When it comes to protecting your home, you want to make sure you’re covered from top to bottom – literally. So, should you have insurance look at your roof? In this article, we will explore the importance of having your roof inspected by your insurance company, why it matters, and the potential benefits it can bring. By the end, you’ll have a clearer understanding of whether or not it’s the right decision for you and your home.

Benefits of Having Insurance Inspect Your Roof

Assessing potential damage

Having insurance inspect your roof can help in assessing potential damage caused by various factors such as severe weather events, aging, or wear and tear. Insurance professionals are trained to identify signs of damage that may not be easily noticeable to the untrained eye. By detecting and addressing potential issues early on, you can prevent more extensive and costly repairs in the future.

Identifying hidden issues

Insurance inspections often reveal hidden issues that may not be apparent during a visual inspection. These hidden issues can include water damage, mold growth, or structural problems that could compromise the integrity of your roof. By identifying and addressing these hidden issues, you can ensure the long-term durability and safety of your roof.

Determining coverage eligibility

Insurance inspections play a crucial role in determining your coverage eligibility. By conducting a thorough assessment, insurance professionals can determine whether or not the damage to your roof is covered under your insurance policy. This can help you understand what repairs or replacements will be covered and provide you with peace of mind knowing that you have financial protection in case of unforeseen events.

When to Consider Having Insurance Inspect Your Roof

After a severe weather event

Severe weather events such as hailstorms, hurricanes, or heavy winds can cause significant damage to your roof. Even if the damage is not immediately visible, it is advisable to have insurance inspect your roof after such events. Insurance professionals have the expertise to identify subtle signs of damage that may worsen over time if not addressed promptly.

When selling or buying a home

Whether you are selling or buying a home, having insurance inspect the roof is essential. For sellers, an inspection can reveal any potential issues that might affect the sale price or slow down the selling process. For buyers, an inspection provides peace of mind, ensuring that the roof is in good condition and that there are no hidden problems that could lead to future expenses.

Periodically for maintenance purposes

Regular insurance inspections are also recommended for maintenance purposes. Roof maintenance is crucial for preserving its lifespan and preventing further damage. Insurance inspections can help catch minor issues before they escalate into more significant problems. By staying proactive with regular inspections, you can extend the life of your roof and avoid costly repairs down the line.

Steps to Take Before Contacting Insurance

Conduct a visual inspection

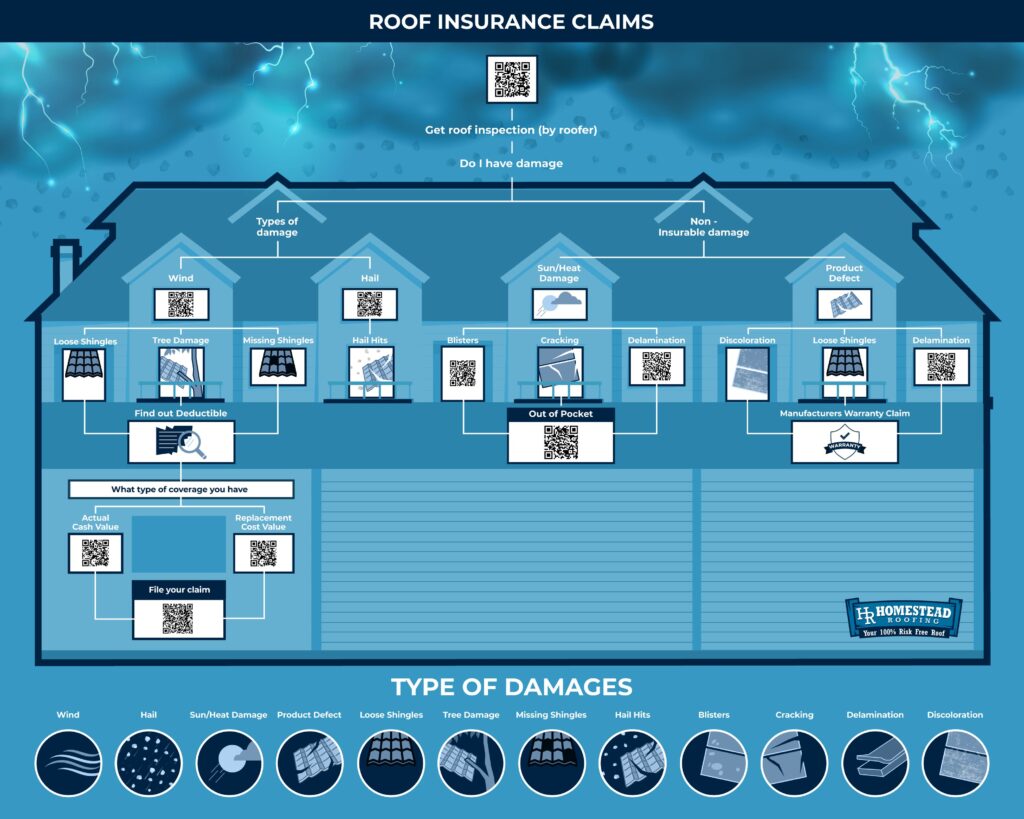

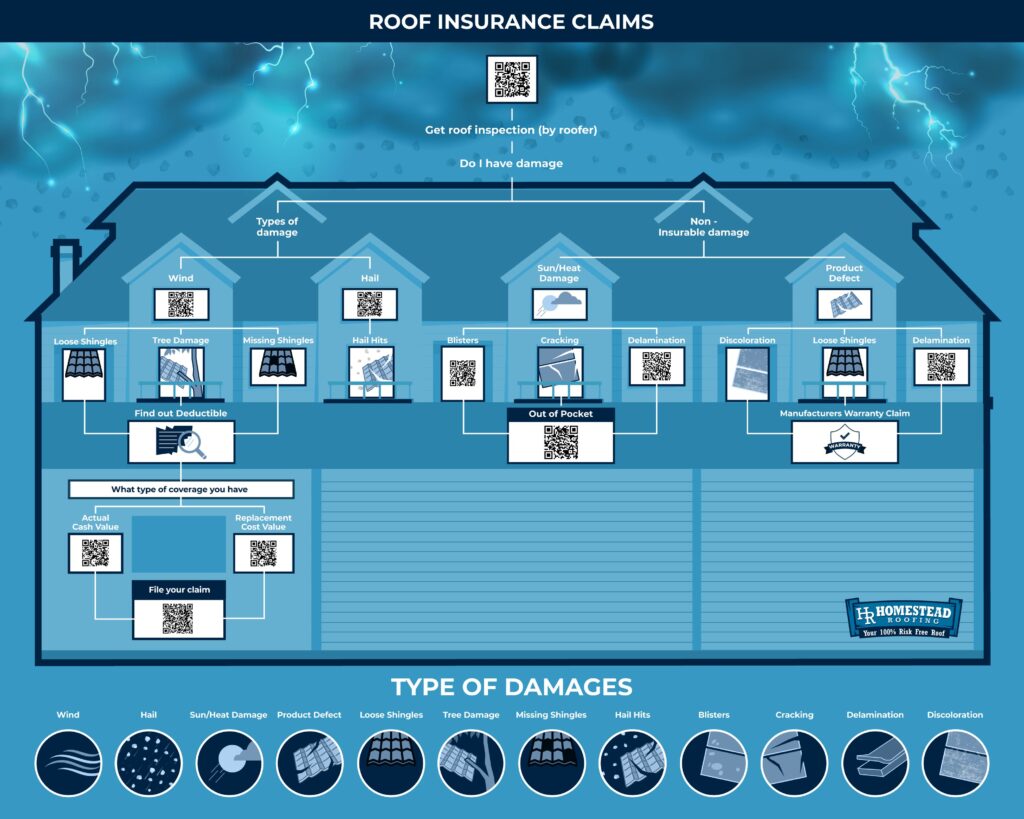

Before contacting your insurance provider, start by conducting a visual inspection of your roof. Look for any obvious signs of damage such as missing or loose shingles, water stains, or sagging areas. While a visual inspection can provide some initial information, it is important to remember that not all damage is visible to the naked eye. This is why involving insurance professionals in the inspection process is crucial.

Document any existing damage

Once you have identified any visible damage, document it by taking photographs or videos. This documentation will serve as evidence when filing a claim with your insurance company. Make sure to capture the extent of the damage from various angles and distances, as this will help support your claim in case of any disputes.

Review your insurance policy

Before contacting your insurance provider, take the time to review your insurance policy. Familiarize yourself with the coverage details, including deductibles, limits, and exclusions. This will help you understand what repairs or replacements are covered by your insurance and what expenses you may need to bear personally. Understanding your policy will also enable you to ask informed questions when discussing your claim with the insurance adjuster.

Choosing the Right Insurance Provider

Research reputation and financial stability

When choosing an insurance provider, it is important to research their reputation and financial stability. Look for reviews and ratings from reputable sources to gauge customer satisfaction and reliability. Additionally, check the financial strength ratings of insurance companies to ensure they have the resources to fulfill their obligations in the event of a claim.

Compare pricing and coverage options

Different insurance providers offer varying pricing and coverage options. Take the time to compare quotes from multiple providers to find the best fit for your needs and budget. Consider the coverage limits, deductibles, and any additional benefits offered by each provider. Don’t solely focus on the premium amount; rather, strive to strike a balance between cost and coverage.

Check for additional benefits and discounts

Beyond pricing and coverage, check for any additional benefits or discounts offered by insurance providers. Some companies offer incentives such as multi-policy discounts, deductible rewards for claim-free years, or discounts for installing certain safety features on your roof. These additional benefits can help you save money and enhance the overall value of your insurance policy.

Process of Having Insurance Inspect Your Roof

Filing a claim

To initiate the insurance inspection process, you will need to file a claim with your insurance provider. Contact your insurance company and provide them with the necessary information, including the date of the incident and a detailed description of the damage. The insurance company will guide you through the claim filing process and provide instructions on the next steps.

Coordinating with insurance adjuster

Once you have filed a claim, your insurance company will assign an insurance adjuster to assess the damage to your roof. The insurance adjuster will contact you to schedule an appointment for the inspection. It is crucial to be responsive and cooperative during this process to ensure a smooth and efficient inspection.

Scheduling the inspection

The insurance adjuster will work with you to schedule the roof inspection at a mutually convenient time. It is important to make sure you or a representative is present during the inspection to provide any necessary access and answer any questions the insurance adjuster may have. Clear your schedule accordingly, as the inspection may take some time depending on the size and complexity of your roof.

Preparing for the Insurance Roof Inspection

Clearing debris from the roof

Before the insurance inspection, make sure to clear any debris from your roof. Remove loose branches, leaves, or any other debris that may obstruct the view of the insurance adjuster. This will help ensure a thorough examination of your roof and prevent any potential safety hazards during the inspection.

Ensuring accessibility to attic and crawl spaces

The insurance adjuster may need access to your attic or crawl spaces to assess the condition of your roof from the interior. Make sure these areas are easily accessible by removing any obstacles or clutter. If necessary, provide a ladder or step stool to facilitate the inspection.

Taking note of previous repairs or replacements

Before the inspection, it is helpful to make a note of any previous repairs or replacements done to your roof. This information can provide context to the insurance adjuster and assist them in evaluating the overall condition of your roof. By being prepared and organized, you can help expedite the inspection process.

What to Expect During the Inspection

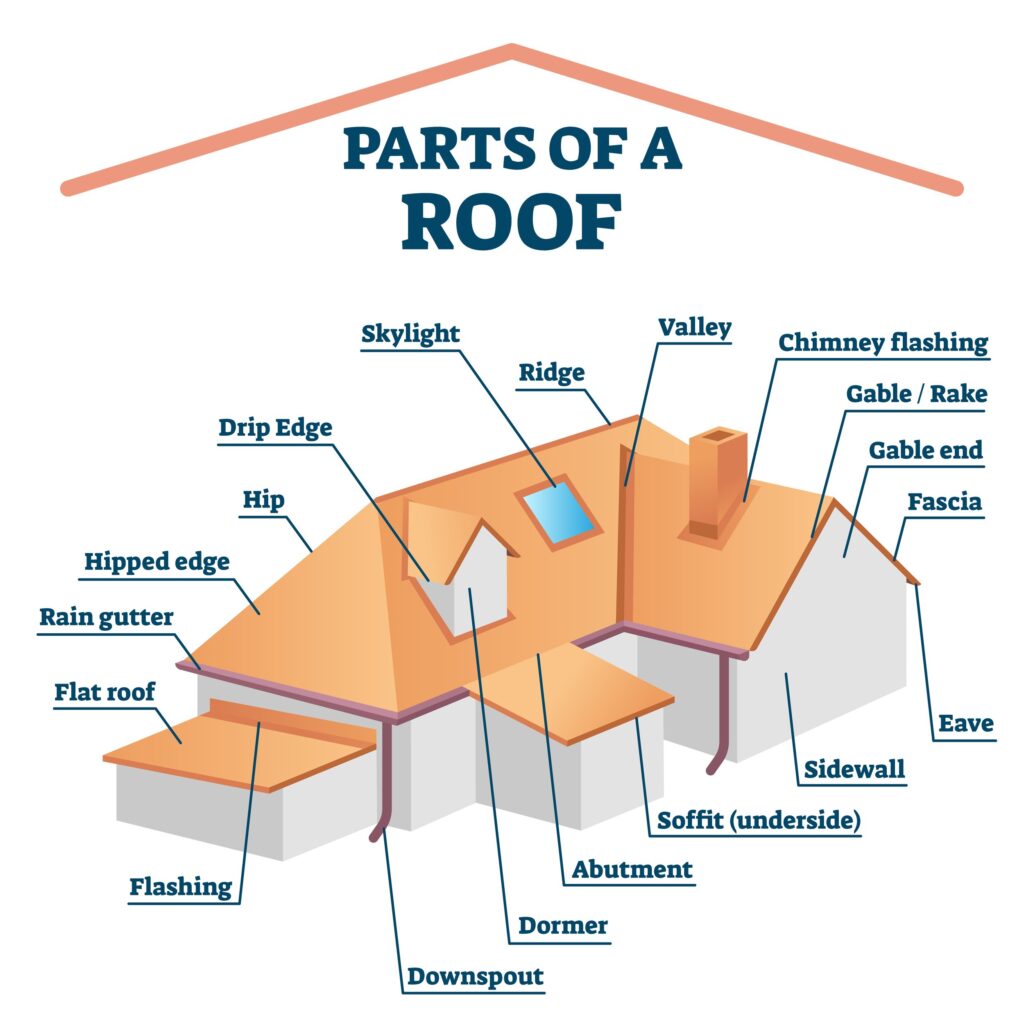

Thorough examination of roof condition

During the insurance roof inspection, the insurance adjuster will conduct a thorough examination of your roof’s condition. They will inspect the shingles, gutters, flashing, and other components to assess their integrity and any signs of damage. The insurance adjuster will also check for any potential weak points or areas prone to future problems.

Evaluation of structural integrity

Alongside the visual inspection, the insurance adjuster will evaluate the structural integrity of your roof. This includes checking for any signs of sagging, unevenness, or instability. Assessing the structural soundness of your roof is crucial, as it directly impacts its ability to withstand future weather events and protect your home.

Recording photographic evidence

To support the assessment and claim process, the insurance adjuster will take photographs or videos of the damage and the overall condition of your roof. These visual records serve as evidence and help in documenting the extent of the damage. Make sure to ask the insurance adjuster for copies of these records for your own documentation.

Post-Inspection Procedures

Receiving the inspection report

After the inspection is complete, the insurance adjuster will provide you with an inspection report detailing their findings. This report will outline the extent of the damage, the recommended repairs or replacements, and any associated costs. Review the inspection report carefully to ensure accuracy and understanding of the coverage and potential repairs required.

Reviewing coverage and potential repairs

Once you have received the inspection report, review your insurance policy to understand the coverage and limitations. Cross-reference the inspection report with your policy to determine what repairs or replacements will be covered by insurance. It may be necessary to consult with your insurance provider or a roofing professional to clarify any discrepancies or address any concerns.

Negotiating with insurance if necessary

In some cases, there may be disagreements or discrepancies between the insurance adjuster’s assessment and your expectations. If you believe the assessment to be inaccurate or incomplete, it is important to engage in open communication with your insurance provider. Provide any additional documentation or evidence that supports your claim and be prepared to negotiate to ensure fair coverage and resolution.

Common Insurance Roof Inspection Pitfalls

Denial of coverage based on pre-existing damage

Insurance providers may deny coverage if they determine that the damage to your roof existed prior to the incident being claimed. This can be a contentious issue as it may be challenging to prove when the damage occurred. To avoid potential denial of coverage, it is crucial to document any existing damage before filing a claim and consult with a roofing professional if needed.

Disagreements over repair costs

Insurance adjusters and policyholders may sometimes disagree on the cost estimates for repairs or replacements. If the insurance adjuster’s assessment does not align with your expectations or quotes from roofing professionals, it is important to engage in open and respectful communication with your insurance provider. Providing detailed documentation and multiple quotes can help support your case and ensure a fair resolution.

Lack of transparency in the inspection process

Occasionally, the lack of transparency in the insurance inspection process can lead to frustration and confusion for policyholders. To avoid this, communicate openly with your insurance provider throughout the process. Ask for clarification on any aspects of the inspection or the subsequent report that you do not understand. Transparency and clear communication are key to a smooth and satisfactory insurance roof inspection experience.

Alternative Options to Insurance Inspection

Hiring a professional roofer for an independent assessment

If you have concerns about the objectivity or accuracy of the insurance inspection, it may be beneficial to hire a professional roofer for an independent assessment. A qualified roofer can provide you with an unbiased evaluation of the damage and necessary repairs. This independent assessment can serve as a valuable second opinion or as supporting evidence during the insurance claim process.

Seeking multiple quotes for repairs

Obtaining multiple quotes from reputable roofing contractors is always a good practice when it comes to repairs or replacements. By comparing quotes, you can ensure that you are getting fair pricing and uncover any discrepancies between the estimate provided by the insurance adjuster and the market rate. Seeking multiple quotes also allows you to find a contractor that you feel comfortable working with.

Exploring financing options for roof replacement

If your insurance coverage is limited or does not include the necessary repairs or replacements, exploring financing options for roof replacement may be necessary. Some roofing companies offer financing plans or assistance programs that can help you manage the cost of a new roof. It is important to carefully evaluate the terms and interest rates before committing to any financing options.

In conclusion, having insurance inspect your roof offers numerous benefits, including the assessment of potential damage, identification of hidden issues, and determining coverage eligibility. It is important to consider insurance inspections after severe weather events, when selling or buying a home, and periodically for maintenance purposes. Before contacting your insurance provider, conduct a visual inspection, document any existing damage, and review your insurance policy. When choosing an insurance provider, research reputation, compare prices and coverage options, and check for additional benefits and discounts. The process of having insurance inspect your roof involves filing a claim, coordinating with the insurance adjuster, and scheduling the inspection. To prepare for the inspection, clear debris from the roof, ensure accessibility to attic and crawl spaces, and take note of previous repairs or replacements. During the inspection, expect a thorough examination of the roof condition, evaluation of structural integrity, and photographic evidence recording. After the inspection, review the inspection report, coverage, and potential repairs, and negotiate with insurance if necessary. Be aware of common pitfalls such as denial of coverage based on pre-existing damage, disagreements over repair costs, and lack of transparency in the inspection process. Finally, consider alternative options such as hiring a professional roofer for an independent assessment, seeking multiple quotes for repairs, or exploring financing options for roof replacement.