Whether you’re a homeowner or thinking about buying a house, it’s important to understand why home insurance premiums can increase. From natural disasters to crime rates, there are various factors that contribute to these rising costs. In this article, we’ll explore the key reasons behind the increase in home insurance premiums, providing you with the knowledge to make informed decisions about your coverage. So, let’s dive in and uncover the factors that can impact your wallet when it comes to protecting your beloved home.

1. Location

1.1 High Risk Areas

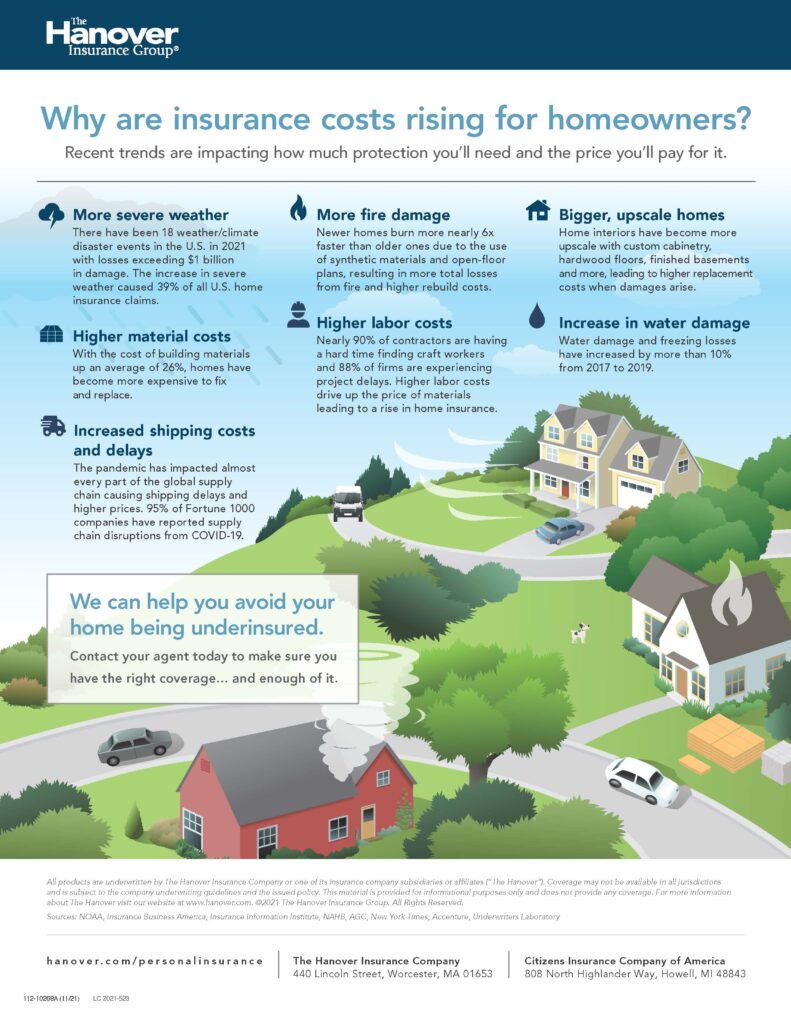

One of the key factors that can contribute to an increase in your home insurance premiums is the location of your property. If your home is situated in a high-risk area, such as a flood zone or an area prone to wildfires, insurers may view it as a greater risk to insure. This is because properties in these areas are more vulnerable to damage, which means that the likelihood of filing a claim is higher. As a result, insurers may charge higher premiums to offset the potential costs.

1.2 Proximity to Natural Disasters

Another factor that can impact your insurance premiums is the proximity of your home to natural disasters, such as hurricanes, earthquakes, or tornadoes. If your property is located in an area that is regularly affected by these types of events, insurers may consider it as a higher risk and, therefore, charge higher premiums. This is because the potential for extensive damage is greater in these regions, leading to increased claim payouts.

1.3 Crime Rates

The crime rate of your area can also influence your home insurance premiums. If you reside in a neighborhood with higher crime rates, insurers may perceive it as a greater risk for theft, vandalism, or other criminal activities. As a result, your premiums may be higher to account for the increased probability of filing a claim related to these incidents. It is important to note that even if you have implemented security measures, such as alarms or surveillance systems, the overall crime rate of your area still plays a significant role in determining your premiums.

2. Home Characteristics

2.1 Age of the Home

The age of your home is an important consideration for insurance companies when calculating your premiums. Older homes are often more susceptible to certain types of damage, such as electrical failures, plumbing issues, or structural deterioration. Additionally, older homes may have outdated building materials and systems that could increase the risk of accidents or damage. Therefore, insurers may charge higher premiums for older homes in order to account for the higher likelihood of claims.

2.2 Construction Materials

The construction materials used in your home can also impact your insurance premiums. Homes constructed with fire-resistant materials, like brick or stucco, tend to have lower premiums since they are less likely to suffer extensive damage in case of a fire. On the other hand, homes built with less fire-resistant materials, such as wood, may have higher premiums due to the increased risk of fire-related incidents. Insurers take into consideration the potential costs of repairing or rebuilding a home based on its construction materials.

2.3 Home Value and Size

The value and size of your home are additional factors that can affect your insurance premiums. Generally, the higher the value of your property, the more expensive it will be to insure since the repair or replacement costs in the event of damage or loss will be higher. Similarly, larger homes tend to have higher premiums due to the increased square footage that needs to be covered. It is important to accurately assess the value and size of your home to avoid any potential gaps in coverage or overpaying for unnecessary protections.

3. Policyholder’s Claims History

3.1 Frequency of Claims

Your claims history plays a significant role in determining your insurance premiums. If you have a history of filing numerous claims in the past, insurers may view you as a higher-risk policyholder. This is because frequent claims suggest a higher likelihood of future claims, resulting in increased costs for the insurance company. As a result, policyholders with a frequent claims history may experience higher premiums compared to those with a clean claims record.

3.2 Severity of Claims

In addition to the frequency of claims, insurers also consider the severity of each claim when assessing the risk associated with a policyholder. If you have a history of filing claims for significant losses or damages, insurers may consider you to be a higher-risk individual. This is because severe claims can result in substantial payouts for the insurance company. As a result, policyholders with a higher severity of claims may face higher premiums to offset the potential costs.

4. Credit Score

4.1 Impact on Insurance Premiums

Your credit score can also influence your home insurance premiums. Insurers often use credit-based insurance scores, which are derived from your credit history, to assess the risk associated with insuring you. Studies have shown a correlation between lower credit scores and an increased likelihood of filing insurance claims. As a result, individuals with lower credit scores may be charged higher premiums. It is important to maintain a good credit score by making timely payments and managing your debts responsibly to potentially secure lower insurance premiums.

5. Deductible Amount

5.1 Higher Deductibles Lead to Lower Premiums

The deductible amount you choose for your home insurance policy can impact your premiums. A deductible is the amount you are responsible for paying out-of-pocket when filing a claim before your insurance coverage kicks in. Generally, insurers offer various deductible options, and a higher deductible often results in lower premiums. This is because policyholders with higher deductibles bear a greater portion of the risk, which leads insurers to charge lower premiums. However, it is important to choose a deductible amount that you can comfortably afford in case of a claim.

6. Insurance Score

6.1 Calculation and Importance

An insurance score is a numerical representation of your risk level as a policyholder. It takes into account various factors, such as your credit score, claims history, and other relevant information. Insurance companies use this score to evaluate your likelihood of filing claims and assess the level of risk associated with insuring you. The higher your insurance score, the lower the perceived risk, which can potentially result in lower insurance premiums. It is important to maintain a good insurance score by managing your credit responsibly and minimizing claim activity.

7. Liability Coverage

7.1 Higher Liability Limits and Premiums

Liability coverage is an essential component of a home insurance policy, as it provides financial protection in case someone is injured on your property or you cause damage to someone else’s property. The liability limit you choose determines the maximum amount your insurance company will cover in these situations. Opting for higher liability limits can offer greater protection, but it often leads to higher insurance premiums. This is because higher limits mean the insurance company may have to pay out more in the event of a claim, which increases the risk for the insurer.

8. Additional Coverage Options

8.1 Adding Riders or Endorsements

To tailor your home insurance policy to your specific needs, you may choose to add additional coverage options known as riders or endorsements. These are additional provisions or modifications to your policy that provide coverage for specific situations or belongings. For example, you might add a rider to cover expensive jewelry, art collections, or home-based businesses. These additional coverages can increase your insurance premiums, as they require the insurer to take on additional risks and potential claim costs beyond the standard policy coverage.

9. Market Conditions

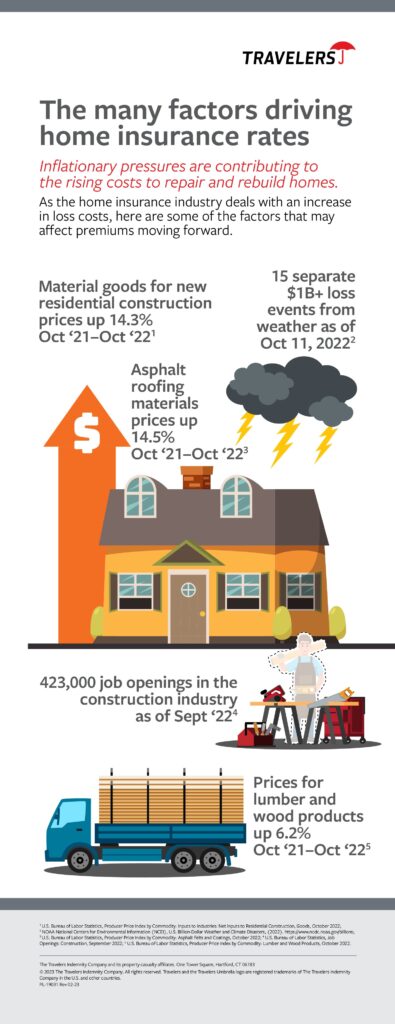

9.1 Inflation and Rising Rebuilding Costs

Market conditions, such as inflation and rising rebuilding costs, can also impact your home insurance premiums. Over time, the cost of construction materials, labor, and other expenses associated with rebuilding or repairing homes may increase due to inflation and market fluctuations. Insurance companies take these factors into account when setting premiums since they need to ensure they can cover the potential costs of rebuilding or repairing your home in the event of a claim. As a result, rising rebuilding costs can contribute to an increase in your insurance premiums over time.

10. Changes in Insurance Company Policies

10.1 Company’s Financial Situation

The financial situation of your insurance company can have an impact on your home insurance premiums. If the insurance company experiences financial difficulties or suffers significant losses, they may need to adjust their pricing structure to mitigate their risks. This can lead to premium increases for policyholders, regardless of individual risk factors. It is important to monitor the financial stability of your insurance company to anticipate any potential changes in premiums.

10.2 Overall Claims Experience

Insurance companies also consider their overall claims experience when determining insurance premiums. If the company has paid out a significant number of claims or experienced a high frequency of claims in a specific geographical area, they may adjust their premiums accordingly. This is to ensure that they can cover the potential costs associated with future claims and maintain their financial stability. Therefore, even if your individual risk factors remain the same, changes in the overall claims experience of the insurance company can result in premium increases.