Owning a home often comes with the responsibility of carrying home insurance. However, if you have a mortgage, you may be wondering if it’s possible to cancel your home insurance. While it’s natural to want to save money, it’s important to understand the implications and potential consequences of such a decision. In this article, we will explore the relationship between having a mortgage and home insurance, providing you with the information you need to make an informed decision about your coverage.

Understanding Home Insurance and Mortgages

What is home insurance?

Home insurance, also known as homeowner’s insurance, is a type of insurance coverage that protects your home and its contents from potential risks and damages. It provides financial security in case of damages caused by events like fire, theft, vandalism, or natural disasters. Home insurance typically covers the cost of repairing or rebuilding your home, as well as replacing your personal belongings.

What is a mortgage?

A mortgage is a loan that is used to finance the purchase of a home or property. When you borrow money from a mortgage lender to buy a house, the property itself serves as collateral for the loan. This means that if you fail to make the mortgage payments, the lender has the right to take possession of your home through a process known as foreclosure.

The connection between home insurance and mortgages

Home insurance and mortgages are closely connected due to the lender’s interest in protecting their investment. When you take out a mortgage to purchase a home, the lender wants to ensure that their investment is protected in case of any damages to the property. As a result, many lenders require borrowers to have home insurance as a condition of the mortgage agreement.

Mandatory Home Insurance with a Mortgage

Lender requirements for home insurance

Most mortgage lenders require borrowers to have a valid and active home insurance policy for the duration of the mortgage. This requirement is typically outlined in the mortgage agreement and is considered to be a condition of the loan. Lenders may also require borrowers to provide proof of insurance before closing on the mortgage.

Primary reasons for mandatory home insurance

Lenders require borrowers to have home insurance for several reasons. Firstly, it protects their financial interest in the property. If the home is damaged or destroyed, the insurance policy will cover the cost of repairs or rebuilding, ensuring that the lender’s investment is protected. Additionally, home insurance provides liability coverage in case someone is injured on the property and decides to sue.

Coverage limits and mortgage terms

When it comes to home insurance, there are coverage limits that determine the maximum amount the insurance company will pay out in the event of a claim. These coverage limits are often tied to the mortgage terms. Lenders require borrowers to have insurance coverage that is equal to or greater than the value of the home to ensure that it can be properly repaired or rebuilt if necessary.

Insurance options offered by lenders

Some mortgage lenders offer insurance options to borrowers as part of their mortgage package. These lender-offered insurance options are designed to provide convenience for borrowers by bundling the cost of insurance with their monthly mortgage payments. However, it’s important to carefully review the terms and conditions of these insurance options to ensure that they meet your coverage needs and are competitively priced.

Consequences of Cancelling Home Insurance with a Mortgage

Risk of being in violation of the mortgage agreement

If you cancel your home insurance without prior approval from your lender, you could be in violation of the mortgage agreement. This violation could have serious consequences, including potential legal action by the lender. It is crucial to review your mortgage agreement before making any decisions regarding your insurance coverage.

Possible penalties and fees

Canceling home insurance without following the proper procedures outlined by your lender can result in penalties and fees. These penalties may include additional charges or an increase in your mortgage interest rate. It’s essential to understand the potential financial implications before making any decisions about canceling your home insurance.

Impact on credit score

Canceling your home insurance without appropriate approval and maintaining continuous coverage can negatively impact your credit score. This can make it more difficult for you to obtain credit in the future and may affect your ability to secure favorable interest rates on other loans or mortgages.

Loss of financial protection

By canceling your home insurance, you are exposing yourself to financial risks and potential losses. Without insurance coverage, you would be responsible for repairing or rebuilding your home and replacing your belongings in the event of damage or loss. This can be a significant financial burden and can jeopardize your financial security.

Cancelling Home Insurance and Mortgage Requirements

Reviewing your mortgage agreement

Before canceling your home insurance, carefully review your mortgage agreement to understand the terms and conditions regarding insurance requirements. Pay close attention to any clauses or provisions related to insurance coverage and communicate with your lender if you have any questions or concerns.

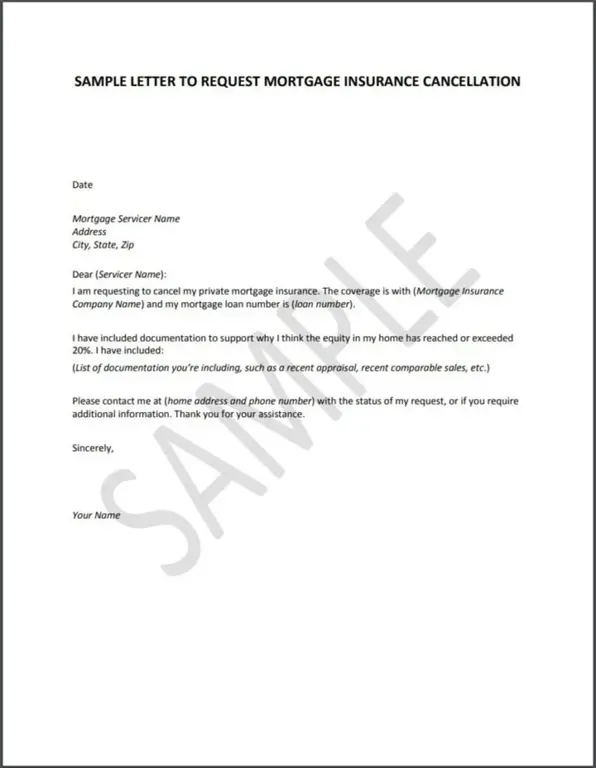

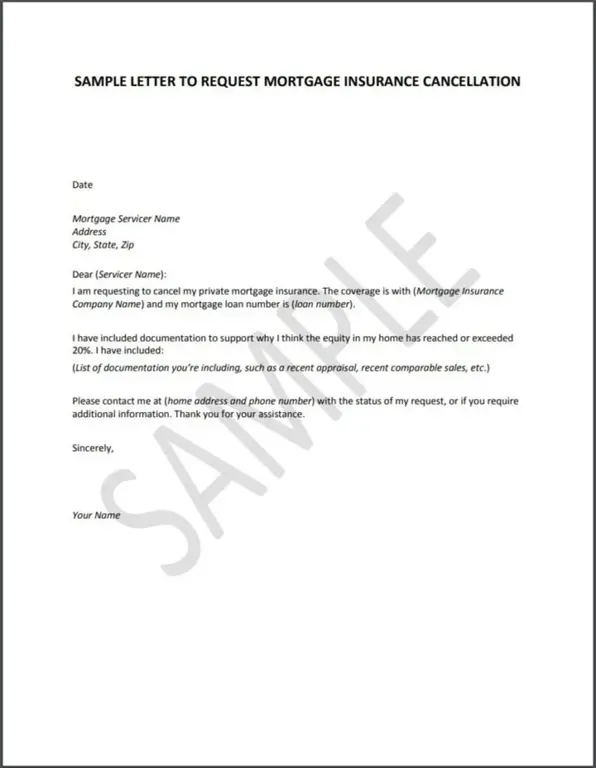

Seeking approval from the lender

If you find yourself in a situation where you need to cancel your home insurance, it is essential to seek approval from your lender first. Contact your lender and explain your circumstances, providing them with any necessary documentation or reasons for canceling the insurance. It’s crucial to obtain written approval from the lender to ensure compliance with the mortgage agreement.

Providing proof of alternate coverage

If you wish to cancel your current home insurance policy, you will need to provide proof of alternate coverage to your lender. This could be in the form of a new home insurance policy or an alternative insurance solution that meets the lender’s requirements. Make sure to inform your lender promptly and provide them with the necessary documentation to avoid any potential issues.

Understanding the lender’s criteria for cancellation

Each lender may have specific criteria and guidelines for canceling home insurance. Some lenders may require the replacement coverage to meet certain criteria or be provided by an insurer on an approved list. Ensure that you understand your lender’s requirements and follow their instructions to ensure a smooth insurance transition.

Options for Maintaining Insurance Coverage

Finding a new homeowner’s insurance policy

If you wish to cancel your current home insurance policy, you can explore options to find a new homeowner’s insurance policy that suits your needs. Contact insurance providers and obtain quotes for coverage that meets or exceeds your lender’s requirements. Compare coverage options, policy terms, and prices to make an informed decision.

Considerations when switching insurance providers

When switching insurance providers, it’s crucial to consider factors beyond just the price of the policy. Take into account the insurer’s reputation, customer reviews, and the quality of their claims service. Additionally, ensure that the new policy’s coverage limits align with your lender’s requirements and that you understand all policy exclusions and limitations.

Maintaining a sufficient level of coverage

When obtaining a new home insurance policy, it is vital to maintain a sufficient level of coverage to protect your home and belongings adequately. It’s a good idea to reassess your coverage needs periodically and make adjustments as necessary. Keep in mind that changes to your home, such as renovations or additions, may require an update to your insurance policy.

Notifying the lender about the new insurance policy

Once you have secured a new home insurance policy, it is essential to inform your lender about the change. Provide them with the necessary documentation, such as the new policy details and the insurer’s contact information. This ensures that your lender has the required information on file and avoids any confusion or potential issues regarding your insurance coverage.

Effects on Mortgage Payments and Escrow Accounts

Escrow accounts and home insurance premiums

Many homeowners with mortgages have an escrow account set up by their lender to cover various expenses, including property taxes and home insurance premiums. The lender collects a portion of these costs with each monthly mortgage payment and holds the funds in the escrow account. The funds in the escrow account are then used to pay for the insurance premium.

Potential changes in mortgage payment

If you cancel your home insurance or switch to a different policy, it can potentially lead to changes in your mortgage payment. The lender will recalculate the escrow portion of your monthly payment based on the new insurance premium amount. This can result in a higher or lower mortgage payment depending on the new policy’s cost.

Adjusting escrow account arrangements

When you make changes to your home insurance policy, such as canceling or switching providers, it’s crucial to inform your lender promptly. They will need to adjust the escrow account arrangements accordingly to ensure that the correct amount is being collected for insurance premiums. Failure to notify the lender may result in payment discrepancies and potential issues with your mortgage account.

Ensuring continuous coverage to avoid payment conflicts

To avoid payment conflicts or disruptions to your mortgage account, it’s important to maintain continuous coverage with your home insurance. Make sure to renew your policy on time and promptly notify your lender of any changes or updates to your insurance coverage. This will help ensure that the escrow account arrangements are accurately maintained, and your mortgage payments remain consistent.

Legal and Financial Risks of No Home Insurance

Liability risks for potential damages or accidents

Without home insurance, you are exposing yourself to significant liability risks. If someone is injured on your property and you don’t have insurance coverage, you may be personally responsible for medical expenses and any legal claims or lawsuits that result from the incident. Home insurance provides liability coverage that protects you from these potential financial burdens.

Loss of protection against natural disasters

Natural disasters can cause extensive damage to your home, and without insurance coverage, the financial burden falls solely on you. Whether it’s a severe storm, a flood, or an earthquake, the costs of repairing or rebuilding your home can be overwhelming. Home insurance provides protection against natural disasters, ensuring that you have the financial support to recover from such events.

Legal obligations tied to home insurance

In some areas, there may be legal obligations to have home insurance. Certain states or local jurisdictions may require homeowners to maintain specific types of insurance coverage, such as flood insurance in flood-prone areas. Failing to comply with these legal requirements can result in penalties or even legal consequences.

Financial consequences of uninsured losses

The financial consequences of uninsured losses can be devastating. If your home is damaged or destroyed and you don’t have insurance coverage, you will be solely responsible for the costs of repairs or rebuilding. This can lead to significant financial strain, potentially forcing you to take out loans or deplete your savings. Home insurance provides a crucial safety net that protects your finances and helps you recover after a loss.

Exploring Alternatives to Traditional Home Insurance

Self-insurance options

Self-insurance is an alternative to traditional home insurance where homeowners assume the financial risks themselves without purchasing an insurance policy. This involves setting aside funds to cover potential losses or damages. While self-insurance can be a valid option for some financially secure homeowners, it’s important to carefully consider the potential risks and ensure that you have sufficient funds to cover any unforeseen events.

Federally backed mortgage programs

Some federally backed mortgage programs, such as those offered by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), have their own insurance requirements. These programs often require borrowers to obtain mortgage insurance instead of traditional home insurance. It’s crucial to understand the specific insurance requirements of these programs if you are considering them for your mortgage.

Mortgage insurance as an alternative

Mortgage insurance is a type of insurance that protects the lender in case the borrower defaults on the mortgage payments. It does not provide coverage for the physical structure of the home or the borrower’s personal belongings. While it is a viable alternative to traditional home insurance, it’s important to note that mortgage insurance does not provide the same level of comprehensive coverage.

Industry-specific insurance solutions

Depending on the nature of your home and property, there may be industry-specific insurance solutions available. For example, if you own a condo, there may be a specific type of insurance designed for condominium owners. Similarly, if you have a historic home, there may be insurance options tailored to protect the unique features and architectural elements of historic properties. Explore these industry-specific insurance solutions to find coverage that suits your specific needs.

Consulting with Insurance and Mortgage Professionals

Seeking advice from insurance brokers

If you have questions or concerns about your home insurance coverage, it can be beneficial to consult with an insurance broker. Insurance brokers are professionals who specialize in finding the right insurance products for their clients. They can help you navigate the complexities of home insurance and provide guidance on finding the coverage that best suits your needs.

Consulting with mortgage lenders

Your mortgage lender is a valuable resource when it comes to understanding your insurance requirements. If you have any doubts or questions about your home insurance policy, reach out to your lender for clarification. They can provide insights into their specific requirements and help you make informed decisions regarding your insurance coverage.

Utilizing the expertise of real estate attorneys

In complex situations or if legal issues arise, it can be helpful to consult with a real estate attorney. Real estate attorneys specialize in property-related legal matters and can provide guidance on insurance requirements, mortgage agreements, and potential legal risks. They can help you navigate any legal challenges and ensure that you are fulfilling your obligations and protecting your interests.

Considering factors specific to your situation

Every homeowner’s situation is unique, and it’s important to consider the factors that are specific to your circumstances. This may include the location of your home, the value of your property, the contents of your home, and your budget. Take into account these factors when making decisions about your home insurance and mortgage requirements to ensure that you have the appropriate level of coverage.

Conclusion

Maintaining home insurance with a mortgage is not only a requirement for most lenders but also a crucial aspect of protecting your investment and financial well-being. Canceling or failing to obtain adequate coverage can lead to significant legal, financial, and personal risks. By understanding the consequences of cancellation and exploring alternatives when necessary, you can make informed decisions that ensure your home and finances are adequately protected. Consult with insurance professionals, mortgage lenders, and real estate attorneys to navigate the complexities and find the best insurance solution for your specific needs.