Imagine you’re faced with the decision of whether or not to file an insurance claim. It’s a predicament many of us find ourselves in, juggling the potential benefits and drawbacks that come with it. In this article, we’ll explore the pros and cons of filing an insurance claim, empowering you with the knowledge to make an informed decision. Whether you’re wondering about the financial implications, the impact on your future premiums, or the possible hassle involved, we’ve got you covered. So grab a cup of tea, get comfortable, and let’s weigh the pros and cons together.

Pros of filing an insurance claim

Financial compensation

One of the major benefits of filing an insurance claim is the potential for financial compensation. Insurance policies are designed to provide coverage for losses and damages, and by filing a claim, you can receive the financial support you need to recover from an unexpected event. Whether it’s reimbursement for medical expenses, compensation for lost income, or recovery of the value of damaged or stolen property, filing a claim can help alleviate the financial burden caused by the incident.

Coverage for repairs and replacements

Another advantage of filing an insurance claim is the coverage it provides for necessary repairs and replacements. If your property is damaged due to a covered event, such as a fire or a natural disaster, your insurance policy can help cover the costs of repairing the damage. Similarly, if your belongings are stolen or destroyed, you may be eligible for reimbursement to replace those items. This coverage can be especially valuable when faced with significant expenses that would otherwise be difficult to afford.

Peace of mind

Filing an insurance claim can also provide you with peace of mind during challenging times. Knowing that you have insurance coverage can help alleviate anxiety and reduce stress when faced with unexpected events. Whether it’s a car accident, a theft, or property damage, having the assurance that you are protected by your insurance policy can offer a sense of security and comfort.

Protection against unexpected expenses

One of the main purposes of insurance is to protect against unexpected expenses. By filing a claim, you can avoid shouldering the full financial burden of an unforeseen event. Insurance policies are designed to help minimize personal outlays and assist in covering unexpected costs that may arise. Whether it’s medical bills, property repairs, or replacing stolen items, filing a claim can provide the necessary financial support to help you get back on your feet.

Access to professional assistance

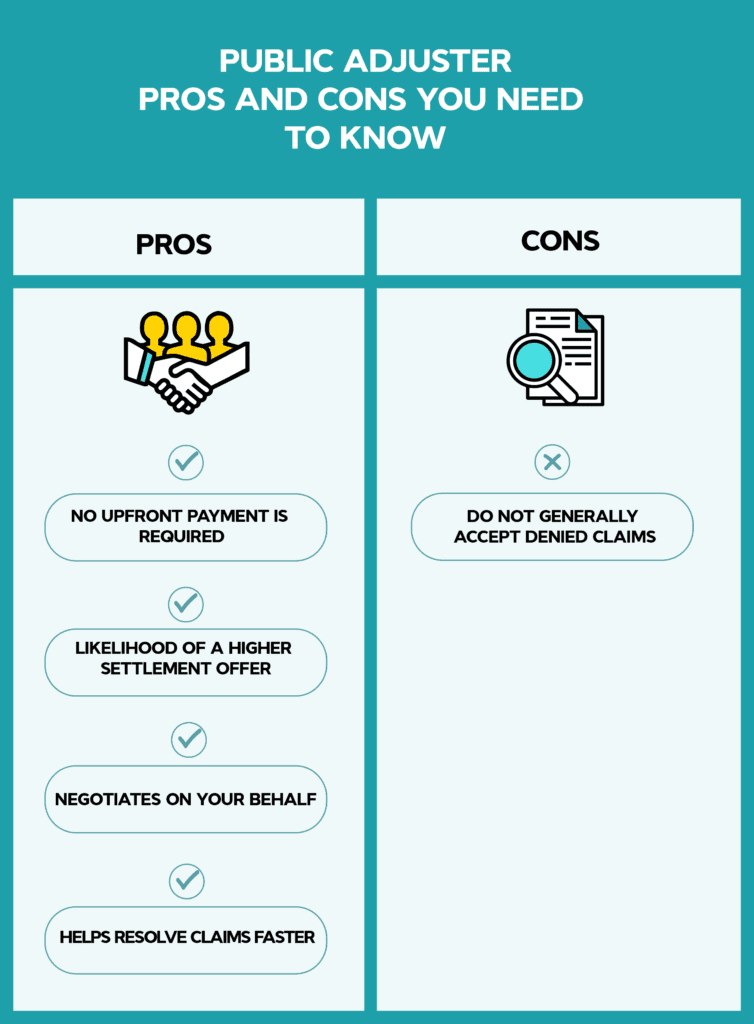

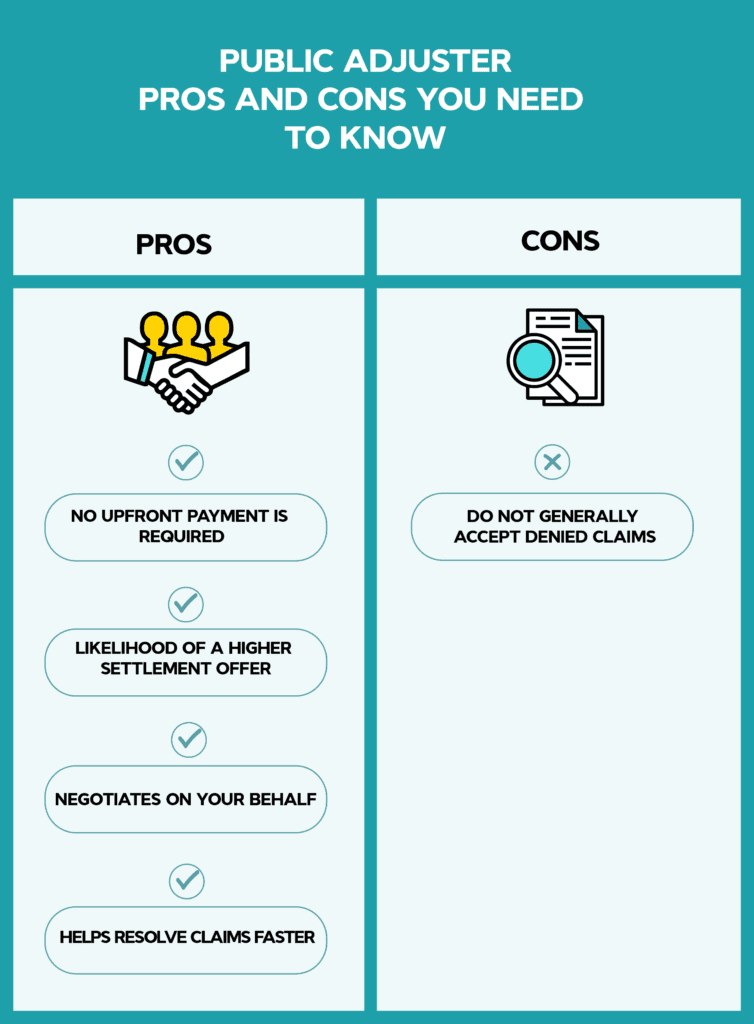

When you file an insurance claim, you gain access to professional assistance throughout the entire process. Insurance companies have teams of experts who specialize in handling claims and can provide guidance along the way. These professionals are well-versed in the documentation and requirements needed to support your claim, and they can help streamline the process, saving you time and effort. Additionally, they can negotiate on your behalf with the insurance company, ensuring that you receive the compensation you deserve.

Cons of filing an insurance claim

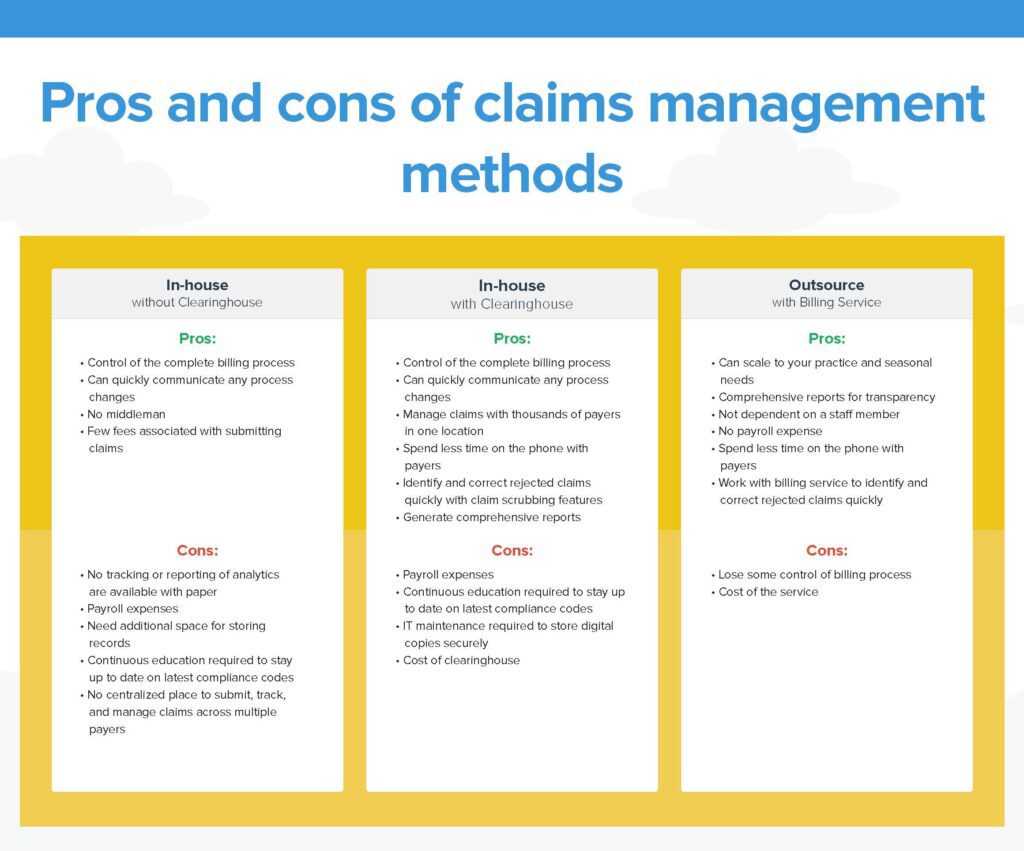

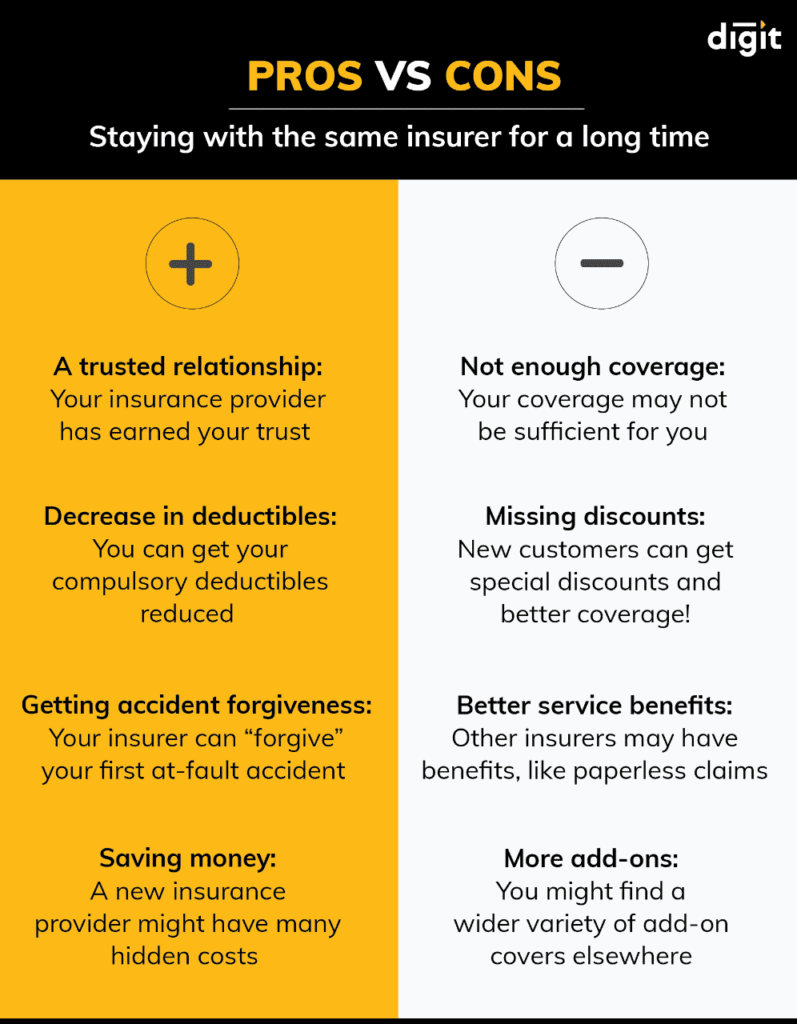

Potential increase in premiums

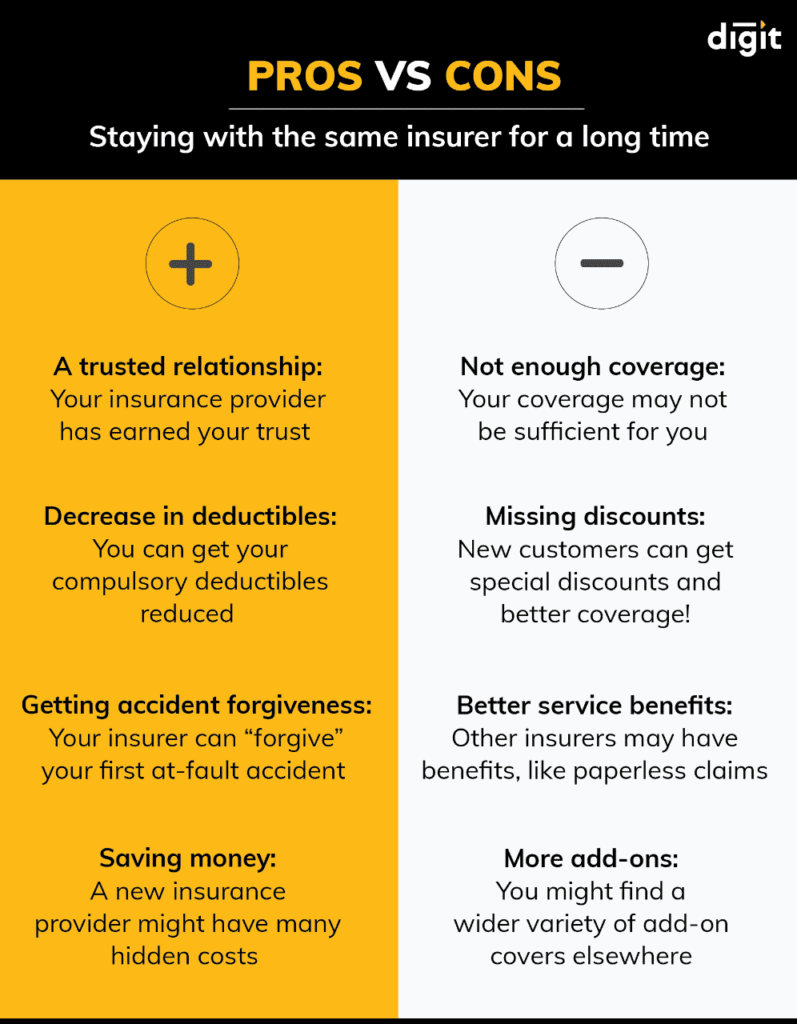

One of the drawbacks of filing an insurance claim is the potential for an increase in premiums. Insurance companies calculate premiums based on various factors, including your claims history. If you file multiple claims or file a claim for a significant loss, it may result in higher premiums. Depending on the policy and the insurance provider, your rates could increase substantially, impacting your monthly budget. It’s important to consider this potential consequence before deciding to file a claim.

Impact on future coverage

Filing an insurance claim can also have an impact on your future coverage. Insurance companies assess risk when determining coverage, and a history of claims may be viewed unfavorably. In some cases, an insurance company may choose to terminate or limit coverage for individuals who have a high frequency of claims or who are considered high-risk. This could leave you scrambling to find new coverage or facing higher premiums if you’re able to secure a new policy. It’s crucial to weigh the potential impact on your future coverage before filing a claim.

Time-consuming process

Another downside of filing an insurance claim is the time it takes to navigate the process. Filing a claim typically involves filling out paperwork, documenting evidence of the incident, and communicating with the insurance company. This can be a time-consuming task, especially if there are multiple parties involved or the claim is complex. Depending on the nature of the claim and the responsiveness of the insurance company, it may take weeks or even months to finalize the claim. If you’re in need of immediate financial assistance, the time it takes to process a claim can be a significant drawback.

Possibility of claim denial

While insurance claims aim to provide financial support, there is always the possibility of claim denial. Insurance companies have specific criteria and conditions outlined in their policies, and if your claim doesn’t meet these requirements, it may be denied. This can be especially disheartening if you’re counting on the compensation to recover from a loss or damage. Before filing a claim, it’s important to carefully review your policy and understand the eligibility criteria to minimize the risk of claim denial.

Effect on claims history

Every claim you file becomes a part of your claims history, which is accessible to insurance companies and can affect your future insurance coverage and rates. If you have a significant number of claims in your history, it may result in higher premiums or even difficulty in obtaining coverage in the future. Insurance companies view individuals with a history of claims as higher risk, which can impact your overall insurability and cost of coverage. It’s important to consider the long-term consequences on your claims history before filing a claim.

Factors to consider before filing a claim

Coverage limits

Before filing a claim, it’s essential to review your insurance policy and understand the coverage limits. Insurance policies often have specific limits on the amount of compensation they provide for different types of losses or damages. If the cost of the claim exceeds the coverage limit, you may be responsible for paying the remaining expenses out of pocket. Understanding these limits can help you determine if filing a claim is the right course of action.

Deductibles and out-of-pocket expenses

In addition to coverage limits, insurance policies also have deductibles, which are the amounts you must pay out of pocket before the insurance company starts covering the costs. It’s important to evaluate the deductibles associated with your policy and consider if the claim amount exceeds the deductible threshold. If the cost of the claim is lower than the deductible, filing a claim may not be financially beneficial.

Type and severity of the damage

The type and severity of the damage should also be taken into account before filing a claim. Insurance policies typically cover specific types of losses or damages, and it’s crucial to determine if your situation falls within the scope of the policy coverage. Additionally, the severity of the damage may impact whether or not it’s worthwhile to file a claim. If the damage is minor and can be easily repaired or replaced without significant expense, it may be more advantageous to handle the costs independently.

Claim history and frequency

Your claim history and frequency should also be considered before filing a claim. If you have a history of frequent claims, it could impact your eligibility for coverage or result in higher premiums. Carefully assess your claims history and evaluate how filing another claim may affect your insurance standing in the long run. In some cases, it may be more prudent to absorb the costs of a minor incident to avoid potential negative consequences on your insurance coverage in the future.

Available alternatives

Finally, exploring available alternatives is crucial before filing a claim. Depending on the situation, there may be alternatives to filing a claim that can mitigate the financial impact. For example, self-funding repairs or replacements, exploring non-insurance options, or considering the feasibility of do-it-yourself solutions may be viable alternatives in certain situations. Evaluating these alternatives can help you make an informed decision based on your specific circumstances.

Financial compensation

Recovery of financial losses

One of the primary advantages of filing an insurance claim is the opportunity to recover your financial losses. Whether you’ve experienced property damage, theft, or a medical emergency, filing a claim can provide the means to recoup the expenses incurred as a result. This financial compensation can help alleviate the burden and allow you to move forward without the added stress of significant financial loss.

Replacement of damaged or stolen items

Insurance claims also offer the opportunity to replace damaged or stolen items. If, for example, your home is burglarized and valuable possessions are stolen, filing a claim will enable you to receive compensation to replace those items. This can be particularly valuable when it comes to high-value items like electronics, jewelry, or furniture. Being able to replace these items can help restore a sense of normalcy and make the recovery process smoother.

Payment for medical expenses

In the case of medical emergencies or injuries, insurance claims provide payment for medical expenses. Whether it’s hospital bills, surgical procedures, or ongoing treatment, medical expenses can quickly add up and become a significant financial burden. By filing an insurance claim, you can have these expenses covered, allowing you to focus on your recovery without the added financial stress.

Compensation for lost income

If you’ve suffered an injury or illness that has resulted in the loss of income, insurance claims can provide compensation for that lost income. This can be crucial in maintaining financial stability during a difficult period. Whether you’re unable to work temporarily or face a long-term disability, having the financial support to replace lost income can alleviate stress and make it easier to manage your financial obligations.

Coverage for repairs and replacements

Repairing damaged property

Filing an insurance claim can provide coverage for repairing damaged property. Whether it’s your home, vehicle, or other assets, insurance policies often include provisions for covering the costs of repairs. If, for example, your home is damaged due to a fire or your car is involved in an accident, filing a claim can help cover the expenses of restoring these items to their pre-loss condition.

Replacing destroyed or stolen items

In cases where property has been destroyed or stolen, insurance claims can provide coverage for replacing these items. Losing valuable possessions can be emotionally distressing, but knowing that you can receive compensation to replace them can offer some relief. Whether it’s electronics, furniture, or personal belongings, having the means to replace these items can help restore a sense of normalcy and minimize the impact of the loss.

Coverage for temporary living expenses

If your home becomes uninhabitable due to damage covered by your insurance policy, filing a claim can provide coverage for temporary living expenses. This can include costs such as hotel accommodations, meals, and other essentials. Having this coverage can ensure that you have a place to stay and your day-to-day needs are met while repairs or renovations are being completed on your home.

Peace of mind

Relief from financial burden

Filing an insurance claim can provide much-needed relief from the financial burden of unexpected events. Whether it’s a natural disaster, a car accident, or a theft, dealing with the expenses associated with these incidents can be overwhelming. By filing a claim, you can rely on your insurance coverage to help alleviate the financial stress and provide the support you need to recover.

Assurance of support in difficult situations

Knowing that you have insurance coverage can offer assurance and support during difficult situations. The unpredictability of life can be daunting, but having the safety net of insurance can provide peace of mind. Whether it’s the loss of a loved one, a major medical emergency, or a significant property damage incident, having insurance coverage can offer reassurance that you have the means to navigate through these challenging times.

Feeling of security and protection

Filing an insurance claim can also provide a feeling of security and protection. By having insurance coverage, you know that you have a safety net in place to help you recover from unexpected events. This sense of security can be invaluable, particularly when faced with uncertainty. Whether it’s knowing that your medical expenses will be covered, or that your property will be repaired or replaced, insurance can offer peace of mind and a sense of stability.

Protection against unexpected expenses

Avoidance of significant financial burden

One of the key benefits of filing an insurance claim is the ability to avoid a significant financial burden. Without insurance coverage, unexpected events can result in substantial out-of-pocket expenses that may be difficult to manage. By filing a claim, you can mitigate these expenses and ensure that you don’t face significant financial hardship as a result of an unforeseen incident.

Minimization of personal outlays

Filing an insurance claim also minimizes personal outlays. Instead of having to cover the full cost of repairs, replacements, or medical expenses, you can rely on your insurance coverage to help shoulder the financial burden. This can free up your personal funds for other needs or emergencies, providing a level of financial flexibility and stability.

Assistance in covering unexpected costs

One of the main purposes of insurance is to provide assistance in covering unexpected costs. By filing a claim, you can rely on your insurance policy to help cover expenses that you may not have planned for or anticipated. Whether it’s the cost of repairing a damaged property, replacing stolen belongings, or covering medical bills, having insurance can ensure that you’re not caught off guard by these unexpected expenses.

Access to professional assistance

Expert guidance throughout the claim process

When you file an insurance claim, you gain access to expert guidance throughout the entire process. Insurance companies have professionals who specialize in handling claims and can provide invaluable assistance and advice. They can guide you through the documentation and requirements needed to support your claim, ensuring that you have everything you need to maximize your chances of a successful claim. Their expertise can help streamline the process, saving you time and effort.

Knowledgeable advice on documentation and requirements

Insurance claims often require specific documentation and adherence to certain requirements. Filing a claim without proper knowledge and understanding of these requirements can potentially result in a denied claim. By working with insurance professionals, you can benefit from their knowledgeable advice on what documentation is needed, how to properly prepare and submit it, and what requirements must be met to support your claim. This guidance can greatly enhance your chances of a successful claims process.

Efficient handling of paperwork and negotiations

Filing an insurance claim involves a significant amount of paperwork and negotiations. Insurance professionals have experience in handling these tasks efficiently and effectively. They can ensure that all the necessary paperwork is completed accurately and submitted on time. Additionally, they can negotiate with the insurance company on your behalf to help ensure that you receive fair compensation for your claim. This efficient handling of paperwork and negotiations can save you valuable time and energy.

Potential increase in premiums

Higher insurance rates

One of the main drawbacks of filing an insurance claim is the potential for higher insurance rates. When you file a claim, your insurance company may view you as a higher risk, which can result in increased premiums. This increase in rates can affect your monthly budget and lead to higher overall insurance costs. It’s important to consider the long-term financial implications of higher premiums before deciding to file a claim.

Loss of discounts or benefits

Filing an insurance claim may also result in the loss of certain discounts or benefits. Insurance companies often offer incentives to policyholders who have a clean claims history or who have not filed a claim within a specified period. When you file a claim, you may lose these discounts or benefits, which can further increase your overall insurance costs. It’s important to weigh the potential loss of discounts against the financial benefits of filing a claim.

Impact on overall insurance costs

In addition to potential increases in premiums, filing an insurance claim can impact your overall insurance costs. When insurance companies determine your rates, they take into account various factors, including your claims history. If you have a history of frequent claims, it may result in higher premiums across all your insurance policies, not just the one you’re filing a claim for. The long-term impact on your overall insurance costs should be considered before deciding to file a claim.

Available alternatives

Self-funding repairs or replacements

Before filing an insurance claim, it’s worth considering self-funding repairs or replacements. Depending on the situation, especially if the damage is minor or the cost of repairs is relatively low, paying for these expenses out of pocket may be a more cost-effective option. If the repair or replacement cost doesn’t exceed your deductible or is only slightly above it, self-funding may save you money in the long run by avoiding potential increases in premiums.

Exploring non-insurance options

Another alternative to filing an insurance claim is exploring non-insurance options. Depending on the situation, there may be other means of seeking compensation or support. For example, if you were involved in an accident, you may be able to pursue a legal claim for damages. If your property was damaged by a third party, you may be able to hold them responsible for the cost of repairs. Exploring these non-insurance options can provide alternative avenues for seeking compensation without necessarily filing a claim.

Considering the feasibility of DIY solutions

In some cases, it may be feasible to explore do-it-yourself (DIY) solutions instead of filing an insurance claim. This is particularly true for minor repairs or damage that can be easily fixed without professional assistance. By taking the DIY approach, you can potentially save on expenses and avoid the potential increase in premiums that may result from filing a claim. However, it’s important to assess the feasibility and safety of DIY solutions before attempting them to ensure that further damage or risks are not incurred.

In summary, filing an insurance claim comes with a list of pros and cons that should be carefully considered before making a decision. The financial compensation, coverage benefits, peace of mind, protection against unexpected expenses, and access to professional assistance are all significant advantages of filing a claim. However, the potential increase in premiums, impact on future coverage, time-consuming process, possibility of claim denial, and effect on claims history are important considerations to keep in mind. It’s crucial to evaluate factors such as coverage limits, deductibles, the type and severity of the damage, claim history, and available alternatives before deciding whether to file a claim. By carefully weighing these factors, you can make an informed decision that aligns with your specific circumstances and goals.