Have you ever wondered if mortgage insurance ever decreases? Well, this article will explore whether mortgage insurance ever goes down and what factors may influence this change. Whether you’re a first-time homebuyer or a homeowner looking to refinance, understanding the ins and outs of mortgage insurance can help you make informed decisions about your financial future. So, read on to discover whether there’s a chance for your mortgage insurance to decrease and how it may impact your home loan.

Factors Affecting Mortgage Insurance

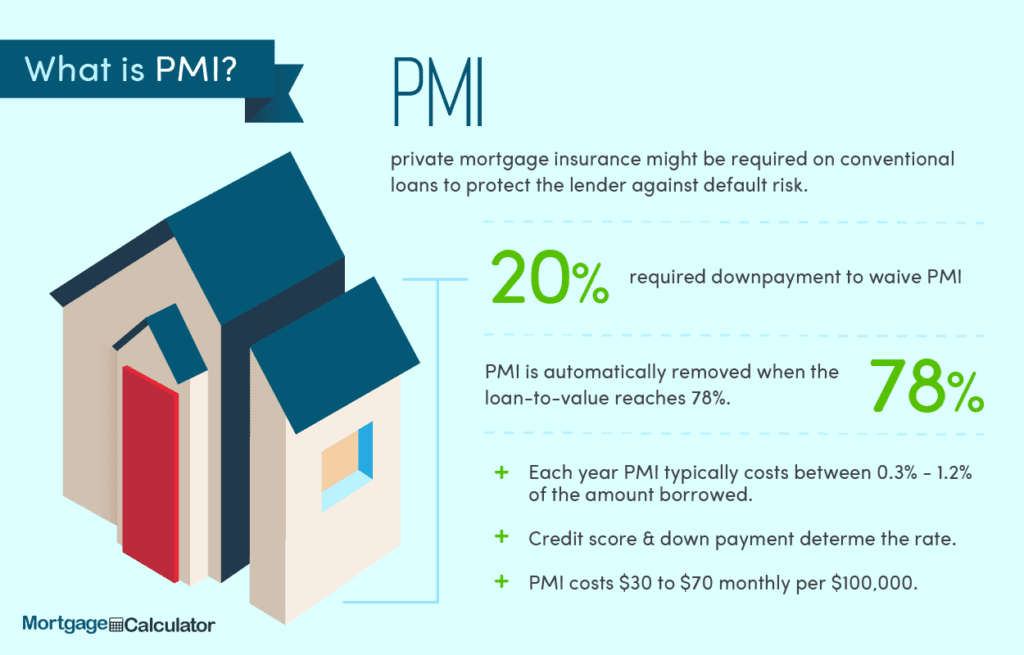

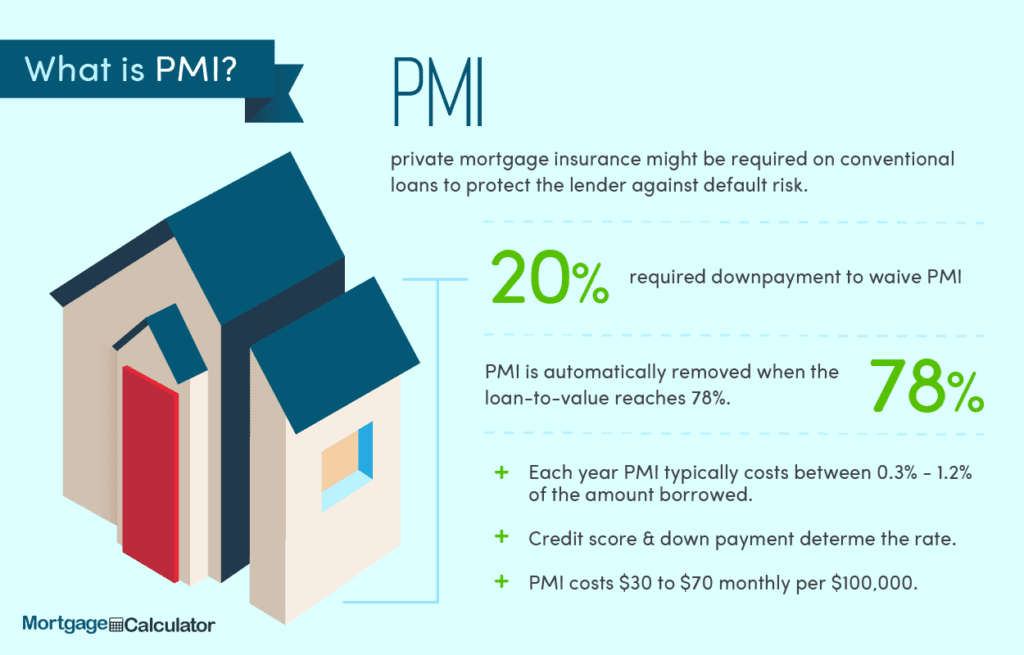

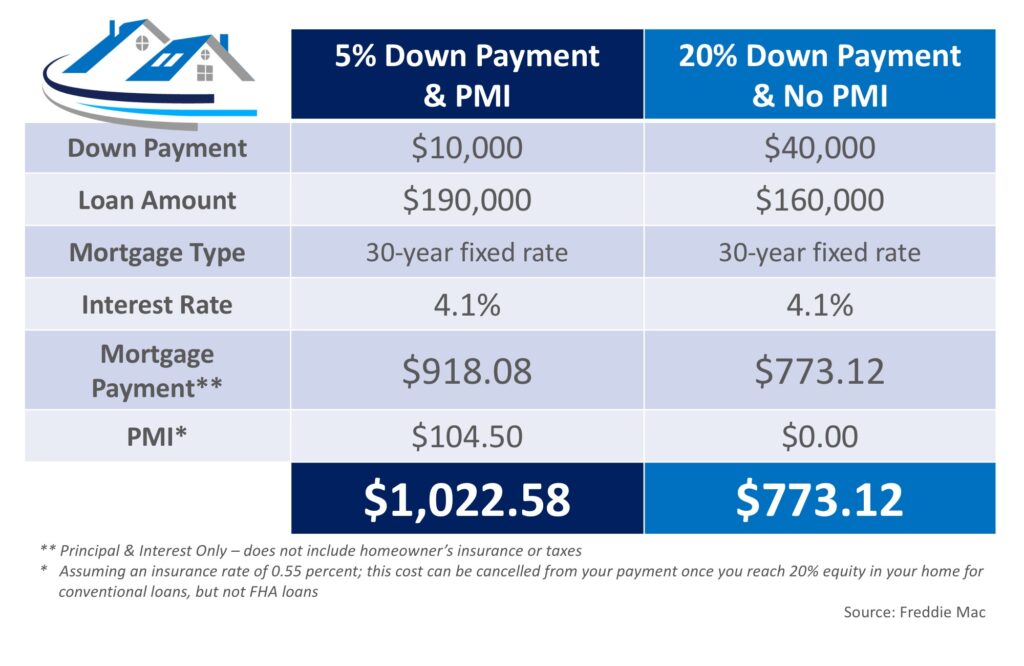

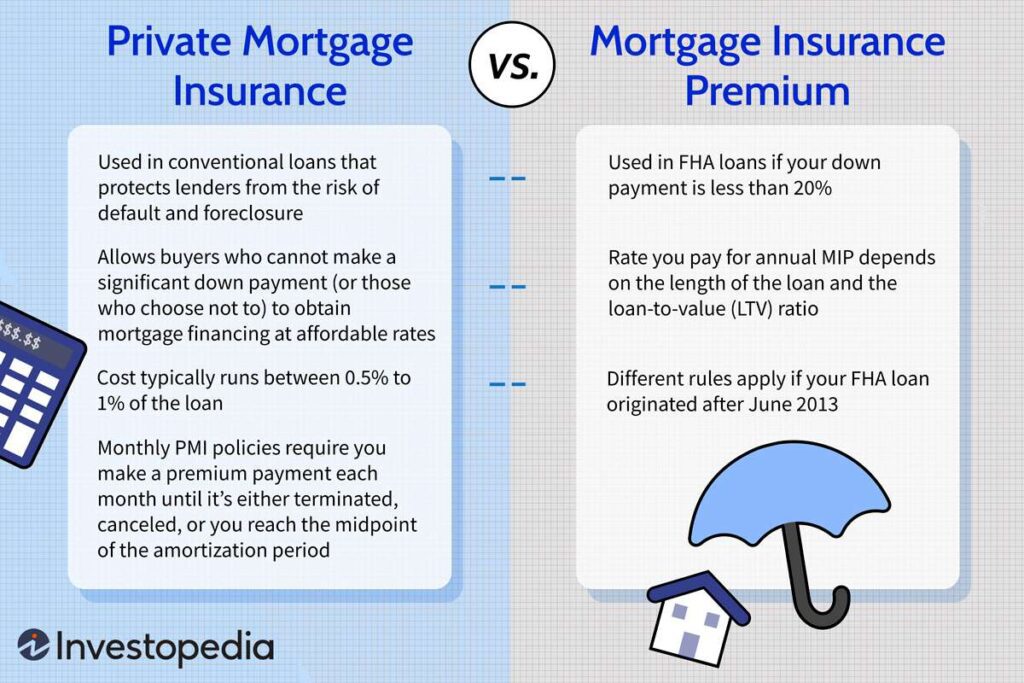

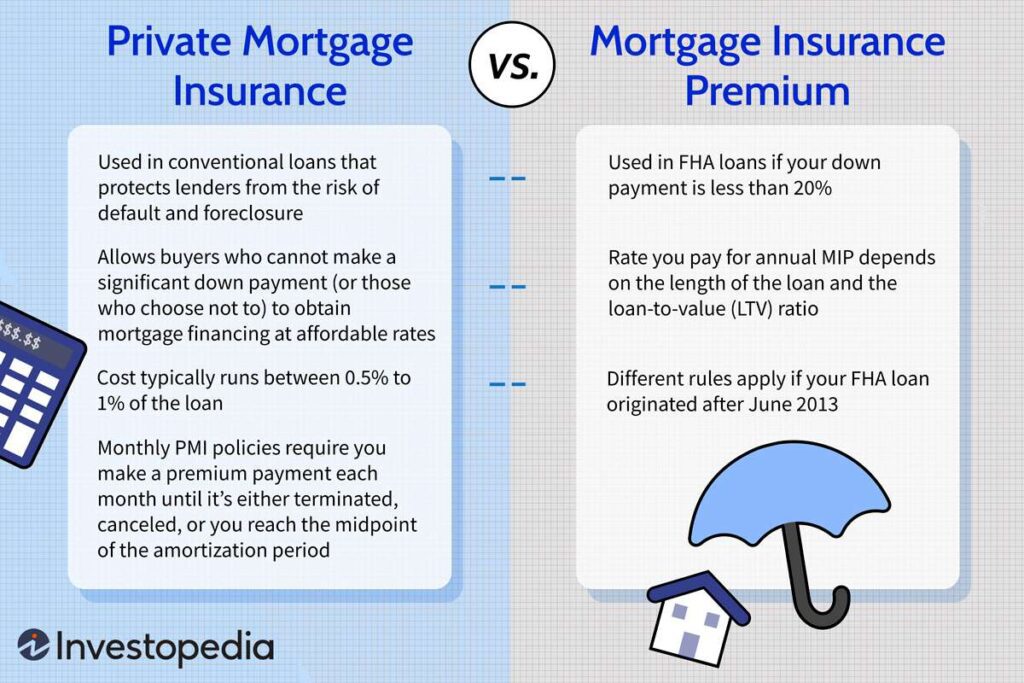

If you’re a homeowner with a mortgage, you may be familiar with the concept of mortgage insurance (MI). This insurance is typically required when you make a down payment of less than 20% on your home. While it’s important to have MI to protect the lender in case you default on your loan, you may wonder if there are any factors that can affect your mortgage insurance over time. In this article, we will explore five key factors that can impact your mortgage insurance: loan-to-value ratio, property value appreciation, mortgage payment history, homeowner request for termination, and automatic termination.

Loan-to-Value Ratio

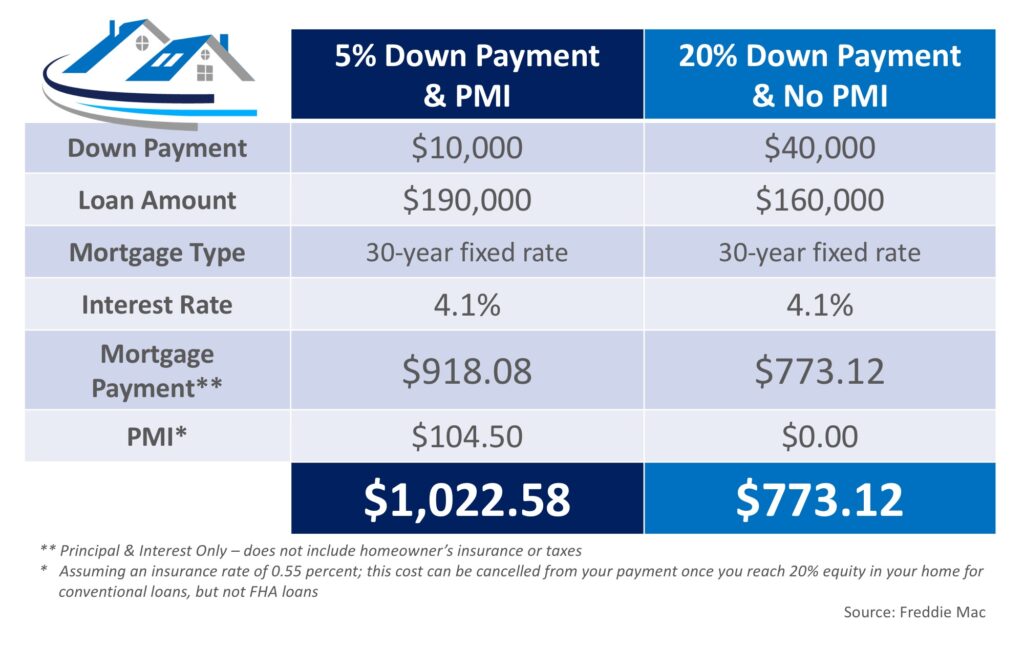

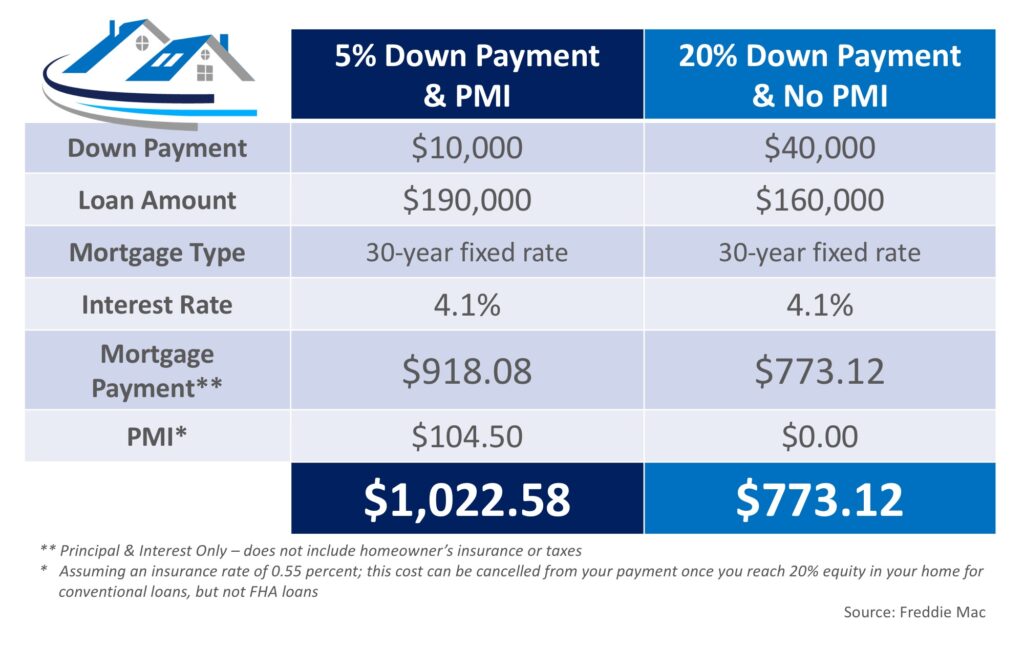

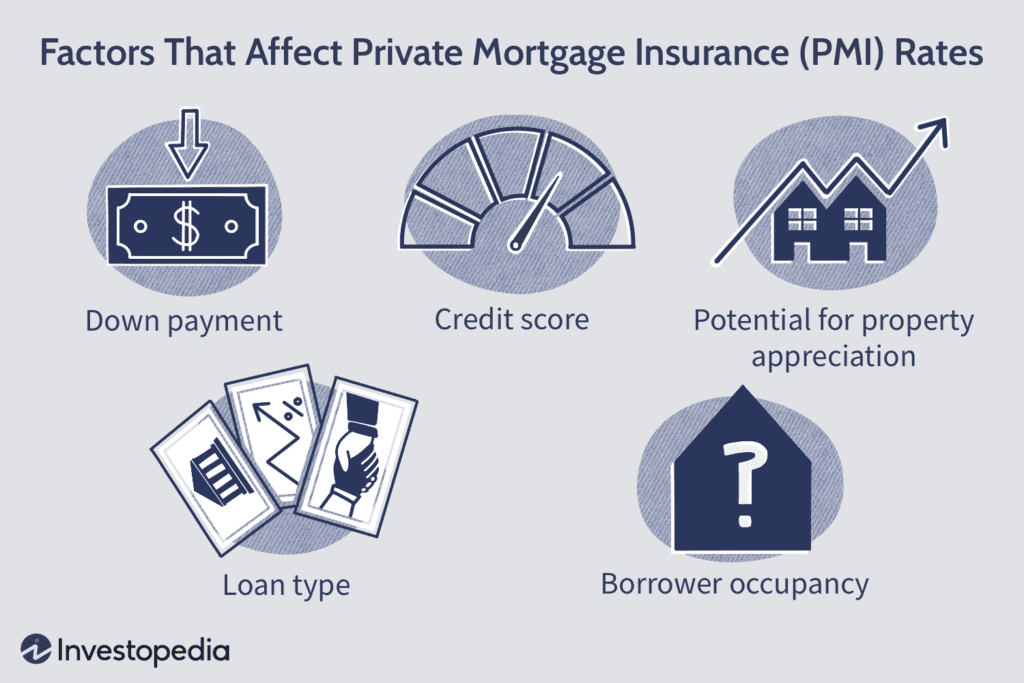

The loan-to-value (LTV) ratio is a crucial factor in determining your mortgage insurance. It is the percentage of your home’s value that is covered by the loan. For example, if you purchase a home worth $200,000 with a loan of $180,000, your LTV ratio would be 90%. The higher the LTV ratio, the higher the risk for the lender, which means higher mortgage insurance premiums for you.

When you first purchase a home, your LTV ratio will likely be higher since you may not have been able to make a large down payment. As you pay down your mortgage principal over time or if your property appreciates in value, your LTV ratio will decrease. This decrease in LTV ratio can lead to a reduction in your mortgage insurance premiums.

Property Value Appreciation

The value of your property can also impact your mortgage insurance. As your property appreciates in value, your LTV ratio decreases, which can result in lower mortgage insurance premiums. Property value appreciation can occur due to various factors such as improvements to your home, renovations in the neighborhood, or general market trends.

While property value appreciation is not something you have direct control over, it’s important to keep an eye on the local real estate market and understand how changes in property values can potentially benefit you in terms of your mortgage insurance.

Mortgage Payment History

Your mortgage payment history plays a significant role in determining your mortgage insurance. A consistently on-time payment history demonstrates your reliability as a borrower and reduces the risk for the lender. On the other hand, late or missed payments can indicate financial instability and may result in higher mortgage insurance premiums.

Maintaining a good payment history is not only beneficial for your mortgage insurance but also for your overall creditworthiness. It is important to make your mortgage payments in full and on time each month to avoid any negative impact on your mortgage insurance and credit score.

Homeowner Request

As a homeowner, you have the option to request the termination of your mortgage insurance once certain criteria are met. This can be a great way to potentially lower your monthly payments and save money in the long term. However, it’s important to note that this option is subject to specific requirements and conditions.

To request the termination of your mortgage insurance, you will typically need to contact your lender and provide necessary documentation such as proof of payment history, current property value, and LTV ratio. It’s essential to carefully review the requirements set by your lender and ensure you meet all the criteria before making the request.

Automatic Termination

In some cases, mortgage insurance can be automatically terminated without the need for a homeowner’s request. This is usually determined by legislation and specific criteria set by regulatory bodies. Automatic termination provides homeowners with the peace of mind that their mortgage insurance will eventually come to an end.

Legislation regarding automatic termination varies depending on the country and region, but it generally requires certain conditions to be met. These conditions typically include reaching a specific LTV ratio, having a good mortgage payment history, and meeting the requirements of the lending institution. When the conditions are met, homeowners have the guaranteed right to cancellation of their mortgage insurance.

Options for Lowering Mortgage Insurance

While certain factors can naturally lower your mortgage insurance over time, there are also strategies that you can proactively implement to potentially reduce the cost of your insurance. Here are four options you can explore:

Refinancing

Refinancing your mortgage is one option that can potentially lower your mortgage insurance premiums. By refinancing, you essentially replace your existing mortgage with a new one, which could lead to a lower interest rate and, in turn, a decrease in mortgage insurance costs.

Before considering refinancing, it’s important to carefully evaluate the costs involved, such as closing costs and fees. Additionally, you’ll need to assess if your creditworthiness and financial situation have improved since obtaining your original mortgage. Refinancing may not be suitable for everyone, so it’s wise to consult with a financial advisor to determine if this option is right for you.

Home Value Appreciation

As mentioned earlier, an increase in property value can lead to a lower LTV ratio, resulting in reduced mortgage insurance premiums. While you may not be able to directly control property value appreciation, you can take steps to maintain and improve your home to increase its value.

Consider investing in renovations or upgrades that are known to add value to your property. This could include kitchen or bathroom remodels, landscaping improvements, or energy-efficient upgrades. By enhancing your home, you may be able to enjoy the benefits of decreased mortgage insurance premiums in the future.

Payment Acceleration

Paying off your mortgage faster can also be a strategy to lower your mortgage insurance costs. Making extra payments towards the principal balance of your loan can help you reach a lower LTV ratio sooner, which may lead to early termination or reduced premiums.

Before implementing a payment acceleration strategy, it’s important to check with your lender to ensure there are no prepayment penalties and that the extra payments are applied correctly. By carefully managing your mortgage payments, you can potentially save on mortgage insurance expenses.

Improving Credit Score

Your credit score plays a significant role in determining your mortgage insurance premiums. A higher credit score indicates better creditworthiness, which reduces the risk for the lender. Therefore, improving your credit score can lead to savings on your mortgage insurance.

To improve your credit score, focus on paying your bills on time, reducing your overall debt, and keeping your credit card balances low. Regularly reviewing your credit report for any errors and addressing them promptly can also aid in improving your credit score. As your credit score increases, you may qualify for lower mortgage insurance premiums.

Refinancing

Refinancing is an option that homeowners often consider to reduce their mortgage insurance costs. By refinancing, you can potentially secure a lower interest rate and adjust the terms of your loan, which may result in decreased mortgage insurance premiums.

When deciding whether to refinance, it’s crucial to consider several factors. First, compare the current interest rates available in the market to determine if they are lower than your current rate. Additionally, understand the closing costs associated with refinancing and ensure they are outweighed by the potential savings on mortgage insurance.

To calculate the potential savings, gather details about your refinancing options, including the new loan amount, interest rate, and terms. Utilize online calculators or consult a mortgage professional to determine the specific dollar amount you could save on your mortgage insurance premiums.

Home Value Appreciation

Home value appreciation can be a significant advantage when it comes to lowering your mortgage insurance. As your property’s value increases, your LTV ratio naturally decreases, potentially leading to a reduction in your mortgage insurance premiums.

To maximize the benefits of home value appreciation, it’s essential to keep your home well-maintained and invest in improvements that can positively impact its value. Regularly assess the state of your property and consider renovations or upgrades that align with current market trends.

It’s worth noting that property values can fluctuate over time, influenced by factors such as the overall housing market, economic conditions, and location. While you cannot control these external factors, ensuring the proper care and maintenance of your property can contribute to its appreciation.

Improving Credit Score

Your credit score is a critical factor in determining your mortgage insurance premiums. A higher credit score indicates better creditworthiness and can lead to lower insurance costs. Therefore, improving your credit score can result in potential savings on your mortgage insurance.

To enhance your credit score, focus on paying your bills on time, reducing your overall debt, and keeping your credit utilization ratio low. Monitor your credit report regularly to identify any errors or discrepancies and take the necessary steps to correct them promptly.

It’s important to understand that improving your credit score may take time and consistent effort. However, the potential savings on mortgage insurance premiums can make it a worthwhile endeavor. Consult with a financial advisor or credit counselor who can provide personalized guidance on improving your creditworthiness.

In conclusion, several factors can affect your mortgage insurance, ranging from your loan-to-value ratio and property value appreciation to your mortgage payment history, homeowner request for termination, and automatic termination. Understanding these factors and their impact on your mortgage insurance premiums can help you make informed decisions and potentially lower your costs. Furthermore, exploring options such as refinancing, home value appreciation, payment acceleration, and improving your credit score can provide additional avenues for reducing your mortgage insurance expenses. Remember to consult with professionals and lenders to determine the best strategies for your specific financial situation. With careful consideration and proactive choices, you can navigate the world of mortgage insurance with confidence and potentially save money in the process.