If you’ve ever wondered whether your home insurance would cover the unfortunate event of your roof caving in, then you’re certainly not alone. It’s a concern that many homeowners have, and rightfully so. After all, your roof is a fundamental part of your house’s structure and protecting it is crucial. In this article, we’ll explore whether home insurance policies typically provide coverage for roof cave-ins and provide you with the information you need to make an informed decision. So, let’s find out if you’re covered when your roof takes an unexpected nosedive!

What is home insurance?

Home insurance is a type of insurance policy that provides financial protection for your home and its contents in case of damage, loss, or theft. It helps cover the costs of repairing or replacing your home and personal belongings in the event of covered perils, such as fire, theft, or natural disasters. Home insurance provides peace of mind knowing that you are financially protected and can rebuild your life in the event of a covered loss.

Definition

Home insurance, also known as homeowner’s insurance or property insurance, is a contract between you and an insurance company. The policy lays out the terms and conditions, as well as the coverage limits and exclusions. You pay a premium to the insurance company, and in return, they agree to cover certain risks and provide compensation for covered losses.

Types of home insurance policies

There are different types of home insurance policies to suit different needs. The most common types include:

-

HO-1 Basic form: This policy provides limited coverage for a handful of perils, such as fire, lightning, vandalism, and theft.

-

HO-2 Broad form: This policy includes coverage for a broader range of perils, including those covered in the HO-1 policy, as well as additional perils like water damage and falling objects.

-

HO-3 Special form: This is the most popular type of home insurance policy. It offers coverage for all perils, except those specifically excluded in the policy. It provides comprehensive protection for both the structure and contents of your home.

-

HO-4 Renter’s insurance: This policy is specifically designed for tenants renting a property. It covers a tenant’s personal belongings and liability, but does not include coverage for the structure itself.

-

HO-5 Comprehensive form: This is a high-level policy that offers extensive coverage for the structure and personal belongings. It provides all-risk coverage, meaning it covers all perils unless specifically excluded.

-

HO-6 Condo insurance: Condo insurance is tailored to the unique needs of condo owners. It covers personal property and liability, as well as any improvements or alterations made to the unit.

-

HO-8 Older home insurance: This policy is designed for older homes that may not meet the replacement value requirements of other policy types. It provides coverage for the actual cash value of the home, taking into account its age and condition.

What does home insurance typically cover?

Home insurance policies typically provide coverage for the following:

-

Dwelling: The structure of your home, including the walls, roof, and foundation.

-

Other structures: Detached structures on your property, such as sheds, garages, and fences.

-

Personal property: Your belongings inside the home, including furniture, appliances, clothing, and electronics.

-

Liability: Protection against lawsuits and claims for bodily injury or property damage that you or your family members may cause to others.

-

Additional living expenses: If your home is uninhabitable due to a covered loss, your policy may cover the cost of temporary living arrangements, such as a hotel or rental property.

It is important to note that coverage limits and exclusions vary between policies, so it is essential to carefully review your policy and discuss any specific coverage needs with your insurance provider.

Understanding roof cave-ins

Roof cave-ins can be a serious and costly issue for homeowners. It occurs when the structural integrity of the roof is compromised, leading to a partial or complete collapse. Understanding the causes and signs of roof cave-ins can help homeowners take necessary precautions and effectively address any potential risks.

Causes of roof cave-ins

Several factors can contribute to roof cave-ins, including:

-

Snow accumulation: Heavy snowfall, especially in areas with cold climates, can put a significant load on the roof, leading to excessive weight and potential collapse.

-

Ice dams: Ice dams form when snow melts and refreezes along the edges of the roof. The accumulated ice can block proper drainage and cause water to penetrate the roof, leading to structural damage.

-

Age and deterioration: Over time, the materials used in roofing can deteriorate, compromising the structural integrity and making it more susceptible to collapse.

-

Improper construction: Poor construction practices, such as inadequate support beams or insufficient use of fasteners, can compromise the stability of the roof structure.

Signs of roof cave-ins

Recognizing the warning signs of a potential roof cave-in is crucial for homeowners to take appropriate action. Some common signs include:

-

Visible sagging: If you notice a significant dip or sagging in your roof, it could indicate structural damage and the potential for a collapse.

-

Cracked or bowed walls: A collapsing roof can cause the walls of your home to crack or bow inward due to the added pressure.

-

Unusual sounds: Creaking or popping sounds coming from the roof can indicate that the structure is under stress and at risk of collapsing.

-

Doors and windows that do not open or close properly: Shifting of the roof structure can cause misalignment in doors and windows, making them difficult to open or close.

It is essential to contact a professional roofing contractor immediately if you notice any of these signs to assess the situation and determine the appropriate course of action.

Coverage for roof cave-ins under home insurance

Home insurance policies typically provide coverage for roof cave-ins, but the extent of coverage may vary depending on the policy and its specific terms and conditions. Here is what you need to know about coverage for roof cave-ins under home insurance:

Standard home insurance policies

Standard home insurance policies, such as HO-3, generally cover damage to the structure of your home, including the roof, in the event of covered perils. However, it is important to review your policy carefully to understand the specific coverage limits and exclusions related to roof cave-ins.

Covered perils

Covered perils are events or circumstances that are included in your home insurance policy. While each policy may differ, common covered perils for roof cave-ins may include:

-

Weight of snow: If the collapse is caused by the weight of snow accumulation, it is usually covered by home insurance.

-

Ice dams: If the roof cave-in results from ice dams that cause extensive damage, the repairs may be covered.

-

Sudden damage: If the collapse is due to sudden and accidental causes like a fallen tree or severe storm, it is likely covered.

It is important to consult your policy or speak with your insurance provider to confirm the specific covered perils related to roof cave-ins.

Exclusions and limitations

While home insurance generally covers roof cave-ins, there may be certain exclusions and limitations that homeowners should be aware of. Common exclusions and limitations may include:

-

Wear and tear: Home insurance is not designed to cover normal wear and tear or aging of the roof that leads to a cave-in.

-

Negligence: If the cave-in results from neglect or failure to maintain the roof properly, it may not be covered by insurance.

-

Gradual deterioration: Home insurance typically excludes damage caused by gradual deterioration, such as rot or decay.

-

Earthquakes or floods: Standard home insurance policies typically do not cover damage caused by earthquakes or floods. Additional coverage may be required for these perils.

To ensure you have the appropriate coverage, it is essential to read your policy carefully and discuss any concerns or questions with your insurance provider.

Filing a claim for a roof cave-in

Experiencing a roof cave-in can be a stressful and overwhelming situation, but knowing how to file a claim with your insurance company can help expedite the process and ensure a smooth resolution. Here are the steps to follow when filing a claim for a roof cave-in:

Initial steps

-

Ensure safety: Before taking any action, ensure the safety of yourself and your family members. If there is a risk of further collapse or structural instability, evacuate the premises and seek professional assistance.

-

Document the damage: Take photographs or videos of the damage to document the extent of the roof cave-in. This evidence will be essential during the claim process.

Documentation required

When filing a claim for a roof cave-in, you will need to gather the necessary documentation to support your case. This may include:

-

Proof of ownership: Provide documentation that proves you are the homeowner, such as a copy of the deed or mortgage statement.

-

Policy information: Have your home insurance policy details readily available, including the policy number, coverage limits, and contact information for your insurance provider.

-

Evidence of the cave-in: Present the photographs or videos you took of the damage as evidence of the roof cave-in. This visual documentation will be crucial for your claim.

-

Receipts and estimates: Keep records of any expenses incurred as a result of the roof cave-in, such as temporary living arrangements or emergency repairs. Collect estimates from reputable contractors for the cost of repairing or rebuilding the roof.

Contacting the insurance company

Contact your insurance company as soon as possible following the roof cave-in. Report the claim and provide all the necessary documentation to support your case. Be prepared to answer questions regarding the cause of the cave-in, the condition of the roof prior to the incident, and any other relevant details.

Claim evaluation and payment

After filing a claim, your insurance company will assign an adjuster to evaluate the damage and determine the reimbursement amount. The adjuster will assess the evidence provided, review your policy coverage, and negotiate with contractors on the cost of repairs or rebuilding. Once the evaluation is complete, the insurance company will issue a payment to cover the approved expenses, subject to any applicable deductibles.

It is worth noting that the claims process can vary between insurance companies, so it is important to ask for guidance and follow the specific instructions provided by your insurance provider.

Preventing roof cave-ins

Prevention is crucial when it comes to protecting your home from roof cave-ins. By implementing a few preventive measures, you can significantly reduce the risk of structural damage and the potential for a costly collapse. Here are some steps you can take to prevent roof cave-ins:

Regular roof maintenance

Regular roof maintenance is essential in ensuring its structural integrity. Schedule annual inspections by a professional roofing contractor who can identify any potential weaknesses or signs of damage. Promptly address any issues identified during the inspection, such as missing shingles, leaks, or damage to the roof structure.

Removing excess snow

If you live in an area prone to heavy snowfall, it is important to remove excess snow from your roof. Using a roof rake or hiring professionals to clear the snow can help alleviate the weight on the roof and reduce the risk of cave-ins. Do not attempt to remove snow yourself if it requires climbing onto the roof, as this can be dangerous.

Ensuring proper attic insulation

Proper attic insulation helps regulate the temperature inside your home and prevents ice dams from forming on the roof. Insulation helps maintain a consistent temperature, minimizing the risk of snow melting and refreezing along the edges of the roof. Ensure that your attic is adequately insulated to prevent ice dams and potential roof cave-ins.

Trimming overhanging trees

Overhanging tree branches can pose a threat to the structural integrity of your roof. During storms or heavy winds, these branches can come into contact with the roof, causing damage and potentially leading to a cave-in. Regularly trim overhanging branches to prevent contact with the roof, reducing the chances of a collapse.

Implementing these preventive measures can help protect your home from roof cave-ins and minimize the likelihood of structural damage. Taking proactive steps to maintain your roof’s integrity can save you from significant repair costs in the long run.

Additional coverage options

While standard home insurance policies typically provide coverage for roof cave-ins, there are additional coverage options you may consider to enhance your protection. These options can provide added peace of mind and ensure you have adequate coverage for potential risks. Here are some additional coverage options to consider:

Adding endorsements to the policy

Endorsements, also known as riders or add-ons, are supplementary insurance policies that can be added to your existing home insurance policy to provide coverage for specific perils or items. You can consider adding endorsements that specifically cover roof cave-ins to enhance your protection and ensure you are adequately covered.

Scheduled personal property coverage

Standard home insurance policies have coverage limits for personal property, such as jewelry, antiques, or artwork. If you have high-value items, consider scheduling additional coverage for those specific items to ensure they are fully covered in the event of a roof cave-in or other covered loss.

Increased dwelling coverage

Standard home insurance policies have coverage limits for the dwelling, which may not be sufficient to cover the full cost of rebuilding in the event of a cave-in. Consider increasing your dwelling coverage to ensure you have enough coverage to completely rebuild your home if necessary.

Before making any changes to your insurance policy or adding additional coverage options, it is important to consult with your insurance provider to understand the costs and details associated with each option.

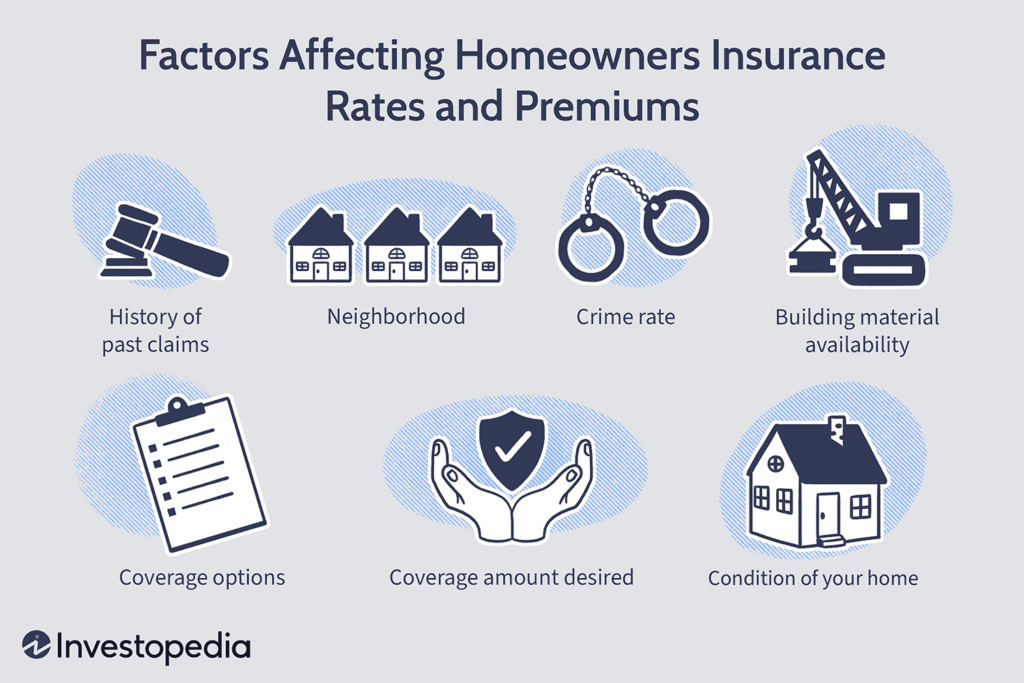

Factors affecting coverage

Several factors can affect the coverage and premiums for roof cave-ins under a home insurance policy. It is essential to consider these factors when evaluating your coverage needs and selecting the right insurance provider. Here are some factors that can impact coverage:

Age and condition of the roof

The age and condition of your roof can affect the coverage and premiums for roof cave-ins. Older roofs or roofs in poor condition may be considered higher risks for collapse and may require additional inspections or maintenance to maintain coverage.

Location

The geographical location of your home can impact the risk of roof cave-ins. Areas with heavy snowfall or harsh winter conditions are more susceptible to cave-ins. Insurance providers may consider the specific risks associated with your location when determining coverage and premiums.

Policy specifics

Different home insurance policies have varying coverage limits, exclusions, and deductibles. Review the specific terms and conditions of your policy to ensure it adequately covers roof cave-ins and any other specific risks you may be concerned about.

Insurance provider

Each insurance provider may have its own guidelines, coverage options, and claim processes. Research different insurance providers, read customer reviews, and compare coverage options to find the right fit for your needs.

Consider these factors when reviewing your coverage options and consult with an insurance professional to understand how they may impact your coverage for roof cave-ins.

Policy exclusions for roof cave-ins

While home insurance typically covers roof cave-ins, there may be certain exclusions and limitations that homeowners should be aware of. Understanding these exclusions can help you assess your coverage needs and consider additional coverage options if necessary. Here are some common exclusions for roof cave-ins:

Wear and tear

Home insurance is not designed to cover maintenance-related issues or normal wear and tear. If a roof cave-in occurs as a result of gradual damage or aging, it may not be covered by insurance. Regular maintenance and timely repairs can help minimize the risk of a cave-in due to wear and tear.

Negligence

If the cause of the roof cave-in is determined to be negligence or failure to properly maintain the roof, it may not be covered by insurance. Homeowners are responsible for ensuring the structural integrity of their roofs and taking preventative measures as necessary.

Gradual deterioration

Damage caused by gradual deterioration, such as rot or decay, is typically not covered by home insurance. Making regular inspections, addressing any signs of deterioration promptly, and maintaining proper ventilation can help prevent gradual damage and potential cave-ins.

Earthquakes or floods

Standard home insurance policies typically do not cover damage caused by earthquakes or floods. If you live in an area prone to these perils, considering additional coverage, such as earthquake insurance or flood insurance, may be necessary to protect against roof cave-ins resulting from these events.

Understanding these exclusions and limitations is crucial in assessing your coverage needs and considering any additional coverage options you may require.

Comparing insurance policies

When it comes to selecting a home insurance policy that covers roof cave-ins, it is important to do your research and compare different providers. Here are some steps to help you make an informed decision:

Researching different providers

Research and compare different insurance providers to understand their reputation, customer service ratings, and coverage options. Read customer reviews and seek recommendations from friends or family members who have had positive experiences with their insurance providers.

Analyzing coverage options and terms

Review the coverage options, terms, and conditions of each policy carefully. Compare coverage limits, deductibles, and exclusions related to roof cave-ins. Ensure that the policy you choose provides adequate coverage for your specific needs and priorities.

Considering premium costs

While price should not be the sole determining factor, consider the premium costs associated with each policy and how they fit within your budget. Evaluate the value provided by each policy and the level of coverage you are comfortable with.

By thoroughly researching and comparing insurance policies, you can choose the one that best suits your needs and provides the coverage you require.

Seeking professional advice

When exploring coverage options for roof cave-ins, seeking professional advice can be highly beneficial. Insurance agents, brokers, public adjusters, and roofing contractors can all provide valuable guidance and expertise. Here are some professionals you may consult:

Consulting an insurance agent or broker

Insurance agents or brokers specialize in helping individuals find appropriate coverage based on their specific needs and preferences. They can guide you through the process, explain coverage options, and answer any questions you may have. An agent or broker can help you navigate the complexities of insurance policies and ensure you have the coverage you need.

Hiring a public adjuster

A public adjuster is an independent insurance professional who can help you with the claims process. They can work on your behalf to assess the damage, negotiate with the insurance company, and help ensure a fair settlement. Public adjusters have extensive knowledge of insurance procedures and can expedite the process of filing a claim for a roof cave-in.

Working with a roofing contractor

Roofing contractors have expertise in assessing and repairing roofs. They can provide valuable insights into the condition of your roof, identify any potential risks, and recommend preventive measures. Consult a reputable roofing contractor to assess your roof’s condition and provide guidance on maintenance and potential repairs.

Seeking professional advice can help you make informed decisions and ensure you have the appropriate coverage for roof cave-ins under your home insurance policy.

In conclusion, while home insurance generally covers roof cave-ins, it is essential to understand the specific coverage limits, exclusions, and conditions outlined in your policy. By implementing preventive measures, regularly maintaining your roof, and considering additional coverage options, you can protect your home from the devastating effects of a roof cave-in. Researching different insurance providers, analyzing coverage options, and seeking professional advice can help you choose the right policy that provides the necessary coverage for your home. Remember, proactive measures and comprehensive coverage can provide the peace of mind you need to protect your most valuable asset – your home.