Have you recently experienced water damage to your home, only to have your homeowner’s claim denied? It can feel frustrating and overwhelming when you’re dealing with the aftermath of water damage, with the added stress of your insurance company denying your claim. But fear not, because in this article, we will explore some steps you can take to navigate through this situation and potentially get your claim approved. From documenting the damage to seeking professional assistance, we’ve got you covered, ensuring that you’ll have the knowledge and support you need during this challenging time.

Understanding Water Damage

Water damage can be a devastating experience for homeowners. It not only causes significant damage to your property but also leads to various health hazards. Understanding the different types and causes of water damage is essential in order to take the necessary precautions and protect your home.

Types of Water Damage

There are three primary types of water damage: clean water damage, grey water damage, and black water damage. Clean water damage refers to damage caused by water from a clean source, such as a broken pipe or a malfunctioning appliance. Grey water damage occurs when water is contaminated with mild chemicals or pollutants, such as water from washing machines or dishwashers. Lastly, black water damage is the most severe type of water damage and involves water that is highly contaminated with bacteria, sewage, or other harmful substances.

Causes of Water Damage

Water damage can be caused by several factors, including natural disasters such as floods, hurricanes, or heavy rains. However, most water damage incidents in homes are a result of internal issues. These can include burst pipes, leaky roofs, faulty plumbing systems, or even clogged gutters. It is crucial to identify the cause of the water damage to prevent further incidents and mitigate the risk of damage to your home.

Common Areas Prone to Water Damage

Certain areas of your home are more susceptible to water damage than others. The basement is a common area prone to water damage due to its location below ground level. Other areas, such as bathrooms, kitchens, and laundry rooms, are also at a higher risk of water damage due to the presence of plumbing fixtures and appliances. It is crucial to regularly inspect these areas for any signs of water damage and take preventive measures to avoid costly repairs in the future.

Signs of Water Damage

Recognizing the signs of water damage early on can save you from extensive and expensive repairs. Some common signs of water damage include water stains on walls or ceilings, a musty odor, warped or buckled flooring, mold growth, or an increase in your water bill without any apparent reason. If you notice any of these signs, it is essential to take immediate action to prevent further damage and address the issue promptly.

Homeowner’s Insurance and Water Damage

Having homeowner’s insurance can provide you with peace of mind in case of water damage incidents. Understanding what your policy covers and how to file a claim is crucial to ensure you receive the necessary compensation to restore your home.

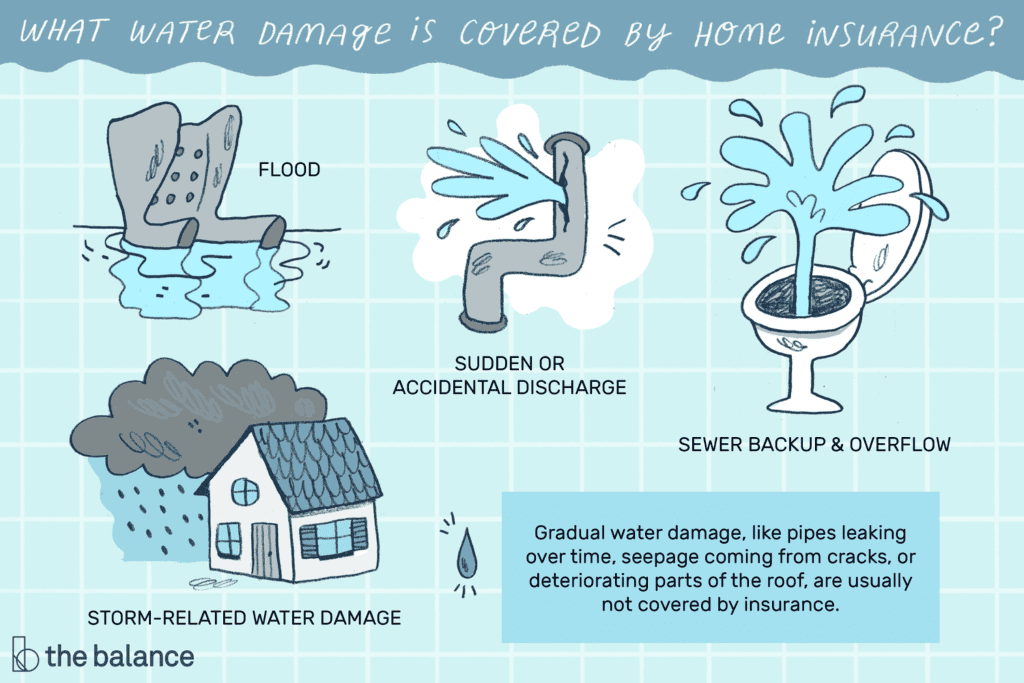

Coverage for Water Damage

Most standard homeowner’s insurance policies cover water damage caused by sudden and accidental events, such as burst pipes or storms. However, it is vital to review your policy thoroughly to understand the extent of coverage and any exclusions that may apply.

Filing a Claim for Water Damage

In the unfortunate event of water damage to your home, it is crucial to file a claim with your insurance company as soon as possible. Contact your insurance agent or company to report the damage and provide them with all the necessary details, including photographs and descriptions of the damage. Promptly documenting the damage is essential to ensure a smooth claims process.

Common Reasons for Denied Claims

While homeowner’s insurance is meant to protect you from unexpected events like water damage, there are instances where claims are denied. Some common reasons for denied claims include failure to mitigate further damage, exclusions in the policy, and insufficient proof of damage. It is essential to familiarize yourself with your policy’s terms and conditions to understand the potential reasons for a denied claim.

Steps to Take After Water Damage

Experiencing water damage in your home can be a stressful and overwhelming situation. However, taking the right steps immediately after the incident can help minimize further damage and increase the chances of a successful insurance claim.

Documenting the Damage

Before contacting your insurance company, it is crucial to document the extent of the water damage. Take photographs or videos of the affected areas, making sure to capture all visible damage. This documentation will serve as crucial evidence when filing a claim.

Contacting Your Insurance Company

Notify your insurance company about the water damage as soon as possible. Provide them with accurate and detailed information about the incident and the resulting damage. Be prepared to answer any questions they may have and follow their instructions regarding the next steps in the claims process.

Hiring a Water Damage Restoration Company

It is advisable to hire a reputable water damage restoration company to assess and repair the damage to your home. These professionals have the necessary expertise and equipment to mitigate further damage, dry out the affected areas, and restore your property to its pre-damaged condition. Keep all receipts and records of the restoration work as these will be necessary to support your insurance claim.

Reviewing Your Homeowner’s Insurance Policy

Understanding the specifics of your homeowner’s insurance policy is crucial to make sure you have adequate coverage for water damage. Taking the time to review your policy’s terms, exclusions, and coverage limits can help you avoid surprises and ensure that you are adequately protected.

Understanding Policy Exclusions

Insurance policies often contain exclusions that may limit coverage for certain types or causes of water damage. Common exclusions include damage caused by flooding, gradual water damage, or lack of maintenance. It is essential to carefully read and understand these exclusions to know what is covered and what is not.

Policy Limits and Deductibles

Your homeowner’s insurance policy will have coverage limits and deductibles that determine the amount the insurance company will pay for a claim. It is crucial to review these limits and deductibles to ensure they align with your needs and budget. If your policy’s limits are insufficient, you may need to consider purchasing additional coverage or increasing your existing limits.

Reviewing Coverage for Water Damage

Pay close attention to the specific coverage for water damage in your homeowner’s insurance policy. Ensure that it includes coverage for both sudden and accidental events, as well as the necessary repairs and restoration work. If you have any concerns or questions, it is recommended that you contact your insurance agent for clarification before an incident occurs.

Reasons for Denied Homeowner’s Claims

Despite having homeowner’s insurance, there are instances where claims for water damage are denied. It is crucial to understand the potential reasons for denied claims to take appropriate steps to prevent them.

Failure to Mitigate Further Damage

Insurance companies expect homeowners to take immediate action to mitigate further damage after a water damage incident. Failure to do so may result in a denied claim. It is essential to act promptly by shutting off the water source, removing excess water, and taking other necessary steps to prevent further damage.

Exclusionary Clauses in the Policy

As mentioned earlier, your homeowner’s insurance policy may contain exclusions that limit coverage for certain types or causes of water damage. Claims related to excluded events or conditions are likely to be denied. Review your policy thoroughly to identify any exclusions that may affect your coverage.

Insufficient Proof of Damage

When filing a claim for water damage, providing sufficient proof of the damage is crucial. Insurance companies require evidence such as photographs, videos, and detailed documentation of the incident. If you fail to provide convincing evidence, your claim may be denied. Take the time to document the damage promptly and accurately to support your claim.

Appealing a Denied Homeowner’s Claim

If your homeowner’s insurance claim for water damage is denied, you still have options to appeal the decision. Understanding the appeal process and gathering additional evidence is crucial to increase your chances of a successful appeal.

Reviewing the Denial Letter

When your claim is denied, the insurance company will provide you with a denial letter detailing the reasons for the denial. Take the time to carefully review this letter and understand why your claim was denied. This will help you identify any weaknesses in your original claim and determine what additional evidence you need to gather.

Gathering Additional Evidence

To strengthen your case, gather any additional evidence that supports your claim. This can include expert opinions, repair estimates, or any other relevant documentation. It may also be helpful to consult with a water damage restoration professional who can provide an unbiased assessment of the damage and its cause.

Working with an Attorney or Public Adjuster

If you face challenges in appealing a denied homeowner’s claim, seeking assistance from an attorney or public adjuster may be beneficial. These professionals have experience dealing with insurance companies and can guide you through the appeal process. Keep in mind that hiring legal representation or a public adjuster may come with additional costs, so carefully weigh the potential benefits against the associated expenses.

Preventing Water Damage in Your Home

While homeowner’s insurance provides financial protection after water damage occurs, taking preventive measures can significantly reduce the risk of damage and save you from the hassle of filing a claim. Here are some steps you can take to prevent water damage in your home.

Regularly Inspecting and Maintaining Your Home

Regular inspections and maintenance tasks can help identify and address potential issues before they lead to water damage. Check your roof for leaks, inspect plumbing fixtures and pipes for any signs of damage or leaks, and ensure that your gutters and downspouts are clear of debris to avoid water accumulation.

Installing a Leak Detection System

Installing a leak detection system can provide early warning signs of potential water damage. These systems use sensors to detect leaks and alert you immediately, allowing you to take prompt action and prevent further damage. Consider installing such a system especially in areas prone to leaks or water damage, such as basements and laundry rooms.

Taking Precautions When Leaving Your Home

Before leaving your home for an extended period, take extra precautions to prevent water damage. Shut off the main water supply to your home to prevent leaks or burst pipes during your absence. Additionally, consider asking a trusted neighbor or friend to check on your home periodically to identify any potential issues and address them before they escalate.

Seeking Legal Assistance

In some cases, seeking legal assistance may become necessary to navigate through the complexities of a denied homeowner’s claim. Understanding when to hire an attorney, finding the right one, and being familiar with legal costs are important factors to consider.

When to Hire an Attorney

If your homeowner’s insurance claim has been denied or if you face challenges in appealing a denied claim, it may be beneficial to hire an attorney. Attorneys specializing in insurance claims can help you understand your rights, guide you through the legal process, and advocate on your behalf in negotiations or court proceedings.

Finding the Right Attorney

Finding the right attorney is crucial for a successful outcome. Seek recommendations from trusted sources, research the attorney’s experience and expertise in insurance claims, and schedule initial consultations to assess their suitability for your case. Choose an attorney who specializes in homeowner’s insurance claims and has a track record of handling similar cases successfully.

Understanding Legal Costs

Before hiring an attorney, it is essential to understand the associated legal costs. Some attorneys may work on a contingency fee basis, meaning they only get paid if they win your case. Others may charge an hourly rate or require a retainer. Discuss the fee structure with your attorney upfront and ensure you have a clear understanding of all potential costs and expenses.

Alternative Options After Denied Claims

If your homeowner’s insurance claim is denied and you are unable to resolve the issue through an appeal or legal assistance, you still have alternative options to pursue.

Mediation and Arbitration

Mediation and arbitration can provide alternative means of resolving disputes without going to court. These processes involve a neutral third party who helps facilitate negotiations and reach a settlement. Mediation and arbitration can be less time-consuming and more cost-effective than litigation.

Filing a Complaint with the State Insurance Department

If you believe your homeowner’s insurance claim has been unfairly denied, you can file a complaint with your state’s insurance department. They have the authority to investigate complaints against insurance companies and take appropriate action to resolve the issue.

Seeking Assistance from Consumer Protection Agencies

Consumer protection agencies can provide valuable assistance if you face difficulties with your homeowner’s insurance claim. They can guide you through the complaint process, inform you of your rights as a consumer, and help ensure that your claim is handled fairly.

Conclusion

Water damage can be a nightmare for homeowners, but being well-informed and taking the necessary precautions can help alleviate some of the stress and financial burden. Understanding the different types and causes of water damage, reviewing your homeowner’s insurance policy, and taking preventive measures are essential steps to protect your home. In the event of water damage, promptly documenting the damage, filing a claim with your insurance company, and hiring a reputable restoration company are crucial to ensuring a smooth recovery process. In cases of denied claims, it is important to review the denial letter, gather additional evidence, and consider seeking legal assistance or alternative options to resolve the issue. By being proactive and knowledgeable, you can safeguard your home and be better prepared to handle any water damage incidents that may arise.