Imagine this: you come home after a long day at work, excited to relax in the comfort of your cozy abode. But as you step inside, a wave of panic washes over you. Water is cascading down from your ceiling and pooling on the floor. Your heart sinks at the sight of the damage. As you try to make sense of what happened, a single question hovers in your mind: would insurance cover water damage caused by an improperly…”

Would Insurance Cover Water Damage Due To An Improperly …

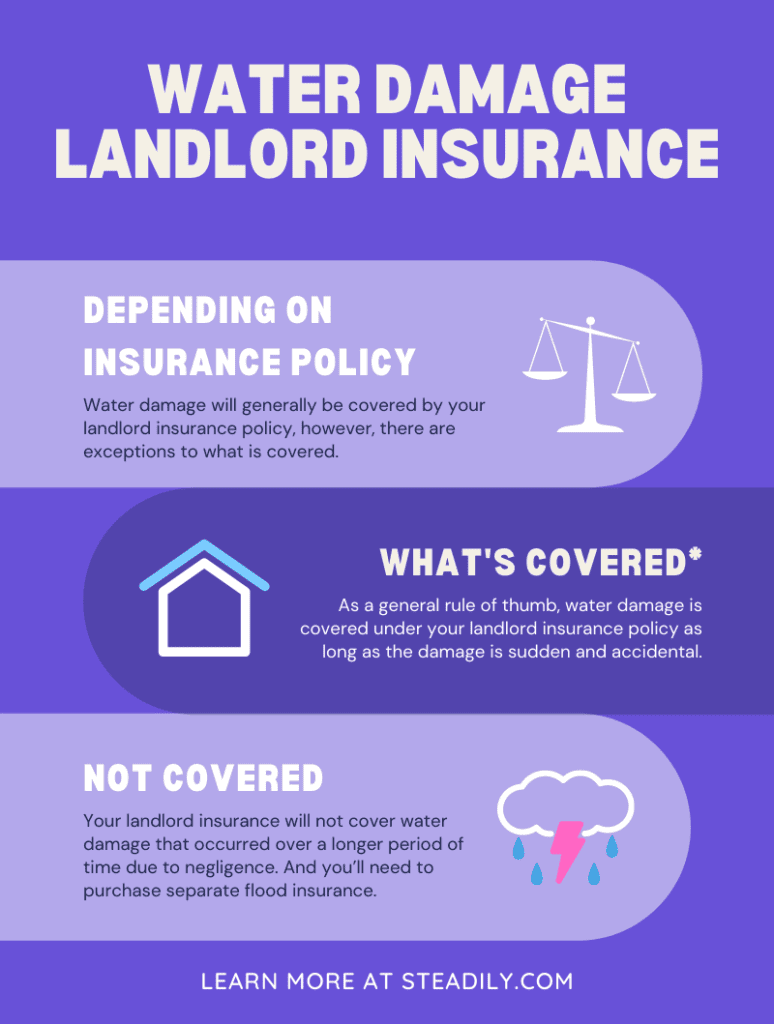

Overview of water damage and insurance coverage

Water damage is a common issue faced by homeowners and renters alike. It can occur due to a variety of reasons, such as burst pipes, leaking roofs, overflowing toilets, or natural disasters like flooding. Dealing with water damage can be a hassle, both emotionally and financially. This is where insurance coverage comes into play.

Insurance coverage for water damage depends on various factors, including the type of insurance policy you have and the circumstances surrounding the damage. In many cases, insurance can provide financial assistance to help you repair or replace the damaged property.

Understanding the concept of negligence

Negligence plays a crucial role in determining whether insurance will cover water damage. Negligence refers to the failure to exercise reasonable care, causing harm or damage to others. When it comes to water damage, negligence can arise from actions or inactions that lead to the damage, such as failure to maintain the property or address issues promptly.

If negligence can be proven, it may affect the responsibility for the water damage and the insurance coverage available to the affected parties. It is important to understand the elements of negligence and how they apply to your situation.

Determining responsibility for water damage

Determining responsibility for water damage can be a complex process. It requires identifying the responsible party based on the specific circumstances surrounding the incident. In some cases, the responsibility lies with the property owner, while in others, it may be the result of tenant actions or maintenance issues.

In situations where negligence is involved, the responsible party may be held accountable for the water damage. This can impact insurance coverage, as negligence may lead to denial or limitation of coverage. It is essential to gather evidence and consult with insurance professionals or legal experts to establish responsibility convincingly.

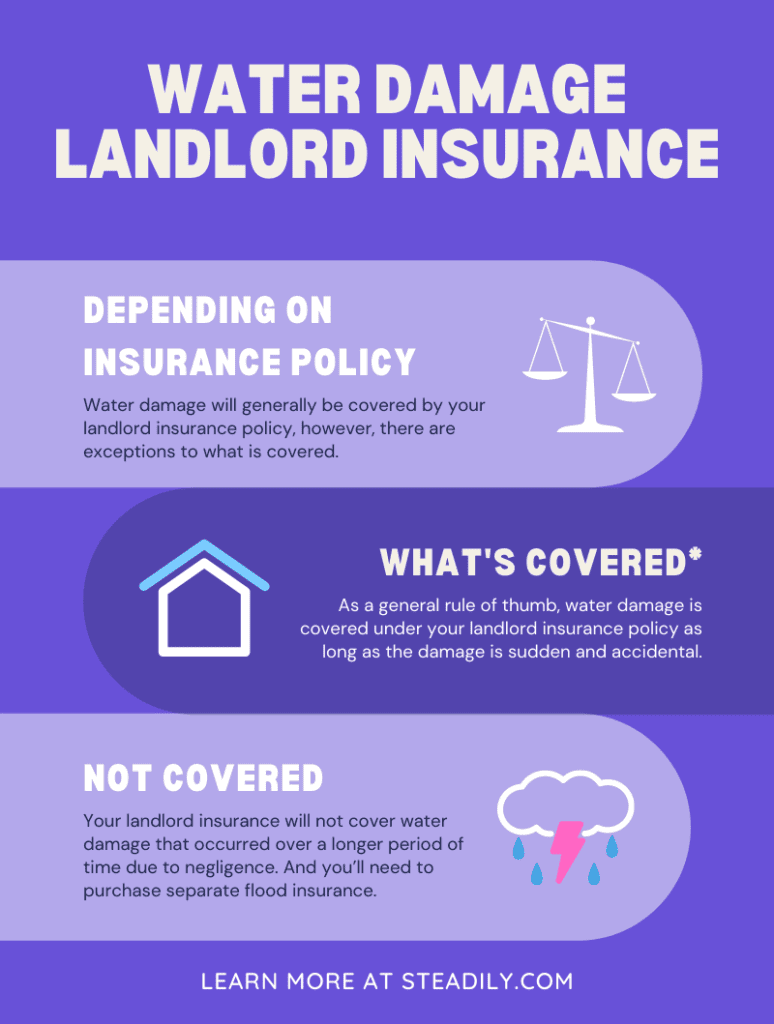

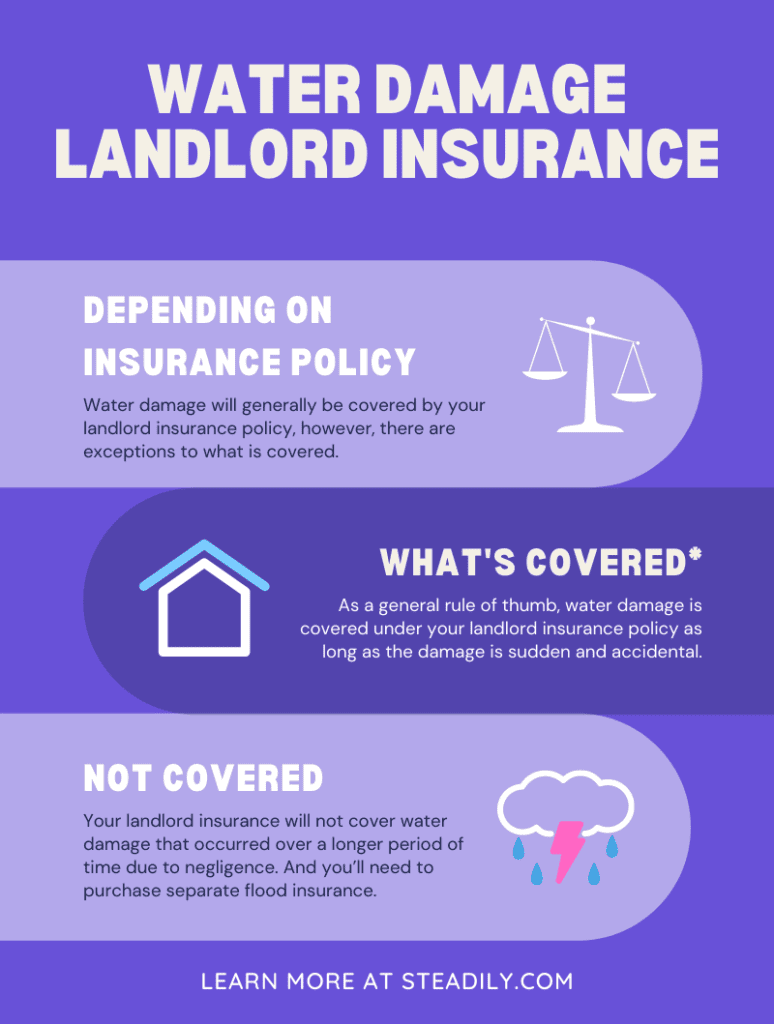

Insurance policies and their coverage for water damage

Different types of insurance policies offer varying degrees of coverage for water damage. It is crucial to understand the specific terms and conditions of your policy, as well as its limitations and exclusions. Several types of insurance policies commonly cover water damage:

Homeowner’s insurance

Homeowner’s insurance typically provides coverage for water damage caused by sudden and accidental events, such as burst pipes or a faulty water heater. However, it may not cover damage resulting from long-term issues, such as gradual leaks or mold growth. Your policy may also exclude coverage for water damage caused by floods, which requires separate flood insurance.

To ensure adequate coverage for water damage, it is essential to review your homeowner’s insurance policy carefully. You may need to consider purchasing additional coverage or endorsements to address specific risks associated with water damage.

Renter’s insurance

Renter’s insurance covers personal property and liability for tenants. Like homeowner’s insurance, it typically covers sudden and accidental water damage. However, it is crucial for tenants to understand that the landlord is generally responsible for maintaining the property and addressing issues that may lead to water damage.

If a tenant’s negligence contributes to water damage, their renter’s insurance may still provide coverage for their personal belongings. However, any damage to the rental property itself may be the landlord’s responsibility, unless the tenant assumed responsibility through a written agreement.

Flood insurance

Flood insurance is a separate policy specifically designed to cover damage caused by flooding. It is important to note that flood insurance is not typically included in homeowner’s or renter’s insurance policies. If your property is at risk of flooding, it is essential to obtain flood insurance to protect against potential water damage caused by floodwaters.

Flood insurance provides coverage for both the structure and contents of your property. It can help cover the costs of repairs or replacements in the event of flood-related water damage. To obtain flood insurance, you can contact the National Flood Insurance Program (NFIP) or private insurance companies offering flood coverage.

Commercial property insurance

Commercial property insurance provides coverage for businesses and their physical assets. Similar to homeowner’s insurance, it covers water damage resulting from sudden and accidental events. However, commercial property insurance may offer specific water damage coverage tailored to the unique needs of commercial properties, such as coverage for damage caused by faulty equipment or pipe bursts.

Obtaining adequate coverage for water damage under commercial property insurance requires a thorough understanding of the policy terms and exclusions. It is advisable to consult with insurance professionals who specialize in commercial property insurance to ensure comprehensive coverage.

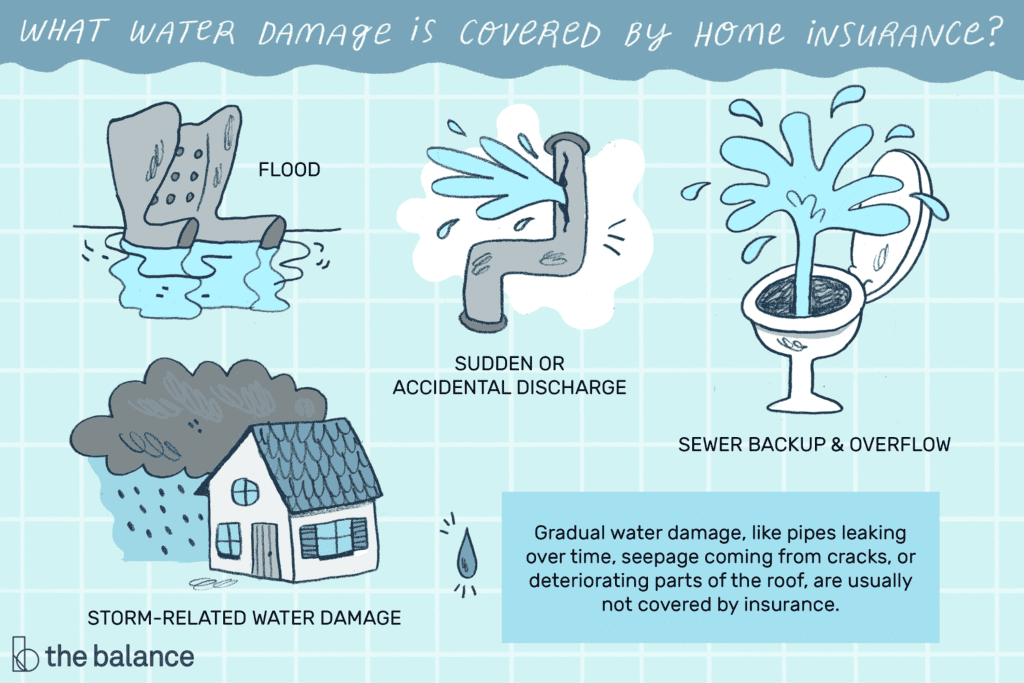

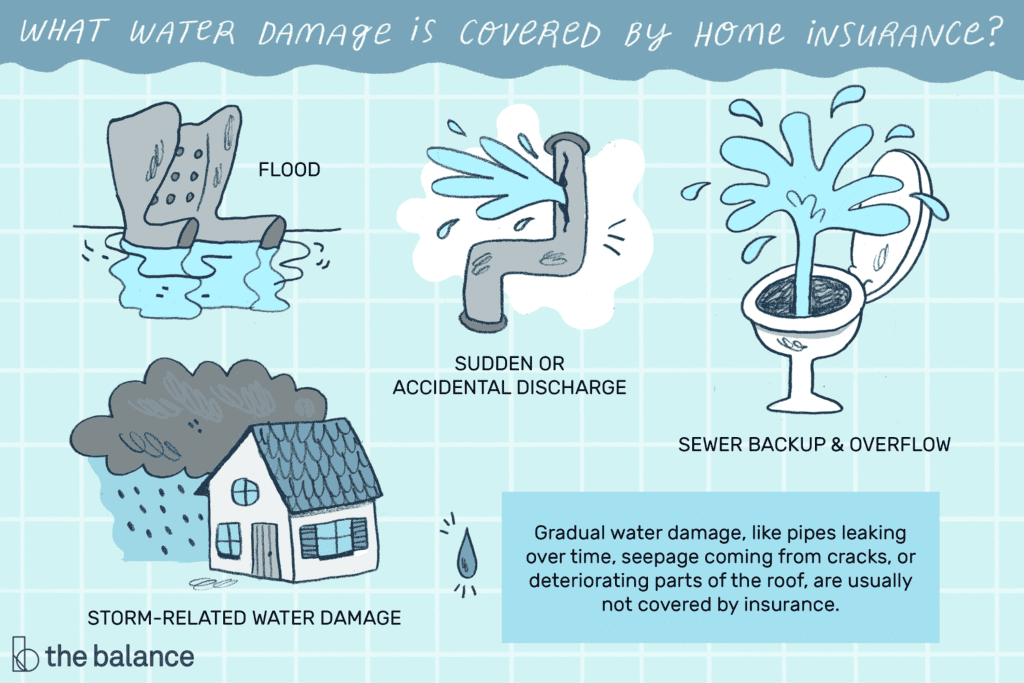

Types of water damage covered by insurance

Insurance policies generally cover certain types of water damage, including:

-

Burst pipes: Insurance typically covers the cost of repairing or replacing property damaged by burst pipes, including damage to walls, flooring, and personal belongings.

-

Accidental leaks: If water damage results from an accidental leak, such as a washing machine overflow, insurance may provide coverage for the associated damages.

-

Roof leaks: Damage caused by roof leaks, such as ceiling or wall damage, may be covered by insurance, depending on the circumstances.

-

Plumbing issues: Insurance can help cover the costs of water damage resulting from plumbing issues, such as pipe bursts or faulty plumbing installations.

Types of water damage not covered by insurance

While insurance can provide valuable coverage for water damage, there are certain types of water damage that are typically not covered by insurance, including:

-

Gradual water damage: Insurance policies often exclude damage caused by gradual water leaks or long-standing issues, as these are considered maintenance-related concerns.

-

Flood damage without flood insurance: Standard homeowner’s or renter’s insurance policies do not cover flood damage. To obtain coverage for flood-related water damage, separate flood insurance is necessary.

-

Negligent maintenance and water damage: If water damage is a result of the property owner or tenant’s negligence in maintenance and repair, insurance may deny coverage for damages.

-

Water damage due to construction or renovation: Damage caused by construction or renovation activities may not be covered by insurance policies. It is essential to consult with your insurance provider and obtain additional coverage if needed.

-

Water damage from natural disasters: Damage resulting from natural disasters like hurricanes, earthquakes, or mudslides may require separate insurance policies specifically designed to cover such events.

In conclusion, insurance coverage for water damage depends on various factors, such as the type of insurance policy, the circumstances of the damage, and the presence of negligence. It is crucial to review your policy carefully, understand its terms, and consider obtaining additional coverage if necessary to ensure adequate protection against water damage. Consulting with insurance professionals can help you navigate the complexities of insurance coverage and make informed decisions. Remember, prevention is always better than cure, so maintaining your property and promptly addressing any water-related issues can help minimize the risk of water damage and insurance claims.