When you purchase a home with a mortgage loan, you may be required to pay for mortgage insurance until a certain milestone is reached. In this article, we will explore the question on everyone’s mind: how long does it take for mortgage insurance to fall off? Understanding this timeline can help you plan ahead and potentially save money in the long run. So, let’s dive in and unravel the mystery behind mortgage insurance expiration.

Understanding Mortgage Insurance

Definition of Mortgage Insurance

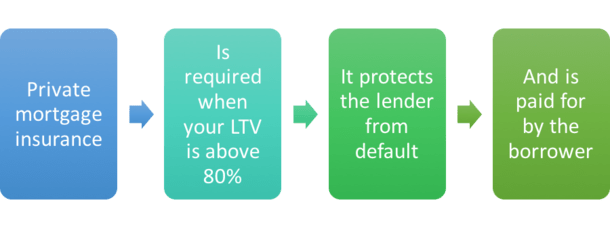

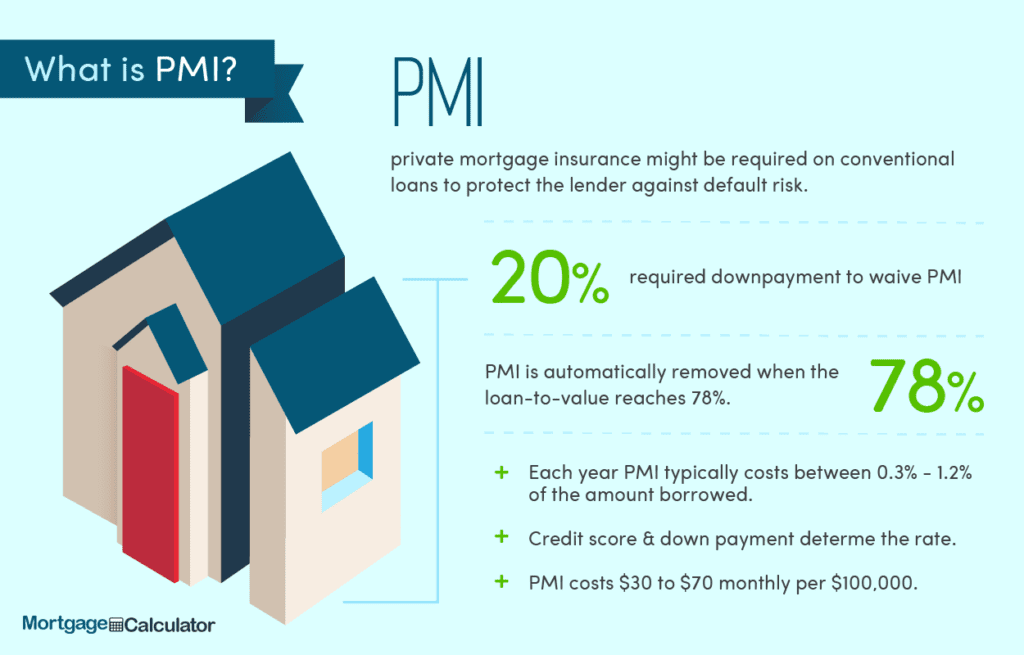

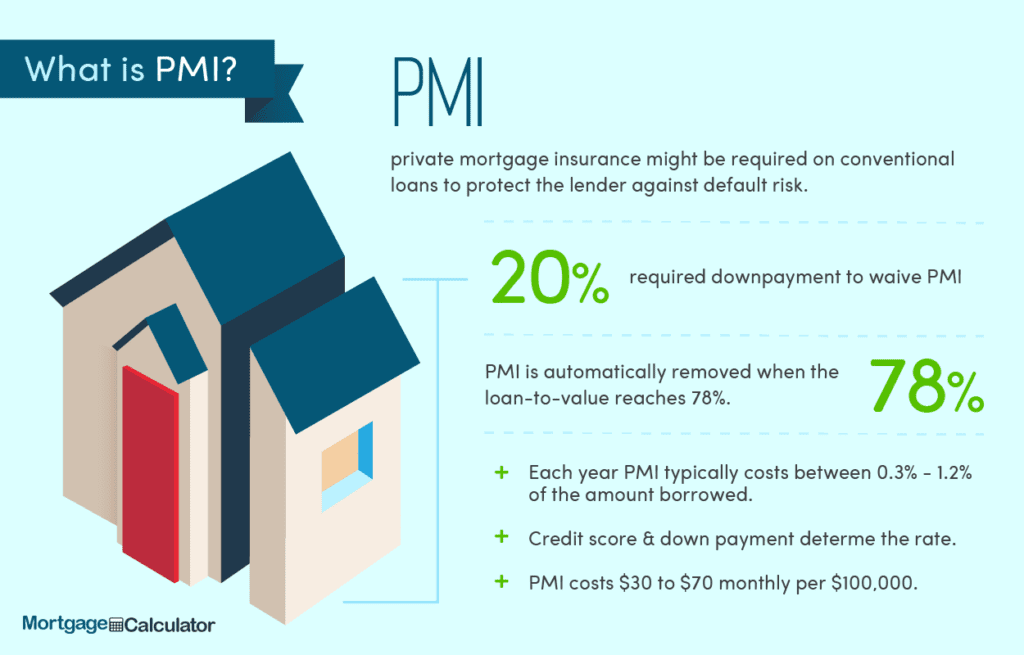

Mortgage insurance is a type of insurance policy that protects the lender in case the borrower defaults on their mortgage payments. It is typically required by lenders when the borrower is making a down payment of less than 20% of the home’s purchase price. The insurance provides the lender with financial protection by reimbursing them for any losses they may incur if the borrower fails to repay the loan.

Types of Mortgage Insurance

There are different types of mortgage insurance available, depending on the loan program and the preferences of the borrower. The three main types of mortgage insurance are Borrower-Paid Mortgage Insurance (BPMI), Lender-Paid Mortgage Insurance (LPMI), and Private Mortgage Insurance (PMI). Each type has its own payment structure and requirements, which can vary based on factors such as loan-to-value ratio and credit score.

Purpose of Mortgage Insurance

The primary purpose of mortgage insurance is to protect the lender from potential financial losses. By requiring borrowers to have mortgage insurance, lenders can offer loans to borrowers with lower down payments, thereby increasing homeownership opportunities. Mortgage insurance also provides a safety net for the borrower by allowing them to obtain a loan with a smaller down payment, making homes more affordable and accessible.

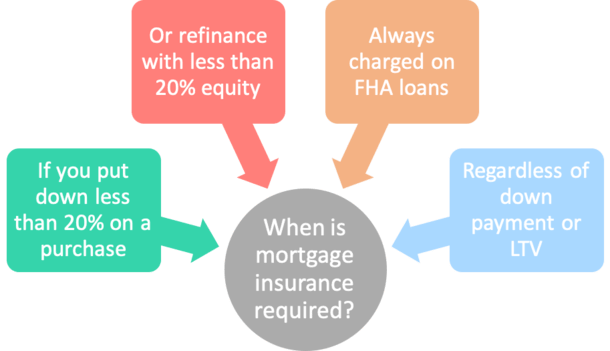

When Does Mortgage Insurance Start?

Initial Payment

Mortgage insurance typically starts with the very first payment you make on your mortgage loan. In most cases, the initial mortgage insurance premium is due at the closing of the loan and is typically rolled into the loan amount. This initial payment is calculated based on the loan-to-value ratio and the loan program you are using.

Loan-to-Value Ratio

The loan-to-value ratio (LTV) plays a significant role in determining when mortgage insurance starts. LTV is the ratio of the loan amount to the appraised value of the property. If you have a higher LTV, meaning a smaller down payment, the mortgage insurance is likely to start from the beginning of the loan. However, if you make a larger down payment and have a lower LTV, the mortgage insurance may not be required.

Loan Programs

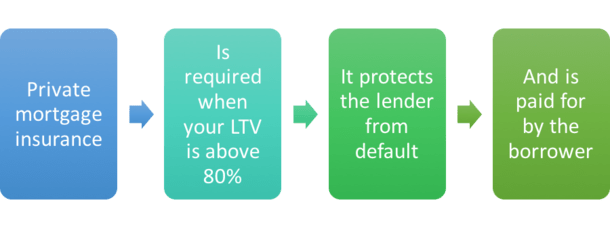

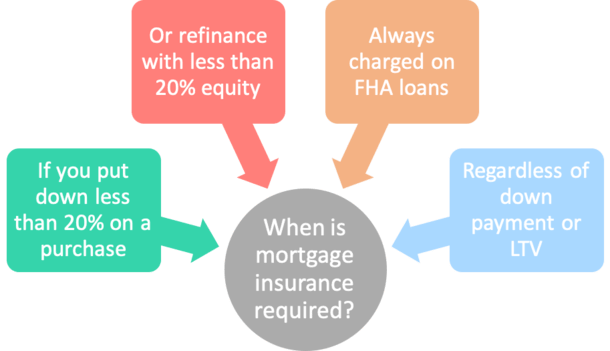

Different loan programs have different requirements regarding mortgage insurance. Conventional loans, which are not insured by the government, typically require mortgage insurance if the borrower makes a down payment of less than 20%. On the other hand, government-backed loans such as FHA (Federal Housing Administration), USDA (United States Department of Agriculture), and VA (Department of Veterans Affairs) loans have their own guidelines for when mortgage insurance starts.

Factors Affecting Mortgage Insurance Duration

Loan-to-Value Ratio

The loan-to-value ratio continues to impact the duration of mortgage insurance even after it has started. As you pay down your mortgage and build equity in your home, your LTV decreases. Once your LTV reaches a certain threshold (usually around 80% to 78%), you may be eligible to have your mortgage insurance canceled or removed.

Loan Program

The loan program you choose can influence how long you will have to pay mortgage insurance. Conventional loans, for example, have different requirements for canceling mortgage insurance compared to FHA, USDA, and VA loans. Each program has its own rules and regulations for the duration of mortgage insurance.

Property Appreciation

Property appreciation can play a role in reducing the duration of mortgage insurance. If the value of your home increases over time, your LTV ratio may decrease more quickly. This could potentially allow you to reach the point where you can request the removal of mortgage insurance sooner than expected.

Payment History

Maintaining a good payment history is crucial for removing mortgage insurance. Consistently making your mortgage payments on time and in full can demonstrate financial responsibility and may make lenders more willing to consider removing mortgage insurance earlier than scheduled.

Automatic Termination

Some loan programs have automatic termination of mortgage insurance when certain conditions are met. For example, FHA loans require mortgage insurance to be paid for at least 11 years if the down payment is less than 10%. However, if you made a down payment of 10% or more, the mortgage insurance can be removed after 11 years.

Conventional Mortgage Insurance

Borrower-Paid Mortgage Insurance (BPMI)

Borrower-Paid Mortgage Insurance (BPMI) is a type of mortgage insurance where the borrower pays the premium. This is the most common type of mortgage insurance for conventional loans with less than a 20% down payment. The BPMI premium is typically added to the monthly mortgage payment or paid as a one-time upfront fee at closing.

Lender-Paid Mortgage Insurance (LPMI)

Lender-Paid Mortgage Insurance (LPMI) is another type of mortgage insurance for conventional loans. Rather than the borrower paying the premium directly, the lender pays the premium on behalf of the borrower. In return, the lender may charge a higher interest rate on the loan to compensate for the cost of the insurance.

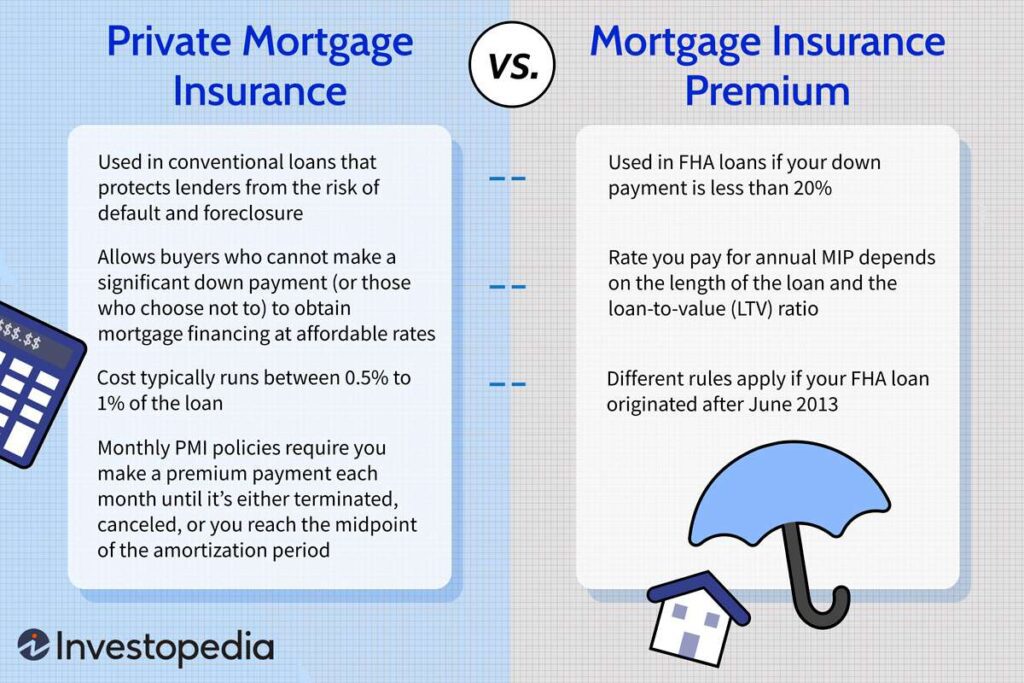

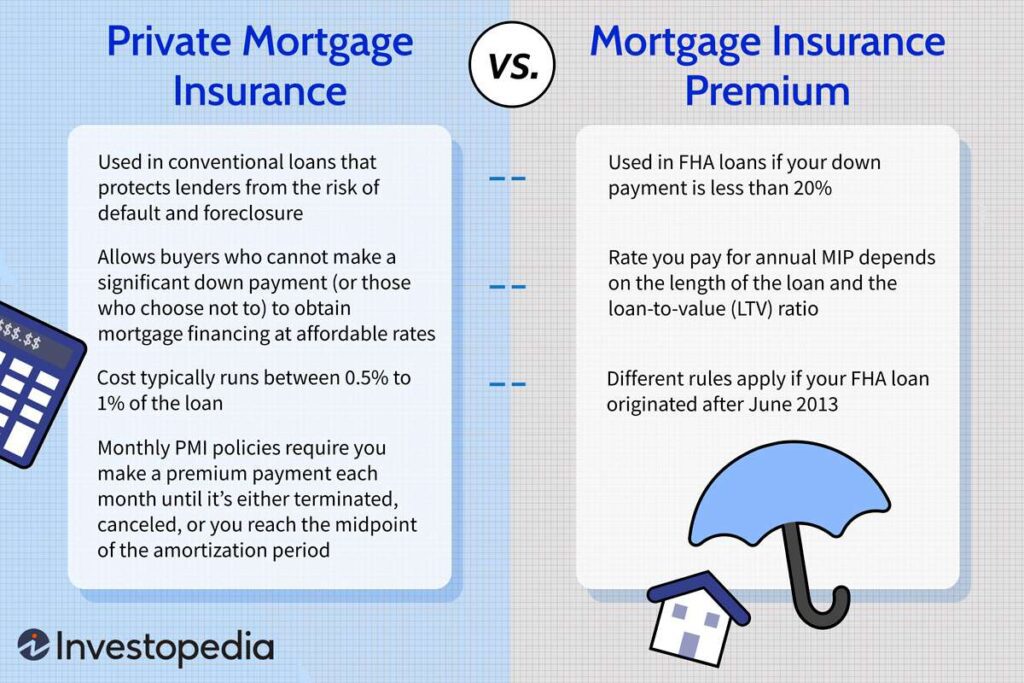

Private Mortgage Insurance (PMI)

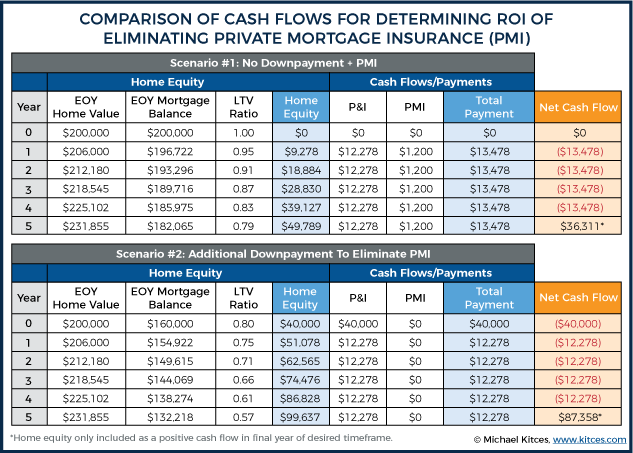

Private Mortgage Insurance (PMI) is a type of mortgage insurance provided by private insurance companies. It is typically required for conventional loans with a down payment of less than 20%. PMI premiums can be paid as part of the monthly mortgage payment or as a lump sum upfront. The cost of PMI can vary depending on factors such as credit score, loan-to-value ratio, and loan program.

Duration of Mortgage Insurance for Different Loan Types

Conventional Loans

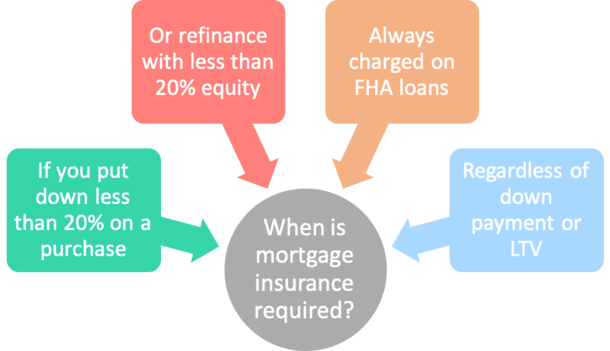

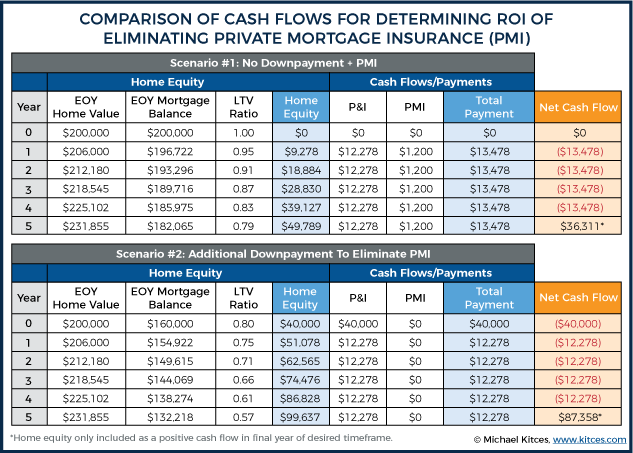

For conventional loans, mortgage insurance can typically be removed once the borrower reaches an LTV ratio of 78% or lower. However, borrowers may be able to request the removal of mortgage insurance when their LTV ratio reaches 80%, depending on the lender and the loan program.

FHA Loans

FHA loans have different rules for the duration of mortgage insurance. If the down payment is less than 10%, mortgage insurance must be paid for the entire term of the loan, which is typically 30 years. If the down payment is 10% or more, mortgage insurance can be removed after 11 years.

USDA Loans

USDA loans also have specific guidelines for mortgage insurance. For loans with an LTV ratio of 90% or higher, mortgage insurance must be paid for the entire term of the loan. If the LTV ratio is below 90%, mortgage insurance can be removed after 11 years.

VA Loans

VA loans do not require mortgage insurance, as they are guaranteed by the Department of Veterans Affairs. However, VA loans do have a funding fee that is typically rolled into the loan amount. The funding fee serves a similar purpose to mortgage insurance by protecting the lender in case of default.

Removing Mortgage Insurance on Conventional Loans

Home Value Appreciation

One way to remove mortgage insurance on conventional loans is through home value appreciation. If your home has appreciated significantly in value, it may push your LTV ratio below the required threshold for mortgage insurance removal. In such cases, you can request a new appraisal to determine the updated value of your home.

Loan-to-Value Ratio

Reaching an LTV ratio of 78% or lower can be a trigger for removing mortgage insurance on conventional loans. Once your LTV ratio meets the lender’s requirements, you can contact your lender and request the removal of mortgage insurance. Some lenders may have additional criteria or paperwork that needs to be completed.

Automatic Termination

In some cases, the mortgage insurance on conventional loans is automatically terminated when the LTV ratio reaches 78%. This means that you don’t need to take any additional steps or contact your lender to have the mortgage insurance removed. However, it is always a good idea to verify with your lender that automatic termination will apply to your loan.

Borrower-Requested Cancellation

Even if your LTV ratio has not reached the required threshold for automatic termination, you may still be able to request the cancellation of mortgage insurance on a conventional loan. Contact your lender and inquire about their specific guidelines for borrower-requested cancellation. This process usually involves providing documentation to demonstrate the property value and equity.

Refinancing

Another option for removing mortgage insurance on conventional loans is to refinance your mortgage. If your home value has significantly increased or your financial situation has improved, refinancing may allow you to obtain a new loan without mortgage insurance. However, refinancing comes with its own costs and considerations, so it’s important to weigh the pros and cons before deciding to refinance.

Removing Mortgage Insurance on FHA Loans

Initial Terms

On FHA loans, the duration of mortgage insurance is determined by the initial terms of the loan. If the down payment is less than 10%, mortgage insurance must be paid for the entire term of the loan, which is typically 30 years. If the down payment is 10% or more, mortgage insurance can be removed after 11 years.

Loan Balance

Another factor that affects the removal of mortgage insurance on FHA loans is the loan balance compared to the home’s value. If the loan balance is 78% or less of the original purchase price, mortgage insurance may be eligible for removal. This requires an appraisal to confirm the current value of the property.

Payment History

Maintaining a good payment history is crucial for the removal of mortgage insurance on FHA loans. Late payments or delinquencies can hinder the ability to have mortgage insurance removed until the loan reaches the required time, even if the LTV ratio meets the criteria.

Refinancing

Refinancing can also be an option for removing mortgage insurance on FHA loans. By refinancing into a new loan with a lower LTV ratio, you may be able to eliminate the need for mortgage insurance. However, it’s important to carefully calculate the costs and benefits of refinancing before making a decision.

Mortgage Insurance Premium (MIP)

On FHA loans, mortgage insurance is known as Mortgage Insurance Premium (MIP). MIP payments are made monthly and may also include an upfront premium that is typically rolled into the loan amount. The duration of MIP payments can vary depending on the down payment and loan term.

Removing Mortgage Insurance on USDA Loans

Term of the Loan

The term of the loan affects the duration of mortgage insurance on USDA loans. If the loan has a term of 30 years, mortgage insurance must be paid for the entire term. However, if the loan has a term of 15 years, mortgage insurance can be removed after 10 years.

Appraised Value

For USDA loans, the appraised value of the property can affect the removal of mortgage insurance. If the appraised value increases significantly and the LTV ratio falls below 80%, you may be eligible for mortgage insurance removal. An appraisal will be required to confirm the current value of the property.

Payment History

Maintaining a good payment history is important for the removal of mortgage insurance on USDA loans. Late payments or delinquencies can impact the ability to have mortgage insurance removed until the loan reaches the required time. It is crucial to make all payments on time to maximize the chances of removing mortgage insurance.

Refinancing

Similar to other loan types, refinancing can be an option for removing mortgage insurance on USDA loans. By refinancing into a new loan with a lower LTV ratio, you may be able to eliminate the need for mortgage insurance. It’s important to carefully consider the costs and benefits before deciding to refinance.

Applicable Fees

Removing mortgage insurance on USDA loans may involve applicable fees. Some lenders may charge fees for processing the removal of mortgage insurance. It’s important to review the terms and conditions of your loan to understand any potential fees associated with the removal of mortgage insurance.

Removing Mortgage Insurance on VA Loans

No Mortgage Insurance

One of the advantages of VA loans is that they do not require mortgage insurance. The Department of Veterans Affairs guarantees VA loans, eliminating the need for borrowers to pay for mortgage insurance. This can result in significant cost savings over the life of the loan.

Funding Fee

While VA loans do not require mortgage insurance, they do have a funding fee. The funding fee is a one-time fee that is typically rolled into the loan amount. The purpose of the funding fee is to offset the costs of the VA loan program. The amount of the funding fee depends on the borrower’s military service, loan type, and down payment.

Refinancing

Refinancing a VA loan can be an option for removing mortgage insurance. If you have built up equity in your home and your credit score has improved, you may be eligible for a conventional loan without mortgage insurance. However, it’s important to consider the costs and benefits of refinancing before making a decision.

Certificate of Eligibility

A certificate of eligibility (COE) is required for VA loans and serves as proof of your entitlement to the loan program. To remove mortgage insurance on a VA loan, you may need to provide a new COE when refinancing or if there are changes to the loan terms. Contact your lender or the Department of Veterans Affairs for more information on obtaining a new COE.

Additional Considerations

Consulting with Lender

When dealing with mortgage insurance, always consult with your lender to understand the specific guidelines and requirements of your loan program. Your lender will be able to provide accurate and up-to-date information tailored to your individual situation.

Tracking Loan Progress

Keep track of your loan progress to determine when you may be eligible to remove mortgage insurance. Monitor your LTV ratio, payment history, and property value appreciation over time. By staying informed, you can plan accordingly and take necessary steps to remove mortgage insurance when eligible.

Understanding Terms and Conditions

Read and understand the terms and conditions of your loan agreement to know when and how mortgage insurance can be removed. Pay close attention to any applicable fees, documentation requirements, and waiting periods. Being informed about the terms and conditions will help you make informed decisions regarding your mortgage insurance.