As you navigate through different stages of life, it’s important to consider the impact that age can have on various aspects of your life, including homeowners insurance. From your first home to your retirement years, age can play a significant role in determining the cost and coverage of your insurance policy. Understanding how age affects homeowners insurance can help you make informed decisions and ensure that you have the right coverage to protect your home and belongings.

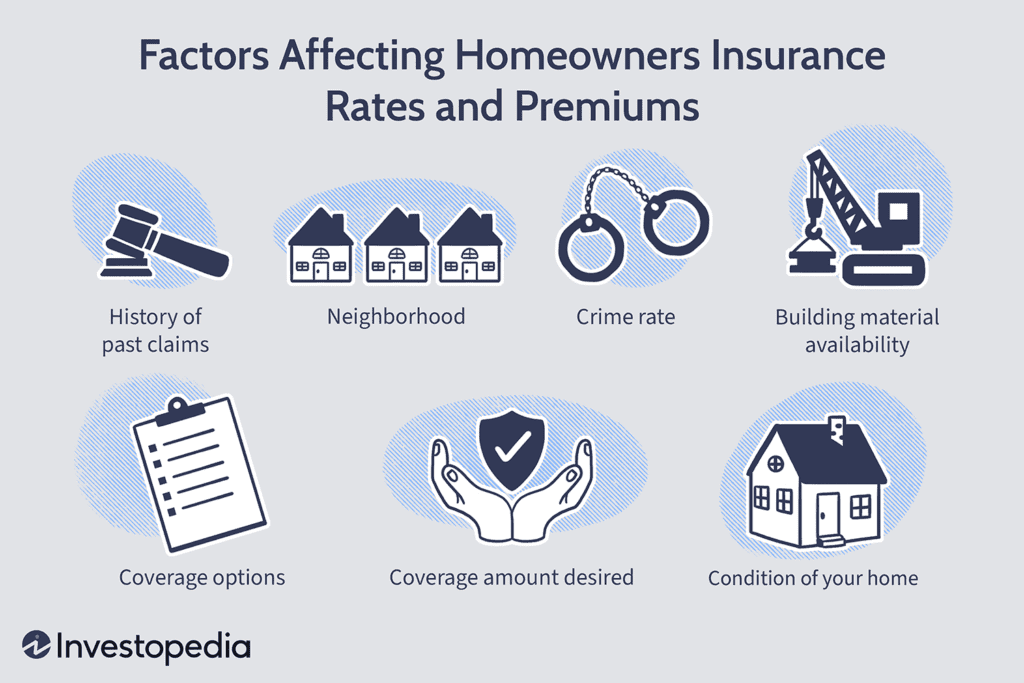

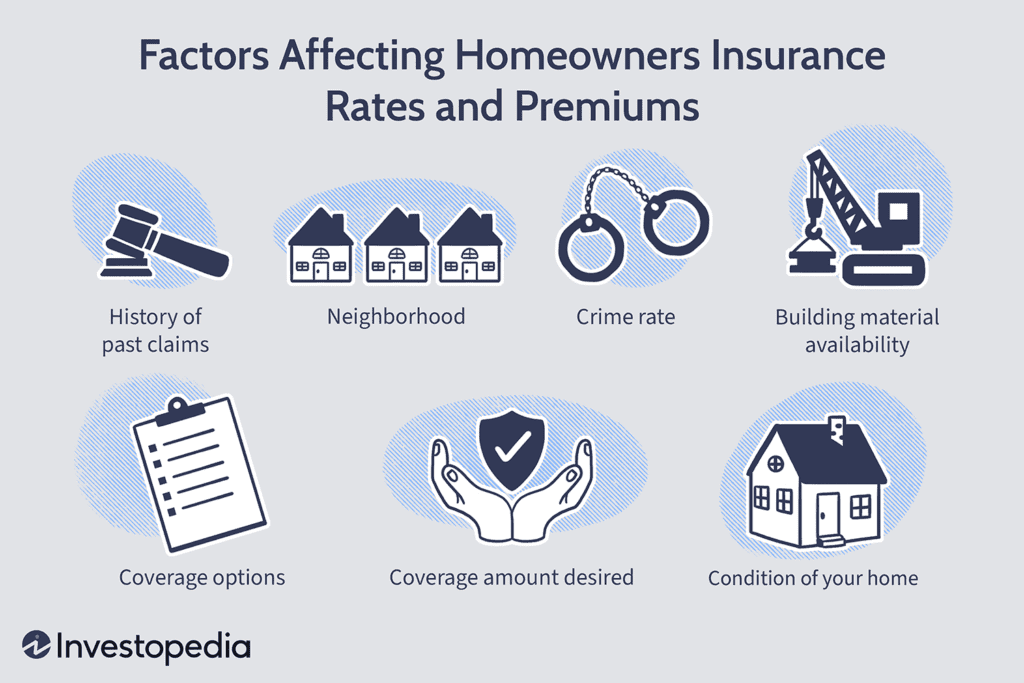

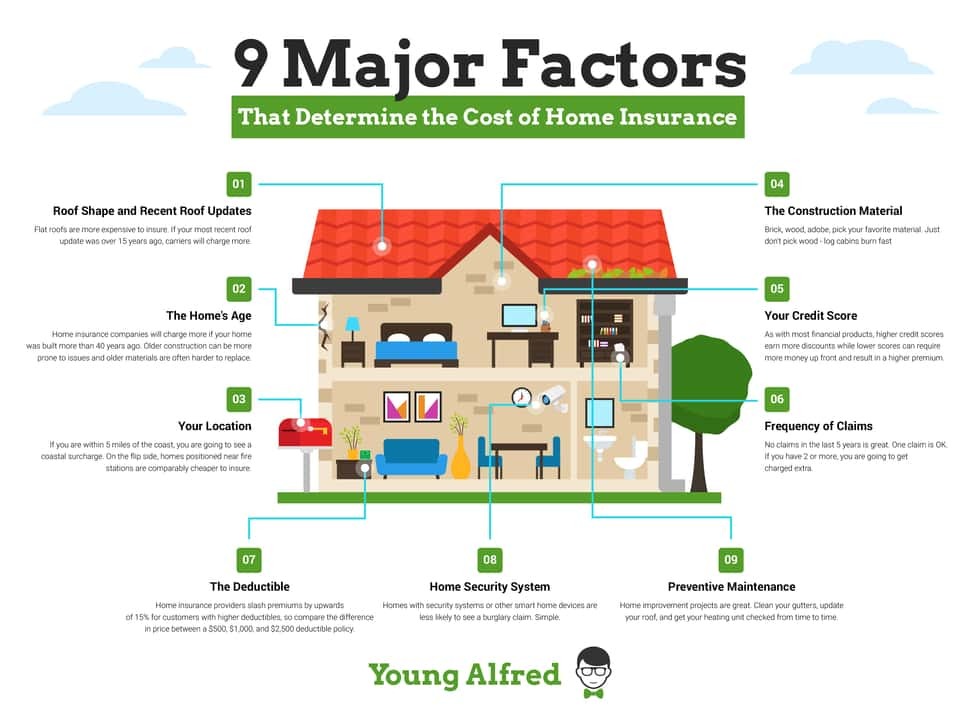

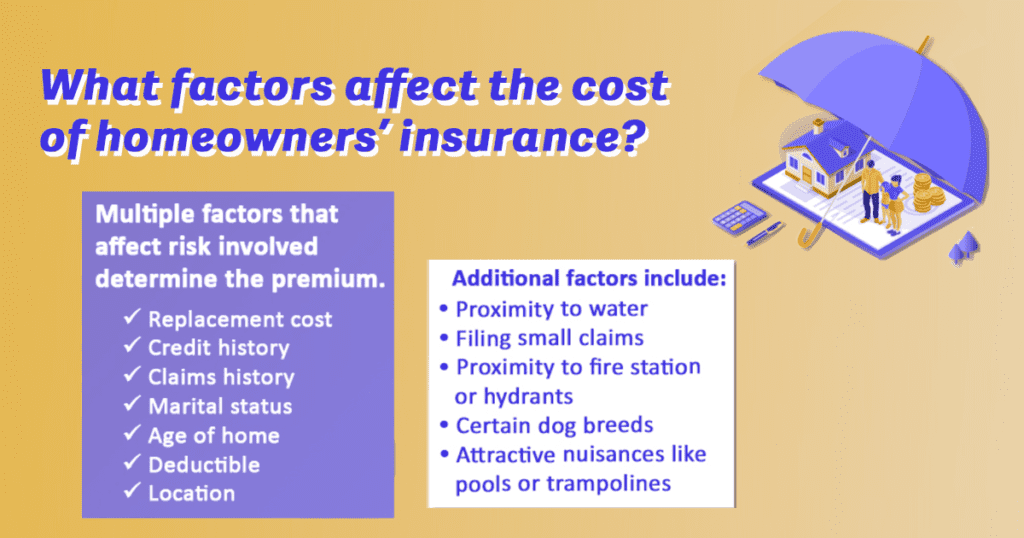

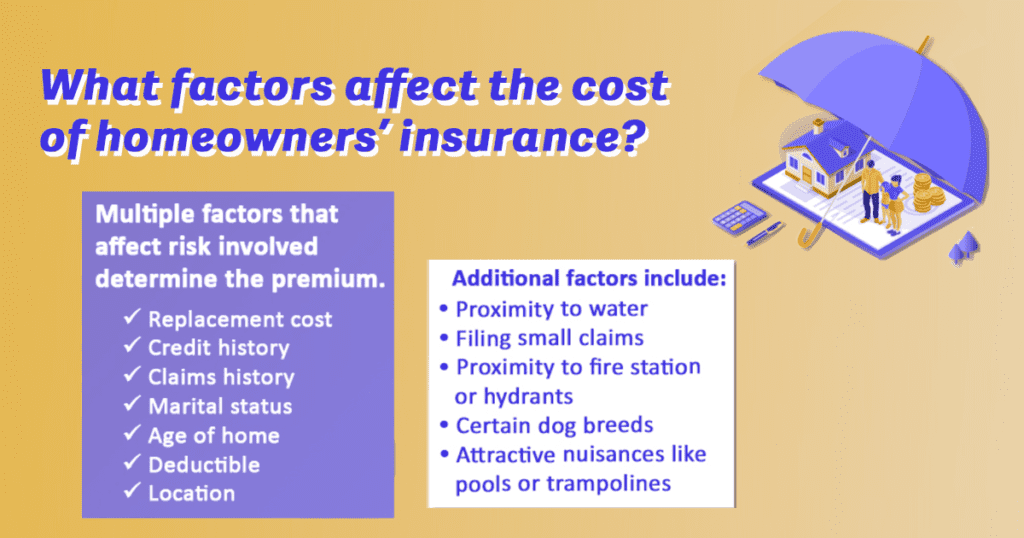

Factors that Affect Homeowners Insurance Premiums

Age as a Key Factor

When it comes to determining homeowners insurance premiums, age plays a significant role. Insurance providers take into consideration the age of the homeowner, as it helps them assess the risk associated with insuring the property. Different age groups may experience varying insurance rates and eligibility criteria. Understanding how age impacts insurance premiums can help homeowners make informed decisions when choosing coverage options.

Younger Homeowners

Younger homeowners, typically those under the age of 35, often face higher insurance premiums compared to their older counterparts. This can be attributed to several factors. Firstly, younger homeowners may have less established credit histories, and insurance providers often consider credit scores when determining premiums. Additionally, younger individuals tend to have less experience with homeownership and may be more prone to accidents or mishaps that could result in filing insurance claims.

Middle-aged Homeowners

Middle-aged homeowners, typically between the ages of 35 and 55, often enjoy relatively lower insurance premiums compared to younger and older homeowners. This is because individuals in this age group are considered to be in their prime years of homeownership. They typically have established credit histories and may have accumulated more assets, contributing to a decreased risk profile from the insurer’s perspective. However, it is still important for middle-aged homeowners to review their coverage periodically to ensure it aligns with their changing needs.

Older Homeowners

As homeowners reach retirement age and beyond, their insurance premiums may exhibit different patterns. Older homeowners, typically aged 55 and above, may experience a slight increase in insurance premiums compared to their middle-aged counterparts. This is partly due to the increased risk associated with aging homes, which may require more frequent repairs or renovations. Furthermore, older homeowners may opt for additional coverage options, such as increased liability limits, to protect their assets in retirement.

Insurance Coverage Options for Different Age Groups

Younger Homeowners

For younger homeowners, selecting the right insurance coverage is crucial. Basic policies designed for first-time homeowners provide essential coverage for the structure of the home, personal belongings, and liability protection. However, given the higher risk profile of younger homeowners, it may be beneficial to explore additional coverage options. Considerations such as adding coverage for expensive electronics, jewelry, or other valuable items can provide extra peace of mind for young homeowners.

Middle-aged Homeowners

Middle-aged homeowners often find themselves in a different stage of life, with evolving needs. Tailoring coverage to these changing needs is important to ensure adequate protection. This may involve adjusting policy limits to reflect changes in property value, renovations, or additions to the home. Additionally, exploring policy add-ons such as water backup coverage or personal umbrella insurance can provide additional safeguards against unexpected events.

Older Homeowners

As homeowners enter retirement, their priorities may shift, and so should their insurance coverage. Considerations for aging homes become paramount, as maintenance, repairs, and potential for insurance claims increase. Older homeowners should assess their coverage to ensure it adequately addresses the specific risks associated with aging properties, such as roof damage, electrical systems, or plumbing issues. Additionally, policy adjustments should be made to align with reduced income and changing lifestyle needs during retirement.

Retirement communities often have unique insurance requirements. It is advisable for older homeowners living in retirement communities to review their insurance policies in consultation with community management. There may be specific coverage requirements for common areas, amenities, or liability related to community activities. Understanding the insurance needs of the retirement community can help homeowners make informed decisions and secure appropriate coverage.

Impact of Age on Insurance Rates and Eligibility

Age and Insurance Premiums

The impact of age on homeowners insurance premiums can be significant. Younger homeowners often face higher premiums due to the increased risk associated with their age group. As homeowners enter middle age, premiums tend to stabilize at more affordable rates. However, older homeowners may experience a slight increase in premiums due to age-related factors impacting their property. It is important for homeowners to understand these age-related trends to better manage their insurance costs.

Younger Homeowners and Higher Premiums

Younger homeowners often face higher insurance premiums due to several factors. In addition to the limited credit history, insurance providers view younger homeowners as relatively inexperienced when it comes to homeownership. Lack of experience can result in more accidents or damage to the property. As a result, insurance providers may charge higher premiums to account for the perceived increased risk.

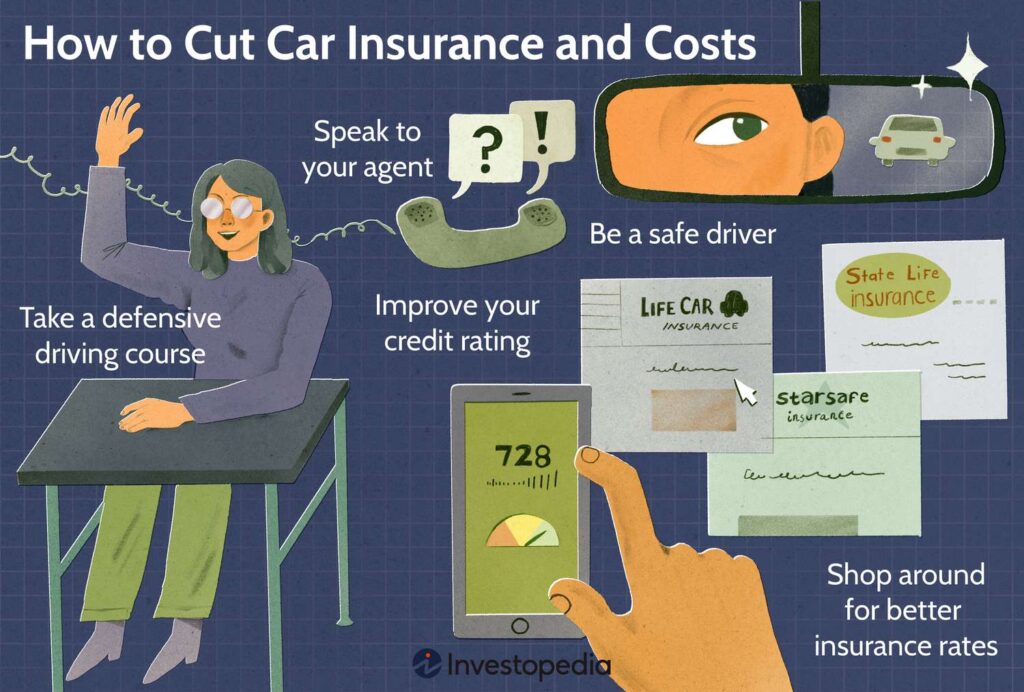

However, younger homeowners can take steps to mitigate these higher premiums. Taking advantage of discounts for home security systems, bundling insurance policies, and maintaining a good credit score can help reduce insurance costs. By demonstrating responsible behavior and minimizing risk factors, younger homeowners can secure more affordable insurance rates.

Factors Mitigating Higher Premiums for Older Homeowners

While older homeowners may experience a slight increase in insurance premiums compared to their middle-aged counterparts, there are factors that can mitigate these higher costs. Older homeowners often have a longer history of homeownership, which insurance providers view favorably. A longer track record of responsible homeownership, combined with a good credit history, can help older homeowners secure more competitive rates. Additionally, opting for policy add-ons that address specific needs, such as increased liability limits, can provide peace of mind and potentially offset the higher premiums.

Age and Policy Eligibility

Younger Homeowners and Probationary Periods

Younger homeowners may face additional eligibility challenges due to their age. Insurance providers may impose probationary periods before offering full coverage to new homeowners. During this period, the homeowner may receive limited coverage or face higher premiums. Probationary periods are typically in place to mitigate the risk associated with insuring new homeowners, taking into account potential lack of experience or financial stability. It is important for younger homeowners to inquire about any probationary periods and understand their implications before finalizing an insurance policy.

Older Homeowners and Eligibility Challenges

While older homeowners may not encounter the same probationary periods as younger homeowners, they may still face eligibility challenges. Insurance providers may scrutinize the condition of aging homes more closely, which can impact eligibility for certain coverage options. Older homes may have outdated systems or structural issues that increase the risk of claims. It is important for older homeowners to be proactive in maintaining their properties and addressing any issues promptly to ensure continued eligibility for desired coverage options.

Understanding the Importance of Age in Underwriting and Claims

Risk Assessment and Underwriting

Insurance providers assess risk when underwriting homeowners insurance policies, and age plays a significant role in this process. Different age groups often exhibit varying risk profiles, which insurers consider when determining coverage options and premiums. By understanding how age impacts risk assessment, homeowners can make informed decisions when it comes to choosing insurance coverage.

Age and Its Impact on Risk

Age is a significant factor in determining risk. Younger homeowners are often perceived to have a higher risk profile due to a combination of factors such as limited experience, potential financial instability, and less established credit histories. Middle-aged homeowners are viewed as having a more stable risk profile, while older homeowners may face increased risk associated with the age of their property. Recognizing these age-related risk assessments allows homeowners to take appropriate measures to manage and mitigate these risks.

Underwriting Considerations Based on Age

Insurance underwriters take various factors into consideration when assessing risk and determining coverage options. Age-related factors such as credit history, claims history, property condition, and location are all considered during the underwriting process. It is important for homeowners to provide accurate and up-to-date information to insurers to ensure they receive appropriate coverage at a fair price. By understanding the underwriting considerations based on age, homeowners can better prepare and provide the necessary information to insurance providers.

Age and Claims Experience

Higher Risk of Claims for Younger Homeowners

Younger homeowners often have a higher risk of filing insurance claims. Inexperience with homeownership, combined with a more active and potentially accident-prone lifestyle, can contribute to a higher likelihood of claims. Common claims filed by younger homeowners may include damage caused by accidents, theft, or liability-related incidents. It is important for younger homeowners to be proactive in understanding their coverage and taking steps to minimize risk factors, such as investing in home security systems or maintaining their properties well.

Age-related Claims for Older Homeowners

As homes age, the likelihood of certain types of claims also increases for older homeowners. Age-related claims may involve issues such as roof damage, plumbing failures, or electrical problems. The wear and tear on aging homes can result in more frequent repairs or replacement needs. Older homeowners should be diligent in maintaining their properties, conducting regular inspections, and promptly addressing any issues to minimize the risk of age-related claims. Understanding common claims associated with aging properties can help homeowners better prepare and protect their investment.

Tips to Secure Affordable Insurance at Any Age

Compare Multiple Quotes

When seeking homeowners insurance, it is essential to compare multiple quotes from different insurance providers. This allows homeowners to evaluate coverage options, exclusions, and premiums offered by various insurers. By comparing quotes, homeowners can secure the most affordable coverage that meets their specific needs.

Bundle Home and Auto Insurance

Many insurance providers offer discounts for bundling home and auto insurance policies. Combining these policies with the same insurer can lead to cost savings and streamlined coverage management. Homeowners should inquire about potential discounts when exploring insurance options, as bundling policies can help secure more affordable rates.

Maintain Good Credit

Maintaining a good credit score can have a positive impact on homeowners insurance premiums. Insurance providers often consider credit history when determining premiums, as it is viewed as an indicator of financial responsibility. By managing credit wisely and paying bills on time, homeowners can help reduce insurance costs.

Invest in Home Security

Investing in home security systems and measures can help mitigate risk factors and potentially lower insurance premiums. Insurance providers may offer discounts for homes equipped with burglar alarms, fire alarms, or surveillance systems. By taking steps to enhance home security, homeowners can demonstrate their commitment to minimizing risks and potentially qualify for lower premiums.

Regularly Review and Update Coverage

Homeowners should periodically review their insurance coverage to ensure it aligns with their changing needs. As homeowners age, their insurance needs may evolve. Regularly assess the coverage limits, deductibles, and add-ons to ensure they accurately reflect the property’s value, personal belongings, and potential risks. Updating coverage can help ensure homeowners have appropriate protection at the most competitive rates.

Conclusion

Age is a significant factor in determining homeowners insurance premiums and eligibility. Younger homeowners often face higher premiums due to their perceived increased risk profile, while older homeowners may experience slight increases in premiums due to the specific risks associated with aging properties. Understanding how age impacts insurance rates and eligibility can help homeowners make informed decisions when selecting coverage options. By taking proactive measures such as maintaining good credit, investing in home security, and regularly reviewing coverage, homeowners can secure affordable insurance at any age.