Did you know that water damage is one of the most common and costly types of damage that homeowners experience? Whether it’s due to a burst pipe, a leaking roof, or a faulty appliance, water damage can wreak havoc on your home and your wallet. But the question remains: is water damage covered by homeowners insurance? In this article, we will explore the answer to this burning question and shed light on what homeowners insurance policies typically cover when it comes to water damage. So, if you’re a homeowner looking to protect your property, keep reading to find out if you’re covered in case of a water disaster.

Overview of Homeowners Insurance Coverage

Basic coverage

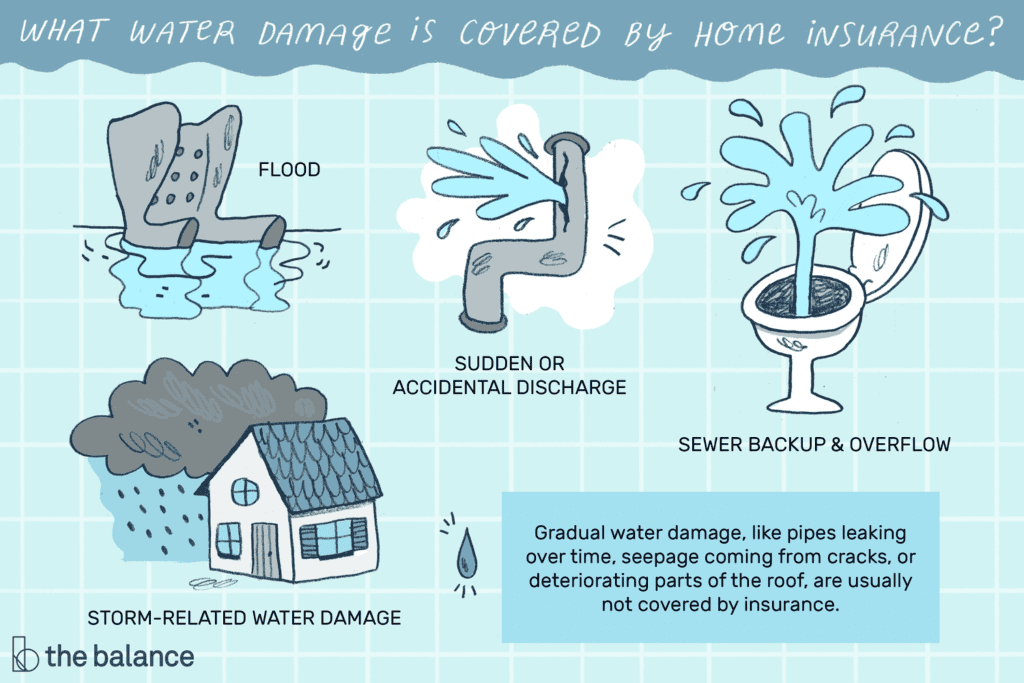

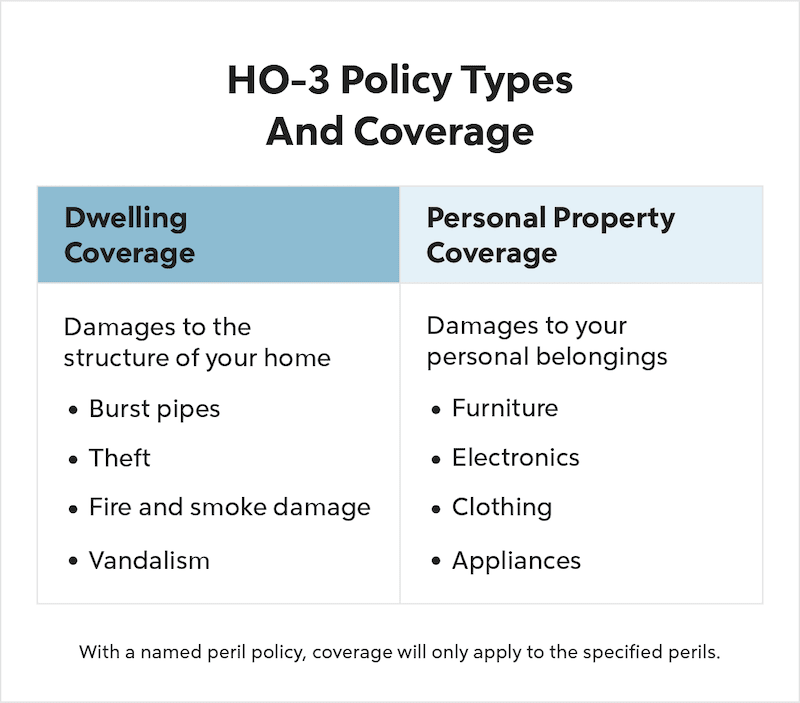

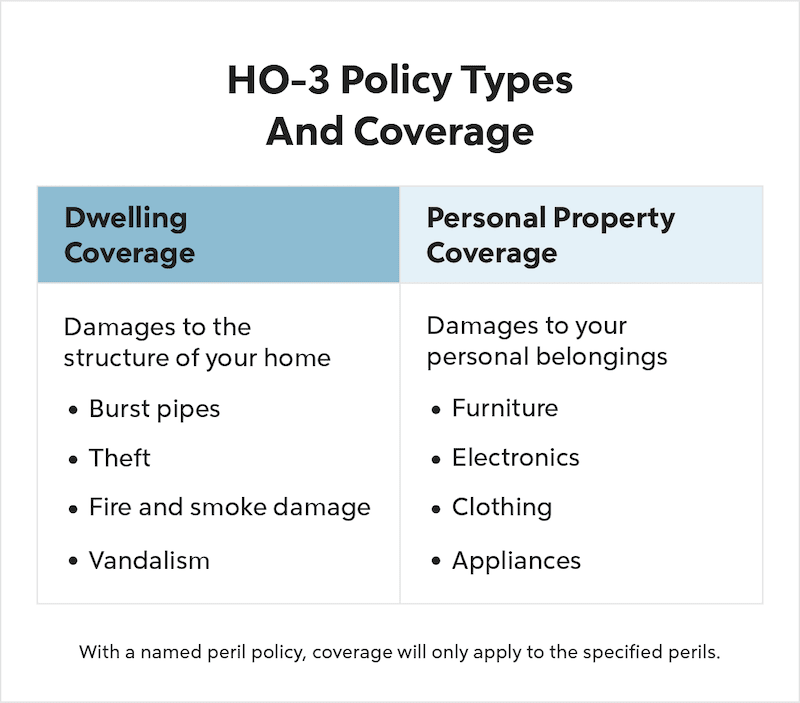

When it comes to homeowners insurance, it’s important to understand what is covered in terms of water damage. Most standard homeowners insurance policies provide coverage for water damage caused by sudden and accidental incidents, such as a burst pipe or a leaking roof. This basic coverage typically includes the cost of repairing or replacing damaged property, as well as any necessary cleanup and restoration.

Additional coverage options

While basic coverage may suffice for some homeowners, others may want to consider additional coverage options for water damage. These additional coverages can vary depending on the insurance provider, but common options include coverage for sewer backup, water damage caused by natural disasters, and coverage for personal belongings that may be damaged due to water-related incidents.

Exclusions and limitations

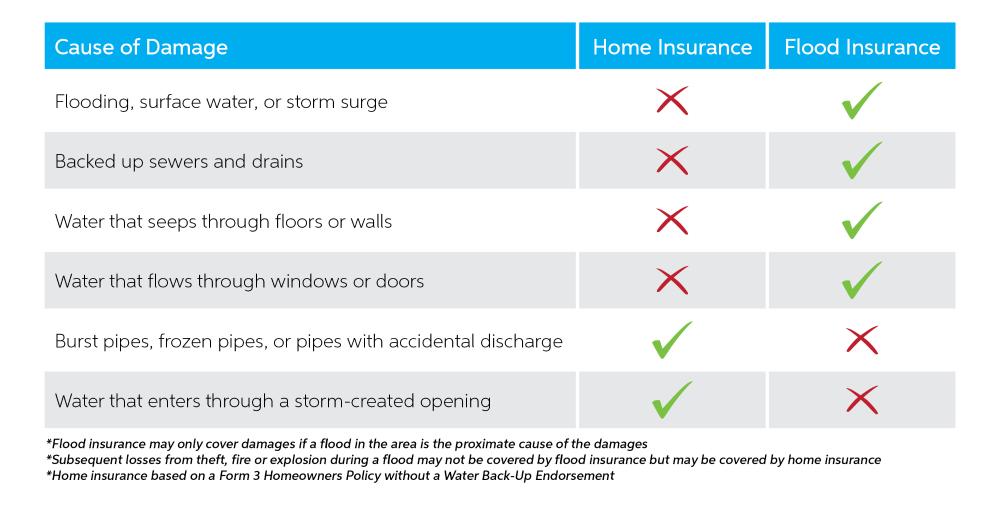

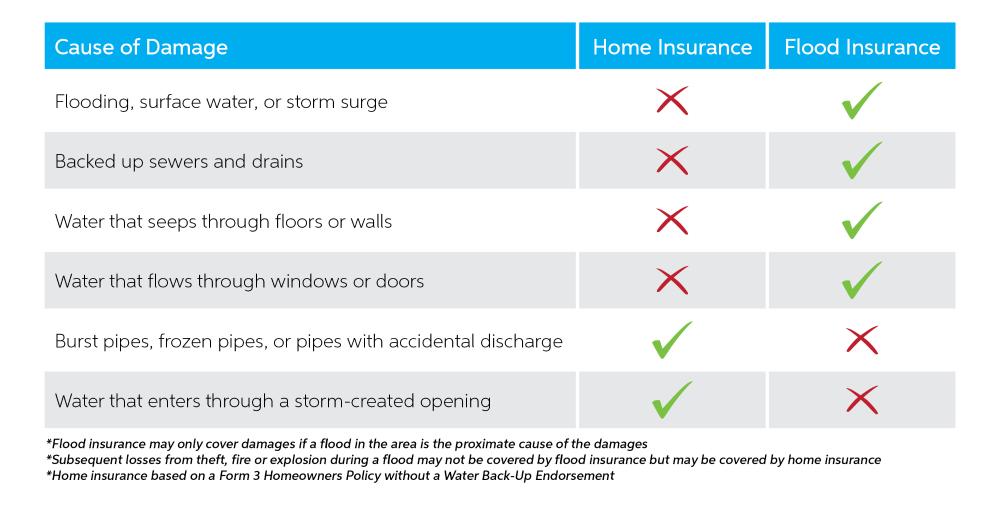

It’s important to note that homeowners insurance policies may also have certain exclusions and limitations when it comes to water damage. For example, damage caused by floods is generally not covered by standard homeowners insurance and would require a separate flood insurance policy. Additionally, some policies may have limitations on the amount of coverage provided for certain types of water damage, so it’s important to review your policy and understand any potential limitations before a water damage incident occurs.

Water Damage Coverage in Homeowners Insurance

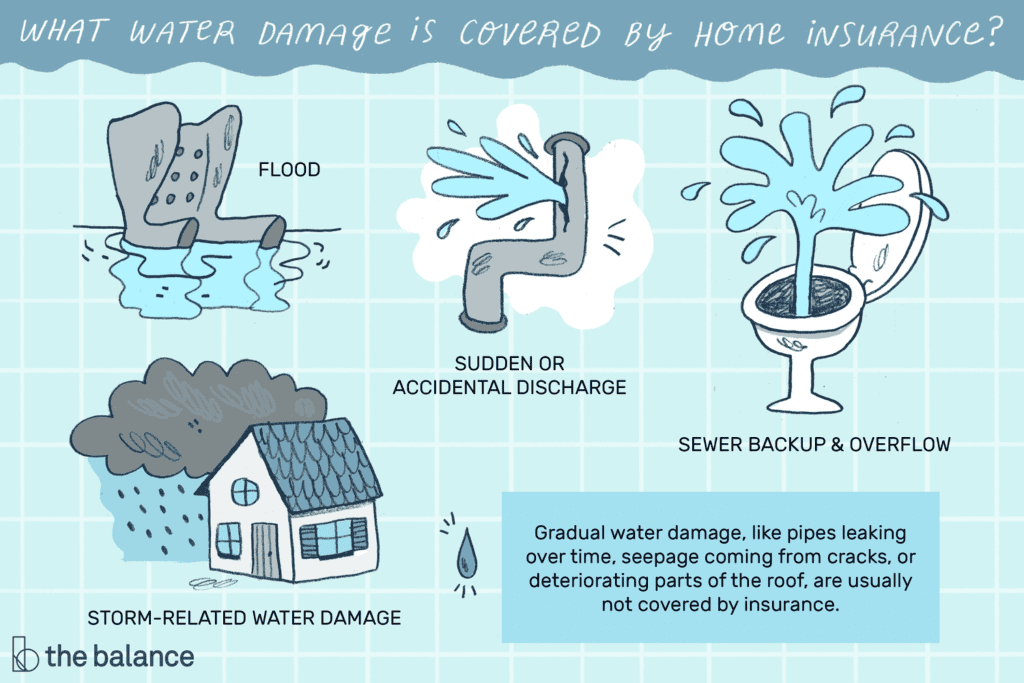

Types of water damage covered

Homeowners insurance typically covers various types of water damage that result from sudden and accidental incidents. This can include damage caused by burst pipes, overflowing toilets or sinks, leaking roofs, and even water damage from firefighting efforts. In these cases, homeowners insurance may cover the cost of repairs, cleanup, and restoration.

Types of water damage not covered

While homeowners insurance covers many types of sudden and accidental water damage, there are certain types that are typically not covered. One notable example is damage caused by floods. To protect against flood damage, homeowners would need to purchase separate flood insurance. Additionally, damage resulting from poor maintenance or negligence, such as a long-standing leak or gradual damage over time, may not be covered by homeowners insurance.

Flood vs. water damage

It’s important to understand the distinction between flood damage and water damage covered by homeowners insurance. Flood damage refers to damage caused by water that has inundated a property due to rising water levels, whether from heavy rains, rivers overflowing, or other natural disasters. Homeowners insurance typically does not cover flood damage and separate flood insurance is needed. On the other hand, water damage is typically covered by homeowners insurance when it is sudden, accidental, and not caused by a flood.

Common Causes of Water Damage

Burst pipes

Burst pipes are a common cause of water damage in homes. This can happen due to freezing temperatures, aging pipes, or excessive pressure. When a pipe bursts, it can release a substantial amount of water into the home, causing damage to walls, ceilings, floors, and belongings. The cost of repairs and restoration can be significant, which is why having homeowners insurance that covers burst pipe damage is crucial.

Leaky roofs

Leaky roofs can lead to water damage if left untreated. Heavy rain, aging materials, or poor installation can cause water to seep through the roof and into the home. Over time, this can result in rotting wood, damaged insulation, and even mold growth. Homeowners insurance that covers water damage from leaky roofs can help cover the costs of repairs and restoration.

Malfunctioning appliances

Appliances such as washing machines, dishwashers, and water heaters can malfunction and cause water damage. A faulty hose, a broken seal, or a leaking pipe within an appliance can release water and lead to significant damage if not addressed promptly. Having homeowners insurance that covers water damage caused by malfunctioning appliances can provide financial protection in such situations.

Sewer backups

Sewer backups are another common cause of water damage in homes. When the sewer system becomes clogged or overloaded, it can cause water and waste to back up into the home through toilets, sinks, or floor drains. This can result in extensive damage and pose health hazards due to the presence of sewage. Homeowners insurance that includes coverage for sewer backups can help cover the costs of cleanup, repairs, and even relocation expenses if necessary.

Natural disasters

Natural disasters such as hurricanes, tornadoes, or heavy storms can cause significant water damage to homes. High winds, heavy rainfall, and flooding can lead to water intrusion, structural damage, and destruction of personal belongings. While basic homeowners insurance policies typically cover damage from natural disasters, it’s important to review your specific policy to ensure you have adequate coverage for such events.

Understanding Water Damage Restoration

Water extraction

Water extraction is an essential step in the water damage restoration process. It involves removing standing water from the affected areas of the home using specialized equipment, such as pumps and vacuums. Prompt water extraction is crucial to prevent further damage and mitigate the risk of mold growth.

Structural drying

After water extraction, the affected areas of the home must undergo structural drying. This process involves using dehumidifiers, fans, and other drying equipment to remove moisture from the walls, floors, and furniture. Proper structural drying is vital to prevent mold growth and ensure the structural integrity of the home.

Mold remediation

Mold growth is a common issue following water damage. Mold can cause a variety of health issues and further damage to the home if not addressed promptly and effectively. Mold remediation involves removing existing mold, treating affected areas with antimicrobial agents, and implementing measures to prevent future mold growth.

Repair and reconstruction

Once the water damage has been mitigated and the affected areas are thoroughly dried and cleaned, repair and reconstruction can begin. This may include repairing or replacing damaged walls, flooring, insulation, and electrical systems. Depending on the extent of the damage, it may also involve rebuilding certain areas of the home.

Steps to Take When Experiencing Water Damage

Contacting your insurance company

The first step when experiencing water damage in your home is to contact your insurance company as soon as possible. Provide them with all the necessary details about the incident, including the cause of the damage and the extent of the water intrusion. Your insurance company will guide you through the claims process and provide instructions on how to proceed.

Mitigating further damage

To prevent further damage, it’s important to take immediate action to mitigate the effects of water damage. This may involve shutting off the main water supply, if possible, to stop the source of water intrusion. It’s also important to remove or protect valuable possessions, furniture, and electronics from the affected areas. Additionally, if it’s safe to do so, opening windows and using fans can help facilitate drying.

Documenting the damage

When experiencing water damage, it’s crucial to document the extent of the damage for insurance purposes. Take photos and videos of the affected areas, including any damaged belongings or property. Keep a detailed record of all expenses related to the water damage, such as cleanup and restoration costs, as well as any temporary living expenses if you’re unable to stay in your home during repairs.

Getting professional help

Water damage restoration is a complex process that requires specialized knowledge and equipment. It’s best to seek professional help from qualified water damage restoration professionals. They have the expertise to assess the extent of the damage, provide a detailed plan for restoration, and execute the necessary repairs and cleanup. Working with professionals ensures that the water damage is properly addressed and minimizes the risk of further complications.

Coverage Limits and Deductibles

Policy coverage limits

When it comes to water damage coverage, homeowners insurance policies may have coverage limits. Coverage limits refer to the maximum amount the insurance company will pay for a covered claim. These limits can vary depending on the policy and may be specified for different types of water damage incidents. It’s important to review your policy to understand your coverage limits and ensure they align with your needs.

Determining deductibles

A deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. When it comes to water damage claims, your homeowners insurance policy will typically have a deductible. The specific deductible amount may vary depending on the policy and could be a fixed dollar amount or a percentage of your overall coverage. It’s important to understand your deductible and factor it into your financial planning for any potential water damage claims.

Special coverage considerations

Depending on your location, the age of your home, and other factors, there may be specific coverage considerations to keep in mind. For example, homeowners in areas prone to hurricanes or floods may need to purchase additional coverage beyond what is offered in a standard homeowners insurance policy. It’s crucial to assess your specific needs and discuss them with your insurance agent to ensure you have adequate coverage for potential water damage incidents.

Costs Associated with Water Damage

Insurance premiums

The cost of homeowners insurance premiums can vary depending on numerous factors, including the coverage amount, the deductible, the location of the home, and the homeowner’s claims history. Generally, homeowners with higher coverage limits and lower deductibles can expect higher premiums. It’s important to consider the cost of insurance premiums when assessing the overall cost associated with potential water damage incidents.

Out-of-pocket expenses

Even with homeowners insurance coverage, there may still be out-of-pocket expenses associated with water damage. This can include any deductible amounts that need to be paid before insurance coverage applies, as well as expenses that exceed the coverage limits specified in the policy. It’s important to be aware of these potential out-of-pocket expenses and budget accordingly.

Additional living expenses

In some cases, water damage can render a home uninhabitable. If you’re unable to stay in your home during the restoration process, you may incur additional living expenses, such as hotel or rental costs. Some homeowners insurance policies include coverage for these additional living expenses. Review your policy to understand if this coverage is included and what limits are in place.

Tips for Preventing Water Damage

Regular maintenance

One of the best ways to prevent water damage is through regular maintenance of your home’s plumbing and water-related systems. This includes inspecting and repairing any leaks, ensuring proper drainage around the foundation, and periodically checking appliances and fixtures for signs of wear or damage. By addressing any potential issues early on, you can prevent water damage before it becomes a major problem.

Proper insulation

Proper insulation in your home can help prevent water damage caused by freezing pipes during cold weather. Insulating exposed pipes, especially in attics, basements, and crawl spaces, can prevent them from freezing and potentially bursting. Additionally, insulating walls and roofs can help prevent leaks and excessive moisture buildup.

Monitoring water usage

Monitoring your water usage can help identify any sudden increases that may indicate a leak or other water-related issue. Keep an eye on your water bills and be alert to any unexpected spikes in usage. If you notice any significant changes, investigate the cause promptly to prevent further damage and higher water bills.

Installing water detection devices

Installing water detection devices, such as leak sensors and automatic shut-off valves, can provide early warnings and prevent water damage from worsening. These devices can detect leaks or excessive moisture and sound an alarm or automatically shut off the water supply to mitigate the damage. Investing in these technologies can save you from costly repairs and insurance claims.

Making a Water Damage Claim

Contacting the insurance company

When experiencing water damage that is covered by your homeowners insurance, it’s important to contact your insurance company as soon as possible to initiate the claims process. Provide them with all the necessary details about the incident, including the cause of the damage, the extent of the damage, and any supporting documentation you have gathered.

Providing evidence of damage

To support your water damage claim, it’s important to provide evidence of the damage to your insurance company. This can include photographs, videos, and documents related to the incident. The more detailed and thorough your documentation, the easier it will be for your insurance company to assess and process your claim.

Working with claims adjusters

After you have filed a water damage claim, an insurance claims adjuster will be assigned to evaluate the damage and determine the appropriate coverage. Cooperate fully with the claims adjuster and provide any additional information or documentation they may request. Be prepared to answer questions and provide any necessary evidence to support your claim.

Claim payouts and coverage

Once your water damage claim has been evaluated and processed, your insurance company will provide a payout based on the coverage specified in your policy. Keep in mind that there may be deductibles and coverage limits that apply. Review the settlement offer carefully and contact your insurance company if you have any questions or concerns about the payout or coverage.

Other Considerations for Water Damage

Secondary damage and hidden costs

Water damage can lead to secondary damage and hidden costs that may not be immediately apparent. For example, prolonged exposure to water and moisture can result in mold growth, which requires additional remediation and restoration efforts. Additionally, there may be hidden damage within walls, ceilings, or under flooring that only becomes evident during the restoration process. It’s important to be prepared for any potential secondary damage and hidden costs that may arise during water damage restoration.

When to seek legal advice

In some cases, disputes may arise between homeowners and insurance companies regarding water damage claims. If you believe your claim has been unjustly denied or if you encounter issues with the claims process, you may want to seek legal advice. An experienced insurance attorney can help you navigate the complexities of your policy and guide you through any legal action that may be necessary.

Water damage coverage for renters

While homeowners insurance primarily protects the structure and contents of a home, renters also have water damage coverage options. Renters insurance typically includes coverage for water damage caused by sudden and accidental incidents, similar to homeowners insurance. Renters should review their policies to understand the coverage limits and any specific exclusions that may be applicable.

In conclusion, water damage can pose significant risks and financial burdens for homeowners. Understanding the coverage provided by homeowners insurance, as well as the steps to take in the event of water damage, is essential. By being proactive in prevention, having the right insurance coverage, and taking immediate action in the event of water damage, homeowners can effectively mitigate the costs and challenges associated with water-related incidents.