When it comes to managing our finances, finding ways to save money is always a top priority. And if you’re looking to lower the cost of your insurance premium, there is a simple yet effective strategy that you can consider. By taking proactive steps to improve your credit score, you may be able to significantly reduce your insurance costs. In this article, we’ll explore how having a good credit score can positively impact your insurance premium and provide you with some actionable tips to improve your creditworthiness. So, if you’re looking for ways to save on insurance while boosting your financial health, keep reading! One way to lower the cost of your insurance premium is by choosing a higher deductible. In this article, we will explore the concept of a deductible, how a higher deductible can lower your premium, and the factors to consider when choosing a deductible.

1. Choose a Higher Deductible

1.1. What is a deductible?

A deductible is the amount of money you have to pay out of pocket before your insurance coverage kicks in. It is a fixed amount set by your insurance company and can vary depending on the type of insurance policy you have. For example, in auto insurance, you may have a deductible of $500 or $1,000.

1.2. How does a higher deductible lower premium?

When you choose a higher deductible, it means you are willing to take on more financial responsibility in the event of a claim. By increasing your deductible, you are essentially shifting some of the risk from the insurance company to yourself. This reduced risk for the insurance company often translates to a lower premium for you.

1.3. Considerations when choosing a deductible

When deciding on the amount of your deductible, it is important to consider your financial situation. While a higher deductible may lead to lower premiums, it also means you will have to pay more out of pocket in case of a claim. Make sure you choose a deductible that you can comfortably afford to pay at any given time.

2. Bundle Your Policies

2.1. What is policy bundling?

Policy bundling is the practice of combining multiple insurance policies, such as auto and home insurance, under the same insurance provider. By bundling your policies, you can often qualify for discounts and enjoy the convenience of managing all your policies in one place.

2.2. Benefits of policy bundling

There are several benefits to bundling your policies. First, you can save money by taking advantage of multi-policy discounts offered by insurance companies. These discounts can often result in significant savings on your premiums. Second, bundling allows for greater convenience and ease of management. Instead of dealing with multiple insurance companies, you only have to communicate with one.

2.3. Factors to consider before bundling

Before bundling your policies, it is important to compare the individual premiums and coverage options for each policy separately. While bundling may offer discounts, it doesn’t guarantee the best rates for each individual policy. Additionally, ensure that the coverage and limits provided by the bundled policies meet your specific needs.

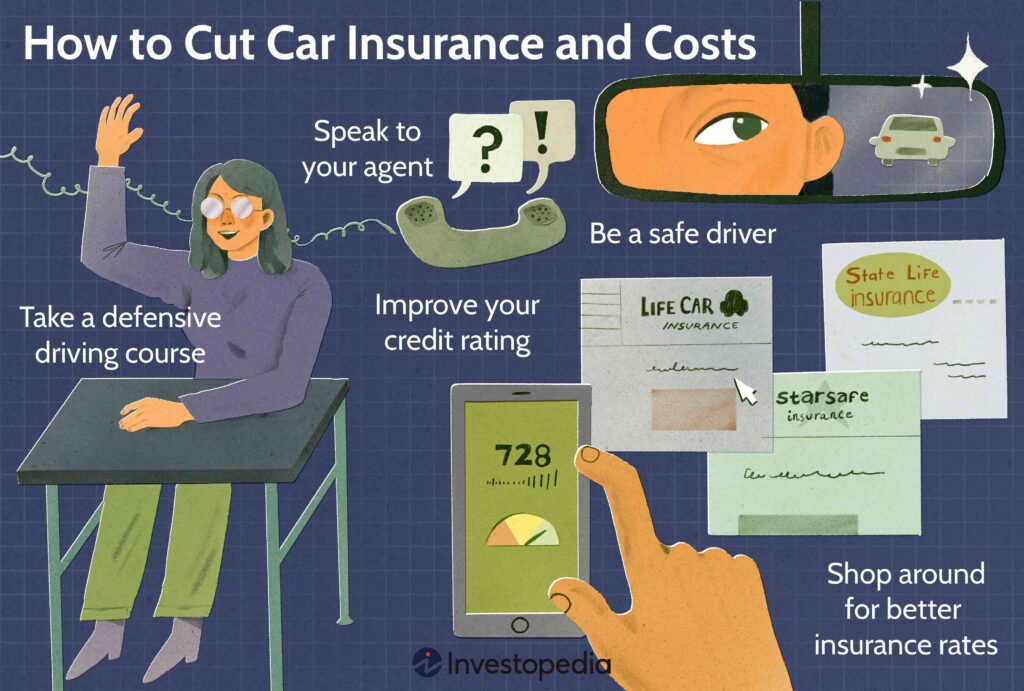

3. Maintain a Good Credit Score

3.1. Importance of credit score for insurance premiums

Your credit score can have an impact on your insurance premiums. Insurance companies often consider credit scores as a factor when determining premiums for certain types of insurance, such as auto and home insurance. A good credit score can contribute to lower premiums, while a poor credit score may result in higher premiums.

3.2. How credit score affects premiums

Insurance companies have found a correlation between credit scores and the likelihood of filing a claim. Individuals with higher credit scores are believed to be more financially responsible and less likely to file claims, resulting in lower premiums. On the other hand, individuals with lower credit scores may be perceived as higher risk, leading to higher premiums.

3.3. Tips to improve your credit score

To maintain a good credit score, it is important to pay your bills on time, keep your credit card balances low, and avoid opening unnecessary credit accounts. Regularly checking your credit report for errors and addressing them promptly can also help improve your credit score over time.

4. Shop Around for Better Rates

4.1. The importance of comparing insurance rates

Shopping around for insurance rates is crucial to ensure you are getting the best value for your money. Insurance premiums can vary significantly between different insurance companies, and comparing rates allows you to identify the most competitive options available to you.

4.2. How to shop around for better rates

To shop around for better insurance rates, you can start by gathering quotes from multiple insurance companies. This can be done by contacting each company directly or utilizing online comparison tools. It is important to provide accurate information when requesting quotes to ensure accurate pricing.

4.3. Considerations when comparing quotes

When comparing insurance quotes, it is important to not only focus on the price but also consider the coverage and customer service provided by each company. Be sure to review the policy terms and conditions, as well as any limitations or exclusions. Additionally, consider the reputation and financial stability of the insurance company before making a decision.

5. Maintain a Safe Driving Record

5.1. Why a clean driving record matters

Maintaining a clean driving record is crucial for keeping your insurance premiums low. Insurance companies consider your driving history when determining your premiums and a history of accidents or traffic violations can result in higher premiums.

5.2. How driving violations impact premiums

Driving violations, such as speeding tickets or at-fault accidents, can signal to insurance companies that you are a higher risk driver. This increased risk often leads to higher premiums as the insurance company anticipates a potential for future claims. Conversely, a clean driving record demonstrates safe driving habits, resulting in lower premiums.

5.3. Tips for maintaining a safe driving record

To maintain a safe driving record, it is important to follow traffic laws and practice defensive driving techniques. Avoid distractions while driving, such as using your phone or eating, and always wear your seatbelt. Additionally, consider taking defensive driving courses to enhance your driving skills and potentially qualify for insurance discounts.

6. Install Safety Features

6.1. Benefits of safety features for insurance premiums

Installing safety features in your vehicle can contribute to lower insurance premiums. Safety features help reduce the risk of accidents and injuries, which insurance companies take into account when determining premiums.

6.2. Types of safety features to consider

There are various safety features you can install in your vehicle to potentially lower your insurance premiums. Some common examples include anti-lock brakes, airbags, electronic stability control, and theft deterrent systems. It is important to check with your insurance company to see which safety features qualify for premium reductions.

6.3. Cost-effectiveness of installing safety features

While installing safety features can lead to lower insurance premiums, it is essential to consider the cost-effectiveness of these additions. Evaluate the cost of adding the safety features against the potential premium savings to ensure you are making a wise financial decision.

7. Consider Usage-Based Insurance

7.1. What is usage-based insurance?

Usage-based insurance, also known as pay-as-you-go insurance, is a type of coverage that takes into account your driving habits and behaviors to determine your premium. It involves utilizing telematics devices or smartphone apps to track factors such as mileage, speed, and driving patterns.

7.2. Pros and cons of usage-based insurance

One of the main benefits of usage-based insurance is the potential for lower premiums if you are a safe driver. By having your driving habits monitored, insurance companies can reward safe and low-mileage drivers with lower rates. However, it may not be suitable for everyone, as it requires sharing driving information and could result in higher premiums for riskier drivers.

7.3. Factors to consider when opting for usage-based insurance

Before opting for usage-based insurance, consider your driving habits and privacy concerns. Evaluate whether you are comfortable with your driving data being tracked and shared with the insurance company. Additionally, ensure that the program aligns with your driving patterns and lifestyle.

8. Take Advantage of Discounts

8.1. Common discounts available

Insurance companies often offer various discounts that can help lower your premiums. Some common discounts include multi-policy discounts, good student discounts, safe driver discounts, and discounts for certain professions or memberships.

8.2. How to qualify for discounts

To qualify for discounts, it is important to communicate with your insurance company and inquire about the available discounts. Provide any necessary documentation or proof required to validate your eligibility for the discounts. Additionally, regularly review your policy and alert your insurance company to any changes that may result in qualifying for new discounts.

8.3. Checking for available discounts

It is always a good practice to periodically check with your insurance company or agent to see if there are any new discounts available. Insurance companies may introduce new discounts or modify existing ones, so staying informed can ensure you are maximizing your savings.

9. Review and Update Your Coverage

9.1. The importance of reviewing your coverage

Regularly reviewing your insurance coverage is essential to ensure you have adequate protection and are not paying for unnecessary or redundant coverage. Changes in your lifestyle, assets, or coverage needs may require adjustments to your policy.

9.2. When to update your coverage

It is important to update your coverage whenever there are significant changes in your life. This can include purchasing a new home, getting married, having children, or acquiring valuable assets. Additionally, as your financial situation improves, you may consider increasing your coverage limits for added protection.

9.3. Factors to consider when adjusting coverage

When adjusting your coverage, consider factors such as your personal circumstances, budget, and risk tolerance. Assess your insurance needs and consult with your insurance provider to determine the appropriate coverage for your specific situation. It may be beneficial to seek professional advice to ensure you are adequately protected.

10. Opt for a Higher Excess

10.1. Understanding excess in insurance

An excess, also known as a deductible, is the amount you agree to contribute towards a claim before your insurance pays the remaining balance. Opting for a higher excess means you are willing to take on more financial responsibility in the event of a claim.

10.2. Advantages of choosing a higher excess

By choosing a higher excess, you can often lower your insurance premiums as insurance companies view it as a decreased liability on their part. It can be a cost-effective strategy if you are confident in your ability to cover the higher excess amount in the event of a claim.

10.3. Factors to consider when selecting an excess amount

When selecting an excess amount, consider your financial situation and ability to pay the excess in the event of a claim. It is important to strike a balance between a higher excess to lower premiums and an amount that you can comfortably afford to contribute at any given time.

In conclusion, there are multiple strategies you can employ to lower the cost of your insurance premiums. By choosing a higher deductible, bundling your policies, maintaining a good credit score, shopping around for better rates, maintaining a safe driving record, installing safety features, considering usage-based insurance, taking advantage of discounts, reviewing and updating your coverage, and opting for a higher excess, you can potentially save money on your insurance premiums while still maintaining the necessary coverage. Remember to assess your individual circumstances, needs, and risks when implementing these strategies to ensure you make informed decisions.