Have you ever wondered if you can ask your insurance provider for a lower rate? Well, the good news is that the answer is yes! In this article, we will explore the possibility of negotiating a lower rate with your insurance company. Whether you’re looking to save some extra money or seeking a better deal, we’ll provide you with tips and insights to help you navigate this process. So, let’s dive in and find out how you can potentially lower your insurance rate with a simple ask.

Can I Ask My Insurance For A Lower Rate?

Understanding Insurance Rates

When it comes to insurance, one of the most common questions people have is whether they can ask their insurance provider for a lower rate. Insurance rates are determined by several factors, such as the type of insurance you have, your personal circumstances, and the risk factors associated with your coverage. It’s important to understand that insurance companies base their rates on statistical data and actuarial calculations, which helps them determine the likelihood of a claim being filed. However, that doesn’t mean you can’t try to negotiate for a lower rate.

Factors Affecting Insurance Rates

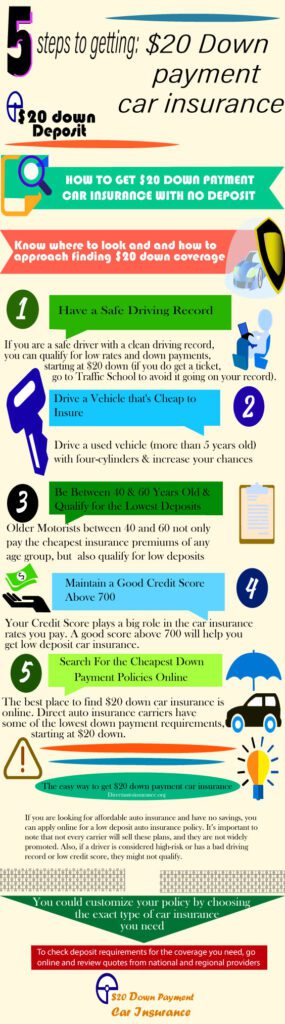

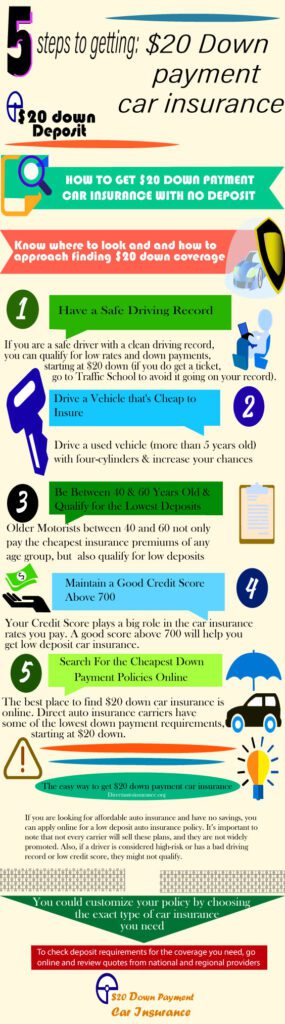

Before reaching out to your insurance company, it’s crucial to have a clear understanding of the factors that affect your insurance rates. These factors can vary depending on the type of insurance you have. For example, when it comes to auto insurance, factors such as your age, driving record, type of vehicle, and even your credit score can all play a role in determining your premium. Similarly, with home insurance, factors such as the age and condition of your home, its location, and the coverage limits you choose can all impact your rates. By understanding these factors, you’ll be better equipped to evaluate whether you’re paying a fair price for your coverage.

Researching Competitive Rates

One of the best ways to determine whether you’re paying too much for insurance is by researching competitive rates. Start by obtaining quotes from different insurance providers that offer the same type of coverage you currently have, or are looking to purchase. Comparing these quotes will give you a better idea of the average rates in the market and allow you to evaluate whether your current rate falls within a reasonable range. Remember, it’s not just about finding the cheapest rate, but rather finding the best value for the coverage you need.

Evaluating Your Coverage Needs

While researching competitive rates can be helpful, it’s also essential to evaluate your coverage needs. This means considering the amount and type of coverage you require to adequately protect yourself and your assets. Sometimes, the reason for a high insurance rate is that you have more coverage than you actually need. If you find that you’re overinsured, you could potentially lower your rate by adjusting your coverage limits. On the other hand, if you find that your coverage limits are too low, it might be worth paying a slightly higher premium for increased protection. Evaluating your coverage needs will help you determine whether your current rate is justified or if there are opportunities to reduce it.

Tips for Negotiating Lower Rates

Once you have a clear understanding of your insurance rates, you can begin the process of negotiating for a lower rate. Here are some tips to help you in this process:

-

Do Your Homework: Before reaching out to your insurance provider, gather as much information as possible. Research similar policies, understand market rates, and be prepared to discuss your findings.

-

Be a Loyal Customer: If you have been a long-standing customer with a good track record, don’t hesitate to mention your loyalty when negotiating. Insurance companies appreciate loyal customers and may be willing to offer you a better rate or additional discounts.

-

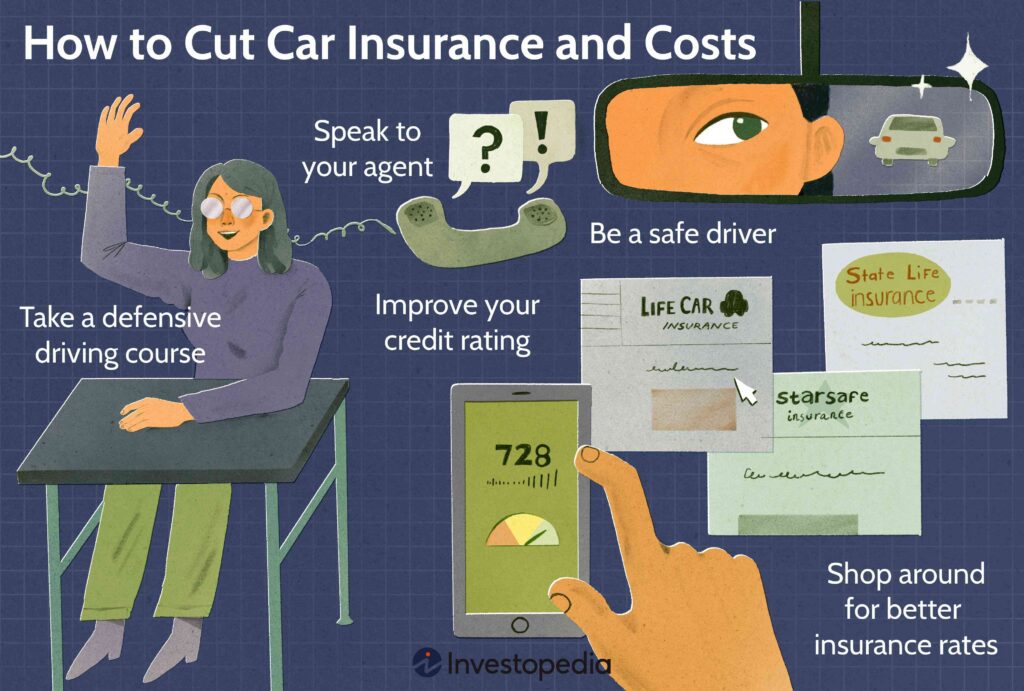

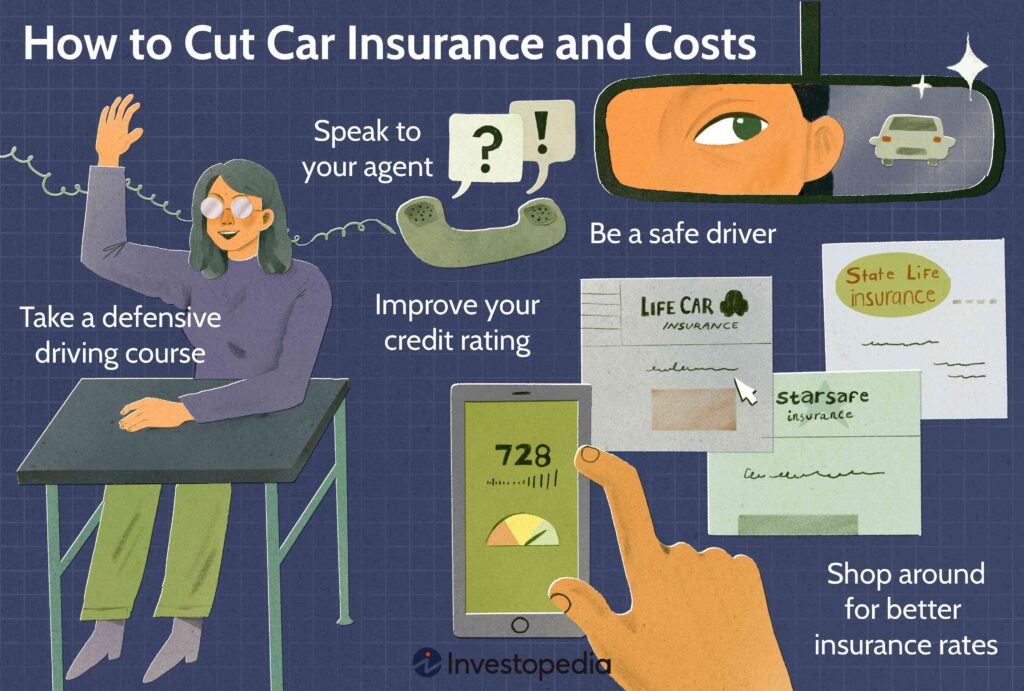

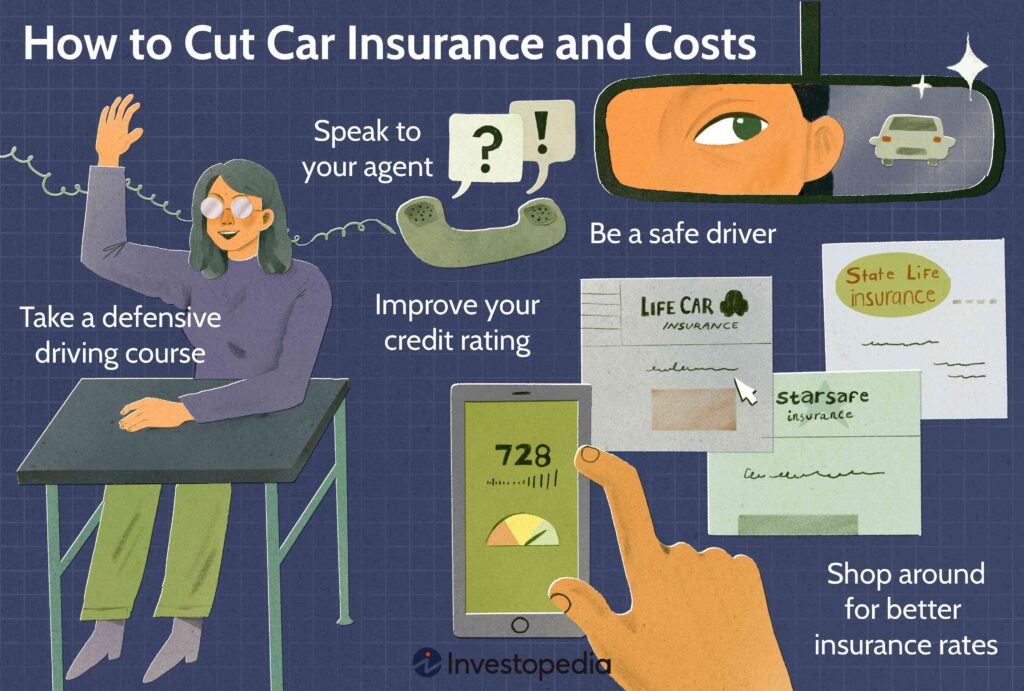

Improve Your Risk Profile: Take steps to improve your risk profile. For example, if you’re an auto insurance policyholder, maintaining a clean driving record and attending defensive driving courses can lower your premiums.

-

Bundle Your Policies: Consider bundling multiple policies with the same insurance provider. Many companies offer discounts for customers who have multiple types of coverage, such as home and auto insurance.

Leveraging Your Loyalty

As mentioned earlier, insurance companies value loyalty. If you have been insured with the same company for a significant period and have a positive history, it’s worth leveraging your loyalty when negotiating for a lower rate. Reach out to your insurance provider, highlight your long-standing relationship, and politely inquire if there are any opportunities for rate reductions or discounts. Sometimes, just asking can make a difference and help you secure a lower rate.

Utilizing Discount Programs

Insurance companies often offer various discount programs that policyholders can take advantage of to lower their rates. These programs are designed to reward customers for certain actions or affiliations that reduce risk. Examples of discount programs include safe driver discounts, student discounts, military discounts, and many more. Take the time to inquire about these programs with your insurance provider and see if you qualify for any discounts that can help reduce your rates.

Considering Bundling Options

Bundling your insurance policies is another effective way to lower your rates. By combining different types of coverage, such as home and auto insurance, with the same provider, you may be eligible for a significant discount. Not only does bundling simplify your insurance needs by having a single point of contact, but it can also result in substantial savings on your premiums.

Seeking Professional Help

If negotiating with your insurance provider seems overwhelming or if you’re not getting the results you desire, seeking professional help might be a good option. Insurance brokers or independent agents who specialize in finding the best insurance rates for their clients can be a valuable resource. They have the knowledge and expertise to navigate the insurance landscape, and they can help you find the most competitive rates while ensuring you have the coverage you need.

Reviewing and Revising Coverage Regularly

Lastly, it’s crucial to regularly review and revise your insurance coverage. As your circumstances change, so do your insurance needs. Life events such as buying a new car, moving to a different location, or renovating your home can all impact your insurance rates. Additionally, as you age, your risk profile may change, making it necessary to reassess your coverage. By reviewing and revising your coverage regularly, you can ensure you’re not overpaying for insurance and that your rates accurately reflect your current situation.

In conclusion, while there are no guarantees, it is possible to ask your insurance provider for a lower rate. By understanding insurance rates, researching competitive options, evaluating your coverage needs, and effectively negotiating, you can increase the likelihood of securing a lower rate. Additionally, leveraging your loyalty, utilizing discount programs, considering bundling options, seeking professional help, and regularly reviewing your coverage are all strategies that can potentially save you money. Remember, the key is to approach the negotiation process with confidence, knowledge, and a friendly tone to maximize your chances of success.