Are you struggling to find a way out of the burden imposed by exorbitant insurance rates? Look no further! We understand the frustration of premium payments weighing you down, and that’s why we’re here to help. In this article, we’ll explore effective strategies and smart tactics that you can employ to navigate your way through the maze of high insurance rates. Discover valuable insights and practical tips that will empower you to take control of your insurance costs. Say goodbye to financial strain and stress, and say hello to affordable coverage that fits your budget!

Shop around for different insurance providers

When it comes to finding the best insurance rates, it’s important to shop around and explore different insurance providers. Each insurance company has its own formulas for determining rates, so it’s worth obtaining quotes from multiple providers to compare coverage and rates. By taking the time to research and gather quotes, you can ensure that you are getting the best value for your money.

Obtain quotes from multiple providers

To truly get a comprehensive understanding of the insurance market, it’s essential to obtain quotes from multiple providers. This will allow you to compare the coverage and rates offered by different companies. You can request quotes either online, by phone, or by visiting insurance offices in person. By doing this, you can assess the options available to you and make an informed decision about which insurance provider suits your needs and budget.

Compare coverage and rates

When reviewing quotes from different insurance providers, it’s crucial to compare not only the rates but also the coverage offered. Insurance policies can vary greatly in terms of the types of coverage included and the limits and deductibles associated with each type. Take the time to carefully review the coverage details to ensure that they align with your needs. While it’s important to find affordable rates, it’s equally important to have adequate coverage in the event of an accident or other unfortunate incident.

Consider different types of insurance providers

While traditional insurance companies may be the first that come to mind, it’s worth considering different types of insurance providers. Some insurance providers operate exclusively online, which often allows them to offer more competitive rates. Others specialize in certain types of insurance, such as auto insurance or home insurance, and may have extensive experience in those areas. By exploring different types of insurance providers, you may find unique options that better suit your specific needs and budget.

Opt for a higher deductible

One effective way to potentially reduce your insurance rates is to opt for a higher deductible. A deductible is the amount of money you must pay out of pocket before your insurance company starts covering the costs. By increasing your deductible, you take on more financial responsibility in the event of a claim, but you may also benefit from lower insurance premiums.

Understand the concept of a deductible

Before choosing a higher deductible, it’s important to understand the concept and implications. Essentially, a deductible is the portion of the claim that you agree to pay. For example, if you have a $500 deductible and file a claim for $2,000, you would be responsible for paying the first $500, and the insurance company would cover the remaining $1,500. By choosing a higher deductible, you are accepting a greater financial risk but may see a reduction in your monthly or annual premium payments.

Calculate potential savings by increasing your deductible

To determine if increasing your deductible is a feasible option, take the time to calculate the potential savings. Compare the difference in premiums between your current deductible and the higher deductible you are considering. Multiply this annual savings by the number of years you expect to have the insurance policy. If the potential savings outweigh the potential out-of-pocket expenses in the event of a claim, then increasing your deductible may be an advantageous choice.

Consider your financial situation before choosing a higher deductible

While a higher deductible can often result in lower insurance premiums, it’s important to consider your financial situation before making a decision. If you don’t have enough savings to cover the higher deductible in the event of a claim, it may be wise to stick with a lower deductible. It’s essential to strike a balance between saving on insurance premiums and being financially prepared for unexpected expenses.

Improve your credit score

Believe it or not, your credit score can have a significant impact on your insurance rates. Insurance companies often consider credit scores when determining premiums, as studies have shown a correlation between credit history and insurance claims. To potentially lower your insurance rates, it’s worth taking steps to improve your credit score.

Understand the impact of credit scores on insurance rates

Insurance companies use credit scores as a risk assessment tool. They believe that individuals with higher credit scores are less likely to file claims, whereas individuals with lower credit scores may be considered higher risk. This risk assessment can result in higher premiums for those with lower credit scores. By understanding how credit scores impact insurance rates, you can take proactive measures to improve your credit and potentially lower your premiums.

Review your credit report for errors

One of the first steps in improving your credit score is to review your credit report for any errors. Mistakes on credit reports can negatively impact your credit score, so it’s crucial to identify and correct them. Obtain a free copy of your credit report from a reputable credit reporting agency and carefully review the information. If you notice any errors or inaccuracies, contact the credit reporting agency and provide the necessary documentation to request corrections.

Take steps to improve your credit score

Improving your credit score takes time and effort, but it can be well worth it in the long run. Make sure to pay your bills on time and in full, as missed or late payments can have a negative impact on your credit score. Additionally, monitor your credit card usage and aim to keep your credit utilization ratio below 30%. Limit the number of credit applications you make, as excessive credit inquiries can lower your score. By adopting responsible credit habits, you can gradually improve your credit score and potentially receive lower insurance rates.

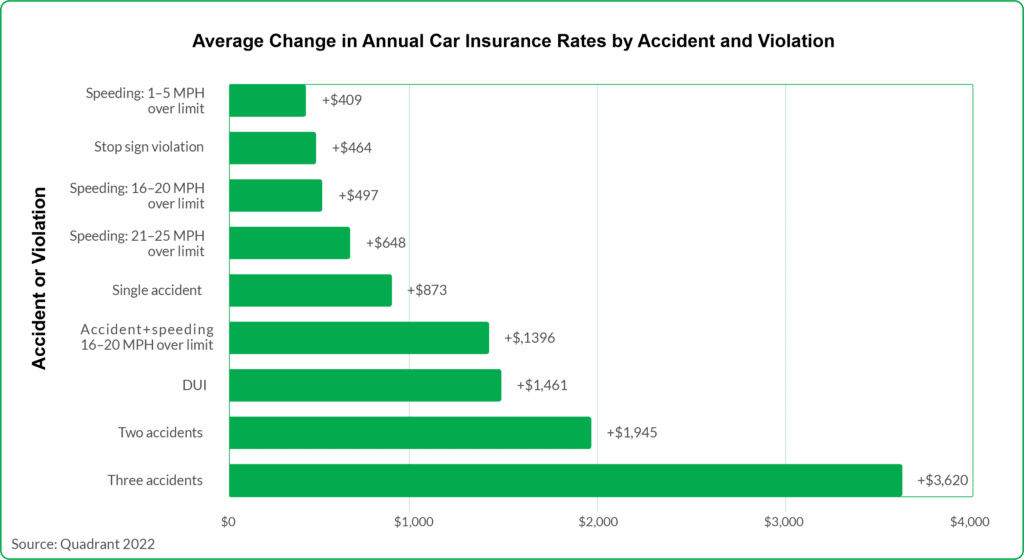

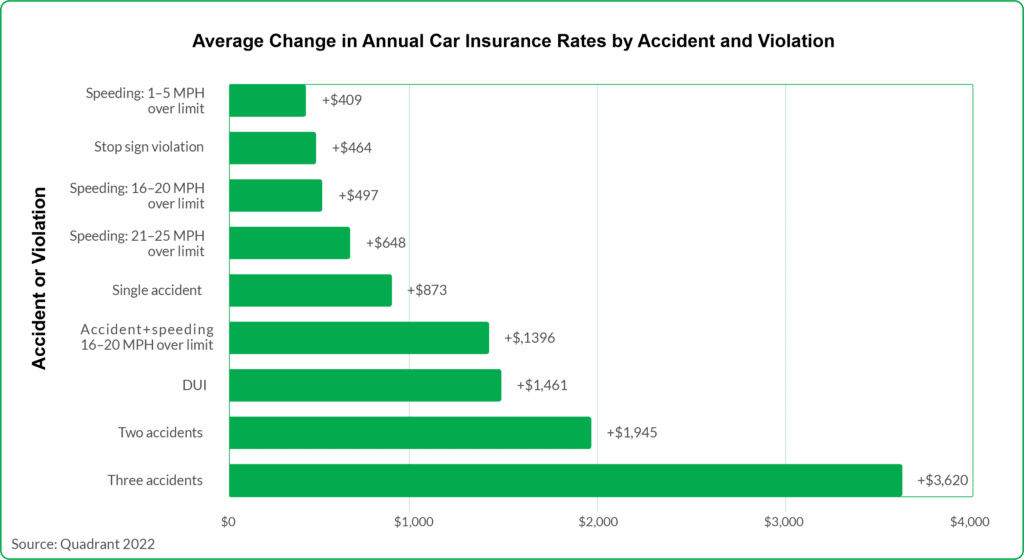

Maintain a good driving record

Maintaining a good driving record is not only essential for your safety but can also help you achieve lower insurance rates. Insurance companies consider your driving record when determining premiums, as it reflects your level of risk as a driver. By following traffic laws and regulations, attending defensive driving courses, and avoiding accidents and traffic violations, you demonstrate to insurance companies that you are a responsible and safe driver.

Follow traffic laws and regulations

One of the simplest and most effective ways to maintain a good driving record is to consistently follow traffic laws and regulations. Obey speed limits, use turn signals, yield the right of way, and always drive defensively. By doing so, you minimize the risk of accidents and traffic violations, which can ultimately lead to higher insurance rates.

Attend defensive driving courses

Defensive driving courses can not only improve your driving skills but also help reduce insurance rates. Many insurance companies offer discounts to drivers who have completed an accredited defensive driving course. These courses provide valuable knowledge and techniques to help you become a safer and more responsible driver. By completing a defensive driving course, you not only enhance your driving abilities but may also be eligible for insurance discounts.

Avoid accidents and traffic violations

Accidents and traffic violations can significantly impact your insurance rates. Insurance companies may consider you a higher risk if you have a history of accidents or violations, resulting in higher premiums. By driving defensively, practicing safe driving habits, and adhering to traffic laws, you can minimize the likelihood of accidents and traffic violations. Not only will this keep you safe on the road, but it can also lead to lower insurance rates.

Bundle your insurance policies

If you have multiple insurance policies, such as auto, home, and life insurance, consider bundling them under one provider. Bundling your policies can often lead to significant savings and simplify the management of your insurance coverage.

Combine multiple insurance policies under one provider

When you bundle your insurance policies, you combine them under one insurance provider. This consolidation allows you to have all your coverage in one place, making it easier to manage and potentially saving you time and effort. Whether it’s auto and home insurance or home and life insurance, bundling your policies can streamline your coverage and potentially lead to cost savings.

Inquire about discounts for bundled policies

Many insurance providers offer discounts for bundled policies. When you inquire about bundling your insurance, ask if there are any additional discounts available. These discounts can further reduce your overall premium, providing you with even greater savings. Always be sure to ask about any potential discounts, as they can vary among insurance providers.

Evaluate the potential savings against individual policies

When considering bundling your insurance policies, it’s important to evaluate the potential savings. Research the rates for individual policies and compare these to the bundled package offered by a specific insurance provider. Sometimes, bundling may not provide the most cost-effective solution for your needs. By carefully assessing the potential savings against the coverage and rates of individual policies, you can make an informed decision about whether bundling is the right choice for you.

Consider a higher level of coverage

While it may seem counterintuitive to opt for a higher level of coverage when aiming to reduce insurance rates, it’s worth considering carefully. Assessing your insurance needs and understanding the potential benefits of additional coverage can help you make an informed decision.

Assess your insurance needs

Take the time to assess your insurance needs and determine what coverage is essential for you and your situation. This may involve considering factors such as the value of your assets, your personal circumstances, and any potential risks you may face. By understanding your insurance needs, you can better evaluate what level of coverage is appropriate for you.

Evaluate the potential benefits of additional coverage

Additional coverage can provide added protection and peace of mind, but it may also come at an increased cost. Consider the potential benefits that come with additional coverage, such as higher policy limits or coverage for specific risks. For example, if you live in an area prone to natural disasters, additional coverage for floods or earthquakes may be beneficial. Evaluate these potential benefits against the potential increase in insurance rates to determine if it’s worth investing in additional coverage.

Calculate the potential increase in insurance rates

Before deciding to opt for a higher level of coverage, it’s important to calculate the potential increase in insurance rates. Contact your insurance provider or use online resources to obtain quotes for different coverage levels. Compare the premiums for your current coverage against the premiums for the higher level of coverage you are considering. This will give you an idea of how much your rates may increase and help you make an informed decision.

Install safety and security features

Another effective way to potentially lower your insurance rates is to install safety and security features in your vehicle or home. These features can reduce the risk of accidents, damage, or theft, making you a lower risk to insurers.

Invest in car security systems

Installing a car security system can help lower your insurance rates, as it reduces the risk of theft and vandalism. Car alarm systems, GPS tracking devices, and immobilizers are examples of security features that may qualify you for discounts. Inquire with your insurance provider about the specific security systems that may make you eligible for savings.

Install smoke detectors and burglar alarms

For homeowners, installing smoke detectors and burglar alarms can make your residence safer and potentially lead to lower insurance rates. These safety features provide early detection and alert systems in the event of a fire or break-in, reducing the likelihood of significant property damage or loss. Consult with your insurance provider to determine which specific safety features warrant potential discounts.

Inquire about safety feature discounts with your insurance provider

When you have safety and security features in place, be sure to inquire with your insurance provider about potential discounts. Insurance companies often offer savings to policyholders who have taken proactive measures to enhance the safety and security of their vehicles or homes. Don’t hesitate to ask about the specific safety features that may result in lower insurance rates, as it could lead to significant savings.

Maintain a good credit history

In addition to improving your credit score, maintaining a good credit history is important for receiving favorable insurance rates. Consistently practicing responsible credit habits can potentially reduce your premiums and ensure that your credit remains in good standing.

Pay bills on time and in full

Paying your bills on time and in full is essential for maintaining a good credit history. Late or missed payments can result in negative marks on your credit report, potentially impacting your credit score. By consistently meeting your financial obligations, you demonstrate to insurance companies that you are a responsible and trustworthy policyholder.

Monitor credit card usage

Proper management of your credit card usage is crucial for maintaining a good credit history. Avoid maxing out your credit cards and aim to keep your balances below 30% of your credit limit. Excessive credit card debt can negatively impact your credit score and potentially lead to higher insurance rates. By monitoring your credit card usage and keeping your balances in check, you can maintain a healthy credit history.

Limit the number of credit applications

Applying for new lines of credit or loans can temporarily lower your credit score due to the inquiry made by potential creditors. While occasional credit applications may not have a significant impact, too many applications within a short period can potentially signal financial instability to insurance companies. Limiting the number of credit applications can help maintain a positive credit history and potentially result in lower insurance premiums.

Take advantage of available discounts

Insurance providers offer various discounts that policyholders can take advantage of to potentially lower their insurance rates. By exploring the available options and asking about potential discounts, you may be able to reduce the cost of your insurance.

Inquire about discounts based on your profession or membership

Many insurance companies offer discounts based on your profession or membership in certain organizations. For example, some providers offer discounts to teachers, military personnel, or members of specific professional associations. Inquire with your insurance provider about any potential professional or membership discounts that may be available to you.

Consider usage-based insurance programs

Usage-based insurance programs utilize telematics devices or smartphone apps to track your driving behavior, allowing insurance companies to offer personalized rates based on your individual driving habits. By signing up for a usage-based insurance program and demonstrating safe driving behavior, you may be eligible for premium discounts. This option is particularly beneficial for drivers who maintain good driving records and practice safe habits.

Ask about discounts for good students or safe drivers

If you are a student or have a young driver in your household, ask your insurance provider about potential discounts for good students and safe drivers. Many insurance companies offer discounts to students who achieve certain academic standards or complete safe driving courses. Encourage your young driver to maintain good grades and enroll in defensive driving courses to potentially qualify for these discounts.

Reduce coverage on older vehicles

For older vehicles that have significantly decreased in value, it may be beneficial to reduce coverage to minimize insurance costs. Assess the value of your vehicle and consider dropping collision or comprehensive coverage if it no longer provides sufficient financial benefits.

Evaluate the value of your vehicle

As vehicles age, their value decreases. If your vehicle is older and has a low market value, it may not be cost-effective to maintain comprehensive or collision coverage. Calculate the approximate value of your vehicle and assess whether the potential payout in the event of a claim justifies the cost of continued coverage.

Consider dropping collision or comprehensive coverage

Collision coverage and comprehensive coverage are additional types of coverage that protect against damage to your vehicle. Collision coverage pays for repairs or replacement if your vehicle is damaged in an accident, while comprehensive coverage covers damage from non-collision incidents like theft or weather damage. If the cost of these coverages exceeds the potential benefits, it may be reasonable to drop them from your policy, particularly for older vehicles with low market values.

Assess the potential savings against the risk

Before deciding to reduce coverage on older vehicles, assess the potential savings against the risk. Consider the likelihood of an accident or incident occurring and weigh it against the cost of maintaining comprehensive or collision coverage. It’s crucial to find the right balance between insurance savings and ensuring that you have adequate coverage in case of an unforeseen event.

Making smart choices when it comes to insurance can help you navigate high insurance rates and find the most cost-effective coverage for your needs. By shopping around, exploring different options, and implementing strategies to reduce risk, you can potentially lower your insurance premiums and save money in the long run. Remember to assess your individual circumstances, consider your financial situation, and consult with insurance professionals who can guide you towards the best choices for your specific needs. With a little effort and knowledge, you can successfully navigate the world of insurance and find the coverage that fits your budget while keeping you protected.