Imagine this scenario: you come home after a long day at work, only to find your basement flooded due to a burst pipe. Panic sets in as you realize the repair costs could skyrocket. In such situations, filing a claim for water damage on your homeowner’s insurance seems like the logical step. However, have you ever wondered if it is actually a bad idea? In this article, we will explore the implications of claiming water damage on your homeowner’s insurance, helping you make an informed decision.

Is It Bad To Claim Water Damage On Your Homeowner’s Insurance?

Understanding Homeowner’s Insurance Policies

When it comes to protecting your home, homeowner’s insurance is an essential investment. It provides coverage for various types of damages, including water damage. However, before making a claim for water damage, it’s important to understand the specifics of your insurance policy.

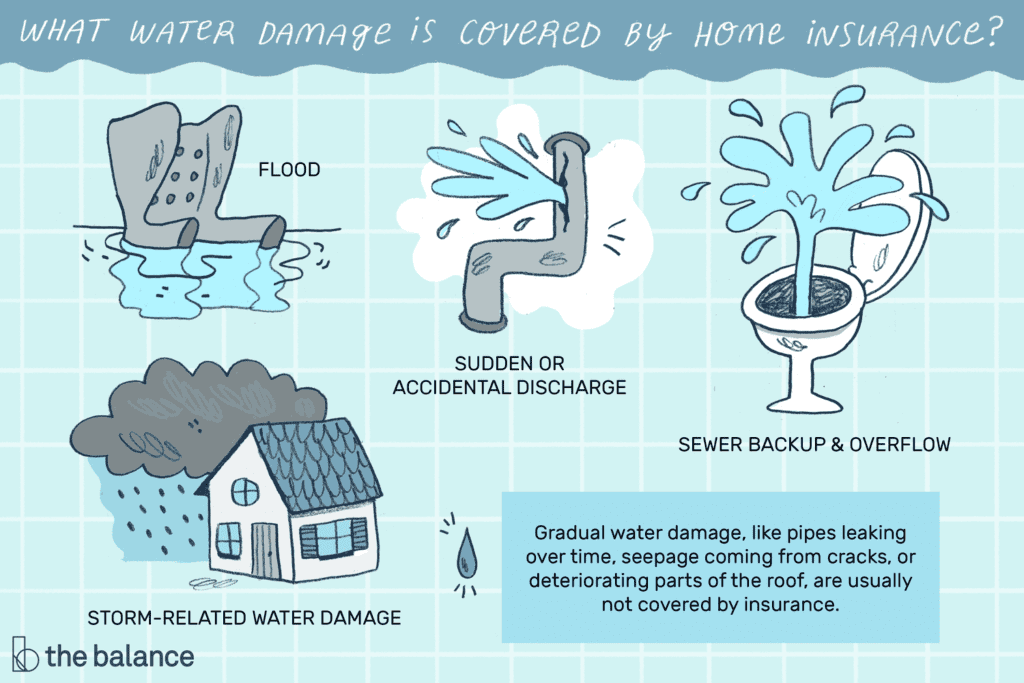

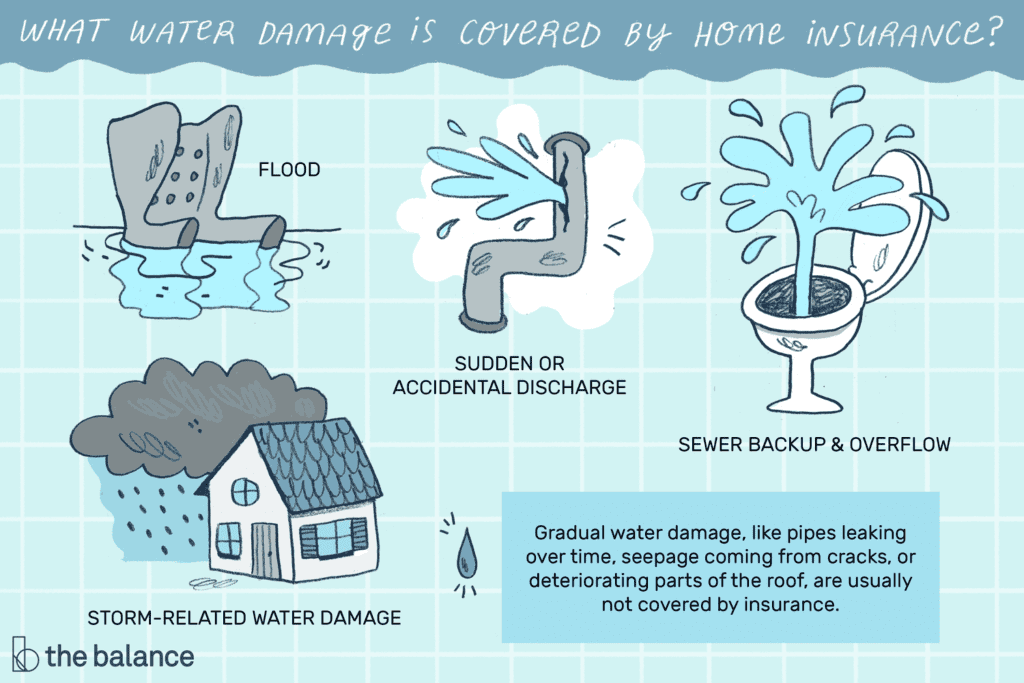

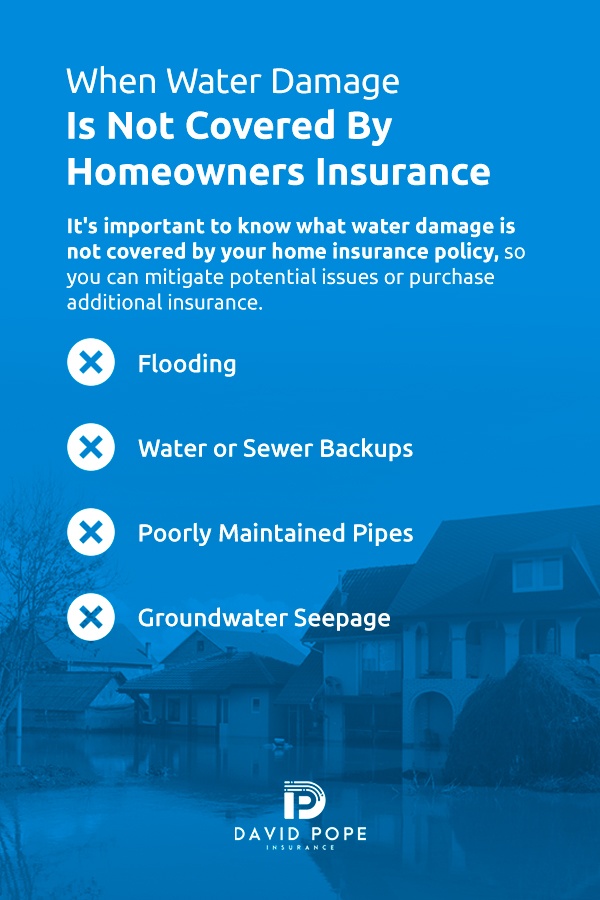

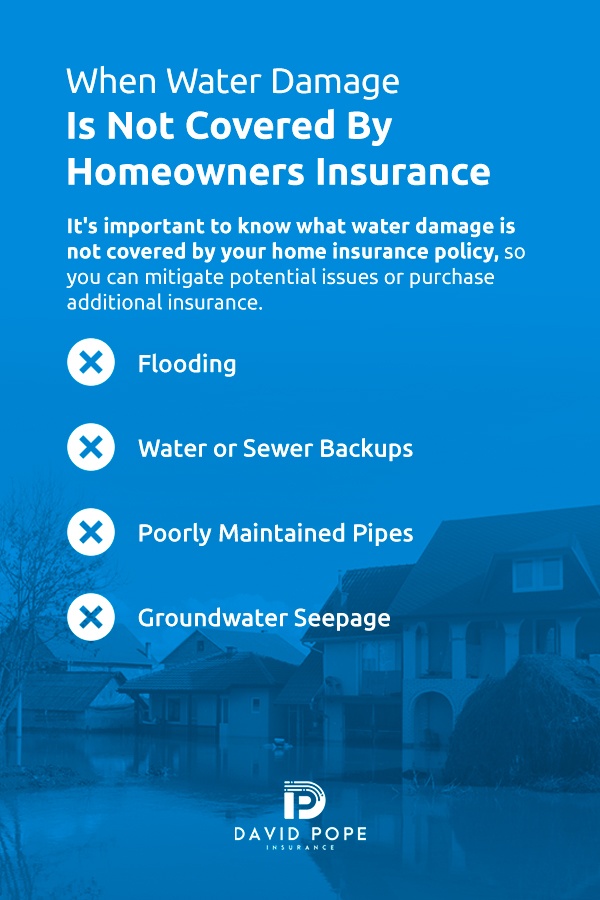

A homeowner’s insurance policy typically includes coverage for sudden and accidental water damage, such as burst pipes, plumbing issues, or appliance failures. However, it may not cover gradual water damage caused by maintenance issues or neglect. Understanding the scope of your coverage is crucial before making a decision about filing a claim.

Determining Water Damage Coverage

Before filing a water damage claim, it’s important to determine whether your policy covers the specific incident that caused the damage. Consult your insurance policy documents or contact your insurance agent to understand the coverage limitations and exclusions related to water damage. This will help you assess the potential benefits and consequences of making a claim.

Depending on the cause of the water damage, your policy may cover the costs of repairs, restoration, and even temporary living expenses if your home becomes uninhabitable. However, keep in mind that certain limits and deductibles may apply. It’s essential to go through the details of your policy and understand the financial implications before proceeding with a claim.

Factors to Consider Before Claiming Water Damage

Before deciding whether to claim water damage on your homeowner’s insurance, consider a few important factors. First, assess the severity of the damage. If the damage is minor and can be repaired without incurring high costs, it might not be worth filing a claim. Remember that small claims can impact your insurance record and potentially affect your premiums in the future.

Second, take into account your deductible. If the cost of repairs is lower than your deductible, it may not be financially beneficial to file the claim. Additionally, consider the potential effect on your insurance premiums in the long term. Making multiple claims within a short period can lead to increased premiums or even non-renewal of your policy.

Potential Consequences of Filing a Water Damage Claim

While homeowner’s insurance is designed to protect you from unexpected damages, filing a water damage claim can have consequences. One potential consequence is the increase in your insurance premiums. Insurance companies may perceive a higher risk associated with your property if you have made multiple claims or if the damage was preventable.

Another consequence is the impact on your coverage limitations. If you have already reached the maximum limits specified in your policy, filing a water damage claim may result in limited coverage for future incidents. It’s important to balance the immediate benefits of a claim with the potential long-term impact on your insurance coverage.

Effect on Homeowner’s Insurance Premiums

Filing a water damage claim can impact your homeowner’s insurance premiums. Insurance companies assess the risk associated with each policyholder, and a history of claims can lead to higher premiums. Even a single claim can result in an increase in premiums, especially if the claim amount is substantial.

Before deciding to file a claim, consider whether the cost of repairs exceeds your deductible significantly. If the damage is minor and the repair costs are minimal, it may be more financially beneficial to handle the repairs yourself instead of risking a potential increase in your premiums.

Effect on Coverage Limitations

Your homeowner’s insurance policy comes with coverage limitations specified in the policy documents. Filing a water damage claim may deplete your coverage limits, leaving you with limited financial support for future incidents. It’s important to evaluate the extent of your policy’s coverage and consider the long-term consequences before filing a claim.

If you frequently experience water damage incidents, it’s important to assess your policy’s coverage limits to ensure they are sufficient to meet your needs. In some cases, you may need to consider purchasing additional coverage or exploring other insurance options to adequately protect against water damage.

Effect on Future Claims

Filing a water damage claim can impact your ability to file future claims on your homeowner’s insurance policy. Insurance companies consider the frequency and severity of claims when determining whether to renew a policy. Making multiple claims in a short period can increase the perceived risk associated with your property and result in higher premiums or even non-renewal of your policy.

Before deciding to file a claim, carefully evaluate the potential impact on your future coverage options. If the damage is minor and the repair costs are manageable, it may be more beneficial to handle the repairs yourself to maintain a favorable insurance record.

Alternatives to Claiming Water Damage

Before rushing to file a water damage claim, explore alternative options. If the damage is minimal and within your budget, it may be more cost-effective to handle the repairs without involving your insurance company. This approach helps you maintain a clean claims history and avoid potential premium increases.

Consider contacting reputable restoration companies or contractors specializing in water damage repairs. They can assess the damage, provide cost estimates, and guide you through the repair process. Taking this alternative route can potentially save you money in the long run and preserve your homeowner’s insurance policy for more significant incidents.

Important Considerations for Water Damage Claims

If you decide to file a water damage claim, there are a few important considerations to keep in mind. First, document the damage thoroughly by taking photographs or videos. This evidence will help support your claim and ensure a smoother claims process.

Next, notify your insurance company as soon as possible to initiate the claims process. Provide them with all the necessary information, including the cause of the damage, estimated repair costs, and any supporting documentation. Prompt reporting can help expedite your claim and minimize any potential disputes.

Be prepared to work closely with your insurance adjuster throughout the claims process. They will evaluate the extent of the damage, estimate repair costs, and determine the reimbursement amount. Maintain clear communication and provide any requested information promptly to ensure a fair and efficient resolution.

Steps to Take When Dealing with Water Damage

When faced with water damage, it’s essential to take immediate action to minimize further damage and protect your property. Follow these steps to effectively deal with water damage:

-

Stop the source of water: If possible, shut off the water supply to prevent further damage. If the source is a burst pipe or other similar issue, repair or replace the damaged section to stop the leak.

-

Document the damage: As mentioned earlier, document the extent of the damage by taking photographs or videos. This evidence will help support your insurance claim.

-

Contact a professional restoration company: Water damage can cause mold growth and structural issues if not addressed promptly. Contact a reputable restoration company to assess the damage and provide guidance on the necessary repairs.

-

Mitigate further damage: Take steps to prevent further damage while waiting for repairs. This may include placing tarps over damaged areas, removing furniture or belongings from affected areas, or using fans to dry out the space.

-

Notify your insurance company: Contact your insurance company to report the water damage and initiate the claims process. Provide all the necessary information and documentation to support your claim.

Remember to prioritize your safety during this process. If the damage is extensive or poses a risk to your health, consider temporarily relocating to a safe location while the repairs take place.

In conclusion, claiming water damage on your homeowner’s insurance can have both immediate and long-term consequences. Before making a decision, thoroughly understand your policy’s coverage, evaluate the severity of the damage, and consider the financial implications. Exploring alternative options and taking immediate action to mitigate further damage can also help protect your property and insurance record.