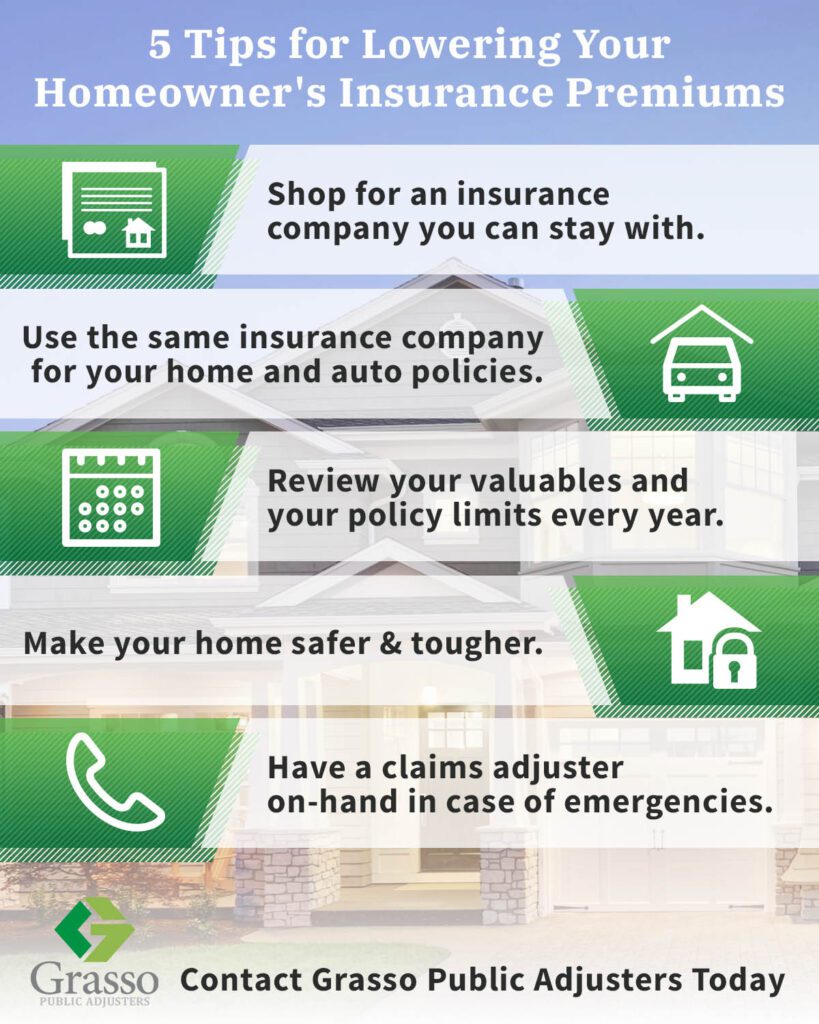

If you’re a homeowner, you understand the importance of securing property insurance to protect your investment. But have you ever wondered what factors can actually lower your property insurance premium? From installing security systems to maintaining a good credit score, there are several tactics you can employ to potentially save money on your property insurance. In this article, we will explore some of the key factors that insurers consider when determining your property insurance premium and provide useful tips on how you can lower it. So, let’s dive in and find out how you can protect your property without breaking the bank!

Home Security Measures

Installing a Security System

Installing a security system is one of the most effective ways to enhance the safety and security of your home. With advancements in technology, there are a wide variety of security systems available in the market, catering to different needs and budgets. These systems usually consist of sensors, cameras, alarms, and a central control panel. By installing a security system, you not only deter potential burglars but also receive immediate alerts in case of any unauthorized access. This can significantly reduce the risk of theft and property damage, leading to lower insurance premiums.

Adding Smoke Detectors

Smoke detectors are a crucial component of any home’s safety measures. They are designed to detect the presence of smoke and alert homeowners to possible fires, providing valuable time to evacuate and call emergency services. By adding smoke detectors in strategic locations throughout your home, such as near bedrooms and the kitchen, you can ensure early detection of smoke or fire-related incidents. This proactive approach to fire safety not only protects your property but also reduces the risk of extensive damage, potentially leading to cost savings on your insurance premiums.

Upgrading Locks and Deadbolts

The security of your home starts at the front door. By upgrading your locks and deadbolts, you can fortify your entry points and make it more difficult for unauthorized individuals to gain access to your property. Consider opting for high-quality, bump-proof locks and reinforced strike plates for added security. Additionally, installing deadbolts that extend deep into the door frame adds an extra layer of protection against forced entry. These simple yet effective upgrades demonstrate your commitment to home security, which insurance providers often reward with lower premiums.

Property Maintenance and Upgrades

Regular Maintenance and Repairs

Regular maintenance and prompt repairs play a crucial role in maintaining the overall condition and safety of your property. By addressing small issues before they escalate into larger problems, you can prevent costly damage and ensure that your home remains in good condition. Keeping up with maintenance tasks such as inspecting and maintaining your HVAC system, checking for plumbing leaks, and inspecting the roof for any signs of damage can help mitigate potential risks and reduce the likelihood of filing insurance claims.

Installing Weather-Resistant Features

Living in a region prone to extreme weather conditions can increase the risk of property damage. Installing weather-resistant features, such as impact-resistant windows and reinforced doors, can help protect your home against strong winds, hail, and flying debris. Additionally, investing in storm shutters or hurricane-resistant roofing materials can further safeguard your property during severe weather events. Insurance providers often offer discounts to homeowners who proactively take steps to reinforce their homes against potential weather-related risks.

Upgrading Electrical and Plumbing Systems

Outdated electrical and plumbing systems pose significant risks not only to the safety and functionality of your home but also to your insurance premiums. Upgrading old wiring to meet modern safety standards helps minimize the risk of electrical fires. Similarly, replacing aging pipes and valves with newer, more durable materials can prevent water leaks and subsequent property damage. By investing in the upgrade and maintenance of your electrical and plumbing systems, you reduce the likelihood of costly claims and demonstrate responsible homeownership to insurance providers.

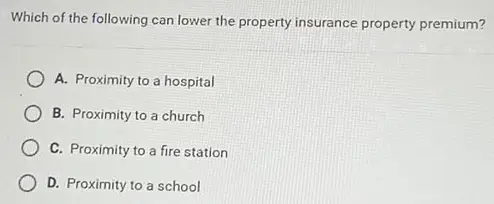

Location Factors

Proximity to Fire Stations

The location of your property plays a key role in determining your insurance premium. Homes located in close proximity to fire stations generally have lower premiums due to the reduced response time in case of a fire emergency. Insurance providers consider this factor because faster response times can significantly minimize property damage and potential loss. When purchasing or considering a new home, it is beneficial to evaluate the distance between the property and the nearest fire station to potentially qualify for lower insurance premiums.

Proximity to Police Stations

Similar to fire stations, the proximity of your home to police stations can impact your insurance premiums. Homes located in areas with a strong police presence and quick response times may enjoy lower premiums. A strong police presence deters criminal activity and enhances the overall security of the neighborhood, reducing the likelihood of theft or vandalism. When selecting a property, it is worth considering the distance between the home and nearby police stations to potentially lower your insurance costs.

Local Climate and Natural Disasters

The climate and natural disaster risks associated with your property’s location are major factors influencing your insurance premium. Areas prone to hurricanes, earthquakes, floods, or wildfires typically have higher premiums due to the increased likelihood of property damage. It is important to understand the natural disaster risks in your region and take necessary precautions to mitigate these risks. This may include reinforcing your property against specific hazards or purchasing additional coverage for natural disasters not covered under standard insurance policies. By taking proactive measures, you can potentially reduce your insurance premium.

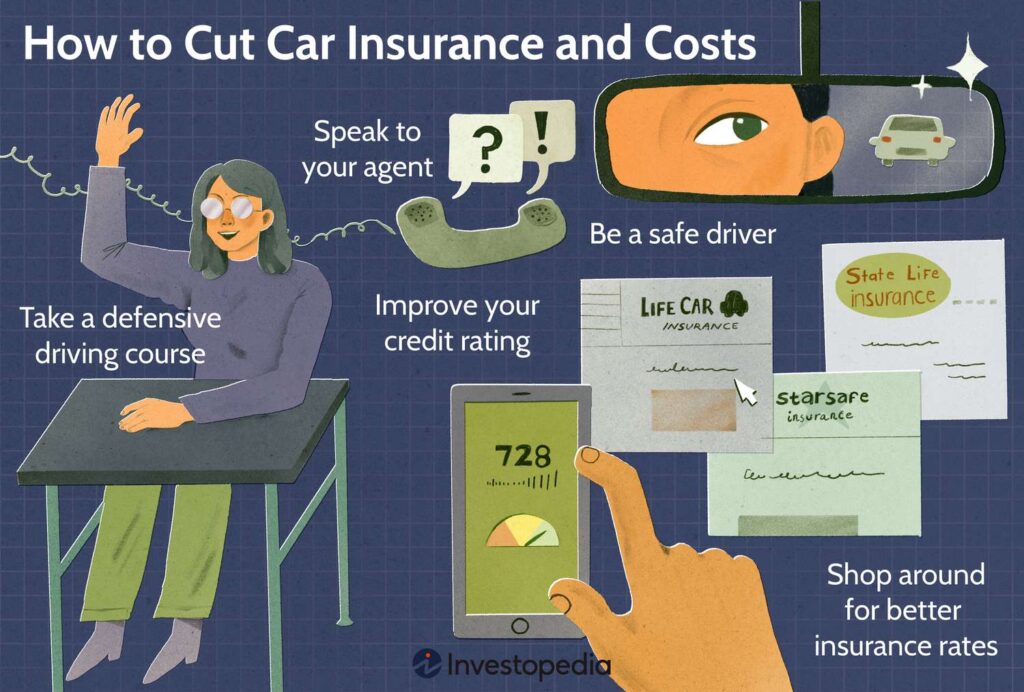

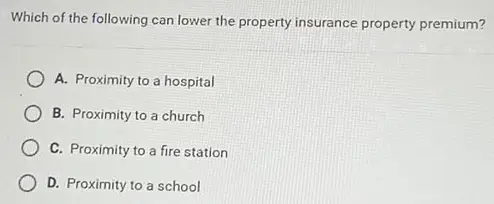

Insurance Policy Options

Choosing Higher Deductibles

One strategy to lower your property insurance premium is to consider choosing a higher deductible. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you assume more financial responsibility in the event of a claim. Insurance providers often offer lower premiums for policies with higher deductibles because it reduces the frequency of smaller claims. It is important to evaluate your financial situation and select a deductible that you can comfortably afford in the event of a loss.

Opting for Actual Cash Value (ACV) Coverage

When selecting an insurance policy, you typically have the option to choose between replacement cost value (RCV) or actual cash value (ACV) coverage. ACV coverage takes into account the depreciation of your property and possessions over time, while RCV coverage provides reimbursement for the full cost of repairing or replacing damaged items. Opting for ACV coverage can result in lower insurance premiums since the insurer’s liability is reduced. However, it is important to carefully consider the implications and potential out-of-pocket expenses when filing a claim under ACV coverage.

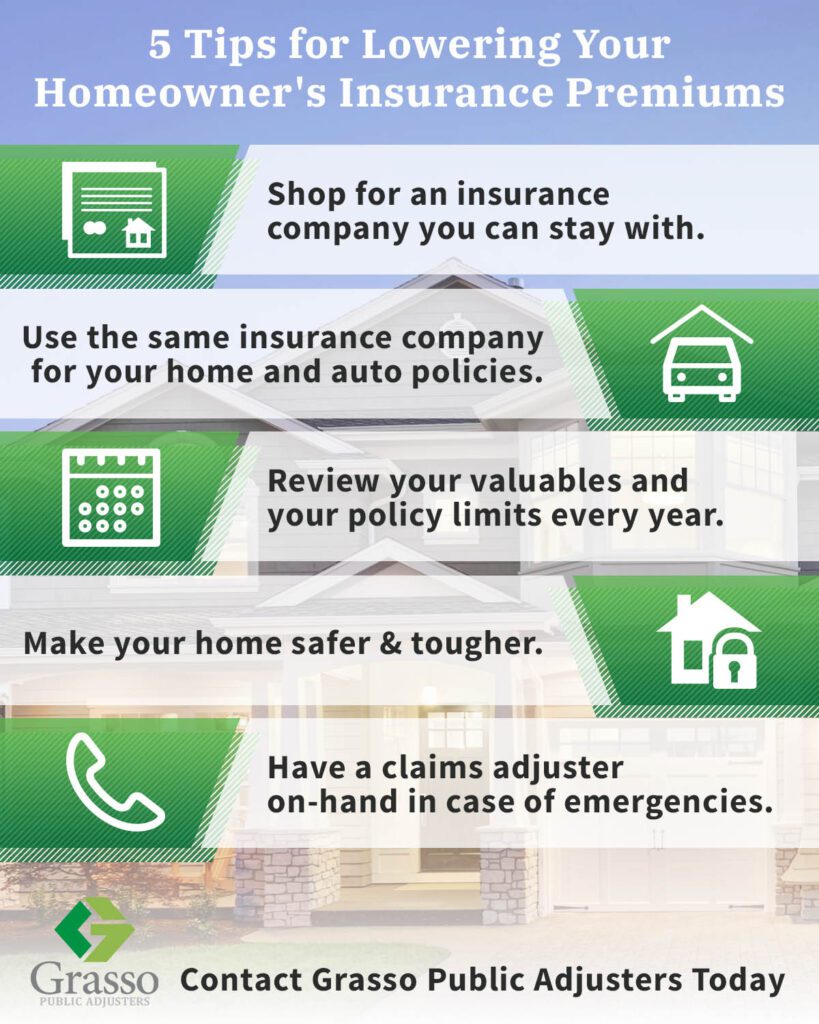

Bundling Policies

Many insurance providers offer discounts to policyholders who bundle their home insurance with other types of insurance, such as auto or umbrella policies. Bundling policies not only simplifies your insurance management by consolidating coverage under one provider but can also lead to cost savings. By bundling multiple policies, insurance companies often offer discounts as a way to retain customer loyalty. It is worth exploring the option of bundling your insurance policies to potentially lower your property insurance premium.

Roofing Improvements

Impact-Resistant Roofing Materials

The type of roofing material used on your property can significantly impact your insurance premium. Choosing impact-resistant materials such as metal, slate, or clay tiles can provide enhanced protection against hail, wind, and falling branches compared to traditional asphalt shingles. These materials are more resistant to damage, resulting in fewer claims, and potentially lower insurance premiums. When considering a roofing replacement or installation, consult with your insurance provider to determine any specific requirements or discounts associated with impact-resistant materials.

Regular Roof Inspections and Maintenance

Maintaining the integrity of your roof is essential to protect your property from water damage and potential structural issues. Regular roof inspections and timely repairs can prevent leaks, deterioration, and other roofing-related problems. Insurance providers often reward homeowners who demonstrate proactive maintenance by offering lower insurance premiums. By regularly inspecting your roof and addressing issues promptly, you not only maintain the value of your property but also potentially reduce your insurance costs.

Roofing Upgrades to Meet Building Codes

Ensuring that your roof meets current building codes is critical in maintaining the safety and structural integrity of your home. Outdated roofing materials or installations may pose higher risks of damage during inclement weather or disasters, leading to higher insurance premiums. By upgrading your roof to meet current building codes, you demonstrate commitment to safety and reduce potential risks, which insurance providers may reward with lower premiums. It is advisable to consult with a professional contractor to assess the compliance of your roof with building codes and make any necessary upgrades.

Updating Electrical Systems

Upgrading Old Wiring

Outdated electrical wiring can pose serious fire hazards and safety risks. Homeowners with old electrical systems may experience higher insurance premiums due to the increased likelihood of electrical fires. Upgrading old wiring to meet modern safety standards significantly reduces these risks and demonstrates responsible homeownership. By hiring a licensed electrician to inspect and upgrade your electrical system, you can potentially qualify for lower insurance premiums while ensuring the safety of your home and its occupants.

Installing Surge Protection Devices

Electrical surges can cause significant damage to your appliances, electronics, and electrical infrastructure. Installing surge protection devices, such as whole-house surge protectors and individual power strips, can safeguard your property against voltage spikes. By protecting your electrical system from surges, you reduce the risk of electrical fires and equipment damage, potentially leading to lower insurance premiums. Consider consulting with an electrician about the appropriate surge protection devices for your home.

Ensuring Proper Electrical Capacity

Overloading your electrical system can lead to frequent tripping of circuit breakers, overheating, and increased fire hazards. Ensuring that your electrical capacity is adequate for your home’s needs is a crucial aspect of property safety. If you have recently added electrical appliances or completed renovations, it may be necessary to assess whether your electrical panel can handle the increased load. By upgrading your electrical capacity to meet your home’s requirements, you mitigate potential risks and may be eligible for lower insurance premiums.

Fire Safety Precautions

Installing Fire Extinguishers

Having readily accessible fire extinguishers in your home is a fundamental fire safety precaution. These devices can significantly minimize the damage caused by small fires and extinguish them before they escalate into larger, more dangerous events. Installing fire extinguishers in strategic locations throughout your property, such as the kitchen, garage, and near fire-prone areas, demonstrates your commitment to fire safety. Insurance providers often offer discounts to homeowners who take proactive measures to prevent fire-related incidents.

Having Fire Sprinkler Systems

Fire sprinkler systems are highly effective in suppressing fires and protecting lives and property. While often associated with commercial buildings, residential fire sprinkler systems are becoming increasingly common in homes. Having a fire sprinkler system installed in your property not only provides additional safety but can also result in lower insurance premiums. Insurance providers recognize the significant reduction in property damage that fire sprinklers can achieve and often offer discounts as a result.

Maintaining Clear Fire Exits

Ensuring that fire exits are clear, unobstructed, and easily accessible is crucial for the safety of your household. In the event of a fire, clear exits facilitate safe and swift evacuations, reducing the risk of injury or loss of life. Insurance companies typically reward homeowners who maintain clear fire exits by offering lower insurance premiums. Regularly inspect your property to ensure that all fire exits are free from clutter and easily identifiable, allowing for quick and safe evacuation if an emergency arises.

Mitigating Water Damage Risks

Installing a Sump Pump or Water Alarms

Basements and crawl spaces are particularly vulnerable to water damage from flooding or seepage. Installing a sump pump or water alarms in these areas can help mitigate the risk of water damage by automatically removing excess water or alerting you to potential leaks. Additionally, consider installing a backup power source for your sump pump to ensure functionality during power outages. By proactively addressing water damage risks, you reduce the likelihood of filing insurance claims and may be eligible for lower premiums.

Properly Insulating Pipes

Freezing temperatures can cause pipes to burst, leading to significant water damage. Properly insulating exposed pipes in your home, particularly in unheated areas, helps prevent freezing and subsequent pipe bursts. Ensuring adequate insulation in your walls, attic, and crawl spaces also helps maintain stable indoor temperatures, reducing the risk of pipe damage. By taking measures to insulate your pipes, you demonstrate proactive risk management and may qualify for lower insurance premiums.

Regularly Cleaning Gutters and Drains

Clogged gutters, downspouts, and drains can cause water to accumulate and overflow, potentially leading to water damage to your property’s foundation, walls, or basement. Regularly cleaning and maintaining these areas is crucial in preventing water-related problems. By ensuring that water flows freely away from your house, you reduce the risk of water damage, which insurance providers recognize. Lower insurance premiums may be available for homeowners who demonstrate regular maintenance of gutters and drains.

Claims History and Loss Prevention

Filing Fewer Insurance Claims

The frequency and severity of insurance claims you file can directly impact your property insurance premium. By striving to minimize the number of claims you file and addressing minor repairs and damages independently, you can effectively lower your insurance premium. Insurance providers often offer discounts or incentives to policyholders with a clean claims history, as it indicates responsible homeownership and a reduced likelihood of future claims. Evaluating the potential costs of filing a claim against your deductible can help determine whether filing a claim is the best course of action.

Implementing Safety Training for Employees

If you operate a business from your property, employee safety is essential, not only from a moral standpoint but also for potential insurance savings. Implementing safety training programs for your employees can greatly reduce the risk of workplace accidents, injuries, and liability claims. Insurance providers often reward businesses that prioritize employee safety by offering lower premiums or discounted rates. By investing in safety training and ensuring a safe working environment, you demonstrate your commitment to employee well-being and may benefit from reduced insurance costs.

Keeping Records of Maintenance and Repairs

Maintaining accurate records of property maintenance and repairs can be beneficial when it comes to assessing insurance premiums. By documenting regular maintenance tasks, repairs, and improvements, you provide evidence of responsible property management and risk mitigation. Insurance providers often consider these records when calculating premiums, as they demonstrate your commitment to maintaining a safe and well-maintained property. Establishing a record-keeping system can help you efficiently track and store maintenance and repair documents, potentially lowering your insurance premium.

Risk Assessment and Loss Control

Conducting Thorough Property Inspections

Regular property inspections are an integral part of risk assessment and loss control. By conducting thorough inspections, you can identify potential hazards or areas that require maintenance or improvement. Inspecting your property allows you to proactively address issues before they cause significant damage or pose safety risks. Insurance providers often view regular property inspections positively as it indicates responsible homeownership and can result in lower insurance premiums. Consider scheduling professional inspections or conducting self-assessments to ensure the safety and maintenance of your property.

Identifying Potential Hazards

Identifying potential hazards is a crucial step in risk assessment and loss control. By recognizing hazards such as uneven walkways, faulty electrical wiring, or slippery surfaces, you can greatly reduce the risk of accidents and property damage. Implementing corrective measures, such as repairing or replacing hazardous components, enhances the overall safety of your property. Insurance providers often appreciate proactive hazard identification and mitigation, leading to the possibility of lower insurance premiums.

Implementing Safety and Security Measures

Implementing safety and security measures is essential in protecting your property and reducing the risk of accidents, theft, and property damage. Installing security systems, smoke detectors, fire extinguishers, and other safety equipment demonstrates your commitment to maintaining a secure environment. Additionally, implementing measures such as proper lighting, fencing, or surveillance systems can deter potential criminals, reducing the risk of burglary or property damage. Insurance providers often reward these safety measures with lower insurance premiums, as they demonstrate responsible homeownership and risk management.

By implementing these home security measures, maintaining your property, considering location factors, choosing the right insurance policy options, making necessary roofing and electrical improvements, taking fire safety precautions, mitigating water damage risks, maintaining a positive claims history, conducting risk assessments, and implementing safety and security measures, you can significantly lower your property insurance premium. Remember, investing in the safety, security, and maintenance of your property not only protects your home and belongings but also brings peace of mind and potential cost savings in the long run.