If you’ve ever wondered how to lower your policy premium, look no further! In this article, we’ll explore some practical tips and tricks that can help you save money on your insurance. Whether it’s for your car, home, or health, we’ve got you covered. So sit back, relax, and let’s dive into the world of policy premiums and how you can bring them down to a more affordable level.

Evaluate your coverage needs

Determine your insurance requirements

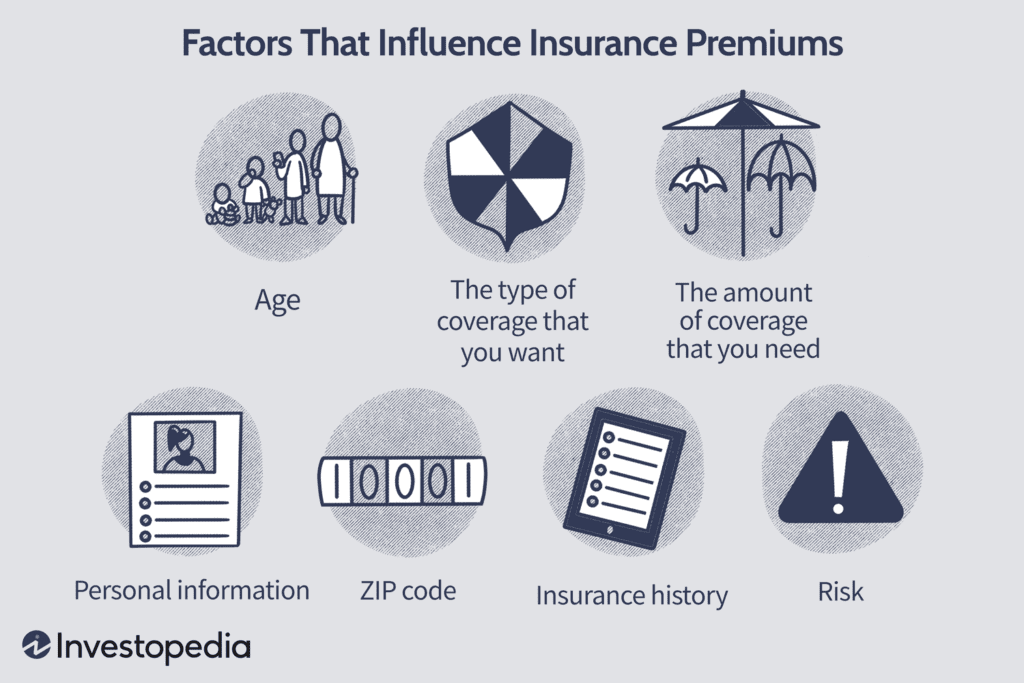

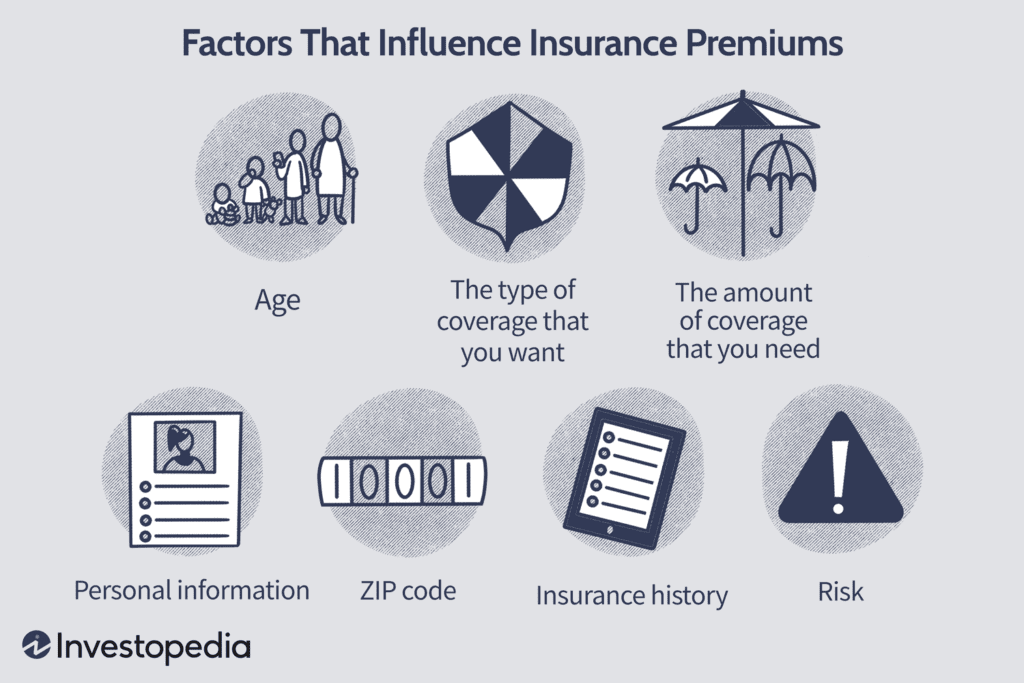

When it comes to reducing your policy premium, the first step is to evaluate your coverage needs. Take some time to analyze your specific insurance requirements. Consider factors such as your assets, liabilities, and potential risks that you may face. This will help you determine the types and amounts of coverage you truly need.

Review your current coverage

Next, take a closer look at your current insurance coverage. Review the policies you currently have in place and assess whether they still meet your needs. Sometimes, we end up with more coverage than necessary or duplicate coverage across different policies. By identifying any gaps or overlaps in your coverage, you can make informed decisions about which policies to keep and which to adjust or eliminate.

Consider your risk tolerance

Everyone’s risk tolerance is different, and it plays a significant role in determining the level of coverage you need. Some individuals are more risk-averse and prefer to have comprehensive coverage for every possible scenario. Others may lean towards a more self-insured approach, accepting higher deductibles or lower policy limits to reduce their premium costs. Consider where you fall on this spectrum and adjust your coverage accordingly to find the right balance for your needs.

Shop around for the best rates

Compare quotes from different insurers

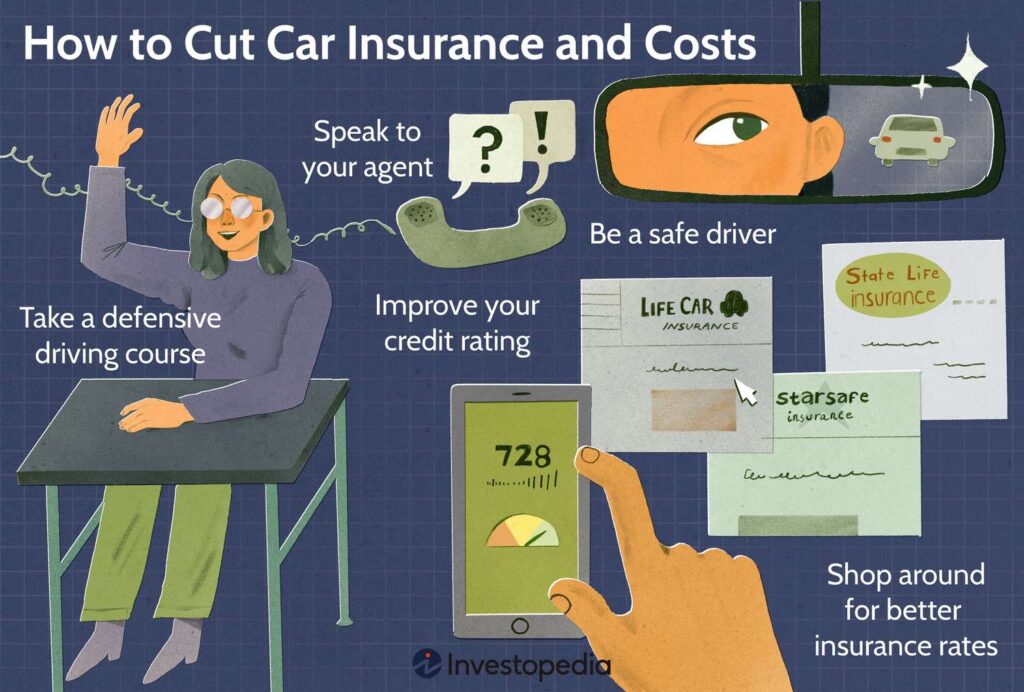

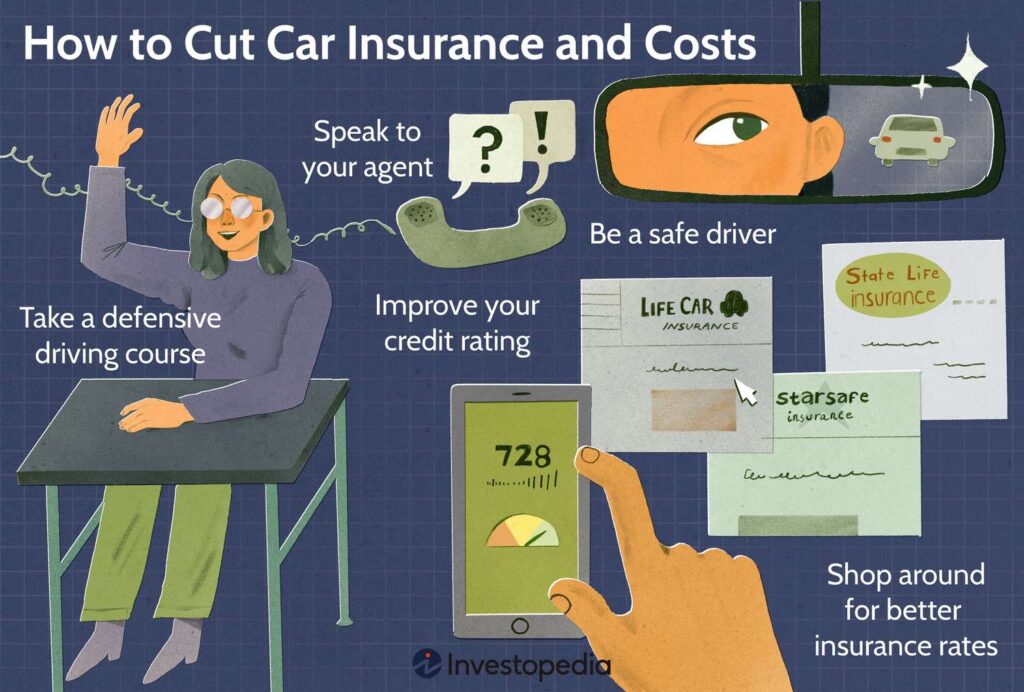

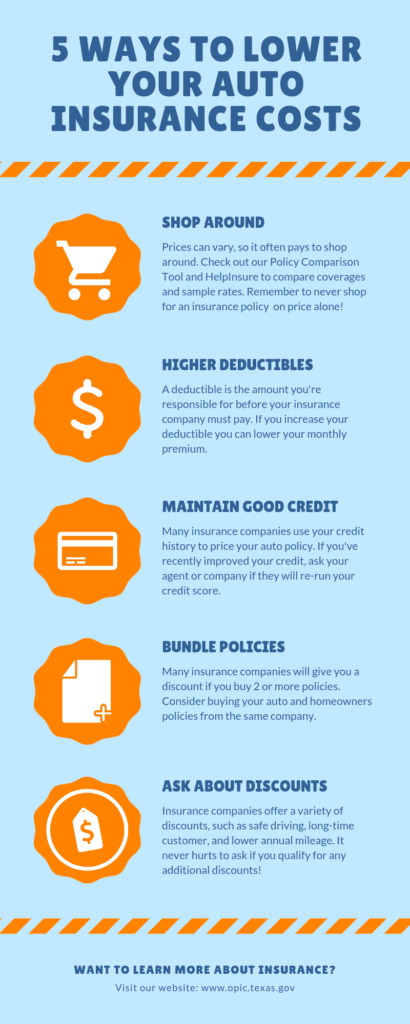

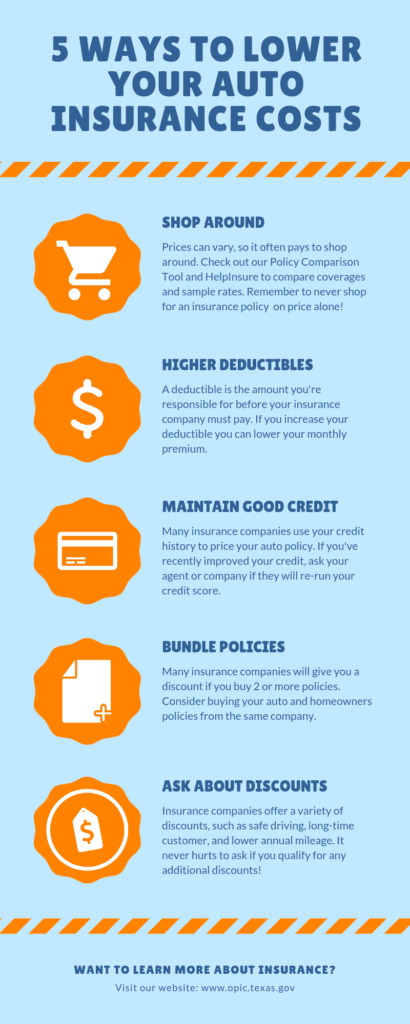

Shopping around for the best rates is an essential step in reducing your policy premium. Insurers vary in the rates they offer for the same coverage, so it’s worth obtaining quotes from multiple insurance companies. Take advantage of online comparison tools or work directly with insurance agents to gather quotes. Compare the coverages and premiums carefully to find the most competitive options that meet your needs.

Consider bundling policies

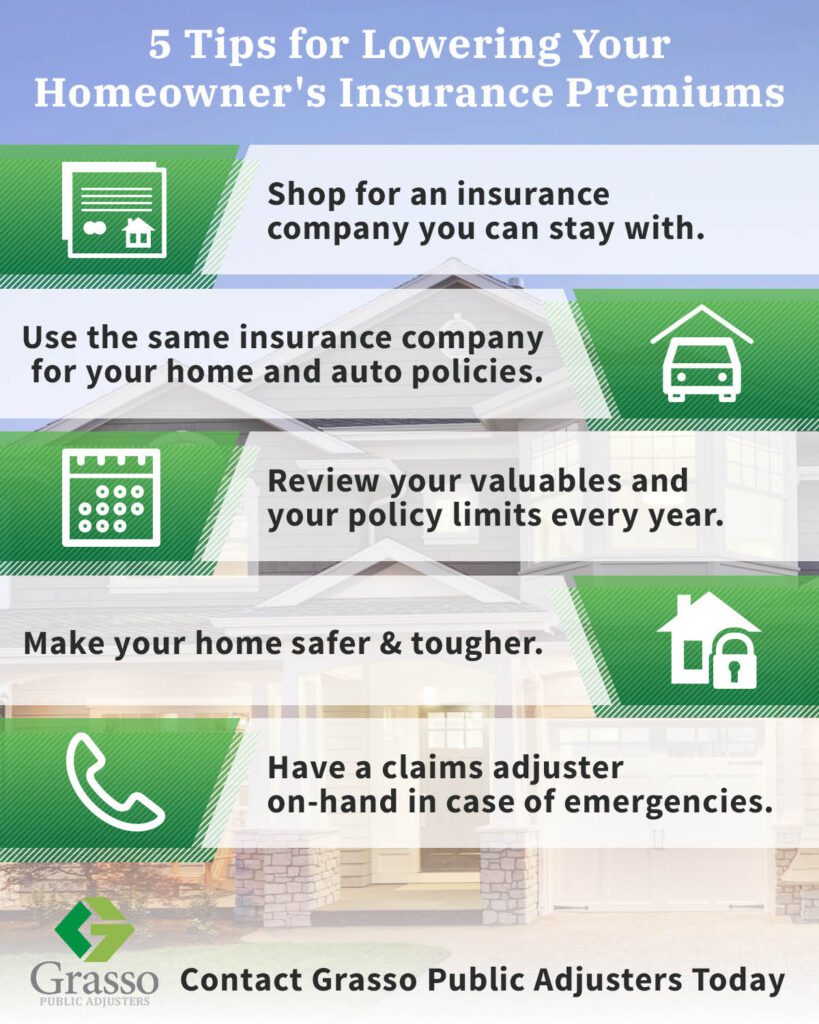

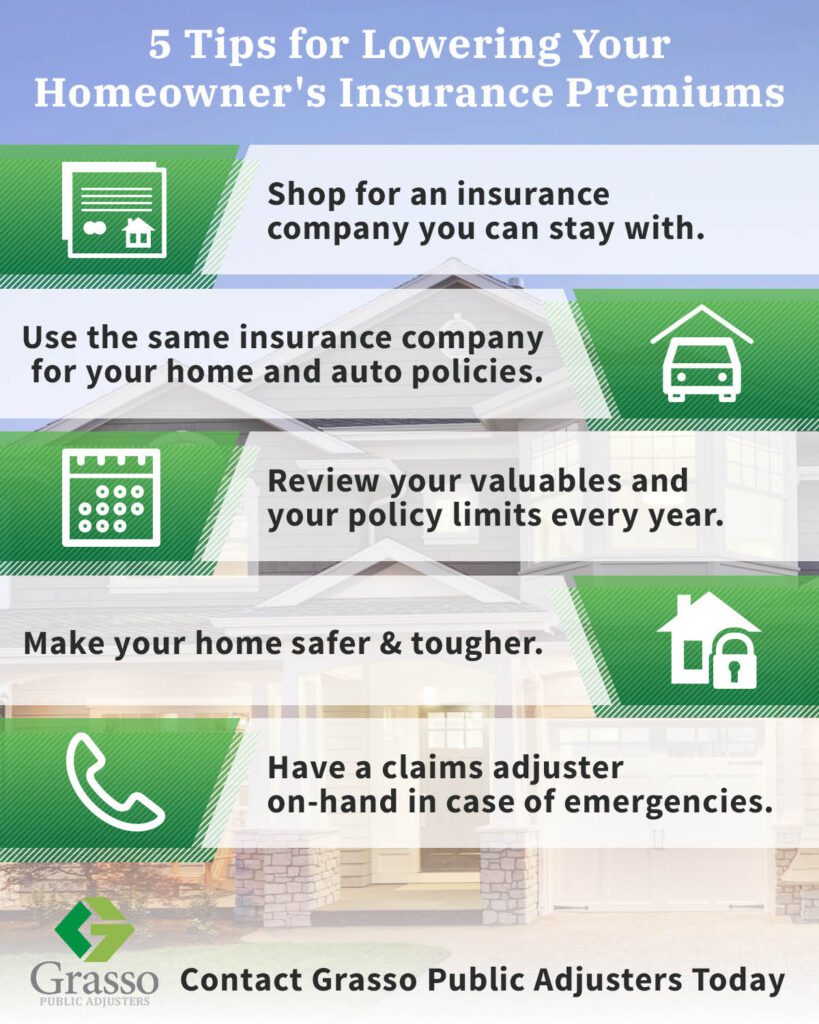

Bundling your insurance policies with the same insurer can often lead to significant savings on your premiums. When you consolidate your policies, such as home and auto, with one company, they may offer a multi-policy discount. This not only simplifies your insurance management but can also result in premium discounts that effectively lower your overall costs. Take the time to evaluate the potential savings through bundling before making a decision.

Look for discounts and incentives

Insurance companies frequently offer discounts and incentives to attract new customers or reward loyal ones. These discounts can vary widely, so be sure to inquire about any available options. Some common discounts include safe driver discounts, good student discounts, and discounts for installing certain safety features in your home or car. Make a list of potential discounts you may be eligible for and factor them into your decision-making process to further reduce your premium.

Improve your credit score

Understand the importance of credit score

Your credit score is an essential factor that insurance companies consider when determining your policy premium. A good credit score indicates a higher level of financial responsibility, which insurers view as an indicator of reduced risk. Understanding the significance of your credit score and its impact on your insurance premiums is crucial in taking steps to improve it.

Check your credit report

To improve your credit score, start by obtaining a copy of your credit report from one of the major credit reporting agencies. Review it carefully for any errors, inaccuracies, or fraudulent activity. Dispute any discrepancies you find and work with the credit reporting agency to resolve them. By ensuring the accuracy of your credit report, you can potentially boost your credit score and potentially enjoy lower policy premiums.

Pay bills on time and reduce debt

Consistently paying your bills on time and managing your debt responsibly can positively impact your credit score. Late payments and outstanding debt can lower your credit score, leading to higher insurance premiums. Make it a priority to pay your bills promptly and reduce your overall debt to improve your financial standing. Over time, this responsible financial behavior can result in lower premium costs.

Raise your deductibles

Understand the concept of deductibles

Deductibles are the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Increasing your deductibles can help lower your policy premium. However, it’s important to understand that you’ll be responsible for paying a higher amount in the event of a claim. Evaluate your ability to handle the increased out-of-pocket expenses before making a decision.

Evaluate your ability to pay out-of-pocket

Before raising your deductibles, evaluate your financial ability to cover the higher out-of-pocket costs. Consider your savings and budget to ensure that you could comfortably handle a deductible increase without causing significant financial strain. It’s crucial to strike a balance between cost savings and your ability to shoulder potential costs in the event of a claim.

Consider the impact on different types of policies

Raising your deductibles may have different implications depending on the types of policies you hold. For example, if you have a comprehensive auto insurance policy, a higher deductible may significantly reduce your premium without compromising coverage for major accidents or theft. On the other hand, a higher deductible on a health insurance policy may require you to pay more out-of-pocket for routine medical expenses. Evaluate the impact on each policy’s coverage and potential savings before making any changes.

Maintain a good driving record

Follow traffic rules and regulations

One of the most effective ways to keep your insurance premiums low is by maintaining a good driving record. This means following traffic rules and regulations at all times. Avoid speeding, reckless driving, or any other behavior that can result in traffic violations. By adhering to the rules of the road, you demonstrate responsible and safe driving habits that insurers value.

Avoid accidents and claims

Accidents and claims can significantly impact your insurance premiums. Insurance companies consider your claims history when determining your premium rates. To keep your policy premium as low as possible, make a conscious effort to avoid accidents and claims. Practice defensive driving techniques, maintain a safe distance from other vehicles, and always be aware of your surroundings. These proactive measures can help prevent accidents and claims, ultimately reducing your premium costs.

Consider defensive driving courses

Taking a defensive driving course can not only enhance your driving skills but can also potentially lower your insurance premiums. Many insurance companies offer discounts to policyholders who have completed a certified defensive driving course. These courses teach valuable techniques for safe driving and accident prevention. Check with your insurance company to see if they offer any discounts for completing defensive driving courses in your area.

Invest in safety and security measures

Install smoke detectors and security systems

Investing in safety and security measures in your home can lead to premium discounts on your homeowners or renters insurance. Install smoke detectors, fire alarms, and carbon monoxide detectors to demonstrate your commitment to safety. Additionally, consider installing a security system that includes burglar alarms, surveillance cameras, and motion detectors. These measures not only provide peace of mind but can also contribute to reducing your insurance costs.

Upgrade your home’s security features

Fortifying your home’s security features can lower the risk of burglaries and vandalism, leading to lower policy premiums. Consider upgrading your doors and windows with more secure options, such as impact-resistant glass or reinforced frames. Install deadbolts and window locks to deter intruders. These improvements can make a significant difference in your home’s security and potentially result in savings on your insurance premiums.

Use anti-theft devices for your vehicle

In the case of auto insurance, using anti-theft devices in your vehicle can help reduce your premium. Insurers view these devices as effective deterrents against theft or unauthorized access to your vehicle. Common anti-theft devices include car alarms, steering wheel locks, and tracking systems. By equipping your vehicle with these security measures, you not only protect your car but also potentially enjoy lower insurance costs.

Bundle policies with family members

Determine eligibility for family policy bundling

If you have family members who require insurance coverage, consider bundling your policies with theirs. Many insurance companies offer discounts for policy bundling within the same household. Evaluate if you’re eligible to bundle policies with your spouse, children, or other family members to enjoy potential premium savings.

Consider the advantages and disadvantages

Bundling policies with family members can offer several advantages. Not only can it lead to lower premiums for everyone involved, but it also simplifies insurance management by consolidating policies. However, it’s essential to carefully consider the specific needs of each family member and ensure that the bundled policies adequately meet their individual requirements. Evaluate the advantages and disadvantages to determine if policy bundling is the right choice for your family.

Consult with an insurance agent

To make an informed decision about policy bundling, consult with an insurance agent. They can provide expert advice and guidance on the different options available to you. An agent can help you compare premiums, coverage limits, and any potential limitations associated with bundling. By working with an agent, you can ensure that you make the most appropriate choices for your family’s insurance needs.

Consider raising your policy limits

Assess your current policy limits

Reviewing and potentially raising your policy limits can be another strategy to reduce your premium. Policy limits refer to the maximum amount your insurance company will pay out in the event of a claim. Higher policy limits generally result in higher premiums, but they also offer increased protection and coverage. Assess your current policy limits and determine if they align with your needs and risk tolerance.

Understand the potential benefits of higher limits

Increasing your policy limits can provide an additional layer of financial security. With higher limits, you have greater protection in the event of a significant loss or liability claim. While this may result in a higher premium, it also minimizes your potential financial exposure. Consider the potential benefits of higher limits and weigh them against the associated premium increase to make an informed decision.

Evaluate the financial impact

Before raising your policy limits, it’s crucial to evaluate the financial impact. Determine if you have the means to comfortably afford the higher premiums without putting a strain on your budget. Consider other aspects of your financial situation, such as savings and emergency funds, to ensure that you can manage the increased costs. Remember to strike a balance between the level of protection you desire and your financial capabilities.

Maintain a good health and lifestyle

Stay fit and adopt a healthy lifestyle

While health insurance premiums are influenced by a variety of factors, maintaining good health and adopting a healthy lifestyle can positively impact your overall costs. Engage in regular exercise, eat a balanced diet, and prioritize preventative care measures. By taking care of your health, you can potentially reduce the frequency of medical visits and minimize the risk of developing chronic conditions that can lead to higher insurance premiums.

Avoid tobacco and excessive alcohol consumption

Tobacco use and excessive alcohol consumption can significantly impact health insurance premiums. Insurance companies associate these behaviors with higher health risks and increased medical expenses. Quitting smoking and reducing alcohol consumption can not only improve your overall health but may also result in lower policy premiums. Consider seeking support from professionals if you need assistance in making these lifestyle changes.

Consider regular health screenings

By undergoing regular health screenings, you can identify potential health issues at an early stage. Detecting and addressing health concerns promptly can prevent them from worsening and potentially leading to higher insurance premiums. Consult with your healthcare provider to determine the appropriate screenings for your age, gender, and medical history. By taking proactive steps towards your health, you can save on insurance costs in the long run.

Take advantage of loyalty discounts

Stay with the same insurance company for a certain period

Insurance companies often offer loyalty discounts to policyholders who stay with them for an extended period. These discounts are a way for insurers to reward customer loyalty. If you’ve been with the same insurance company for some time, inquire about any loyalty discounts that may be available to you. Staying loyal to your insurer can result in long-term savings on your policy premiums.

Inquire about loyalty discount programs

In addition to staying with the same insurer, inquire about any loyalty discount programs they may have. Some insurance companies offer additional benefits or discounts for policyholders who have been with them for a certain number of years. These programs can include perks such as decreasing deductibles or bonus coverage options. By taking advantage of these programs, you can enjoy further savings on your insurance premiums.

Evaluate the overall benefits

When considering loyalty discounts, evaluate the overall benefits of staying with the same insurance company. While loyalty discounts can result in lower premiums, it’s essential to assess the quality of service, coverage options, and claim handling provided by the insurer. Sometimes, switching to a new insurer may offer better rates and coverage that outweigh loyalty discounts. Consider all factors and compare different options before making a decision.

In conclusion, reducing your policy premiums requires careful evaluation of your coverage needs, comparing quotes from different insurers, improving your credit score, adjusting deductibles, maintaining a good driving record, investing in safety and security measures, bundling policies with family members, raising policy limits, adopting a healthy lifestyle, and taking advantage of loyalty discounts. By following these steps and considering each section’s recommendations, you can potentially lower your insurance premiums while still maintaining adequate coverage. Remember to consult with insurance professionals to ensure that any changes align with your specific needs and circumstances. With a little effort and research, you can find the best ways to reduce your policy premiums and achieve peace of mind.