Imagine this scenario: you’ve experienced damage to your home, and your insurance company has offered you a settlement. However, you feel that the amount they’re willing to pay is insufficient to cover the necessary repairs. In this article, we will explore effective strategies and tips on how to ask for more money from your home insurance company. By using these methods, you can ensure that you receive the fair compensation you deserve, allowing you to restore your home to its former glory with peace of mind.

Research your Policy Coverage

Before you begin the process of asking for more money from your home insurance company, it’s crucial that you first research and understand your policy coverage in detail. Start by reviewing your policy documents, including the terms and conditions. Pay close attention to the coverage limits, which will give you a clear understanding of what is and isn’t covered under your policy. Take note of any exclusions or limitations that may apply to your claim. This will help you set realistic expectations and know the boundaries within which you can negotiate.

Document Property Damage

Once you have familiarized yourself with your policy coverage, the next step is to thoroughly document any property damage that has occurred. Take photographs of the damage from multiple angles to ensure you capture the full extent of the loss. These photographs will serve as visual evidence to support your claim. In addition to photographs, gather any necessary documents such as receipts for repairs or replacements, invoices, or any other relevant paperwork. These documents will support the evidence of the damage and strengthen your case. Finally, obtain repair estimates from reputable professionals to provide an accurate assessment of the cost of repairs or replacements.

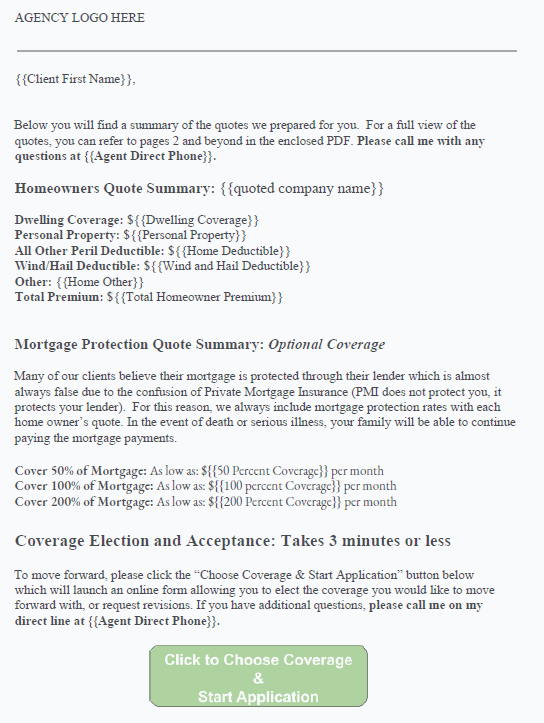

Contact Insurance Agent or Claims Department

Now that you have all the necessary documentation, it’s time to contact your insurance agent or the claims department of your insurance company. Locate the contact details either on your policy documents or through the company’s website. Notify them about the claim and provide a concise summary of the incident. Be prepared to provide all the necessary information, including the date of the incident, details about the damage, and any supporting documentation you have gathered. The insurance agent or claims department representative will guide you through the next steps of the claims process.

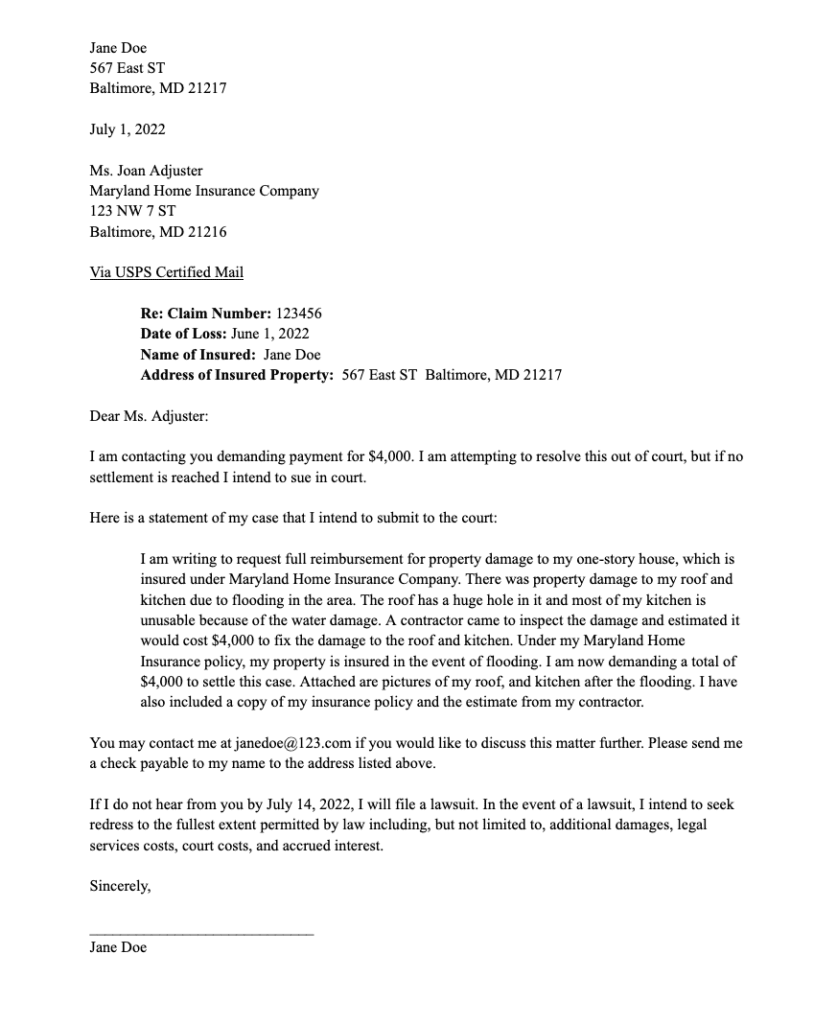

File a Formal Claim

To proceed with the claims process, you will need to submit a written claim letter to your insurance company. This letter should include a detailed account of the incident, the damages incurred, and any supporting documentation such as photographs, estimates, and receipts. Clearly state the desired settlement amount you are requesting based on your evaluation of the damages. It’s important to be thorough and provide all the required documentation to strengthen your case. This will demonstrate that you have done your due diligence in preparing your claim and increase the likelihood of a satisfactory outcome.

Review and Understand the Adjuster’s Evaluation

After you have filed your claim, an adjuster from the insurance company will assess the damages and provide an evaluation of the settlement amount they are willing to offer. Take the time to carefully evaluate the adjuster’s offer in relation to your own assessment of the damages. If the settlement amount is lower than you expected or feel is fair, don’t hesitate to request a detailed explanation from the adjuster. Seek clarification on how they arrived at their figure and whether any additional factors were considered. If necessary, consider hiring a public adjuster who can advocate on your behalf and negotiate with the insurance company to ensure a fair settlement.

Present Evidence Supporting a Higher Settlement

If you believe the adjuster’s evaluation does not adequately compensate you for the damages, it’s essential to present evidence supporting a higher settlement. Compile any additional evidence of damages that may have been overlooked or underestimated. This can include photographs, professional opinions or estimates, and any other documentation that highlights the true extent of the loss. Additionally, review your policy provisions to identify any relevant clauses that may entitle you to additional compensation. By presenting a compelling case backed by evidence, you increase your chances of obtaining a higher settlement offer.

Negotiate with Insurance Company

Negotiating with your insurance company may be necessary to reach a satisfactory outcome. Prior to entering negotiations, it’s important to prepare by thoroughly reviewing your claim, understanding your policy and its provisions, and gathering all the supporting evidence you have collected. When negotiating, clearly articulate your position, emphasizing the validity of your claim, the extent of the damages, and why you believe a higher settlement amount is justified. It’s also important to consider the insurance company’s perspective and be open to potential compromises. Finding common ground and approaching negotiations with a willingness to reach a fair resolution can lead to a mutually agreeable outcome.

Seek Legal Advice

In certain situations, it may be necessary to involve an attorney who specializes in insurance law. If negotiations with the insurance company reach an impasse or if you feel that your rights are not being respected, it’s crucial to know when to seek legal advice. An experienced insurance attorney can provide guidance throughout the claims process, help protect your rights, and ensure that you receive fair compensation. When selecting an attorney, it’s important to find someone reputable who has a strong track record in dealing with insurance claims and understands the intricacies of insurance law. A competent attorney will navigate the legal process on your behalf and work towards securing a more favorable outcome.

Consider Mediation or Arbitration

If reaching a settlement through negotiation proves challenging, alternative dispute resolution methods such as mediation or arbitration can be viable options to explore. Mediation involves engaging in a facilitated negotiation process with the assistance of a neutral third party mediator. The mediator helps facilitate communication and guides the parties towards a mutually agreeable resolution. If mediation fails to yield a satisfactory outcome, arbitration can be considered. Arbitration involves presenting your case before an impartial arbitrator, who will evaluate the evidence and make a legally binding decision. Both mediation and arbitration provide alternative avenues for resolving disputes when traditional negotiation methods have been exhausted.

File a Complaint or Appeal

In the event that you are unsatisfied with the outcome of your claim, you have the right to file a complaint or appeal. This step should only be taken when you believe there has been a significant oversight or error in the handling of your claim. Familiarize yourself with the complaint process outlined by your insurance company and follow the necessary steps to submit a formal complaint. Provide a clear and concise explanation of why you feel the claim was mishandled or inadequately settled. If necessary, consider involving regulatory bodies or ombudsmen who oversee the insurance industry, as they can provide an impartial assessment of your case and assist in resolving any disputes.