insurance provides financial protection against unexpected events such as theft, fire, or natural disasters, and can also offer liability coverage and additional living expenses. Even if your landlord has homeowners insurance, it may not cover your personal belongings or liability.

When evaluating renters insurance policies, it’s important to consider factors such as coverage limits, deductibles, and additional coverage options. You can also take steps to maximize the benefits of renters insurance, such as creating a home inventory and regularly reviewing and updating your coverage.

Ultimately, the peace of mind and financial protection that renters insurance can provide is invaluable. As a renter, it’s important to carefully consider your personal circumstances and make an informed decision. So, is renters insurance a need or want? We leave that decision up to you. But we do advise that you carefully consider the benefits and risks before making a choice.

FAQ

Q: Is renters insurance necessary?

A: Yes, renters insurance is important for protecting your personal belongings and providing liability coverage.

Q: What does renters insurance cover?

A: Renters insurance covers your personal belongings, provides liability coverage, and can help with additional living expenses.

Q: Why should I get renters insurance?

A: Renters insurance provides financial protection against theft, fire, or other disasters and gives you peace of mind.

Q: How is renters insurance different from homeowners insurance?

A: Renters insurance is specifically designed for tenants and covers personal belongings, while homeowners insurance covers the structure of the home.

Q: How much does renters insurance cost?

A: The cost of renters insurance depends on factors such as location, coverage limits, and deductibles. It is important to shop around and find an affordable policy.

Q: Why is renters insurance important?

A: Renters insurance is important because it provides financial protection and can help you recover from unexpected expenses due to theft, fire, or other disasters.

Q: What factors should I consider when choosing renters insurance?

A: When choosing renters insurance, consider factors such as coverage limits, deductibles, and additional coverage options. Evaluate your specific needs and compare insurance providers.

Q: How can I get the most out of my renters insurance?

A: To maximize the benefits of renters insurance, create a home inventory, understand policy exclusions, and regularly review and update your coverage. Follow the proper procedures for filing claims and maintain good communication with your insurance company.