Living in a multi-story building can have its advantages, but it can also lead to unexpected challenges. One such challenge arises when the upstairs owner’s insurance fails to cover damages caused by a leak or other incidents. In such a situation, it’s natural to wonder what legal options are available to you as the affected downstairs owner. In the following article, we will explore the potential paths you can take to seek recourse and understand how you can protect your rights in the event of such an insurance shortfall. So, let’s dive into the world of legal options and find out how you can navigate through this complex situation.

What Are My Legal Options If The Upstairs Owner’s Insurance Denies My Claim

If the upstairs owner’s insurance denies your claim, it can be a frustrating and stressful situation, especially if you have suffered damages or losses that should be covered by their policy. However, you do have legal options available to you in such cases. Here are some steps you can take if you find yourself in this situation.

Firstly, it is essential to carefully review the denial letter from the upstairs owner’s insurance. Look for specific reasons why your claim was denied and evaluate whether those reasons are valid. Insurance policies can be complex documents, so it might be helpful to consult with an attorney who specializes in insurance law. They can analyze your specific situation and advise you on the best course of action.

If you believe that the denial of your claim is unjust, you can file an appeal with the insurance company. Many insurance companies have an internal appeal process that allows you to present additional evidence or challenge their decision. Be sure to gather any supporting documentation, such as photographs, receipts, or witness statements, that can help strengthen your case.

If the internal appeal process does not resolve your claim, you may consider pursuing legal action against the upstairs owner’s insurance company. In some cases, this may involve filing a lawsuit. An attorney can guide you through the litigation process, help build a strong case on your behalf, and represent your interests in negotiations or court proceedings.

Keep in mind that insurance laws can vary from state to state, so it is crucial to consult with an attorney familiar with the specific laws in your jurisdiction. They can provide you with tailored advice and ensure that you understand your rights and options under the applicable laws.

What Are My Legal Options If The Upstairs Owner’s Insurance Does Not Cover the Damages Fully

If the upstairs owner’s insurance does not cover the damages fully, you may have legal options to pursue the remaining amount. Insurance policies typically have coverage limits and exclusions, which means that some damages may not be fully covered. In such cases, here’s what you can do.

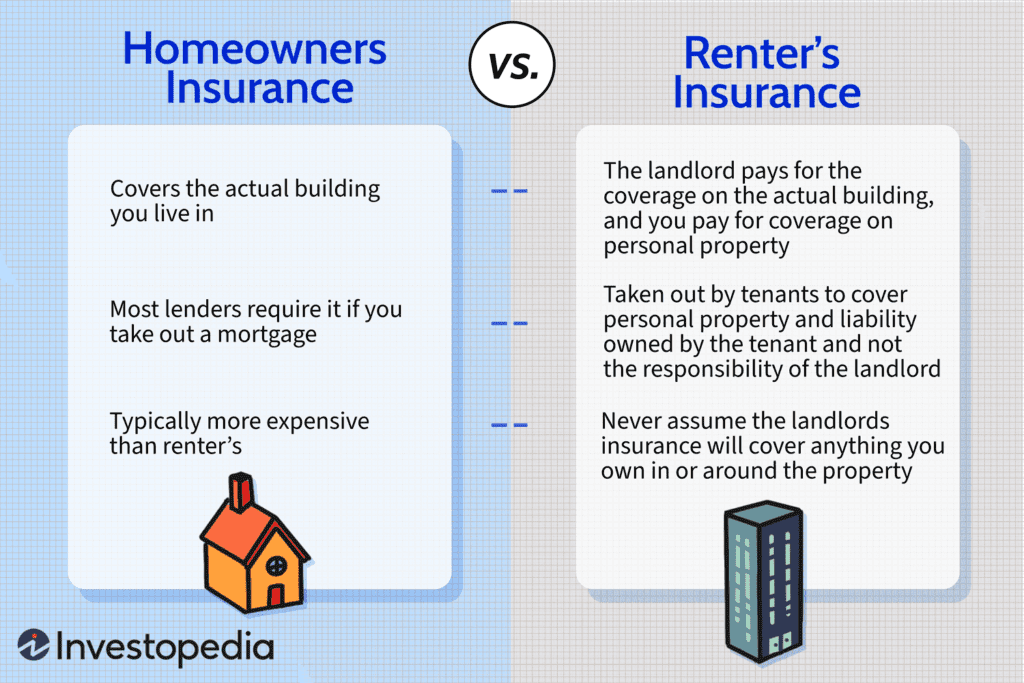

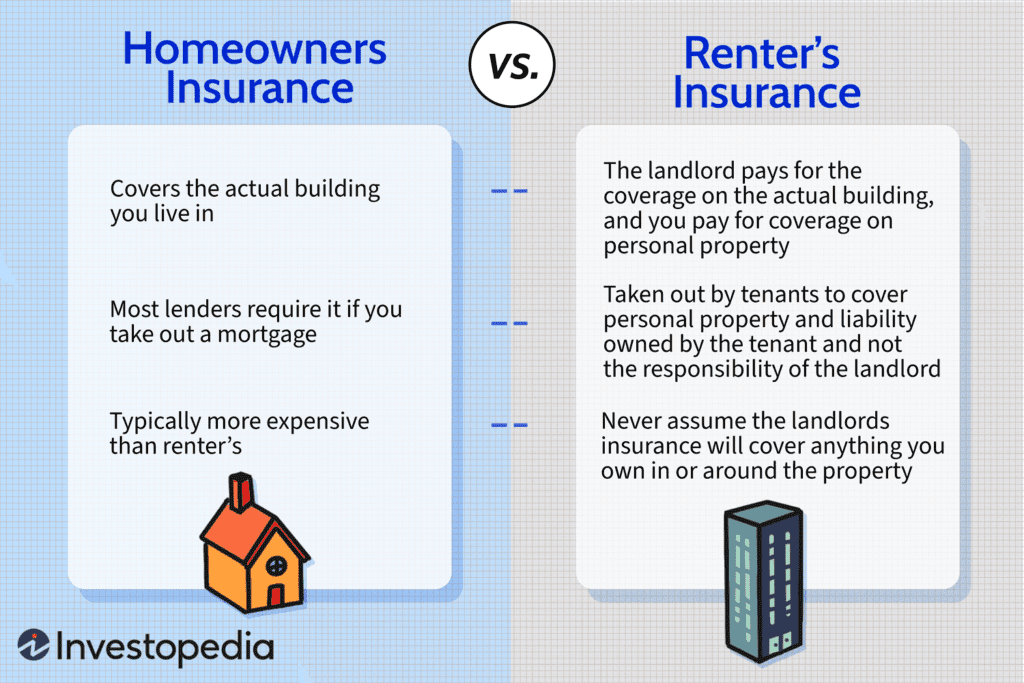

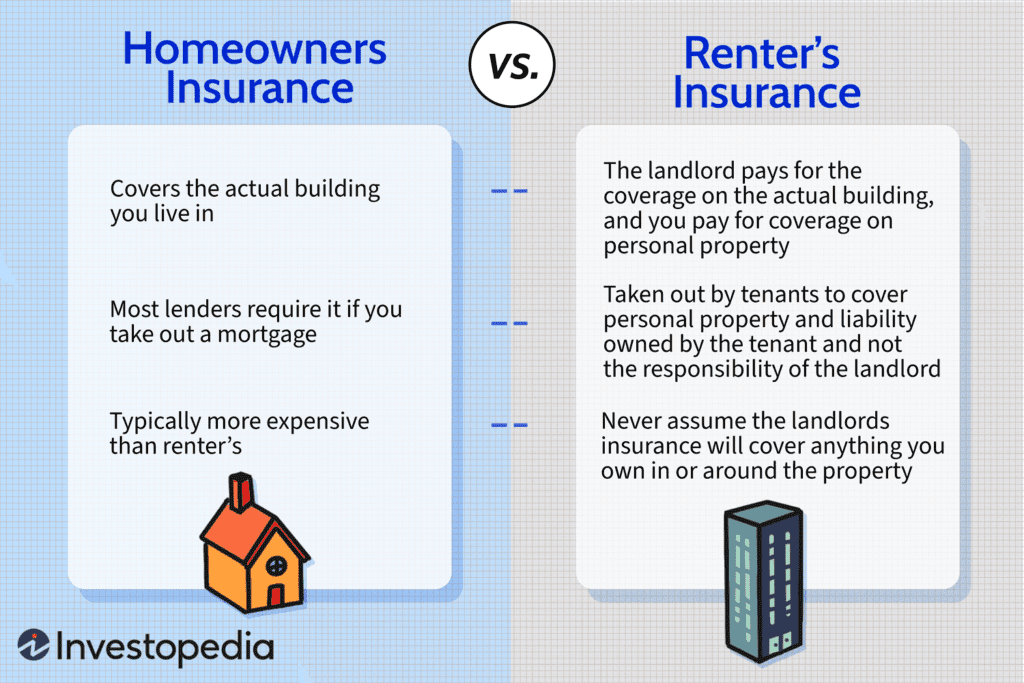

First, review your own insurance policy to determine if you have any coverage that can compensate for the remaining damages. For example, if you have homeowner’s insurance or renter’s insurance, your policy may provide coverage for certain losses or damages. Contact your insurance provider to understand your coverage options and file a claim if applicable.

If you do not have additional insurance coverage, you can consider negotiating with the upstairs owner’s insurance company. Insurance policies often have a process for filing a supplemental claim or disputing coverage decisions. Contact the insurance company and provide any supporting documentation, such as repair estimates or expert evaluations, to demonstrate the extent of the damages. Engaging in open and respectful communication with the insurance company can sometimes lead to a resolution.

If negotiations with the insurance company are unsuccessful, consulting with an attorney experienced in insurance law can be beneficial. They can navigate the complexities of insurance policies, help determine if the denial of coverage is lawful, and advise you on the best legal course of action. In some cases, it may be necessary to pursue legal action against the upstairs owner’s insurance company to seek fair compensation for the damages.

What Are My Legal Options If The Upstairs Owner’s Insurance Delays the Claim Process

If the upstairs owner’s insurance unnecessarily delays the claim process, it can cause significant inconvenience and financial strain. Insurance companies are typically required to handle claims promptly and in good faith. If you find yourself facing delays, here are some legal options to consider:

Start by reviewing the terms of the insurance policy. Familiarize yourself with any provisions related to claim processing timeframes or good faith obligations. These terms can help you determine if the insurance company is violating its contractual obligations.

Document the delays and keep a record of all communication with the upstairs owner’s insurance company. This includes emails, letters, phone calls, and any other correspondence related to your claim. Be sure to note dates and times, names of representatives you speak with, and the content of the conversations.

If the delays continue, consider submitting a written complaint to the insurance company’s internal grievance department. Many insurance companies have dedicated departments responsible for handling customer complaints. Clearly outline the issues you have encountered, provide supporting documentation, and request a prompt resolution.

If internal complaint processes do not resolve the issue, you may file a complaint with your state insurance regulator. Each state has a department or agency responsible for regulating insurance companies. They can investigate complaints against the insurance company and potentially take disciplinary actions if violations are found.

In more serious cases, where the delays are substantial and causing significant harm, consulting with an attorney experienced in insurance law can be beneficial. They can evaluate your situation, advise you on your legal rights, and help you take appropriate legal action against the upstairs owner’s insurance company if necessary.

What Are My Legal Options If The Upstairs Owner’s Insurance Provides a Low Settlement Offer

When the upstairs owner’s insurance offers a low settlement for your claim, it can be frustrating and discouraging. However, there are legal options available to help ensure you receive fair compensation for your losses or damages. Here’s what you can do:

First, thoroughly review the settlement offer and compare it to the damages you have suffered. If you believe that the offer does not adequately cover your losses, gather supporting documentation to substantiate your claim. This can include repair estimates, medical bills, expert evaluations, or any other evidence that demonstrates the extent of your damages.

Consider negotiating with the upstairs owner’s insurance company. You can respond to their offer with a counteroffer, supported by the documentation you have gathered. Engage in open and respectful communication, clearly explaining why you believe their offer is insufficient and providing evidence to support your counteroffer.

If negotiations do not result in a satisfactory settlement, consult with an attorney experienced in insurance law. They can evaluate your case, assess the fairness of the insurance company’s offer, and advise you on the best legal course of action. In some instances, it may be necessary to file a lawsuit against the upstairs owner’s insurance company to seek fair compensation for your losses or damages.

Keep in mind that insurance laws can vary by jurisdiction, so it is crucial to consult with an attorney familiar with the specific regulations in your state. They can provide guidance tailored to your circumstances and ensure that you understand your legal rights and options.

What Are My Legal Options If The Upstairs Owner’s Insurance Refuses to Communicate

If the upstairs owner’s insurance refuses to communicate with you regarding your claim, it can create unnecessary difficulties and delays in the resolution process. However, you do have legal options to encourage the insurance company to engage in communication. Here’s what you can do:

Make sure you have made all reasonable efforts to contact the insurance company. Document your attempts, including dates, times, and methods of communication. Save any correspondence or evidence that can demonstrate your efforts to engage in communication.

Send a formal written request to the upstairs owner’s insurance company, requesting communication and a response to your inquiries. Clearly indicate that their lack of communication is impeding the resolution of your claim and that you expect a prompt response. Send the request via certified mail or another method that provides proof of delivery.

If the insurance company still does not respond, you may file a complaint with your state insurance regulator. Provide the regulator with a detailed account of your communication attempts, the lack of response from the insurance company, and any supporting documentation. The regulator can investigate your complaint and potentially take action against the insurance company for non-compliance with communication obligations.

If all else fails, consulting with an attorney experienced in insurance law can help you navigate the situation. They can evaluate your circumstances, advise you on your legal rights, and suggest the most appropriate legal action to encourage the upstairs owner’s insurance company to fulfill their communication obligations.

Remember, it is important to consult with an attorney familiar with the laws in your jurisdiction to ensure you understand your rights and options based on your specific circumstances.

What Are My Legal Options If The Upstairs Owner’s Insurance Has Policy Exclusions

When the upstairs owner’s insurance has policy exclusions that prevent coverage for certain damages, it can be disheartening. However, depending on the specifics of your situation, you may still have legal options. Here’s what you can consider:

Carefully review the insurance policy to understand the specific exclusions that apply to your claim. Exclusions are typically outlined in the policy’s terms and conditions. If the policy language is unclear or confusing, consult with an attorney experienced in insurance law. They can help interpret the language and explain how it applies to your situation.

If you believe the exclusions cited by the upstairs owner’s insurance are being misapplied or unjustly invoked, gather any supporting evidence that demonstrates the coverage should apply. This can include expert opinions, relevant case law, or industry standards.

Engage in respectful and open communication with the insurance company. Seek clarification on the reasons behind the exclusions and provide any evidence or arguments that support your position. The insurance company may reconsider their position if presented with compelling evidence.

If the insurance company continues to rely on policy exclusions to deny your claim, or if you believe their interpretation of the exclusions is incorrect, consulting with an attorney is advisable. They can evaluate the policy language, examine the facts of your situation, and advise you on the best course of action. In some cases, it may be necessary to pursue legal action against the upstairs owner’s insurance company to challenge the exclusion and seek coverage for the damages.

Remember, insurance laws can vary from state to state, so it is crucial to consult with an attorney familiar with the laws in your jurisdiction. They can provide you with personalized advice based on the specific regulations applicable to your circumstance.

What Are My Legal Options If The Upstairs Owner’s Insurance Acts in Bad Faith

Discovering that the upstairs owner’s insurance has acted in bad faith toward your claim can be deeply distressing. Insurance companies have a legal duty to act in good faith and deal fairly with policyholders. If you believe the insurance company has acted in bad faith, here are some legal options you can consider:

Document all interactions with the upstairs owner’s insurance company and gather any evidence that supports your claim of bad faith. This can include emails, letters, or other communication that shows the insurer’s unfair or deceptive practices.

Consult with an attorney experienced in insurance law to evaluate your situation. They can review your documentation, assess the insurer’s actions, and determine if there are grounds for a bad faith claim.

If it is determined that the insurer has indeed acted in bad faith, your attorney can guide you through the process of filing a bad faith insurance claim. This typically involves sending a formal demand letter outlining the insurer’s wrongful conduct and the damages suffered as a result. In some cases, the demand letter alone may prompt the insurer to reconsider their actions and offer a fair resolution.

If the insurer does not respond satisfactorily to the demand letter, your attorney can help you file a lawsuit against the upstairs owner’s insurance company alleging bad faith. In such a lawsuit, you may seek compensatory damages, which can include the amount owed under the policy, as well as additional damages for emotional distress or other harm caused by the insurer’s bad faith conduct.

Keep in mind that bad faith claims can be complex and vary significantly based on state laws. Consulting with an attorney experienced in bad faith insurance claims is crucial to understand your legal rights and navigate the process effectively.

What Are My Legal Options If The Upstairs Owner’s Insurance Does Not Exist

If you discover that the upstairs owner’s insurance does not exist, it can be concerning, especially if you are facing damages or losses that should be covered. While the absence of insurance complicates the resolution process, there are still legal options you can explore:

Review the terms of your own insurance policy. If you have homeowner’s insurance or renter’s insurance, check if your policy covers damages caused by the upstairs neighbor or other liable parties. Your policy may provide coverage for such situations, and you can file a claim with your insurance provider.

Evaluate if the upstairs owner has personal assets or liability insurance outside of the absent insurance policy. If they do, you may consider pursuing a legal claim directly against the owner. Consult with an attorney specialized in personal injury or property damage cases to assess the viability of such a claim and guide you through the legal process.

Consult with an attorney experienced in insurance law to explore additional legal avenues. Depending on the circumstances, there may be other potential liable parties, such as property management companies or landlords, that can be pursued for compensation.

In severe cases where financial recovery seems unlikely, you may need to consider absorbing the costs yourself. However, consulting with an attorney is still advisable, as they can help ensure you understand all available options and potential legal repercussions.

Remember, laws and legal options can vary depending on the jurisdiction and specific details of your case. Consulting with an attorney experienced in insurance law and personal injury or property damage cases is crucial to receive personalized advice based on your circumstances.

What Are My Legal Options If The Upstairs Owner’s Insurance Wrongly Attributes Fault

When the upstairs owner’s insurance wrongly attributes fault to you, it can be frustrating and can hinder your ability to obtain fair compensation for damages or losses. If you believe the insurance company has mistakenly assigned fault, consider the following legal options:

Gather any evidence that demonstrates your lack of fault or supports an alternative theory of liability. This can include photographs, witness statements, or expert opinions. Documentation that contradicts the insurance company’s account can significantly strengthen your case.

Engage in open and respectful communication with the upstairs owner’s insurance company. Clearly explain why you believe their attribution of fault is erroneous, providing the evidence you have gathered to support your argument. The insurer may reconsider their decision if presented with convincing evidence.

If negotiations and communication with the insurance company do not resolve the issue, consult with an attorney experienced in insurance law. They can evaluate the evidence, assess the insurance company’s attribution of fault, and advise you on the best legal course of action.

In some cases, it may be necessary to file a lawsuit against the upstairs owner’s insurance company to challenge their attribution of fault. An attorney can guide you through the litigation process, represent your interests, and argue your case in court to seek a fair resolution.

Remember, laws surrounding fault attribution can vary from state to state, so it is important to consult with an attorney familiar with the laws in your jurisdiction. They can provide you with personalized advice based on the specific legal requirements of your circumstance.

What Are My Legal Options If The Upstairs Owner’s Insurance Cancels the Policy

If the upstairs owner’s insurance cancels their policy, it can complicate the claims process and potentially leave you without coverage for damages or losses. In such cases, there are legal options available to protect your rights and seek compensation.

Review the terms of your own insurance policy. If you have homeowner’s insurance or renter’s insurance, check if your policy includes coverage for damages caused by third parties or situations where the responsible party’s insurance has been canceled. Your policy may provide coverage for such scenarios, and you can file a claim with your insurance provider.

Consult with an attorney experienced in insurance law to understand your legal rights and options. They can help evaluate the circumstances surrounding the cancellation of the upstairs owner’s policy and guide you through the claims process.

Investigate the reasons behind the cancellation of the upstairs owner’s insurance policy. If the cancellation was unjust or in violation of laws or regulations, consult with your attorney about potential legal action against the insurance company.

If your attorney determines that there is no viable insurance coverage available, they can assist you in exploring other legal avenues for compensation. This may include pursuing a legal claim directly against the upstairs owner or any other potentially liable parties.

Remember, insurance laws and legal options can vary widely based on the specific details of your case and the jurisdiction you are in. Consulting with an attorney experienced in insurance law and personal injury or property damage cases is crucial to receive personalized advice tailored to your circumstances.