In the complex world of healthcare, one question often arises – can providers negotiate prices with insurance companies? As a healthcare provider, understanding the dynamics of pricing and insurance can be crucial for your practice’s success. This article explores the possibilities and challenges of negotiating prices with insurance companies, shedding light on the potential benefits and considerations that come with such negotiations. So, if you’re eager to learn more about how providers can navigate these negotiations, read on!

Understanding Provider-Insurance Company Dynamics

As a healthcare provider, it is important to understand the dynamics between insurance companies and providers. These two parties play crucial roles in the delivery and financing of healthcare. By comprehending these roles, you can navigate the negotiation process more effectively and achieve favorable outcomes.

The role of insurance companies

Insurance companies act as intermediaries between patients and healthcare providers. They play a pivotal role in managing financial risks associated with healthcare expenses. Insurance companies create and sell insurance plans, also known as policies, to individuals and organizations. These policies provide coverage for specific healthcare services and procedures.

Additionally, insurance companies negotiate contracts with healthcare providers, determining the reimbursement rates for the services rendered to policyholders. Insurance companies utilize their extensive knowledge and experience in the healthcare industry to negotiate fair and reasonable rates that align with their financial goals.

The role of healthcare providers

Healthcare providers, on the other hand, are organizations or individuals that deliver medical, surgical, or other health-related services to patients. Healthcare providers include hospitals, clinics, physicians, surgeons, and other specialized healthcare professionals.

Providers strive to deliver high-quality care while managing their financial viability. They rely on reimbursement from insurance companies to cover their operational costs, such as staff salaries, medical supplies, and facility maintenance. Negotiating prices with insurance companies becomes crucial for providers to ensure fair and adequate compensation for the care they deliver.

The need for negotiation

Negotiation between providers and insurance companies is essential to establish mutually agreeable terms for reimbursement rates and other contract terms. Both parties have different priorities and concerns, which must be addressed through negotiation. Providers aim for fair reimbursement to sustain their operations, while insurance companies aim to control costs and maintain profitability.

Without effective negotiation, providers may face financial challenges, reducing their ability to provide quality care. Likewise, insurance companies may struggle to offer affordable insurance premiums if reimbursement rates are not carefully negotiated. Negotiation enables both parties to find common ground and establish a working relationship that benefits patients, providers, and insurance companies.

Factors Influencing Price Negotiations

When engaging in price negotiations, providers and insurance companies consider various factors that influence the outcome. Understanding these factors can help providers strategize and advocate for fair reimbursement rates.

Market forces

Market forces, such as supply and demand, significantly impact price negotiations. In regions with limited provider options, insurance companies may have less negotiating power, resulting in higher reimbursement rates. Conversely, in areas with a surplus of providers, insurance companies may have more leverage to negotiate lower rates. Providers need to consider the market dynamics of their region when preparing for negotiations.

Provider network size

The size and strength of a provider’s network can influence negotiations. Insurance companies prefer to work with providers who have a broader network, as it allows them to offer their policyholders a wide range of options for healthcare services. Providers with a larger network may have an advantage during negotiations, as insurance companies may be willing to offer higher reimbursement rates to ensure their inclusion in the provider network.

Quality of services

The quality of care provided by healthcare providers is an essential factor in negotiations. Insurance companies often consider national quality benchmarks and performance metrics to assess the value and efficiency of a provider’s services. Providers who consistently demonstrate high-quality outcomes and patient satisfaction may have more leverage during negotiations. Investing in quality improvement programs and tracking performance measures can strengthen a provider’s negotiation position.

Patient volume

The patient volume that a provider attracts plays a significant role in negotiations. Insurance companies strive to maintain a balanced provider network, ensuring that their policyholders have access to a sufficient number of providers. Providers who can demonstrate a robust patient volume are more likely to negotiate favorable reimbursement rates, as insurance companies value their ability to meet patient demand.

Insurance company policies

Insurance companies often have specific policies and guidelines that influence negotiations. These policies can dictate reimbursement methodologies, limit the inclusion of certain services, or define the processes for appealing claim denials. Providers must familiarize themselves with the policies of the insurance companies they engage with, as it will affect the negotiation strategies and eventual outcomes.

Negotiation Strategies for Providers

To navigate price negotiations successfully, providers must employ effective strategies. These strategies take into account the insurance company’s perspective and leverage various factors to secure favorable terms.

Understanding the insurance company’s perspective

Providers should invest time and effort in understanding the insurance company’s goals, constraints, and market position. By familiarizing themselves with the insurance industry, providers can better anticipate the insurer’s priorities and tailor their negotiation approach accordingly. This understanding allows providers to develop persuasive arguments that address the insurer’s concerns while advocating for fair reimbursement rates.

Preparing a negotiation plan

Before entering into negotiations, providers should develop a comprehensive negotiation plan. This plan should outline the provider’s goals, desired contract terms, and potential alternative options. Providers should research the insurance company’s policies, reimbursement rates for similar services in the market, and the negotiation history of peers. Additionally, developing a strong understanding of the provider’s own financials and costs helps in setting realistic negotiation targets.

Leveraging market competition

Providers can leverage market competition to their advantage during negotiations. By highlighting their unique services, quality outcomes, and patient satisfaction, providers can demonstrate their value proposition to insurance companies. Especially in markets where providers have distinct and sought-after specialties or expertise, insurance companies may be more willing to negotiate higher rates to secure the provider’s services.

Emphasizing value-based care

With the growing focus on value-based care, providers can align their negotiation strategies with this shift in healthcare delivery. By emphasizing outcomes, patient experience, and cost-effectiveness, providers can position themselves as partners in improving healthcare quality while reducing overall costs. Insurance companies increasingly value providers who can demonstrate a commitment to value-based care and may be more inclined to negotiate favorable reimbursement rates.

Building strong relationships with insurance representatives

Relationship-building is fundamental to successful negotiations. By establishing open lines of communication and fostering positive relationships with insurance company representatives, providers can create a conducive negotiation environment. Taking the time to understand the priorities and challenges faced by insurance representatives allows for more collaborative negotiations, potentially resulting in more favorable contract terms.

The Role of Contracting in Price Negotiations

Contracts between providers and insurance companies play a pivotal role in price negotiations. The terms and conditions outlined in these contracts have enduring implications for reimbursement rates and other facets of the provider-insurer relationship.

Importance of provider contracts

Provider contracts are legally binding agreements that outline the terms and conditions for reimbursement and service provision. These contracts serve as the foundation for the negotiation process and establish expectations for both parties. A well-drafted provider contract can protect a provider’s financial interests and help secure fair reimbursement rates.

Contract terms affecting negotiations

Various contract terms significantly impact price negotiations and the overall relationship between providers and insurance companies. Key terms include reimbursement rates, inclusion of quality metrics, length and renewal terms of contracts, and the processes for dispute resolution. Providers must carefully review and negotiate these terms to ensure their interests are protected and their financial viability is maintained.

Reimbursement rates

Arguably the most critical aspect of a provider contract is the reimbursement rate. This rate determines the amount of money the insurance company will pay the provider for each service rendered. Providers must advocate for fair and reasonable reimbursement rates that cover their costs while allowing for a margin of profitability. Negotiating higher reimbursement rates is critical for providers to sustain their operations and deliver quality care.

Inclusion of quality metrics

Advancements in healthcare quality measurement have led insurance companies to include quality metrics in their contracts with providers. These metrics assess the performance and outcomes of healthcare providers, enabling insurance companies to differentiate between high-performing and lower-performing providers. Providers who excel in quality metrics may have more negotiating power, as insurance companies value their contributions to patient care.

Length and renewal terms of contracts

The length and renewal terms of provider contracts influence negotiations. Longer-term contracts provide stability and predictability for providers, allowing them to plan their financials and investments with more confidence. Providers should aim for contract lengths that align with their strategic objectives while ensuring fair renegotiation opportunities at the end of each term.

Common Challenges Faced by Providers

Negotiations with insurance companies can present numerous challenges for providers, impacting their financial viability and ability to deliver quality care. Providers must navigate these challenges to achieve fair reimbursement rates and maintain sustainability.

Market dominance of insurance companies

In certain regions, insurance companies may dominate the market, resulting in less competition and limited options for providers. When insurance companies hold significant market power, they may have more control over negotiations, potentially leading to lower reimbursement rates. Providers in these scenarios often face the challenge of balancing financial viability with the need to meet patient demand.

Negotiating with multiple payers

Providers who work with multiple insurance companies face the complexity of negotiating with each payer separately. Each insurance company may have different policies, reimbursement rates, and contract terms, requiring providers to invest additional time and resources in negotiating individual agreements. Managing these negotiations efficiently while advocating for fair reimbursement rates can be a significant challenge, particularly for smaller providers or those with limited negotiation experience.

Balancing affordability and fair reimbursement

Striking a balance between affordability for patients and fair reimbursement for providers is a challenge often faced during negotiations. Insurance companies aim to provide affordable premiums for their policyholders, and high reimbursement rates can contribute to increased premiums. Providers, on the other hand, depend on fair reimbursement to cover their costs and sustain their operations. Negotiating at this intersection of affordability and fair reimbursement requires creative solutions and compromise from both parties.

Limited leverage for sole providers

Providers who operate as sole practitioners or in small practices may face limited negotiation leverage. Insurance companies often have more negotiating power when faced with individual providers who lack the resources and network strength of larger healthcare organizations. Small providers must develop strategies to maximize their negotiating power and advocate for fair reimbursement rates, leveraging factors such as quality outcomes and patient demand.

Understanding payment methodologies

Insurance companies utilize various payment methodologies, such as fee-for-service, capitation, and bundled payments. Each methodology has its own intricacies, affecting reimbursement rates and revenue streams for providers. Understanding the payment methodologies employed by insurance companies is crucial for providers to accurately assess their financial viability and develop negotiation strategies that align with their preferred payment structure.

Regulatory Considerations in Negotiations

Negotiations between providers and insurance companies also operate within the framework of regulatory guidelines and requirements. Providers must be aware of the legal landscape to ensure compliance and protect their interests during negotiations.

Anti-trust and competition laws

Antitrust and competition laws play a significant role in negotiations, as they aim to prevent anti-competitive behavior and ensure fairness in the market. Providers must be cautious to adhere to these laws and avoid engaging in activities that may be deemed anti-competitive, such as collusion or price fixing. Violation of antitrust regulations can lead to severe legal consequences and damage the reputation of the provider.

State insurance regulations

State insurance regulations govern the insurance industry and protect the rights of policyholders. These regulations vary by state, and providers need to familiarize themselves with the specific regulations in their operating jurisdiction. Understanding state insurance regulations can help providers navigate negotiations, as it provides insights into the parameters within which insurance companies can operate.

Fair contracting practices

Many states have enacted fair contracting laws to ensure transparency, fairness, and clarity in provider-insurer negotiations. These laws typically address issues such as prompt payment, dispute resolution, and fair negotiation principles. Providers should familiarize themselves with fair contracting laws applicable to their practice and leverage these regulations to protect their financial interests during negotiations.

Negotiating within network adequacy requirements

Network adequacy refers to the sufficiency and accessibility of healthcare providers in an insurance company’s network. Many states have established network adequacy requirements to ensure that policyholders have access to an adequate number of providers. Providers need to understand these requirements and advocate for their inclusion in insurer networks, especially if their absence may negatively impact patient access to care.

Impact of healthcare reform on negotiations

The ever-evolving landscape of healthcare reform also has implications for negotiations between providers and insurance companies. Changes in regulation, government policies, and reimbursement models can significantly impact the negotiation process. Providers should stay informed about healthcare reform initiatives and be proactive in adapting their negotiation strategies to align with evolving healthcare dynamics.

Negotiation Outcomes and Impacts

The outcomes of provider-insurance company negotiations have far-reaching implications for all stakeholders involved in healthcare delivery and financing. Understanding these outcomes and their impacts helps providers navigate negotiations effectively and advocate for desired results.

Achieving favorable reimbursement rates

One of the primary goals for providers in negotiations is to secure favorable reimbursement rates. Higher reimbursement rates allow providers to cover their costs and invest in enhancing patient care. Negotiating favorable reimbursement rates positively impacts a provider’s financial viability and sustainability, contributing to the overall quality of care delivered.

Increasing patient affordability

Negotiations also influence patient affordability and out-of-pocket expenses. When providers successfully negotiate reasonable reimbursement rates, insurance companies can manage their costs better, potentially leading to lower insurance premiums for policyholders. This reduction in premiums can enhance patient affordability, ensuring that healthcare remains accessible to a broader population.

Implications for out-of-network services

Negotiation outcomes impact the provision of out-of-network services. Providers who fail to secure favorable agreements with insurance companies may face challenges when delivering services to patients who are covered by different insurance plans. Negotiations should aim to ensure that patients have access to out-of-network services when needed, and providers should advocate for fair reimbursement for these services.

Provider network participation

Negotiation outcomes determine whether a provider is included in an insurance company’s network. Being part of an insurance company’s network is crucial for attracting patients covered by that insurance plan. Negotiating favorable contract terms and reimbursement rates increases the likelihood of participation in a broader provider network, expanding a provider’s patient base.

Effects on patient choice and access to care

Negotiation outcomes impact patient choice and access to care. If negotiations fail to secure adequate reimbursement rates, providers may be forced to limit the number of insurance plans they accept or even terminate contracts, reducing patient options for care. Conversely, successful negotiations increase the likelihood that providers will accept a wider range of insurance plans, ensuring patient access to a diverse provider network.

Future Trends in Provider-Insurance Company Negotiations

Provider-insurance company negotiations will continue to evolve alongside healthcare reforms, advances in technology, and changes in reimbursement models. Providers must stay aware of emerging trends to adapt their negotiation strategies and maximize favorable outcomes.

Shift towards value-based reimbursement

The healthcare industry is increasingly moving towards value-based reimbursement models that reward providers for delivering high-quality, cost-effective care. Provider-insurance company negotiations will likely evolve to incorporate performance metrics and incentives that align with value-based care. Providers who position themselves as partners in achieving value-based goals will have a competitive advantage during negotiations.

Technology’s influence on negotiations

Advancements in technology, such as electronic health records and data analytics, are reshaping the negotiation landscape. Providers can leverage technology to gather and present data that demonstrates their value proposition, quality outcomes, and cost-efficiency. Technology-enabled negotiations can facilitate more transparent and data-driven discussions, fostering partnerships between providers and insurance companies.

Emerging models of provider contracting

New models of provider contracting, such as accountable care organizations (ACOs) and bundled payments, are gaining prominence. These models incentivize providers to coordinate care, assume financial accountability, and focus on improving patient outcomes. Negotiations within these models require providers to align their strategies with the overarching goals of the contracting arrangement and advocate for fair reimbursement structures that support collaboration and quality improvement.

Inclusion of telehealth services

Telehealth services have witnessed rapid growth, particularly in response to the COVID-19 pandemic. Negotiations between providers and insurance companies are now exploring the inclusion of telehealth services in provider contracts. Providers advocating for fair reimbursement rates for virtual care can ensure the sustainability and continued growth of telehealth services, expanding access to care for patients.

Potential impact of public option plans

Public option plans, aimed at increasing access to affordable healthcare, may influence negotiations between providers and insurance companies. These plans seek to offer government-run insurance options alongside private insurance, introducing new dynamics to negotiation processes. Providers must monitor and adapt to the changing landscape to effectively negotiate reimbursement rates and contract terms with public option plans.

Strategies for Providers Without Negotiating Power

Providers who lack significant negotiating power can still employ strategies to advocate for their financial interests and negotiate favorable terms with stronger insurance companies.

Joining provider networks

Joining established provider networks can provide smaller providers with more negotiation power. Insurance companies often rely on provider networks to offer comprehensive coverage to their policyholders. By aligning with provider networks, smaller providers gain access to a larger patient base and a united front during negotiations.

Exploring alternative payment models

Providers can explore alternative payment models, such as direct primary care or concierge medicine, as a strategy to negotiate with insurance companies. These models involve a direct financial relationship between the provider and the patient, reducing reliance on insurance reimbursement. By diversifying their revenue streams, providers can gain more control over negotiations with insurance companies.

Engaging in collaborative negotiations

Collaborating with other providers, hospitals, or healthcare organizations can strengthen negotiating power. By forming alliances, providers can pool resources, share negotiation strategies, and leverage a collective voice during negotiations. Collaborative negotiations can level the playing field for smaller providers by demonstrating greater market presence and negotiating influence.

Considerations for smaller providers

Providers with limited negotiating power should consider other factors that could influence negotiations. Emphasizing quality outcomes, patient satisfaction, and unique services can differentiate smaller providers from larger competitors. Highlighting the value that smaller providers bring to the insurance network can result in more favorable reimbursement rates and inclusion in insurance plans.

Advocating for policy changes

Providers can actively engage in advocacy efforts to influence policy changes that may impact negotiations. By collaborating with professional associations and participating in relevant legislative initiatives, providers can shape the regulatory environment in ways that benefit their negotiations. Policymakers often rely on the expertise and experiences of providers when formulating healthcare policies.

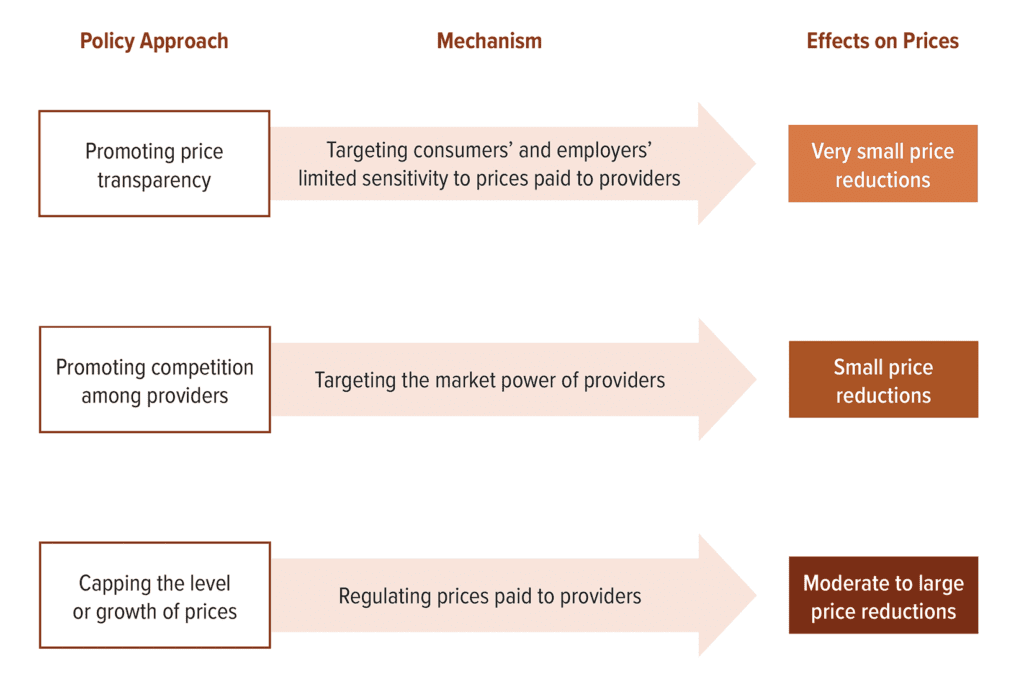

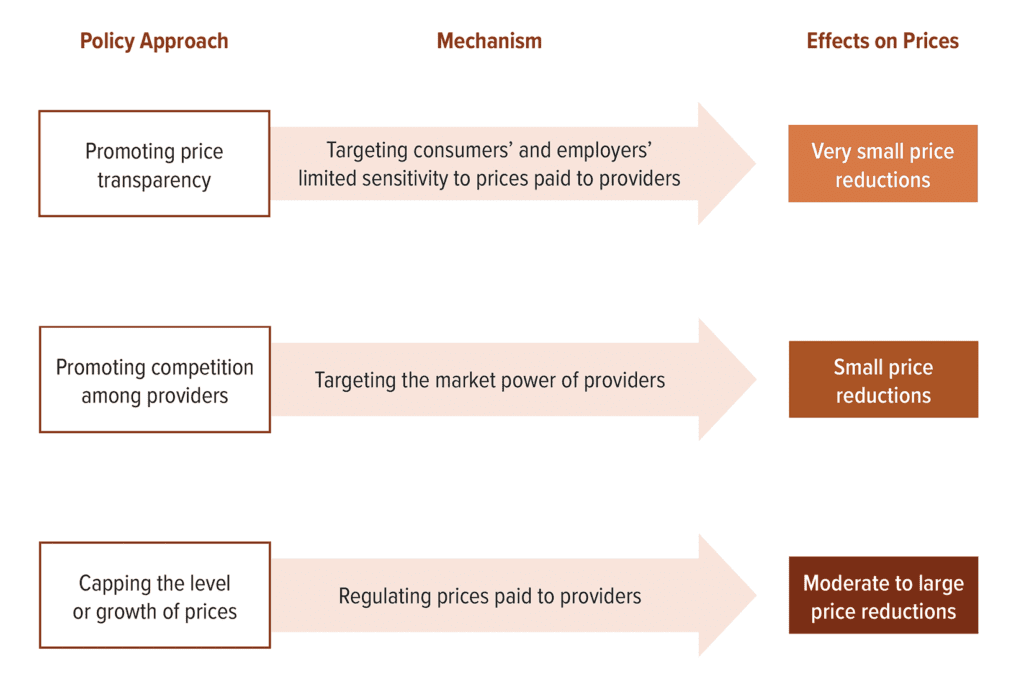

Implications for Healthcare Costs

The outcomes of provider-insurance company negotiations have significant implications for healthcare costs. Balancing cost containment and quality care is a complex challenge that requires collaborative efforts from all stakeholders involved in healthcare delivery and financing.

Impact on insurance premiums

Negotiation outcomes influence the cost of insurance premiums for individuals and organizations. Higher reimbursement rates agreed upon during negotiations can increase insurance costs for policyholders. Conversely, successful negotiations that lead to fair reimbursement rates can promote cost containment and contribute to more affordable insurance premiums.

Effects on patient out-of-pocket expenses

Negotiating fair reimbursement rates can impact patient out-of-pocket expenses. When providers secure reasonable rates, insurance companies can manage their costs, potentially reducing the financial burden on patients. Lower out-of-pocket expenses ensure that patients can access necessary care without undue financial hardship.

Balancing cost containment and quality care

Negotiations between providers and insurance companies must strike a balance between cost containment and the delivery of quality care. While insurance companies aim to control costs and maintain profitability, providers must advocate for fair reimbursement rates that cover the costs of delivering quality care. Successful negotiations take into account the financial viability of providers while ensuring insurers can offer affordable premiums to policyholders.

Influence on healthcare affordability

Negotiation outcomes significantly influence the affordability of healthcare services. Higher reimbursement rates can impact the overall cost of care, making it more expensive for patients. Conversely, successful negotiations that promote fair reimbursement rates contribute to healthcare affordability, ensuring that individuals and families can access necessary care without facing excessive financial hardship.

Addressing concerns of rising healthcare costs

Negotiations play a crucial role in addressing concerns related to rising healthcare costs. By advocating for fair reimbursement rates and cost containment measures, providers can contribute to the overall efforts to control healthcare costs. Negotiation outcomes that result in sustainable reimbursement rates directly impact the affordability and accessibility of healthcare services.

In conclusion, negotiating prices with insurance companies is an essential aspect of the healthcare ecosystem. Providers must understand the dynamics between insurance companies and providers, as well as the factors influencing price negotiations. Employing effective negotiation strategies, understanding the role of contracts, navigating common challenges, and considering regulatory considerations are critical for providers seeking fair and sustainable reimbursement rates. The outcomes of provider-insurance company negotiations have far-reaching impacts on healthcare costs, patient affordability, and access to care. By staying informed about emerging trends, providers can proactively adapt their negotiation strategies and contribute to the ongoing efforts to balance cost containment and quality care in the healthcare industry.