If you’ve recently experienced water damage to your property, you might be feeling overwhelmed by the sky-high insurance estimate that follows. It can be disheartening to see just how much it will cost to restore and repair the damage. But fear not, because this article aims to provide you with valuable insights and helpful tips on how to navigate this situation. We understand that dealing with insurance claims can be a daunting task, so let’s explore why insurance estimates after water damage tend to be so high and what steps you can take to ensure a fair assessment.

Factors Influencing High Insurance Estimates

Water damage can have a significant impact on your insurance estimates. Several factors come into play when determining the cost of coverage. Understanding these factors can help you better navigate the insurance process and potentially mitigate some of the expenses.

Extent of Water Damage

The extent of water damage is one of the primary factors influencing insurance estimates. If water has affected a large portion of your property, such as multiple rooms or floors, the potential repair costs can be significant. Furthermore, the more extensive the damage, the higher the likelihood of secondary issues such as mold growth or structural damage, which can further increase the insurance estimate.

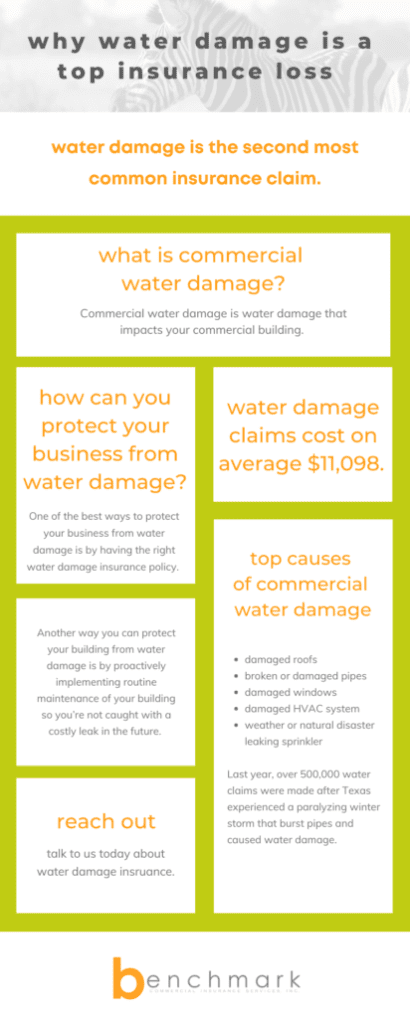

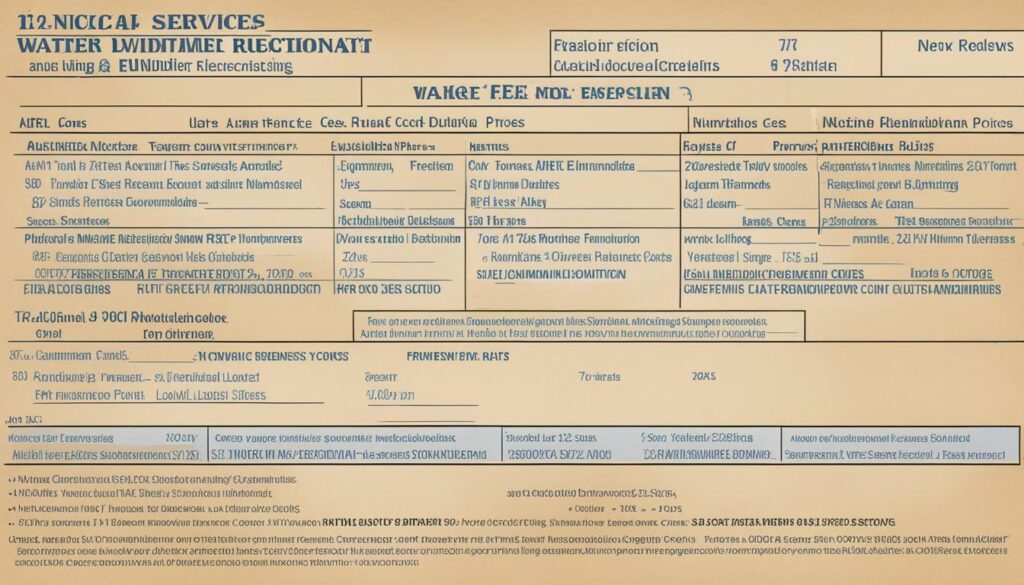

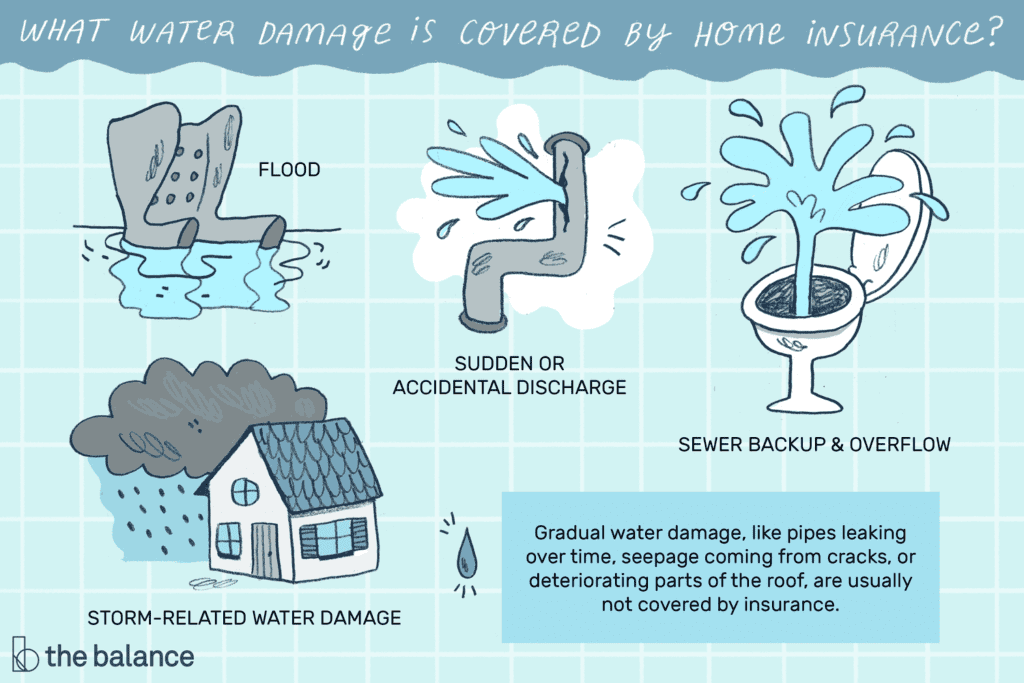

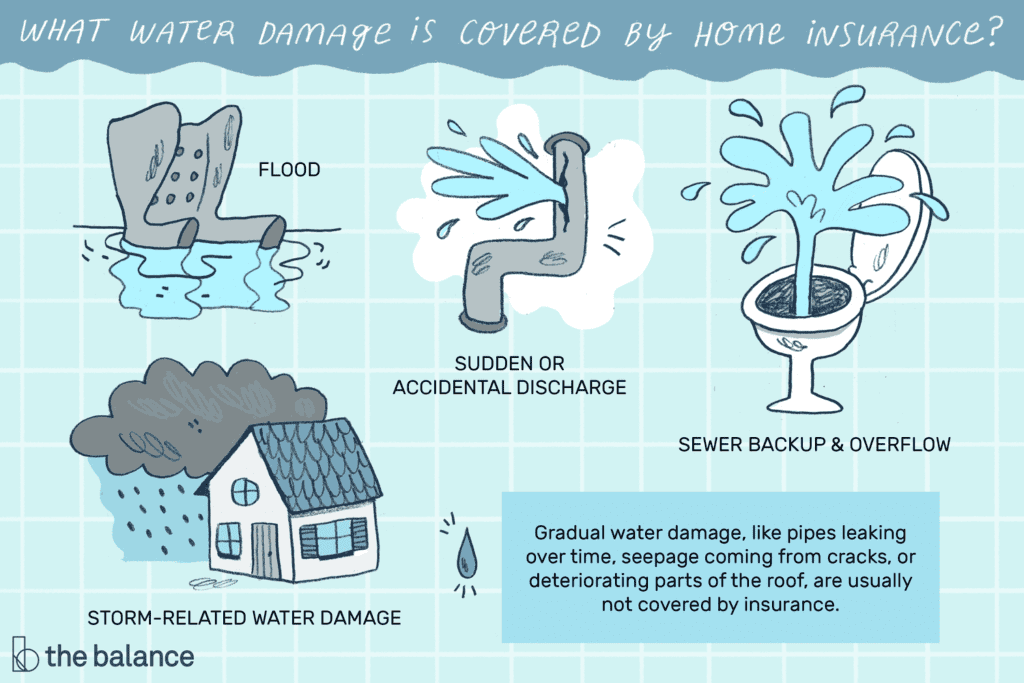

Type of Water Damage

The type of water damage also plays a role in determining insurance estimates. Generally, there are three categories of water damage: clean water, gray water, and black water. Clean water damage, such as a burst pipe, is typically the least severe and can be easier and less costly to repair. Gray water damage, which may come from sources like a dishwasher or washing machine, can contain some contaminants and may require more extensive restoration measures. Black water damage, from sources like sewage backup or flooding, is the most severe and poses potential health hazards. Insurance estimates for black water damage are often the highest due to the complexity and risks involved in the restoration process.

Location of Water Damage

The location of the water damage within your property can also influence insurance estimates. If the water damage has affected essential areas such as the foundation, electrical system, or HVAC system, the repair costs can be significantly higher. Furthermore, damage to critical infrastructure can lead to additional expenses such as temporary housing arrangements or the need to relocate until the repairs are complete.

Age of Property

The age of your property can be a contributing factor to high insurance estimates after water damage. Older buildings may have outdated systems and materials that are more susceptible to water-related issues. Additionally, the overall condition of the property can affect the cost of repairs, with older properties potentially requiring more extensive restoration measures.

Value of Property

The value of your property is another key consideration when determining insurance estimates. Higher-value properties typically require more costly repairs, as the materials and finishes used are often of higher quality. Additionally, the insurance company takes into account the potential impact of the damage on the property’s overall value, which can further drive up the estimate.

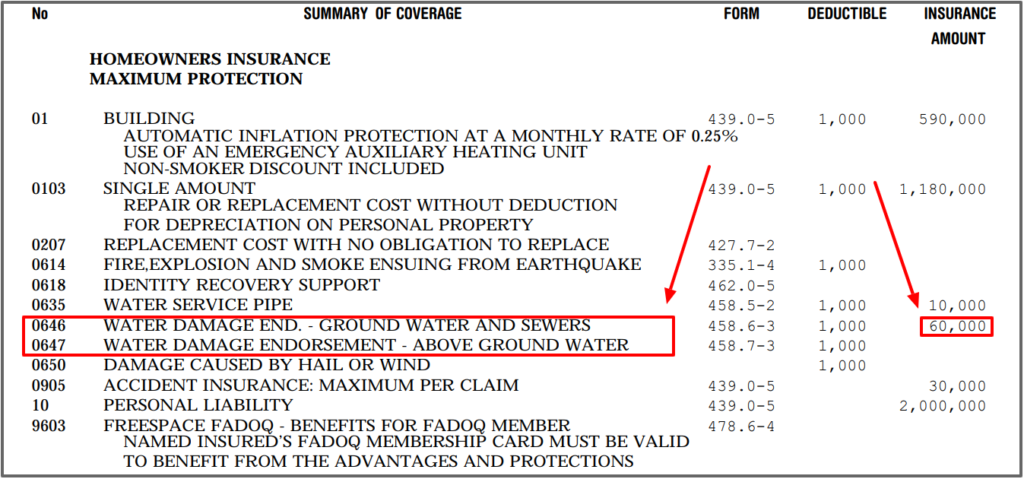

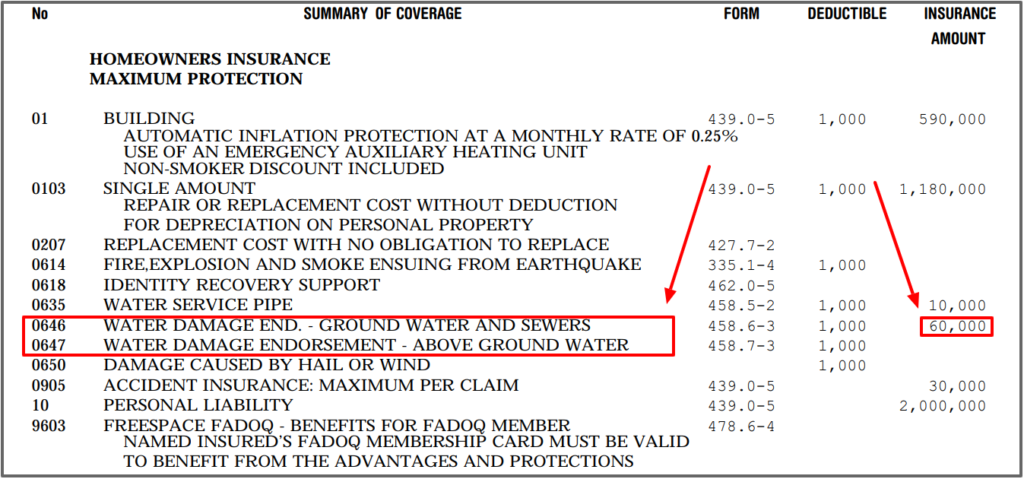

Insurance Coverage

The type and extent of insurance coverage you have can significantly impact the insurance estimate. Different policies offer varying degrees of coverage for water damage and related issues. Some policies may provide comprehensive coverage, including restoration costs and temporary living arrangements, while others may have more limited coverage. It is crucial to review your insurance policy and understand the terms and limitations to have a realistic expectation of the estimated costs.

Assessment Process for Insurance Estimates

When dealing with an insurance claim for water damage, there is a standardized assessment process that insurance companies follow to determine the estimated costs. Understanding this process can help you better navigate the claims process and ensure a fair evaluation of the damages.

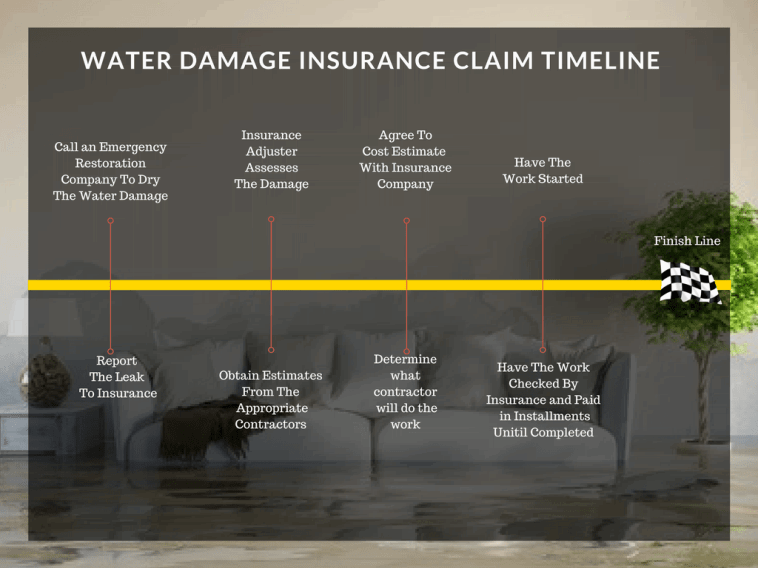

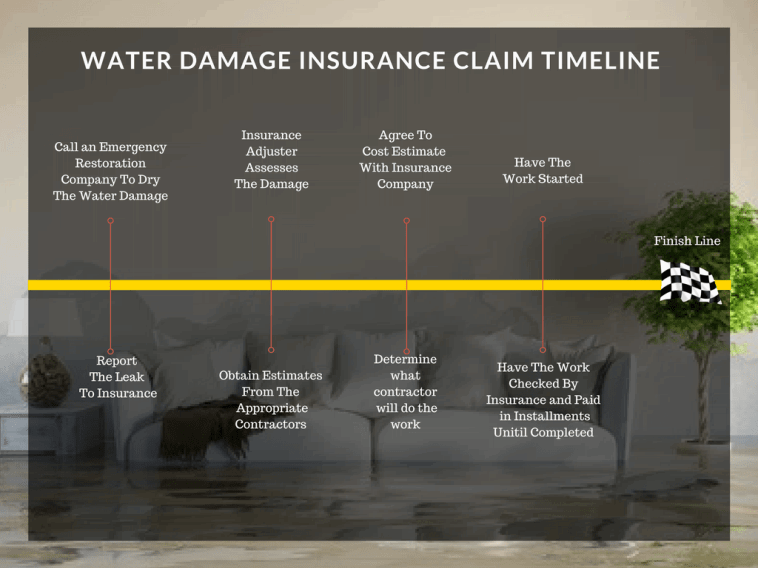

Initial Inspection

The assessment process begins with an initial inspection of the property by a claims adjuster. The adjuster will evaluate the extent of the water damage and document the affected areas. This inspection is crucial as it forms the basis for the insurance estimate and subsequent claim evaluation.

Documenting the Damage

During the inspection, the claims adjuster will document the damage by taking photographs, videos, and detailed notes. This documentation serves as evidence for the insurance company to assess the extent of the damage accurately. It is essential to cooperate with the adjuster during this process and provide any relevant information regarding the cause and timeline of the damage.

Estimating Repair Costs

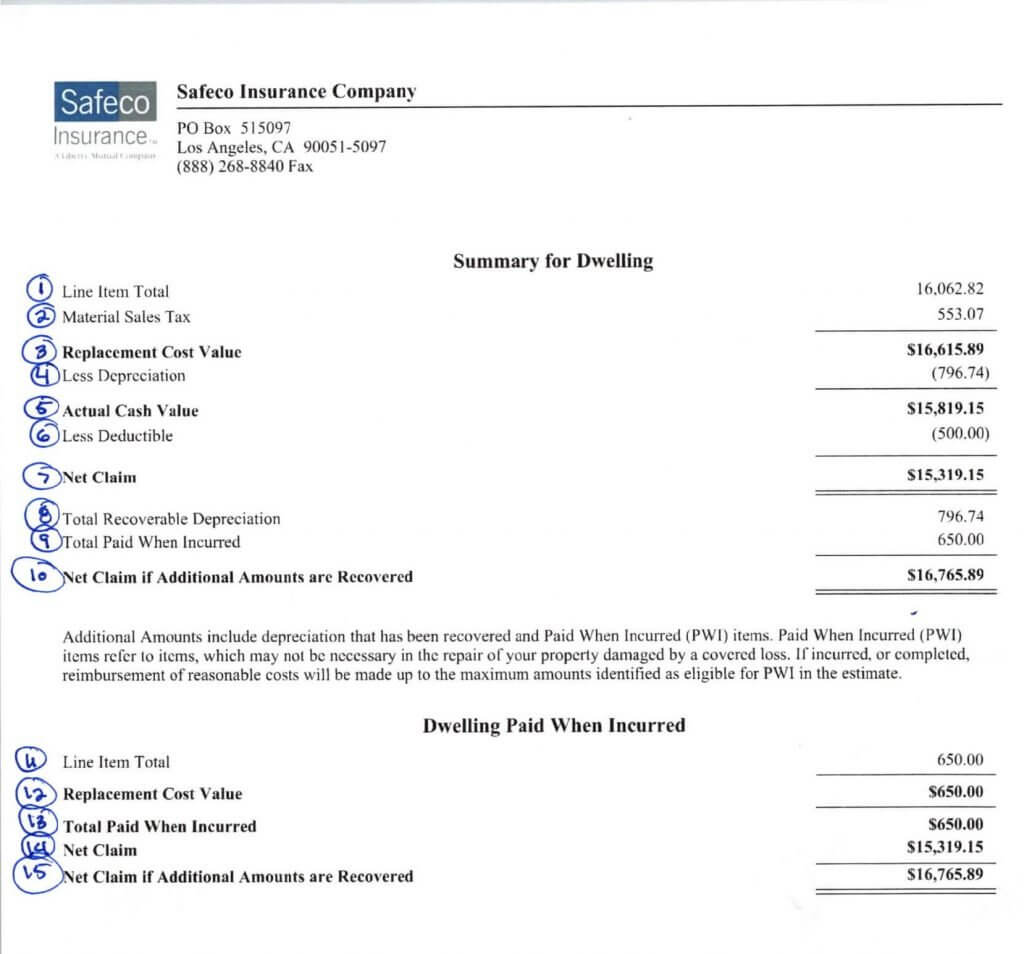

After documenting the damage, the insurance company will estimate the repair costs based on various factors such as labor, materials, and potential additional expenses. This estimation takes into account the extent and type of damage, as well as the local market rates for restoration services. The company may also consult contractors or professionals experienced in water damage repair to aid in the estimation process.

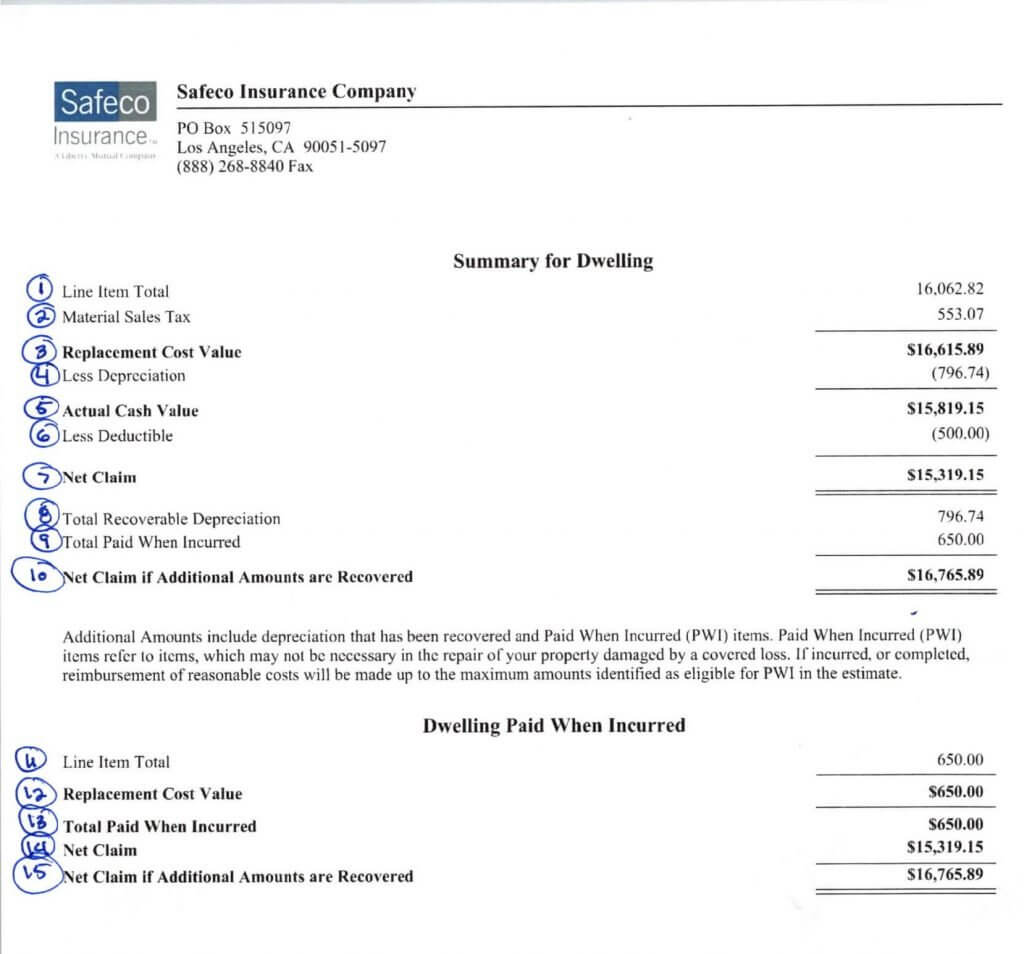

Adjusting for Depreciation

Insurance estimates often take into account the depreciation of the damaged property. Adjusting for depreciation means considering the age, wear and tear, and overall value of the damaged items or parts of the property. The insurance company will factor in the depreciated value when determining the reimbursement or coverage amount, which can lower the estimate.

Considering Additional Damages

During the assessment process, the insurance company will also consider any additional damages that may have occurred as a result of the water damage. This can include mold growth, structural issues, or damage to personal possessions. The estimation for these additional damages is typically included in the insurance estimate, but it is essential to ensure that all damages are adequately documented and accounted for.

Mitigation and Restoration Measures

Once the insurance estimate has been determined and the claim is approved, mitigating and restoring the water damage becomes the next crucial step. This process involves various measures to prevent further damage, restore the property to its pre-damage condition, and ensure the safety and well-being of the occupants.

Emergency Water Extraction

The first step in mitigating water damage is often emergency water extraction. This involves the removal of standing water from the property to prevent further damage and mold growth. Professional water restoration companies utilize specialized equipment to extract water efficiently and minimize the potential for secondary issues.

Mold Remediation

One of the most critical aspects of water damage restoration is mold remediation. Moisture and high humidity levels can create optimal conditions for mold growth. Mold can cause severe health problems and compromise the structural integrity of the property. Professional mold remediation experts employ specialized techniques and equipment to identify and eradicate mold, ensuring a safe and healthy living environment.

Structural Repairs

Water damage can compromise the structural integrity of a property, leading to weakened foundations, rotting wood, or compromised building materials. Structural repairs aim to restore the stability and safety of the property. This process may involve repairing or replacing damaged walls, floors, ceilings, and other structural components.

Content and Possession Restoration

In addition to the physical structure, water damage can also impact personal belongings and possessions within the property. Content and possession restoration involves salvaging and restoring items that have been damaged by water. This can include furniture, electronics, clothing, documents, and sentimental items. Restoration techniques such as specialized cleaning, deodorizing, and drying are employed to preserve as much of the possessions as possible.

Hiring a Public Adjuster

Dealing with an insurance claim after water damage can be a complex and overwhelming process. Hiring a public adjuster can provide invaluable assistance in navigating the insurance maze and ensuring a fair settlement for your claim.

Role of a Public Adjuster

A public adjuster is a licensed professional who represents the policyholder in negotiating and settling insurance claims. Unlike independent or company adjusters, who work for the insurance company, public adjusters work solely on behalf of the policyholder. Their role is to protect the policyholder’s interests and maximize the claim settlement by thoroughly assessing the damages, documenting the losses, and negotiating with the insurance company.

Benefits of Hiring a Public Adjuster

There are several benefits to hiring a public adjuster when dealing with a high insurance estimate after water damage. First and foremost, public adjusters have extensive experience and knowledge in handling insurance claims, including water damage-related ones. They understand the intricacies of the insurance industry and can navigate the complex claim process on your behalf.

Second, public adjusters can provide an accurate and comprehensive assessment of the damages, ensuring that no aspect of the claim is overlooked or undervalued. They have the expertise to identify hidden damages, assess the long-term implications of the water damage, and thoroughly document the losses. This comprehensive approach increases the likelihood of a fair and satisfactory claim settlement.

Another significant benefit of hiring a public adjuster is their negotiation skills. Public adjusters are experienced in dealing with insurance companies and understand the tactics often used to minimize claims or undervalue damages. They can effectively negotiate with insurance adjusters, advocating for your rights and ensuring that you receive the compensation you deserve.

Appealing Insurance Estimates

If you find yourself faced with a very high insurance estimate after water damage, appealing the estimate may be a viable option. Successfully appealing an insurance estimate requires a thorough understanding of the estimation process, careful review of the insurance policy, and the presentation of a solid case supported by compelling evidence.

Understanding the Estimation Process

To appeal an insurance estimate, it is crucial to understand the estimation process employed by your insurance company. Familiarize yourself with the factors and methodologies used to arrive at the estimate. This knowledge will enable you to identify any discrepancies or inaccuracies in the initial assessment, increasing your chances of a successful appeal.

Reviewing the Insurance Policy

Carefully reviewing your insurance policy is essential when appealing an estimate. Look for any provisions or coverage limitations that may affect the estimated cost of repairs. Pay close attention to exclusions or deductibles that may result in lower coverage than expected. Understanding your policy will help you craft a well-supported appeal.

Collecting Supporting Evidence

When appealing an insurance estimate, compelling supporting evidence is critical. Gather all relevant documentation, including photographs, videos, receipts, invoices, and expert opinions. This evidence should clearly demonstrate the extent of the damages, the necessity of the repairs, and the associated costs. Well-organized and compelling evidence can strengthen your case and increase the likelihood of a successful appeal.

Presenting a Solid Case

Crafting a persuasive appeal requires presenting a solid case to the insurance company. Clearly outline the grounds for your appeal, highlighting any discrepancies or inaccuracies in the initial estimate. Present your supporting evidence in a structured and concise manner, emphasizing its relevance and validity. Convey your point of view effectively and assertively, making a well-supported argument for a lower insurance estimate.

Seeking Legal Assistance

In some cases, seeking legal assistance may be necessary to appeal a high insurance estimate after water damage. If negotiations with the insurance company are unsuccessful or the complexity of the claim requires legal expertise, consulting with an attorney specializing in insurance claims can be advantageous. An attorney can help you understand your rights, advocate on your behalf, and guide you through the appeal process.

In conclusion, dealing with a very high insurance estimate after water damage can be challenging, but understanding the factors that influence the estimation process, the steps involved in assessing the damages, and the potential mitigation and restoration measures can help you navigate the insurance claims process more effectively. Additionally, considering the benefits of hiring a public adjuster and understanding the steps to appeal an insurance estimate can assist in achieving a fair settlement. Remember to gather supporting evidence, review your insurance policy, and, if necessary, seek legal assistance to ensure your rights are protected and you receive the compensation you deserve.