If you’re a college student living in a dorm, you may be wondering who is responsible for insuring the building and its contents. In most cases, the college or university itself is responsible for obtaining insurance coverage for the dormitory building and common areas such as hallways and lounges.

However, when it comes to insuring personal belongings inside the dorm room, the responsibility typically falls on the student. That means you will need to obtain your own insurance policy to cover your personal property, such as clothing, electronics, and furniture.

Keep in mind that the exact insurance coverage and responsibility may vary depending on the specific college or university as well as the type of dormitory. It’s important to check with your school and insurance provider to ensure that you have the appropriate coverage and that you understand your responsibilities.

Key Takeaways:

- The college or university is generally responsible for obtaining insurance coverage for the dormitory building and common areas.

- Students are typically responsible for obtaining their own insurance to cover personal belongings in the dorm room.

- Insurance coverage and responsibility may differ depending on the school and type of dormitory.

Understanding College Dorm Insurance Coverage

When it comes to insurance responsibility in a college dorm, it’s essential to understand what dorm insurance coverage entails. Most universities require students to have some form of insurance coverage to protect themselves, their roommates, and their belongings.

Dorm insurance coverage typically includes liability coverage, which protects you in case you accidentally cause damage to someone else’s property or cause injury to another person. Your insurance may also cover damage to your personal belongings caused by theft, vandalism, or a natural disaster.

It’s important to read and understand the terms and conditions of your dorm insurance coverage before moving in, so you know what is and isn’t covered. Some insurance policies may have limitations on the amount of coverage, and you may need additional insurance for items like high-value electronics or jewelry.

It’s also crucial to understand who is responsible for the insurance coverage in a college dorm. While some universities may offer insurance coverage as part of their student housing package, others may require students to purchase their own insurance. In some cases, parents’ homeowner’s insurance may also provide coverage for their child’s belongings in college dorms.

If you’re unsure about the insurance responsibility in your college dorm, it’s always best to check with your university’s housing office or speak with a licensed insurance agent to ensure you have adequate coverage for your needs.

Understanding College Dorm Insurance Coverage

If you’re still confused about the details of your dorm insurance coverage, consider speaking with an insurance agent who can answer any questions you may have. They can help you determine if you need additional insurance coverage and provide you with a clear understanding of your responsibilities as a policyholder.

The Role of Students in College Dorm Insurance

If you’re a college student living in a dorm, you may be wondering who is responsible for insurance coverage. While the college or university may have insurance coverage for the dorm building itself, this coverage may not extend to the personal belongings of individual students.

So, who pays for insurance in a dorm? Generally, it’s up to each individual student to secure their own insurance coverage for their personal belongings within the dorm. This type of insurance is known as student dorm insurance coverage.

While it may seem like an unnecessary expense, having student dorm insurance coverage can provide peace of mind and financial protection in the event of theft, damage, or loss of personal belongings.

It’s important to note that each college or university may have different policies and requirements for student dorm insurance coverage. Some may require students to have a certain amount of coverage, while others may offer optional insurance plans for students to choose from.

Before purchasing student dorm insurance coverage, it’s a good idea to check with your college or university to see if they have any specific requirements or recommendations for insurance providers.

Next, we’ll delve deeper into the specifics of insurance coverage for students living in college dorms.

Insurance Coverage for Students in College Dorms

As a college student living in a dorm, it’s important to understand the extent of insurance coverage available to you. In general, most colleges and universities provide some level of insurance coverage for students living in dorms. However, it’s important to note that this coverage may be limited and may not cover all damages or losses that may occur.

The insurance coverage provided by your college or university may include protection for damages to your room or building due to fire, vandalism, or natural disasters. However, it may not cover damages or losses to personal belongings such as laptops, electronics, or jewelry. In such cases, it’s important to consider additional insurance options to ensure that your personal belongings are protected.

One option to consider is renters insurance, which provides coverage for personal property and liability protection for accidents that may occur in your dorm room. This type of insurance can be purchased through a private insurance company and is often very affordable for college students.

| Tip: | Make sure to review and understand the terms of any insurance coverage provided by your college or university before making any decisions on additional coverage |

|---|

Another insurance option to consider is a personal articles policy, which provides coverage for valuable items such as jewelry, artwork, and collectibles. This type of policy may be necessary if you have expensive items that may not be covered under your renters insurance policy.

It’s important to note that insurance coverage for students in college dorms can vary depending on the insurance company and policy. Make sure to shop around and compare policies to find the best coverage for your needs and budget.

Overall, protecting yourself and your personal belongings with appropriate insurance coverage is essential as a college student living in a dorm. Make sure to do your research and consider all options to find the best coverage for your specific needs.

Factors Affecting College Dorm Insurance Coverage

When it comes to obtaining insurance for living in a college dorm, there are a number of factors that can affect the coverage you receive. It’s important to be aware of these factors so that you can make informed decisions about your insurance coverage.

- Location of the Dorm: The location of your dorm can impact the cost and extent of coverage you receive. If your dorm is located in an area with high crime rates, it may be more expensive to insure.

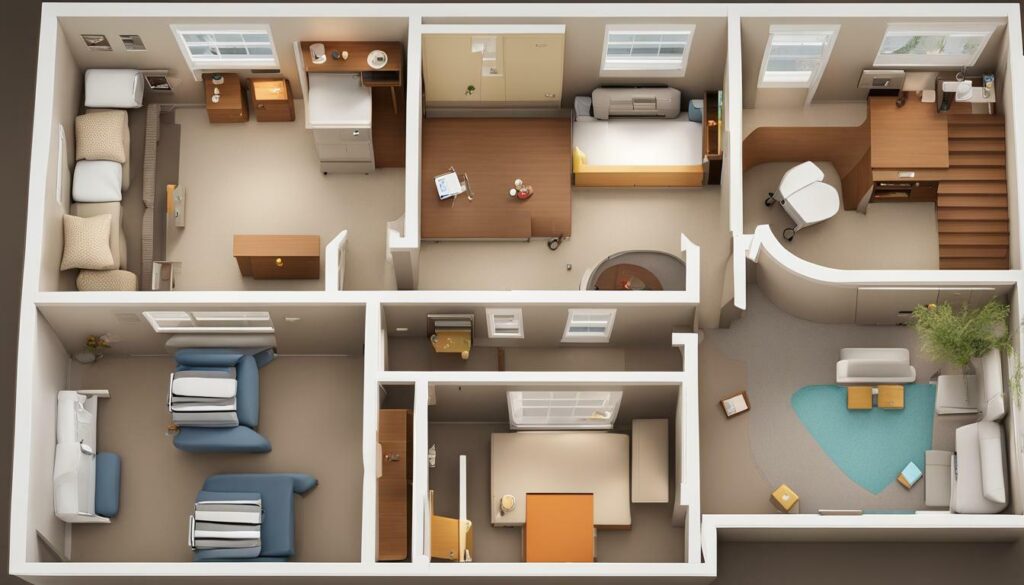

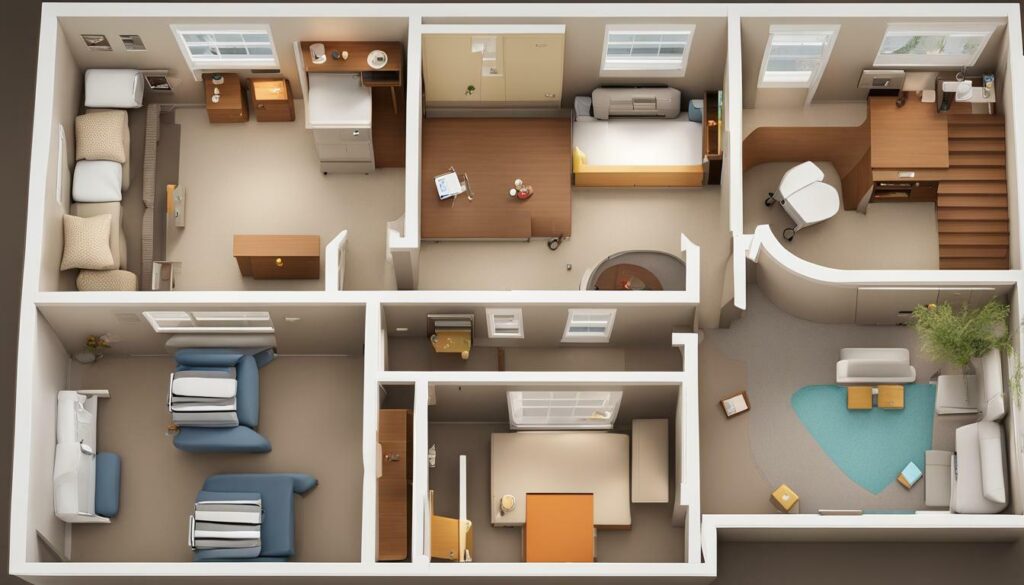

- Residence Type: Different types of residences may have different insurance requirements and coverage options. For example, a suite-style dorm may have different insurance needs than a traditional, communal-style dorm.

- Nature of Possessions: The items you bring to your dorm can impact your insurance coverage. Expensive electronics or jewelry may require additional coverage beyond what is offered in a standard dorm insurance policy.

- Policies of the College: The insurance policies of your college can also impact the coverage you receive. Some colleges may have specific requirements for insurance coverage or may offer their own insurance policies to students.

By considering these factors, you can ensure that you have appropriate insurance coverage for your needs and budget. It’s also important to regularly review and update your insurance coverage as needed, particularly if any of these factors change.

Additional Insurance Options for College Students

While dorm insurance coverage is typically provided by colleges or universities, it may not cover all incidents or damages. As a responsible student, it’s important to consider supplementing your dorm insurance coverage with additional options.

One option is renter’s insurance. This type of insurance provides coverage for your personal belongings, such as electronics, furniture, and clothing, in case of theft, fire, or other damages. It also covers liability for accidents that may occur in your dorm room, such as if a visitor is injured while on your property.

Another option is liability insurance. This type of insurance provides coverage in case you are responsible for damages or injuries to others, such as if you accidentally start a fire in your dorm room that spreads to other rooms.

When considering additional insurance options, it’s important to review the coverage limits and deductibles. You should also compare quotes from different insurance providers to find the best rates and coverage options for your needs.

Keep in mind that while additional insurance options can provide added peace of mind, you are responsible for paying the premiums. It’s important to budget for these extra expenses and to choose the coverage options that fit within your budget.

By supplementing your dorm insurance coverage with additional options, you can be better prepared for unexpected incidents and damages. Consider your options carefully to find the best coverage for your individual needs and budget.

Tips for Choosing the Right Dorm Insurance Coverage

When it comes to selecting the right dorm insurance coverage, there are a few key factors to consider.

- Review Your University’s Insurance Policy: Before selecting a dorm insurance policy, make sure you understand your university’s insurance policy. Some universities may already provide insurance coverage for students living in dorms, so you may not need to purchase additional coverage.

- Assess Your Needs: Consider what items you have in your dorm room that need insurance coverage. Do you have expensive electronics or valuable jewelry that require additional coverage? Make sure the policy you choose covers the items that are most important to you.

- Compare Policies: Don’t settle for the first insurance policy you come across. Take the time to compare policies from different providers to ensure you are getting the best coverage at the most affordable price.

- Read the Fine Print: Before signing up for a dorm insurance policy, make sure you read the fine print to understand what is covered and what is not. You don’t want to be caught off guard when it’s time to file a claim.

- Consider Adding a Personal Liability Policy: In addition to dorm insurance coverage, you may also want to consider a personal liability policy. This will protect you in the event that someone is injured in your dorm room and decides to take legal action against you.

By following these tips, you can ensure that you choose the right dorm insurance coverage for your needs and have the peace of mind knowing that your belongings are protected.

Understanding Insurance Claim Process for College Dorms

If you experience any incidents while living in a college dorm, such as theft or damage to your personal property, you may need to file an insurance claim. Here is a step-by-step guide on how to do so.

- Report the incident to the appropriate authorities: Before filing an insurance claim, make sure you report the incident to the relevant authorities, such as your dorm supervisor or campus security. This will help you establish a record of the incident and ensure that any necessary investigations are conducted.

- Review your insurance policy: Take a close look at your college dorm insurance policy to review the coverage limits and any exclusions. This will help you understand what you can and cannot claim for.

- Document the damages: Gather as much evidence as possible to support your claim. Take photos or videos of the damages, and keep any receipts or other relevant documents that can establish the value of your personal property.

- Contact your insurance provider: Contact your insurance provider to inform them of the incident and file a claim. Be prepared to provide them with the evidence you have collected, as well as any other information they require to process your claim.

- Cooperate with the investigation: Your insurance provider will likely conduct an investigation into your claim to verify the details and assess the damages. Cooperate with them throughout the process and provide them with any additional information they request.

- Wait for the outcome: Your insurance provider will review your claim and determine whether to approve or deny it. If approved, they will provide you with compensation or repair services according to the terms of your policy. If denied, they will explain the reasons for the denial.

Remember, it’s important to understand the claims process and your policy coverage before incidents happen, so that you can be prepared and protect your personal property appropriately.

For more information on insurance coverage for students in college dorms, check out our other sections.

The Role of Students in College Dorm Insurance

When it comes to insurance coverage in college dorms, students may wonder whether or not they are responsible for it. The answer to this question may vary depending on the school and the type of insurance policy. Generally, the responsibility for dorm insurance lies with the college or university.

However, it’s important to note that some schools may require students to obtain their own insurance policy. In this case, it is the responsibility of the student to obtain the necessary coverage. Additionally, if a student causes damage to the dorm or other students’ property, they may be held responsible for the related expenses.

It’s essential for students to understand their college dorm insurance responsibility and ensure they have the appropriate coverage. This can help protect them financially in the case of unexpected incidents, such as theft or damage to personal property. Be sure to review your school’s policies and consult with an insurance professional to determine the best course of action for your specific situation.

Insurance Coverage for Personal Belongings in College Dorms

If you’re a college student living in a dorm, it’s important to consider the extent of insurance coverage for your personal belongings. In most cases, the insurance coverage provided by the college or university will only cover the building and common areas, leaving your personal belongings unprotected in the event of theft, damage or other incidents.

Fortunately, there are insurance options available specifically designed for college students. Some of these policies offer coverage for personal belongings such as laptops, furniture, clothing, and electronics while others provide liability protection in case someone is injured in your dorm room.

When selecting an insurance policy for your personal belongings, it’s important to review the coverage limits and deductibles. Some policies may have low premiums but high deductibles, which means that you would have to pay a significant amount out of pocket before the insurance company would cover any losses. On the other hand, some policies may have high premiums but low deductibles, which means that you would pay less out of pocket but the overall cost of the policy would be higher.

Make sure to read the fine print and understand the terms of the policy before signing up. You may also want to consider adding additional coverage for specific items, such as expensive jewelry or musical instruments, if the coverage limits of the policy are not sufficient.

Remember, college dorm insurance coverage may not be enough to protect your personal belongings. It’s important to take the necessary steps to safeguard your valuable items, such as using a lock on your dorm room door, backing up important files on a cloud service, and keeping an inventory of your belongings.

By taking the time to understand your insurance coverage options and taking measures to protect your personal belongings, you can have peace of mind knowing that you’re financially protected in case of an incident.

Conclusion

Congratulations! You have reached the end of our comprehensive guide on college dorm insurance coverage. We hope this article has been helpful in addressing your concerns and questions about insurance for college students living in dorms.

Remember, it’s important to understand the general coverage of insurance in college dorms and who is responsible for it. Additionally, you should explore the specific insurance coverage options available for students living in college dorms and consider additional insurance options to supplement your dorm insurance coverage.

Takeaways

To summarize, here are the key takeaways:

- Typically, the college or university covers the insurance for college dorms.

- Understanding college dorm insurance coverage is crucial to ensure adequate protection against incidents that may occur in dorms.

- While the college generally covers dorm insurance, students should still be aware of their responsibilities and whether they need additional coverage.

- Factors such as the type of dorm and location can affect the insurance coverage for students in college dorms.

- It’s important to choose the right dorm insurance coverage and understand the claims process for incidents that may occur in college dorms.

- Sharing a college dorm can affect insurance coverage and responsibilities.

- Lastly, students should be aware of the extent of insurance coverage for personal belongings in college dorms and take steps to protect their valuable items.

We hope the information provided in this article helps you make informed decisions about insurance coverage in college dorms. Stay safe and protect yourself with adequate insurance coverage!

FAQ

Q: Who is generally responsible for covering insurance in a college dorm?

A: The responsibility for insurance coverage in a college dorm can vary depending on the specific circumstances. In some cases, the college or university may provide insurance coverage for students living in the dorms. However, it is always recommended for students to check with their college or university to understand the insurance policies and any additional coverage they may need.

Q: What does college dorm insurance coverage typically include?

A: College dorm insurance coverage typically includes protection for personal belongings against theft, fire, water damage, and other covered perils. It may also provide liability coverage in case someone is injured in the dorm room or if the student accidentally damages someone else’s property. However, the specific coverage and limits can vary depending on the insurance policy.

Q: Are students responsible for paying for college dorm insurance?

A: The responsibility for paying for college dorm insurance can depend on the college or university’s policies. Some institutions may include the cost of insurance coverage in the dorm fees or tuition, while others may require students to purchase their own insurance. It is important for students to clarify this with their college or university to ensure they have the appropriate coverage in place.

Q: What other insurance options are available for college students?

A: In addition to dorm insurance coverage, college students may consider other insurance options to supplement their coverage. These may include renter’s insurance if they move off-campus, health insurance, auto insurance if they have a car on campus, and personal property insurance for valuable items such as laptops or jewelry.

Q: What factors can affect the insurance coverage for students in college dorms?

A: Several factors can affect the insurance coverage for students in college dorms, including the location of the dorm, the presence of security measures, the type of insurance policy, and any additional coverage options chosen by the student. It is important for students to carefully review their insurance policies and understand any limitations or exclusions that may apply to their coverage.

Q: How can college students choose the right dorm insurance coverage?

A: To choose the right dorm insurance coverage, college students should consider their specific needs and circumstances. They should review the coverage options available, assess the value of their belongings, and evaluate the limits and deductibles of different insurance policies. It may also be helpful to seek advice from insurance professionals or consult with the college or university’s insurance department.

Q: What is the process for filing an insurance claim for incidents in college dorms?

A: The process for filing an insurance claim for incidents that occur in college dorms typically involves notifying the insurance company as soon as possible, documenting the incident and any damages or losses, providing supporting evidence or witnesses if available, and working with the insurance company to complete any required forms or documentation. It is important for students to familiarize themselves with their insurance policy and follow the specific claim procedures outlined by their insurance provider.

Q: What factors should be considered when sharing a college dorm?

A: When sharing a college dorm, it is important to consider the insurance coverage and responsibilities. Students should discuss and clarify who is responsible for purchasing insurance and the coverage limits. It may be beneficial to create an inventory of shared belongings and consider separate insurance coverage for personal belongings. Additionally, establishing ground rules for personal property and liability can help prevent disputes and ensure everyone is protected.

Q: What insurance coverage is available for personal belongings in college dorms?

A: Insurance coverage for personal belongings in college dorms typically includes protection against theft, fire, water damage, and other covered perils. The extent of coverage can vary depending on the insurance policy and its limits. Students may choose to purchase additional coverage or riders for valuable items such as electronics, jewelry, or musical instruments.