Imagine coming home after a long day to find water pouring from your ceiling, damaging your precious belongings and creating a disaster in your living space. This unexpected and stressful situation is unfortunately not uncommon for homeowners, and knowing how to navigate the process of filing an insurance claim for water damage becomes crucial. In this article, we will explore the essential steps you need to take when making a homeowner insurance claim for water damage, ensuring that you receive the support you need during this challenging time. From documenting the damage to communicating effectively with your insurance company, we’ve got you covered with expert advice and tips to help you successfully navigate the claims process.

Understanding Homeowner Insurance

What is homeowner insurance?

Homeowner insurance, also known as home insurance or property insurance, is a type of insurance coverage that protects homeowners against financial loss or damage to their property. It provides coverage for various perils such as fire, theft, vandalism, and natural disasters. Homeowner insurance not only protects the physical structure of your home but also covers your personal belongings and provides liability coverage in case someone is injured on your property.

Types of homeowner insurance coverage

There are several types of homeowner insurance coverage available, and it’s important to understand the different options in order to choose the right one for your needs:

- Dwelling coverage: This covers the structure of your home, including the walls, roof, foundation, and attached structures such as garages.

- Personal property coverage: This provides coverage for your personal belongings, such as furniture, electronics, and clothing, in case they are damaged or stolen.

- Liability coverage: This protects you financially if someone gets injured on your property and decides to sue you.

- Additional living expenses coverage: If your home becomes uninhabitable due to a covered peril, this coverage helps pay for temporary living expenses such as hotel bills and meals.

- Medical payments coverage: This covers the medical expenses of someone who gets injured on your property, regardless of whether you are at fault.

- Other structures coverage: This covers structures on your property that are not attached to your home, such as sheds, fences, and detached garages.

Each homeowner insurance policy may have different coverage limits and deductibles, so it’s important to carefully review the policy document to understand what is covered and what is not.

Water Damage and Homeowner Insurance

Common causes of water damage

Water damage can occur in various ways, and it’s important to be aware of the common causes so you can take preventive measures. Some common causes of water damage include:

- Burst or leaking pipes: This can happen due to freezing temperatures, old or corroded pipes, or sudden changes in water pressure.

- Plumbing system issues: Clogs, backups, and faulty plumbing fixtures can lead to water damage.

- Appliance leaks: Malfunctioning washing machines, dishwashers, refrigerators, or water heaters can cause water damage if not fixed promptly.

- Roof leaks: Damage to the roof, missing shingles, or clogged gutters can result in water seeping into your home.

- Natural disasters: Heavy rainfall, floods, hurricanes, or storms can cause extensive water damage.

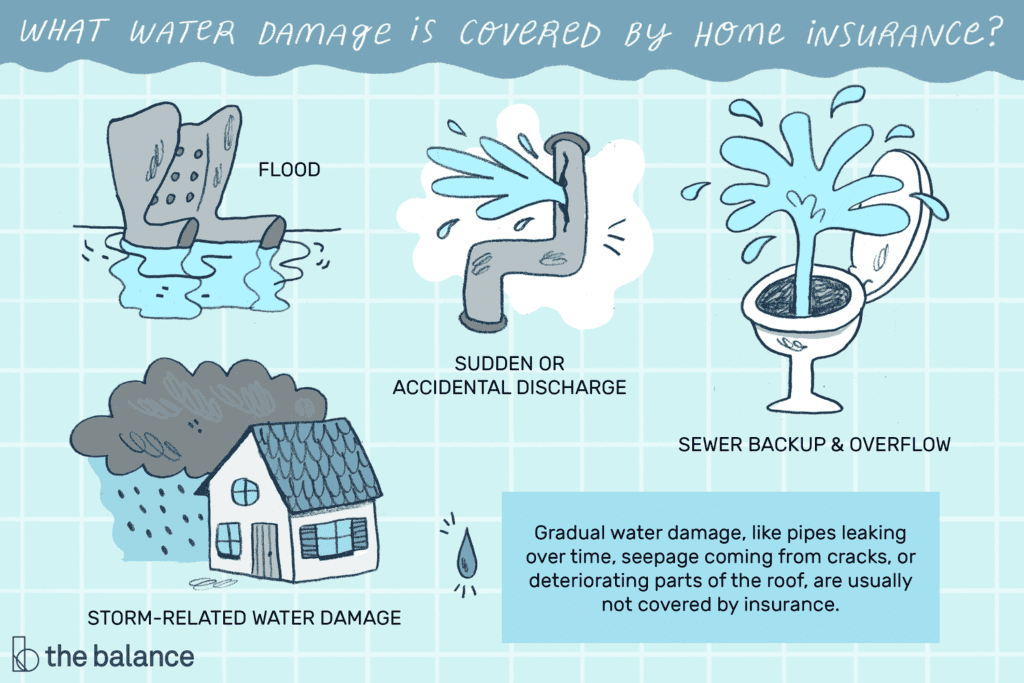

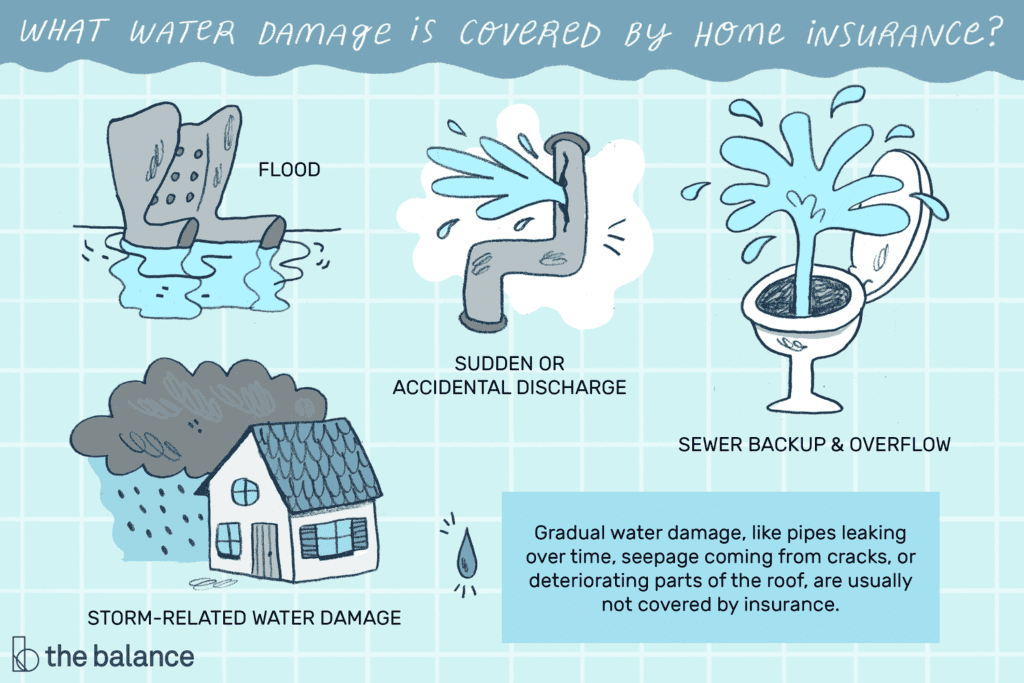

Extent of water damage covered by homeowner insurance

The extent of water damage covered by homeowner insurance depends on the specific policy and the cause of the damage. Generally, sudden and accidental water damage is covered by most standard homeowner insurance policies, as long as it is not due to negligence or lack of maintenance.

Typically, homeowner insurance covers water damage caused by burst pipes, overflowing appliances, or sudden roof leaks. However, it’s important to note that coverage may vary between policies and insurance companies. It’s essential to review your policy and contact your insurer to understand the specific coverage for water damage.

Exclusions and limitations of coverage

While homeowner insurance provides coverage for water damage in many cases, there are certain exclusions and limitations to be aware of. Some common exclusions from coverage include:

- Flood damage: Homeowner insurance policies typically do not cover damage caused by floods. Separate flood insurance is needed to protect against losses caused by rising water levels.

- Gradual damage: Damage that occurs over time, such as long-term leaks or seepage, may not be covered. It is important to promptly address any signs of water damage to prevent it from worsening.

- Negligence and lack of maintenance: If the water damage is a result of negligence, lack of maintenance, or failure to address a known issue, the insurance company may deny the claim.

- Mold damage: Generally, homeowner insurance policies have limitations on coverage for mold damage. It’s important to understand the specific terms and conditions outlined in your policy.

Reviewing your policy and discussing any questions or concerns with your insurer will help you understand the exclusions and limitations of coverage for water damage under your specific homeowner insurance policy.

Steps to Take Before Filing a Claim

Assessing the water damage

Before filing a homeowner insurance claim for water damage, it is crucial to assess the extent of the damage. Take a thorough look at your property to determine the areas affected by water and the severity of the damage. This initial assessment will help you provide accurate information to your insurer and adjuster.

Mitigating further damage

Once the water damage has been assessed, it’s important to take immediate action to mitigate further damage. This includes stopping the source of the water if possible, such as shutting off the main water supply or fixing a leaking pipe. Additionally, removing any standing water and drying out the affected areas can help prevent mold growth and further damage to your property.

Documenting the damage

To support your homeowner insurance claim, it’s essential to document the water damage with clear and detailed evidence. Take photographs or videos of the affected areas, making sure to capture the extent of the damage and any visible signs of water intrusion. This documentation will be valuable during the claims process.

Contacting your insurer

Once you have assessed the water damage, mitigated further damage, and documented the evidence, it’s time to contact your insurer. Notify them about the water damage and initiate the claims process. Provide them with accurate and detailed information about the incident, including the cause of the water damage and the extent of the loss.

Filing the Homeowner Insurance Claim

Reviewing your policy

Before filing a homeowner insurance claim for water damage, it’s important to carefully review your policy. Familiarize yourself with the coverage limits, deductibles, and any specific requirements or exclusions related to water damage. Understanding your policy will help you navigate the claims process more effectively.

Notifying your insurer

Once you have reviewed your policy, you need to notify your insurer about the water damage and your intention to file a claim. Contact your insurance company’s claims department or agent and provide them with the necessary information, such as the date of the incident, the cause of the damage, and the extent of the loss.

Submitting the claim

To officially file the homeowner insurance claim, you will be required to provide detailed documentation of the water damage. This includes photographs or videos, a description of the damage, and any supporting documents such as receipts for repairs or replacements. Follow your insurer’s instructions for submitting the claim, either online, by mail, or through their mobile app.

Working with an adjuster

After submitting the claim, your insurer will assign an adjuster to evaluate the water damage and determine the amount of compensation you are entitled to. The adjuster will schedule an inspection of your property, assess the extent of the damage, and verify the cause of the water damage. Cooperate with the adjuster and provide any additional information or documentation they may need to process your claim.

Investigation and Damage Assessment

Inspecting the property

Once the homeowner insurance claim is filed, an investigation will be conducted to assess the water damage and determine the extent of coverage eligibility. The insurance company may send a claims adjuster or hire an independent inspector to visit your property and conduct a thorough inspection. This inspection will help determine the cause of the damage and assess the scope of repairs or replacements needed.

Assessing the extent of damage

During the inspection, the adjuster or inspector will assess the extent of the water damage to your property. They will evaluate the affected areas, identify any structural damage, and determine the necessary repairs or replacements. This assessment will help the insurance company determine the amount of compensation you are eligible for under your policy.

Identifying the cause

Determining the cause of the water damage is an important step in the claims process. The insurance company will investigate the cause to determine if it is covered under your policy. If the cause of the damage is not covered or falls under an exclusion, the claim may be denied. Understanding the cause of the water damage will help you navigate the claims process and provide accurate information to the insurance company.

Determining coverage eligibility

Based on the investigation and damage assessment, the insurance company will determine the coverage eligibility for your water damage claim. They will evaluate your policy, review the inspection report, and consider any applicable exclusions or limitations. The decision will be communicated to you, either approving the claim and specifying the compensation amount or denying the claim with a detailed explanation.

Documentation and Evidence

Keeping records of communication

Throughout the claims process, it’s important to keep thorough records of all communication with your insurer. This includes phone calls, emails, and any written correspondence. Document the date, time, and details of each interaction, including the names of those you spoke with and the information discussed. These records will serve as evidence and can be helpful if any disputes arise during the claims process.

Taking photographs and videos

As mentioned earlier, documenting the water damage with photographs and videos is crucial. Take clear and detailed pictures of all affected areas, making sure to capture close-ups of damaged materials, visible water intrusion, and any related issues such as mold growth. Videos can provide a comprehensive overview of the damage and help support your claim.

Collecting receipts and estimates

Keep all receipts and estimates related to the water damage and any repair or restoration work. This includes receipts for emergency repairs, drying equipment rentals, materials purchased, and labor costs. Additionally, collect estimates from contractors or restoration companies detailing the scope of work and associated costs. These documents will help validate your claim and provide evidence of the financial losses incurred.

Obtaining expert opinions

In some cases, it may be necessary to obtain expert opinions to support your homeowner insurance claim for water damage. This could include opinions from plumbers, roofers, or other professionals knowledgeable in identifying the cause and extent of water damage. These expert opinions can assist in strengthening your claim, particularly if there are disputes or disagreements with the insurance company’s assessment.

Claims Settlement Process

Evaluation by the insurer

Once the homeowner insurance claim is submitted and the investigation is complete, the insurance company will evaluate the claim to determine the amount of compensation. They will review the inspection report, the evidence provided, and any applicable documentation. Based on their evaluation, the insurer will make an initial settlement offer.

Negotiating a settlement

Upon receiving the initial settlement offer, you have the opportunity to negotiate if you believe it is inadequate or if you have additional evidence to support a higher valuation of your claim. Discuss your concerns or provide any supplementary documentation to support your position. This negotiation process aims to reach a fair settlement for both parties.

Receiving payment

If an agreement is reached during the negotiation process, the insurance company will issue the settlement payment. Depending on the terms of your policy and the agreement, the payment may be made directly to you or to the contractors or restoration companies involved in the repairs. Review the settlement details carefully to ensure it aligns with the agreed-upon terms.

Disputes and appeals

In the event of disputes or disagreements regarding the settlement offer, you have the right to appeal the decision. Contact your insurance company to discuss the appeal process and provide any additional evidence or information that supports your claim. It may be necessary to involve a mediator or seek legal assistance to resolve the dispute if negotiations are unsuccessful.

Water Damage Restoration

Choosing a reputable restoration company

Once the homeowner insurance claim is settled, it’s important to choose a reputable water damage restoration company to handle the repairs and restoration process. Look for companies with experience in water damage restoration and a good reputation for quality work. Ask for references and obtain multiple estimates to ensure you are getting a fair price.

Reviewing cost estimates

Before proceeding with the water damage restoration, carefully review the estimates provided by restoration companies. Ensure that the estimates align with the scope of work discussed during the evaluation process. Compare estimates from different companies to make an informed decision.

Monitoring the restoration process

Throughout the restoration process, it’s important to monitor the progress and quality of work being done. Regularly communicate with the restoration company to stay informed about the timeline, any potential delays, and any issues that may arise. Address any concerns promptly to ensure the restoration is completed to your satisfaction.

Retaining documents for future claims

After the water damage restoration is complete, retain all the documentation, receipts, and warranties related to the repairs and replacements. These records will be valuable in the future if you need to file another homeowner insurance claim or if you decide to sell your property. Keep them in a safe and easily accessible place for reference.

Preventing Water Damage

Routine maintenance and inspections

Prevention is key when it comes to water damage. Regularly inspect and maintain your property to identify potential issues early on. Check for leaks, signs of water intrusion, and any plumbing or appliance malfunctions. Promptly address any maintenance or repair needs to prevent water damage from occurring.

Installing water leak detection systems

Consider installing water leak detection systems in your home. These systems can alert you to potential leaks or abnormal water usage, allowing you to take immediate action before the damage becomes extensive. There are various types of leak detection systems available, ranging from simple alarms to sophisticated smart home systems that can detect and shut off the water supply automatically.

Properly sealing windows and doors

Ensure that windows and doors are properly sealed to prevent water intrusion during heavy rainfall or storms. Check for cracks, gaps, or any areas where water could potentially seep in. Proper sealing will help protect your home from water damage and save you from potential insurance claims.

Understanding the plumbing system

Understanding your home’s plumbing system and vigilant usage can help prevent water damage. Be mindful of what you flush down toilets, properly dispose of cooking oils and grease, and avoid pouring harmful substances down drains. Additionally, know the location of the main water shut-off valve and how to turn it off in case of an emergency.

Tips for Successful Claims

Reviewing your policy regularly

Regularly review your homeowner insurance policy to ensure it provides adequate coverage for your needs. As circumstances change, such as renovations, property value increases, or the acquisition of valuable belongings, it’s important to update your policy accordingly. Staying informed about your coverage will help you handle any future claims more effectively.

Reporting damages promptly

Promptly report any damages or incidents that could potentially lead to a homeowner insurance claim. Timely reporting allows your insurance company to initiate the claims process quickly and can help prevent further damage. Failure to report damages promptly may result in a denial of the claim or limited coverage.

Cooperating with the insurer

Cooperation with your insurance company is essential throughout the claims process. Promptly respond to requests for information or documentation, and provide accurate and detailed information about the incident and the damages. Cooperating with the insurer will help streamline the claims process and ensure a smooth resolution.

Seeking professional help if needed

If you encounter any challenges or difficulties during the homeowner insurance claim process, don’t hesitate to seek professional help. Insurance claim professionals, such as public adjusters or attorneys specializing in insurance claims, can provide guidance and representation. They can help ensure that your rights are protected and that you receive fair compensation for your water damage claim.

In conclusion, understanding homeowner insurance is crucial for homeowners to protect their property and belongings from various risks, including water damage. Familiarizing yourself with the types of coverage available, knowing the common causes of water damage, and taking the necessary steps before filing a claim will help navigate the claims process more smoothly. Proper documentation, effective communication with your insurer, and cooperation during the investigation and damage assessment stages are key to a successful homeowner insurance claim. Lastly, taking preventive measures to avoid water damage and following the tips for successful claims will help homeowners safeguard their homes and handle any future incidents effectively.