Imagine coming home after a long day at work, only to find water pouring from your ceiling and ruining your precious belongings. You quickly file a claim with your insurance company, hoping they will cover the damages. However, to your dismay, your claim for water damage is denied. This devastating situation has become a common occurrence for many homeowners across the country.

Possible Reasons for Denial of Homeowners Claim for Water Damage

As a homeowner, it can be devastating to have your claim for water damage denied. Understanding the possible reasons for denial can help you navigate the claims process more effectively and potentially avoid denial in the future. Here are some common factors that may contribute to the denial of a homeowners claim for water damage.

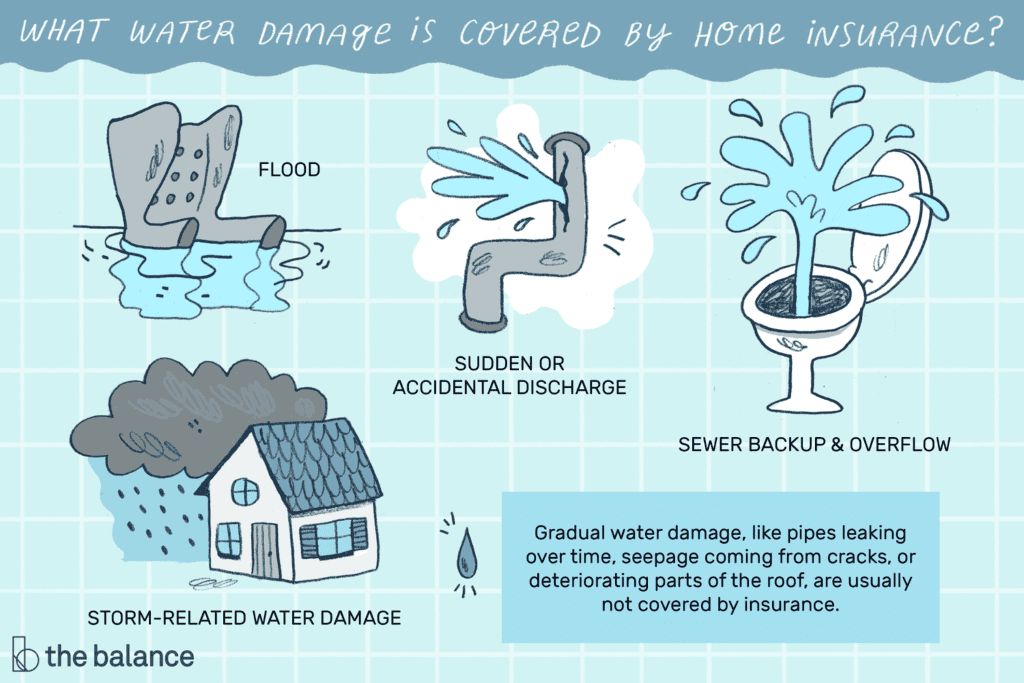

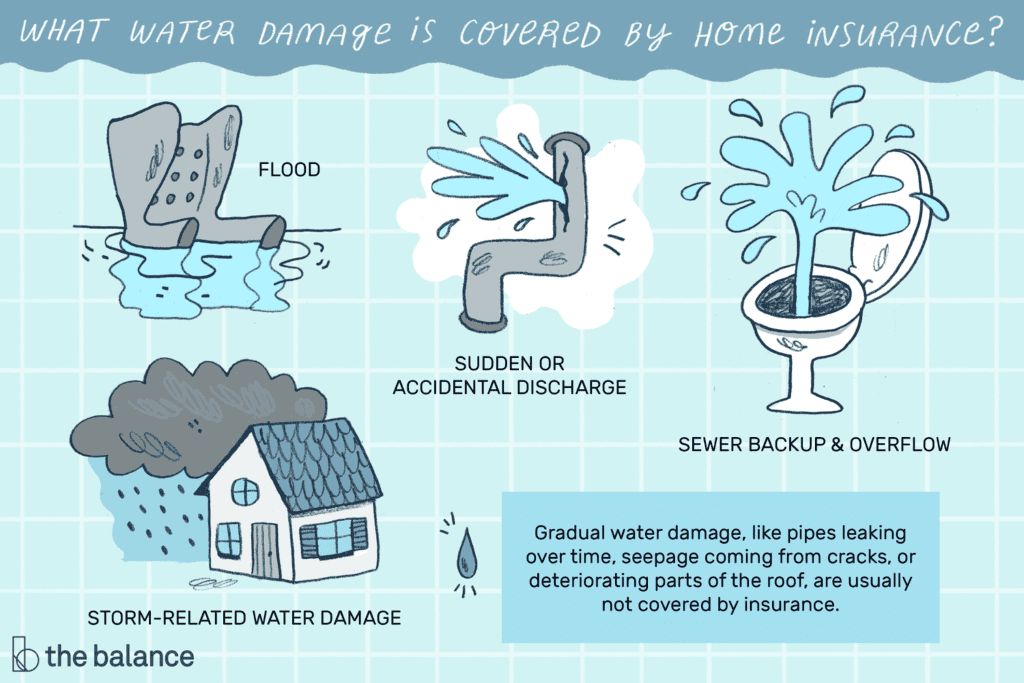

Lack of Coverage for Water Damage

One of the most common reasons for denial of a homeowners claim for water damage is simply the lack of coverage for such incidents in your insurance policy. Not all homeowner insurance policies cover water damage, especially if it is caused by certain factors such as floods or sewer backups. It is crucial to review your policy carefully to determine if you have the necessary coverage in place. If not, you may want to consider adding additional coverage options to protect yourself against water damage.

Exclusion Clause in the Insurance Policy

Another reason why your claim for water damage may be denied is the presence of specific exclusions for water-related damages in your insurance policy. Insurance policies typically contain fine print that outlines the specific circumstances under which coverage may be denied. It is important to thoroughly read and understand these exclusion clauses to ensure you are aware of any limitations related to water damage coverage. If you are unsure about the interpretation of any clause, it may be helpful to consult with your insurance agent or a legal professional.

Failure to Notify the Insurance Company on Time

Promptly notifying your insurance company about water damage is crucial to ensure the success of your claim. Failure to report the damage in a timely manner may lead to denial. Insurance companies typically require policyholders to report incidents as soon as possible, often within a specific timeframe. This requirement enables the insurance company to assess the damage promptly and take appropriate measures. Failing to notify your insurance company on time can raise concerns about the validity of your claim and may result in denial.

Policyholder’s Negligence or Intentional Act

Your own negligence or intentional actions may contribute to the denial of your homeowners claim for water damage. For example, neglecting to maintain your plumbing system or intentionally causing water damage may be grounds for denial. Insurance companies expect homeowners to take reasonable precautions to prevent damage to their property. If your actions are seen as negligent or intentional, the insurance company may argue that you have breached your duty to protect your home, leading to a denial of your claim.

Pre-existing Damage or Wear and Tear

Insurance companies often scrutinize claims for water damage to determine whether any pre-existing damage or wear and tear contributed to the incident. If your property shows signs of deterioration or damage before the reported water damage occurred, the insurance company may deny your claim on the grounds that the damage was not sudden or accidental. They may argue that the damage resulted from long-term neglect or wear and tear, rather than an insurable event. It is essential to provide evidence and documentation to support your claim and demonstrate that the water damage is separate from any pre-existing issues.

Failure to Mitigate the Damage

Taking prompt action to mitigate the damage caused by water is essential after discovering a water-related incident in your home. Failure to mitigate the damage can give the insurance company reason to deny your claim. Mitigation actions may include stopping the source of the water, drying affected areas, and preventing further damage. If they can prove that your delay in taking these necessary steps exacerbated the damage, the insurance company may argue that you did not fulfill your duty to mitigate loss, leading to claim denial.

Disputes With the Insurance Company Regarding Loss Assessment

Disagreements between policyholders and insurance companies regarding the extent of loss can also lead to denial of a homeowners claim for water damage. Insurance adjusters assess the damage and determine the amount of coverage to which you are entitled. If there is a disagreement between your assessment and that of the insurance company, it can result in a denial. Seeking professional assistance, such as hiring a public claims adjuster, can help you navigate this dispute and ensure a fair assessment of your damages.

Insufficient Evidence to Support the Claim

To support your claim, you must provide strong evidence demonstrating the cause and extent of the water damage. Insufficient evidence backing your claim can result in denial. Key documents and information include photographs or videos of the damage, receipts for repairs or restoration, and any relevant expert reports. It is essential to document the damage thoroughly and gather any supporting evidence as soon as possible to strengthen your claim and avoid denial due to lack of evidence.

Inadequate Insurance Coverage

Sometimes, the denial of a homeowners claim for water damage can be attributed to inadequate insurance coverage. It is important to regularly review your insurance policy to ensure it adequately covers potential risks, such as water damage. If your policy does not provide sufficient coverage for water-related incidents, you may consider evaluating your coverage options and obtaining additional protection. Being underinsured can leave you vulnerable to claim denial or inadequate compensation.

Errors in the Claim Process

Mistakes made during the claim submission and processing can also lead to claim denial. The claims process can be complex and requires attention to detail. Errors such as providing incorrect information, incomplete documentation, or missing deadlines can jeopardize the success of your claim. Working with an experienced insurance agent or claims professional can help you navigate the claim process and avoid these potential errors.

In conclusion, there are several possible reasons for the denial of a homeowners claim for water damage. Lack of coverage, exclusion clauses in the policy, failure to notify the insurance company on time, policyholder negligence or intentional acts, pre-existing damage or wear and tear, failure to mitigate the damage, disputes with the insurance company regarding loss assessment, insufficient evidence, inadequate insurance coverage, and errors in the claim process can all contribute to denial. By understanding these factors and taking necessary precautions, you can mitigate the risk of denial and ensure proper protection for your home.