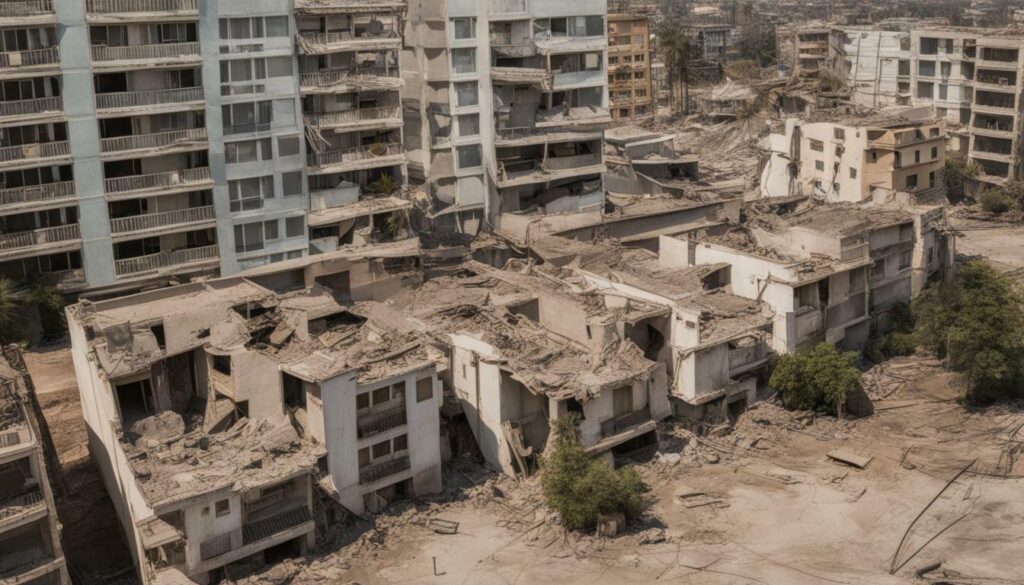

As a condo association, protecting your property and the peace of mind of your community from unexpected disasters is crucial. Earthquakes can strike without warning and cause significant damage to a building, leaving behind a trail of destruction and financial loss. This is where earthquake insurance for condo associations comes in.

Earthquake insurance is a specialized form of coverage that is designed to protect a property from damages caused by a seismic event. It is especially important for regions that are prone to earthquakes, but even areas with a lower risk of earthquakes can be affected. Condo association earthquake insurance covers damages to the building’s structure, common areas, and personal property owned by the association.

Key Takeaways:

- Earthquake insurance is important for protecting condo associations from unexpected seismic events.

- It covers damages to the building’s structure, common areas, and personal property owned by the association.

- Even regions with a lower risk of earthquakes can be affected, making earthquake insurance relevant for all condo associations.

The Basics of Condo Association Earthquake Insurance

If you are a part of a condo association, it is essential to understand the importance of earthquake insurance coverage. While many people believe that their individual condo insurance policy will cover any earthquake-related damages, this is not always the case. Condo association earthquake coverage provides added protection for the entire building and common areas, in addition to individual units.

The coverage for condo association earthquake insurance includes damages to the building, including structural repairs and any loss of personal property belonging to the association. It is important to note that the coverage limits and deductibles can vary, and you should review them carefully to ensure that your condo association has adequate protection.

Unlike individual condo insurance, which only covers damage to personal property, condo association earthquake insurance covers damages to the entire building. However, it is important to understand that there may be exclusions in the policy, so it is crucial to review the details of the policy with an experienced insurance agent.

The Importance of Understanding Coverage Limits and Deductibles

It is essential to understand the coverage limits and deductibles for condo association earthquake insurance. The coverage limits refer to the maximum amount that the insurance company will pay for damages, while the deductible is the amount that the condo association must pay before the insurance coverage takes effect.

It is important to review both the limits and deductibles carefully to ensure that the condo association has adequate coverage. In some cases, it may be necessary to increase the coverage limits or decrease the deductible to ensure that the association has enough protection in the event of an earthquake.

Overall, condo association earthquake insurance is a crucial aspect of protecting your property and providing peace of mind in the event of an unexpected seismic event. By understanding the basics of this type of insurance coverage and working with an experienced insurance agent, you can ensure that your condo association has the appropriate protection to weather any earthquake-related damages.

Exploring Earthquake Insurance Options for Condo Associations

When considering earthquake insurance options for condo associations, there are several routes to choose from. The first option is a standalone earthquake policy, specifically designed to cover earthquake-related damages. Another option is to add an endorsement to the association’s existing policy, which can provide additional coverage for earthquakes. Finally, group coverage options may be available through the association’s master policy, which provides coverage to all unit owners.

It’s essential to understand the differences between these options and the coverage they offer. Standalone earthquake policies may have higher premiums but may provide more comprehensive coverage. Endorsements to existing policies are often more affordable but might have lower coverage limits or exclusions. Group coverage options are beneficial for associations that want to provide coverage for all unit owners, but it’s essential to ensure that the policy’s limits meet the association’s needs.

When exploring earthquake insurance options for condo associations, it’s crucial to work with an experienced insurance agent. They can help you evaluate your options and determine the most suitable coverage for your association’s unique circumstances. Your agent can also help you understand the policy limits, deductibles, and exclusions to ensure that you have adequate coverage.

Ultimately, the coverage you choose for your condo association depends on your association’s location, building type, and financial stability. Conducting a comprehensive risk assessment can help you determine the coverage limits you need and the right insurance option for your association. It’s vital to have earthquake insurance to ensure that your association is financially protected in the event of earthquake-related damages.

Benefits of Earthquake Insurance for Condo Associations

Earthquake insurance for condo associations can provide valuable protection in the event of a seismic event. Since earthquakes can cause significant, costly damage to buildings and personal property, earthquake insurance can provide peace of mind and financial stability.

One significant benefit of earthquake insurance for condo associations is that it can protect the association from the financial burden of repairs and replacements. The policy can cover structural repairs, such as fixing foundation cracks, repairing walls, and even rebuilding the entire building if necessary. Additionally, the policy can cover personal property replacement costs for condo owners, including furniture, electronics, and appliances that may be damaged in an earthquake.

Another benefit of earthquake insurance for condo associations is that it can help expedite the recovery process. After an earthquake, it can take time for the condo association to secure necessary funds for repairs or replacement through other means, such as special assessments or loans. With earthquake insurance in place, the claims process can help speed up the recovery process and get the property back to pre-earthquake condition faster.

Additionally, having earthquake insurance can help maintain the overall value of the property. If a condo association experiences significant damage from an earthquake and has no insurance, the value of the property may decrease. However, with earthquake insurance in place, the property’s value can remain stable, even in the event of an earthquake.

Overall, earthquake insurance for condo associations can provide essential protection against the unexpected. By having adequate coverage in place, condo associations can ensure the financial stability and peace of mind of both the association and its members in the event of an earthquake.

Understanding Condo Association Earthquake Liability Coverage

As a condo association, it’s crucial to not only protect your property from earthquake damage but also any liability that may arise from seismic events. That’s where condo association earthquake liability coverage comes in.

This type of coverage protects the association from legal claims and lawsuits resulting from injuries or property damage caused by earthquakes. It can cover damages to common areas, as well as personal injury claims from condo owners or visitors. However, it’s important to review policy limits and exclusions to ensure adequate coverage for the association’s specific needs.

Without proper earthquake liability coverage, a condo association could face significant financial and legal consequences in the event of an earthquake. Don’t put your association’s financial stability at risk – make sure you have adequate earthquake liability coverage in place.

Factors to Consider When Choosing Earthquake Insurance

Choosing earthquake insurance for your condo association in [location] requires thorough consideration of several factors. It’s important to understand that each condo association has unique circumstances that affect the type and level of coverage that is appropriate. Here are some factors to consider:

Geographical Location

[Location] is prone to earthquakes, with a history of seismic events over the years. It’s essential to take into account the specific location of your condo association when selecting earthquake insurance. The proximity to fault lines, the soil type, and the seismic zone all influence the risk of earthquake damage. Insurance premiums vary depending on the location and the level of risk. It’s advisable to work with an insurance agent who understands the local geological features and can recommend the appropriate coverage.

Building’s Age and Construction Type

The age and construction type of your condo building can also affect the level of earthquake insurance coverage you need. Older buildings may have structural weaknesses that make them more susceptible to damage during an earthquake. Buildings made of unreinforced masonry, for instance, are more likely to collapse than those made of steel or reinforced concrete. It’s important to have a comprehensive risk assessment that evaluates the building’s seismic resistance and recommends appropriate coverage.

Association’s Financial Stability

Having earthquake insurance is essential, but it’s also crucial to consider the association’s financial stability when selecting coverage. The deductible and coverage limits can significantly impact the association’s ability to recover financially after an earthquake event. It’s important to choose coverage that is affordable and sustainable for the association in the long term. Working with an experienced insurance agent can help you find a balance between adequate coverage and financial stability.

Ultimately, selecting earthquake insurance for your condo association in [location] requires a thorough understanding of the risk factors, coverage options, and financial implications. Taking the time to evaluate each of these factors will help ensure that you have the appropriate coverage to protect your property and peace of mind.

Common Misconceptions about Condo Association Earthquake Insurance

When it comes to earthquake insurance for condo associations, there are several misconceptions that could lead to inadequate coverage and financial risks. By debunking these myths, you can make informed decisions and adequately protect your property and peace of mind.

Myth: Individual Condo Owners are Responsible for Earthquake Damage

Many condo owners assume that they are solely responsible for earthquake damage to their unit and personal belongings. However, in the event of a seismic event, the condo association may also suffer damage to common areas, building structures, and other shared property. Without adequate earthquake insurance coverage, the condo association would have to bear the financial burden of repairs.

Ensure that your condo association has an earthquake insurance policy in place to protect against these types of damages.

Myth: Existing Insurance Policies Automatically Cover Earthquakes

Another common misconception is that existing insurance policies, such as homeowners or commercial property policies, automatically cover earthquake damage. In reality, earthquake coverage is often excluded from standard insurance policies, requiring a separate earthquake insurance policy or endorsement for adequate protection.

Review your current insurance policies with an experienced insurance agent to determine if additional earthquake coverage is needed for your condo association.

Myth: All Condo Association Earthquake Policies Are the Same

Not all earthquake insurance policies for condo associations are created equal. Each policy may have different coverage limits, deductibles, exclusions, and premiums. It’s essential to work with an experienced insurance agent to evaluate your condo association’s unique needs and select the most suitable policy for your budget and risk tolerance.

Do your research and compare multiple options before selecting an earthquake insurance policy for your condo association.

Remember that the cost of earthquake insurance pales in comparison to the cost of rebuilding an entire condo building.

Steps to Take After Purchasing Earthquake Insurance

Now that your condo association has secured earthquake insurance, there are several important steps you should take to ensure maximum protection and coverage in the event of an earthquake.

Step 1: Review Your Policy Documents

It’s important to thoroughly review your policy documents to understand the exact coverage and exclusions of your condo association earthquake insurance. Take note of coverage limits, deductibles, and any additional endorsements or riders that may be included.

Step 2: Educate Condo Owners

Make sure all condo owners are aware of the earthquake insurance policy and understand the claims process. Provide them with copies of the policy documents and answer any questions they may have to ensure everyone is on the same page.

Step 3: Maintain Open Communication with Your Insurance Provider

Keep the lines of communication open with your insurance provider and notify them immediately in the event of an earthquake. Work with them to file a claim, provide necessary documentation, and get the recovery process started as quickly as possible.

Step 4: Be Proactive in Disaster Preparedness

Having earthquake insurance is just one part of disaster preparedness. Make sure your condo association has a detailed emergency plan in place and that all owners are aware of it. Conduct regular earthquake drills and inspections to ensure the building is up to code and safe for occupants.

Following these steps can help ensure that your condo association is fully prepared and protected in the event of an earthquake. Remember, being proactive and informed is the key to minimizing the potential damage and maintaining the value of your property.

Conclusion

Protecting your condo association from earthquake damage is crucial for maintaining the value of your property and peace of mind. As discussed in this article, earthquake insurance for condo associations can provide financial protection and expedite the recovery process in the event of a seismic event. When exploring your options, it’s important to consider your unique circumstances such as your geographical location, building age and construction type, and financial stability.

It’s also important to review policy limits, exclusions, and liability coverage to ensure adequate protection. By working with an experienced insurance agent, you can make an informed decision and select the most suitable option for your condo association’s needs.

Remember that purchasing earthquake insurance is only the first step. After obtaining coverage, it’s crucial to review policy documents, educate condo owners about coverage and claims procedures, and maintain open communication with your insurance provider. By taking these necessary steps, you can ensure that your condo association is prepared for potential earthquake events.

Don’t wait until it’s too late. Protect your condo association with earthquake insurance today.

FAQ

Q: What does earthquake insurance for condo associations cover?

A: Earthquake insurance for condo associations typically covers damages caused by seismic events, including structural repairs, loss of personal property, and additional living expenses. It may also provide liability coverage for injuries or property damage caused by earthquakes.

Q: How is condo association earthquake insurance different from individual condo owner insurance?

A: Condo association earthquake insurance covers the shared property and common areas of the condo association, while individual condo owner insurance typically only covers the unit and personal belongings of the owner. Condo association insurance is essential to protect the collective interests of all condo owners.

Q: What are the options available for condo associations when it comes to earthquake insurance?

A: Condo associations have various options for earthquake insurance, including standalone earthquake policies, endorsements to existing policies, and group coverage options. Working with an experienced insurance agent can help determine the most suitable option for the condo association.

Q: What are the benefits of having earthquake insurance for condo associations?

A: Earthquake insurance provides financial protection for condo associations in the event of earthquake-related damages. It covers structural repairs, loss of personal property, and can help expedite the recovery process for the association. It also helps maintain the overall value of the property.

Q: What is condo association earthquake liability coverage?

A: Condo association earthquake liability coverage protects the association from legal claims and lawsuits arising from injuries or property damage caused by earthquake events. It is an important aspect of comprehensive earthquake insurance for condo associations.

Q: What factors should condo associations consider when choosing earthquake insurance?

A: Condo associations should consider factors such as the geographical location of the property, the building’s age and construction type, and the association’s financial stability. A comprehensive risk assessment is essential to determine the appropriate coverage for the condo association.

Q: What are common misconceptions about condo association earthquake insurance?

A: Common misconceptions include the belief that individual condo owners are solely responsible for earthquake damage or that existing insurance policies automatically cover earthquakes. It is important to have accurate information and understand the specific insurance needs of condo associations.

Q: What steps should condo associations take after purchasing earthquake insurance?

A: After purchasing earthquake insurance, condo associations should review the policy documents, educate condo owners about coverage and claims procedures, and maintain open communication with the insurance provider. Being proactive in preparing for potential earthquake events is crucial.