Imagine the frustration and panic that comes with discovering water damage in your home. It’s a situation no one wants to face, but unfortunately, accidents happen. In this article, we will explore the world of insurance claims for water damage and the importance of being prepared for such situations. From understanding the process to knowing what to expect, this article will guide you through your first insurance claim for water damage. Whether it’s a burst pipe or a flooded basement, we’ve got you covered. So sit back, relax, and let’s dive into the world of water damage insurance claims together.

Understanding Water Damage Insurance Claims

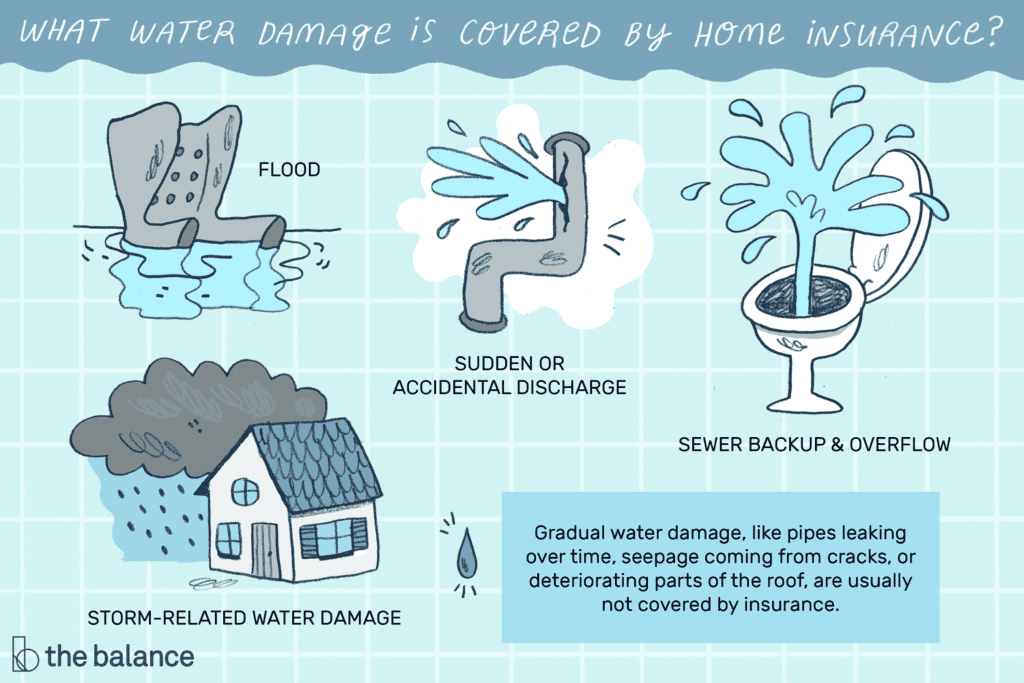

Water damage insurance is a type of coverage that helps protect homeowners and property owners from the financial burden of repairs and replacements caused by water-related incidents. It provides protection against various types of water damage, such as burst pipes, floods, leaks, and sewer backups. By having water damage insurance, you can have peace of mind knowing that you are financially protected from the unexpected costs that come with water damage.

When it comes to water damage insurance claims, it’s essential to understand the types of water damage covered by insurance policies. This knowledge will help you determine if your specific situation is eligible for a claim. Generally, insurance policies cover accidental and sudden water damage, but it’s crucial to review your policy to verify the specific coverage you have. Some common types of water damage covered by insurance include burst or frozen pipes, plumbing issues, roof leaks, and water damage caused by fire extinguishing efforts.

Preparing to File a Water Damage Insurance Claim

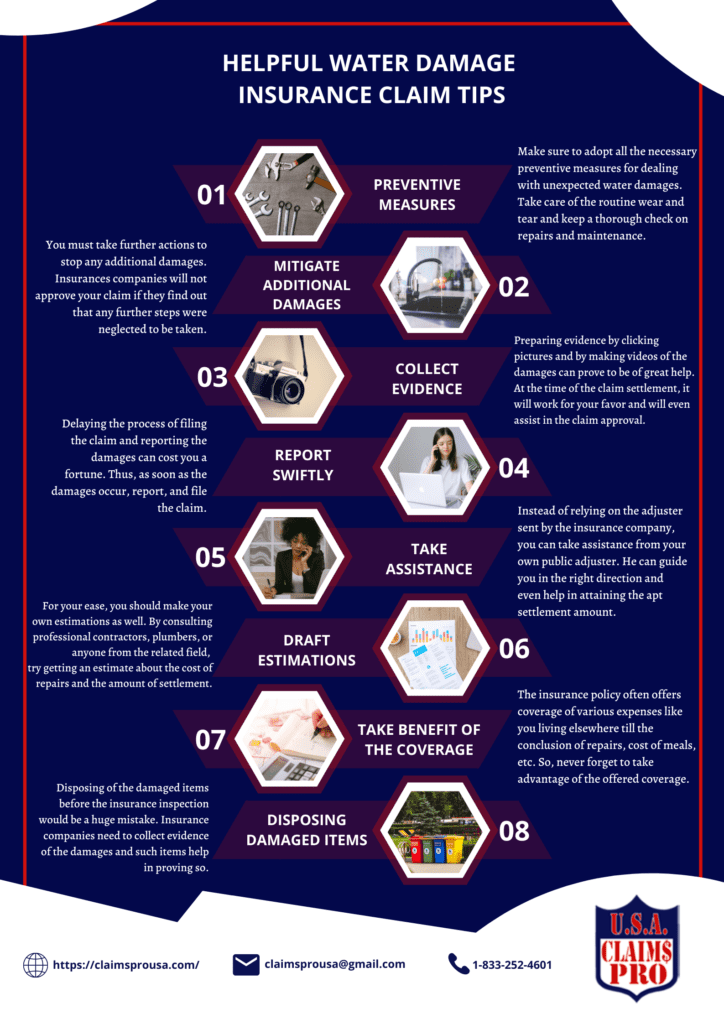

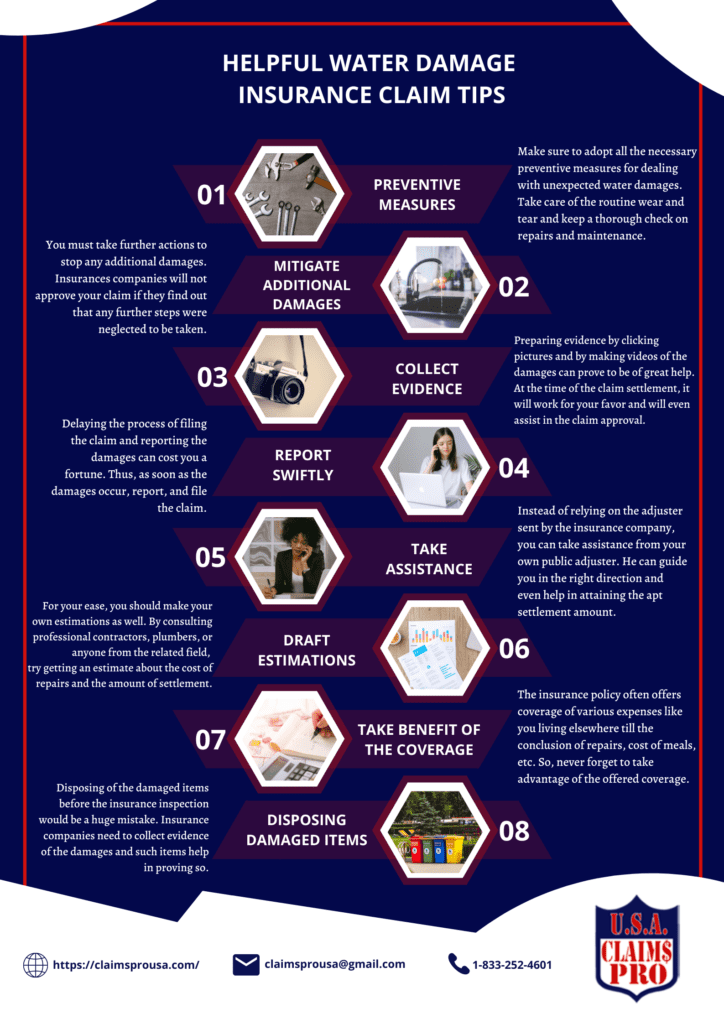

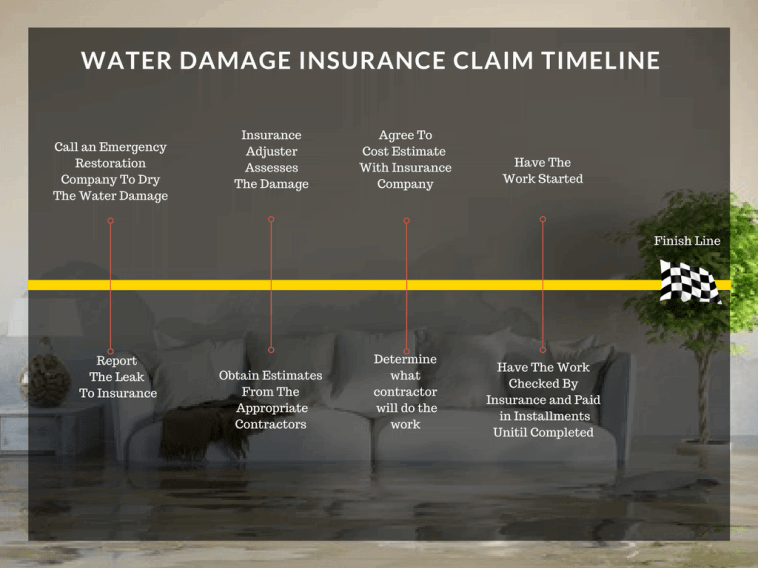

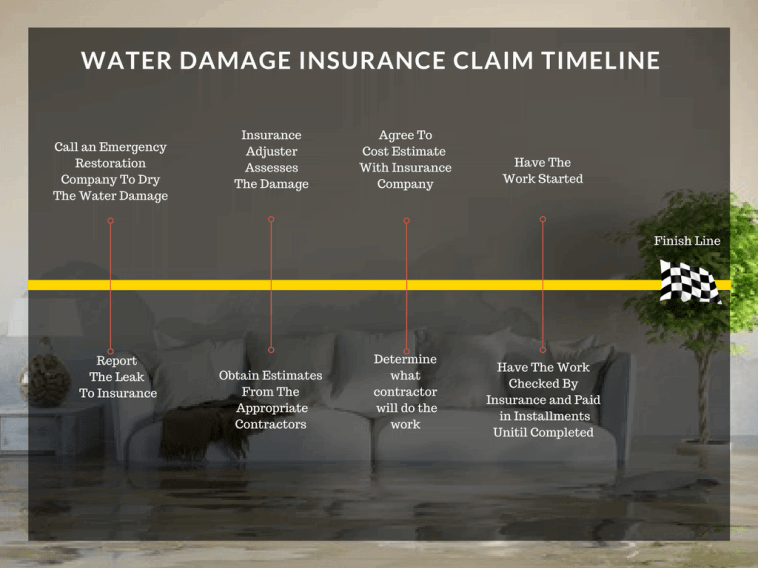

Before you file a water damage insurance claim, it’s important to take a few necessary steps to ensure a smooth process. First and foremost, document the water damage by taking photos and videos of the affected areas. This documentation will serve as evidence of the damage and will help support your claim. Additionally, be sure to notify your insurance company as soon as possible. Promptly reporting the damage will not only expedite the claims process but also show your proactive approach in addressing the issue.

To file a water damage insurance claim, you will need to gather some essential documents. These may include your insurance policy documents, proof of ownership or occupancy, receipts or invoices for repairs or replacements, and any other relevant documents that support your claim. Understanding your policy coverage is also vital, as it will help you determine what damages and expenses are eligible for reimbursement.

Steps to File a Water Damage Insurance Claim

Once you have prepared all the necessary documents, it’s time to file your water damage insurance claim. Start by contacting your insurance agent or the customer service representative specified by your insurance company. Provide them with all the relevant information regarding the incident and the damages incurred. It’s important to be thorough and accurate in your explanation, as this will help facilitate the claims process.

After contacting your insurance agent, you will be asked to submit an initial claim. The initial claim form may be available online or can be mailed to you, depending on your insurance company’s procedures. Fill out the form completely and accurately, providing all the required information. Be sure to attach any supporting documentation, such as photographs, invoices, or repair estimates, to strengthen your claim.

Once your initial claim is submitted, the insurance company will assign an adjuster to assess the damage. The adjuster will visit your property to inspect the water damage and evaluate the extent of the loss. It’s essential to cooperate with the adjuster and provide any additional information or documentation they may request.

After the damage assessment, the insurance company will provide you with a claim settlement offer. This offer will include the amount they are willing to pay for your claim. It is important to carefully review this settlement offer and negotiate if necessary. If you believe the offer is inadequate or if there are discrepancies, you have the right to dispute the settlement. Working with the insurance company and providing additional evidence or expert opinions can help you negotiate a fair settlement.

Common Challenges in Water Damage Insurance Claims

While water damage insurance claims aim to provide financial assistance for homeowners or property owners, there can be common challenges that arise during the claims process. One challenge is policy limitations and exclusions. Some insurance policies have specific limitations or exclusions for certain types of water damage, such as flood damage or water damage resulting from neglect or lack of maintenance. It’s crucial to thoroughly review your policy and understand its coverage to avoid any surprises or misunderstandings.

Disputes over coverage can also occur during the claims process. In some cases, the insurance company may disagree with your assessment of the damages or the cause of the water damage. This can lead to delays or denials of your claim. It’s important to provide thorough documentation and evidence to support your claim and work diligently with the insurance company to resolve any disputes.

Delays in claims processing can be frustrating for policyholders. Insurance companies may have specific protocols and procedures that can cause delays in processing your claim. It’s important to stay proactive and follow up with your insurance company regularly to ensure your claim is being processed in a timely manner.

Denied or underpaid claims are another challenge that can occur. It’s possible for the insurance company to deny your claim or offer a settlement that does not fully cover your damages. In such cases, it’s essential to understand your rights as a policyholder and seek professional help if needed. Engaging the services of a public adjuster or legal professional specializing in insurance claims can assist you in navigating the claims process and fighting for a fair settlement.

Tips for a Successful Water Damage Insurance Claim

To increase the chances of a successful water damage insurance claim, there are several important tips to keep in mind. Acting promptly after the incident is crucial. Notifying your insurance company as soon as possible and documenting the damage promptly will help establish the timeline and severity of the water damage.

Provide thorough documentation of the water damage. This includes taking clear photos or videos of the affected areas, as well as keeping records of any receipts, invoices, or repair estimates related to the damage. The more detailed and comprehensive your documentation, the stronger your claim will be.

Communicating effectively with the insurance company is essential throughout the claims process. Be sure to maintain open lines of communication and promptly respond to any requests for information or documents. Clear and concise communication will help expedite the process and ensure that all necessary information is provided.

Understanding the details of your insurance policy is crucial. Familiarize yourself with the coverage, limitations, and exclusions in your policy to avoid any misunderstandings or surprises during the claims process. If there are any uncertainties or ambiguities, reach out to your insurance agent for clarification.

Seek professional help if needed. If you encounter challenges during the claims process or feel overwhelmed by the complexities of the insurance industry, consider engaging the services of a public adjuster. Public adjusters work on behalf of policyholders and can provide valuable expertise and support in navigating the claims process.

The Importance of Proper Water Damage Restoration

After filing a water damage insurance claim, it’s important to understand the significance of proper water damage restoration. Water damage can result in various issues, such as mold growth, structural damage, and compromised air quality. Immediate restoration is crucial to prevent further damage and mitigate potential health risks.

Working with qualified restoration professionals is essential in ensuring thorough and effective restoration. These professionals have the knowledge, experience, and equipment to properly assess the damage and implement the necessary restoration measures. They can conduct mold remediation, drying and dehumidification, structural repairs, and other necessary tasks to restore your property to its pre-damage condition.

Preventing further damage is another key aspect of proper water damage restoration. Restoration professionals will take steps to prevent secondary damage, such as securing the property, extracting excess water, and implementing drying techniques. By mitigating further damage, you can minimize the extent of the loss and reduce the overall costs associated with the water damage.

Securing the property during the restoration process is vital to protect your belongings and prevent unauthorized access. Restoration professionals will take steps to secure the property, such as boarding up windows, implementing temporary fencing, or installing security systems, as needed. This will provide peace of mind and ensure that your property is protected throughout the restoration process.

Understanding Insurance Claim Payouts for Water Damage

When it comes to insurance claim payouts for water damage, there are several important factors to consider. Two common methods of calculating payouts are actual cash value (ACV) and replacement cost coverage (RCC). ACV takes into account depreciation and pays the value of the damaged property at the time of the loss. RCC, on the other hand, covers the cost of replacing or repairing the damaged property without factoring in depreciation.

Several factors can influence claim payouts, such as the extent of the damage, the materials and labor required for repairs or replacements, and the coverage limits of your policy. It’s important to carefully review your insurance policy and understand its coverage for different types of water damage. This will help you assess whether the claim settlement offer accurately reflects the cost of restoring or replacing your damaged property.

Depreciation and recoverable depreciation are important concepts to understand regarding insurance claim payouts. Depreciation refers to the decrease in value of an item over time due to wear and tear. Recoverable depreciation is the portion of depreciation that can be claimed once the damaged property has been repaired or replaced. It’s important to provide proof of repairs or replacements to recover the depreciation amount.

Receiving the claim payment is the final step in the claims process. Once the claim settlement has been agreed upon and any disputes have been resolved, the insurance company will issue a payment. This payment can be made through various methods, such as direct deposit or a physical check. It’s important to review the claim payment to ensure it accurately reflects the agreed-upon settlement and covers all eligible expenses.

Potential Consequences of Water Damage Claims

Filing a water damage insurance claim can have potential consequences that extend beyond the immediate claims process. One consequence to consider is the impact on future insurance premiums. Depending on the severity and frequency of the water damage claims, your insurance premiums may increase. It’s important to weigh the cost of potential premium increases against the benefits of filing a claim.

Consideration of the deductible is another important aspect. The deductible is the amount of money the policyholder is responsible for paying before the insurance company covers the remaining costs. It’s important to understand your deductible and factor it into your decision to file a water damage insurance claim. If the cost of repairs or replacements is minimal and falls below your deductible, it may not be beneficial to file a claim.

Preventing future water damage should be a priority for homeowners and property owners. After experiencing water damage and filing an insurance claim, it’s crucial to learn from the incident and take preventive measures. This may include routine maintenance, regular inspections, and implementing water damage prevention strategies. By taking proactive steps, you can reduce the risk of future water damage and potentially avoid the need for future insurance claims.

Taking preventive measures is especially crucial in areas prone to water damage, such as flood-prone regions or properties with a history of previous water damage. By investing in flood insurance or implementing additional protective measures, such as sump pumps, backflow prevention devices, or reinforced roofing, you can reduce the likelihood and severity of future water damage incidents.

The Role of Public Adjusters in Water Damage Insurance Claims

In some cases, hiring a public adjuster can be beneficial when dealing with water damage insurance claims. Public adjusters are licensed professionals who work on behalf of policyholders to help navigate the insurance claims process. They can provide valuable expertise, negotiate with insurance companies, and advocate for fair claim settlements.

One of the key roles of a public adjuster is to handle the complex paperwork and documentation required for insurance claims. They can assist in accurately documenting the water damage, assessing the extent of the loss, and compiling the necessary evidence and supporting documentation. This can alleviate the burden on the policyholder and ensure a thorough and comprehensive claim submission.

Benefits of hiring a public adjuster include their knowledge and understanding of insurance policies and the claims process. They can interpret the language and terms in your insurance policy, ensuring that you understand your coverage and rights as a policyholder. Public adjusters are also skilled in negotiating with insurance companies, increasing the likelihood of a fair claim settlement.

Working with a public adjuster involves clear and open communication. It’s important to provide them with all the relevant information, documentation, and details of the water damage incident. By maintaining open lines of communication and promptly responding to any requests or inquiries, you can help streamline the claims process and maximize the outcome of your claim.

Public adjusters typically charge a fee for their services, which is usually a percentage of the final claim settlement. It’s important to discuss and understand the fees and costs involved before hiring a public adjuster. Consider the potential benefits and value they can bring to your claim process when deciding whether to engage their services.

Conclusion

Water damage insurance claims can be complex and challenging, but with proper understanding and preparation, you can navigate the process successfully. It’s important to familiarize yourself with your policy coverage, document the water damage promptly, and communicate effectively with your insurance company. Seeking professional assistance or guidance, such as from public adjusters or restoration professionals, can also greatly benefit your claim.

Remember, taking immediate action after water damage occurs is crucial. By providing thorough documentation, understanding your policy details, and taking preventive measures, you can protect your property and minimize the financial impact of water damage incidents. In the end, with the right knowledge and approach, you can achieve a successful water damage insurance claim and restore your property to its pre-damage condition.