You rely on your home to provide a safe haven for you and your loved ones, so it’s crucial to ensure that it is protected. That’s where home insurance comes in – a safeguard that shields your most valuable asset from unexpected mishaps. But what exactly does home insurance cover? It encompasses a wide range of scenarios, such as damage caused by fire, theft or vandalism, natural disasters like storms or earthquakes, and even liability coverage in case someone gets injured on your property. Essentially, home insurance provides you with the peace of mind knowing that you’re not alone when the unexpected strikes.

Dwelling Coverage

Structure of the house

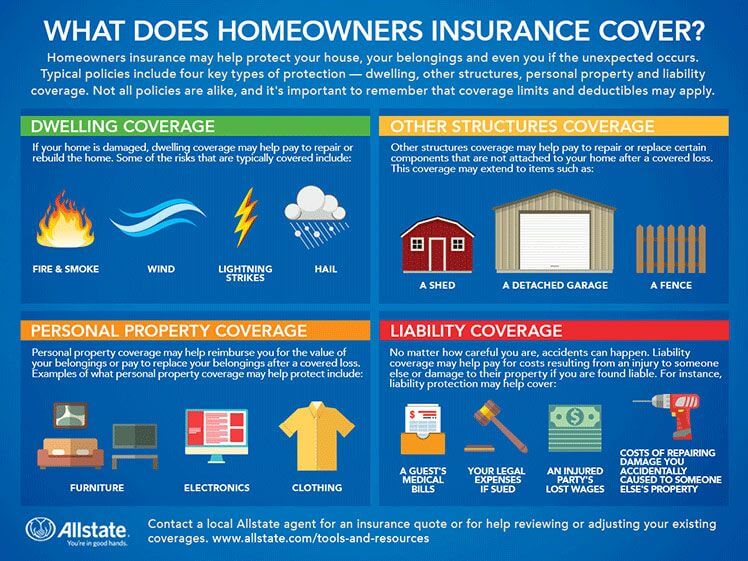

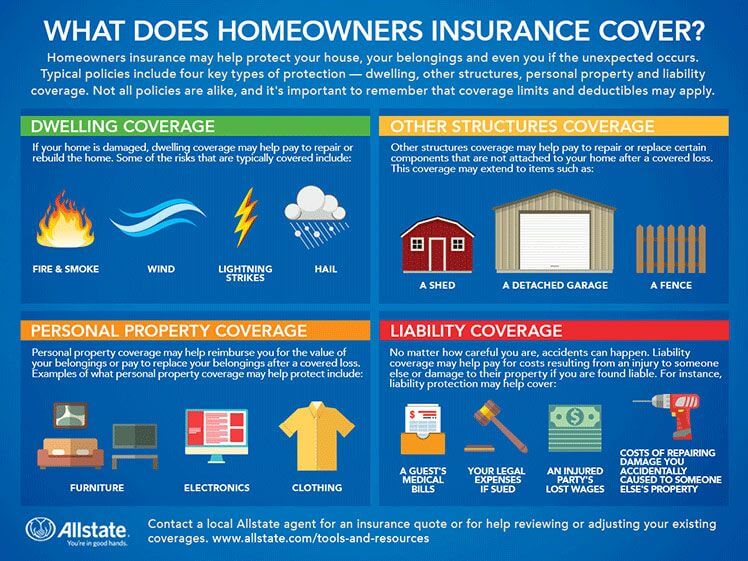

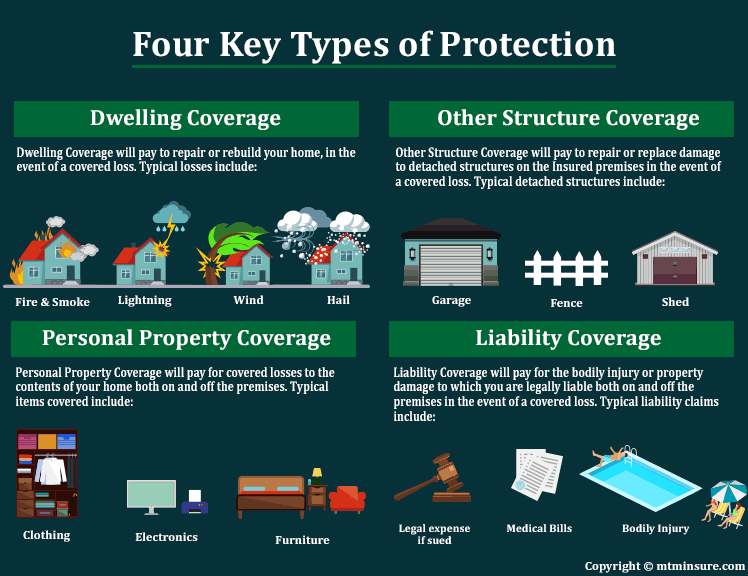

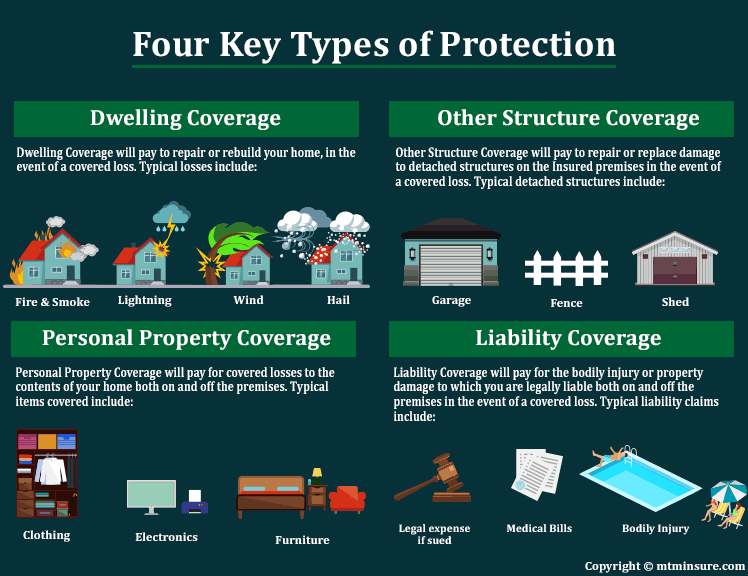

Dwelling coverage is an essential component of home insurance that provides protection for the structure of your house. This coverage includes your home’s foundation, walls, roof, and other permanent structures, such as attached garages or enclosed porches. It protects against a range of perils, including fire, storms, and vandalism. If your home is damaged or destroyed by a covered event, dwelling coverage can help cover the costs of repairs or even the complete reconstruction of your home.

Attached structures

In addition to the main structure of your home, dwelling coverage also extends to attached structures like garages, carports, or sheds. These attached structures are typically included in your policy coverage, ensuring that any damage they sustain is financially protected. Whether it’s a storm damaging your garage or a fire affecting your carport, attached structure coverage can help cover the repair costs and provide peace of mind.

Detached structures

If you have detached structures on your property, such as a separate workshop or a guesthouse, dwelling coverage can also extend to protect these structures. Whether it’s a strong windstorm damaging your workshop or a fire affecting your guesthouse, home insurance typically covers the repair or replacement costs for these detached structures. This coverage is especially valuable if these structures are integral parts of your lifestyle or if they serve a significant purpose in your everyday life.

Personal Property Coverage

Furniture and appliances

Personal property coverage is designed to protect your belongings within your home, including furniture, appliances, and other household items. Whether it’s a fire damaging your couch or a burst pipe ruining your washing machine, personal property coverage can help cover the cost of repairing, replacing, or reimbursing you for the loss of these items. It’s important to take inventory of your belongings and determine their value to ensure your personal property coverage adequately protects your possessions.

Electronics and gadgets

In today’s digital age, many of us have an array of electronics and gadgets that play a crucial role in our daily lives. Home insurance typically covers damage or loss of electronics due to covered perils such as fire, theft, or vandalism. Whether it’s your television, laptop, or gaming console, personal property coverage can provide financial assistance to repair or replace these items. It’s important to review your policy to ensure your coverage is enough to protect the full value of your electronics.

Clothing and jewelry

Your wardrobe and jewelry collection hold both practical and sentimental value, making them an important part of your personal property that needs protection. Home insurance can offer coverage for clothing and jewelry in case of damage, loss, or theft. Whether it’s a theft resulting in the loss of your precious necklace or a fire damaging your wardrobe, personal property coverage ensures that you can recover the financial value of these items and continue to feel secure knowing your cherished belongings are protected.

Art and collectibles

If you are an art enthusiast or collector, you understand the value and sentiment attached to your pieces. Home insurance typically covers your art and collectibles in case of damage or theft. Whether it’s a natural disaster damaging your art collection or a break-in leading to stolen collectibles, personal property coverage can help replace or repair these valuable items. Consider getting an appraisal for your high-value items to ensure adequate coverage for their full value.

Liability Coverage

Bodily injury to others

Liability coverage is an integral part of home insurance, providing protection if someone is injured on your property due to your negligence. If someone sustains bodily injury while visiting your home, liability coverage can help cover medical expenses, rehabilitation costs, and even legal fees if the injured party decides to file a lawsuit. It’s important to have sufficient liability coverage that aligns with your financial assets, as significant medical expenses or legal costs can quickly deplete your financial resources.

Property damage to others

Accidents can happen, and if you unintentionally damage someone else’s property, liability coverage can help cover the costs of repair or replacement. This coverage extends beyond the physical structure of other people’s property and can include damage caused by your children or pets. So if your child accidentally breaks a neighbor’s window or your dog damages a neighbor’s fence, liability coverage can provide financial protection and help maintain good relationships within your community.

Additional Living Expenses Coverage

Temporary housing

In the event that your home becomes uninhabitable due to a covered peril, additional living expenses coverage, often referred to as loss of use coverage, can provide assistance for temporary housing. This coverage helps cover the costs of renting a temporary residence, such as an apartment or a hotel, while your home is being repaired or rebuilt. It can also include expenses for necessary additional utilities and even pet boarding if your temporary housing does not allow pets. Additional living expenses coverage ensures that you and your family can maintain a comfortable lifestyle during challenging times.

Food and transportation expenses

When your home is undergoing repairs or rebuilding, you may incur additional expenses for food and transportation. Additional living expenses coverage can help cover these costs, ensuring that you and your family can continue to meet your daily needs. This coverage can include reimbursement for restaurant meals, groceries, and transportation expenses beyond your normal routine. Whether it’s dining out more frequently or the need for alternative commuting options, additional living expenses coverage provides the necessary financial support to help you navigate these unexpected and often stressful situations.

Medical Payments Coverage

Coverage for injuries sustained by guests

Accidents can happen at any time, even within the confines of your own home. Medical payments coverage, also known as medical expense coverage, grants protection if a guest is injured on your property, regardless of fault. This coverage can help cover medical expenses, including hospital bills, doctor’s visits, and even necessary surgeries, up to the specified limit in your policy. Medical payments coverage demonstrates your commitment to the well-being of your guests and can provide them with the necessary financial assistance to recover from their injuries.

Loss of Use Coverage

Coverage for additional living expenses during repairs or rebuilding

When your home suffers significant damage and becomes uninhabitable, loss of use coverage becomes crucial. This coverage ensures that you have the financial means to cover additional living expenses while your home is under repair or being rebuilt. It can help with the costs of temporary housing, food, transportation, and other essential expenses that arise during this transitional period. Whether it takes weeks or months to restore your home, loss of use coverage provides you with the necessary peace of mind and stability during this challenging time.

Natural Disasters Coverage

Fire damage

Fire is one of the most common perils that can cause severe damage to your home. Home insurance typically covers fire damage, including structural damage to your home and the loss of personal property. From a small kitchen fire to a devastating blaze, your dwelling coverage and personal property coverage can come to your rescue, providing the financial means to repair or rebuild your home and replace your belongings.

Windstorm or hail damage

Whether it’s a powerful windstorm or a destructive hailstorm, nature’s fury can wreak havoc on your home’s structure and its contents. Dwelling coverage often includes protection against windstorm and hail damage, allowing you to receive the necessary assistance to restore your home and replace damaged or destroyed personal property. From roof repairs to broken windows, windstorm or hail damage coverage ensures that you can recover from the financial burden imposed by these unpredictable weather events.

Flood damage

While home insurance typically covers many perils, it generally excludes flood damage. If you live in an area prone to flooding, it’s essential to consider purchasing separate flood insurance to protect your home and belongings. Flood damage can be financially devastating, leading to the destruction of your home’s foundation, walls, electrical systems, and personal property. Proper coverage against flood damage helps ensure that you can recover and rebuild after a flood event without shouldering the overwhelming costs on your own.

Earthquake damage

For those residing in earthquake-prone regions, earthquake coverage is vital for protecting your home and investments. Earthquakes can cause severe structural damage and often lead to the loss or destruction of personal belongings. Earthquake coverage can help cover the cost of repairs, including foundation stabilization and structural reinforcements, as well as the replacement of damaged or destroyed personal property. By acquiring earthquake coverage, you can have peace of mind knowing that you are financially protected from the aftermath of a seismic event.

Vandalism and Theft Coverage

Stolen belongings

Thefts and break-ins can be emotionally and financially distressing. Home insurance typically offers coverage for stolen belongings, allowing you to recover the cost of your stolen items. This coverage extends to personal property both inside your home and outside, such as bikes or lawnmowers. If you’ve fallen victim to a theft or break-in, vandalism and theft coverage ensures that you can replace your stolen belongings and restore security within your home.

Property damage due to vandalism

Acts of vandalism can lead to significant damage to your property, from broken windows to graffiti-covered walls. Home insurance provides coverage for property damage caused by vandalism, allowing you to restore your home to its previous condition. Whether it’s repairing or replacing damaged property, vandalism and theft coverage ensures that you don’t bear the financial burden alone when facing malicious acts.

Personal Liability Coverage

Legal costs for defense

In the unfortunate event that you are faced with a liability lawsuit, personal liability coverage can provide financial assistance for legal defense costs. Legal fees can quickly accumulate, and navigating the complexities of a lawsuit can be overwhelming. Personal liability coverage ensures that you have the necessary resources to hire an attorney and protect your interests in court. Whether the lawsuit stems from bodily injury or property damage, this coverage offers peace of mind by alleviating the potentially significant financial burden associated with legal proceedings.

Settlements or judgments

Personal liability coverage not only helps cover legal defense costs but also provides protection in the form of settlements or judgments. If you are found liable for causing bodily injury or property damage to others and are required to pay for damages, personal liability coverage can help cover these expenses. Settlements or judgments can include medical expenses, property repair costs, and compensation for pain and suffering. With personal liability coverage, you can rest assured that you have financial protection against unforeseen liability claims that may arise.

Optional Coverage

Home business coverage

If you operate a home-based business, it’s important to consider obtaining additional coverage for your business assets and potential liability risks. Home insurance typically does not cover business-related items, such as specialized equipment, inventory, or loss of business income. Home business coverage provides protection in case of property damage or loss to your business assets and helps cover potential liability claims related to your business operations conducted within your home. By securing this optional coverage, you can safeguard your business and its financial stability.

Identity theft coverage

Identity theft has become a prevalent concern in today’s digital world. Optional identity theft coverage provides financial protection and assistance if you become a victim of identity theft. This coverage typically includes reimbursement for expenses related to recovering your stolen identity, such as legal fees, credit monitoring services, and lost wages. Identity theft coverage offers peace of mind, ensuring that you have the necessary support and resources to navigate the challenging process of reclaiming your stolen identity.

Scheduled personal property coverage

While home insurance typically covers personal property, there are often limits on coverage for high-value items. If you own valuable items such as expensive jewelry, artwork, or antiques, scheduled personal property coverage can provide additional protection. By scheduling these items individually and specifying their value, you can obtain comprehensive coverage that extends beyond the limits of standard personal property coverage. Scheduled personal property coverage ensures that your high-value belongings are adequately protected, giving you peace of mind and financial security.

In conclusion, home insurance provides a wide range of coverage to protect you, your belongings, and your financial well-being in the face of various perils and liability risks. From the structure of your house to the personal property within, home insurance offers comprehensive protection against natural disasters, theft, vandalism, and potential liability claims. Remember to review your policy carefully, ensuring that it aligns with your needs and offers adequate coverage for your dwelling, personal property, liability risks, and any additional optional coverage you may require. By securing the appropriate coverage, you can rest easy knowing that you are prepared for unforeseen events and can face any challenges that come your way.