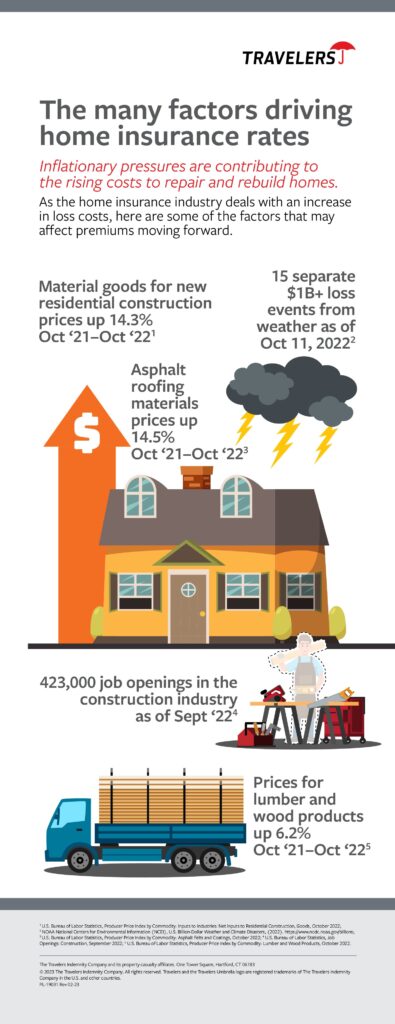

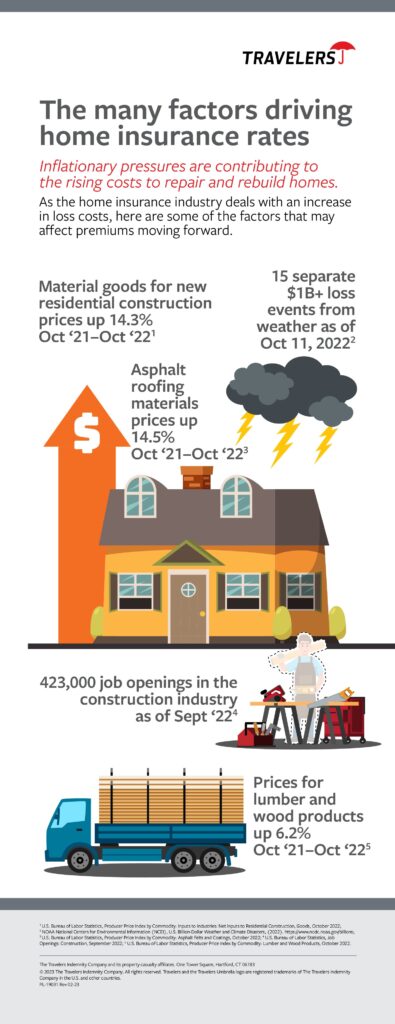

Are you curious about what factors can impact your homeowners insurance premium? Understanding what can cause your insurance rates to increase is essential to ensure you are adequately protected without breaking the bank. Factors such as the age of your home, the location, the presence of certain types of pets, and even your credit score can all play a role in determining the cost of your homeowners insurance. By knowing what to expect, you can make informed decisions and find the policy that best fits your needs and budget.

Type of Home

Age of home

The age of your home can have an impact on your homeowners insurance premium. Older homes tend to have greater risks associated with them, such as outdated wiring or plumbing, which can increase the likelihood of fire or water damage. As a result, insurance companies may charge higher premiums to account for these potential risks.

Construction materials used

The construction materials used in your home can also affect your insurance premium. Certain materials, such as wood, are more prone to fire damage compared to materials like brick or concrete. If your home is constructed using materials that pose a higher risk, insurance companies may charge a higher premium to offset the increased chance of a claim.

Special features or unique architecture

If your home has special features or unique architecture, it may also impact your homeowners insurance premium. Special features like a pool, hot tub, or high-end appliances can increase the value of your home and the cost to replace or repair them in the event of a claim. Similarly, unique architecture or historical significance might require specialized coverage, which can lead to higher premiums.

Location

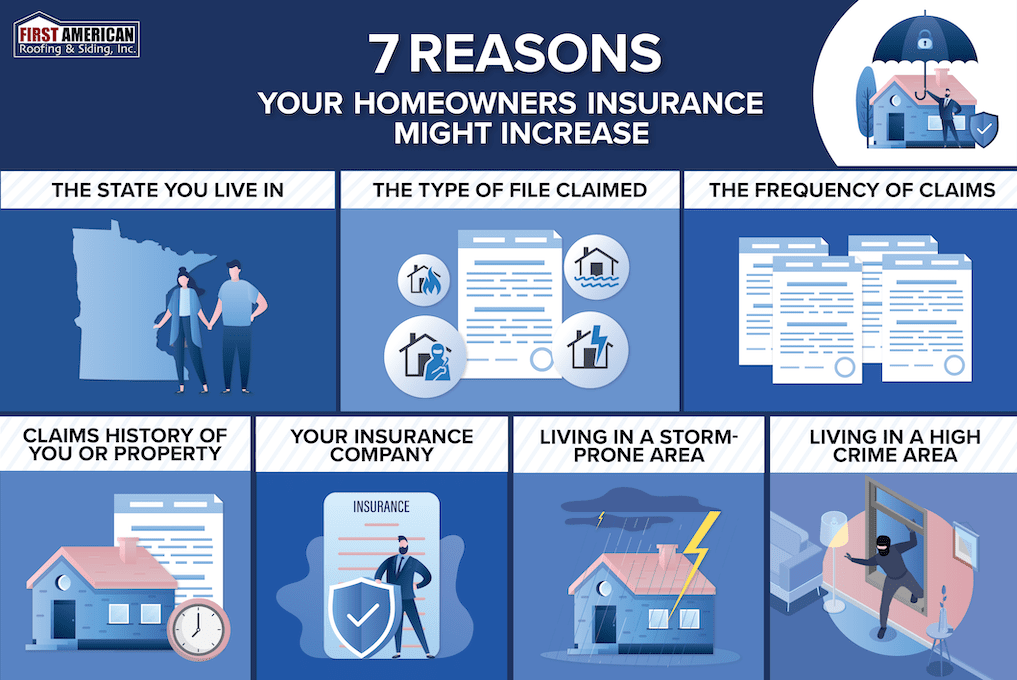

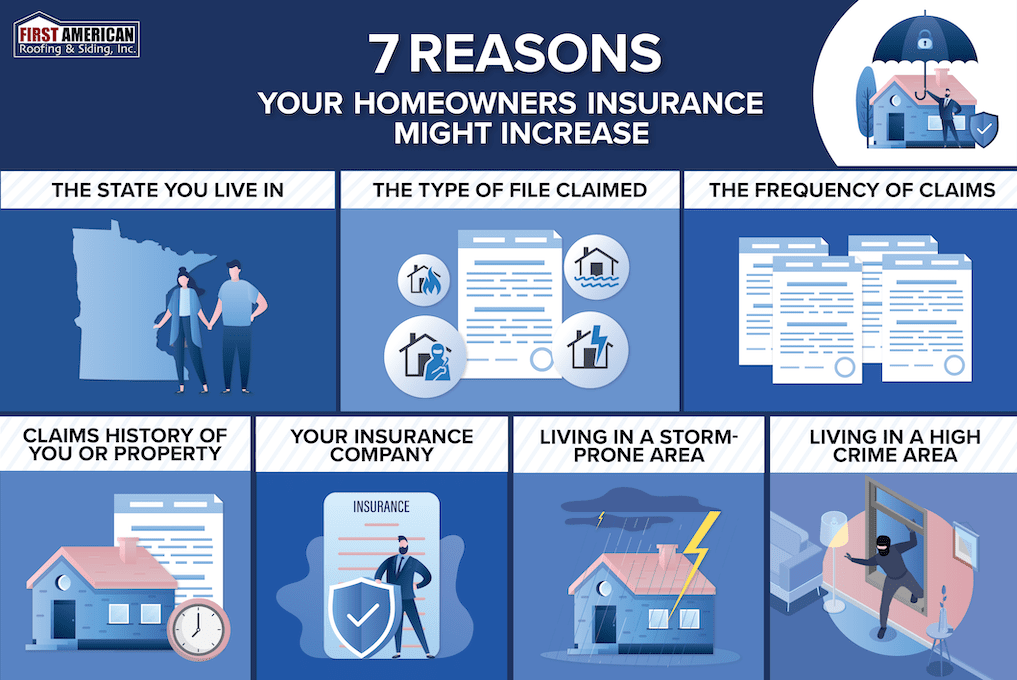

Proximity to natural disaster-prone areas

The location of your home is an important factor that insurance companies consider when determining your homeowners insurance premium. If your home is situated in an area prone to natural disasters such as hurricanes, earthquakes, or floods, you may face higher premiums. This is because these areas have a higher likelihood of property damage and expensive claims.

Crime rate in the neighborhood

Another factor that can impact your homeowners insurance premium is the crime rate in your neighborhood. If your area has a higher crime rate, insurance companies may consider it riskier to insure your home due to the increased chance of theft or vandalism. This can result in higher premiums to account for the potential claims associated with the higher crime rate.

Availability of emergency services

The availability of emergency services in your area can also influence your homeowners insurance premium. If your home is located far away from fire stations, police stations, or hospitals, insurers may perceive it as a higher risk. In case of an emergency, delayed response times may lead to more significant damage, increasing the likelihood of a costly claim. As a result, you may face higher premiums to mitigate this risk.

Home Value

Higher value of property

The value of your property plays a crucial role in determining your homeowners insurance premium. If your home has a higher value, it means that the insurance company would need to pay a substantial amount to replace or repair it in case of a covered event. As a result, homes with higher values tend to have higher insurance premiums.

Expensive personal belongings

If you own expensive personal belongings, such as jewelry, artwork, or high-end electronics, it can impact your homeowners insurance premium. These items typically require additional coverage, known as scheduled personal property coverage, to ensure they are adequately protected in case of theft, loss, or damage. Insuring valuable personal belongings can increase your overall premium due to the higher replacement costs associated with these items.

Claim History

Frequent or recent claims

Your claim history can have a significant impact on your homeowners insurance premium. If you have a history of filing frequent or recent claims, insurance companies may perceive you as a higher risk. This is because multiple claims suggest a higher likelihood of future claims, resulting in increased costs for the insurer. As a result, you may face higher premiums due to your claim history.

Types of claims made

The types of claims you have made in the past can also influence your homeowners insurance premium. Certain types of claims, such as water damage or liability claims, may be more costly for insurance companies compared to other types of claims like minor repairs. If you have a history of filing claims that are typically expensive to resolve, insurance companies may charge higher premiums to accommodate the potential costs associated with those types of claims.

Credit Score

Poor credit score

Your credit score can impact your homeowners insurance premium. Insurance companies often use credit-based insurance scores, which are derived from your credit history, to assess your risk as a policyholder. If you have a poor credit score, insurers may consider you a higher risk and charge higher premiums. It is important to maintain a good credit score to potentially qualify for lower homeowners insurance premiums.

Deductible

Choosing a low deductible

The deductible you choose for your homeowners insurance policy can also affect your premium. A deductible is the amount you are responsible for paying before your insurance coverage kicks in. Opting for a lower deductible means that the insurance company would have to cover a larger portion of the claim, resulting in higher premiums. On the other hand, choosing a higher deductible can lower your premium, as you would be responsible for a larger amount in the event of a claim.

Coverage Limits

Opting for high coverage limits

The coverage limits you select for your homeowners insurance policy can impact your premium. Coverage limits refer to the maximum amount an insurance company will pay for a covered claim. Opting for higher coverage limits means that the insurer would potentially have to pay more in the event of a claim, resulting in higher premiums. It is important to strike a balance between adequate coverage and affordable premiums when selecting your coverage limits.

Pets

Owning certain dog breeds

If you own certain dog breeds that are commonly considered aggressive or have a history of bites, it can impact your homeowners insurance premium. Some insurance companies have restrictions or exclusions for specific dog breeds, as they may deem them to be a higher liability risk. In those cases, you may need to seek specialized coverage or look for insurance companies that do not have breed-specific restrictions, which could potentially lead to higher premiums.

Pets with a history of aggression

Even if you do not own a dog breed with a reputation for aggression, owning any pet with a history of aggression can still impact your homeowners insurance premium. If your pet has a history of biting or attacking others, insurers may perceive it as a liability risk and charge higher premiums to cover the potential costs of injury claims related to your pet.

Safety Features

Lack of security measures

The presence or absence of security measures in your home can influence your homeowners insurance premium. Homes without security measures, such as alarm systems, deadbolts, or surveillance cameras, are more vulnerable to theft and burglary. Insurance companies may charge higher premiums to offset the increased risk of property loss or damage due to the lack of security measures. Implementing security measures can potentially lower your insurance premium.

Presence of fire sprinklers

Having fire sprinkler systems installed in your home can impact your homeowners insurance premium. Fire sprinklers can help extinguish fires quickly, preventing significant property damage. As a result, insurance companies may offer discounts or lower premiums for homes equipped with fire sprinkler systems. Their presence can demonstrate a proactive approach to fire safety, potentially reducing the risk of a costly claim.

Additional Factors

Using the home for business purposes

If you use your home for business purposes, it can impact your homeowners insurance premium. Running a business from your home introduces additional liability risks and may require specialized coverage. Insurance companies may charge higher premiums to account for the increased risk associated with business-related activities, such as inventory, client visits, or employees working on-site.

Having a swimming pool

Owning a swimming pool can also affect your homeowners insurance premium. Pools pose liability risks, such as the potential for drowning accidents or injuries. Insurance companies may charge higher premiums to cover the increased risk associated with pool ownership. Implementing safety measures, such as pool fences and alarm systems, can help mitigate these risks and potentially lower your insurance premium.

Renting out the property

If you rent out your property, whether as a long-term rental or through platforms like Airbnb, it can impact your homeowners insurance premium. Renting out your property introduces additional risks, such as potential property damage caused by tenants or liability claims from guests. Insurance companies may charge higher premiums or require specialized landlord insurance to account for these increased risks. It is important to inform your insurer if you plan to rent out your property to ensure you have the appropriate coverage.

In conclusion, several factors can result in a higher homeowners insurance premium. The type of home, its age, construction materials used, special features, and unique architecture can all influence your premium. The location of your home, including proximity to natural disaster-prone areas, crime rate in the neighborhood, and availability of emergency services, can also impact your premium. Other factors such as the value of your property, expensive personal belongings, claim history, credit score, deductible choice, coverage limits, pets, safety features, and additional factors like using the home for business, having a swimming pool, or renting out the property can all contribute to a potential increase in your homeowners insurance premium. It is important to carefully consider these factors and work with your insurance provider to find the right balance between coverage and affordability.