Imagine finally purchasing your dream home, only to find out that you have to pay mortgage insurance on top of your monthly mortgage payments. It’s natural to wonder how long this extra expense will stick around. The length of time that mortgage insurance stays on your loan can vary depending on a few factors. Let’s explore the duration of mortgage insurance and discover when you can finally breathe a sigh of relief.

What is Mortgage Insurance?

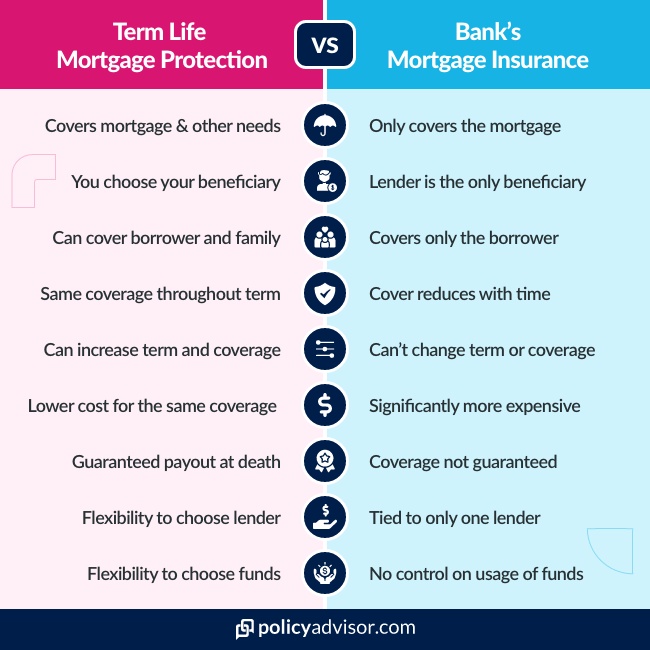

Mortgage insurance is a type of insurance that protects the lender in the event that the borrower defaults on the loan. It is typically required when the down payment on a home is less than 20% of the purchase price. Mortgage insurance provides a safety net for lenders, allowing them to recover their losses if the borrower is unable to make the necessary payments.

Definition of Mortgage Insurance

Mortgage insurance is a financial product that is designed to protect lenders from the risk of borrower default. It is typically required for borrowers who have a down payment of less than 20% of the home’s purchase price. The mortgage insurance policy is paid for by the borrower, either as a monthly premium or as an upfront payment at the time of closing.

Purpose of Mortgage Insurance

The purpose of mortgage insurance is to reduce the risk for lenders when lending to borrowers with a smaller down payment. By having mortgage insurance in place, lenders are more willing to approve loans for borrowers who may not have enough funds for a larger down payment. This allows more individuals to become homeowners and helps to stimulate the housing market.

Types of Mortgage Insurance

There are several types of mortgage insurance available, each catering to specific needs and circumstances of borrowers. These include:

Private Mortgage Insurance (PMI)

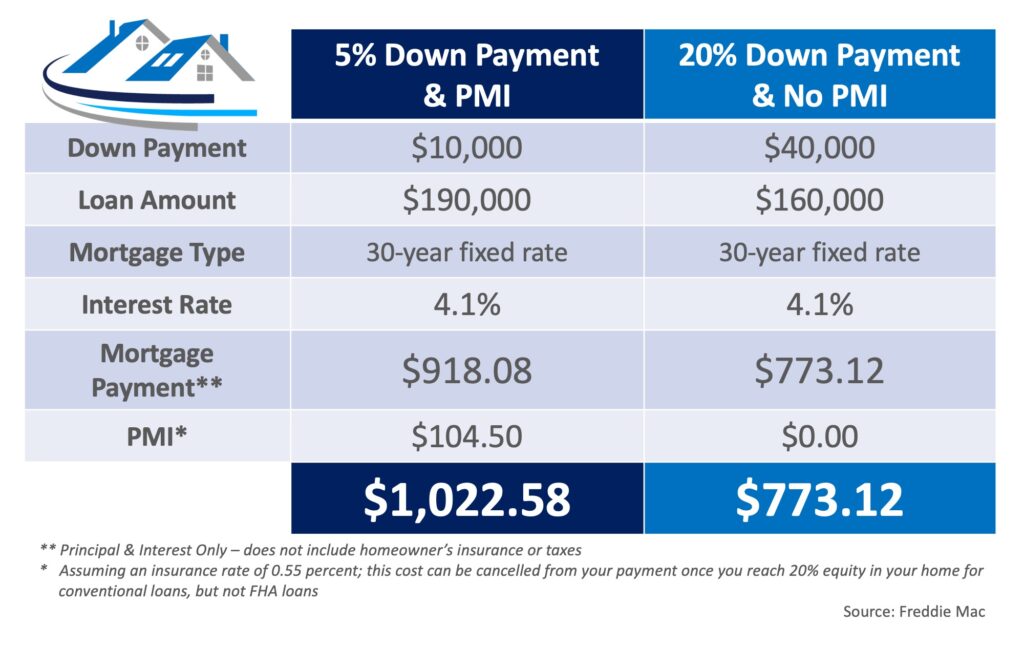

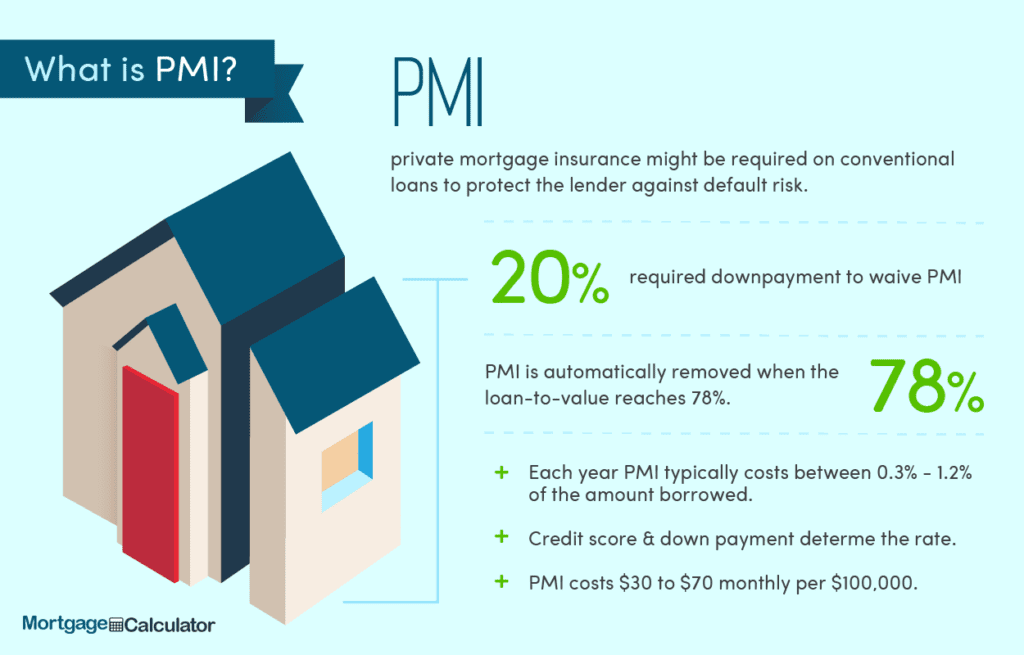

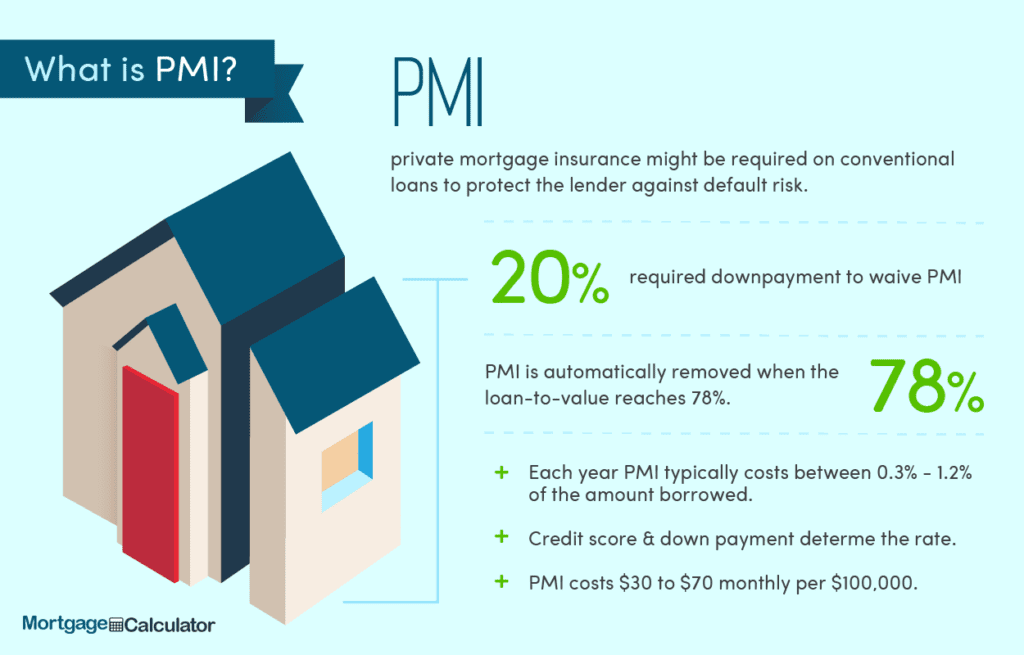

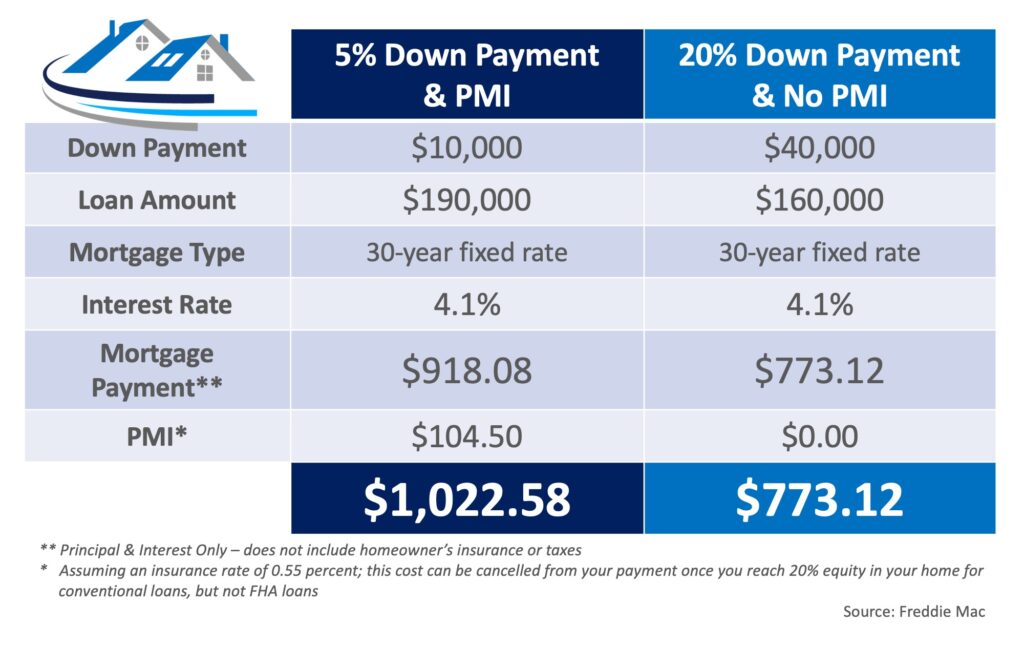

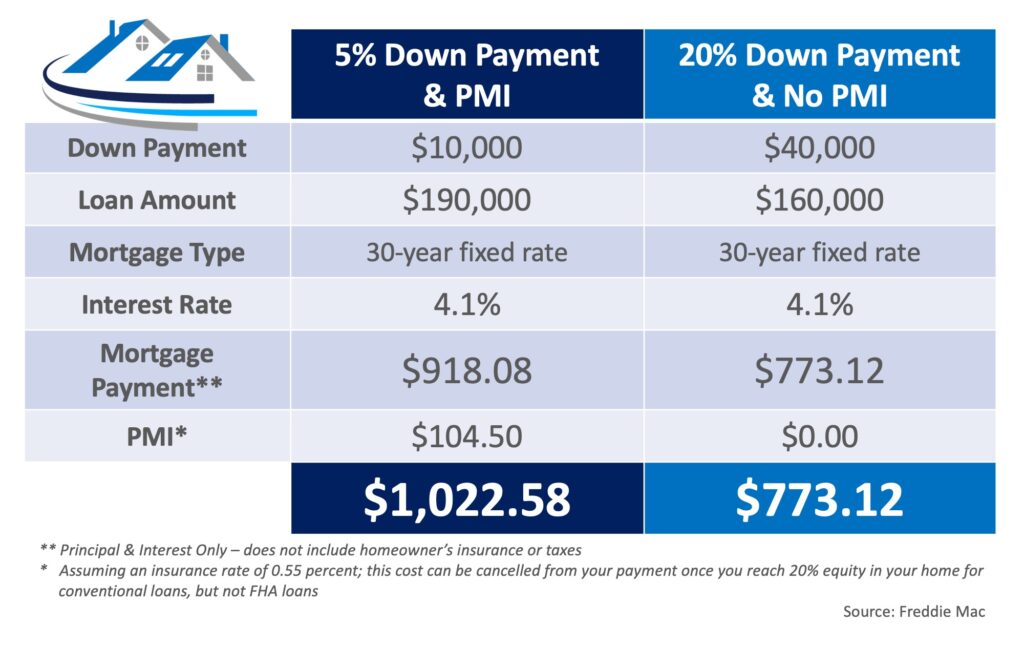

Private mortgage insurance, commonly known as PMI, is the most common type of mortgage insurance. It is typically required for conventional loans with a down payment of less than 20%. PMI is provided by private insurance companies and can be paid as a monthly premium or as a lump sum at closing.

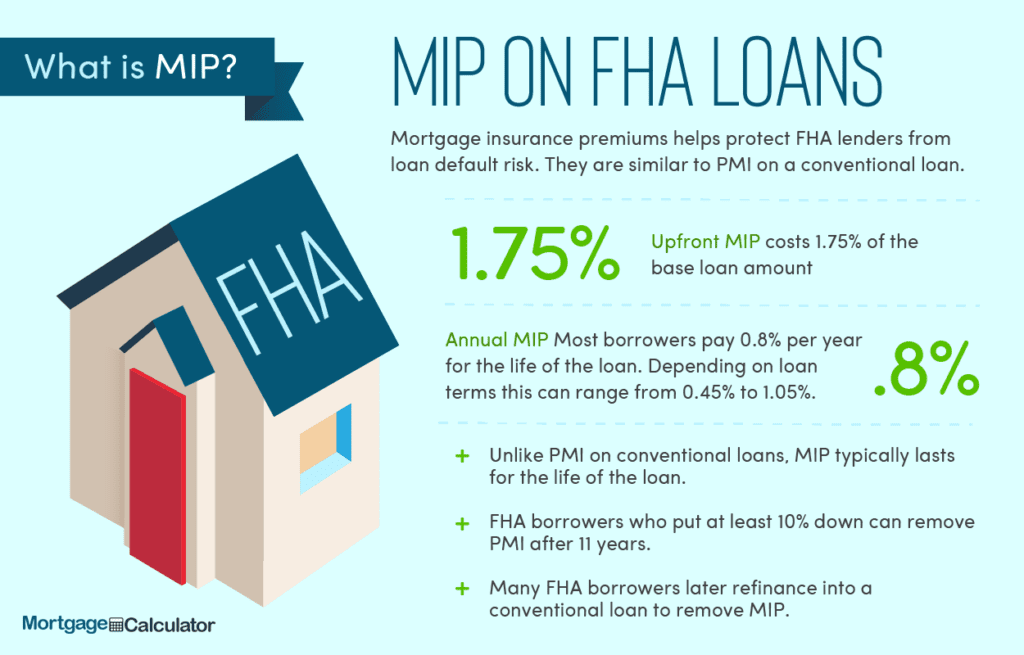

Federal Housing Administration (FHA) Mortgage Insurance

FHA mortgage insurance is required for loans insured by the Federal Housing Administration. It is designed to protect lenders in case borrowers default on their loans. FHA mortgage insurance is paid by the borrower as both an upfront premium and a monthly premium. This type of mortgage insurance is available to borrowers with a credit score of 580 and above.

Veterans Affairs (VA) Mortgage Insurance

VA mortgage insurance is available to eligible veterans, active duty service members, and their surviving spouses. Unlike other types of mortgage insurance, VA mortgage insurance is not paid by the borrower. Instead, it is funded by the VA and helps protect lenders against the risk of default. VA loans generally do not require a down payment or mortgage insurance.

US Department of Agriculture (USDA) Mortgage Insurance

USDA mortgage insurance is specifically for home loans issued by the US Department of Agriculture for rural and suburban properties. Similar to VA mortgage insurance, USDA mortgage insurance is not paid by the borrower. It is funded by the USDA to protect lenders from the risk of default. USDA loans typically do not require a down payment or mortgage insurance.

How Long Does Mortgage Insurance Stay On?

The duration of mortgage insurance depends on various factors, including the type of loan and the individual’s financial circumstances. Here is a breakdown of the stay-on periods for the different types of mortgage insurance.

PMI Stay On Period

For conventional loans with private mortgage insurance, the stay-on period varies depending on the borrower’s equity and loan-to-value ratio (LTV). Here are the key factors that determine how long PMI stays on:

Conventional Loan:

If the loan-to-value ratio (LTV) is 90% or less, PMI is required until the loan is paid down to 80% of the original appraised value or the original purchase price, whichever is lower.

If the loan-to-value ratio (LTV) is above 90%, PMI is required until the loan is paid down to 78% of the original appraised value or the original purchase price, whichever is lower.

Borrower’s Equity:

As the borrower pays down the loan and builds equity in the home, the need for mortgage insurance diminishes. Therefore, the rate at which the borrower gains equity in the property affects how long PMI stays on.

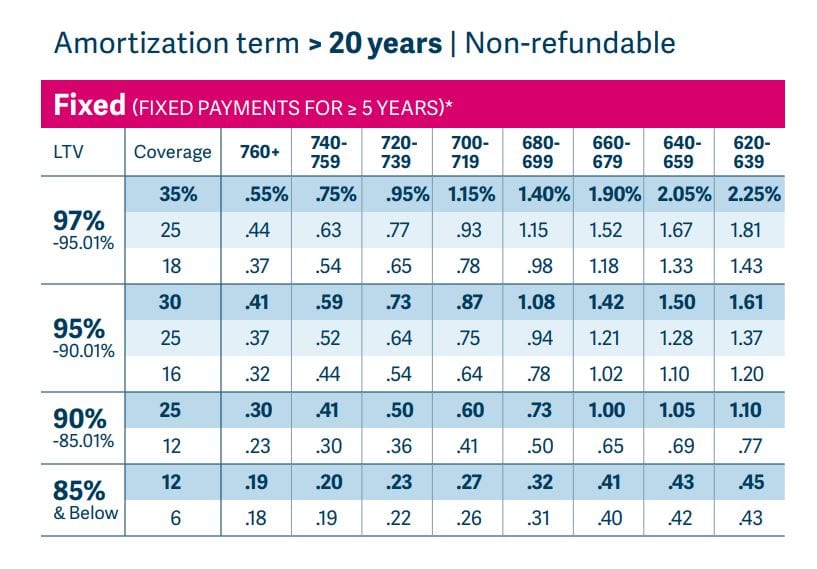

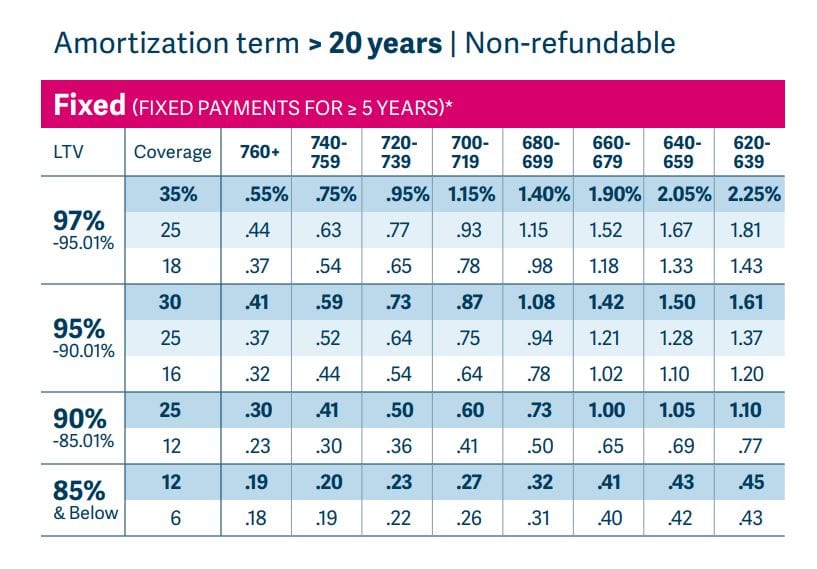

Loan-to-Value Ratio (LTV):

The loan-to-value ratio is the percentage of the loan amount compared to the appraised value or purchase price of the property, whichever is lower. The LTV ratio is a crucial factor in determining how long PMI stays on. The higher the LTV ratio, the longer PMI will be required.

Cancellation of PMI:

Borrowers may request the cancellation of PMI once the loan reaches the required LTV ratio. However, lenders are not obligated to automatically cancel PMI, so it’s essential for borrowers to actively monitor their loan balance and request PMI termination when they meet the criteria.

Automatic Termination of PMI:

Under a federal law known as the Homeowners Protection Act (HPA), PMI must be automatically terminated when the loan reaches 78% of the original value or 22% equity. However, certain conditions must be met for this automatic termination to take place.

Request for PMI Termination:

If the automatic termination requirements are not met, borrowers can request the cancellation of PMI once they believe they have met the necessary criteria. This typically involves contacting the lender and providing documentation to support the request, such as an appraisal to demonstrate the current value of the home.

FHA Mortgage Insurance Stay On Period

FHA mortgage insurance has a different stay-on period compared to PMI. The duration of FHA mortgage insurance depends on several factors, including when the loan was originated and the loan-to-value ratio at the time of closing. Here are the key points to consider:

Different Scenarios for FHA Mortgage Insurance:

FHA mortgage insurance can vary for loans with different LTV ratios at the time of closing. For loans with an LTV ratio of 90% or less, the stay-on period for FHA mortgage insurance is 11 years. However, for loans with an LTV ratio above 90%, FHA mortgage insurance remains in effect for the life of the loan.

Minimum FHA Mortgage Insurance Duration:

Regardless of the LTV ratio, FHA mortgage insurance must remain on the loan for a minimum of 11 years. Even if the LTV ratio drops below 78%, FHA mortgage insurance will still be required until the 11-year mark has been reached.

VA Mortgage Insurance Stay On Period

VA loans do not require mortgage insurance. However, there is a funding fee associated with VA loans that serves a similar purpose. The funding fee is paid by the borrower and helps protect lenders from the risk of default. The stay-on period for the funding fee depends on the type of VA loan and the borrower’s circumstances.

VA Funding Fee:

The VA funding fee is a one-time payment made by the borrower at the time of closing. The fee varies depending on factors such as the type of loan, the down payment amount, and the borrower’s military service category.

Duration of VA Mortgage Insurance:

Unlike other types of mortgage insurance, VA mortgage insurance remains in effect for the life of the loan. However, the funding fee paid at closing helps protect lenders in the event of default.

USDA Mortgage Insurance Stay On Period

Similar to VA loans, USDA loans do not require traditional mortgage insurance. Instead, they have a guarantee fee that serves a similar purpose in protecting lenders. The duration of USDA mortgage insurance depends on the borrower’s situation.

USDA Guarantee Fee:

The USDA guarantee fee is a one-time payment made by the borrower at the time of closing. The fee helps protect lenders against the risk of default. The amount of the guarantee fee is based on the loan amount and is generally lower than traditional mortgage insurance premiums.

Duration of USDA Mortgage Insurance:

USDA mortgage insurance remains in effect for the life of the loan. However, the guarantee fee paid at closing provides lenders with a level of protection in case of borrower default.

Factors Impacting Mortgage Insurance Duration

Several factors can impact the duration of mortgage insurance. These factors include the type of loan, loan amount, loan-to-value ratio, credit score, and borrower’s equity.

Type of Loan:

Different types of loans, such as conventional loans, FHA loans, VA loans, and USDA loans, have varying requirements and stay-on periods for mortgage insurance.

Loan Amount:

The loan amount impacts the duration of mortgage insurance. Higher loan amounts may require longer periods of mortgage insurance coverage.

Loan-to-Value Ratio:

The loan-to-value ratio compares the loan amount to the appraised value or purchase price of the property. A higher LTV ratio typically results in a longer duration of mortgage insurance.

Credit Score:

Borrowers with a lower credit score may be subject to longer stays of mortgage insurance or higher premiums.

Borrower’s Equity:

As the borrower pays down the loan and builds equity in the home, the need for mortgage insurance diminishes. Faster equity buildup can result in a shorter duration of mortgage insurance.

How to Remove Mortgage Insurance?

Removing mortgage insurance typically involves meeting specific criteria set by the lender or the loan program. Here is an overview of how to remove mortgage insurance for different types of loans.

Conventional Loan:

To remove PMI on a conventional loan, borrowers must reach the required loan-to-value ratio. This can be accomplished through a combination of paying down the loan, making home improvements that increase the property’s value, or a combination of the two. Once the required LTV ratio is met, borrowers can request the cancellation of PMI from their lender.

FHA Loan:

FHA loans have stricter requirements for removing mortgage insurance. For loans originated after June 3, 2013, the only way to remove FHA mortgage insurance is by refinancing the loan into a conventional mortgage. However, older FHA loans may be eligible for mortgage insurance removal if certain criteria are met.

VA Loan:

VA loans do not require mortgage insurance, so borrowers do not need to worry about removing it. However, VA loans do have an upfront funding fee, which is a one-time payment made at closing.

USDA Loan:

Similar to VA loans, USDA loans do not require traditional mortgage insurance. Borrowers do not need to worry about removing it, but they do have a guarantee fee to fulfill at closing.

Conclusion

Mortgage insurance is an important component of certain mortgages, providing protection for lenders against the risk of borrower default. The duration of mortgage insurance varies depending on the type of loan, the loan-to-value ratio, and other factors. Understanding the stay-on periods and the requirements for removing mortgage insurance is crucial for borrowers looking to save on their monthly payments. By staying informed and taking steps to build equity in their homes, borrowers can work towards removing mortgage insurance and enjoying the benefits of homeownership.