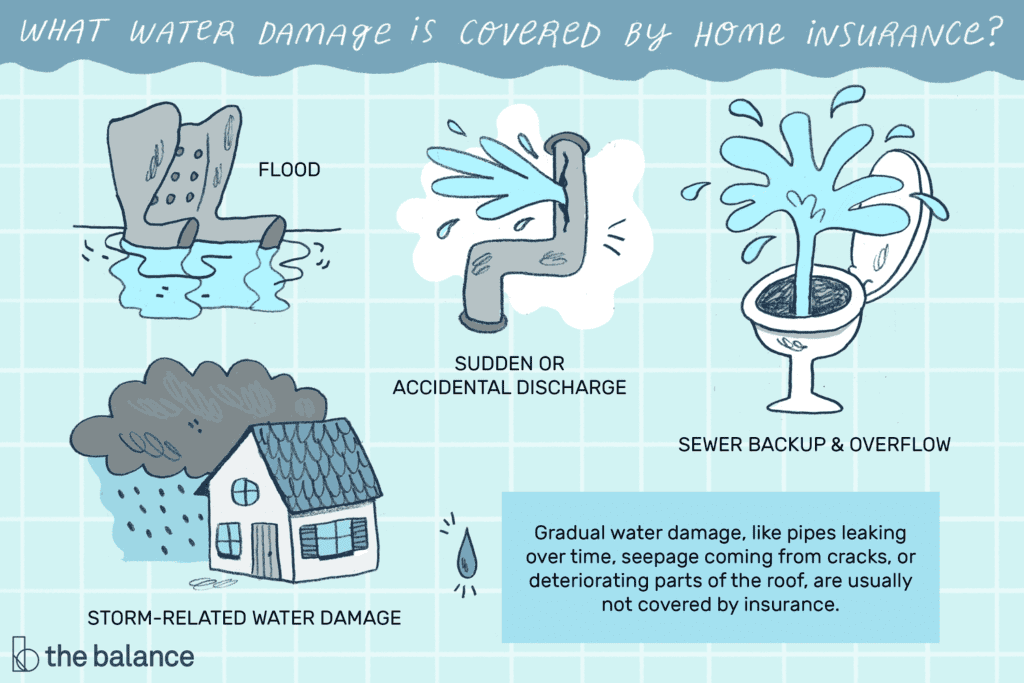

You’re probably well aware of the importance of having insurance coverage for potential disasters like fires or theft, but have you ever stopped to think about what kind of water damage your insurance actually covers? It’s a crucial question to ponder, as water damage can be quite costly to repair. In this article, we’ll explore the various types of water damage that insurance typically covers, allowing you to understand the extent of your policy’s protection and giving you peace of mind for the future.

Water Damage Covered by Insurance

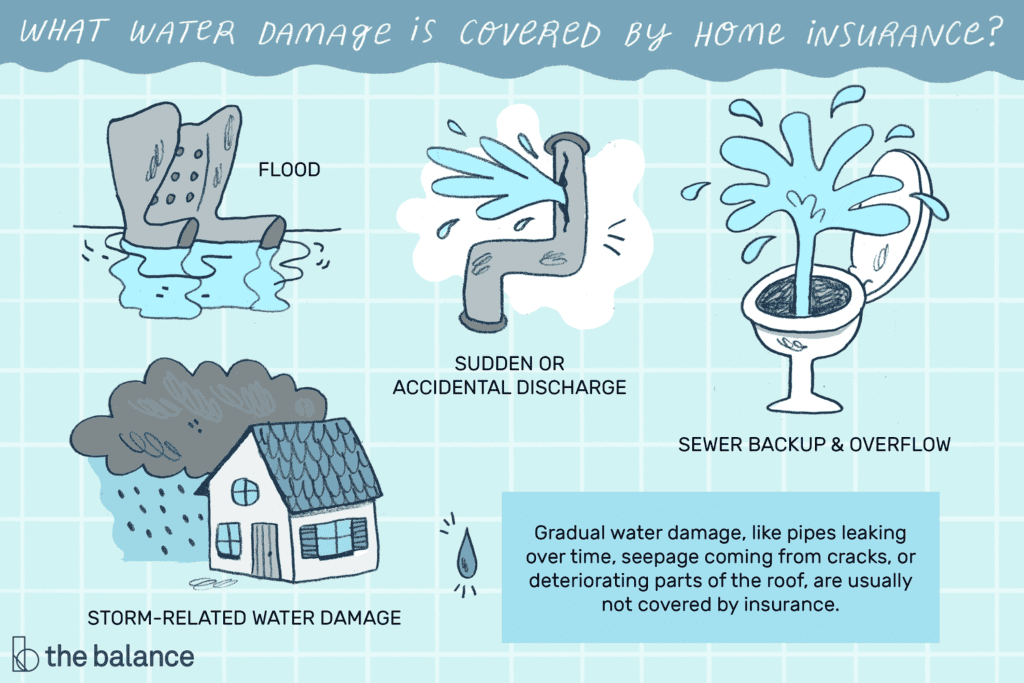

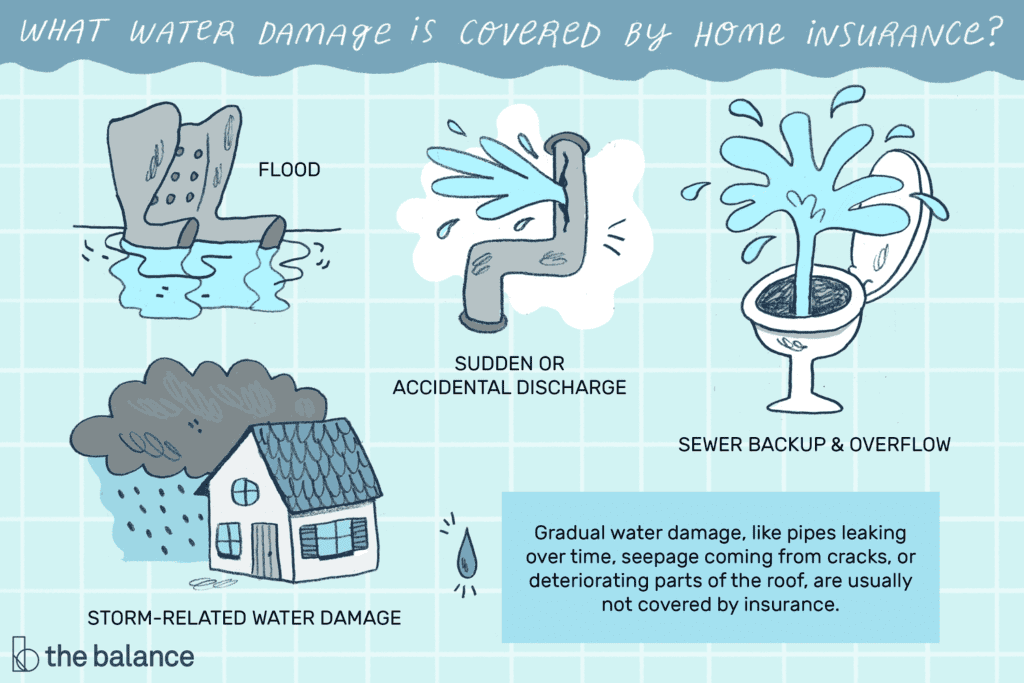

Sudden and Accidental Water Damage

One type of water damage that is typically covered by insurance is sudden and accidental water damage. This refers to unexpected incidents that cause water damage, such as a burst pipe or a washing machine overflow. Insurance companies understand that these incidents are unforeseen and beyond your control, so they usually provide coverage for the resulting water damage.

Water Damage from Leaks

Water damage caused by leaks is another type that is often covered by insurance. Leaks can occur in various areas of your home, such as the roof, windows, or plumbing system. If these leaks lead to water damage, insurance policies typically offer coverage for repairs and restoration.

Water Damage from Burst Pipes

Burst pipes can cause significant water damage to your home. Thankfully, most insurance policies cover this type of water damage. Burst pipes can occur due to cold weather, aging pipes, or even water pressure issues. When a pipe bursts, it can quickly flood your home and cause damage to walls, furniture, and personal belongings. Insurance coverage allows you to recover from these unexpected incidents without bearing the full financial burden.

Water Damage from Plumbing Issues

Plumbing issues can also lead to water damage in your home. Whether it’s a faulty pipe, a clogged drain, or a malfunctioning appliance, water damage caused by plumbing issues is typically covered by insurance. It’s important to promptly address any plumbing problems to prevent further damage and ensure coverage from your insurance policy.

Water Damage from Fire Suppression System

In the event of a fire, fire suppression systems like sprinklers can save lives. However, the water used by these systems can also cause water damage to your property. Fortunately, insurance policies often cover water damage caused by fire suppression systems. This coverage ensures that you can recover not only from the fire but also from the water damage that occurred during the suppression process.

Water Damage from Natural Disasters

Natural disasters, such as hurricanes, storms, or even heavy rainfall, can result in severe water damage to your home. While these events are beyond your control, most insurance policies include coverage for water damage caused by natural disasters. It’s essential to read the fine print of your policy to understand the specific coverage limits and deductibles associated with natural disasters in your area.

Water Damage from Roof Leaks

A leaky roof can cause extensive water damage if left unaddressed. Fortunately, insurance policies often cover water damage resulting from roof leaks. Whether the leaks are due to storm damage, aging roof materials, or other unforeseen events, your insurance can help cover the costs of repairs and restoration.

Water Damage from Appliance Malfunctions

Appliances like dishwashers, refrigerators, or water heaters can malfunction and cause water damage in your home. Thankfully, insurance typically covers water damage resulting from appliance malfunctions. Whether it’s a faulty seal, a broken hose, or a malfunctioning pump, your insurance policy can provide the necessary coverage to repair the damage caused.

Water Damage from Sewer Backup

Sewer backups can be a messy and costly problem to deal with. When your sewer system becomes overwhelmed or experiences blockages, it can result in water damage in your home. Fortunately, most insurance policies cover water damage caused by sewer backups. This coverage can help cover the cost of cleaning, repairs, and restoration.

Water Damage from Vandalism or Theft

Water damage resulting from acts of vandalism or theft is often covered by insurance. If someone maliciously damages your plumbing system, causing water damage, or if they steal your appliances and cause water-related issues, your insurance policy can provide coverage. It’s crucial to file a police report and document the damages for proper insurance claims.

Water Damage Not Covered by Insurance

Gradual Water Damage

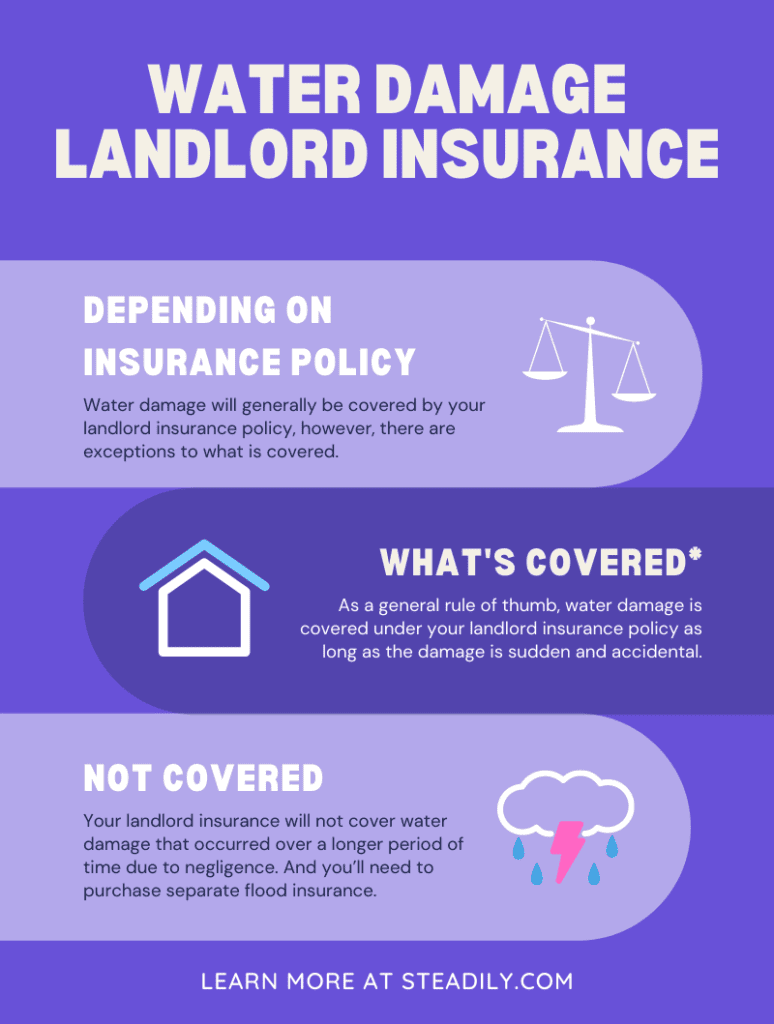

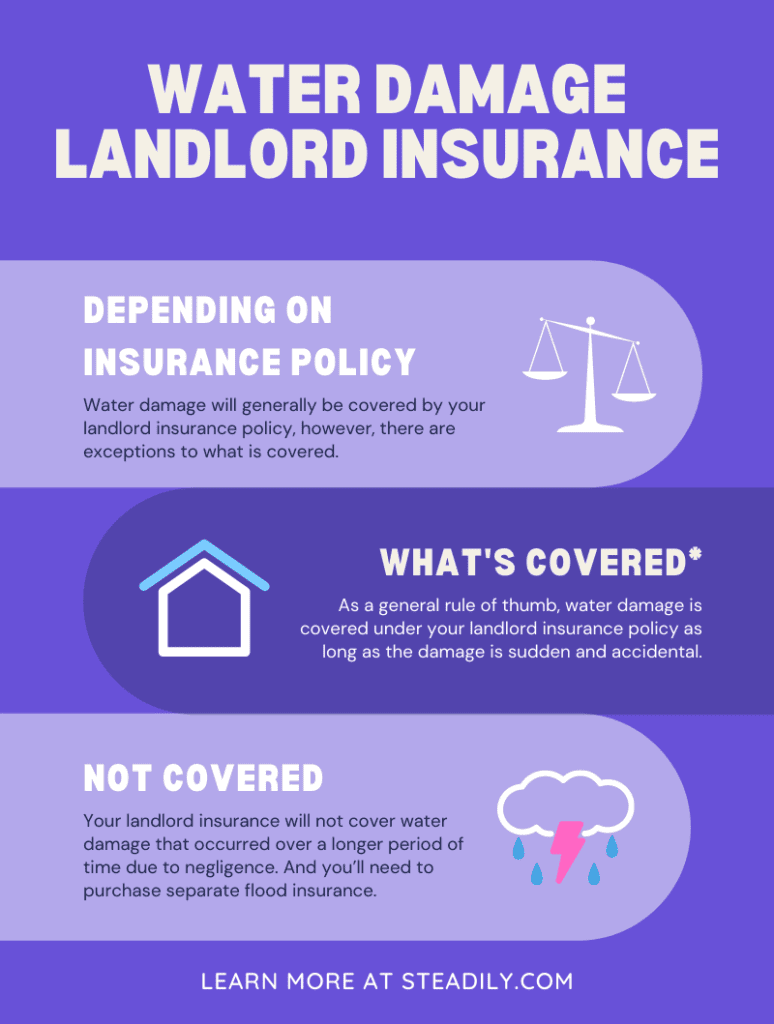

While insurance policies typically cover sudden and accidental water damage, they often do not cover gradual water damage. Gradual water damage refers to issues that develop over time, such as a slow leak or hidden plumbing problems. Insurance companies expect homeowners to properly maintain their properties and address these gradual issues promptly. If you ignore a slow leak or fail to maintain your home adequately, resulting water damage may not be covered by insurance.

Negligence-Based Water Damage

Water damage caused by negligence is generally not covered by insurance. If you neglect to perform regular maintenance on your property, fail to address known issues, or disregard safety precautions, insurance companies may consider the resulting water damage as your responsibility. It’s essential to be proactive in maintaining your home to avoid potential water damage and the possibility of being denied an insurance claim.

Water Damage from Floods

Flood damage is typically not covered by standard homeowners’ insurance policies. To protect your home from flood-related water damage, you would need to purchase a separate flood insurance policy through the National Flood Insurance Program (NFIP) or a private insurer. It’s crucial to understand the flood risk in your area and consider purchasing flood insurance if you reside in a flood-prone region.

Water Damage from Ground Seepage

Water damage caused by ground seepage is generally not covered by insurance. Ground seepage refers to water that enters your home through the foundation or basement walls due to hydrostatic pressure. Insurance companies may exclude this type of water damage from coverage since it is often viewed as a maintenance issue rather than an unforeseen event.

Water Damage from Earthquakes

Homeowners insurance policies typically do not cover water damage resulting from earthquakes. Earthquakes can cause a variety of issues, including broken pipes and damaged plumbing systems, leading to water damage. To protect your home from earthquake-related water damage, you would need to purchase earthquake insurance, which is typically offered as a separate policy or endorsement.

Water Damage from Sewer or Drainage Problems

Water damage caused by sewer or drainage problems may not be covered by insurance. If your property experiences issues with aging sewer lines, poor drainage, or other similar problems, insurance companies may consider it a maintenance issue and exclude coverage. It’s essential to regularly maintain your sewer and drainage systems to prevent potential water damage.

Water Damage from Poor Home Maintenance

Poor home maintenance can often result in water damage, but insurance policies may not cover this type of damage. It’s essential to perform regular inspections and maintenance tasks, such as roof inspections, checking for leaks, and addressing any issues promptly. By properly maintaining your home, you can prevent water damage and avoid potential insurance coverage denials.

Water Damage from Mold or Fungus

While water damage and mold often go hand in hand, insurance policies may not cover damage caused by mold or fungus. Mold and fungus growth typically occur due to water damage that is not promptly addressed or adequately remediated. Insurance companies may consider mold growth to be preventable through proper maintenance and prompt water damage restoration.

Water Damage from Pest Infestation

Water damage resulting from a pest infestation may not be covered by insurance. Pests like termites or rodents can cause water damage by chewing through pipes or creating nests in your plumbing system. Insurance companies often consider pest infestations to be a maintenance issue and exclude coverage for resulting water damage.

Water Damage from Wear and Tear

Water damage resulting from general wear and tear is typically not covered by insurance. Over time, plumbing systems, appliances, and other components of your home can deteriorate and cause water-related issues. Insurance companies expect homeowners to address these issues through regular maintenance and repairs to prevent resulting water damage.

In conclusion, insurance coverage for water damage varies depending on the cause and circumstances of the damage. While sudden and accidental water damage, such as burst pipes or leaks, is typically covered, gradual damage, neglect-based damage, and damage caused by floods or earthquakes may not be covered. It’s vital to review your insurance policy thoroughly and understand the specific coverage and exclusions to ensure you have adequate protection in case of water damage. Regular maintenance, prompt repairs, and proactive measures can help prevent water damage and potential insurance claim denials.