If you’re a homeowner, you know the importance of having insurance to protect your property and belongings. But did you know that certain factors can cause your homeowners insurance premiums to increase? In this article, we’ll explore four or more key factors that can impact the cost of your insurance. By understanding these factors, you’ll be better equipped to make informed decisions about your coverage and potentially save money in the long run. So, let’s dive in and take a closer look at what could be affecting your homeowners insurance premiums.

1. Location

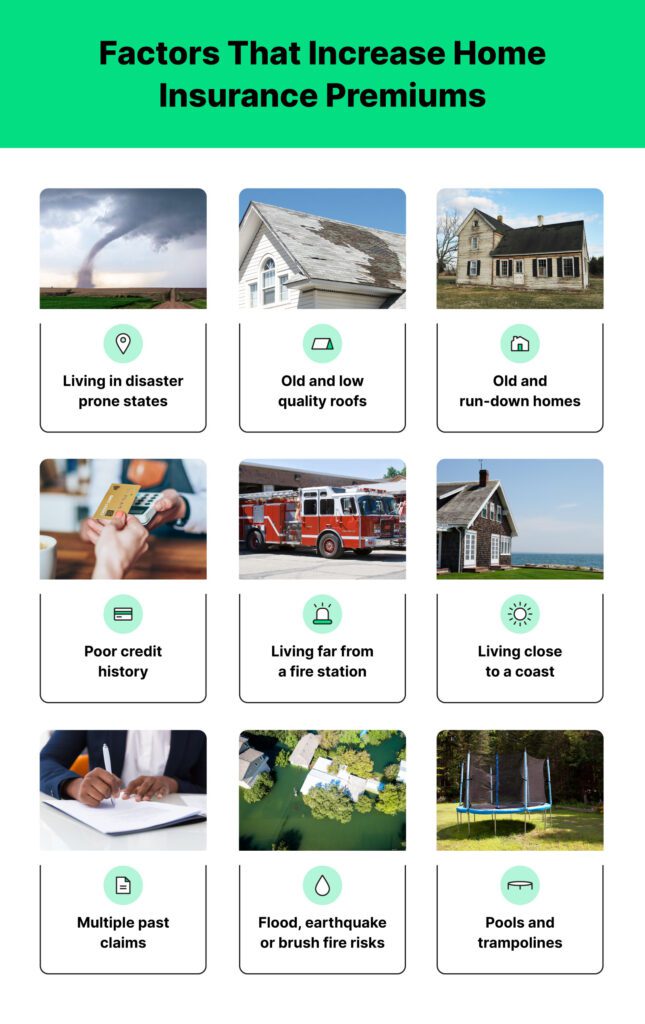

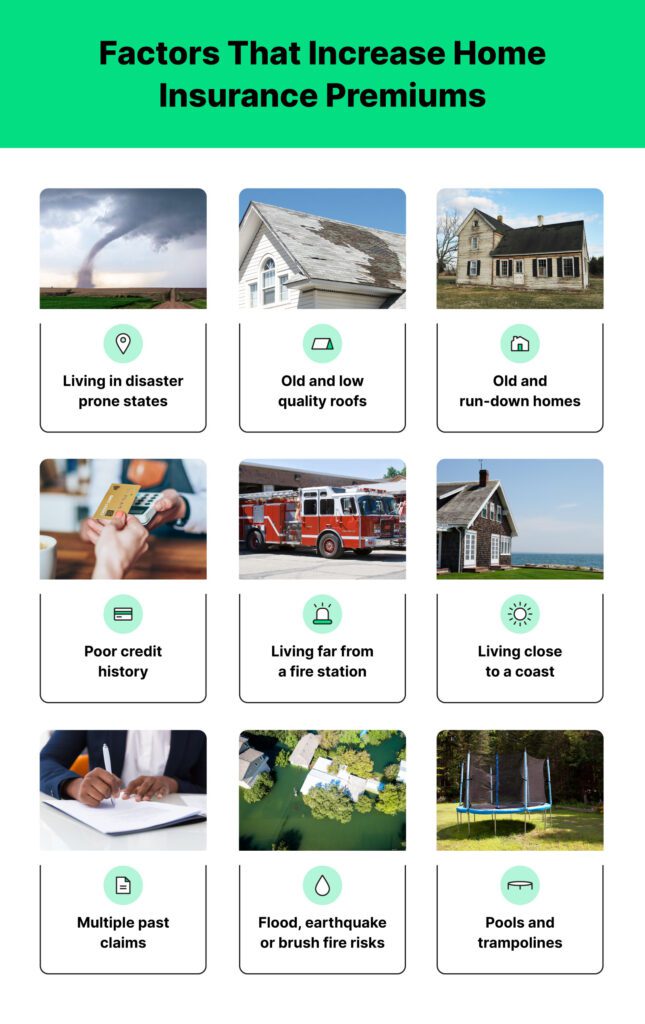

Proximity to Natural Disasters

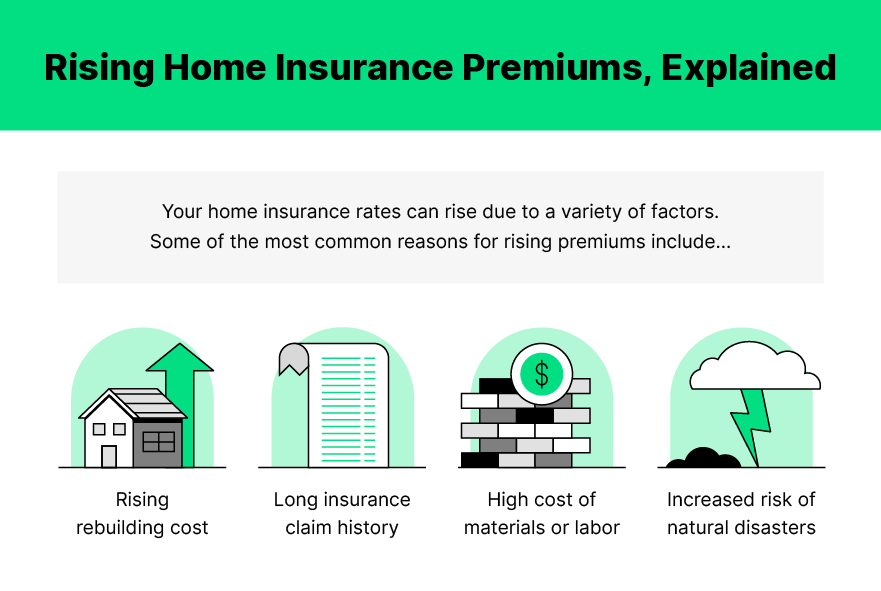

When determining your homeowners insurance premiums, one important factor that insurance companies consider is the proximity of your home to natural disasters. If your home is located in an area prone to hurricanes, earthquakes, wildfires, or other natural disasters, your insurance premiums may be higher. This is because these areas have an increased risk of property damage, which means a higher likelihood that insurance claims will be made.

Crime Rate in the Area

Another factor that can affect your homeowners insurance premiums is the crime rate in the area where your home is located. If you live in a high-crime area with a higher likelihood of theft, vandalism, or burglary, insurance companies may consider your home at a higher risk and charge higher premiums to compensate for that risk. On the other hand, if you live in a safe neighborhood with a low crime rate, you may be eligible for lower insurance premiums.

Local Fire Protection

The availability and quality of local fire protection services can also impact your homeowners insurance premiums. Insurance companies assess the fire protection capabilities in your area, including the proximity of fire hydrants, the response time of the local fire department, and the quality of the fire department’s equipment. Homes situated in areas with better fire protection are considered to have a reduced risk of fire damage, resulting in potentially lower insurance premiums.

Flood Zone Classification

If your property is located in a flood-prone area, your homeowners insurance premiums may be affected. Flood damage is not typically covered by standard homeowners insurance policies, so residing in a high-risk flood zone can result in higher premiums, as you may need to purchase additional flood insurance. Insurance companies determine flood zone classifications based on various factors such as elevation, historical flood data, and proximity to bodies of water. It is essential to check if your home is in a flood zone and assess the potential impact on your insurance premiums.

2. Building Characteristics

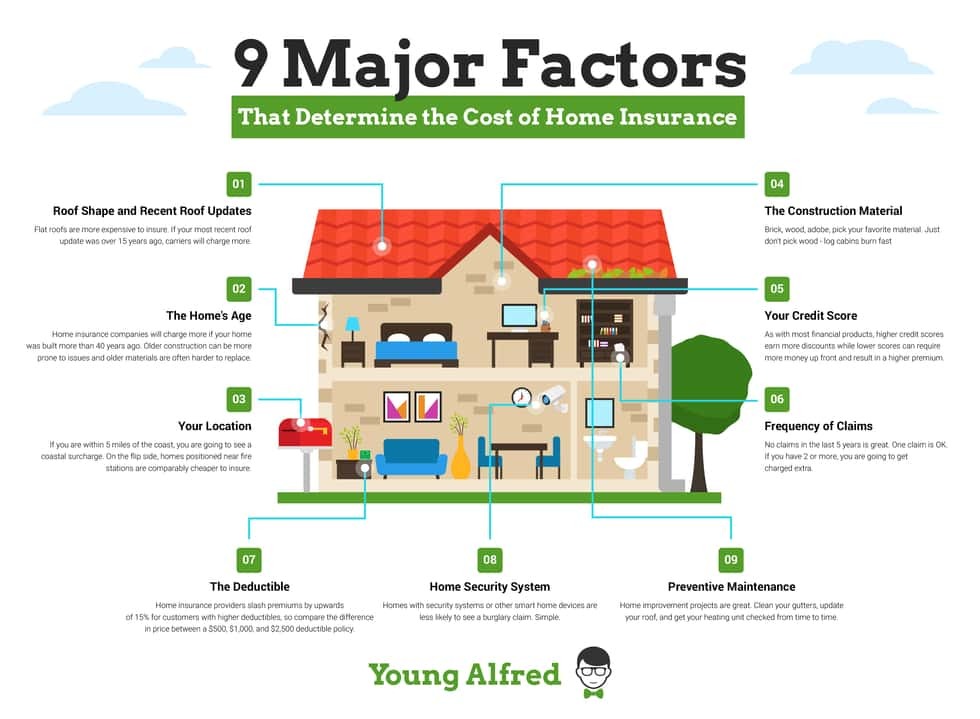

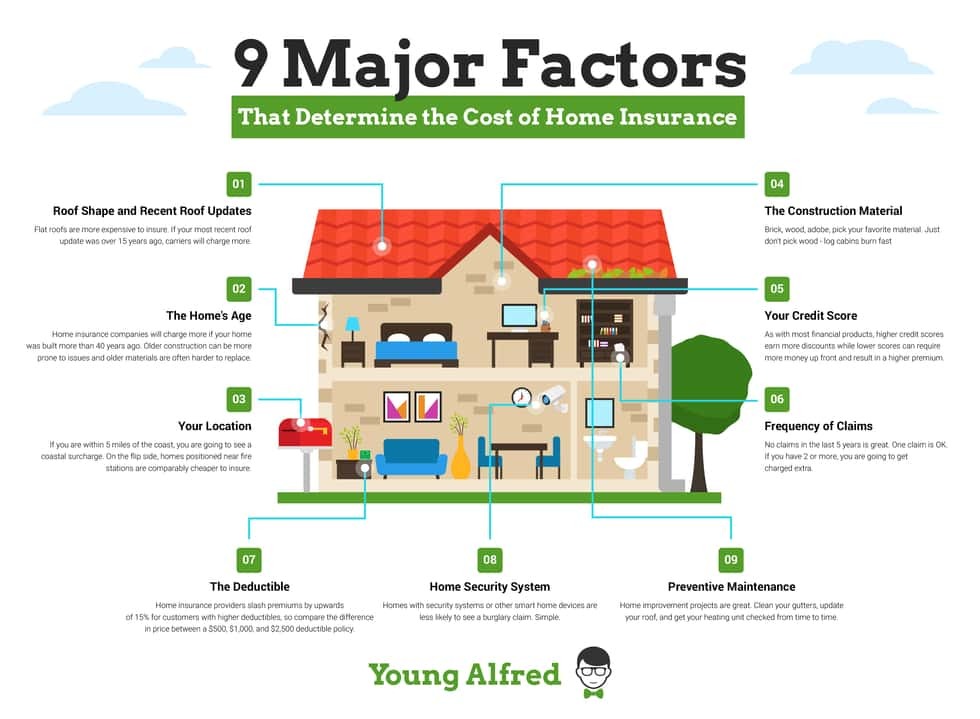

Age of the Property

The age of your property plays a significant role in determining your homeowners insurance premiums. Older homes may have outdated electrical systems, plumbing, or structural components that pose a higher risk of damage or accidents. As a result, insuring older homes often comes with higher premiums. On the other hand, newer homes typically have more modern construction materials and safety features, resulting in potentially lower insurance premiums.

Type of Construction Materials

The type of construction materials used in your home can also affect your insurance premiums. Homes built with fire-resistant materials such as brick, concrete, or masonry tend to have lower premiums due to their reduced risk of fire damage. On the other hand, homes made of wood or other flammable materials may have higher premiums due to the increased risk of fire. Additionally, homes constructed with durable materials that can withstand severe weather conditions may also qualify for lower premiums.

Roof Type and Age

The type and age of your roof are important considerations for insurance companies when assessing your premiums. Roofs made of sturdy materials like metal or tile generally have a longer lifespan and are more resistant to damage, resulting in potentially lower premiums. In contrast, roofs made of asphalt shingles or older roofs nearing the end of their lifespan may increase your insurance costs, as they are more susceptible to damage from storms, strong winds, or other perils.

Safety Features

The presence of safety features in your home can also impact your homeowners insurance premiums. Installing security systems, smoke detectors, fire alarms, and sprinkler systems can reduce the risk of theft, fire, and other damages. Insurance companies often offer discounts or lower premiums for homes with these safety features since they enhance the overall safety of the property. Upgrading or adding safety features not only protects your home but may also help you save money on your insurance premiums.

3. Personal Factors

Credit Score

Your credit score can have an impact on your homeowners insurance premiums. Insurance companies may consider individuals with higher credit scores as less likely to file claims. Therefore, a good credit score can potentially help you secure lower premiums. On the other hand, if you have a low credit score, insurance companies may view you as a higher risk, leading to higher insurance premiums.

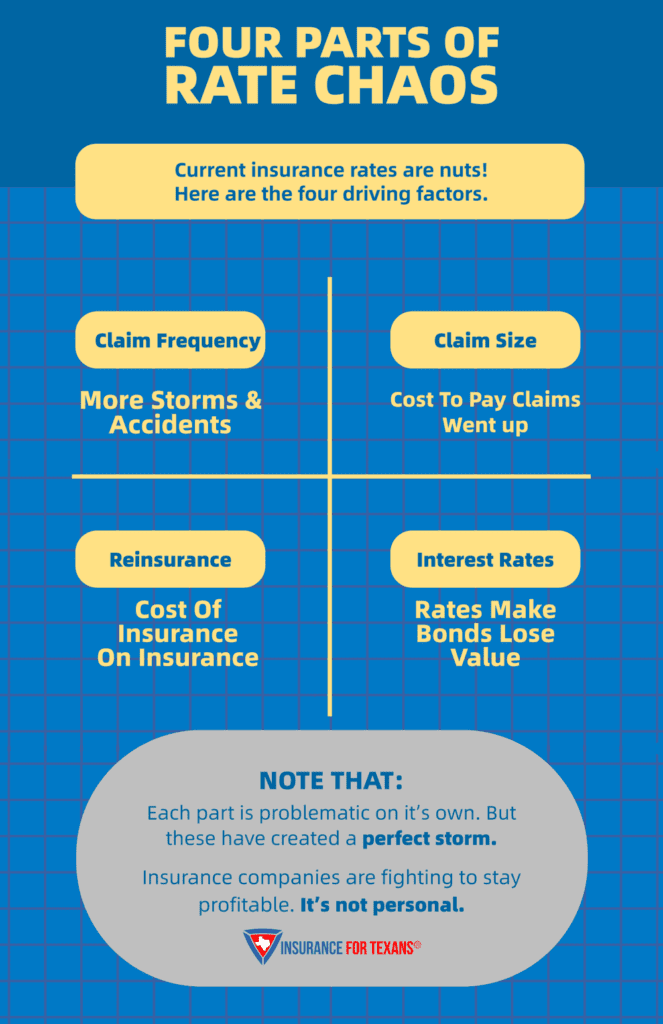

Claim History

Your claim history plays a significant role in determining your homeowners insurance premiums. If you have a history of multiple claims or costly claims, insurance companies may consider you a high-risk policyholder and charge higher premiums as a result. On the contrary, if you have a claim-free history or a minimal claims record, you may qualify for lower insurance premiums.

Occupancy

The occupancy of your home can affect your insurance premiums. Insurance companies differentiate between primary residences, rental properties, and vacation homes. Primary residences typically have lower insurance premiums since they are occupied by the homeowners and pose less risk than properties that are rented out or unoccupied for long periods. If you are insuring a rental property or a vacation home, expect higher premiums due to the increased risk associated with these types of properties.

Pet Ownership

Owning certain dog breeds or exotic pets can impact your homeowners insurance premiums. Insurance companies may consider certain dog breeds as high risk due to a perceived higher likelihood of bites or attacks. If you own a dog that falls under these breed restrictions, insurance companies may charge higher premiums or exclude liability coverage related to pet incidents. Additionally, exotic pets may also affect your premiums due to potential property damage or liability risks associated with their presence.

4. Policy Details

Coverage Amount

The coverage amount you choose for your homeowners insurance policy can directly impact your premiums. Higher coverage limits mean more financial protection, but they also result in higher insurance premiums. It’s essential to evaluate your personal needs and the value of your assets when deciding on the appropriate coverage amount. Balancing adequate coverage with affordable premiums is key to securing the right policy for your home.

Deductible Level

The deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Typically, higher deductibles translate to lower insurance premiums, while lower deductibles result in higher premiums. Choosing a higher deductible can help you save on premiums, but it’s important to assess your financial situation and ability to cover the deductible in the event of a claim.

Additional Coverage Options

Insurance companies offer various additional coverage options that can be added to your homeowners insurance policy. These options, such as personal property endorsements, sewer backup coverage, or identity theft protection, provide additional financial protection but may also increase your insurance premiums. It’s crucial to review the available options carefully and consider their costs and benefits before adding them to your policy.

Policy Discounts

Insurance companies often provide discounts that can help lower your homeowners insurance premiums. Common discounts include bundling multiple policies, installing security systems, having a claims-free history, or being a long-term customer. Additionally, some insurance companies offer discounts for specific professions or membership in certain organizations. It’s important to inquire about any available discounts and see if you qualify for them to potentially reduce your insurance costs.

5. Home Value

Market Value

The market value of your home is the price at which it could be sold in the current real estate market. While the market value is important for determining property taxes, it does not directly impact homeowners insurance premiums. Insurance companies care more about the replacement cost of your home and its contents, rather than the market value, when determining the appropriate coverage and premiums.

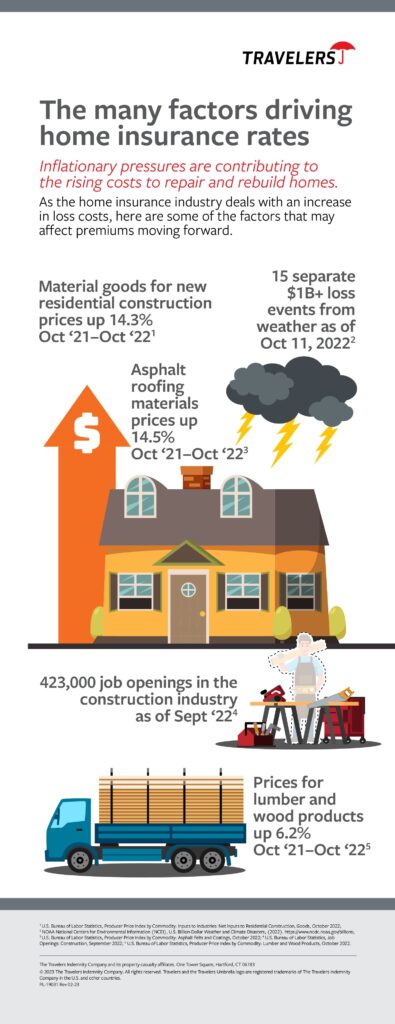

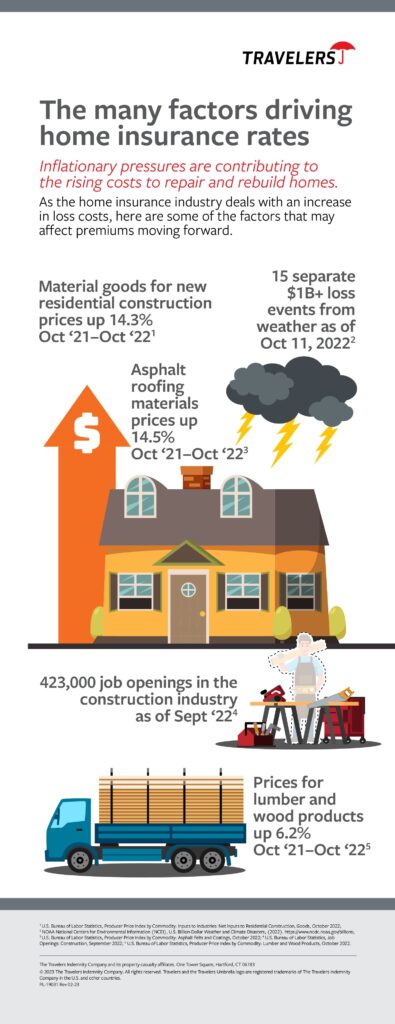

Replacement Cost

The replacement cost of your home is the estimated cost to rebuild it in the event of a total loss. This includes the construction costs, labor, and materials needed to restore your home to its pre-loss condition. Insurance companies typically base their premiums on the replacement cost value, as it reflects the potential risk and the amount of coverage needed. The higher the replacement cost, the higher your insurance premiums are likely to be.

Home Improvements

Home improvements can affect your homeowners insurance premiums. Upgrades such as a new roof, updated electrical or plumbing systems, or the installation of security features can qualify you for discounts, as they reduce the risk of damage or accidents. However, major additions or renovations that increase the value of your home or its replacement cost may result in higher premiums, as you need additional coverage to protect the improved property.

Property Size

The size of your property can also influence your homeowners insurance premiums. Larger homes generally have higher replacement costs, more contents to insure, and potentially more liability risks. As a result, insurance companies often charge higher premiums for homes with larger square footage. Similarly, if your property has additional structures such as detached garages, sheds, or guest houses, they may need separate coverage and can contribute to higher premiums.

6. Liability Risks

Swimming Pool

If you have a swimming pool on your property, it can increase your homeowners insurance premiums. Pools pose a higher liability risk, as accidents, injuries, or drownings can occur. Insurance companies typically recommend safety measures such as pool fences, locked gates, and pool alarms to mitigate these risks. Complying with these safety guidelines may help reduce the impact on your premiums.

Trampoline

Owning a trampoline can also impact your homeowners insurance premiums due to the liability risks associated with them. Trampolines can cause injuries, especially to children, resulting in potential liability claims. Some insurance companies may exclude coverage for injuries related to trampolines or charge higher premiums to offset the increased risk. It’s important to check with your insurance provider about their trampoline policy and any safety measures required to maintain coverage.

Garden Ponds

While garden ponds can be a beautiful addition to your property, they can also increase your homeowners insurance premiums. Ponds, especially if they contain fish or attract wildlife, may pose a higher risk of accidents, injuries, or property damage. Insurance companies may consider the liability risks associated with ponds when determining your premiums. Installing safety measures such as fences or protective covers can help mitigate these risks and potentially reduce your premiums.

Playground Equipment

If you have playground equipment on your property, such as swings, slides, or playsets, it can impact your homeowners insurance premiums. Insurance companies consider the potential liability risks associated with these structures, as accidents and injuries can occur. Ensuring proper maintenance, using age-appropriate equipment, and adhering to safety guidelines can help minimize these risks and potentially lower your insurance premiums.

7. Business Conducted at Home

Home Office

Running a home-based business can affect your homeowners insurance premiums. Business-related equipment, inventory, and liability risks associated with customers or employees visiting your home office may not be covered under a standard homeowners policy. You may need to obtain additional coverage, such as a business owners policy (BOP) or a commercial insurance policy, to adequately protect your business assets. Insurance premiums for these policies will depend on factors specific to your business, such as the nature of the business and the coverage limits needed.

Professional Services

If you provide professional services from your home, such as consulting or therapy services, it can impact your homeowners insurance premiums. Insurance companies may consider the liability risks associated with these services and may require specific coverage or higher policy limits to adequately protect your business assets. Consulting with your insurance provider to ensure you have appropriate coverage can help manage the impact on your premiums.

Customers or Clients Visiting

If you regularly have customers or clients visiting your home for business purposes, it can impact your homeowners insurance premiums. Increased foot traffic and potential liability risks associated with visitors can lead to higher premiums. Insurance companies may require additional liability coverage to protect against potential accidents or injuries that may occur on your property.

Inventory or Equipment

If your home-based business involves storing inventory or expensive equipment on your property, it can impact your homeowners insurance premiums. Standard homeowners policies typically have limited coverage for business property, and you may need additional coverage to protect your inventory and equipment adequately. The value of your business assets and the need for specific coverage will influence the impact on your insurance premiums.

8. Smoking

Smokers in the Household

If there are smokers living in your household, it can affect your homeowners insurance premiums. Smoking poses a higher risk of fire, and insurance companies take this into consideration when determining premiums. Certain insurance providers may charge higher premiums for homes with smokers due to the increased likelihood of fire-related claims. Quitting smoking or ensuring proper safety measures can help mitigate these risks and potentially reduce your premiums.

Fire Risk

Smoking-related fire risks can impact your homeowners insurance premiums. Fires caused by smoking materials can lead to extensive property damage, injuries, and potential liability claims. Insurance companies may consider the presence of smokers and the safety measures in place, such as fire-resistant ashtrays or smoke detectors, when assessing the risk and setting premiums. Taking precautions to reduce the fire risk associated with smoking can help manage the impact on your insurance costs.

Property Damage

Smoking-related property damage can influence your homeowners insurance premiums. Burns, scorch marks, or stains caused by smoking materials can deteriorate the condition of your property and potentially lead to claims. Insurance companies may charge higher premiums or exclude coverage for property damage specifically related to smoking. Maintaining a smoke-free environment within your home can help prevent these types of damage and potentially save on insurance costs.

9. Previous Insurance Cancellations

Policy Lapses

If you have a history of policy lapses, it can impact your homeowners insurance premiums. Insurance companies consider lapses as a potential risk, as it suggests a lack of continuous coverage and may indicate a higher likelihood of future claims. Having a record of policy lapses can result in higher premiums or even difficulty in obtaining coverage from certain insurance providers.

Non-Payment

Non-payment of insurance premiums can have consequences on your homeowners insurance premiums. Insurance companies may view non-payment as an indication of financial instability and may charge higher premiums or deny coverage altogether. It’s important to ensure timely payment of insurance premiums to maintain a good insurance record and avoid any negative impact on your premiums.

High-Risk Claims

Having a history of high-risk claims can affect your homeowners insurance premiums. Insurance companies classify certain types of claims as high-risk, such as water damage, mold, or personal injury claims. If you have a history of frequent or costly claims in these categories, insurance companies may charge higher premiums to offset the increased risk of future occurrences.

Fraudulent Activity

Engaging in fraudulent activity related to homeowners insurance can have severe consequences on your premiums and insurability. Fraudulent claims or misrepresenting information can lead to policy cancellations, difficulty in obtaining new coverage, and potential legal consequences. It’s crucial to be honest and transparent throughout the insurance process to maintain the trust of your insurance provider and ensure fair and accurate premiums.

10. Nearby Construction

Renovations

Nearby construction or renovations can impact your homeowners insurance premiums. Construction activities near your property can increase the risk of property damage, accidents, or disruptions to utility services. Insurance companies may perceive these risks as higher and adjust your premiums accordingly. Keeping your insurance provider informed about nearby construction activities can help them accurately assess the risk and potential impact on your premiums.

New Developments

The development of new properties in your area can affect your homeowners insurance premiums. Increased population density or the introduction of other structures near your property may lead to changes in the risk assessment conducted by insurance companies. Depending on the impact of these developments on your property’s exposure to risks, your insurance premiums may be adjusted.

Potential Property Damage

If nearby construction activities pose a risk of property damage to your home, it can impact your homeowners insurance premiums. Activities such as excavation, heavy machinery operation, or demolition can increase the likelihood of accidental damage or structural problems. Insurance companies may increase your premiums to account for this increased risk.

Disruption to Surrounding Area

Construction activities near your property can cause disruptions to the surrounding area, potentially impacting your homeowners insurance premiums. Temporary road closures, changes in traffic patterns, or altered access to emergency services can affect the overall safety and response times in your neighborhood. Insurance companies may consider these factors when determining your premiums, as they can influence the level of risk associated with your property.

In conclusion, there are numerous factors that can impact your homeowners insurance premiums. From the location and characteristics of your home to personal factors and policy details, each aspect plays a role in determining the cost of insuring your property. It’s essential to understand these factors and their potential impact to make informed decisions when selecting homeowners insurance coverage. By considering these factors and discussing them with your insurance provider, you can find the right balance between adequate coverage and affordable premiums. Remember to regularly review your policy to ensure your coverage aligns with your current needs and circumstances.