You’ve recently found yourself in a bit of a predicament – you’re dealing with a home insurance claim that involves water, and you couldn’t be more confused. It’s a frustrating situation to be in, especially when you’re not sure where to turn for answers. But fear not, because help is on its way! In this article, we’ll break down the ins and outs of dealing with a home insurance claim involving water, providing you with the clarity and guidance you need to navigate this bewildering process. So sit back, relax, and let’s unravel the mysteries of home insurance claims together!

Understanding Home Insurance Claims

Home insurance provides coverage for various types of claims, including water damage claims. Understanding the process of filing a water damage claim is essential to ensure that you receive the right compensation for the damages you incurred. This article aims to guide you through the process, from assessing the damage to working with claims adjusters, and addressing common challenges that may arise during the claims process.

Types of Home Insurance Claims

Before delving into water damage claims, it’s important to have an understanding of the different types of claims covered by home insurance. These may include claims related to fire damage, theft, natural disasters, and water damage, among others. Each type of claim has its own specific requirements and processes, and water damage claims are no exception.

Common Causes of Water Damage

Water damage can occur due to a variety of reasons, and it is crucial to identify the cause to determine the coverage under your home insurance policy. Common causes of water damage include burst pipes, leaky roofs, plumbing issues, malfunctioning appliances, and natural disasters such as floods and storms. Understanding the specific cause of the water damage is essential when filing a claim to ensure that it falls within the policy’s coverage.

Importance of Water Damage Coverage

Water damage can cause significant financial burdens, and having appropriate coverage for such incidents is essential to protect your investment and ensure your peace of mind. Water damage coverage typically includes repair costs, replacement of damaged items or structures, and expenses related to temporary living arrangements if your home becomes uninhabitable. Without water damage coverage, you may be left with hefty out-of-pocket expenses.

Filing a Water Damage Claim

When water damage occurs, it’s crucial to take immediate action to minimize further damage and start the claims process. Follow these steps to effectively file a water damage claim:

Assessing the Damage

As soon as you discover water damage, assess the extent of the damage and document it thoroughly. Take photographs or videos of the affected areas and damaged belongings. This documentation will play a vital role when submitting your claim to the insurance company.

Contacting the Insurance Company

Once you have assessed the damage, promptly contact your insurance company to initiate the claims process. Provide them with all the necessary information, including the cause of the damage, the date and time it occurred, and any relevant documentation you have gathered. The sooner you notify the insurance company, the sooner they can start assessing your claim.

Documenting the Damage

Working hand in hand with your insurance company, it’s essential to provide detailed documentation of the damage. This includes providing invoices, receipts, and estimates for repair or replacement costs. The more precise and organized your documentation is, the smoother the claims process will be.

Mitigating Further Damage

In addition to assessing and documenting the damage, take immediate steps to mitigate further damage. This may involve turning off the water supply, covering exposed areas, or arranging for temporary repairs. Review your insurance policy to understand the steps you can take to mitigate further damage without jeopardizing your claim.

Navigating the Claims Process

Understanding the claims process is key to successfully navigating through it. Here are some important aspects to consider when filing a water damage claim:

Understanding the Policy Coverage

Thoroughly review your insurance policy to understand the specific coverage you have for water damage. Pay attention to any exclusions or limitations that may impact your claims process. Understanding your policy will ensure that you know what to expect and avoid any surprises during the claims process.

Submitting Required Documentation

Providing accurate and complete documentation is crucial to support your water damage claim. Be mindful of the deadlines set by your insurance company for submitting documentation. Double-check all receipts, estimates, and other supporting documents to ensure accuracy and comprehensiveness.

Working with Claims Adjusters

During the claims process, you will likely be assigned a claims adjuster who will evaluate your claim. The claims adjuster will assess the damage, review your documentation, and determine the appropriate compensation. Cooperating and providing any requested information to the claims adjuster in a timely manner will help in expediting the process.

Claim Resolution Process

Once the claims adjuster evaluates your claim, they will provide you with a claim resolution. This may involve an offer for compensation or a denial of your claim. If the offered compensation is acceptable, you can proceed to the settlement. However, if the resolution is not satisfactory, you have the option to appeal or negotiate further.

Coverage and Limitations

Understanding what is covered and the limitations of your insurance policy is crucial when it comes to water damage claims. Here are a few key considerations:

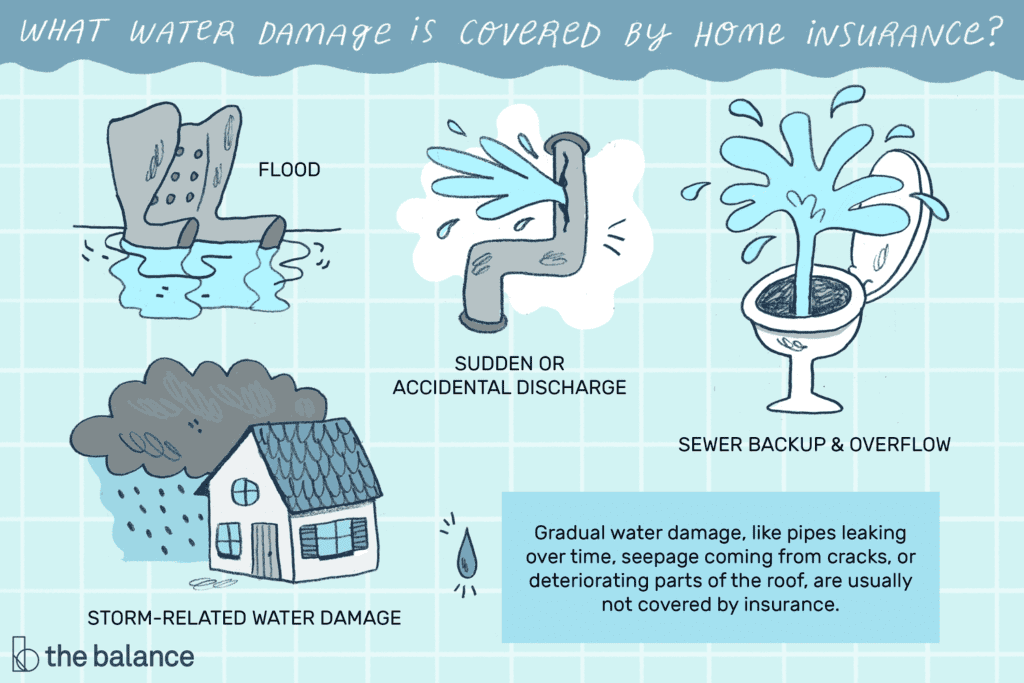

Covered Water Damage

Your insurance policy will outline what types of water damage are covered. It is important to note that coverage may vary depending on the cause of the damage. For example, damage caused by a sudden burst pipe may be covered, while gradual leakage may not. Familiarize yourself with the covered water damage scenarios specified in your policy.

Exclusions and Limitations

Insurance policies often have exclusions and limitations that may restrict coverage for certain types of water damage. Common exclusions include damage caused by floods or seepage, neglect or lack of maintenance, and damage from certain types of natural disasters. Carefully review your policy to understand these exclusions and limitations.

Factors Affecting Claim Payout

Several factors can affect the potential payout of your water damage claim. These may include your policy’s coverage limits, deductibles, and the assessed value of the damage. Familiarize yourself with these factors to set realistic expectations for your claim payout.

Understanding Deductibles and Limits

Your insurance policy will include information about deductibles and coverage limits. A deductible is the amount you are responsible for paying before the insurance coverage kicks in. Coverage limits refer to the maximum amount the insurance company will pay for a claim. Understanding these terms will help you determine the financial implications of a water damage claim.

Water Damage Restoration

Once your water damage claim has been approved and settled, the next step is restoring your home back to its pre-damage state. Here are some important factors to consider during the restoration process:

Hiring Professional Restoration Services

Water damage restoration requires specialized knowledge and equipment. It is advisable to hire professional restoration services to ensure that the restoration is done effectively and efficiently. Restoration professionals will assess the damage, dry out the affected areas, salvage belongings if possible, and repair or replace any damaged structures.

Costs Involved in Restoration

The cost of water damage restoration can vary depending on the extent of the damage. It is important to discuss the costs and payment arrangements with the restoration company beforehand. Keep accurate records of all expenses associated with the restoration process, as these may be reimbursable by your insurance company.

Working with the Restoration Company

Effective communication and collaboration with the restoration company are crucial during the restoration process. Regularly communicate with the restoration team, provide them with any necessary documentation, and address any concerns or questions promptly. This will help ensure a smoother and more successful restoration process.

Claim Denials and Appeals

Despite your best efforts, it is possible for your water damage claim to be denied by the insurance company. If this happens, there are steps you can take:

Reasons for Claim Denials

Claim denials can occur for various reasons, such as policy exclusions, inadequate documentation, failure to report the damage in a timely manner, or disputes over the cause of the damage. Understanding the specific reason for the denial is essential in determining your next steps.

Reviewing the Denial Letter

If your water damage claim is denied, carefully review the denial letter provided by the insurance company. The denial letter will outline the reasons for the denial and any options you have for appealing the decision. Take note of the deadlines and requirements outlined in the letter.

Appealing a Denied Claim

If you believe your water damage claim was wrongly denied, you have the right to appeal the decision. Consult your insurance policy to understand the appeals process and the required documentation. Provide any additional evidence or information that supports your claim and clearly outlines why you believe the denial was incorrect.

Preventing Water Damage

While having the appropriate insurance coverage is crucial, preventing water damage in the first place is always the best approach. Here are some preventive measures you can take:

Regular Home Maintenance

Regularly inspecting and maintaining your home is key to preventing water damage. Check for leaks, cracks, or other signs of water intrusion regularly. Ensure that your gutters are clean and functioning properly, and inspect your roof for any damage or missing shingles. Establishing a routine maintenance schedule can help identify and address potential issues before they escalate.

Installing Water Detection Devices

Installing water detection devices, such as water sensors and leak detectors, can provide an early warning system for potential water damage. These devices can alert you to any leaks or water accumulation, allowing you to take immediate action and minimize damage.

Safeguarding Plumbing Systems

Maintaining your plumbing systems is essential to prevent water damage. Insulate exposed pipes to prevent freezing and subsequent bursts during cold weather. Regularly inspect your plumbing fixtures and address any leaks or issues promptly. Being proactive in maintaining your plumbing can help prevent costly water damage.

Addressing Drainage Issues

Improper drainage can lead to water accumulation around your home, causing potential water damage. Ensure that your property has adequate drainage systems in place, such as properly functioning gutters, downspouts, and grading. Address any drainage issues promptly to prevent water from pooling near your home’s foundation.

Common Challenges in Water Damage Claims

While filing a water damage claim, some common challenges may arise that can complicate the process. It’s important to be aware of these challenges and take appropriate action:

Delayed Claim Processing

Claim processing times can vary depending on the complexity of the claim and the workload of the insurance company. However, if you experience excessive delays in the claims process, it is recommended to follow up with your insurance company. Document all communication and maintain a record of the dates and details of each interaction.

Disputes over Coverage

Disputes over coverage can occur when there is a disagreement between the policyholder and the insurance company regarding the cause of the water damage or the applicability of certain policy provisions. In cases of disputes, it may be necessary to enlist the help of a public adjuster or legal professional to advocate for your rights and negotiate on your behalf.

Inadequate Compensation

In some cases, the compensation offered by the insurance company may seem insufficient to cover all the damages and losses you incurred. If you believe the offered compensation is inadequate, gather supporting evidence and documentation to demonstrate the true extent of the damage. Engaging a public adjuster or seeking legal assistance can help in obtaining a fair settlement.

Importance of Professional Help

When dealing with water damage claims, professional assistance can make a significant difference in achieving a favorable outcome. Consider the following options for seeking professional help:

Engaging Public Adjusters

Public adjusters are licensed professionals who work on behalf of policyholders to assist with insurance claims. They can evaluate the damage, prepare accurate documentation, negotiate with the insurance company, and advocate for a fair settlement. Engaging a public adjuster can alleviate some of the stress associated with the claims process and increase the chances of a successful outcome.

Hiring Water Damage Restoration Experts

Water damage restoration experts have the knowledge, experience, and equipment to effectively restore your home after water damage. They will thoroughly assess the damage, provide comprehensive restoration plans, and work diligently to mitigate the damage. Hiring professionals ensures that the restoration process is handled properly, giving you peace of mind knowing that your home is in capable hands.

Legal Assistance in Claim Disputes

In cases where disputes arise over coverage or claim denials, legal assistance may be necessary. A lawyer specializing in insurance claim disputes can help navigate complex legal matters, interpret policy language, and advocate for your rights. They can guide you through the appeals process, negotiate with the insurance company, and, if necessary, litigate on your behalf.

Understanding Policy Terminology

To fully comprehend your home insurance policy, it’s essential to understand commonly used terms. Here are a few terms often found in policies relating to water damage claims:

Actual Cash Value (ACV)

Actual Cash Value refers to the value of the damaged property at the time of the loss, taking into account depreciation. When a water damage claim is settled based on ACV, the insurance company will consider the age, condition, and useful life of the damaged item when determining the compensation.

Replacement Cost Value (RCV)

Replacement Cost Value represents the cost of repairing or replacing the damaged property without accounting for depreciation. Claims settled based on RCV provide coverage for the full cost of repairing or replacing damaged items, as long as the replacement is of similar kind and quality.

Loss of Use

Loss of Use coverage applies when your home becomes uninhabitable due to water damage or other covered events. It provides compensation for additional living expenses, including temporary accommodation, meals, and other necessary expenses incurred while your home is being restored.

Scheduled Personal Property

Certain valuable items, such as jewelry, artwork, or collectibles, may require additional coverage beyond what is provided by your standard insurance policy. Scheduled Personal Property coverage allows you to specifically list and insure these items, usually at their appraised or agreed-upon value.

In conclusion, understanding the process of filing a water damage claim, the coverage and limitations of your insurance policy, and the preventive measures you can take is crucial to navigate the claims process successfully. Promptly assess and document the damage, communicate effectively with your insurance company, and consider seeking professional help when needed. By being well-informed and proactive, you can ensure that you receive the appropriate compensation to recover from water damage and protect your home.