Imagine this scenario: your home has recently been impacted by a devastating water damage incident, leaving you feeling helpless and overwhelmed. To add to your frustrations, your insurance provider, State Farm, is denying your claim for coverage. As you ponder your next steps, the question looms in your mind: should you take legal action and sue? In this article, we will explore the intricacies of State Farm denying a water-damage claim and delve into the considerations and options you should weigh before making such a decision. You don’t have to face this predicament alone – read on to discover the best path forward.

Understanding Water Damage Claims

Water damage claims are a common occurrence for homeowners and renters alike. Understanding the ins and outs of these claims is crucial when it comes to protecting your property and finances. Water damage refers to any damage caused by the presence or intrusion of water that affects a structure or its contents. This can range from minor issues such as a leaking pipe to major disasters like floods or burst sewer lines.

Types of Water Damage

Water damage can come in various forms, each with its own set of challenges. The most common types of water damage include:

-

Flood Damage: This occurs when water overflows and inundates an area, whether it is due to heavy rain, melting snow, or a natural disaster. Flood damage can cause extensive destruction to both the structure and belongings within the affected property.

-

Leaks and Plumbing Issues: These are the most common causes of water damage in homes. Leaky pipes, faulty plumbing systems, and malfunctioning appliances can lead to slow leaks or sudden bursts, causing damage to walls, floors, and personal belongings.

-

Roof Damage: A damaged or improperly installed roof can allow water to seep through, leading to leaks, mold growth, and structural issues. This type of water damage is often not immediately noticeable and can cause long-term damage if left unaddressed.

-

Sewer Backup: When the sewer system becomes overwhelmed, it can result in sewage backing up into homes or basements. Sewer backup poses serious health risks and can cause significant damage to a property’s structure and belongings.

Common Causes of Water Damage

While water damage can happen unexpectedly, there are several common causes to be aware of. Understanding these causes can help you take preventive measures to minimize the risk of water damage. Some common causes of water damage include:

-

Weather-related Events: Heavy rain, storms, hurricanes, or snowmelt can all lead to water damage. Poor drainage, lack of proper grading, or inadequate waterproofing can exacerbate the problem.

-

Faulty Plumbing: Aging or poorly maintained plumbing systems can develop leaks, bursts, or pipe corrosion, leading to water damage within walls, floors, or ceilings.

-

Appliance Malfunctions: Water heaters, washing machines, dishwashers, and other household appliances can malfunction and cause water damage. These malfunctions can arise from defective parts, poor installation, or lack of regular maintenance.

-

Roof and Gutter Issues: Damaged or improperly installed roofs, clogged gutters, or missing shingles can allow water to seep into the building, leading to water damage over time.

Preventing water damage is essential, but even with the best precautions, accidents can still happen. That’s where insurance coverage becomes crucial.

Insurance Coverage for Water Damage

Does State Farm cover water damage claims?

If you are a policyholder with State Farm, you may wonder if your water damage claim will be covered. State Farm typically provides coverage for water damage caused by sudden and accidental events, such as burst pipes or appliance malfunctions. However, it’s important to review your policy’s specific terms and conditions to understand the extent of your coverage.

Policy Exclusions for Water Damage

While State Farm offers coverage for water damage, there are certain circumstances where your claim may be denied due to policy exclusions. Some common exclusions for water damage claims include:

-

Flood Damage: Standard homeowner’s insurance policies usually do not cover damage caused by flooding. Separate flood insurance is often required for coverage in flood-prone areas.

-

Negligence or Lack of Maintenance: If the water damage is a result of your neglect or failure to properly maintain your property, State Farm may deny your claim.

-

Gradual Damage: Insurance policies typically exclude coverage for damage that occurs gradually over time, such as slow leaks or seepage.

-

Sewer Backup: While some policies may include coverage for sewer backup, others may require additional coverage or separate endorsements.

Coverage Limits for Water Damage Claims

It’s essential to be aware of your policy’s coverage limits for water damage claims. Your policy will specify the maximum amount that State Farm will pay for property repairs, replacement of damaged belongings, and any additional living expenses you may incur if your home is uninhabitable due to water damage. Understanding these limits will help you make an informed decision when filing a claim.

Reasons for Denial

No one wants their water damage claim to be denied, but it’s essential to be prepared for the possibility. Understanding the reasons why State Farm might deny a claim can help you navigate the claims process more effectively.

Failure to Report the Claim in a Timely Manner

One of the common reasons for claim denials is failure to report the water damage in a timely manner. It’s important to notify State Farm as soon as you become aware of the damage to ensure that your claim is properly documented and processed promptly. Delaying the claim reporting can result in the denial of reimbursement for repairs or replacements.

Insufficient Evidence of Water Damage

State Farm may require evidence and documentation to support your water damage claim. Submitting insufficient or incomplete evidence can lead to claim denial. It’s crucial to document the damage thoroughly, taking photographs, videos, and written descriptions of the affected areas and belongings. It’s also recommended to keep records of any repairs or restoration efforts undertaken.

Policy Exclusions Applied by State Farm

As mentioned earlier, policy exclusions can result in claim denial. State Farm will carefully review your policy to determine if the cause of the water damage falls within the coverage provided. If the damage is attributed to an excluded event or circumstance, such as flooding or lack of maintenance, your claim may be denied.

Reviewing Your Policy

Before filing a water damage claim with State Farm, it’s important to carefully review your insurance policy. Understanding the terms and conditions of your policy will help you determine if your specific situation qualifies for coverage. Pay close attention to the following aspects:

Understanding the Terms and Conditions of Your Policy

Take the time to read and understand your policy’s terms and conditions. Familiarize yourself with the language used, as insurance policies can be complex. Knowing the specific coverage provided, limitations, deductibles, and exclusions will enable you to make informed decisions regarding your claim.

Identifying Coverage and Exclusions for Water Damage

Look for sections in your policy that specifically address water damage coverage. Take note of any exclusions or limitations that may impact your claim eligibility. If you have any doubts or questions, don’t hesitate to reach out to your State Farm agent for clarification.

Appealing a Denial

Receiving a denial from State Farm for your water damage claim can be disheartening. However, there’s still hope. You have the option to appeal the decision and present additional evidence or arguments to support your claim.

Gathering Supporting Evidence

To strengthen your appeal, gather additional evidence to support your claim. This may include expert opinions, contractor estimates, or any other relevant documentation that can substantiate your case. Be sure to address any specific reasons for denial mentioned in the claim denial letter.

Writing an Effective Appeal Letter

Crafting a compelling appeal letter is essential when disputing a denied claim. Clearly state your case, including the facts surrounding the water damage, the reasons you believe your claim should be approved, and any new evidence you have collected. Be concise, organized, and respectful in your writing. It may also be helpful to seek guidance from a professional, such as a public adjuster or attorney, to ensure your appeal is well-constructed.

Working with a Public Adjuster or Attorney

If you find the appeals process daunting or overwhelming, consider seeking assistance from a public adjuster or insurance attorney. These professionals specialize in insurance claims and can provide valuable guidance throughout the appeals process. They can help you navigate the complexities of the claim, gather evidence, and draft effective appeal letters.

Considering Legal Action

While appealing the denial is an option, there may be instances where pursuing legal action against State Farm becomes necessary. It’s important to carefully consider the following factors before taking this step.

When is it Appropriate to Sue State Farm?

Suing State Farm should be considered a last resort when all other avenues have been exhausted. Legal action may be appropriate if State Farm has acted in bad faith, wrongfully denied your claim, or failed to honor the terms of your policy. Consult with a qualified attorney who specializes in insurance disputes to assess the strength of your case and determine if legal action is warranted.

The Cost and Potential Benefits of a Lawsuit

Before proceeding with a lawsuit, it’s crucial to weigh the potential costs and benefits. Legal fees, court costs, and the time commitment involved in litigation should be carefully considered. Additionally, consider the potential benefits of a successful lawsuit, such as receiving the compensation you deserve or holding State Farm accountable for their actions.

Finding a Reliable Attorney for Insurance Disputes

If you decide to pursue legal action, finding a trustworthy attorney experienced in insurance disputes is vital. Seek recommendations, research online, and schedule consultations with several attorneys to assess their expertise, track record, and compatibility with your case. A competent attorney will guide you through the legal process, protect your rights, and advocate on your behalf.

Steps to File a Lawsuit

If you have made the decision to proceed with a lawsuit against State Farm for water damage denial, understanding the necessary steps involved is crucial.

Consultation with an Attorney

Before filing a lawsuit, consult with an attorney who specializes in insurance disputes. They will evaluate the strengths and weaknesses of your case, guide you through the legal process, and provide advice on the best course of action.

Gathering Evidence and Preparing Documentation

To build a strong case, gather all relevant evidence, documents, and photographs that support your claim. This may include policy documents, claim denial letters, photographs of the water damage, repair estimates, and any correspondence with State Farm. Organize these materials in a clear and concise manner to present to your attorney.

Filing a Complaint in Court

Once you have prepared all necessary documentation, your attorney will file a complaint on your behalf in the appropriate court. The complaint outlines the details of your claim and the relief you are seeking. State Farm will be served with a copy of the complaint, and the legal process will begin.

The Litigation Process

If your lawsuit against State Farm proceeds, you will enter the litigation process. This can be a complex and time-consuming endeavor, but understanding the various stages can help you navigate the process effectively.

Discovery Phase

During the discovery phase, both parties exchange information and evidence relevant to the case. This may involve depositions, interrogatories, and requests for documents. Each side investigates the other’s claims and defenses to build their arguments.

Settlement Negotiations

Throughout the litigation process, settlement negotiations may occur. Both parties, along with their legal representatives, may engage in discussions to reach a resolution outside of court. Settlements can offer a quicker and more cost-effective resolution, but it’s important to carefully consider the terms before accepting.

Trial and Judgment

In the event that a settlement cannot be reached, the case will proceed to trial. Each party presents their arguments, witnesses, and evidence to the court. The judge or jury will then make a decision, determining whether State Farm should be held liable for the water damage claim and, if so, the appropriate damages to be awarded.

Alternatives to Lawsuits

While lawsuits can be an effective way to address water damage claim denials, they are not always the only option. There are alternative approaches that can potentially resolve disputes more amicably.

Mediation and Arbitration

Mediation and arbitration offer alternative methods for resolving insurance disputes. Mediation involves a neutral third party who helps facilitate negotiations between you and State Farm to find a mutually agreeable resolution. Arbitration, on the other hand, involves a neutral third party who reviews the evidence and makes a binding decision. These options can be less time-consuming and costly than a lawsuit.

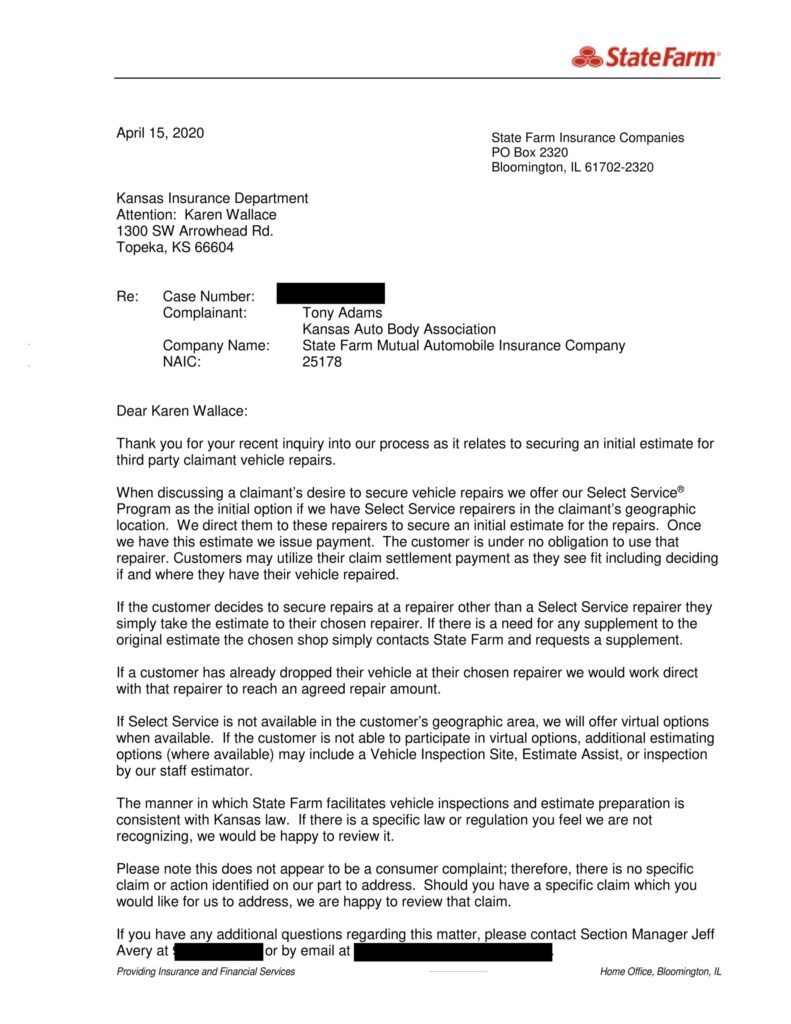

State Insurance Department Complaints

Filing a complaint with your state’s insurance department is another avenue to consider. State insurance departments have procedures in place to assist consumers in resolving disputes with insurance companies. They can act as intermediaries, investigate your complaint, and advocate on your behalf.

Seeking Assistance from Consumer Protection Agencies

Consumer protection agencies can also provide guidance and assistance when dealing with insurance-related disputes. These agencies are equipped to handle consumer complaints, provide resources, and help navigate the claims process. These avenues can be particularly useful if you prefer a less adversarial approach or if you need additional support in dealing with State Farm.

Weighing Your Options

Deciding whether or not to pursue legal action against State Farm for a denied water damage claim is a significant choice that requires careful consideration. It’s important to weigh the potential outcomes, as well as the time, effort, and emotional toll involved.

Considering the Potential Outcomes

Considering the potential outcomes is essential when deciding whether to pursue legal action or explore alternative options. A successful lawsuit could result in the compensation you deserve, holding State Farm accountable, and potentially setting a precedent for other policyholders. Conversely, an unfavorable outcome can result in added expenses and disappointment.

Time, Effort, and Emotional Toll

Lawsuits can be lengthy and emotionally taxing processes. It’s crucial to consider the time and effort required to navigate the legal system. Lawsuits can also be stressful and emotionally draining, so it’s important to weigh these factors when deciding how to proceed.

Exploring Alternative Solutions

While lawsuits can provide resolution, exploring alternative solutions might be a more practical approach for some. Mediation, arbitration, filing complaints with state insurance departments, or seeking assistance from consumer protection agencies can offer less confrontational methods of resolving disputes.

Ultimately, the decision to sue State Farm or pursue other avenues rests with you, the policyholder. Engaging professional guidance and thoroughly considering your options can help you make an informed choice about the best course of action for your specific situation. Remember, navigating water damage claims can be challenging, but by understanding your policy, thoroughly documenting damage, and seeking appropriate support, you can increase your chances of a successful resolution.