Are you curious about what your home insurance actually covers? Well, look no further! This article will provide you with a comprehensive overview of what you can typically expect from your home insurance policy. Whether it’s protection against natural disasters, liability coverage, or coverage for your personal belongings, we’ve got you covered. So, sit back, relax, and let’s explore the world of home insurance together.

Structure of the Home

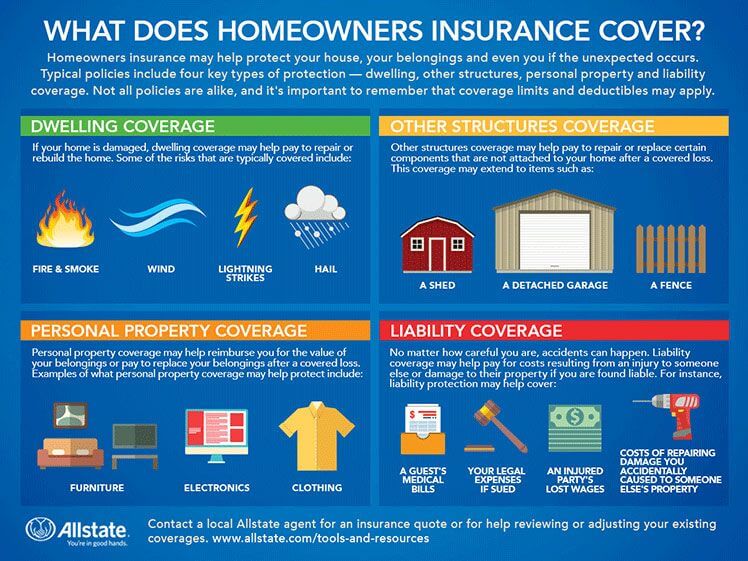

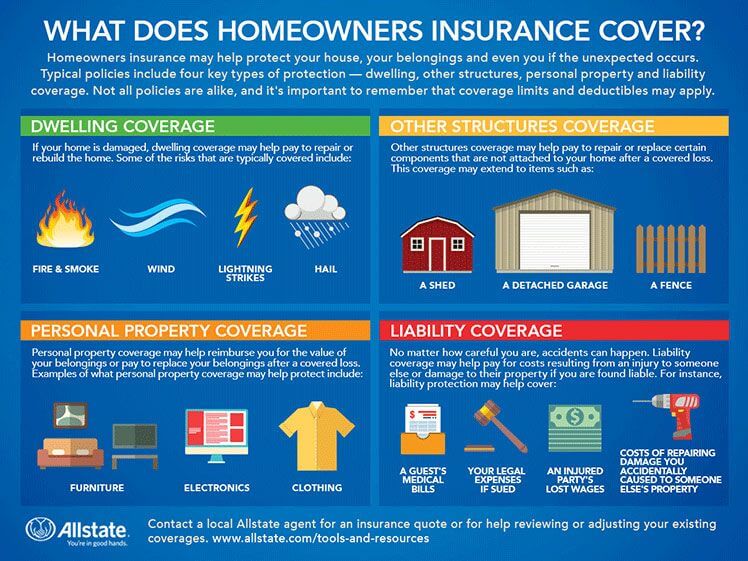

When it comes to protecting your home, there are a few key factors to consider. One important aspect is the structure of your dwelling, and that’s where dwelling coverage comes into play. Dwelling coverage is designed to protect the physical structure of your home, including the walls, roof, and foundation. In the event of damage caused by covered perils such as fire, windstorm, or vandalism, your dwelling coverage can help cover the costs of repairs or even the full replacement of your home.

But what about other structures on your property, such as a detached garage, shed, or fence? This is where other structures coverage comes in. Other structures coverage is an essential part of your home insurance policy and can provide protection for these additional structures. If a storm damages your garage or a tree falls on your fence, for example, your other structures coverage can help cover the cost of repairs or replacement.

Personal Belongings

Your personal belongings are an important part of your home. From furniture and appliances to clothing and electronics, these items hold both practical and sentimental value. That’s why it’s crucial to have personal property coverage as part of your home insurance policy. Personal property coverage helps protect your belongings in the event of theft, fire, or other covered perils.

Personal property coverage extends beyond just protecting your belongings while they are in your home. It also provides off-premises coverage, meaning that your personal belongings are covered even when they are outside of your home. So, if your laptop is stolen while you’re at a coffee shop or your luggage is lost during a vacation, your personal property coverage can help reimburse you for the loss.

Liability Protection

Liability protection is an important aspect of your home insurance policy that many people overlook. Accidents can happen at any time, and if someone is injured on your property, you could be held liable for their medical expenses and even legal fees. That’s where liability coverage comes in.

Bodily injury liability coverage helps protect you financially if someone is injured on your property and you are found responsible. It can help cover their medical bills, pain and suffering, and even lost wages. Property damage liability coverage, on the other hand, provides coverage in the event that you accidentally damage someone else’s property, such as a neighbor’s fence or their car.

In addition to bodily injury and property damage liability coverage, your home insurance policy may also include medical payments coverage. This coverage can help pay for medical expenses if a guest is injured on your property, regardless of whether or not you are found at fault. It provides peace of mind knowing that if someone gets hurt while visiting you, their medical costs can be taken care of without a lengthy legal battle.

Additional Living Expenses

In the unfortunate event that your home is damaged and becomes uninhabitable, you may need to find temporary accommodation while repairs are being made. This is where additional living expenses coverage, also known as loss of use coverage, comes into play.

Loss of use coverage provides financial assistance to cover the cost of living expenses such as hotel bills, meals, and even transportation while your home is being repaired or rebuilt. It ensures that you can maintain your standard of living even in the face of a temporary displacement.

Natural Disasters

Natural disasters are unpredictable and can cause significant damage to your home. That’s why it’s essential to have coverage for various types of natural disasters to protect yourself and your property.

Fire and smoke damage coverage is a crucial part of your home insurance policy. Fires can be devastating, not only damaging your home but also destroying your personal belongings. Smoke damage can be equally destructive, leaving behind lasting odors and potentially harmful residue. Having fire and smoke damage coverage helps ensure that you are protected financially in the event of such disasters.

Weather-related damage can result from severe storms, including windstorms, hailstorms, and hurricanes. These events can cause extensive damage to the structure of your home, as well as your personal belongings. With weather-related damage coverage, you can have peace of mind knowing that you are protected from the financial burden of repairing or replacing damaged property.

Earthquakes and volcanic eruptions are unique forces of nature that can cause significant damage to homes. Unfortunately, standard home insurance policies typically do not cover these events. However, depending on where you live, you may be able to add earthquake or volcanic eruption coverage as an additional rider to your policy. It’s worth considering if you reside in an area prone to these natural disasters.

Flood damage coverage is also typically not included in standard home insurance policies. Flooding can cause extensive damage to the foundation, walls, and belongings in your home. However, you may have the option to purchase separate flood insurance through the National Flood Insurance Program (NFIP) or private insurers. It’s important to assess the flood risk in your area and consider adding this coverage if necessary.

Theft and Vandalism

No one wants to imagine their home being targeted by thieves or vandals, but unfortunately, these incidents can happen. That’s why it’s crucial to have coverage in place to protect yourself from the financial consequences of theft and vandalism.

Stolen belongings coverage is designed to reimburse you for the value of your personal belongings that are stolen during a break-in or theft. This coverage can help replace your stolen items so that you can get back on your feet and continue with your day-to-day life.

Vandalized property coverage provides financial assistance in the event that your home or personal property is intentionally damaged by vandals. It helps cover the costs of repairs or replacements needed to restore your property to its previous condition.

Accidental Damage

Accidents happen, even in the safety of your own home. Whether it’s a mishap that causes damage to your walls or a clumsy moment leading to a broken window, accidental damage coverage can help you recover from these unexpected incidents.

Accidental damage to the home coverage ensures that you are protected financially in the event of accidental damage caused by you or a family member. It can help cover the cost of repairs or replacements needed to fix the damage.

Loss of Valuables

Some items in your home may hold significant monetary or sentimental value. Examples include expensive jewelry, collectibles, or even family heirlooms. To adequately protect these high-value items, consider adding high-value item coverage to your home insurance policy.

High-value item coverage provides additional protection for valuable possessions beyond what is typically covered by your standard policy. It ensures that you are adequately reimbursed for the loss or damage of these items, giving you peace of mind knowing that your most treasured belongings are protected.

Identity theft protection is another important aspect of loss of valuables coverage. With the increasing prevalence of cybercrime, including identity theft, having coverage to help navigate the aftermath of identity theft can be invaluable. Identity theft protection coverage can help cover expenses related to identity restoration, legal fees, and even lost wages.

Personal Liability

Accidents on your property can lead to personal liability claims, which can be financially devastating if you are found responsible. Personal liability coverage is designed to protect you in these situations.

Injuries on your property coverage provides financial assistance if someone is injured on your property and you are held responsible. It helps cover their medical expenses, pain and suffering, and even lost wages. This coverage can be a lifesaver in situations where a guest is injured and holds you accountable.

Legal defense costs coverage is another important aspect of personal liability protection. If someone files a lawsuit against you due to an incident on your property, legal expenses can quickly add up. This coverage can help offset the cost of hiring an attorney and other legal fees, ensuring that you have the resources to defend yourself.

Additional Coverages and Riders

In addition to the core coverages discussed above, there are several additional coverages and riders that you may want to consider adding to your home insurance policy for added protection.

If you run a business from your home, it’s essential to have coverage for your home business. A standard home insurance policy may not provide sufficient coverage for business-related equipment, liability, or lost income. Adding coverage for your home business can help protect your assets and livelihood.

Water backup and sump pump overflow coverage is another optional coverage that can be added to your policy. If your home experiences water damage due to a backed-up sewer or a malfunctioning sump pump, this coverage can help cover the costs of cleanup and repairs.

If you own valuable jewelry or other high-value items, your standard personal property coverage may have limits on their coverage. Adding specific coverage for jewelry and valuable items can help ensure that these possessions are adequately protected in the event of loss, theft, or damage.

When undergoing home renovations, it’s important to consider insurance coverage for this period. Renovations can increase the risk of accidents, property damage, and theft. Insurance for home renovations can provide coverage for these risks during construction, giving you peace of mind throughout the process.

In conclusion, home insurance typically covers the structure of your home, personal belongings, liability protection, additional living expenses, natural disasters, theft and vandalism, accidental damage, loss of valuables, personal liability, and various additional coverages and riders. It’s important to review your policy and discuss your specific needs with an insurance professional to ensure that your home and everything in it is adequately protected.