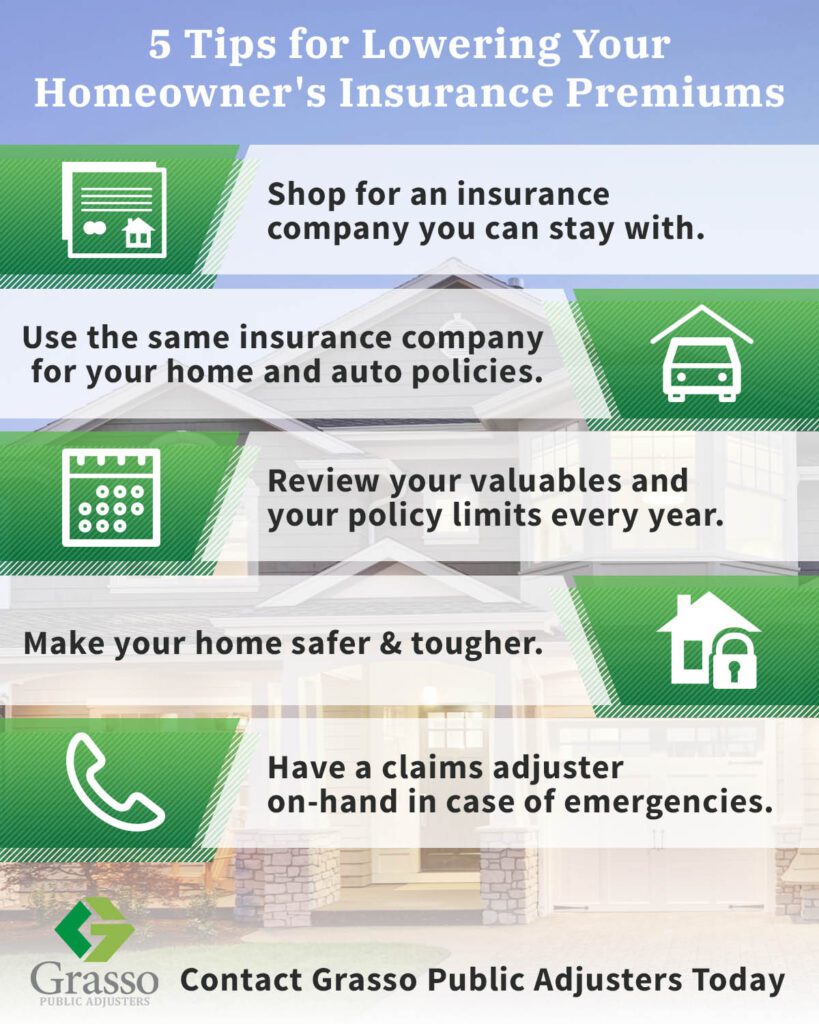

Looking to save some money on your homeowners insurance? We’ve got you covered! In this article, we will explore effective strategies for lowering your annual premiums on your homeowners insurance policy. From increasing your deductible to installing security systems, we’ll provide you with valuable tips and insights to help you keep more money in your pocket while ensuring your home remains protected. So, grab a cup of tea, sit back, and let’s dive into the world of homeowners insurance savings!

1. Review and Evaluate Current Coverage

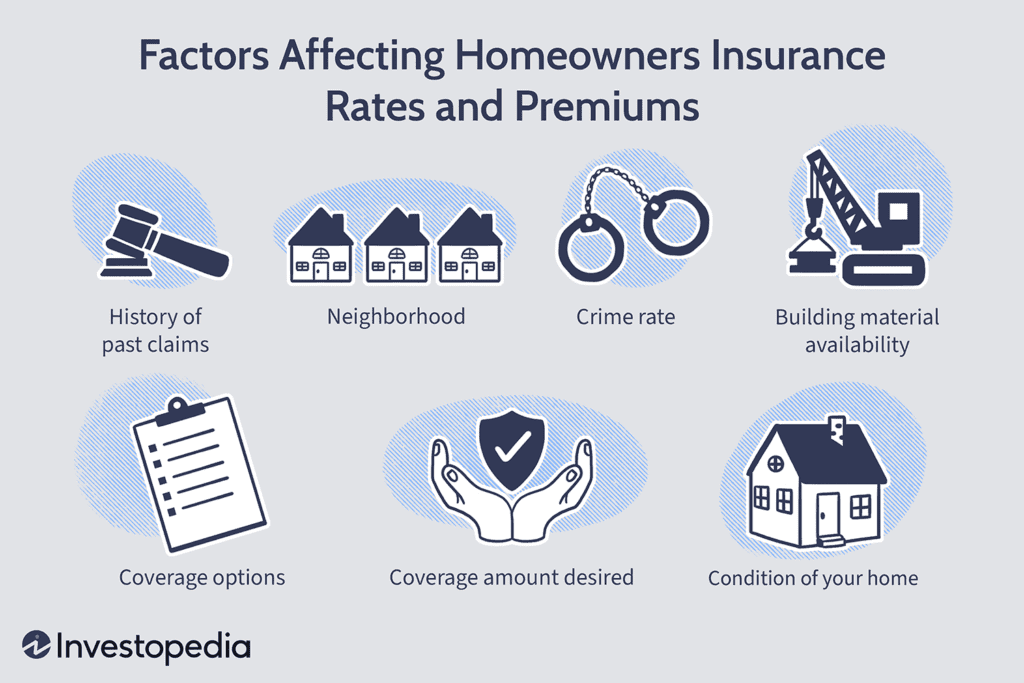

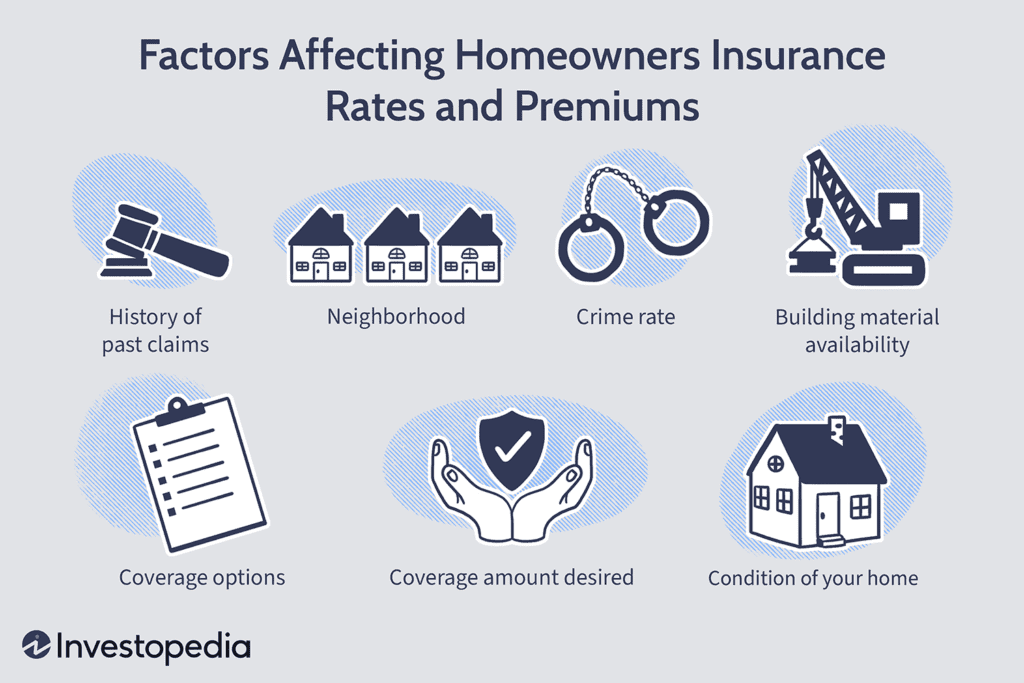

Examine the policy

The first step to lowering your homeowners insurance premiums is to review and thoroughly examine your current policy. Take the time to go through each coverage aspect and understand what it entails. Familiarize yourself with the policy’s terms and conditions, so you know what you’re covered for and what you’re not.

Assess the coverage limits

Once you understand your policy, assess the coverage limits. This refers to the maximum amount your insurer will pay in the event of a claim. Evaluate whether your current coverage limits align with the value of your home and belongings. If you find that your coverage limits are too high, you could consider reducing them to potentially lower your premiums.

Consider deductibles

Deductibles are the amount you pay out of pocket when you file a claim before your insurance kicks in. Higher deductibles typically result in lower premiums. Consider whether you are comfortable with increasing your deductible to reduce your annual premiums. Just make sure you choose a deductible amount that you can affor.

Determine necessary coverage

Lastly, determine whether you have any unnecessary coverage that can be excluded from your policy. For example, if you have a policy that includes coverage for events that are unlikely to occur in your area, you might want to consider removing that coverage to save on premiums. Ensure that you retain the essential coverage for your specific needs, but don’t pay for coverage you don’t need.

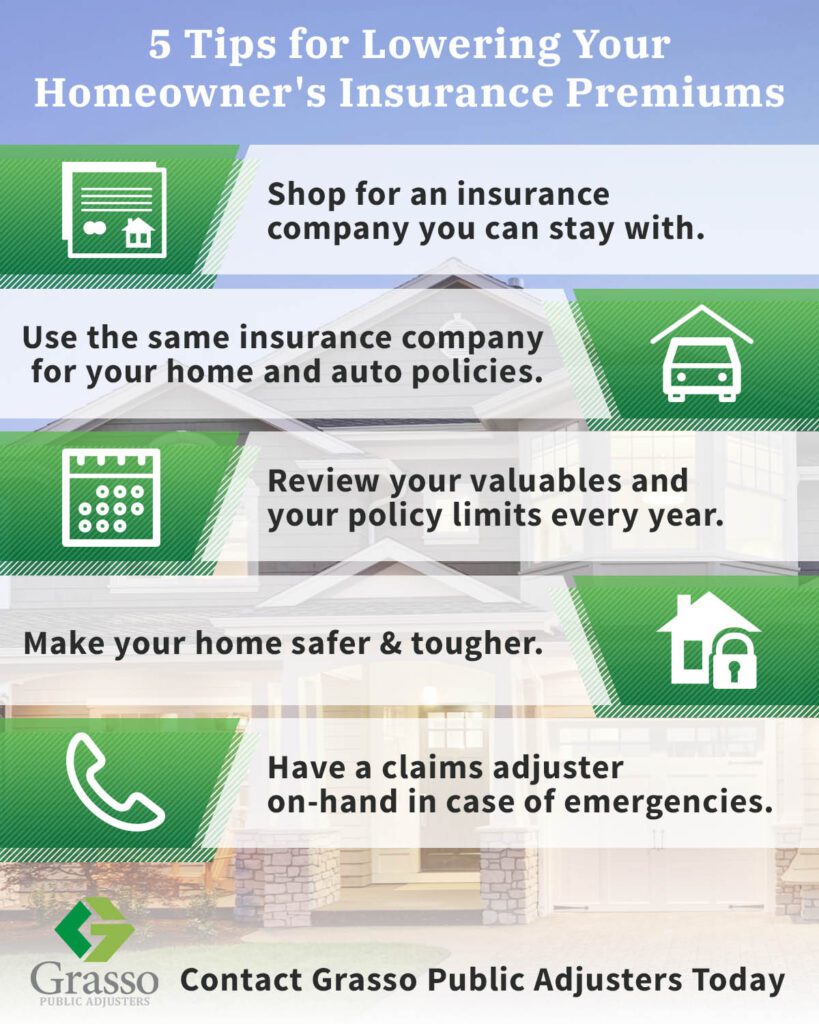

2. Shop Around for Multiple Quotes

Contact multiple insurers

To get the best deal on your homeowners insurance, it’s essential to shop around and obtain quotes from multiple insurers. Contact at least three different insurance companies and request quotes based on your specific requirements. This will give you a better understanding of the prevailing rates and help you make an informed decision.

Compare coverage and premiums

Once you have obtained quotes from different insurers, compare the coverage and premiums offered. Don’t just focus on the price; make sure the coverage provided matches your needs and expectations. Consider the limits, exclusions, and additional features offered by each policy. By comparing both coverage and premiums, you can find the right balance that suits your budget and provides the necessary protection.

Consider bundling options

If you already have other insurance policies, such as auto insurance, consider bundling your policies with the same insurance company. Many insurers offer discounts for bundling multiple policies together. This can lead to significant savings and the convenience of managing all your policies in one place.

Check for discounts

Don’t forget to ask each insurance provider about any available discounts. Insurers often offer various discounts based on factors such as home security measures, fire protection systems, and being claims-free. Additionally, certain professional groups or associations may have partnerships with insurers that offer discounted rates for their members. Explore all available discount options to maximize your savings on premiums.

3. Maintain a Good Credit Score

Understand credit-based insurance scores

Insurance companies often use credit-based insurance scores to assess the risk profile of potential policyholders. These scores are based on your credit history and can influence the premiums you pay for homeowners insurance. Understanding how credit-based insurance scores work can help you take the necessary steps to maintain or improve your score.

Monitor credit reports regularly

To ensure you have a good credit score, it’s crucial to monitor your credit reports regularly. Obtain copies of your credit reports from all three major credit bureaus – Experian, Equifax, and TransUnion – and review them for any errors. Dispute any inaccuracies and work towards improving your credit history.

Pay bills on time

One of the most significant factors affecting your credit score is your payment history. Make it a priority to pay your bills on time, including credit card statements, loan payments, and utility bills. Consistently paying your bills on time demonstrates responsible financial behavior and can positively impact your credit-based insurance score.

Reduce credit card debt

Credit card utilization, or the ratio of your credit card balances to their credit limits, is another component of your credit score. Aim to keep your credit card balances at an optimal level by reducing your overall debt. Paying off credit card balances can improve your credit utilization rate and, subsequently, your credit-based insurance score.

4. Increase Home Security Measures

Install smoke detectors and fire alarms

Enhancing your home’s safety measures can not only protect your loved ones but also lead to potential savings on your homeowners insurance. Install smoke detectors and fire alarms throughout your home. Make sure they are in proper working condition and regularly test them to ensure functionality.

Upgrade door and window locks

Securing your home against potential break-ins is an important step towards reducing your insurance premiums. Consider upgrading your door and window locks to more secure options. Deadbolts, window locks, and reinforced entry points can create an additional layer of protection and demonstrate to insurers that you have taken measures to reduce the risk of theft.

Install a security system

Investing in a home security system can provide peace of mind and lower your insurance premiums. Look for professionally monitored security systems that are connected to a central monitoring station. These systems can detect intruders, smoke, fire, and other emergencies, prompting a quick response to mitigate potential damage.

Consider a neighborhood watch

If your neighborhood has a neighborhood watch program, consider participating. Neighborhood watch programs involve residents actively looking out for each other’s properties and reporting suspicious activities to the authorities. Being part of a neighborhood watch can demonstrate to insurers that your community is proactive in preventing crime, potentially resulting in lower premiums.

5. Improve Home Safety Precautions

Implement proper home maintenance

Regular home maintenance is essential for preventing accidents and maintaining the value of your property. Ensure your home’s structure is sound, and all systems are functioning as they should. Undertake repairs promptly and keep up with routine maintenance tasks such as cleaning gutters, inspecting the roof, and maintaining the HVAC systems.

Update electrical and plumbing systems

Outdated electrical and plumbing systems can increase the risk of damage to your home and, in turn, affect your homeowners insurance premiums. Consider updating these systems to meet current safety standards and reduce the likelihood of accidents, such as electrical fires or water leaks.

Address potential hazards

Identify and address any potential hazards in and around your home. This could include removing dead trees or branches that pose a risk of falling or addressing slippery surfaces that could cause slip and fall accidents. By proactively dealing with these hazards, you can reduce the likelihood of accidents and potentially lower your insurance premiums.

Take measures to prevent water damage

Water damage is one of the most common and costly issues homeowners face. By taking preventive measures, you can minimize the risk and potentially reduce your insurance premiums. Install water leak detection systems, reinforce vulnerable areas prone to leaks, and ensure proper drainage around your property. Regularly inspect and maintain plumbing fixtures and pipes to catch any issues early on.

6. Bundle Home and Auto Insurance Policies

Contact insurance providers

If you have both homeowners and auto insurance, reaching out to your insurance providers to inquire about bundling options is a smart move. Contact each insurer to understand the potential savings and benefits of bundling your policies together.

Inquire about bundling discounts

Many insurance companies offer attractive discounts when you bundle your home and auto insurance policies together. These discounts can vary, so it’s important to ask each insurer about their specific bundle offers. You may find that bundling results in lower premiums for both policies while providing the convenience of dealing with a single insurance provider.

Consider coverage needs

Before bundling your policies, carefully consider your coverage needs for both homeowners and auto insurance. Ensure that the bundled policies provide adequate coverage for your specific requirements. Review the terms, conditions, and limits to confirm that the bundled coverage meets all your needs.

Evaluate the savings

Once you have obtained quotes or estimates for bundled home and auto insurance policies, evaluate the potential savings. Compare the total premiums for separate policies against the bundled premiums to determine the cost-effectiveness of the bundle. If the savings are significant and the coverage meets your needs, bundling can be an excellent way to lower your overall insurance costs.

7. Raise the Deductible Amount

Understand deductible implications

Opting for a higher deductible can significantly reduce your homeowners insurance premiums. However, it’s essential to understand the implications of choosing a higher deductible. A higher deductible means you’ll have to pay more out of pocket in the event of a claim before your insurance coverage kicks in.

Calculate potential savings

To determine whether raising your deductible is a viable strategy, calculate the potential savings. Consider the difference in premiums between your current deductible and a higher one. Compare this savings amount with the additional out-of-pocket expense you would incur if you had to file a claim and pay the higher deductible.

Set a deductible amount accordingly

Based on your calculations and financial considerations, set a deductible amount that strikes the right balance. Choose an amount that provides a noticeable reduction in premiums but remains affordable should you need to file a claim in the future. Consider your financial situation and the likelihood of filing a claim when deciding on your deductible.

Ensure affordability

While a higher deductible can lead to savings, it’s essential to ensure that you can afford the increased out-of-pocket expense if the need arises. Carefully evaluate your budget and savings to determine the maximum deductible amount that is financially feasible for you.

8. Maintain a Claim-Free History

Document incidents

Keeping a record of incidents, even minor ones, can be beneficial when it comes to maintaining a claim-free history. Take note of any accidents or damage that occur around your property, regardless of whether you decide to file a claim. This documentation can serve as proof of your responsible behavior to insurers.

Consider self-repairs for minor damages

For minor damages, consider taking care of the repairs yourself rather than filing a claim. While insurance is designed to cover significant damages, filing multiple small claims can negatively impact your claim-free history and potentially lead to increased premiums. Evaluate whether it’s financially feasible to handle minor repairs on your own.

Avoid filing small claims

As mentioned earlier, filing multiple small claims can have adverse effects on your homeowners insurance premiums. Insurance companies often view frequent claims as an indicator of higher risk, resulting in premium increases. Unless the damage is significant and requires substantial financial assistance, consider handling minor incidents without involving your insurance provider.

Discuss with an insurance agent

If you’re unsure about whether to file a claim or have questions about maintaining a claim-free history, it’s a good idea to discuss your concerns with an insurance agent. They can provide guidance based on your specific situation and help you make an informed decision that aligns with your goals of keeping your premiums low.

9. Stay Loyal to the Insurance Company

Inquire about loyalty discounts

Some insurers offer loyalty discounts to policyholders who have stayed with them for an extended period. Inquire about loyalty programs or discounts offered by your insurance company. Loyalty discounts can provide additional savings on your premiums as a reward for your continued business.

Stay with the same insurer

While it’s essential to shop around for the best insurance rates, there can be advantages to staying with the same insurer. By staying with one insurance company, you may qualify for loyalty discounts, and building a long-term relationship with your insurer can simplify your insurance management process.

Review policy periodically

Although loyalty can be beneficial, it’s still important to review your policy periodically. Insurance needs can change over time, and it’s crucial to ensure that your coverage remains adequate and competitive in terms of rates. Conduct an annual review of your policy to verify that it still meets your needs and to compare it with other available options.

Consider alternatives if necessary

If you find that your current insurance company no longer offers competitive rates or suitable coverage options, don’t hesitate to explore alternatives. While loyalty is valuable, it’s equally important to have an insurance provider that meets your needs both in terms of coverage and affordability. Compare quotes from different insurers to ensure you are getting the best value for your money.

10. Take Advantage of Available Discounts

Inquire about available discounts

Insurance companies often offer various discounts that policyholders can take advantage of to lower their premiums. When obtaining quotes or renewing your policy, make sure to inquire about any available discounts. These discounts can be based on factors such as home safety features, policy bundling, or even your age or profession.

Consider safety features for discounts

Installing safety features in your home can not only provide peace of mind but also make you eligible for additional discounts. Inquire about the specific safety features that may lead to premium reductions, such as smoke detectors, fire alarms, security systems, and deadbolt locks. Prioritize the implementation of these features to both safeguard your home and lower your insurance costs.

Ask about age-related discounts

Some insurance companies offer age-related discounts to homeowners who are considered to be in a lower-risk demographic. As you grow older, you may become eligible for these discounts, resulting in further savings on your premiums. When discussing your policy with your insurance provider, ask if age-related discounts are available to you.

Explore professional group discounts

Many professional groups and associations have partnerships with insurance companies. These partnerships often result in discounted insurance rates for members. If you are a member of any professional group or organization, inquire about any available group discounts on homeowners insurance. These discounts can be a significant contributor to reducing your annual premiums.

By following these ten steps, you can effectively lower your annual homeowners insurance premiums. Remember to regularly review your policy, explore available discounts, and maintain a safe and secure home. By taking a proactive approach and considering all the options available to you, you can ensure that you have adequate coverage while enjoying the cost savings that come with it.