Imagine being able to save money on your insurance premium without sacrificing coverage or benefits. Well, there are two simple things you can do to make this a reality. By taking these steps, you could potentially see a significant reduction in your insurance costs, allowing you to have more money in your pocket for the things you love. In this article, we will explore these two factors that could positively impact your insurance premium, giving you the power to save and protect what matters most to you. So, let’s jump in and discover these game-changing tips!

1. Maintaining a Safe Driving Record

1.1 Obeying Traffic Laws

One of the most effective ways to maintain a safe driving record and potentially reduce your insurance premium is by obeying all traffic laws. This includes following speed limits, stopping at red lights and stop signs, using signaling devices properly, and adhering to any other traffic regulations in your area. By demonstrating responsible and law-abiding behavior on the road, you can minimize the risk of accidents and violations that may increase your insurance rates.

1.2 Avoiding Traffic Violations

Avoiding traffic violations is another crucial aspect of maintaining a safe driving record. By refraining from actions such as running red lights, making illegal turns, or texting while driving, you can significantly reduce the likelihood of accidents and subsequent insurance claims. Traffic violations can not only lead to increased premiums but also result in fines, points on your driving record, and even the suspension of your driver’s license. By staying vigilant and making responsible choices, you can keep your driving record clean and your insurance rates affordable.

1.3 Following Speed Limits

Speeding is a common cause of accidents and can have detrimental effects on your insurance premiums. By always adhering to speed limits and adjusting your driving speed to match road conditions, you can minimize the risk of accidents and demonstrate your commitment to safe driving. Speeding tickets and convictions can lead to higher insurance rates as they indicate a higher likelihood of being involved in a collision. By following speed limits, you not only avoid costly fines but also maintain a safe driving record, which may result in lower insurance premiums.

1.4 Implementing Defensive Driving Techniques

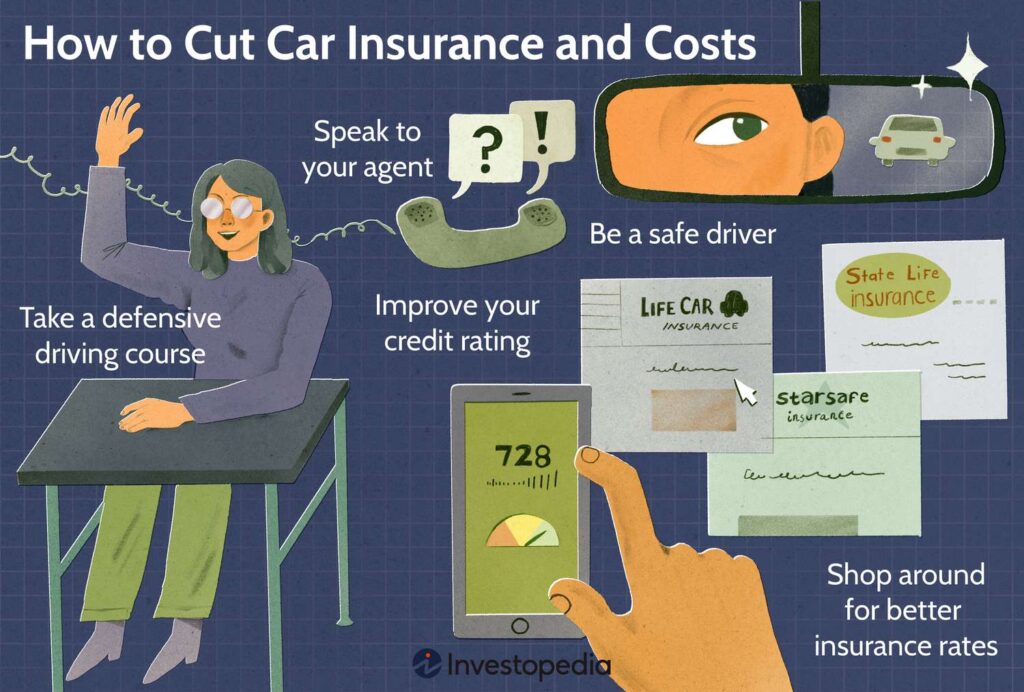

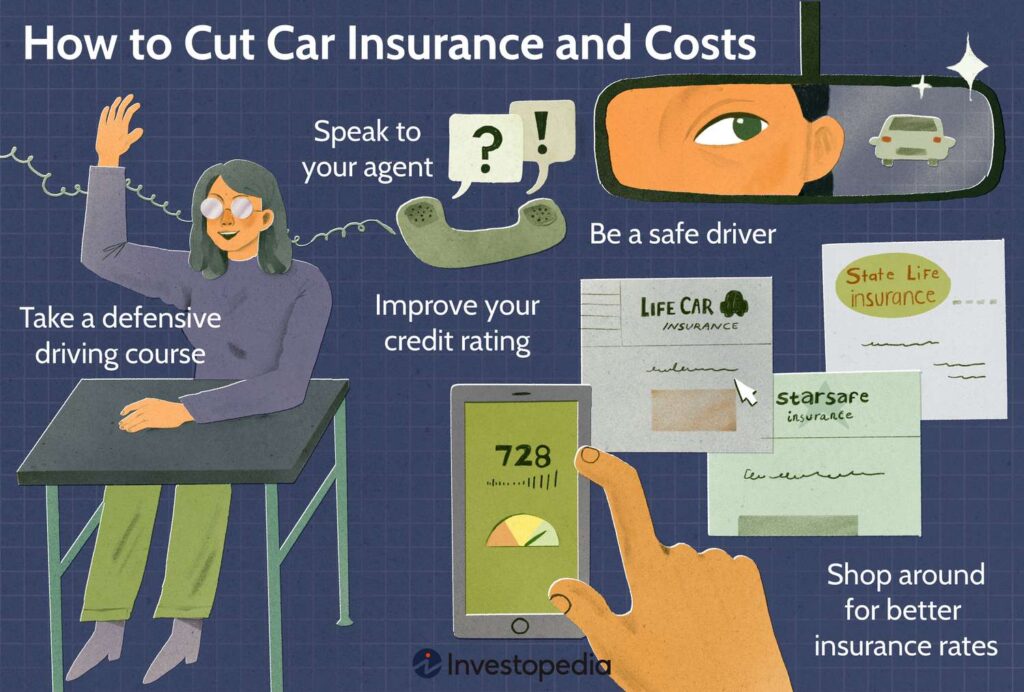

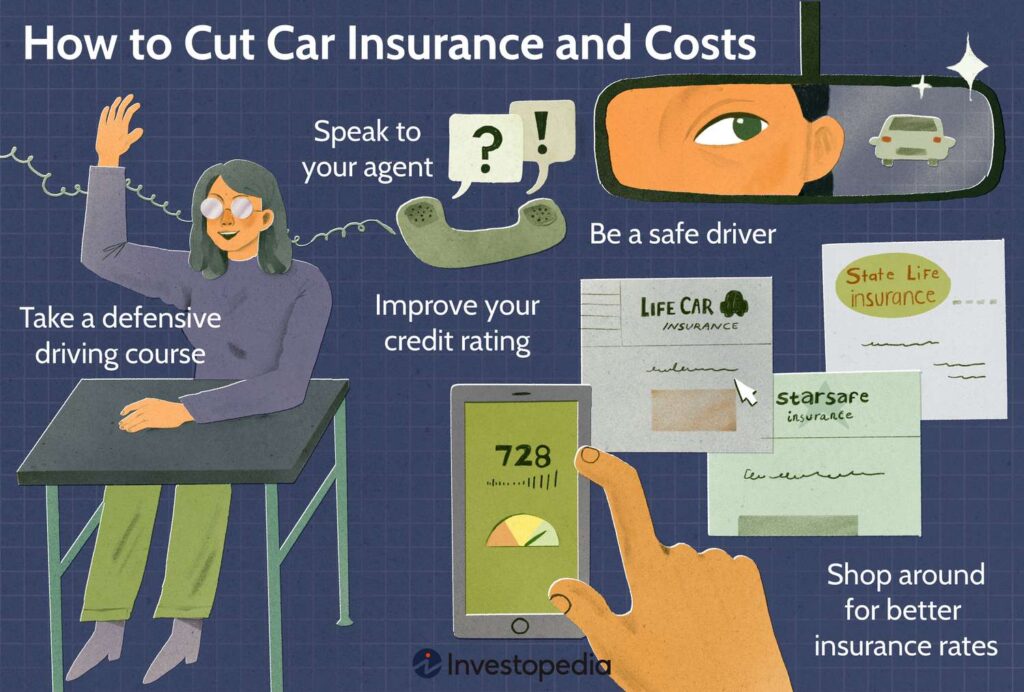

Implementing defensive driving techniques can go a long way in reducing your insurance premium. Defensive driving involves actively anticipating potential hazards, maintaining a safe distance from other vehicles, and constantly scanning the road for potential dangers. By being proactive in your driving approach, you can minimize the risk of accidents and demonstrate your commitment to safe practices. Insurance companies often provide discounts to policyholders who have completed defensive driving courses or can prove proficiency in defensive driving techniques.

1.5 Attending Defensive Driving Courses

Attending defensive driving courses is not only a great way to enhance your driving skills but can also have a positive impact on your insurance premiums. Defensive driving courses provide valuable knowledge and strategies to help you become a safer and more responsible driver. Many insurance providers offer discounts to policyholders who have completed approved defensive driving courses. By investing your time in these courses and improving your driving skills, you can potentially reduce your insurance premium while also making the roads safer for yourself and others.

2. Installing Safety Features in Your Vehicle

2.1 Installing Anti-Theft Devices

Installing anti-theft devices in your vehicle can significantly reduce the risk of theft and vandalism, thereby potentially lowering your insurance premium. Anti-theft devices, such as car alarms, steering wheel locks, and tracking systems, make it more difficult for thieves to target your vehicle. Insurance companies often reward policyholders who take proactive steps to protect their cars by offering discounts on their premiums. Installing anti-theft devices not only provides peace of mind but can also help save you money on your insurance coverage.

2.2 Adding Airbags

Adding airbags to your vehicle is another effective way to enhance safety and potentially reduce your insurance premiums. Airbags are designed to deploy in the event of a collision, providing an extra layer of protection for vehicle occupants. Their presence reduces the risk of severe injuries and can minimize the cost of medical claims resulting from accidents. Many insurance companies offer discounts for vehicles equipped with airbags as they are considered an important safety feature. By investing in airbags, you not only prioritize the well-being of yourself and your passengers but also demonstrate to insurance providers that you take safety seriously.

2.3 Equipping Your Vehicle with Anti-lock Brakes

Equipping your vehicle with anti-lock brakes (ABS) is another safety feature that can help lower your insurance premiums. ABS is designed to prevent the wheels from locking during sudden or hard braking, allowing the driver to maintain steering control and avoid potential accidents. Insurance companies recognize the effectiveness of ABS in reducing the risk of collisions and often provide discounts to vehicles equipped with this safety feature. By investing in ABS, you not only enhance the safety of your vehicle but also potentially save money on your insurance coverage.

2.4 Installing Daytime Running Lights

Installing daytime running lights (DRL) is a simple yet effective way to improve visibility on the road and potentially reduce your insurance premiums. DRL are low-intensity lights that automatically turn on when the vehicle is running, enhancing visibility for other drivers and pedestrians. The increased visibility provided by DRL can significantly reduce the risk of accidents, particularly during low-light conditions or inclement weather. Insurance companies often offer discounts for vehicles equipped with DRL as they are considered a proactive safety measure. By installing DRL, you not only improve the overall safety of your vehicle but may also enjoy lower insurance premiums.

2.5 Utilizing Blind Spot Monitoring Systems

Blind spot monitoring systems are innovative safety features that can help prevent accidents and lower insurance premiums. These systems use sensors or cameras to alert drivers when there is a vehicle in their blind spot, reducing the risk of dangerous lane changes or collisions. By utilizing a blind spot monitoring system, drivers gain an additional layer of protection and are less likely to be involved in accidents caused by blind spot-related issues. Insurance providers often offer discounts for vehicles equipped with this technology as it demonstrates the driver’s commitment to safety. By investing in a blind spot monitoring system, you not only enhance your driving experience but also potentially save on insurance costs.

3. Choosing a Higher Deductible

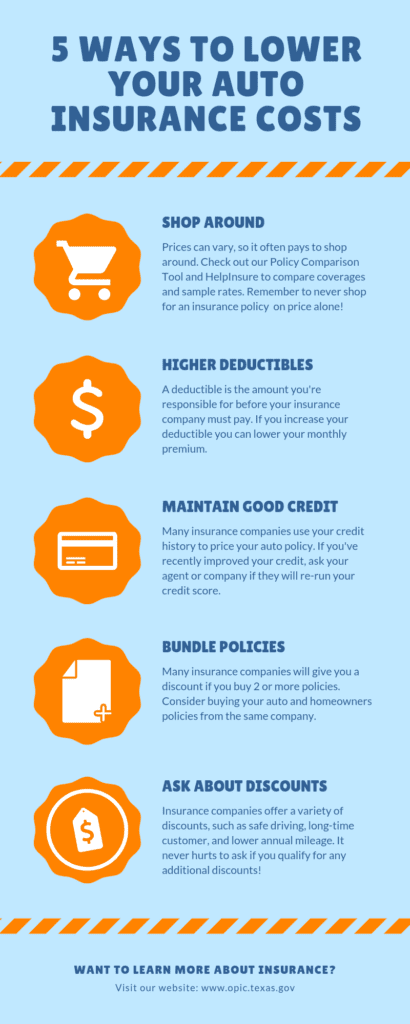

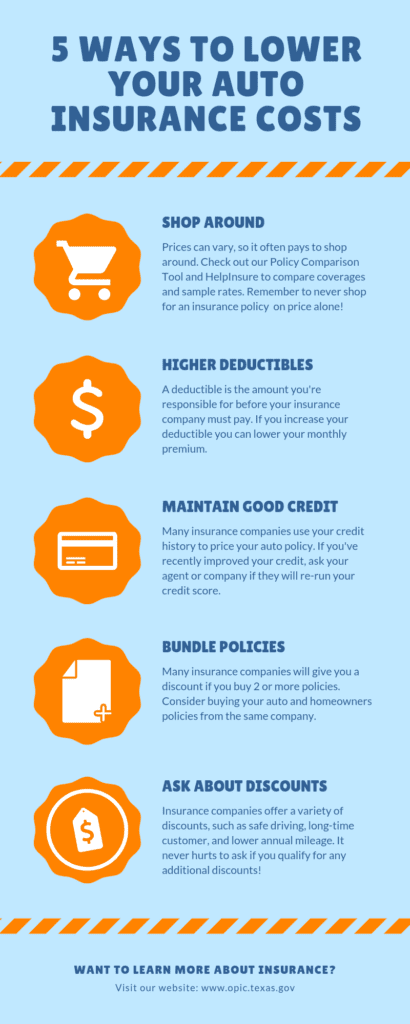

3.1 How Deductibles Work

Understanding how deductibles work is crucial when considering ways to reduce your insurance premiums. A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and file a claim for $1,500 in damages, you would pay the initial $500, while the insurance company covers the remaining $1,000. Choosing a higher deductible means you will have a larger out-of-pocket expense in the event of a claim, but it can also result in lower insurance premiums.

3.2 Impact on Insurance Premiums

Opting for a higher deductible can have a direct impact on your insurance premiums. Insurance companies typically offer lower premiums for policies with higher deductibles because it shifts more of the financial burden to the policyholder in the event of a claim. By accepting a higher deductible, you demonstrate to the insurance company that you are willing to assume a greater portion of the risk. This reduced risk for the insurance provider often translates to lower premiums for the policyholder. However, it’s essential to carefully evaluate your financial situation before choosing a higher deductible, as you must be prepared to cover the increased out-of-pocket expenses.

3.3 Evaluating Your Financial Situation

Before deciding on a higher deductible, it is crucial to evaluate your financial situation to ensure you can comfortably afford the out-of-pocket expense. While choosing a higher deductible can result in lower insurance premiums, it also means you will be responsible for paying a more significant portion of the costs in the event of a claim. Consider your current savings, income, and overall financial stability to determine if a higher deductible is feasible for you. Make sure you have enough funds set aside to cover the deductible without causing financial hardship.

3.4 Calculating Potential Savings

To determine the potential savings of choosing a higher deductible, calculate the difference in premiums between different deductible options. Insurance companies often provide policy quotes with various deductible amounts, allowing you to evaluate the cost difference. By comparing and calculating the potential savings over time, you can determine if the reduced premiums outweigh the increased out-of-pocket expenses. Keep in mind that the potential savings may vary depending on factors such as your driving history, location, and the type of coverage you require.

3.5 Balancing Deductible and Risk

Choosing the right deductible amount is a balancing act between potential savings and the level of financial risk you are willing to assume. While a higher deductible can lead to lower premiums, it also means you will have higher out-of-pocket expenses in the event of a claim. Consider factors such as your driving history, financial stability, and the value of your vehicle when determining the appropriate deductible amount. It’s essential to find a balance that aligns with your financial capabilities while still providing an acceptable level of protection and potential premium reduction.

4. Maintaining a Good Credit Score

4.1 Importance of Credit Score in Insurance

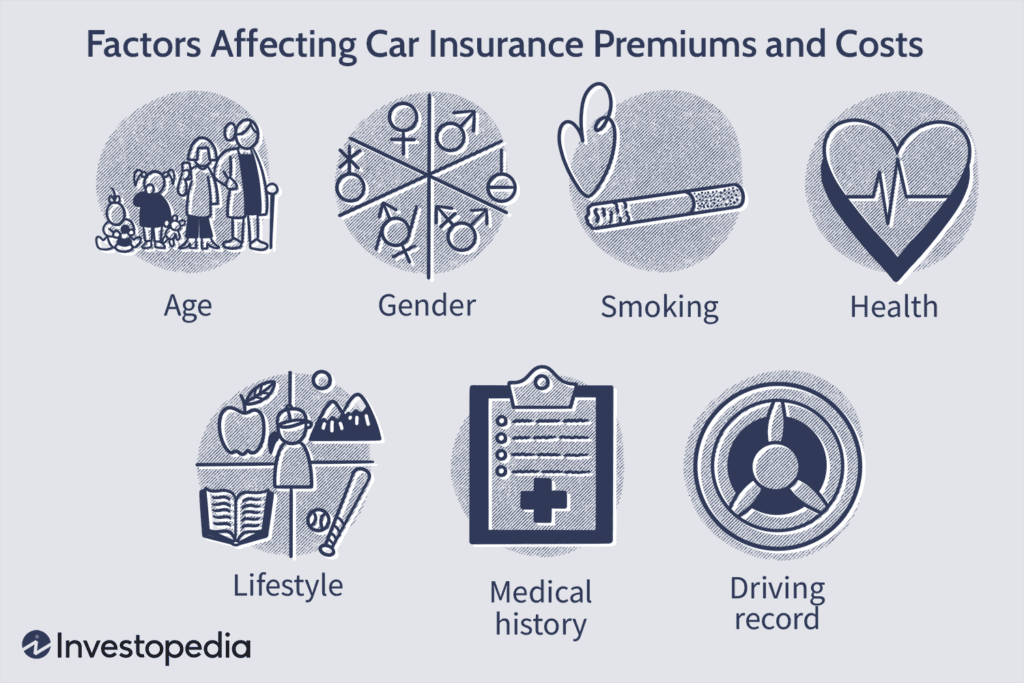

Your credit score plays an important role in various aspects of your financial life, including your insurance premiums. Insurance companies use credit-based insurance scores to assess the risk associated with insuring an individual. A credit-based insurance score is calculated using information from your credit report, such as your payment history, outstanding debt, and length of credit history. By maintaining a good credit score, you demonstrate to insurance providers that you are financially responsible and less likely to file insurance claims.

4.2 How Credit Score Affects Premiums

Your credit score directly influences your insurance premiums. Individuals with higher credit scores are often considered lower risk and may benefit from lower insurance premiums. Conversely, individuals with lower credit scores may be viewed as higher risk and may face higher insurance costs. Insurance companies rely on statistical data that shows a correlation between credit-based insurance scores and the likelihood of filing claims. By consistently maintaining a good credit score, you can potentially enjoy more affordable insurance premiums.

4.3 Steps to Improve Your Credit Score

Improving your credit score takes time and effort, but the potential benefits are well worth it. Start by reviewing your credit report for any errors or discrepancies that may be negatively impacting your score. Address any inaccuracies by contacting the credit reporting agencies and providing the necessary documentation. Next, focus on paying your bills on time and reducing your overall debt. Paying down high credit card balances and avoiding new debt can have a positive impact on your credit score over time. It’s essential to be patient and maintain responsible financial habits to see improvements in your credit score.

4.4 Monitoring and Managing Your Credit

Monitoring and managing your credit is an ongoing responsibility that can help maintain a good credit score and potentially reduce your insurance premiums. Regularly check your credit reports from the three major credit reporting agencies—Equifax, Experian, and TransUnion—to ensure they are accurate and up-to-date. Utilize credit monitoring services that notify you of any significant changes in your credit profile. By promptly addressing any issues or potential identity theft, you can protect your credit score and maintain a positive insurance-related financial profile.

4.5 Seeking Professional Credit Counseling

If you are struggling to improve your credit score on your own, seeking professional credit counseling may be beneficial. Credit counselors are trained professionals who can analyze your credit situation, provide personalized advice, and help you develop a plan to improve your credit score. They can assist in negotiating with creditors, setting realistic financial goals, and providing ongoing support and education. Professional credit counseling can provide valuable insights and strategies to help you achieve a better credit score, which can lead to potential savings on your insurance premiums.

5. Bundling Multiple Policies

5.1 Understanding Policy Bundling

Bundling multiple policies, such as auto and home insurance, with the same insurance provider is a strategy that can potentially save you money on your insurance premiums. Policy bundling involves combining different insurance policies under one insurance company. For example, instead of having separate providers for your auto and home insurance, you can choose to bundle them with the same insurer. This consolidation allows you to manage your policies more efficiently and can often result in discounts and cost savings.

5.2 Benefits of Bundling

There are several benefits to bundling multiple policies with the same insurance company. Firstly, you can enjoy the convenience of having all your policies in one place, simplifying the management and payment processes. Additionally, insurance companies often provide discounts for policy bundles, resulting in cost savings. Bundling can also enhance your overall coverage. By consolidating your policies, you may benefit from added perks, such as higher liability limits or expanded coverage options. Exploring bundling options can be a wise financial decision that maximizes your insurance-related savings.

5.3 Exploring Different Policy Combinations

When considering policy bundling, it is essential to explore different policy combinations to identify the most cost-effective options for your specific needs. Start by evaluating the types of insurance policies you require, such as auto, home, renters, or umbrella coverage. Compare quotes from different insurance providers to determine the potential savings offered through bundling. Take into account factors such as coverage limits and deductibles to ensure you are receiving the necessary protection at the best possible price. Shopping around and seeking multiple quotes can help you make an informed decision and find the most advantageous policy bundle for your circumstances.

5.4 Comparing Bundled Offers

Comparing bundled offers from different insurance providers is crucial to ensure you are getting the best value for your money. Consider factors such as the reputation and financial stability of the insurance companies, as well as the level of customer service they provide. Look for any additional benefits or discounts offered through bundled policies, such as accident forgiveness, deductible rewards, or roadside assistance. By thoroughly comparing bundled offers, you can find the most competitive rates and comprehensive coverage that align with your insurance needs.

5.5 Reevaluating Bundle Options Annually

Once you have chosen a bundled insurance option, it is important to reevaluate your bundle annually to ensure it still meets your needs and provides the best value. Circumstances can change over time, such as purchasing a new vehicle, renovating your home, or relocating. These changes may require adjustments to your insurance coverage or the need for additional policies. As your needs evolve, periodically review your bundle and consult with your insurance provider to ensure you have the appropriate coverage at the most competitive rates. Regularly reassessing your bundle options can help you maximize savings and maintain optimal coverage.

6. Embracing Life Changes

6.1 Getting Married

Getting married can have a positive impact on your insurance premiums. Insurance companies often consider married individuals to be more responsible and statistically less likely to be involved in accidents. As a result, they may offer lower premiums to married policyholders. When you get married, it is important to inform your insurance provider and update your marital status on your policy. By doing so, you can potentially benefit from reduced insurance premiums and enjoy savings as you start your life together.

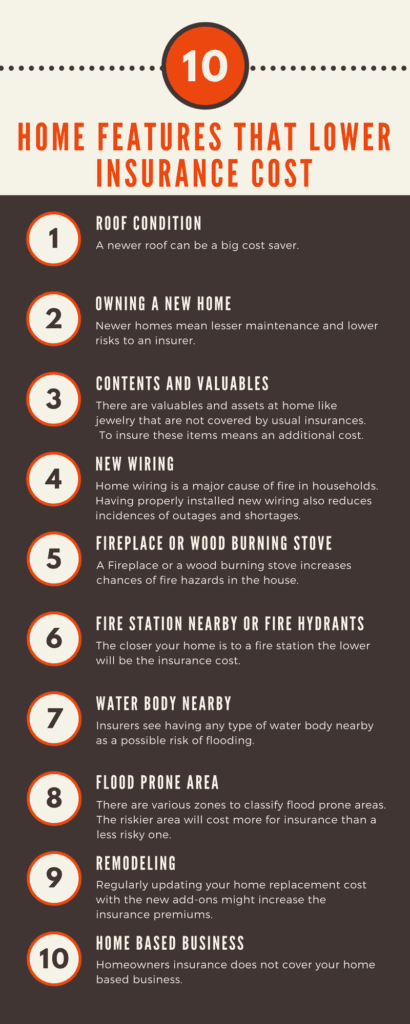

6.2 Moving to a Safer Neighborhood

Moving to a safer neighborhood can positively influence your insurance premiums. Insurance companies assess the level of risk associated with the location where your vehicle is typically parked or where your home is situated. Safer neighborhoods with lower crime rates and less traffic congestion are often associated with lower insurance premiums. If you are planning to move, research the safety records and crime rates of different neighborhoods you are considering. By selecting a safer neighborhood, you can potentially enjoy lower insurance costs and greater peace of mind.

6.3 Updating Your Occupation

Your occupation can impact your insurance premiums. Certain occupations, such as those with minimal driving or desk-based jobs, are considered lower risk by insurance companies. If you have recently changed careers or your occupation has significantly changed, inform your insurance provider so they can update your policy accordingly. By accurately reflecting your occupation and how you use your vehicle for work, you can potentially benefit from lower insurance premiums that align with the decreased risk associated with your new occupation.

6.4 Retiring from Driving

Retiring from driving is a significant life change that can lead to reduced insurance premiums. As a retiree, you are likely to drive less frequently, reducing the risk of accidents and insurance claims. Insurance companies often offer discounts to policyholders who are no longer commuting to work or using their vehicles for business purposes. When you retire, inform your insurance provider and discuss the changes in your driving habits. By doing so, you can potentially qualify for lower insurance premiums as you enjoy the benefits of retirement.

6.5 Becoming a Member of Alumni or Professional Associations

Membership in alumni or professional associations can provide additional benefits and potentially reduce your insurance premiums. Many insurance companies offer special discounts or group rates for members of specific organizations. By becoming a member of such associations, you can take advantage of these discounts and enjoy potentially lower insurance costs. Research alumni networks, professional organizations, or trade groups that you are eligible to join and inquire about any insurance partnerships or discounts available to members. By leveraging your affiliations, you can potentially access exclusive savings on your insurance premiums.

7. Driving Less

7.1 Carpooling or Using Public Transportation

Driving less is a practical way to reduce your insurance premiums. Insurance companies consider the mileage you drive annually when determining your rates. By reducing your driving mileage, you decrease the likelihood of accidents and claims, leading to potential premium reductions. Consider carpooling with coworkers or using public transportation for your daily commute. Carpooling not only helps lower your insurance premiums but also reduces fuel costs and contributes to a more sustainable environment. Explore public transportation options in your area and evaluate how utilizing these alternatives can benefit your insurance costs.

7.2 Working from Home

Working from home, whether full-time or part-time, can have a positive impact on your insurance premiums. By eliminating the daily commute to a traditional workplace, your vehicle mileage decreases, reducing the risk of accidents and claims. Inform your insurance provider about your change in work status and discuss the potential premium adjustments. Some insurance companies offer specific rates or discounts for individuals who primarily work from home. Taking advantage of these offerings can help you enjoy savings on your insurance coverage while embracing the flexibility of a remote work arrangement.

7.3 Shortening Your Commute

Reducing the length of your daily commute can contribute to lower insurance premiums. Insurance companies often consider longer commutes to be associated with increased risk due to more time spent on the road. If possible, consider relocating closer to your workplace or finding a job that minimizes commuting distance. By shortening your commute, you decrease your exposure to potential accidents and demonstrate your commitment to responsible driving habits. Discuss any changes in your commute with your insurance provider to explore potential premium reductions.

7.4 Adjusting Your Mileage Estimates

When estimating your annual mileage for insurance purposes, it is important to be as accurate as possible. If you initially provided a higher estimate but find that you are driving significantly less, contact your insurance provider to update your mileage. By adjusting your mileage estimates to reflect your actual driving habits, you can potentially qualify for lower insurance premiums. Regularly reassess your driving patterns and update your insurance provider accordingly to ensure you are receiving appropriate coverage at the best possible rates.

7.5 Choosing Low-Mileage Discounts

Many insurance companies offer low-mileage discounts for policyholders who drive fewer miles annually. Low-mileage discounts are designed for individuals who drive significantly less than the average driver, reducing the risk of accidents and claims. If you believe that you qualify for a low-mileage discount, contact your insurance provider to inquire about this potential savings opportunity. Provide accurate information about your driving habits and odometer readings to ensure you receive the appropriate discounts. By choosing low-mileage discounts, you can potentially enjoy significant cost savings on your insurance coverage.

8. Being a Loyal Customer

8.1 Assessing Loyalty Discounts

Loyalty discounts are incentives offered by insurance companies to reward loyal customers who stay with the same provider for an extended period. These discounts can be in the form of reduced premiums, special policy features, or additional coverage options. Assess your current insurance policies and evaluate if you have been a long-term customer with a specific insurance provider. Inquire with your insurance company about any loyalty discounts available to you. By remaining loyal to your insurance provider, you may benefit from exclusive savings and enhanced coverage options.

8.2 Staying with the Same Insurance Company

Staying with the same insurance company for an extended period can lead to loyalty discounts and potentially lower insurance premiums. Insurance companies value customer retention and often offer incentives to policyholders who remain with them over time. By maintaining a positive relationship with your insurance provider and consistently renewing your policies, you can potentially enjoy reduced premiums, enhanced policy features, and other benefits that demonstrate the value of your loyalty. Review your policy annually, inquire about loyalty rewards, and consider the long-term advantages of remaining with your current insurance company.

8.3 Longevity with the Company

The longevity of your relationship with an insurance company can have a positive impact on your insurance premiums. Insurance providers often consider policyholders with long histories of consistent coverage to be lower risk and may offer discounts or reduced premiums as a result. When evaluating insurance options, consider the importance of longevity and the potential savings it can bring. By choosing an insurance company that values customer loyalty and staying with that company for an extended period, you can potentially enjoy lower insurance premiums that reflect your commitment and loyalty.

8.4 Evaluating Competing Offers

While loyalty to a single insurance company can lead to benefits, it is crucial to periodically evaluate competing offers to ensure you are receiving the best possible rates. Shop around and request quotes from multiple insurance providers to compare premiums, coverage options, and discounts. Assess the overall value offered by each insurer and consider potential savings associated with switching providers. However, remember to consider the benefits of loyalty discounts and the relationship you have built with your current insurance company. Balancing loyalty and competitive pricing can help you make an informed decision that maximizes your insurance-related savings.

8.5 Negotiating Renewal Rates

When it comes time to renew your insurance policy, take the opportunity to negotiate renewal rates with your insurance provider. Contact your insurance company and express your interest in potentially reducing your premiums. Explain any changes in your circumstances that may warrant a rate adjustment or inquire about any new discounts or offers that may be available. Insurance companies value customer satisfaction and may be open to renegotiating rates to retain your business. By engaging in open and respectful communication, you may be able to secure a reduced premium that reflects your loyalty and commitment to responsible driving.

9. Maintaining Continuous Coverage

9.1 Avoiding Policy Lapses

Maintaining continuous coverage is crucial to potentially reduce your insurance premiums. Allowing your insurance policy to lapse, even briefly, can result in higher premiums when you reinstate coverage. Insurance companies view policy lapses as a risk factor, as it suggests a potential increase in claims or a lack of responsible coverage. To ensure continuous coverage, always pay your insurance premiums on time and renew your policies before they expire. By avoiding policy lapses, you demonstrate to insurance providers that you are a responsible policyholder, potentially leading to more affordable insurance rates.

9.2 Importance of Continuous Coverage

Continuous coverage is vital for several reasons. Firstly, it ensures that you are protected against potential risks and liabilities associated with driving or owning a vehicle. Secondly, maintaining continuous coverage helps establish a favorable insurance history, which can lead to lower premiums. Insurance companies often consider your prior coverage and evaluate whether you have had any lapses when determining your rates. By consistently maintaining coverage, you demonstrate a responsible and reliable insurance history that may result in cost savings.

9.3 Impact on Premiums

Allowing your insurance coverage to lapse can have a direct impact on your premiums. When you reinstate coverage after a lapse, insurance companies often consider the gap in coverage as a risk factor. Policyholders who have had lapses may face higher premiums as insurance providers view them as potentially higher risk. To avoid the negative impact on your premiums, prioritize continuous coverage and ensure you promptly renew your policies to maintain a favorable insurance history. By doing so, you give yourself the opportunity for more affordable insurance premiums.

9.4 Shopping for Affordable Insurance Options

Shopping for affordable insurance options is essential to potentially reduce your premiums if you find that your current provider offers higher rates. Research different insurance companies and request quotes to compare premium amounts. Consider factors such as coverage limits, deductibles, and customer service when evaluating potential insurance providers. By actively exploring the market and considering various options, you can find an insurance policy that better aligns with your budget and potentially offers reduced premiums. Regularly shopping for insurance ensures that you are receiving competitive rates that reflect your unique circumstances.

9.5 Considering Non-Standard Insurance Providers

If you encounter challenges in obtaining affordable insurance coverage due to a poor driving history or previous claims, considering non-standard insurance providers may be beneficial. Non-standard insurance providers specialize in insuring high-risk drivers or individuals who have difficulty obtaining coverage from standard insurance companies. While premiums with non-standard insurance providers may initially be higher, they often offer the opportunity to gradually lower rates over time by maintaining continuous coverage and demonstrating responsible driving behavior. Evaluating non-standard insurance options allows you to explore potential savings and secure appropriate coverage despite previous challenges.

10. Aging and Driving Experience

10.1 The Effect of Age on Insurance Premiums

Age plays a significant role in insurance premiums. Younger and inexperienced drivers typically face higher insurance costs due to statistics indicating a higher likelihood of accidents and claims among this demographic. Conversely, as drivers age and gain more experience, insurance premiums tend to decrease. Insurance companies view mature drivers as lower risk, resulting in potential savings. As you age, it is important to periodically review your insurance coverage to ensure you are benefiting from reduced premiums that reflect your driving experience.

10.2 Discounts for Experienced and Mature Drivers

Experienced and mature drivers often qualify for specific discounts that can help lower their insurance premiums. Insurance companies recognize that individuals with proven driving records and a history of responsible behavior on the road present lower risk. As a result, they offer various discounts, such as safe driver discounts or mature driver discounts, to incentivize and reward experienced drivers. If you are an experienced driver, contact your insurance provider to inquire about discounts specific to your age group and driving experience. By taking advantage of these offerings, you can potentially reduce your insurance premiums and enjoy the cost savings associated with your experience.

10.3 Taking Advantage of Senior Discounts

As a senior driver, you may be eligible for additional discounts on your insurance premiums. Many insurance companies offer specialized programs and discounts for older drivers to acknowledge their reduced risk and experience. These discounts may take into account factors such as reduced driving mileage, senior-focused driving courses, and specific age-related considerations. Contact your insurance provider to inquire about any senior discounts or programs they offer. By taking advantage of these benefits, you can potentially lower your insurance premiums while still maintaining the appropriate coverage for your unique circumstances.

10.4 Adjusting Coverage Based on Changing Needs

As your driving needs change with age, it is important to adjust your insurance coverage accordingly. Evaluate factors such as your vehicle’s value, driving habits, and overall financial situation to determine the appropriate coverage limits and policy options. For example, if you have paid off your vehicle or significantly reduced its value, you may consider adjusting your coverage to save on premiums. Additionally, if you are driving less frequently due to retirement or lifestyle changes, explore potential reductions in your coverage to align with your new driving habits. Regularly reassessing your coverage needs ensures that you are not overpaying for unnecessary coverage while still maintaining appropriate protection.

10.5 Completing Driving Courses for Seniors

Completing driving courses specifically designed for seniors can have a positive impact on your insurance premiums. These courses often focus on safe driving techniques, traffic laws, and age-related considerations. Insurance companies recognize the value of ongoing education and the potential impact on reducing accidents and claims. Taking a senior driving course demonstrates your commitment to safe driving practices and can result in insurance discounts. Research the driving courses available in your area designed specifically for senior drivers and inquire about any insurance benefits associated with completing them. By investing in your driving skills, you can potentially enjoy reduced insurance premiums and enhanced safety on the road.

In conclusion, there are various strategies and factors to consider when aiming to reduce insurance premiums. Maintaining a safe driving record, installing safety features in your vehicle, choosing a higher deductible, maintaining a good credit score, bundling multiple policies, embracing life changes, driving less, being a loyal customer, maintaining continuous coverage, and considering age-related factors are all essential aspects that can potentially lower your insurance premiums. By implementing these strategies and evaluating your circumstances regularly, you can maximize your insurance-related savings while still maintaining appropriate coverage. Remember to consult with your insurance provider to discuss available options and identify the best approach for your specific situation.