Are you feeling baffled and overwhelmed by the whole process of homeowners insurance claims? Rest assured, you are not alone. Many people find themselves in a state of confusion when it comes to navigating the complexities and intricacies of filing a claim. From understanding the coverage limits to estimating the damage and negotiating with the insurance company, it can be a daunting task. But fear not, because in this article, we will shed light on the subject and help you gain a clearer understanding of homeowners insurance claims. So sit back, relax, and let’s unravel the mysteries together.

Understanding Homeowners Insurance Claims

What is homeowners insurance?

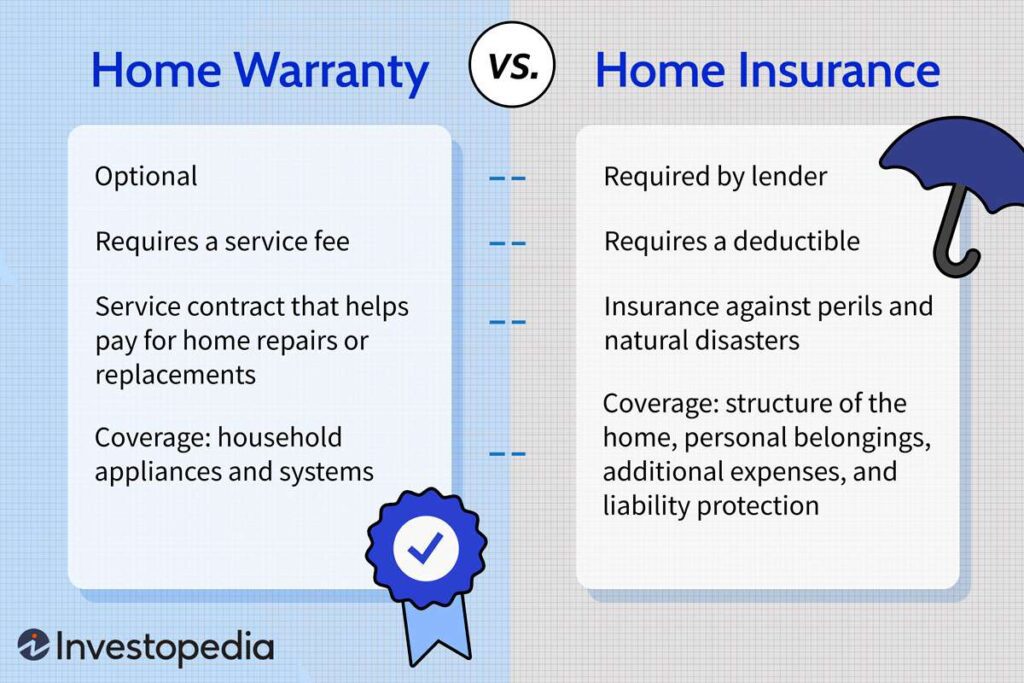

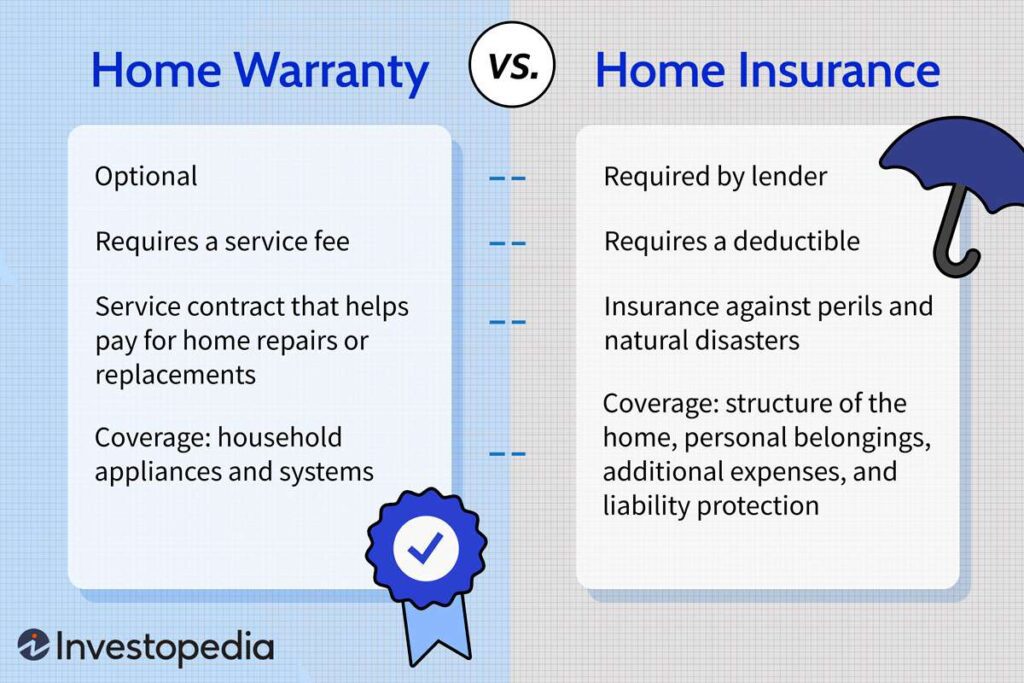

Homeowners insurance is a form of property insurance that provides financial protection to homeowners in the event of damage or loss to their property or belongings. It helps cover the costs of repairs, replacement, or rebuilding after a covered event, such as a fire, burglary, or natural disaster.

Why do you need homeowners insurance?

As a homeowner, having insurance is essential to protect your investment and ensure you have the financial means to recover from unexpected events. Without homeowners insurance, you would be solely responsible for covering the costs of repairing or rebuilding your home, replacing your belongings, and potentially facing liability claims if someone is injured on your property.

What are homeowners insurance claims?

A homeowners insurance claim is a request for financial compensation made by a policyholder to their insurance company when there is damage or loss to their property or belongings. When you file a claim, you are seeking assistance from your insurance provider to cover the costs associated with repairing or replacing what was damaged or lost.

Types of Homeowners Insurance Claims

Property damage claims

Property damage claims are the most common type of homeowners insurance claims. They involve damage to the structure of your home or your personal property. Examples of property damage claims could include a tree falling on your house during a storm, a burst pipe causing water damage, or a fire destroying your belongings.

Liability claims

Liability claims are another important aspect of homeowners insurance. They come into play when someone is injured on your property and holds you responsible for their injuries. Your insurance policy would cover the legal and medical expenses associated with the liability claim, protecting you from potential financial ruin.

Loss of use claims

Loss of use claims provide coverage for additional living expenses if you are temporarily unable to live in your home due to damage from a covered event. This coverage helps pay for alternative accommodations, meals, and other necessary expenses while your home is being repaired or rebuilt.

Steps to File a Homeowners Insurance Claim

Contact your insurance provider

As soon as you discover damage or loss to your property, it is vital to contact your insurance provider to initiate the claims process. They will guide you through the necessary steps and provide you with the information you need to file a successful claim.

Document the damage

Before making any repairs or cleaning up, take photos or videos of the damage. This visual evidence will be valuable when filing your claim. Additionally, make a detailed list of all the damaged or lost items, including their approximate value and purchase date if possible.

File a claim with your insurance company

Once you have gathered all the necessary documentation, submit a claim to your insurance company. Provide them with the evidence you have gathered, including photos, videos, and any supporting documents. Be prepared to answer questions and provide additional information as needed.

Review the claim settlement offer

After your insurance company has reviewed your claim, they will offer a settlement amount. Review this offer carefully and ensure it adequately covers your losses. If you believe the offer is unfair or insufficient, you have the right to negotiate with your insurance company to reach a fair resolution.

Common Issues with Homeowners Insurance Claims

Denied claims

Insurance companies may deny a claim for several reasons, such as policy exclusions or disputes over the cause of the damage. If your claim is denied, carefully review your policy and consult with your insurance agent to understand the reasons for denial and explore potential options for appeal.

Underpaid claims

Sometimes insurance companies may undervalue the cost of repairs or replacement, leaving you with insufficient funds to fully restore your property. If you believe your claim is underpaid, gather evidence, such as estimates from reputable contractors, and present your case to your insurance company for a fair reassessment.

Delays in claim processing

Unfortunately, claim processing times can be lengthy, especially during times of high demand, such as after natural disasters. While it is frustrating to wait, keep in regular contact with your insurance company to ensure your claim is progressing and to address any issues that may cause unnecessary delays.

Disputed claims

Disputes can arise between policyholders and insurance companies when there is disagreement over coverage, the cause of the damage, or the value of the claim. If you find yourself in a dispute with your insurance company, consider seeking legal advice or engaging in alternative dispute resolution methods, such as mediation or arbitration.

Tips to Navigate the Homeowners Insurance Claims Process

Read and understand your policy

Before you need to file a claim, take the time to carefully review your homeowners insurance policy. Familiarize yourself with the coverage limits, deductibles, and any exclusions that may affect your ability to file a successful claim. Understanding your policy will help you avoid surprises and make informed decisions.

Keep meticulous records

Throughout the claims process, maintain detailed records of all communications with your insurance company, including phone calls, emails, and written correspondence. Keep copies of all documentation related to your claim, such as receipts, estimates, and invoices. These records will assist you in providing evidence and supporting your claim.

Seek professional assistance if necessary

If you are encountering challenges with your claim or facing significant damages, consider seeking professional assistance. Public adjusters specialize in negotiating with insurance companies on behalf of policyholders and can help ensure you receive a fair settlement. Additionally, legal advice may be necessary if you are involved in a dispute or if your claim is wrongfully denied.

Follow up with your insurance company

Do not hesitate to follow up with your insurance company to check the status of your claim or address any concerns. Regular communication ensures that your claim remains a priority and provides an opportunity for you to provide any additional information or documentation required to move the process forward.

Factors Affecting Homeowners Insurance Claims

Deductibles

The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums but may require you to bear a larger portion of the cost in the event of a claim.

Coverage limits

Each homeowners insurance policy has coverage limits, which determine the maximum amount your insurance company will pay for a claim. It is essential to ensure that your coverage limits adequately protect the value of your property and belongings.

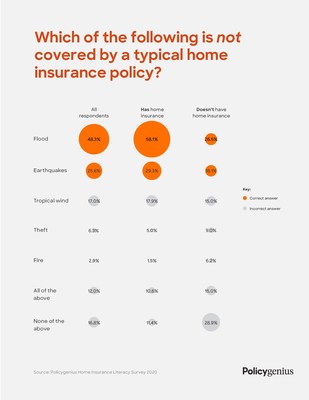

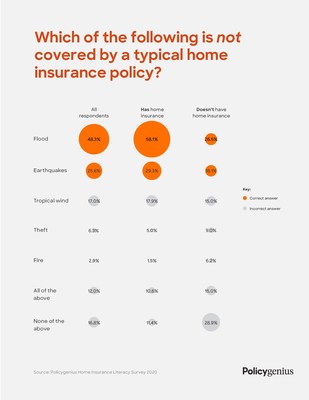

Policy exclusions

Exclusions are specific situations or events that your homeowners insurance policy does not cover. Common exclusions include flood damage, earthquakes, and certain types of negligence. Review your policy carefully to understand what is not covered and consider purchasing additional coverage if needed.

Policy endorsements

Policy endorsements, also known as riders or add-ons, are additional coverages that you can add to your homeowners insurance policy for specific items or circumstances. For example, if you own valuable jewelry, you may need to endorse your policy to ensure those items are fully covered.

Understanding Claim Settlements

Actual cash value vs. replacement cost

When it comes to claim settlements, insurance companies may offer either actual cash value or replacement cost coverage. Actual cash value takes depreciation into account when calculating the settlement amount, while replacement cost provides funds to replace the damaged or lost items with new ones of similar quality.

Factors affecting the settlement amount

Several factors affect the settlement amount, including the extent of the damage, the age of the property or belongings, and the coverage limits stated in your policy. Your insurance company will consider these factors when determining the appropriate amount to reimburse you.

Negotiating a fair settlement

If you believe the settlement offer does not adequately cover your loss, you can negotiate with your insurance company. Present any additional evidence, estimates, or expert opinions that support your claim for a higher settlement. It is important to be persistent and advocate for yourself to ensure a fair outcome.

Importance of Documenting the Loss

Photographing and videotaping the damage

Visual documentation is crucial when filing a homeowners insurance claim. Take clear photographs and videos of the damage from multiple angles, capturing all the affected areas. These images will serve as evidence for your insurance company and help support your claim.

Recording details of the incident

In addition to visual evidence, provide a detailed written account of the incident that caused the damage. Include the date, time, and any relevant circumstances or events leading up to the loss. This information will assist your insurance company in understanding the cause and extent of the damage.

Keeping receipts and invoices

To support the value of your belongings, keep receipts, invoices, and any other proof of purchase. This documentation is especially important for high-value items, as it helps establish their worth and ensures you are appropriately compensated in the event of loss or damage.

Frequently Asked Questions about Homeowners Insurance Claims

How long does it take to process a claim?

The time it takes to process a homeowners insurance claim varies depending on the complexity of the claim and the workload of the insurance company. Simple claims can be resolved quickly, while more complex claims may take weeks or even months. Stay in communication with your insurance company to stay informed about the progress of your claim.

What if I disagree with the claim settlement?

If you disagree with the settlement amount offered by your insurance company, you have the right to dispute it. Review your policy, gather additional evidence, and present your case to your insurance company. If a resolution cannot be reached, you may need to seek legal advice or explore alternative dispute resolution methods.

Does homeowners insurance cover natural disasters?

Standard homeowners insurance policies typically do not cover damage caused by natural disasters such as earthquakes and floods. However, additional coverage options may be available for these events. It is essential to review your policy and consider purchasing additional coverage if you live in an area prone to natural disasters.

Can I make temporary repairs before filing a claim?

Yes, you can make temporary repairs to prevent further damage or ensure your safety. Keep records of any temporary repairs you make and save the receipts for any materials or services used. However, it is important to note that you should not make permanent repairs before filing a claim, as your insurance company may need to assess the damage themselves.

Conclusion

Understanding the homeowners insurance claims process is crucial for effectively handling unexpected events and protecting your most valuable asset. By familiarizing yourself with the types of claims, steps to file a claim, common issues, and tips for navigating the process, you can confidently navigate the complexities of homeowners insurance claims. Remember to maintain detailed records, communicate regularly with your insurance company, and seek professional assistance if needed. With this knowledge, you can ensure you receive a fair settlement to help you recover and rebuild after a loss.