Have you ever wondered why insurance rates seem to be constantly on the rise? It can be frustrating and leave you questioning why you have to pay such high premiums month after month. But fear not, there are valid reasons behind the seemingly exorbitant costs. From the increasing frequency of accidents to the soaring medical expenses, this article delves into the factors that contribute to high insurance prices, helping you understand the rationale behind those seemingly steep bills. So sit back, relax, and let’s explore the world of insurance rates together.

Factors Affecting Insurance Rates

When it comes to insurance rates, there are several factors that come into play. These factors are taken into consideration by insurance companies when determining the premiums you will pay. While the specific formulas used may vary between insurance providers, understanding these factors can give you a better understanding of why your insurance rates may be high.

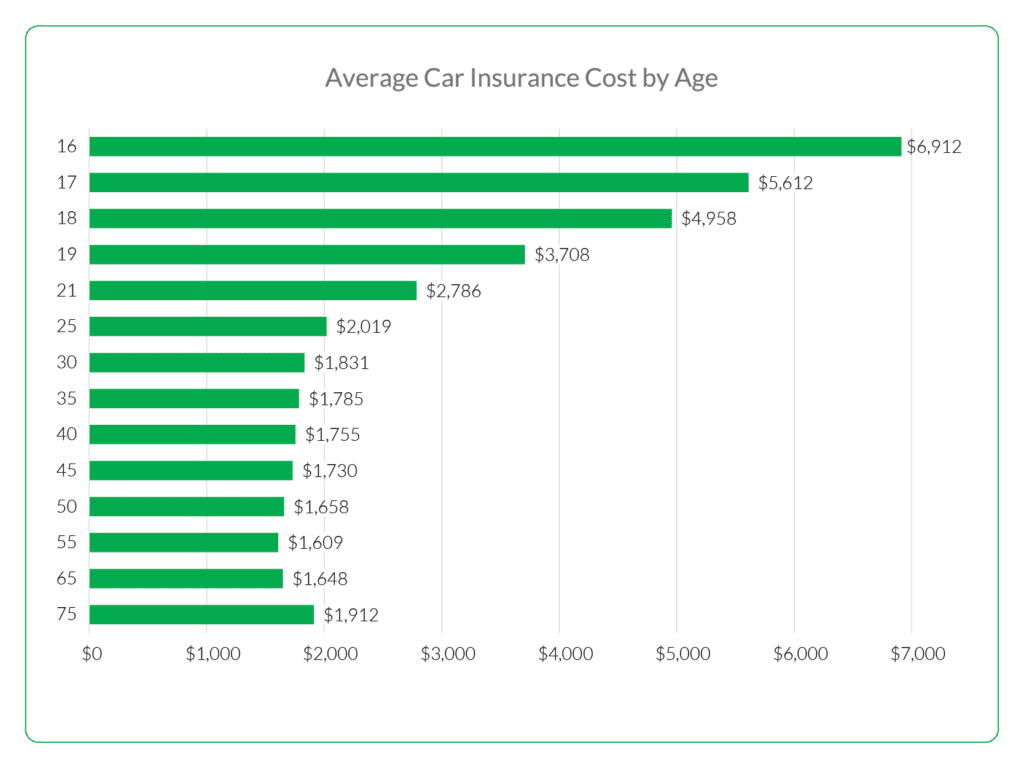

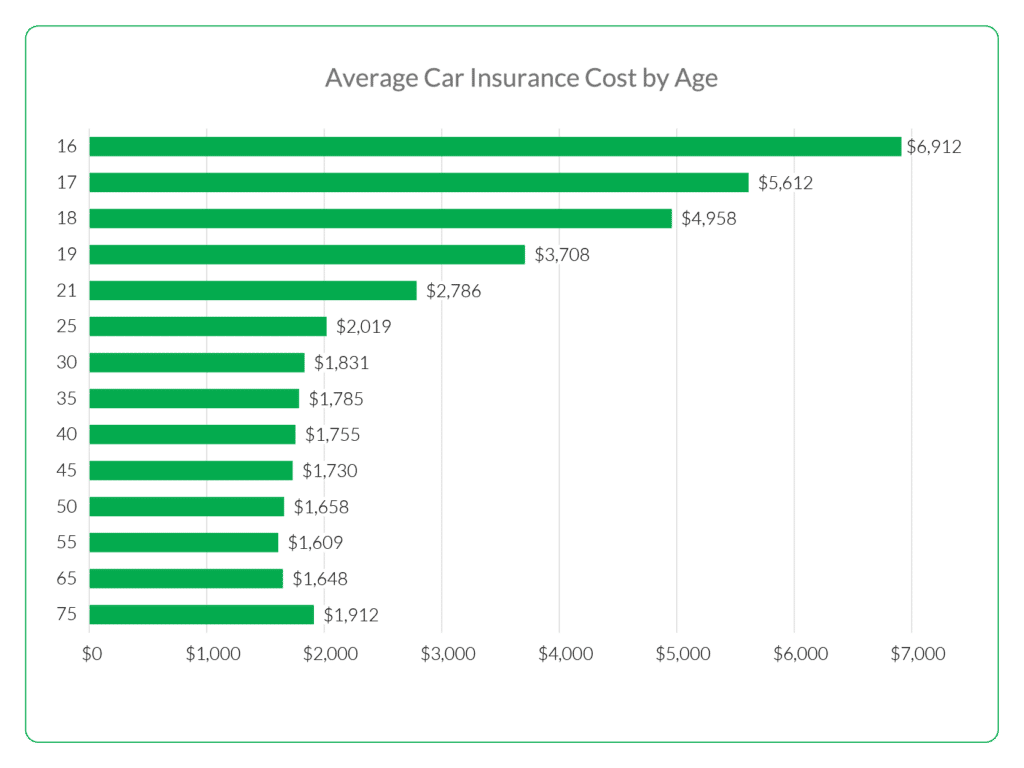

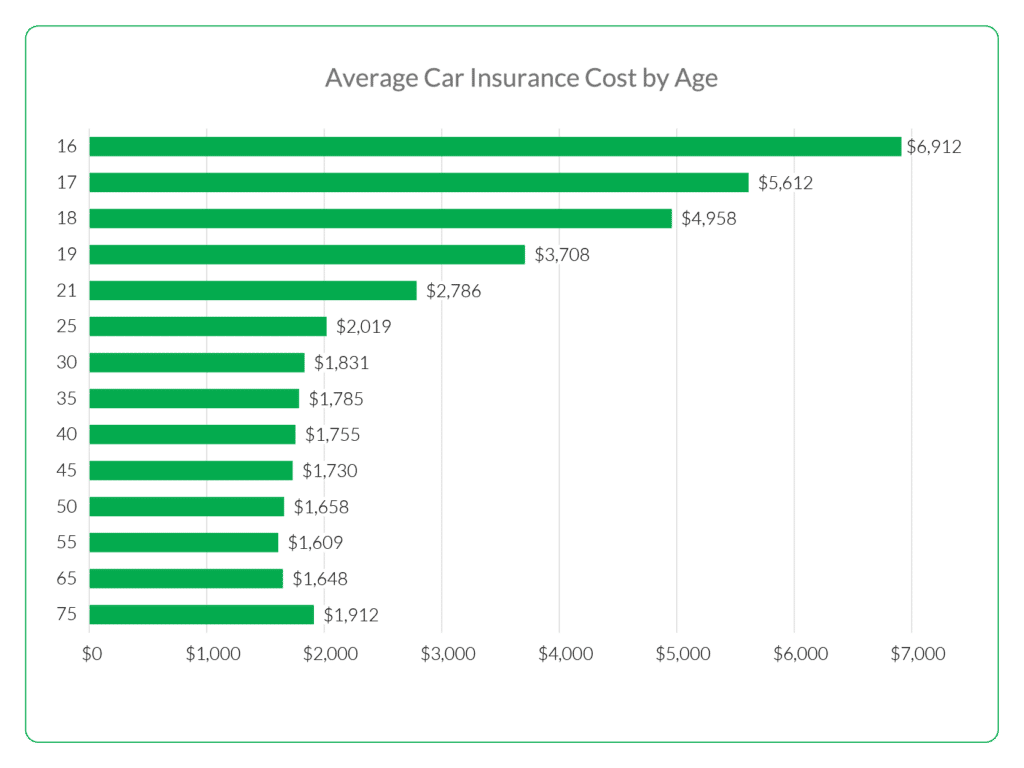

Age and Gender

Your age and gender are among the first factors that insurance companies consider when determining your insurance rates. Teenagers, for example, tend to have higher rates due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, elderly drivers may also have higher rates due to the potential health concerns that can affect their driving abilities. Young adults, typically between the ages of 18 and 25, may also face higher rates due to their perceived higher risk.

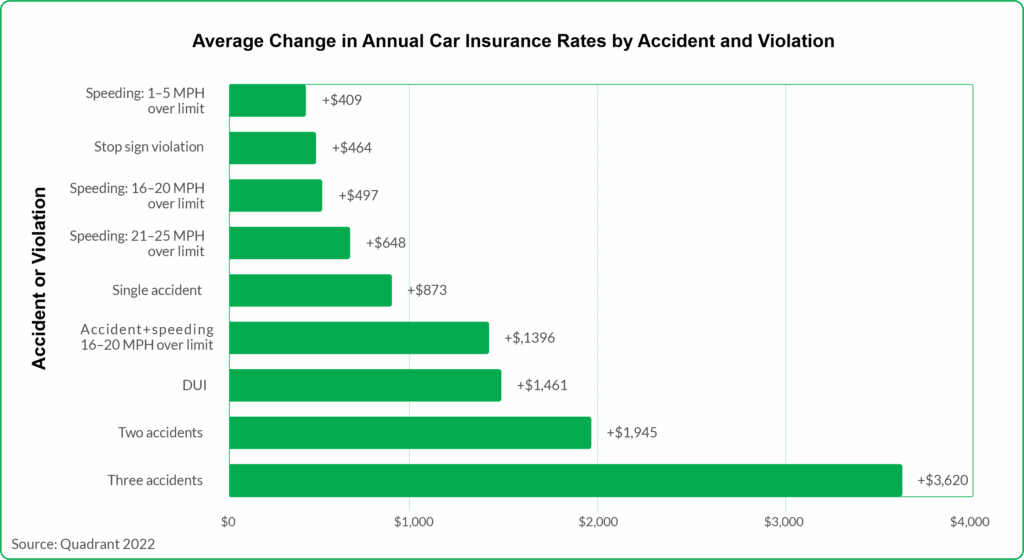

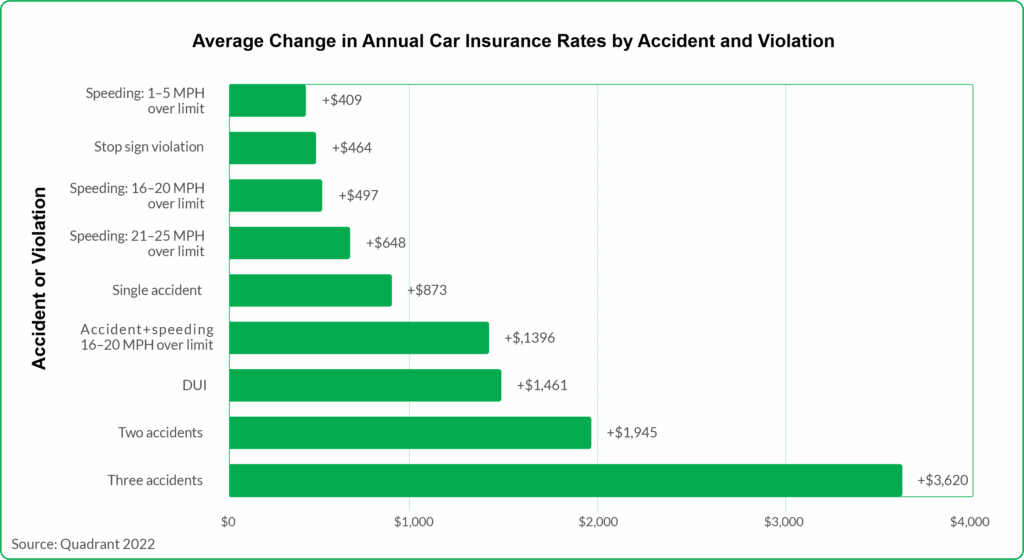

Driving History

Your driving history plays a significant role in determining your insurance rates. Insurance companies look at factors such as accidents, tickets, and any DUI or DWI convictions. If you have a history of accidents or traffic violations, insurance companies may consider you a higher risk driver, which can lead to higher premiums. Similarly, having a DUI or DWI conviction on your record can significantly impact your rates due to the increased risk associated with impaired driving. Additionally, insurance companies also take into account your claims history, as multiple claims can indicate a higher likelihood of future claims.

Type of Vehicle

The type of vehicle you drive can have a substantial impact on your insurance rates as well. Luxury or sports cars are generally more expensive to repair or replace, making them higher risk in the eyes of insurance companies. Moreover, they may also be more likely to be targeted by thieves, which increases the risk for theft-related claims. Vehicles with low-safety ratings can also result in higher rates due to the increased potential for injuries in accidents.

Location

Your location also influences your insurance rates. Living in urban areas often leads to higher rates due to the increased likelihood of accidents and theft. High crime rates in certain areas can also result in higher premiums, as insurance companies consider the risk of theft and vandalism. Additionally, areas prone to natural disasters, such as hurricanes or earthquakes, may also have higher rates due to the increased probability of filing claims.

Credit Score

Believe it or not, your credit score can affect your insurance rates as well. Insurance companies have found a correlation between credit scores and insurance risk, leading them to use credit scores as a factor in determining premiums. A lower credit score may indicate a higher risk for filing claims, resulting in higher rates. It is important to keep an eye on your credit score and work towards maintaining a good credit standing, as it can positively impact your insurance rates.

Annual Mileage

The number of miles you drive in a year can also impact your insurance rates. Insurance companies consider higher mileage as an increased risk factor, as more time spent on the road increases the likelihood of accidents. Conversely, if you have low annual mileage, you may be eligible for low mileage discounts, as your reduced time on the road decreases the probability of getting into an accident.

Insurance Claims

The frequency and legitimacy of insurance claims can also play a role in determining your rates. Insurance companies keep track of any past claims you have made, as multiple claims can indicate a higher likelihood of filing future claims. Moreover, fraudulent claims can lead to increased rates for everyone, as insurers try to recoup the cost of fraudulent payouts.

Lack of Competition

In some areas, there may be limited options when it comes to insurance providers. This lack of competition can lead to higher insurance rates, as consumers have fewer options to choose from. Additionally, monopolistic markets, where one insurance company has a dominant presence, can result in higher rates due to the lack of competition to drive prices down.

Natural Disasters

The occurrence of natural disasters in your area can impact your insurance rates. Insurance companies take into account the risk of damage or loss due to natural disasters such as hurricanes, wildfires, or floods. If you live in an area prone to these events, your insurance rates may be higher to account for the increased likelihood of making a claim.

In conclusion, insurance rates are influenced by a variety of factors. Age and gender, driving history, type of vehicle, location, credit score, annual mileage, insurance claims, lack of competition, and natural disasters all contribute to the higher rates you may be experiencing. Understanding these factors can help you make informed decisions to potentially lower your insurance premiums. It is always a good idea to consult with different insurance providers, compare quotes, and explore any available discounts to find the best coverage at the most affordable price.