In this article, you will discover helpful tips to navigate the process of filing a water damage insurance claim. Dealing with water damage can be stressful, but understanding how to properly document and communicate the extent of the damage can make a significant difference in receiving the compensation you deserve. From gathering evidence to contacting your insurance company, we will provide you with practical advice that will streamline the claim process and help you get back on your feet in no time.

1. Document the Damage

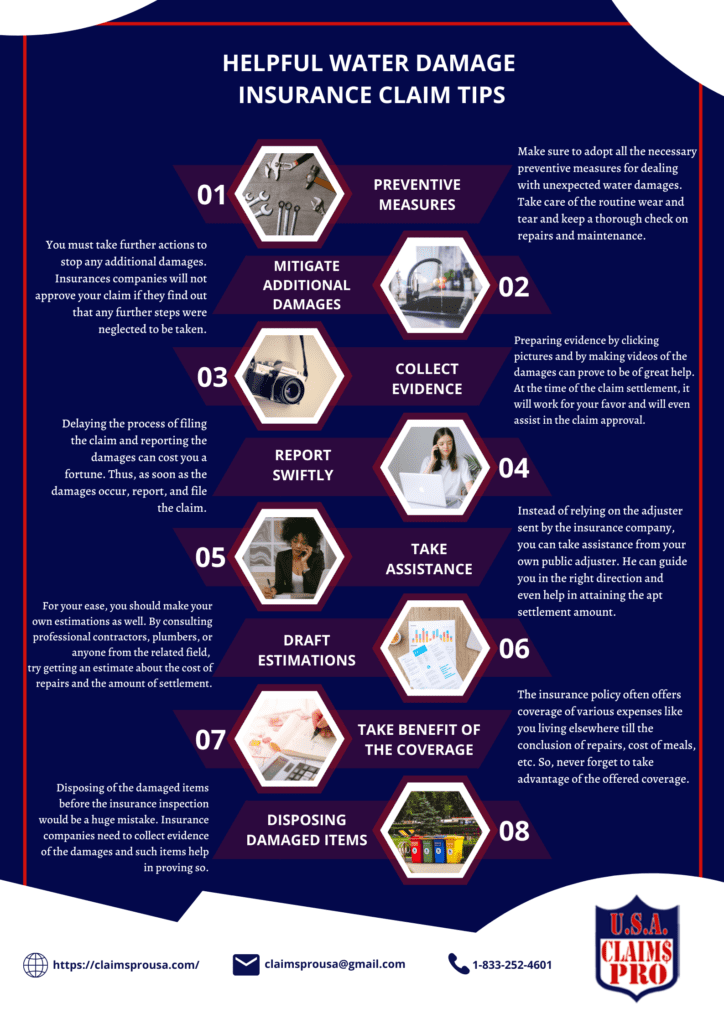

Accidents happen, and when they do, it’s important to act quickly and efficiently to ensure a smooth insurance claims process. The first step in filing a water damage insurance claim is to document the damage thoroughly. This documentation will serve as crucial evidence when it comes time to submit your claim.

Take photos and videos

Start by taking clear and detailed photos of the affected areas. Be sure to capture the extent of the damage, including any waterlogged furniture, structural issues, or mold growth. It’s best to take multiple angles of each affected area to ensure nothing is missed. Additionally, consider taking videos that provide a broader view of the damage. These visual records can be invaluable during the claims process.

Make a detailed list of damaged items

Next, create a comprehensive list of all the items that have been damaged due to the water incident. This includes furniture, electronics, appliances, clothing, and any other possessions that have been affected. Take note of the brand, model, and estimated value of each item, if possible. Keep in mind that even items that may not appear damaged initially, such as carpets or drywall, may need to be replaced due to potential hidden water damage or mold growth.

2. Report the Incident

Once you have documented the damage, it’s time to report the incident to your insurance company. Promptly notifying them about the water damage is crucial, as many policies have specific time limits for reporting claims. Failure to report the incident within the specified timeframe may result in your claim being denied.

Contact your insurance company

Contact your insurance company as soon as possible after the water damage occurs. Have all the necessary information ready, including your policy number, the date and time of the incident, and a detailed description of what happened. Be prepared to provide the photos and videos you took, as well as the list of damaged items. Your insurance company will guide you through the next steps of the claims process.

Notify relevant authorities if necessary

In some cases, it may be necessary to notify local authorities about the water damage incident. This is particularly true if the damage is extensive or if it resulted from a natural disaster or other catastrophic event. Informing the relevant authorities can ensure that the appropriate steps are taken to address the situation and may be required for certain types of claims or coverage.

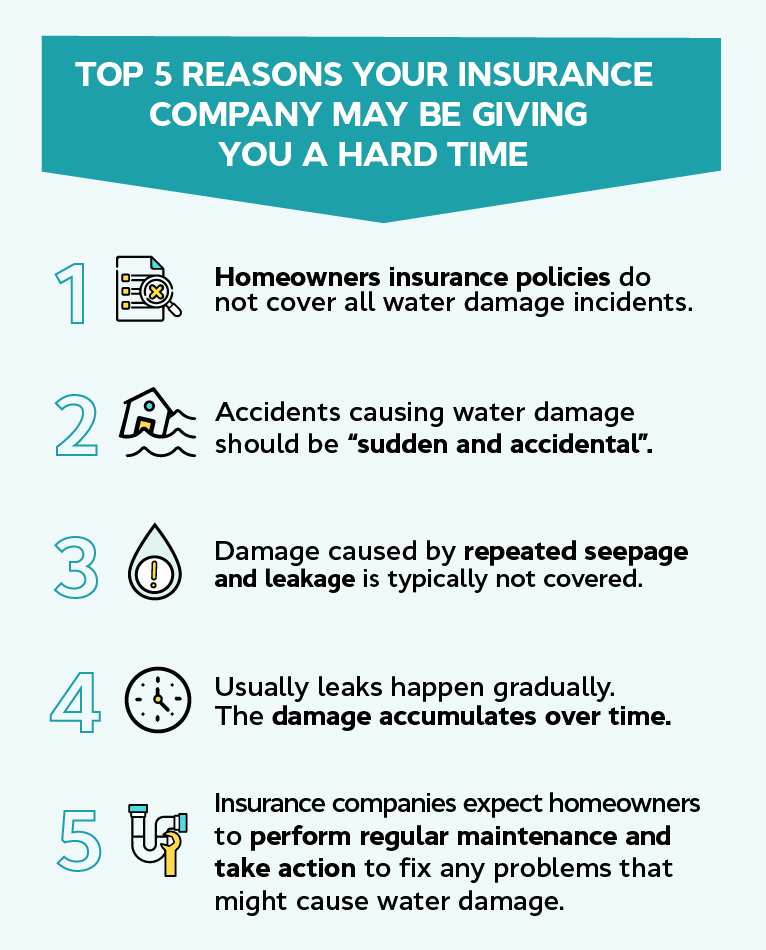

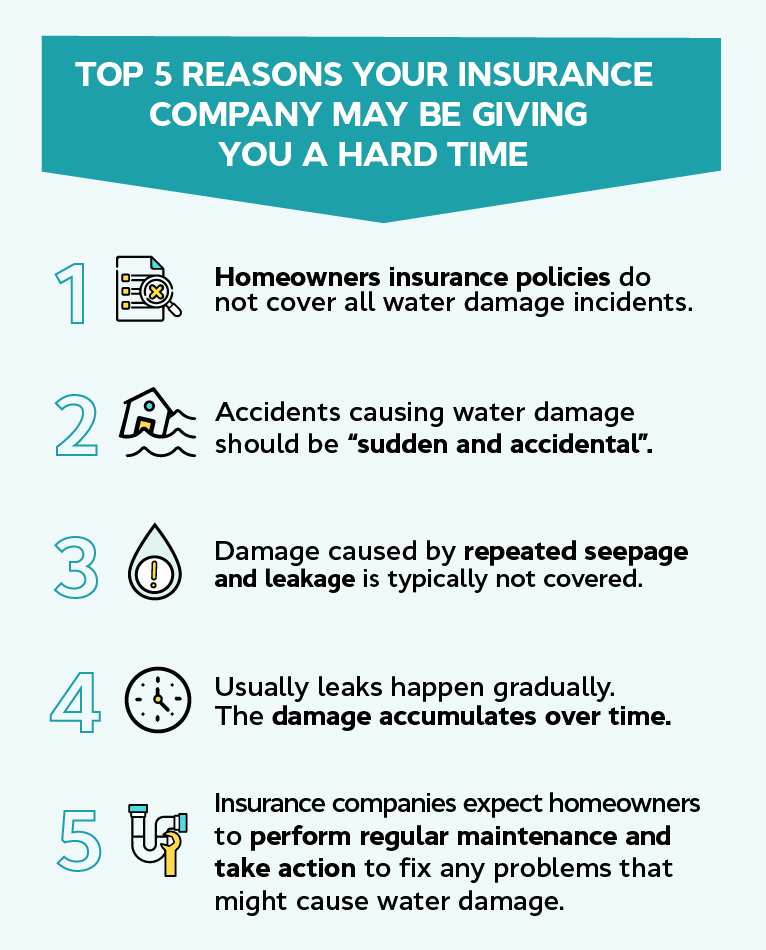

3. Review Your Insurance Policy

Before proceeding further, take the time to carefully review your insurance policy. Understanding your coverage and any exclusions is essential for a successful water damage insurance claim.

Understand the coverage and exclusions

Review your policy to determine what types of water damage are covered. Some policies may cover sudden and accidental water damage, while others may exclude coverage for certain types of water damage, such as flooding or water backups. Understanding these details will help manage your expectations and allow you to determine how to proceed with your claim.

Check for specific water damage provisions

Certain insurance policies may have specific provisions related to water damage. These provisions often outline the steps you need to take in the event of a water incident, such as mitigating further damage or hiring professional help. Familiarize yourself with these provisions to ensure that you are meeting all necessary requirements.

4. Mitigate Further Damage

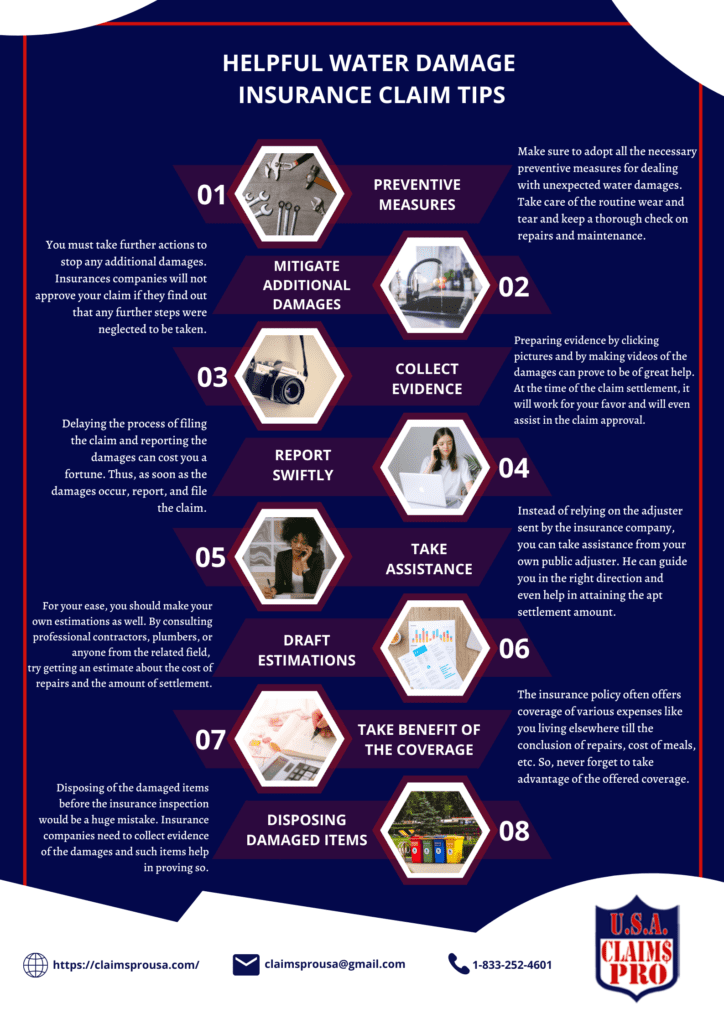

While waiting for your insurance claim to be processed, it’s essential to take immediate action to prevent any further damage to your property. Mitigation measures can help minimize the impact of the water damage and demonstrate to your insurance company that you have taken responsible steps to protect your home.

Take necessary steps to prevent additional damage

Depending on the nature of the water damage, there are several steps you can take to mitigate further harm. For example, if the water damage is due to a burst pipe, turn off the water supply to prevent additional flooding. If there are any visible leaks, patch them up or use buckets to collect the water. Removing any standing water and setting up fans or dehumidifiers to dry out affected areas can also help minimize damage.

Keep records of mitigation efforts

Throughout the mitigation process, keep detailed records of all the steps you have taken. This includes any repairs, receipts for equipment rentals or purchases, and any communication with contractors or repair professionals. These records will serve as evidence of your effort to prevent further damage and may be essential for your insurance claim.

5. Gather Evidence

To support your insurance claim, it’s important to gather as much evidence as possible. This evidence will help demonstrate the extent of the damage and the associated costs for repairs and replacements.

Collect invoices, receipts, and repair estimates

Keep all invoices and receipts for any expenses related to the water damage incident. This includes invoices for emergency repairs, professional clean-up services, temporary housing, and any other relevant expenses. Additionally, obtain repair estimates from reputable contractors or restoration companies to provide an accurate assessment of the costs involved. These documents will strengthen your claim and increase the chances of a fair settlement.

Obtain expert opinions or assessments

In some cases, it may be necessary to seek expert opinions or assessments to support your claim. For example, if you suspect mold growth due to the water damage, hiring a certified mold inspector can provide an unbiased assessment. Similarly, if there are structural issues, consulting with a licensed contractor or engineer can help establish the extent of the damage and the necessary repairs. These expert opinions will carry weight in your claim and help negotiate a fair settlement.

6. Report Losses and Expenses

When filing your water damage insurance claim, it’s crucial to provide accurate and detailed information regarding your losses and expenses. This will help ensure that you receive proper compensation for your damages.

Provide accurate and detailed information

When filling out the claim forms or speaking with your insurance adjuster, be as accurate and detailed as possible in describing the damage. Include the date and time of the incident, a description of what happened, and the scope of the damage. Include any information related to the mitigation efforts you have taken to prevent further damage.

Include all related costs and expenses

In addition to the physical losses, it’s essential to include all the costs and expenses that have been incurred as a result of the water damage incident. This includes repairs, replacements, temporary accommodations, storage fees for belongings, and even costs for meals if you were forced to eat out during the restoration process. By including all relevant costs, you can maximize your claim and ensure a fair settlement.

7. Maintain Communication

Effective communication with your insurance adjuster is key to a successful water damage insurance claim. Stay in regular contact and keep copies of all correspondence to ensure a smooth claims process.

Stay in regular contact with your insurance adjuster

Make sure to maintain open lines of communication with your insurance adjuster throughout the claims process. Respond promptly to any requests for information or documentation and provide updates on any new developments or expenses. Building a good rapport with your adjuster can help streamline the process and expedite your claim.

Keep copies of all correspondence

Whenever you communicate with your insurance company or adjuster, make sure to keep copies of all emails, letters, or any other form of communication. These records will serve as proof of the discussions and agreements made during the claims process. If any disputes arise, having these records on hand will help protect your rights and ensure a fair resolution.

8. Follow the Claims Process

To ensure a smooth and efficient claims process, it’s crucial to follow the designated procedures outlined by your insurance company.

Submit the claim promptly

Submit your claim as soon as possible after the water damage incident. Insurance companies often have specific time limits for filing claims, and failure to meet these deadlines may result in your claim being denied. Be sure to include all required documents and evidence, such as photos, videos, invoices, and estimates, when submitting your claim.

Follow any required documentation or forms

Review the instructions provided by your insurance company and follow any required documentation or forms precisely. Missing or incomplete information can lead to delays in processing your claim or even a denial. Take the time to thoroughly read and understand the requirements, and seek clarification from your insurance company if necessary.

9. Get Professional Help if Needed

While filing a water damage insurance claim can often be done independently, there are situations where it may be beneficial to seek professional assistance.

Consider hiring a public adjuster

If you find yourself overwhelmed or facing challenges during the claims process, consider hiring a public adjuster. Public adjusters are independent professionals who specialize in assessing and negotiating insurance claims on behalf of the policyholders. They have experience in dealing with insurance companies and can help ensure that you receive a fair settlement.

Consult with an attorney if there are disputes

In cases where there are disputes or complex legal issues surrounding your claim, it may be necessary to consult with an attorney who specializes in insurance law. An attorney can provide valuable guidance throughout the claims process, protect your rights, and help navigate any legal obstacles that may arise.

10. Be Prepared for the Outcome

When it comes to insurance claims, it’s important to understand the potential outcomes and be prepared for the final decision.

Understand the possible claim settlement options

Insurance companies may offer different settlement options depending on your policy and the extent of the damage. This could include reimbursement for repair costs, replacement of damaged items, or cash settlements. Familiarize yourself with the options available to you and carefully review any settlement offers before accepting.

Review and evaluate the final decision

Once a decision has been made regarding your claim, carefully review the details and evaluate whether it meets your expectations and adequately compensates you for your losses. If you have any concerns or believe that the settlement is unfair, consult with your insurance adjuster and consider seeking professional advice from a public adjuster or attorney.

In conclusion, filing a water damage insurance claim requires proactive steps, thorough documentation, and effective communication. By following these tips and being prepared for the claims process, you can increase the likelihood of a successful claim and ensure that you receive the compensation you are entitled to. Remember, stay organized, provide accurate information, and seek assistance when needed to navigate the process with confidence.