So you’re the proud parent of an energetic and curious little one who loves exploring the world around them. As much as we adore our children’s adventurous spirit, sometimes their innocent curiosity leads to unintentional mishaps. But fret not! Today, we will delve into the topic of whether homeowners insurance covers the damages caused by your active kids. Whether it’s a spilled glass of milk on your brand new carpet or a baseball through the living room window, we’ll explore the possibilities and offer some helpful insights to put your mind at ease.

Does Homeowners Insurance Cover Damage From My Kid …

Understanding Homeowners Insurance

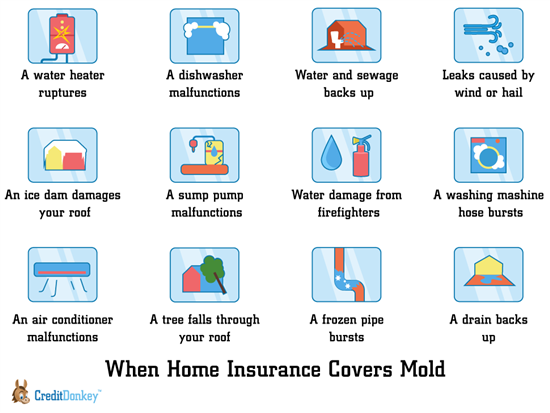

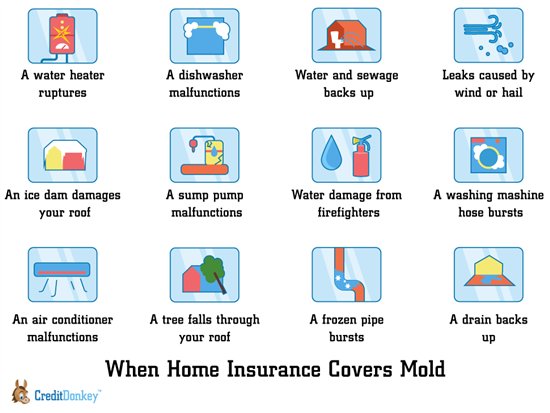

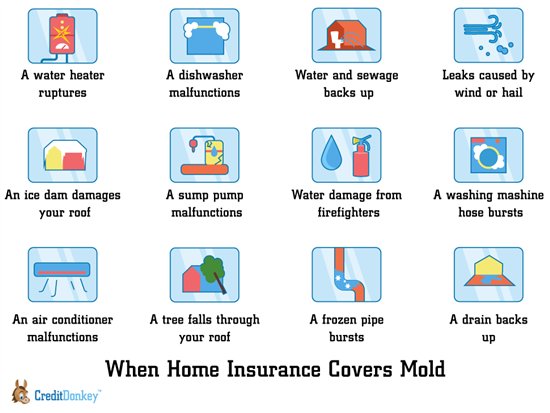

As a homeowner, it’s essential to understand the ins and outs of your homeowners insurance policy. Homeowners insurance protects you financially in case of property damage or liability in your home. It typically covers incidents such as fire, theft, and certain natural disasters. However, when it comes to damage caused by your child, the coverage can vary depending on the circumstances.

Coverage for Property Damage

Homeowners insurance typically covers property damage, including damage caused by your child. However, it’s crucial to pay attention to the specific terms and conditions of your policy. Some insurance policies may provide coverage for accidental damage caused by your children, while others may not. It’s recommended to review your policy or consult with your insurance agent to understand the specific coverage in your particular situation.

Types of Property Damage

Property damage caused by children can range from minor accidents to serious incidents. Common types of property damage include broken windows, damaged furniture, spilled liquids on electronics, and holes in walls. While accidents do happen, it’s essential to ensure that you have the appropriate coverage to protect yourself financially in case of such incidents.

Accidental Damage Caused by Children

Accidental damage caused by children is often covered by homeowners insurance. If your child accidentally breaks a window while playing baseball in the backyard or spills juice on your laptop, your insurance policy may help cover the cost of repairs or replacement. It’s important to note that policies differ, so it’s crucial to review your specific coverage and deductible amounts.

Coverage for Deliberate Damage

While accidental damage is generally covered, deliberate damage caused by your child may not be included in your homeowners insurance policy. If your child intentionally damages property, such as throwing objects or purposely breaking items, it may not be covered by your insurance. Deliberate damage is typically seen as a deliberate act and may be considered an excluded peril in your policy.

Negligence and Intentional Acts

Insurance policies commonly distinguish between intentional acts and accidental damage caused by negligence. Negligence refers to a lack of reasonable care, while intentional acts involve the deliberate intent to cause damage. If your child’s actions are deemed intentional, it’s unlikely that your homeowners insurance will cover the resulting damages. It’s essential to teach your child about responsibility and the consequences of their actions to avoid such incidents.

Insurance Claims Process

If your child causes damage to your property, you may need to file an insurance claim to seek reimbursement for the repairs or replacements required. The insurance claims process generally involves notifying your insurance company about the incident, providing documentation and evidence of the damage, and working with an adjuster to assess the situation. It’s important to get in touch with your insurance provider promptly and follow their instructions to ensure a smooth claims process.

Filing a Claim for Kid-Induced Damage

When filing a claim for property damage caused by your child, it’s crucial to document the incident thoroughly. Take photos or videos of the damage, gather any relevant receipts or estimates for repairs, and write down a detailed account of what occurred. This documentation will serve as evidence when filing your claim and may help expedite the process. Contact your insurance company to initiate the claim and provide them with all the necessary information.

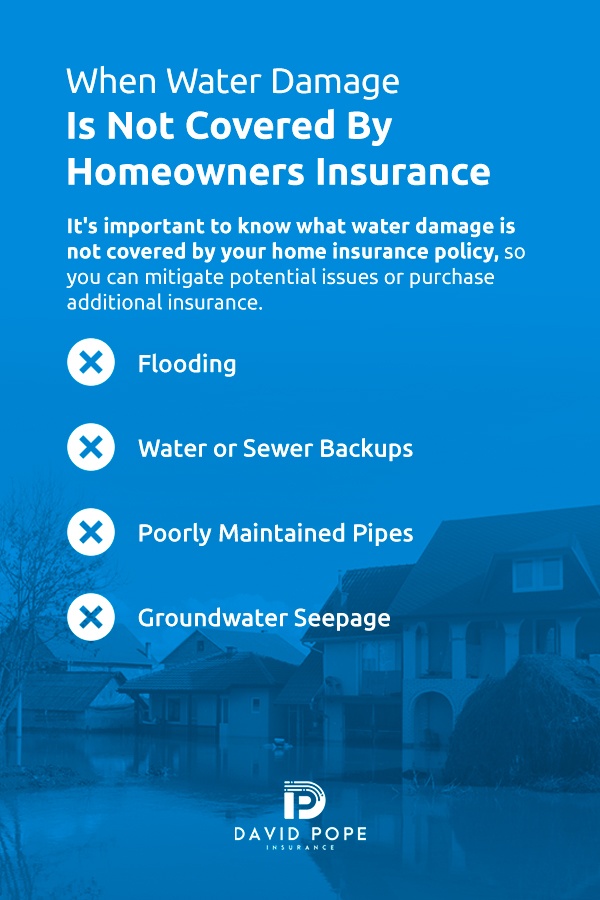

Damage Exclusions

Although homeowners insurance generally covers accidental damage caused by children, certain types of damage may be excluded from coverage. Some insurance policies have specific exclusions for certain incidents, such as damage caused by pets or wear and tear. It’s important to review your policy carefully to understand any limitations or exclusions that may apply. If you have concerns about potential exclusions, reach out to your insurance agent for clarification.

Prevention and Safety Measures

While homeowners insurance provides financial protection, it’s always best to prevent damage from occurring in the first place. Implementing safety measures and educating your children on responsible behavior can help avoid accidents and unwanted damage. Teach them about the importance of handling objects with care, being mindful of their surroundings, and the potential consequences of their actions. By taking preventative measures, you can reduce the likelihood of property damage and maintain a safe home environment.

In conclusion, homeowners insurance generally covers accidental damage caused by children, but it’s crucial to review your specific policy to understand the coverage and any exclusions. If your child causes intentional damage, it’s unlikely to be covered by insurance. Be proactive in teaching your child about responsibility and safety to minimize the risk of damage. In case of property damage, document the incident thoroughly and promptly file a claim to seek reimbursement. By understanding your policy, taking preventative measures, and fostering responsible behavior, you can minimize the impact of kid-induced damage on your homeowners insurance coverage.