When it comes to repairing or renovating your home, the decision to start with a contractor or an insurance claim is a crucial one. With numerous factors to consider, you might find yourself wondering which route is the best option for you. In this article, we will explore the advantages and disadvantages of beginning with a contractor or initiating an insurance claim. By examining both approaches, you can make an informed decision that suits your specific needs and ensures a smooth and successful home improvement journey.

Factors to Consider Before Making a Decision

When it comes to making a decision between starting with a contractor or an insurance company, there are several important factors to consider. These factors can greatly impact the outcome of your project, so it’s crucial to take them into account before making a final decision.

Budget

One of the key factors to consider is your budget. How much are you willing to invest in your project? Starting with a contractor may require a significant upfront investment, as you’ll be paying for their services and materials. On the other hand, starting with an insurance company may involve paying insurance premiums, which can also add up over time.

It’s important to evaluate your financial situation and determine what you can afford. Consider whether a contractor’s price fits within your budget or if the ongoing costs of insurance premiums are a better fit for your financial capabilities.

Timeline

Another important factor to consider is the timeline of your project. How urgent is the work that needs to be done? If you’re facing an emergency situation, such as a burst pipe or a leaking roof, starting with a contractor may be the quickest option. They can respond promptly and address the issue immediately.

In contrast, starting with an insurance company may involve a longer process. You’ll need to file a claim, wait for approval, and then coordinate with a contractor within the insurance company’s network. This can extend the timeline of your project significantly.

Project Complexity

The complexity of your project is another crucial factor to consider. Some projects may be straightforward and can be easily handled by a contractor. However, if your project involves intricate details, specialized equipment, or extensive knowledge in a particular field, it may be advantageous to start with an insurance company.

Insurance companies often have a network of contractors with diverse specialties and expertise. They can provide you with the right professionals who have the necessary skills to handle complex projects efficiently.

Starting with a Contractor

If you’ve decided that starting with a contractor is the right choice for your project, there are advantages and disadvantages to be aware of.

Advantages of Starting with a Contractor

Starting with a contractor allows you to have more control over the selection process. You can research and choose a contractor based on their experience, expertise, and portfolio. This gives you the freedom to find a contractor who aligns with your vision and requirements.

Additionally, starting with a contractor provides you with the opportunity to communicate directly with the person who will be working on your project. This direct line of communication facilitates efficient collaboration and ensures that your needs and expectations are met.

Disadvantages of Starting with a Contractor

One potential disadvantage of starting with a contractor is the financial investment required. Contractors may charge fees upfront or ask for partial payments throughout the project. This can strain your budget, especially if unexpected expenses arise.

Another disadvantage is the reliance on a single contractor. If the contractor you choose becomes unavailable or fails to meet your expectations, it can significantly impact the progress and success of your project. It’s important to thoroughly research and choose a reliable and reputable contractor to minimize this risk.

Starting with an Insurance

If you believe that starting with an insurance company is the best approach for your project, there are advantages and disadvantages to consider.

Advantages of Starting with an Insurance

One of the main advantages of starting with an insurance company is the peace of mind it provides. Insurance coverage can protect you from unexpected expenses and liabilities that may arise during your project. This can alleviate financial stress and give you confidence in moving forward with your plans.

Additionally, starting with an insurance company allows you access to their network of contractors. These contractors have been vetted and approved by the insurance company, ensuring that they meet certain standards of quality and professionalism. This can give you added assurance that you’re working with reputable professionals.

Disadvantages of Starting with an Insurance

One potential disadvantage of starting with an insurance company is the complexity of the claims process. Filing a claim, waiting for approval, and coordinating with the insurance company’s contractors can be time-consuming and may cause delays in starting your project. It’s important to consider whether the added steps and potential complications are worth the convenience of insurance coverage.

Another disadvantage is the limited contractor options that may be available through the insurance company. While insurance companies typically have a network of contractors, you may not have the same freedom to choose a contractor who aligns perfectly with your preferences and requirements. You’ll need to carefully evaluate the options provided by the insurance company and ensure that they meet your standards.

When to Start with a Contractor

Now that we’ve explored both options, it’s important to understand when it may be best to start with a contractor.

Emergencies

In emergency situations where immediate action is required, starting with a contractor is often the most practical choice. Emergencies such as burst pipes, severe damages, or electrical issues necessitate urgent attention to prevent further damage or harm.

Contractors specialized in emergency repairs can quickly assess the situation, provide temporary fixes if necessary, and ensure that the problem is addressed promptly. Starting with a contractor in these cases can minimize the overall impact of the emergency and help bring the situation under control.

Preferential Contractors

If you have a specific contractor in mind who you trust and prefer to work with, then starting with a contractor is the ideal choice. Whether it’s due to a previous positive experience, a personal recommendation, or a specific specialty required for your project, having the freedom to choose your preferred contractor gives you the confidence and peace of mind in moving forward.

Starting with a chosen contractor ensures that you have a level of familiarity and trust, as you may have already established a rapport with them. This can contribute to smoother communication, efficient work, and ultimately, a higher level of satisfaction with the end result.

Complex Projects

For complex projects that require specialized skills or extensive knowledge, starting with a contractor who possesses the required expertise is crucial. Some projects involve intricate details, unique materials, or specific design elements that demand a contractor with experience in handling similar complexities.

A knowledgeable and experienced contractor can navigate the complexities efficiently, ensuring that all aspects of the project are addressed effectively. Their expertise can lead to better problem-solving, superior craftsmanship, and an overall successful outcome.

When to Start with an Insurance

On the other hand, there are situations where starting with an insurance company may be the more suitable option.

Insurance Coverage

If your project involves significant risks, starting with an insurance company can provide you with the necessary coverage. Insurance policies often protect against damages, liabilities, and unforeseen expenses that may occur during the course of a project.

Having insurance coverage can offer financial security and peace of mind, especially for larger and more complex projects. It safeguards you against potential losses and ensures that you won’t bear the burden of unexpected costs.

Limited Contractor Options

In some cases, you may face limited options when it comes to choosing a contractor. This may be due to location constraints, a lack of available contractors, or specialized requirements that only a select few contractors can fulfill.

Starting with an insurance company can offer a solution in such circumstances. Insurance companies typically have a network of approved contractors, giving you access to reliable professionals who have already been vetted by the insurance company. This can save you time and effort in searching for contractors on your own and provide you with a narrowed-down selection of reputable options.

Budget Constraints

If you’re working within a tight budget, starting with an insurance company may be more financially feasible. Insurance premiums are often paid on a monthly or annual basis, allowing you to manage your budget more easily.

While starting with an insurance company may not cover the full costs of your project, it can still provide valuable financial support by alleviating some of the burdensome expenses. It’s important to assess your budget constraints and evaluate how insurance coverage aligns with your financial situation.

Questions to Ask a Contractor

Once you’ve decided to start with a contractor, it’s essential to ask them the right questions to ensure they are the best fit for your project.

Experience and Expertise

Ask the contractor about their experience in the industry and their expertise in handling projects similar to yours. Inquire about the range of projects they have worked on and whether they have any specialized skills or certifications.

Additionally, ask about their team and whether they have any subcontractors or collaborators. Understanding their level of experience and the breadth of their knowledge will help you assess their capability and suitability for your project.

References and Portfolio

Ask the contractor for references from previous clients. Contacting these references can give you insights into the contractor’s professionalism, reliability, and quality of work. It’s important to inquire about the reference’s satisfaction with the project, adherence to timelines, and overall experience working with the contractor.

Furthermore, request to see their portfolio or examples of their previous work. This will allow you to assess the contractor’s style, craftsmanship, and attention to detail. It’s crucial to have a clear understanding of the quality of their work and whether it aligns with your expectations.

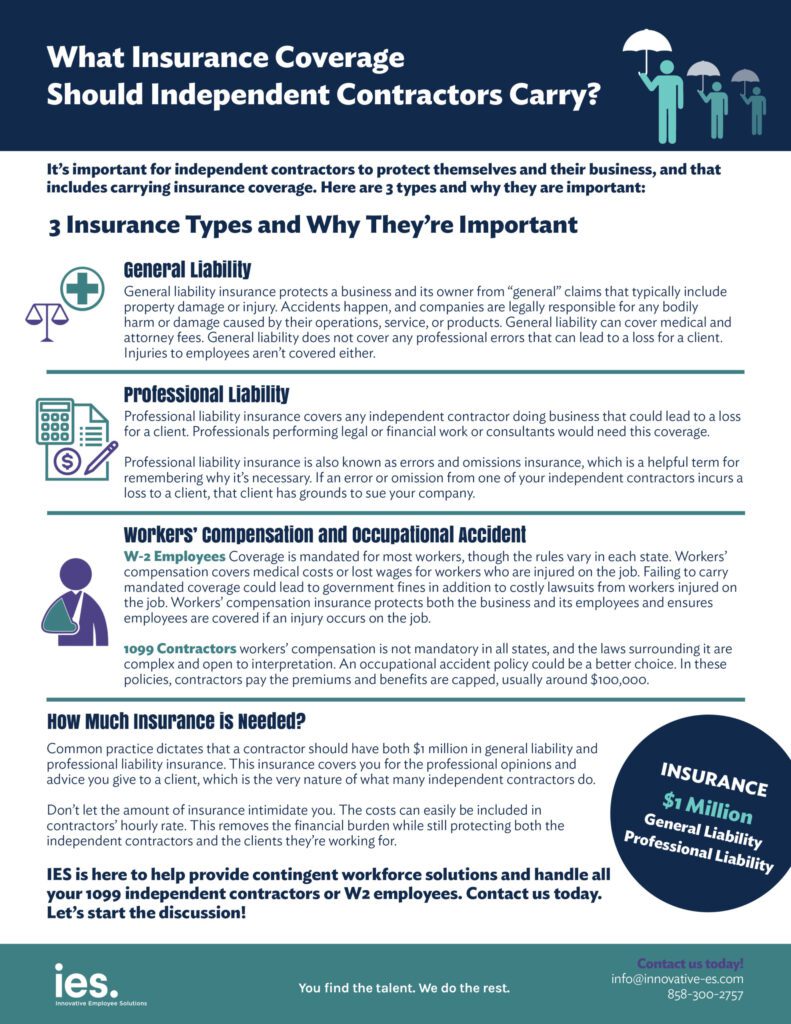

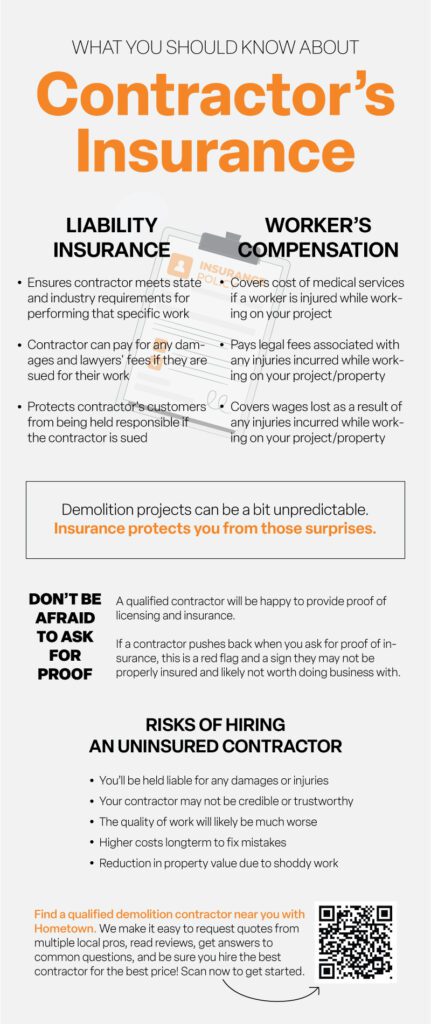

Insurance and Licensing

Verify that the contractor is properly insured and licensed. Request proof of insurance coverage, including liability insurance and workers’ compensation insurance. This ensures that you won’t be held liable for any accidents or damages that may occur during the project.

Additionally, inquire about their licensing and certifications. Depending on your local jurisdiction, certain trades may require specific licenses to perform the work. Confirming the contractor’s compliance with these requirements is essential to ensure that they are operating legally and professionally.

Questions to Ask an Insurance Company

If you decide to start with an insurance company, it’s crucial to gather all the necessary information to make an informed decision.

Coverage Details

Ask the insurance company for detailed information about their coverage. Inquire about the types of damages and liabilities that the policy covers. Understand the limitations and exclusions of the policy to ensure that it aligns with your project’s specific needs.

Additionally, ask about the maximum coverage limits and whether there are deductibles or additional costs associated with filing a claim. It’s important to have a comprehensive understanding of what the insurance policy entails to avoid any surprises later on.

Claim Process

Understand the claim process and the steps involved in filing a claim. Inquire about the documentation and evidence required to support your claim. Ask about the timeline for claim approval and the typical response time for the insurance company.

Furthermore, discuss how the insurance company handles disputes or disagreements regarding claims. Clarify the expectations and procedures involved in case of disagreements to ensure a smooth claim process.

Contractor Network

If the insurance company has a network of contractors, ask for details about these contractors. Inquire about the criteria used to vet and approve contractors for the network. Understand the process of engaging a contractor through the insurance company and how the coordination between you, the insurance company, and the contractor will work.

Additionally, ask about the insurance company’s relationship with the contractors in their network. Understand whether the insurance company has direct control over the contractors or if it’s a more informal partnership. This will help you assess the level of accountability and quality assurance provided by the insurance company’s contractors.

Making the Final Decision

After considering the factors, advantages, disadvantages, and asking the necessary questions, it’s time to make the final decision.

Weighting the Pros and Cons

Evaluate the pros and cons of starting with a contractor versus starting with an insurance company. Consider the specific needs of your project and how each option fulfills those needs. Analyze the financial implications, timeline considerations, and quality assurance offered by each option.

Make a comprehensive list of the advantages and disadvantages, and assign weight to each factor based on their importance to your project’s success. This will help you objectively assess the options and determine which one aligns most closely with your requirements.

Determining the Most Suitable Option

Based on the evaluation of the pros and cons, determine which option is the most suitable for your project. Consider the factors that are crucial to the success and smooth operation of your project.

Remember that every project is unique, and what works for one may not work for another. Focus on aligning your decision with the specific needs of your project and your personal preferences.

Considering the Project Requirements

Lastly, consider the specific requirements of your project and how they impact your decision. If your project requires specialized knowledge, immediate attention, or insurance coverage, weigh these requirements heavily in your final decision-making process.

It’s essential to prioritize the needs and goals of your project over other factors. By doing so, you’ll ensure that you make an informed decision that sets your project on the path to success.

Conclusion

In conclusion, choosing whether to start with a contractor or an insurance company depends on several factors that are unique to each individual project. Evaluating your budget, timeline, and project complexity is crucial in making an informed decision. Starting with a contractor provides more control and flexibility, while starting with an insurance company offers financial protection and a network of approved contractors.

Assessing the advantages and disadvantages of each option, as well as asking the right questions to both contractors and insurance companies, can help guide your decision-making process. Weighing the pros and cons, considering the requirements of your project, and objectively analyzing all the factors involved will ultimately lead you to the most suitable option.

Remember that making the right decision is essential for the success of your project. So take the time to evaluate your options, gather all the necessary information, and make an informed choice that aligns with your goals and expectations.