If you’ve ever experienced the frustration of a leaky roof, you’re probably familiar with the resulting water damage that can wreak havoc on your home. But what you may not know is whether or not your homeowner’s insurance will cover the costs of repairing that damage. Many homeowners find themselves asking, “Is water damage from a leaky roof covered by homeowner’s insurance?” In this article, we will explore the answer to this common question and shed light on what you can expect when it comes to filing a claim for water damage caused by a leaky roof. So let’s address this concern and put your mind at ease.

Is Water Damage from a Leaky Roof Covered by Homeowners Insurance?

Understanding the Coverage

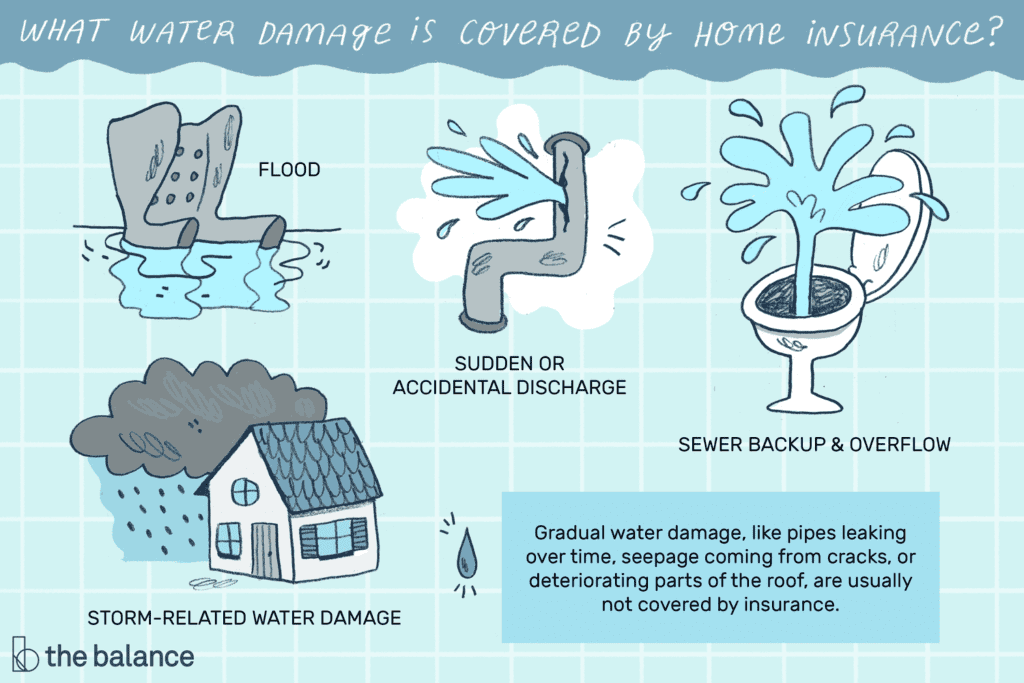

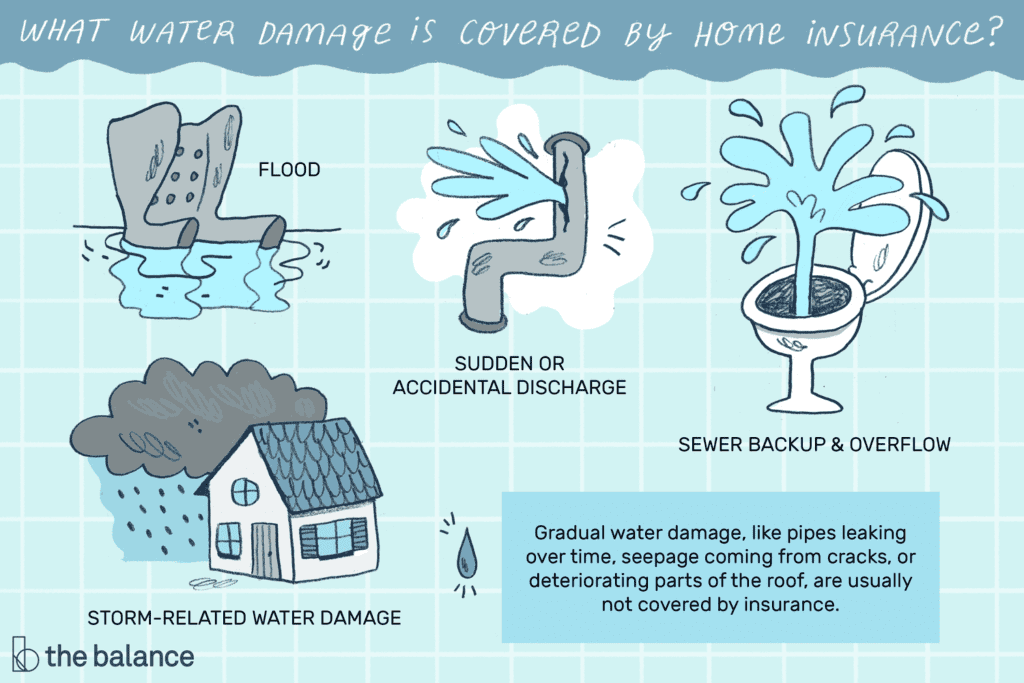

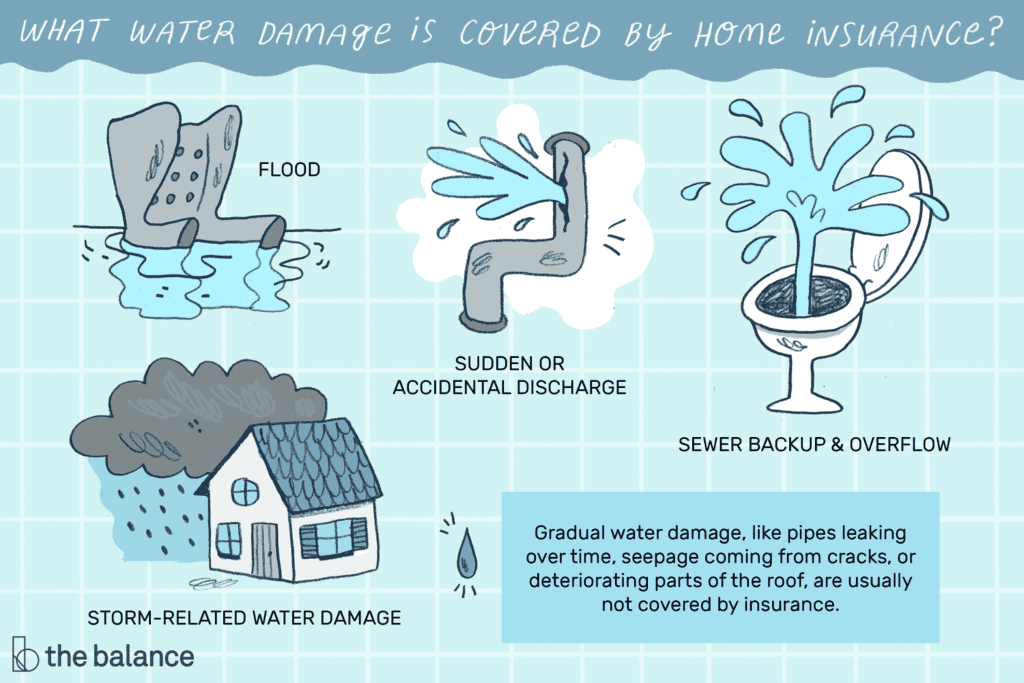

When it comes to protecting your home against any unforeseen damages, homeowners insurance plays a crucial role. However, it is essential to understand the coverage your policy provides, particularly if you encounter water damage resulting from a leaky roof. While homeowners insurance generally covers certain types of water damage, coverage for a leaky roof can vary depending on several factors.

Policy Types and Coverage

The type of homeowners insurance policy you have will ultimately determine the extent of coverage for water damage caused by a leaky roof. There are different types of policies available, including basic, broad, and special form policies, each with varying levels of coverage.

A basic policy typically offers coverage for specific perils, such as fire, lightning, and hail, but may not include coverage for a leaky roof. On the other hand, a broad policy may cover a wider range of perils, including water damage caused by a leaky roof, but it may still have limitations. Lastly, a special form policy often provides the most comprehensive coverage, including water damage resulting from a leaky roof, unless specifically excluded in the policy.

To determine the coverage for water damage from a leaky roof, it is crucial to carefully review your insurance policy and consult with your insurance provider. They will be able to provide guidance on the specific coverage and limitations of your policy.

Coverage for Exterior and Interior Damage

When it comes to water damage caused by a leaky roof, homeowners insurance policies generally provide coverage for both exterior and interior damage. Exterior damage refers to any structural damage or deterioration to the roof itself, while interior damage includes any harm caused to the contents or structure within your home.

For example, if a severe storm causes your roof to develop a leak, resulting in water seeping through the ceiling and damaging your furniture or walls, your homeowners insurance policy may typically cover the cost of repairing both the roof and the interior damage. However, the coverage may be subject to certain exclusions and limitations, as we will discuss in the following section.

Exclusions and Limitations

While homeowners insurance policies generally cover water damage from a leaky roof, it is important to be aware of any exclusions and limitations that may apply. These exclusions and limitations can vary depending on the insurance provider and specific policy.

One common exclusion is the concept of gradual damage. If the water damage from a leaky roof is determined to be the result of gradual damage, which means the issue developed over time due to neglect or lack of maintenance, your claim may be denied. It is crucial to regularly inspect your roof and promptly address any potential issues to avoid being caught off guard by roof leaks and subsequent water damage.

Additionally, many insurance policies have limitations on coverage for roof repairs and replacements. Some policies may only cover the actual cash value (ACV) of the roof, which takes into account depreciation, while others may offer coverage for the replacement cost value (RCV) of the roof. Understanding these terms and limitations is essential to ensure you receive adequate compensation for repairs or replacements.

Determining Responsibility

Determining responsibility for a leaky roof and subsequent water damage can sometimes be a complex process. In general, homeowners insurance policies will cover water damage caused by sudden and accidental events. However, if the damage is the result of a maintenance issue or neglect, the responsibility may fall on the homeowner.

To determine responsibility, insurance providers typically conduct a thorough investigation to assess the cause of the leaky roof. They may consider factors such as the age of the roof, any signs of neglect or lack of maintenance, and the specifics of the damage. It is essential to cooperate fully with your insurance provider during this process and provide any necessary documentation or evidence to support your claim.

Preventive Measures

Prevention is always better than dealing with the aftermath of water damage. Taking preventive measures can help minimize the risk of a leaky roof and subsequent water damage, ultimately saving you time, money, and stress.

Regularly inspecting your roof and addressing any potential issues, such as loose or damaged shingles, can help prevent leaks. Additionally, clearing debris, such as leaves and branches, from your roof and gutters can prevent water from pooling and causing damage. Maintaining proper attic ventilation can also help prevent moisture buildup that can lead to roof leaks.

Furthermore, it is beneficial to familiarize yourself with your policy’s requirements regarding roof maintenance. Some insurance providers require regular roof maintenance as a condition of coverage, so ensuring you meet these requirements can help avoid potential claim denials.

Steps to Take When Damage Occurs

In the unfortunate event of water damage caused by a leaky roof, it is crucial to take immediate action to mitigate further damage and ensure your safety. Here are some steps you should consider taking:

-

Safety First: Ensure everyone in your household is safe and evacuate if necessary. Be cautious of any electrical hazards and structural instability caused by the water damage.

-

Mitigate Further Damage: If it is safe to do so, try to minimize the extent of the water damage by placing buckets or containers to catch dripping water and using towels or mops to absorb as much water as possible.

-

Document the Damage: Take photos or videos of the water damage and any affected belongings. These visual records can be valuable evidence when filing your insurance claim.

-

Contact Your Insurance Provider: Notify your insurance provider about the water damage and seek guidance on the claims process. They will guide you through the necessary steps to initiate your claim.

Filing a Claim

Filing a claim for water damage caused by a leaky roof typically involves providing detailed information about the incident, the extent of the damage, and any relevant supporting documentation. Here are some key steps to follow when filing a claim:

-

Report the Incident: Notify your insurance provider as soon as possible to report the water damage incident. Provide them with accurate details and answer any questions they may have.

-

Document the Damage: As previously mentioned, document the extent of the damage with photos or videos. Take inventory of any affected belongings and keep records of their value.

-

Keep Receipts and Invoices: Maintain records of any expenses incurred due to the water damage, such as temporary repairs or accommodation costs, as these may be eligible for reimbursement.

-

Cooperate with the Investigation: Respond to any requests for information or documentation promptly. Be prepared to provide evidence that supports your claim and demonstrates the cause of the leaky roof.

Professional Assessment and Repairs

Once you have filed your claim, your insurance provider may schedule a professional assessment of the damage. An insurance adjuster will evaluate the extent of the water damage, determine the cause of the leaky roof, and estimate the cost of repairs or replacements.

It is crucial to cooperate fully with the insurance adjuster and provide them with access to the damaged areas. Their assessment will help determine the compensation you are eligible to receive for the repairs or replacements needed to address the water damage and fix the leaky roof.

Following the assessment, you can proceed with the necessary repairs. It is generally recommended to hire a professional roofing contractor to ensure the repairs are completed correctly and to industry standards. Keep in mind that some insurance policies may require you to use specific contractors or obtain multiple estimates before proceeding with the repairs.

Conclusion

Water damage from a leaky roof can be a distressing situation for any homeowner. Understanding the coverage provided by your homeowners insurance policy and taking preventive measures can help mitigate the risk and ensure you are prepared in case of any water damage incidents. It is essential to review your policy, consult with your insurance provider, and promptly address any necessary maintenance to protect your home and belongings. If you do experience water damage from a leaky roof, following the necessary steps to file a claim and working with your insurance provider will help ensure a smooth claims process and the necessary repairs or replacements.