Imagine you’re enjoying a peaceful evening at home when suddenly, you hear a dripping sound. You look up and there it is – a roof leak. Panic sets in as you wonder what to do next. Is it worth the hassle to file an insurance claim for a roof leak? In this article, we will explore the factors you should consider when deciding whether or not to claim a roof leak on insurance. Stay with us to make an informed decision.

Factors to consider before making a claim

Severity of the roof leak

One of the first factors you should consider before making a claim for a roof leak is the severity of the damage. Is it just a small, manageable leak that can be easily repaired? Or is it a significant leak that requires extensive repairs? Assessing the severity of the roof leak will help you determine if making an insurance claim is necessary.

Cost of repairs

Another important factor to consider is the cost of repairs. Take into account the estimated cost of fixing the roof leak and determine if it exceeds your deductible. If the repairs are minor and the cost falls below your deductible, it may not be worth making an insurance claim as you would have to pay for the repairs out of pocket.

Policy coverage and deductibles

Review your insurance policy to understand what kind of coverage you have for roof leaks. Some policies may cover roof leaks caused by certain perils such as storms or fallen trees, while others may not provide coverage at all. Additionally, consider your deductible amount, which is the out-of-pocket expense you must pay before insurance coverage kicks in. Make sure you understand your policy’s deductibles and how they may impact your decision to make a claim.

Effect on future insurance premiums

It’s important to consider how making a claim for a roof leak may affect your future insurance premiums. Insurance companies may view frequent claims as a higher risk and could potentially increase your premiums or even cancel your policy. Assess the potential impact on your premiums before making a decision on whether to claim the roof leak on insurance.

Steps to take before claiming roof leak on insurance

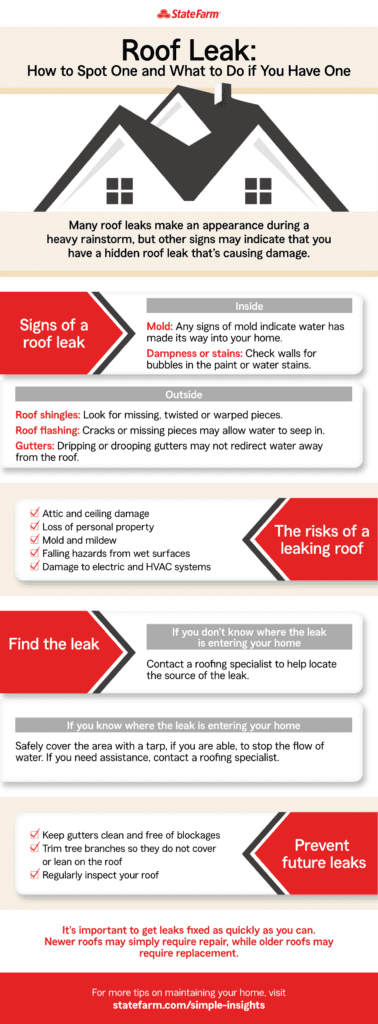

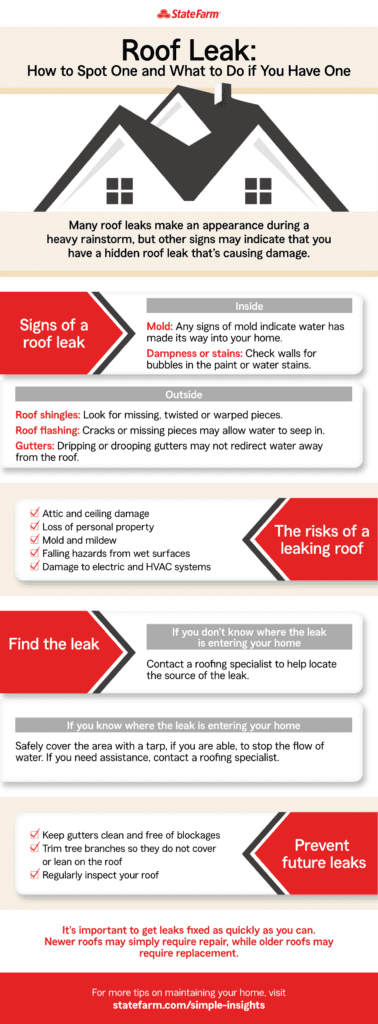

Assess the damage

Before you file an insurance claim for a roof leak, assess the extent of the damage. Determine if the leak is isolated to a specific area or if it has caused widespread damage. Look for signs of water stains, rot, or mold. This evaluation will help you provide accurate information to your insurance company and determine the best course of action.

Contact a professional roofer

Once you have assessed the damage, it’s advisable to contact a professional roofer for a thorough inspection. A roofer will have the expertise to identify the source of the leak, assess the overall condition of your roof, and provide an estimate for repairs. Their assessment is crucial in determining if making an insurance claim is necessary or if the repairs can be self-funded.

Document the damage

Before making an insurance claim, document the damage by taking photographs or videos. This documentation will serve as evidence to support your claim and can help the insurance company evaluate the extent of the damage. Be sure to capture clear images of the affected areas, as well as any collateral damage inside your home caused by the roof leak.

Understand your insurance policy

It’s essential to thoroughly read and understand your insurance policy before proceeding with a claim. Familiarize yourself with the coverage limits, deductibles, and any exclusions that may apply to roof leaks. Understanding your policy will help you determine if making a claim is the right decision and ensure that you follow the correct procedures when filing the claim.

Advantages of claiming a roof leak on insurance

Financial relief

One of the significant advantages of claiming a roof leak on insurance is the financial relief it provides. Repairs for a roof leak can be costly, and having insurance coverage can help offset some or all of the expenses. Depending on your policy, your insurance company may cover the cost of repairing the leak or even replacing the entire roof if necessary.

Coverage for additional damages

Another benefit of making an insurance claim is the potential coverage for additional damages caused by the roof leak. Water damage inside your home, such as ruined furniture or flooring, may also be covered under your policy. This can save you from incurring additional out-of-pocket expenses for repairs or replacements.

Speedy repairs

By making a claim, you can expedite the repair process. Insurance companies often work with a network of contractors and can quickly arrange for repairs to be done. Their expertise and resources can help ensure that the necessary repairs are carried out promptly, minimizing further damage to your property.

Protection against potential future leaks

If your insurance policy covers future roof leaks, making a claim for your current leak can provide you with added protection for potential future leaks. With the repairs or replacements done, you may have a reduced risk of experiencing further leaks in the near future, giving you peace of mind and potentially saving you from additional repair costs down the line.

Disadvantages of claiming a roof leak on insurance

Risk of increased premiums

One of the main disadvantages of making an insurance claim for a roof leak is the risk of increased premiums. Insurance companies may view frequent claims as a potential risk and adjust your premiums accordingly. Before making a claim, consider the potential long-term impact on your insurance premiums and weigh it against the benefits of making the claim.

Potential policy cancellations

In some cases, filing too many claims or claims for significant damages may lead to the cancellation of your insurance policy. Insurance companies may consider you a high-risk policyholder if you have a history of frequent claims or if the cost of the damages exceeds a certain threshold. Losing your insurance coverage can be a major inconvenience and may make it difficult to obtain new coverage in the future.

Limitations and exclusions

It’s crucial to be aware that insurance policies often have limitations and exclusions when it comes to roof leaks. Certain types of damage, such as wear and tear or neglect, may not be covered under your policy. Additionally, there may be limitations on the age or condition of the roof for coverage to apply. Understanding these limitations and exclusions can help you determine if making a claim is worth pursuing.

Higher deductibles

When making an insurance claim, you will typically have to pay a deductible out of pocket before coverage begins. Depending on your policy, the deductible for roof leaks may be higher than for other types of claims. Consider the amount of your deductible and evaluate if it is financially feasible for you to cover it before proceeding with a claim.

Alternative options to consider

Self-funding the repairs

If the cost of repairs for your roof leak is below your deductible or if the damage is minimal, you may choose to self-fund the repairs. This option eliminates the need to involve your insurance company and can avoid potential increases in premiums. However, it’s important to ensure that the repairs are done properly to prevent further damage and potential issues in the future.

Seeking assistance from a roofer

Instead of making an insurance claim, you can explore options for assistance from a roofer. Some professional roofers offer financing options or payment plans to help homeowners cover the cost of repairs. Discussing the available options with a roofer can help you find a more affordable way to address the roof leak without involving your insurance company.

Exploring roofing warranties

Check if your roof is still covered by any manufacturer’s warranties. If the leak is due to a defect in materials or workmanship, the manufacturer’s warranty may provide coverage for repairs or replacements. Understanding the terms and conditions of your roof’s warranty can help you avoid filing an insurance claim when alternative coverage is available.

Home warranty coverage

If you have a home warranty, it’s worth reviewing the policy to determine if roof leaks are covered. Some home warranty plans include coverage for specific components of your home, such as HVAC systems or plumbing, which may also include roof leaks. Consulting your home warranty provider can help you understand if this option is a viable alternative to making an insurance claim.

Steps to follow when making an insurance claim

Contact your insurance company

Before filing a claim, contact your insurance company to notify them of the roof leak. They will guide you on the next steps to take and provide you with any necessary forms or documentation required. Be prepared to provide details about the date and cause of the leak, as well as an estimate of the damages.

Provide necessary documentation

To support your insurance claim, gather all necessary documentation related to the roof leak. This may include photographs, videos, or written statements from professionals, such as roofers or contractors, who have inspected the damage. Make sure the documentation clearly shows the extent of the damage and any related expenses.

Schedule an inspection

The insurance company may require an inspection to assess the roof leak and verify the damages. They may send an adjuster or request that you hire an independent inspector to evaluate the extent of the damage. Cooperate with the inspection process and provide any access needed to thoroughly assess the situation.

Review the claim decision

After the inspection, the insurance company will review your claim and make a decision on coverage. They will inform you of their decision and provide an explanation of the amount they will cover, if applicable. Review the claim decision carefully to ensure accuracy and address any questions or concerns you may have.

Common mistakes to avoid when claiming roof leaks

Filing a claim for minor damages

Avoid filing a claim for minor damages that fall within your deductible. Making unnecessary claims can result in increased premiums or even policy cancellations. It’s important to assess the severity of the leak and the cost of repairs before deciding to make a claim.

Neglecting routine maintenance

Regular roof maintenance is crucial to prevent leaks and extend the lifespan of your roof. Neglecting routine maintenance, such as cleaning gutters or checking for signs of damage, may lead to roofing issues that are considered negligence by insurance companies. Stay proactive in maintaining your roof to avoid potential coverage issues.

Incomplete or insufficient documentation

Accurate and thorough documentation is essential when filing an insurance claim. Failing to provide sufficient evidence of the damages may result in a denied claim or reduced coverage. Take the time to gather all necessary documentation, including photographs, videos, and professional assessments, to support your claim.

Not understanding policy exclusions

Before filing a claim, familiarize yourself with the exclusions listed in your insurance policy. Some policies may have specific exclusions for roof leaks caused by certain perils or if the roof is past a certain age. Understanding these exclusions will help you set realistic expectations for your claim and avoid any potential surprises.

Tips for a successful roof leak insurance claim

Follow the claims process diligently

When making an insurance claim, ensure that you follow the claims process diligently. Adhere to the timelines and requirements set by your insurance company, and promptly provide any requested documentation. Following the correct procedures can help expedite your claim and ensure a smoother process.

Work with a reputable roofer

Collaborating with a reputable roofer is crucial when making a roof leak insurance claim. A skilled and experienced roofer can provide accurate assessments, documentation, and repairs that will support your claim. Choose a roofer with a solid reputation and positive customer reviews to ensure the best outcome for your claim.

Keep records of all communication

Maintain a record of all communication with your insurance company, including phone calls, emails, and written correspondence. This documentation will be valuable in case of any disputes or discrepancies during the claims process. Having a clear record of communication ensures that you can easily refer back to conversations and agreements.

Review the claim settlement

Once your claim is settled, carefully review the claim settlement to ensure that all damages and expenses have been covered correctly. If you believe there are discrepancies or missed items, discuss them with your insurance company and provide any additional documentation to support your case. It’s essential to address any issues before accepting the settlement.

Understanding insurance jargon related to roof leaks

Actual Cash Value (ACV)

Actual Cash Value (ACV) refers to the value of your property or possessions at the time of the loss. When it comes to roof leaks, insurance companies may base the claim settlement on the ACV, taking into account the depreciation of the roof since its installation. This means that the insurance company will consider the age and condition of the roof when determining the amount of coverage they provide.

Replacement Cost Value (RCV)

Replacement Cost Value (RCV) is the cost to replace or repair your property or possessions with materials of similar kind and quality without deducting for depreciation. For roof leaks, insurance companies may offer coverage based on the RCV, which means they will reimburse you for the full cost of repairing or replacing the damaged portion of your roof.

Coverage limits

Coverage limits refer to the maximum amount an insurance policy will pay for a covered loss. For roof leaks, your policy may have specific coverage limits that determine the maximum amount of reimbursement you can receive for repairs or replacements. It’s crucial to review your policy and understand the coverage limits to avoid any surprises during the claims process.

Deductibles and endorsements

Deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in. When it comes to roof leaks, your insurance policy may have a specific deductible for this type of claim. Additionally, endorsements are supplemental coverages that you can add to your policy to expand or enhance the coverage for roof leaks. Review your policy to understand the deductible and any available endorsements.

Conclusion

Deciding whether to claim a roof leak on insurance requires careful consideration of several factors. Assessing the severity of the leak, understanding the cost of repairs, and reviewing your insurance policy are crucial steps in the decision-making process. Claiming a roof leak on insurance can provide financial relief, coverage for additional damages, and speedy repairs. However, it also carries the risk of increased premiums, policy cancellations, limitations, and higher deductibles. Exploring alternative options and following the correct procedures when making a claim are essential for a successful outcome. By evaluating the pros and cons and making an informed decision, you can confidently navigate the process of claiming a roof leak on insurance.