Have you ever wondered when your insurance rates will finally start to decrease? As you navigate through the various stages of life, your insurance premiums can become a significant financial burden. Understanding the factors that influence when your insurance costs might go down can help you plan ahead and potentially save money. In this article, we will explore the age at which your insurance rates typically decrease and provide some insights to help you make informed decisions about your coverage.

Factors that Affect Insurance Rates

When it comes to determining your auto insurance rates, there are several factors that insurance companies take into consideration. These factors help insurers assess the level of risk associated with insuring a particular driver or vehicle. By understanding these factors, you can have a better understanding of why your insurance rates may be higher or lower compared to others.

Driving Experience

One of the primary factors insurance companies consider when determining your rates is your driving experience. Generally, the more experience you have as a driver, the lower your insurance rates will be. This is because experienced drivers are assumed to be more knowledgeable and skilled on the road, thus reducing their likelihood of being involved in accidents.

Driving Record

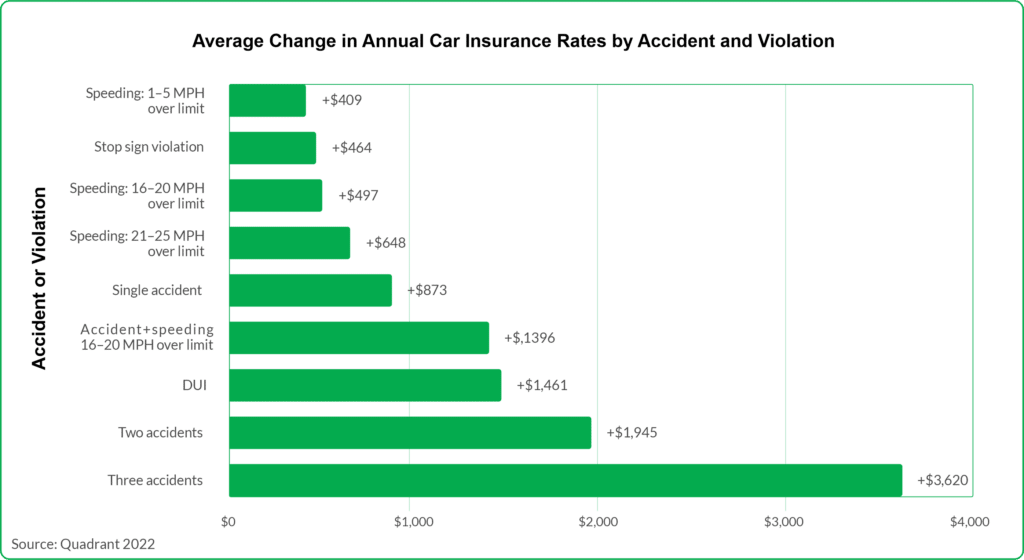

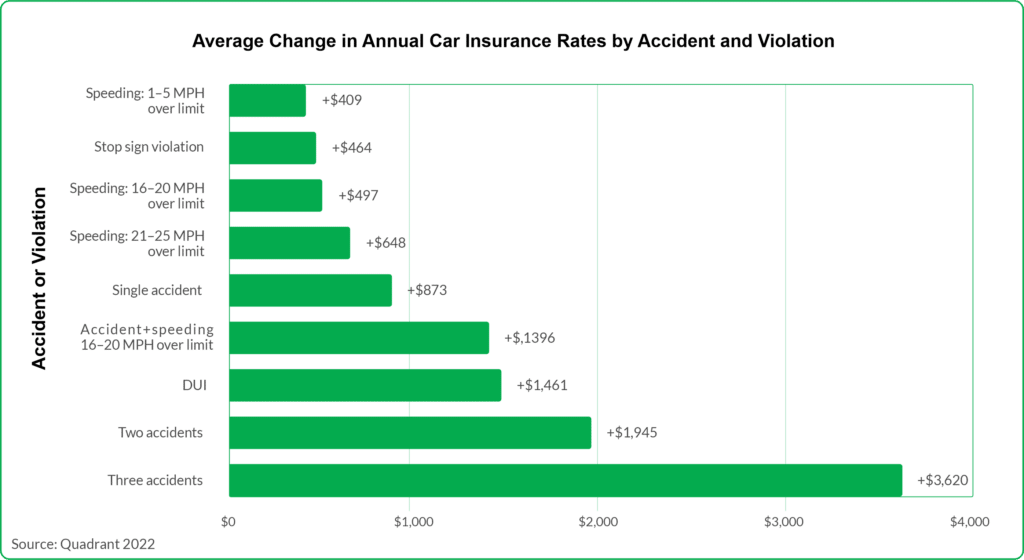

Your driving record is another crucial factor that insurance companies look at closely. Any traffic violations, accidents, or claims you have on your record can significantly impact your insurance rates. If you have a clean driving record with no violations or accidents, you are more likely to receive lower insurance rates. On the other hand, a history of frequent accidents or traffic violations can result in higher premiums.

Type of Vehicle

The type of vehicle you drive also plays a role in determining your insurance rates. Insurance companies take into account the make, model, and year of your vehicle to assess the risk associated with insuring it. Generally, vehicles with high-performance capabilities or a history of being stolen may result in higher insurance rates. Conversely, driving a safe and reliable vehicle can help reduce your premiums.

Location

Where you live can have a significant impact on your auto insurance rates. Insurance companies consider factors such as the crime rate, population density, and frequency of accidents in your area. If you reside in a densely populated urban area with a high crime rate, your insurance rates are likely to be higher compared to someone living in a rural area with fewer risks.

Claim History

Your claim history is another factor insurers take into account when determining your rates. If you have a history of frequently filing claims, insurance companies consider you to be a higher-risk driver. On the other hand, if your claim history is clean and you have a record of being a responsible driver, you may be eligible for lower insurance rates.

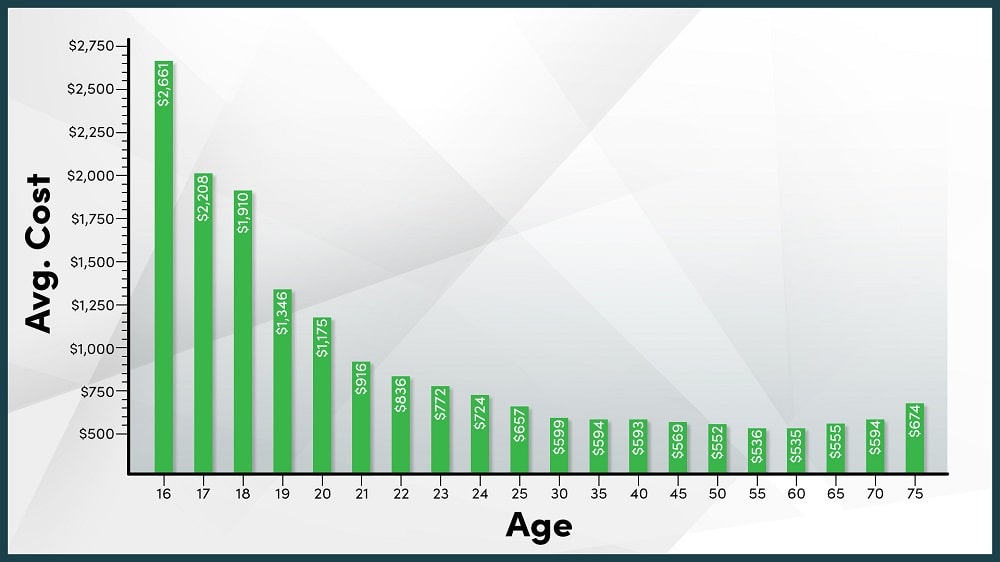

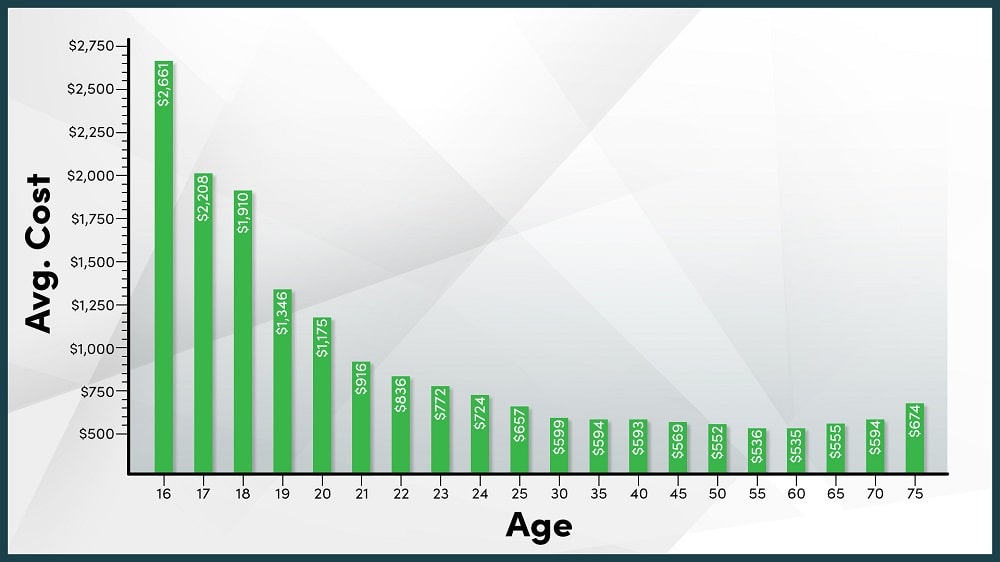

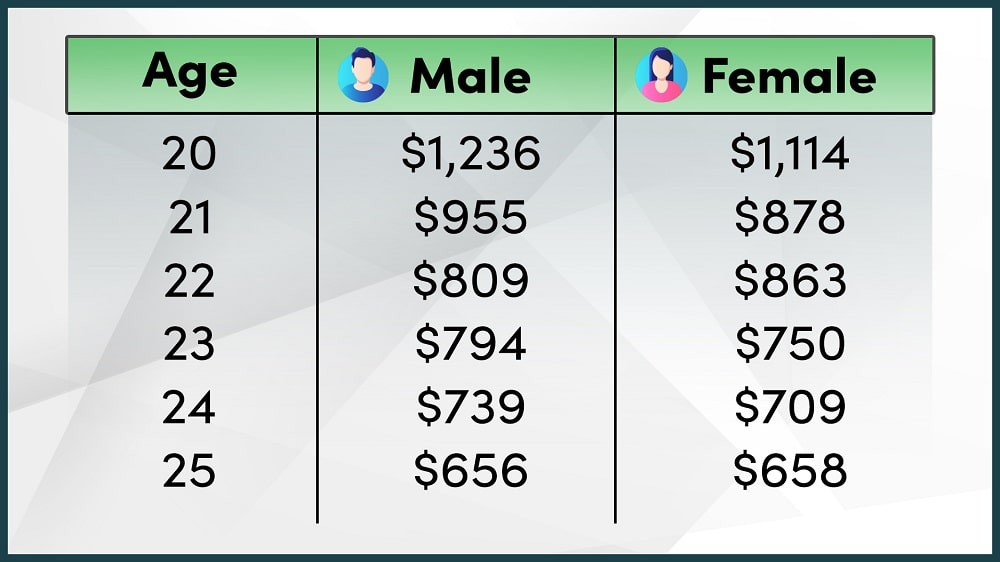

Auto Insurance Rates for Young Drivers

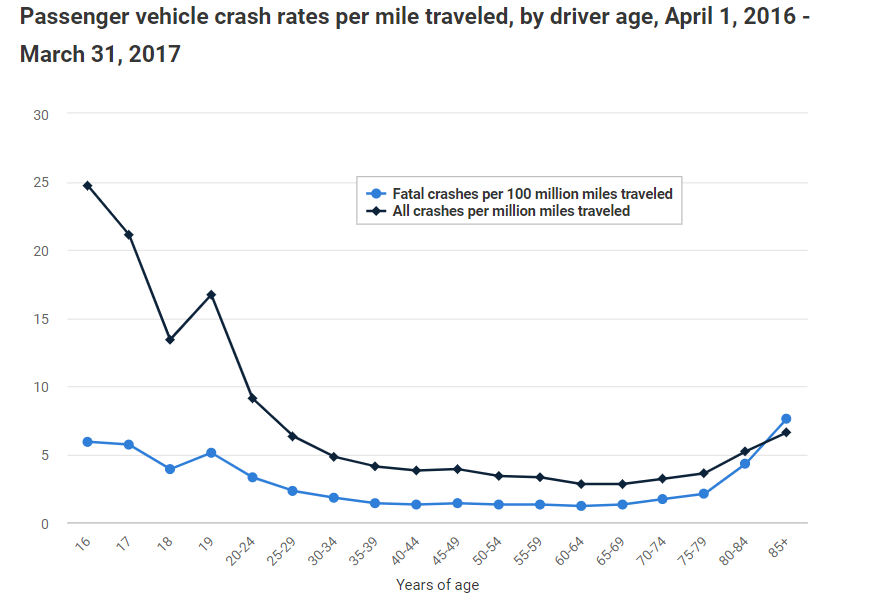

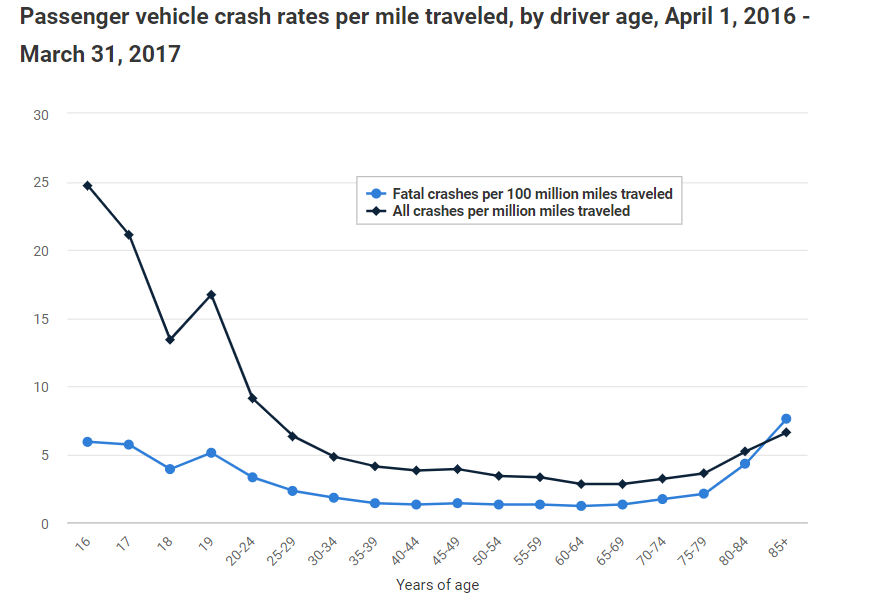

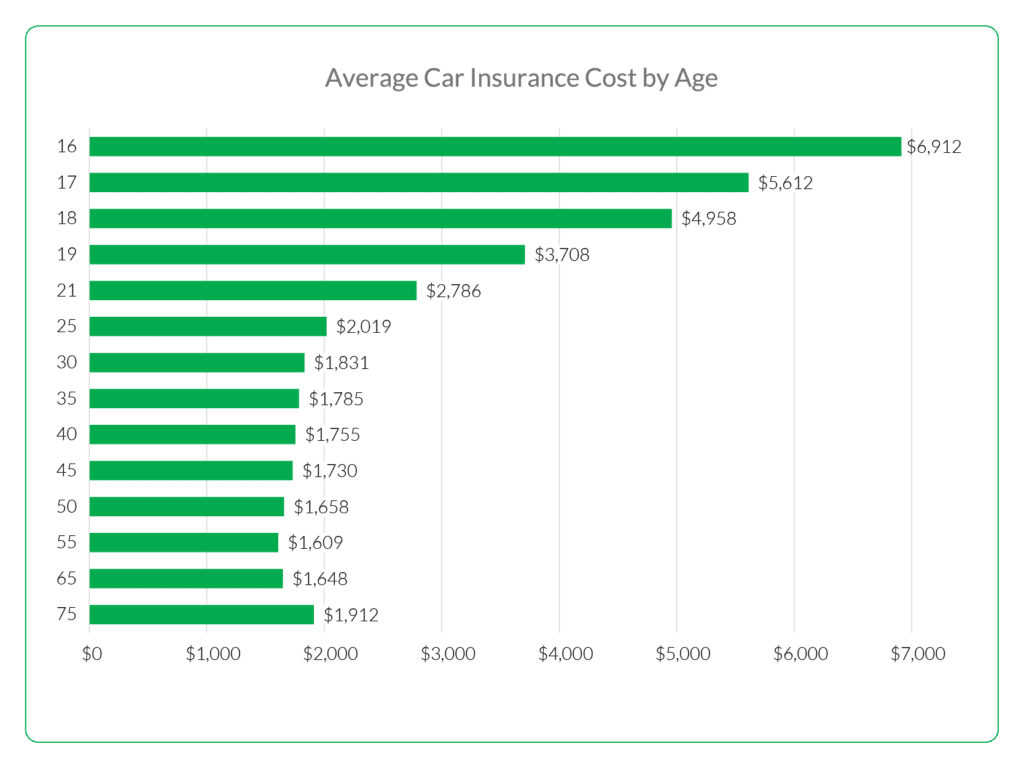

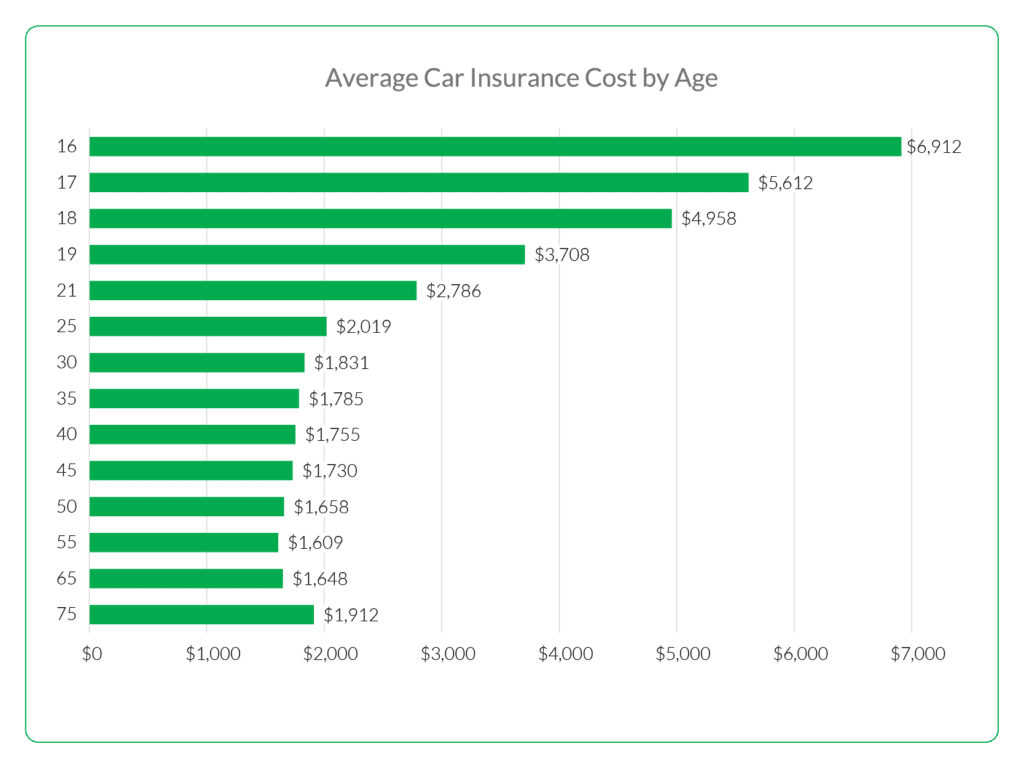

Young drivers, particularly teenagers, often face higher insurance rates compared to more experienced drivers. This is due to various reasons, including a lack of driving experience and a higher likelihood of being involved in accidents.

Teenage Drivers

Insurance rates for teenage drivers are generally higher because they are statistically more prone to accidents compared to other age groups. Young drivers often lack the experience and maturity needed to handle complex driving situations. Additionally, peer distractions and a tendency to engage in risky driving behaviors further contribute to higher insurance rates for teenagers.

Transition to Independent Policies

As young drivers gain more experience and reach the age of 18 or 21, they may have the option to transition to independent policies. This transition allows them to separate from their parents’ insurance plans and establish their own coverage. While independent policies may result in higher premiums initially, they also provide an opportunity for young drivers to build their own insurance history and potentially access lower rates in the future.

Good Student Discounts

Many insurance companies offer discounts for good students. If you’re a young driver who maintains good grades, you may be eligible for this discount. Insurance companies often believe that students who excel academically are more likely to exhibit responsible behaviors, both on and off the road. This can help offset the higher insurance rates typically associated with young drivers.

Auto Insurance Rates for Middle-Aged Drivers

As drivers progress into middle-age, their insurance rates may begin to change based on a variety of factors.

Age vs. Experience

Middle-aged drivers often benefit from a combination of age and experience, which can result in lower insurance rates. As drivers reach their thirties and forties, they typically have more driving experience, making them less prone to accidents. Insurance companies view middle-aged drivers as more responsible and, therefore, less risky to insure.

Marital Status

Believe it or not, your marital status can also affect your insurance rates. Married drivers often enjoy lower insurance premiums compared to single individuals. Insurance companies statistically find that married drivers exhibit more responsible driving behaviors, resulting in fewer accidents. So, if you’re married, you may be eligible for reduced auto insurance rates.

Credit Rating

Your credit rating can play a surprising role in determining your auto insurance rates. Many insurance companies use credit scores as a factor in calculating premiums. Studies have shown a correlation between a person’s credit rating and their likelihood of filing insurance claims. Insurance companies believe that individuals with better credit ratings are more likely to be responsible and less likely to engage in risky behavior on the road.

Auto Insurance Rates for Senior Drivers

Just as insurance rates for young drivers tend to be higher, senior drivers may also experience fluctuations in their premiums based on factors specific to their age group.

Gradual Decrease in Rates

Generally, insurance rates for senior drivers tend to decrease gradually as they age. This decline is due to the accumulation of driving experience and a more cautious approach to the road. Insurance companies view senior drivers as less risky because they typically drive fewer miles and are more likely to prioritize safety.

Retiree Discounts

Many insurance companies offer specific discounts for retirees. Retirees often have more flexibility in their schedules, allowing them to avoid driving during peak hours or congested areas. Additionally, retired drivers tend to have more time to maintain their vehicles properly, further reducing the risk of accidents. Taking advantage of retiree discounts can help senior drivers save on their auto insurance premiums.

Driving Skills Evaluation

Some insurance companies may offer the option of a driving skills evaluation for senior drivers. This evaluation assesses a driver’s abilities and can potentially result in lower insurance rates if the driver demonstrates excellent skills. It’s a proactive approach that allows senior drivers to showcase their continued competency on the road and potentially access more affordable insurance rates.

Tips to Reduce Auto Insurance Rates

Regardless of your age or driving experience, there are several steps you can take to potentially reduce your auto insurance rates. Here are some helpful tips:

Maintain a Clean Driving Record

One of the most effective ways to keep your insurance rates low is to maintain a clean driving record. Avoiding accidents, traffic violations, and claims can help demonstrate your responsibility as a driver, which insurers value.

Take Defensive Driving Courses

Completing a defensive driving course can not only improve your driving skills but also result in potential insurance discounts. Many insurers offer discounts to drivers who have completed recognized defensive driving courses. These courses provide valuable insights into safe driving practices and can help bolster your credibility as a responsible driver.

Increase Deductibles

Consider increasing your deductibles to potentially lower your insurance rates. A deductible is the amount you’re responsible for paying out of pocket in the event of a claim. By increasing your deductibles, insurance companies view you as taking on more risk and often reward this with lower premiums.

Bundle Policies

Combining multiple insurance policies, such as auto and home insurance, with the same insurer can often lead to discounted rates. Insurance companies appreciate customer loyalty and may offer significant savings when you bundle your policies together.

Shop Around for the Best Rates

Don’t hesitate to compare rates from multiple insurance providers. Different insurers have varying methodologies and factors that influence their pricing. By obtaining quotes from different companies, you can ensure you’re getting the best possible rate for your auto insurance coverage.

In conclusion, there are various factors that influence auto insurance rates, regardless of your age. By understanding these factors, you can make informed decisions to potentially reduce your premiums. Whether you’re a young driver, middle-aged driver, or a senior driver, taking steps such as maintaining a clean driving record, seeking discounts, and shopping around can help you secure the best possible rates for your auto insurance coverage.