Have you ever wondered what types of water damage are covered by insurance? Well, you’re in luck because we’re here to provide you with all the information you need. Whether it’s a burst pipe, a leaking roof, or even a flooded basement, insurance can offer you protection and peace of mind. So sit back, relax, and let us break down the different types of water damage that insurance typically covers.

1. Water Damage Basics

Water damage can be a homeowner’s worst nightmare, causing extensive damage and requiring costly repairs. Understanding the basics of water damage is crucial in order to protect your home and belongings. In addition, having the right insurance coverage is essential to ensure that you are financially protected in the event of water damage. There are various types of water damage that can occur, ranging from minor leaks to major floods. It is important to know what types of water damage your insurance policy covers, as well as any exclusions that may apply.

Understanding Water Damage

Water damage refers to any damage that is caused by water entering a property and affecting the structure or contents. This can occur as a result of various factors such as leaks, burst pipes, plumbing issues, roof leaks, appliance malfunctions, sewage backups, and natural disasters like storms or floods. Water damage can lead to structural issues, mold growth, and damage to personal belongings, making it essential to address the problem as soon as possible to minimize the damage.

Importance of Insurance Coverage

Having insurance coverage that includes protection against water damage is essential for homeowners. Water damage can result in hefty repair and restoration costs, which can be difficult to bear without insurance coverage. By having the right insurance policy in place, you can have peace of mind knowing that you are financially protected in case of water damage. It is important to review your insurance policy and understand the coverage it provides for water damage to ensure you have adequate protection.

Types of Water Damage

There are various types of water damage that can occur in a home. Understanding these types can help you identify and address the issues in a timely manner. Some common types of water damage include:

- Accidental Leaks and Burst Pipes: These can occur due to aging or faulty plumbing, extreme weather conditions, or improper installation. They can cause significant water damage to your property if not addressed promptly.

- Plumbing Issues: Problems such as leaks, pipe bursts, or malfunctioning fixtures can lead to water damage if not repaired promptly. Regular inspection and maintenance of plumbing systems are essential to prevent such issues.

- Sewage Backups: Blockages in the sewage system can cause wastewater to back up into your home, resulting in extensive water damage and potential health hazards. Immediate action is necessary to address sewage backups.

- Roof Leaks: Damaged or poorly maintained roofs can allow water to seep into your home, leading to water damage. Regular roof inspections and timely repairs can help prevent roof leaks.

- Appliance Malfunctions: Washing machines, dishwashers, refrigerators, and other appliances can malfunction and cause water damage if not properly maintained or if there is a defect.

- Leaking Appliances and Fixtures: Leaks in appliances and fixtures, such as faucets or showerheads, can result in water damage if not fixed promptly.

- Storm and Weather-Related Water Damage: Heavy rain, hurricanes, floods, or snowmelt can cause significant water damage to homes. It is important to have appropriate measures in place to prevent or mitigate such damage.

- Firefighting Efforts: While firefighting activities are necessary to protect lives and property, they can also result in water damage. Water used to extinguish fires can cause significant damage to the structure and belongings.

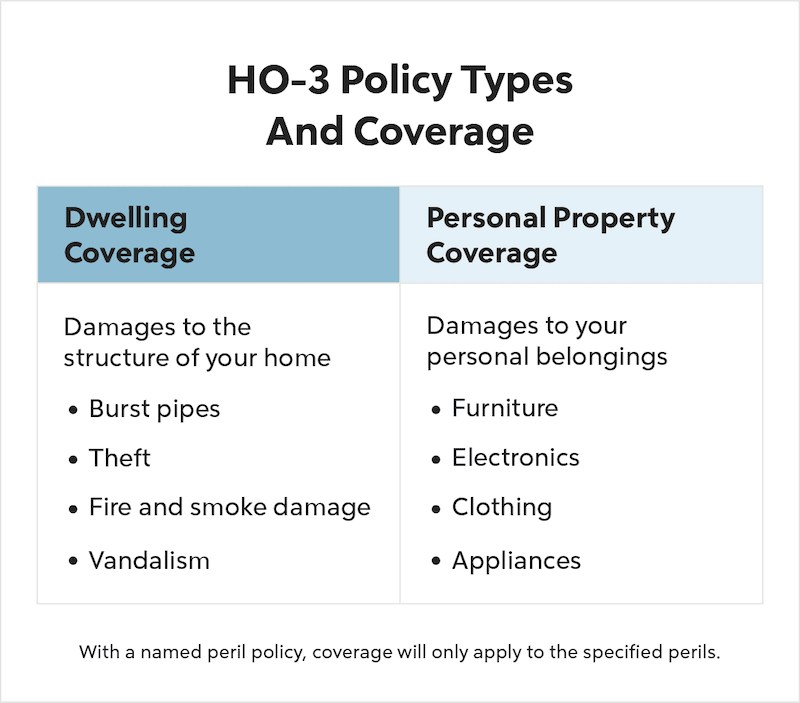

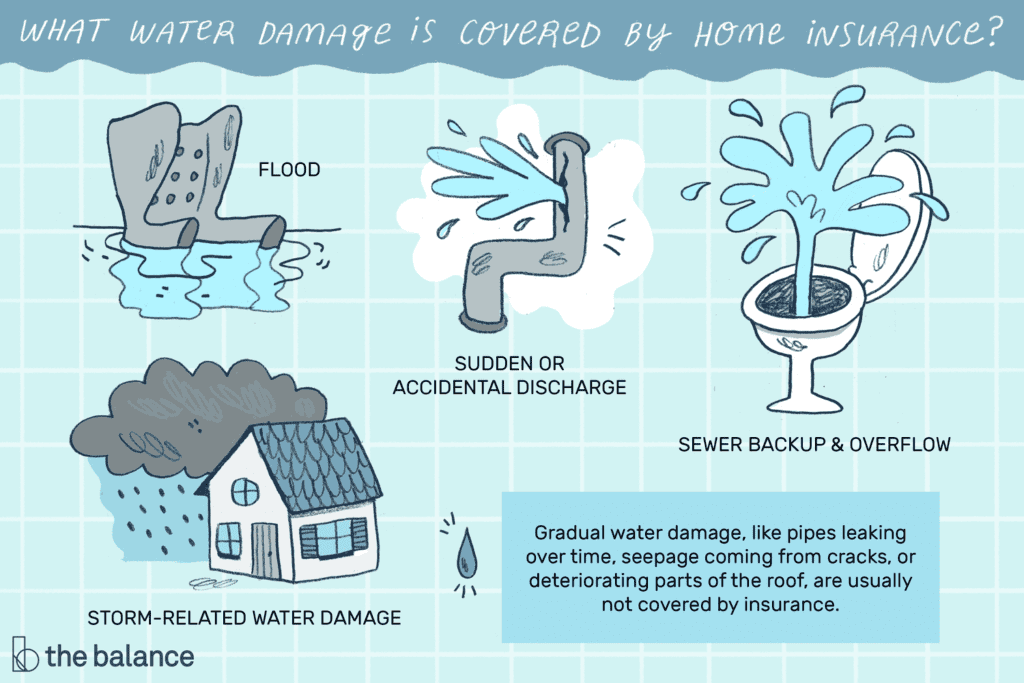

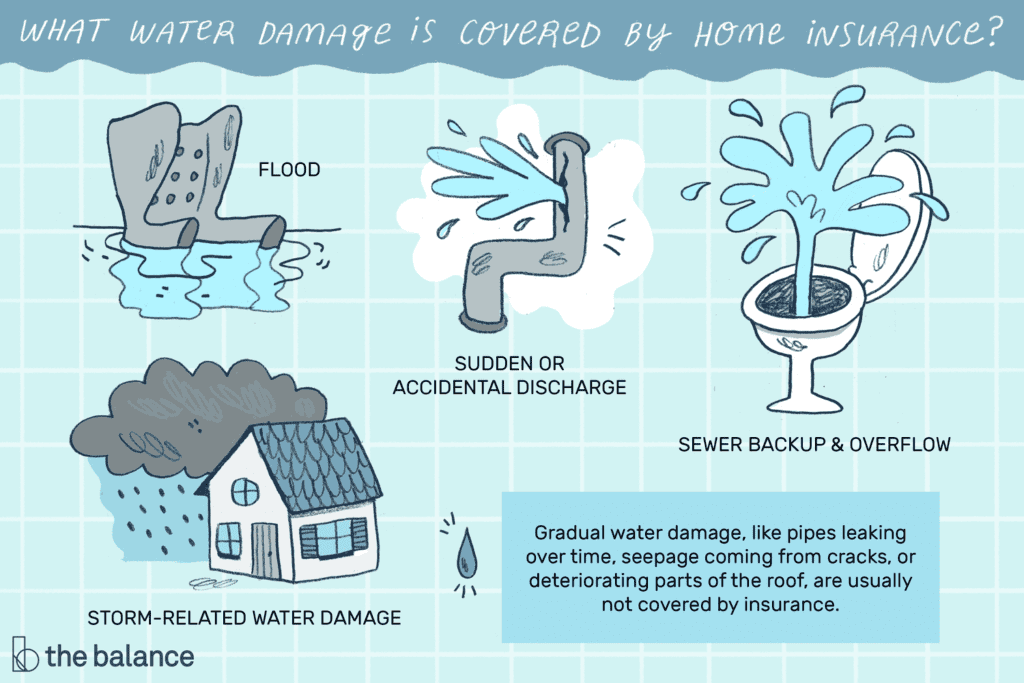

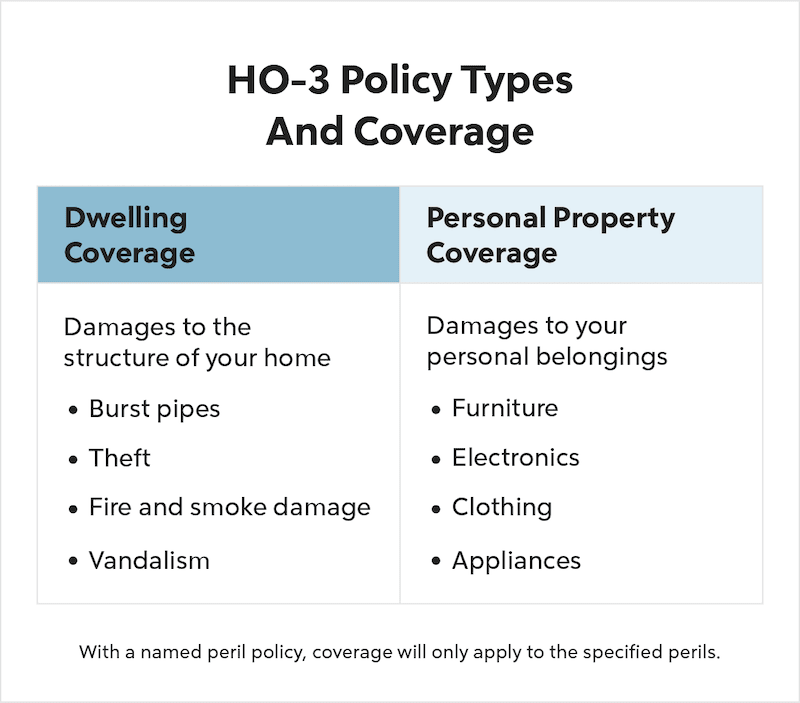

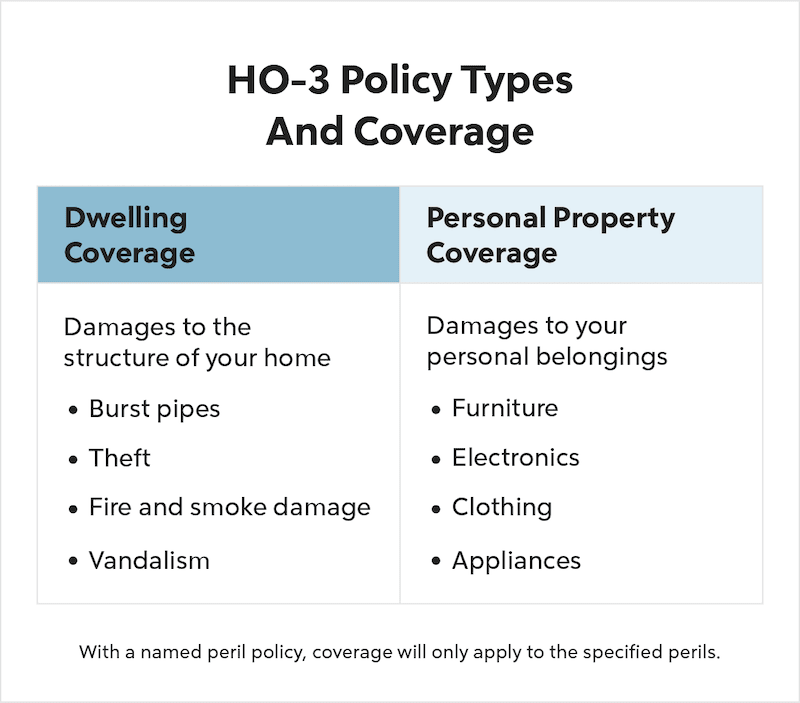

2. Covered Water Damage

When it comes to insurance coverage for water damage, it is important to understand what types of water damage your policy covers. While coverage can vary depending on the insurance company and policy, there are several common water damage scenarios that are typically covered.

Accidental Leaks and Burst Pipes

Most insurance policies cover accidental leaks and burst pipes that result in water damage. These incidents can cause significant damage to your property, including the structure and personal belongings. If you experience a burst pipe or accidental leak, it is important to document the damage and contact your insurance company as soon as possible to initiate the claims process.

Plumbing Issues

Insurance policies often cover water damage caused by plumbing issues such as leaks, pipe bursts, or malfunctioning fixtures. Regular inspection and maintenance of your plumbing system can help prevent such issues. If you encounter plumbing problems that result in water damage, contact your insurance company to file a claim.

Sewage Backups

While sewage backups can be unpleasant and hazardous, insurance policies generally cover water damage resulting from such incidents. It is essential to take immediate action to address sewage backups and minimize the damage. Contact your insurance company as soon as possible to inform them about the situation and start the claims process.

Roof Leaks

Water damage caused by roof leaks is typically covered by insurance policies. Regular roof inspections and timely repairs can help prevent roof leaks and minimize the risk of water damage. If you notice a roof leak, document the damage and contact your insurance company to file a claim.

Appliance Malfunctions

Most insurance policies cover water damage caused by appliance malfunctions, such as leaks from washing machines, dishwashers, and refrigerators. Proper maintenance and regular inspections of appliances can help prevent malfunctions and reduce the risk of water damage. If you experience an appliance malfunction that leads to water damage, contact your insurance company to initiate the claims process.

Leaking Appliances and Fixtures

Insurance policies typically cover water damage caused by leaking appliances and fixtures, such as faucets or showerheads. Promptly fixing any leaks can help prevent extensive water damage. If you have a leaking appliance or fixture that results in water damage, document the damage and contact your insurance company to file a claim.

Storm and Weather-Related Water Damage

Insurance policies generally provide coverage for water damage resulting from storms, hurricanes, heavy rain, or snowmelt. However, it is important to review your policy to understand the specific coverage limits and any additional requirements, such as the need for flood insurance in flood-prone areas. If your property sustains water damage due to severe weather conditions, contact your insurance company to initiate the claims process.

Firefighting Efforts

Water damage caused by firefighting efforts is typically covered by insurance policies. While it is a necessary measure to protect lives and property, the water used to extinguish fires can cause significant damage. If your property experiences water damage as a result of firefighting activities, document the damage and contact your insurance company to file a claim.

3. Excluded Water Damage

While insurance policies provide coverage for various types of water damage, there are certain scenarios that are typically excluded from coverage. It is important to understand these exclusions to ensure you have appropriate coverage in place or take necessary precautions to prevent such incidents.

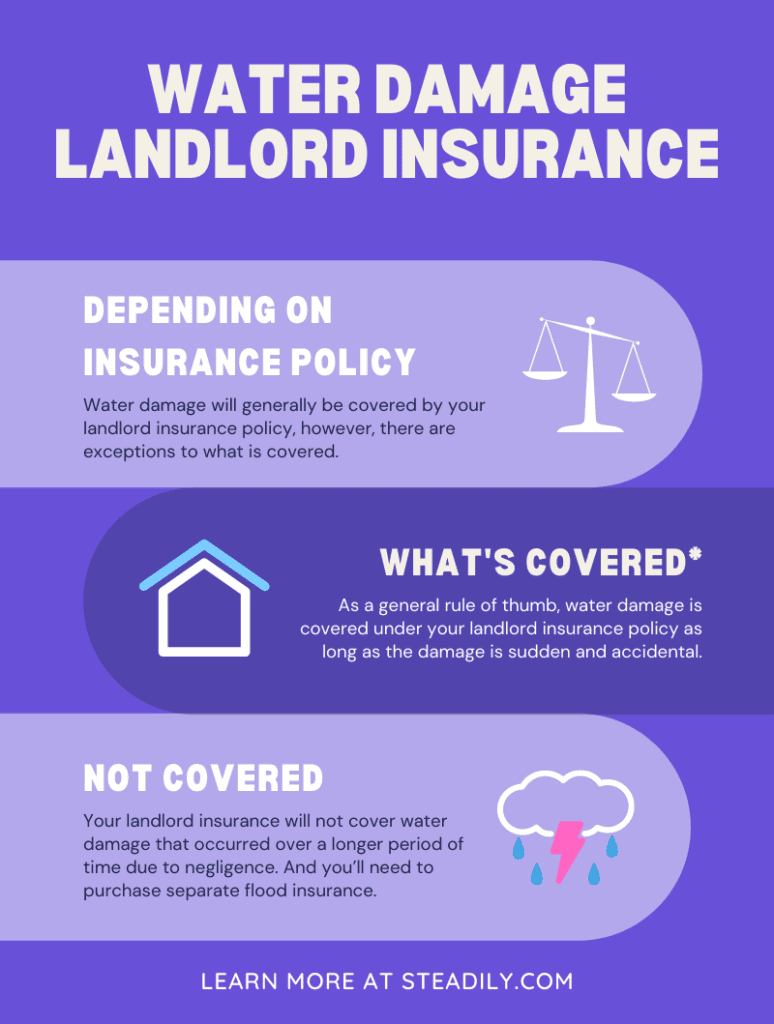

Flood Damage

Flood damage caused by natural disasters or overflowing bodies of water is generally not covered by standard homeowners insurance policies. To protect your home against flood damage, you may need to purchase a separate flood insurance policy. It is important to assess your property’s flood risk and consider obtaining flood insurance if you reside in a flood-prone area.

Gradual Water Damage

Gradual water damage that occurs over time, such as slow leaks or moisture buildup, is often excluded from coverage. Insurance policies typically require sudden and accidental water damage for coverage. Regular maintenance and prompt repair of any leaks or plumbing issues can help prevent gradual water damage.

Negligence or Lack of Maintenance

Water damage resulting from negligence or lack of maintenance is generally not covered by insurance policies. It is important to properly maintain your property, address any issues promptly, and take necessary precautions to prevent water damage. Failure to do so may result in denial of insurance claims for related damage.

Water Damage from a Vacant Home

Insurance policies may exclude coverage for water damage that occurs in a vacant home. If your property will be unoccupied for an extended period of time, it is advisable to contact your insurance company to discuss your coverage options. They may be able to provide recommendations or offer vacant home insurance to protect against potential water damage.

Other Exclusions

Insurance policies may have additional exclusions or limitations for water damage coverage. It is crucial to carefully review your policy to understand the specific coverage details, exclusions, and any limitations that may apply. If you have any questions or concerns about your coverage, reach out to your insurance agent for clarification.

4. Additional Coverage Options

In addition to standard homeowners insurance coverage, there are additional options available to enhance your protection against water damage.

Flood Insurance

As mentioned earlier, flood damage is typically excluded from standard homeowners insurance policies. To safeguard your home against flood damage, consider purchasing a separate flood insurance policy. Flood insurance can provide coverage for both the structure and contents of your home in the event of a flood. It is important to assess your flood risk and consult with your insurance agent to determine the appropriate level of coverage.

Water Backup Coverage

Water backup coverage is designed to protect against damage caused by the backup of water or sewage into your home. This coverage can help cover the costs of cleanup, repairs, and replacement of damaged items resulting from such incidents. Water backup coverage is typically available as an additional endorsement to your homeowners insurance policy. Consult with your insurance agent to determine if this coverage is right for you.

Enhanced Water Protection

Some insurance companies offer enhanced water protection endorsements or packages that provide additional coverage for water damage. These enhancements may include coverage for things like mold remediation, increased coverage limits for water damage claims, or coverage for damage caused by sump pump failures. It is worth exploring these options with your insurance provider to ensure you have comprehensive protection against water damage.

In conclusion, water damage can have a significant impact on your home and finances. Understanding the basics of water damage, the types of water damage covered by insurance, and the exclusions is essential for homeowners. Review your insurance policy to ensure you have adequate coverage for water damage and consider additional coverage options, such as flood insurance or water backup coverage, to enhance your protection. Taking proactive measures to prevent water damage, promptly addressing any issues, and maintaining your property can also help minimize the risk of water damage. By being informed and prepared, you can protect your home and belongings from the potentially devastating effects of water damage.